How to Get Into Cryptocurrency in 2024 – Top Tips

Although digital assets have been around for over a decade, many investors still find the crypto market overwhelming. However, contrary to popular belief, getting started with a first-time crypto investment is fairly simple.

This guide explains how investors can venture into the space of cryptocurrencies. We also share some handy tips on how to get into cryptocurrency safely while minimizing the overall risks.

10 Top Tips on How to Get Into Cryptocurrency in 2024

Here are some useful tips to follow when trying to get into the crypto space as a beginner:

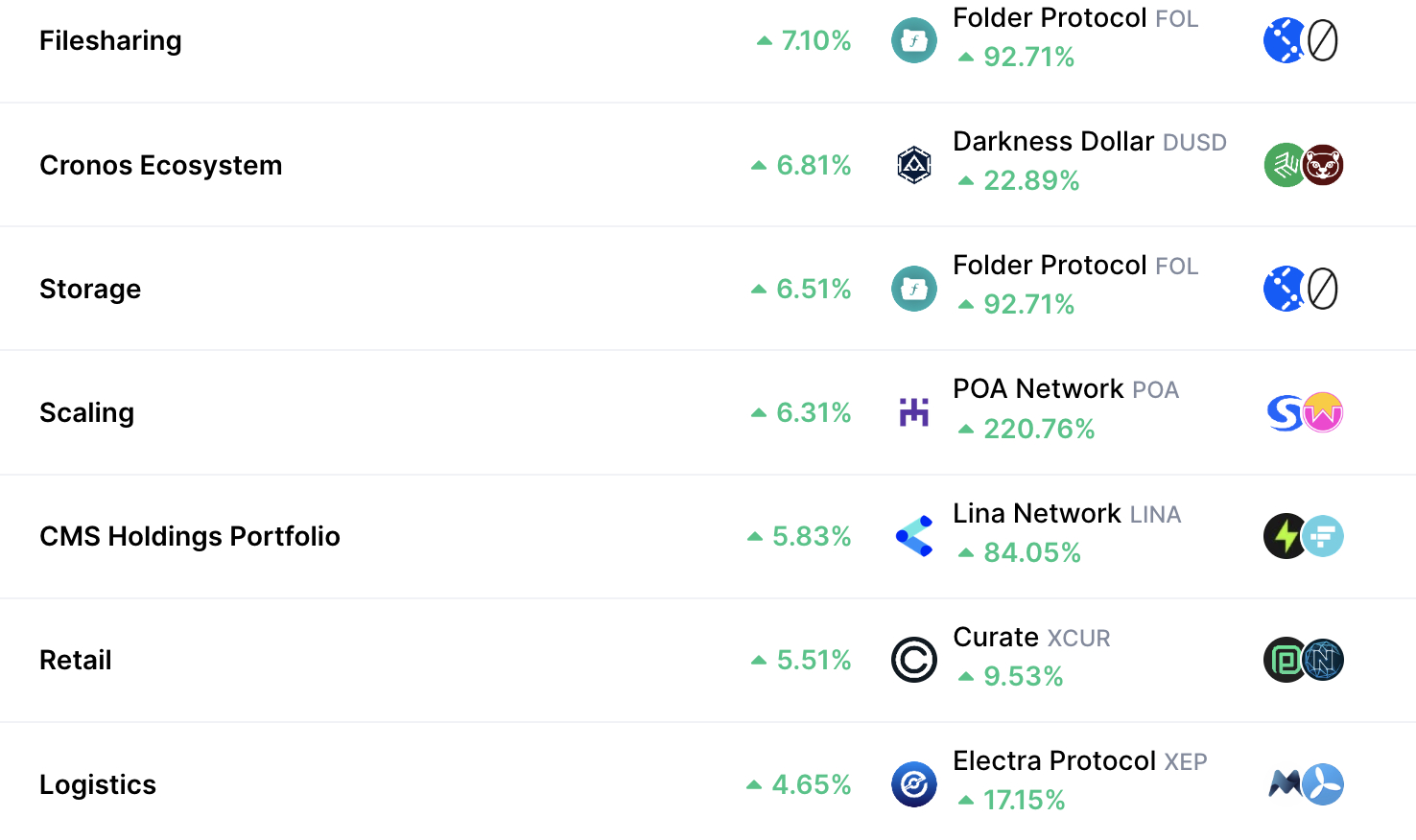

- Find low-cost, high-potential crypto projects like Dogeverse

- Learn about the crypto market

- Develop a strategy

- Learn how to store cryptocurrency safely

- Choose a crypto exchange or broker

- Diversify your investment portfolio

- Invest with a dollar-cost averaging strategy

- Gain exposure to cryptocurrency indirectly

- Earn passive income with crypto staking

- Use leverage carefully

For complete beginners, we have an extensive guide on what cryptocurrency is, explaining how digital tokens work and how they are different from other assets such as stocks and commodities.

A Closer Look at How to Get Started in Cryptocurrency

Starting in cryptocurrency can seem daunting, but with the right approach, you can potentially find the next cryptocurrency to explode and understand how to get rich with crypto.

This section guides you through the ten essential steps for getting started in cryptocurrency: from identifying promising low-cost crypto projects and understanding market dynamics, to earning through crypto staking and using leverage wisely.

1. Crypto Presales: Get Into the Crypto Market at a Low Entry Price

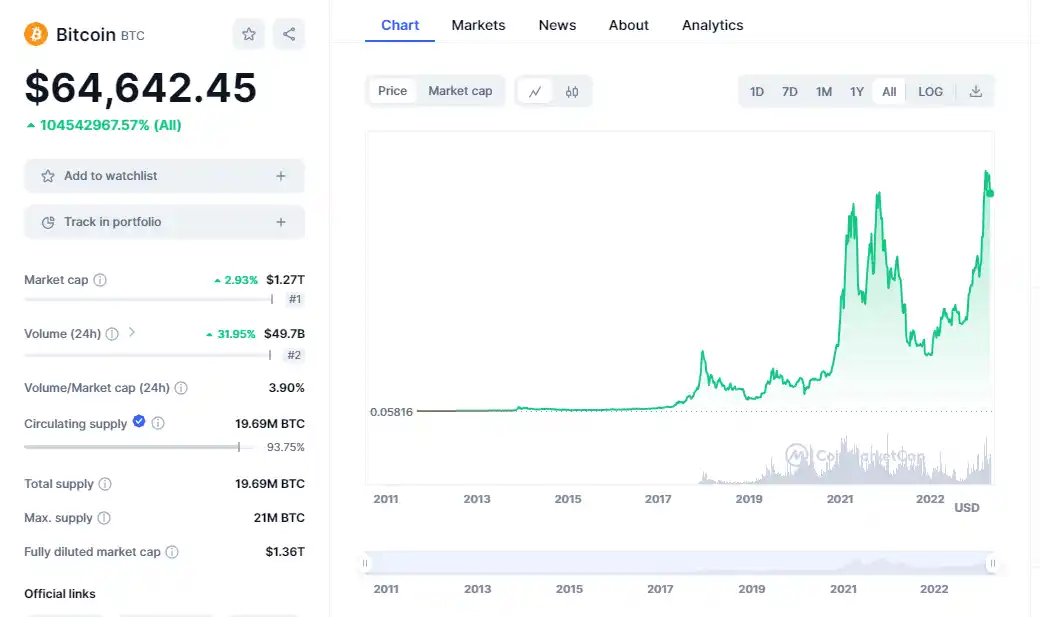

Purchasing cryptocurrencies during their presale stage allows investors to enter the crypto market at a low cost. Unlike established cryptocurrencies like Bitcoin and Ethereum, which may seem expensive with current prices around $60,000 and $3,000 respectively, presale cryptos offer a more accessible entry point.

Crypto presales occur before the tokens are available on public exchanges and aim to raise funds for new crypto projects. These early-stage investments allow investors to buy tokens at significantly lower prices than their potential future market value, providing high upside potential without requiring large investments.

For example, Ethereum’s presale in 2014 priced tokens at just $0.31 each. By 2021, the price had surged to over $4,900. Early investors in successful presales like Ethereum have seen substantial returns.

With this in mind, we have researched a number of upcoming crypto presales that have every chance of mirroring the success of Ethereum, dogwifhat, and other notable projects. These presales can be a great way to get started in the crypto space without risking large amounts of money.

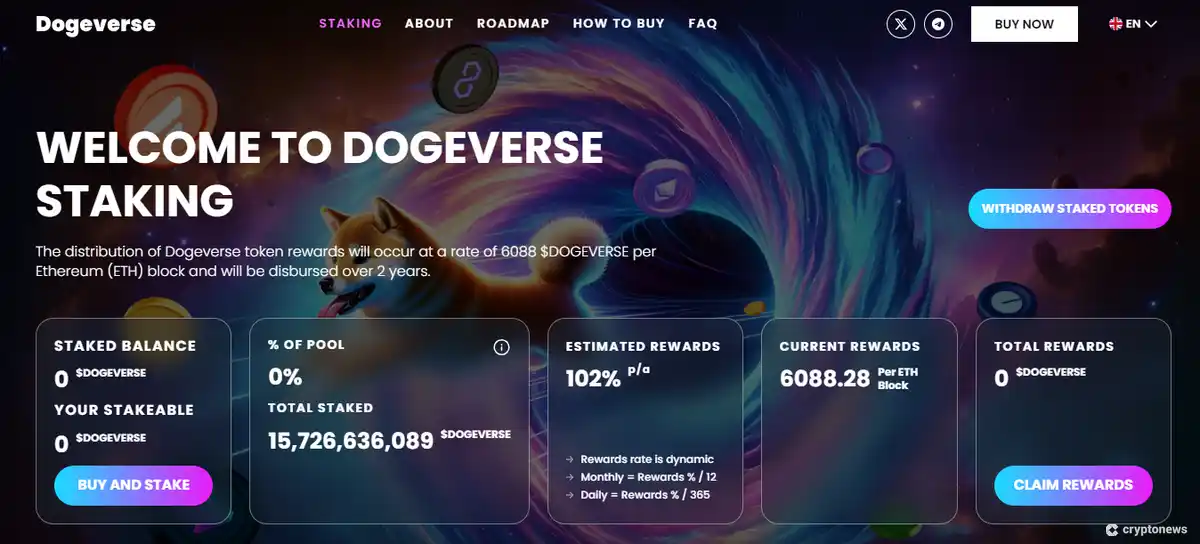

Dogeverse: The First-Ever Multichain Meme Coin

Dogeverse, an emerging multichain meme coin, has quickly captivated the crypto community by raising $13 million so far in its presale. Modeled after Shiba Inu, this token leverages its cross-chain capabilities, aiming to revolutionize meme coin functionalities across various blockchain ecosystems.

Built on a multichain network that includes Ethereum, BNB Smart Chain, Polygon, Avalanche, Base, and Solana, Dogeverse allows purchases through various cryptocurrencies, including USDT. In addition, this multichain approach avoids the energy-intensive Proof-of-Work consensus, aligning with more sustainable blockchain operations.

With plans for CoinGecko and CoinMarketCap listings and subsequent DEX and CEX listings, Dogeverse is positioned for significant growth. The platform also offers staking options on Ethereum, providing passive income opportunities to token holders.

Sponge V2: Meme Coin Offering a P2E Game and Staking Rewards

Sponge V2, the sequel to the popular memecoin Sponge V1, has a strong value proposition and solid growth numbers so far, making it one of the most popular crypto presales right now.

In the 2023 bear market, Sponge V1 registered a $100 million market cap, ensured presence in more than ten centralized exchanges, and accumulated 13,000+ holders. Sponge V2 has added even more to the proposition by introducing a play-to-earn (P2E) game.

Holders can also earn more $SPONGEV2 by staking their tokens on the official website. In terms of tokenomics, Sponge V2 spends less on marketing and more on CEX liquidity.

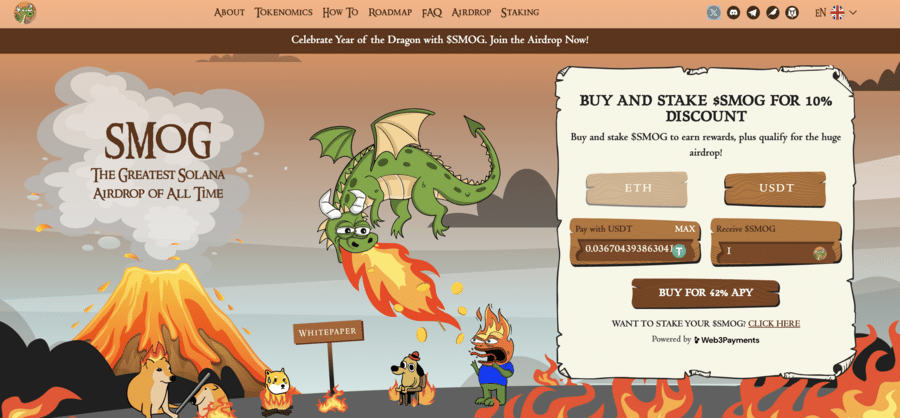

Smog: Best Alternative to a Crypto Presale, $100 Million Market Cap

Smog is a new meme token that has offered huge returns since its exchange listing. In February 2024, $SMOG was listed on the Jupiter decentralized exchange. The initial market cap was only $2 million, which soared past $100 million in just a couple of days.

This cryptocurrency promises to conduct one of the biggest crypto airdrops on the Solana blockchain. From a total supply of 1.4 billion tokens, 490 million will be offered as airdrops. Users can sign up for the airdrop campaign with Zealy and start completing tasks and challenges to earn airdrop points.

The $SMOG token can also be staked on the smart contract to generate passive income. More than 10 million tokens have been locked on the smart contract.

To promote the project, Smog is allocating 50% of the token supply for marketing purposes. Smog will be eyeing new listings on tier-one exchanges. This can help increase trading volume and offer further growth in the long-term.

2. Learn About the Crypto Market

Investors should have a good understanding of the crypto market. To get started, they should familiarize themselves with the most popular cryptocurrency terms.

When navigating the crypto space, investors will come across many new terms, such as HODL, crypto wallets, NFTs, meme coins, and exchanges, which might have a different meaning elsewhere.

It’s also crucial for investors to have a clear idea about cryptocurrency regulations in their country. Although cryptos are largely unregulated, some countries have policies that limit the trading of digital assets, and each has distinct rules regarding crypto tax.

3. Develop a Strategy

When it comes to developing a strategy to get in cryptocurrency, investors can take two approaches:

Long-Term Investing

Long-term crypto holding, often known as “HODLing,” involves buying and holding cryptocurrencies with the expectation that their value will increase over the years.

Investors in this strategy are less concerned with short-term fluctuations and more focused on the potential substantial gains in the future. These long-term investments are often less stressful than day trading, since they don’t require constant market monitoring.

Long-term holders often rely on fundamental analysis, evaluating the broader market trends and the technological potential of a cryptocurrency. This approach is more suited to those who prefer a “set it and forget it” investment style, which can be particularly appealing to beginners.

While long-term holding requires patience, it can be highly rewarding as cryptocurrencies have shown the potential for considerable appreciation over time. Investors can adjust their long-term strategies based on their financial goals and risk appetite as they become more familiar with the crypto market.

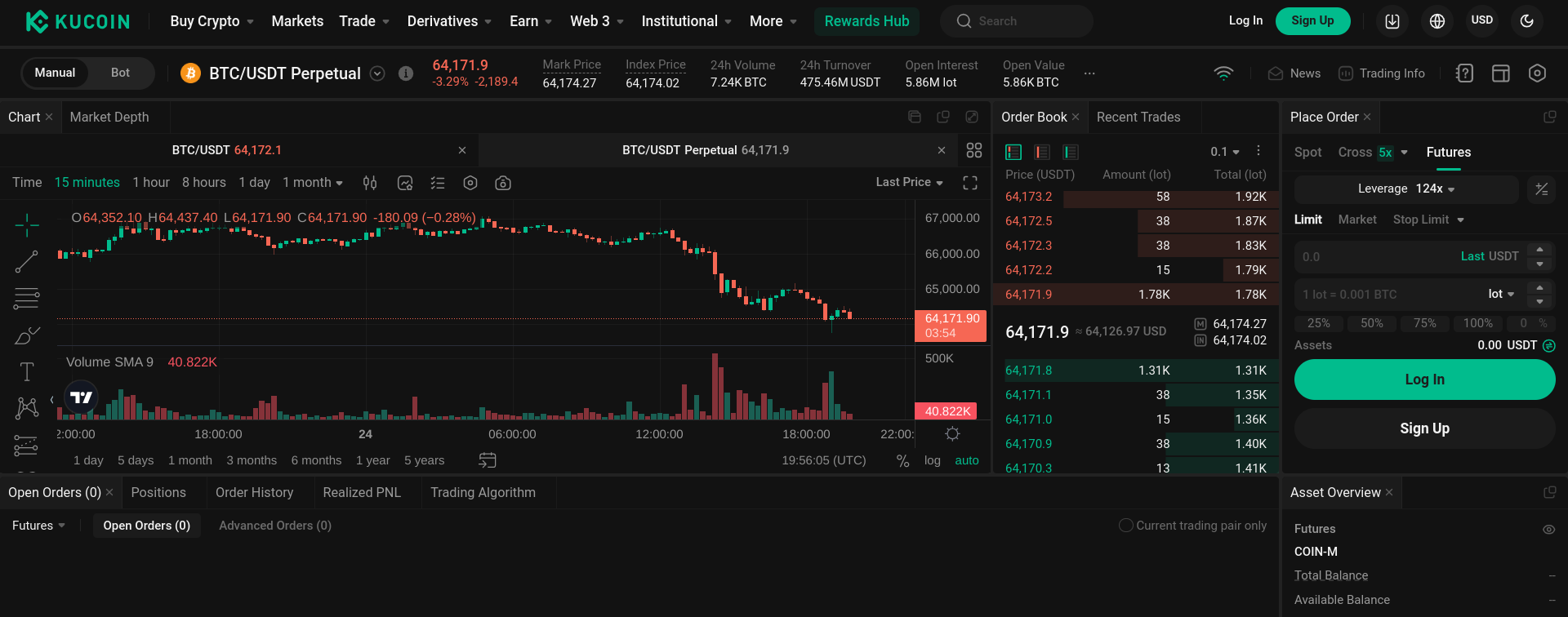

Short-Term Trading

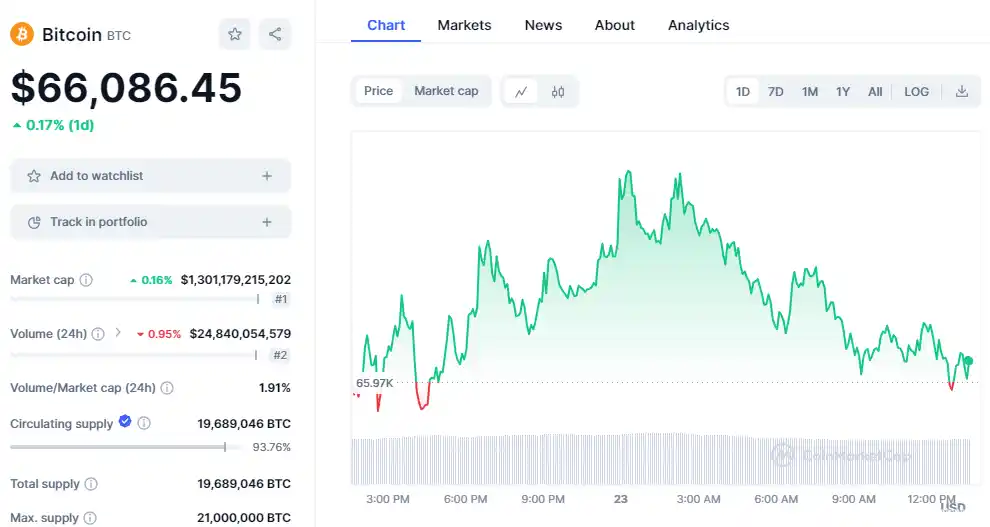

Crypto day trading involves speculating on short-term price movements to make profits. Traders open and close positions quickly, often within hours or even minutes, to capitalize on price fluctuations.

For example, a trader might buy Bitcoin expecting its price to rise by day’s end and sell it a few hours later for a small profit. These profits can accumulate from multiple trades.

Traders use various strategies, including technical analysis and crypto tools to guide their trading decisions. They also use derivatives like CFDs to profit from both rising and falling prices. Unlike long-term investors, traders focus on short-term crypto gains rather than the long-term growth potential of the assets.

Crypto trading requires a good understanding of market mechanisms and is less suited for complete beginners. As traders gain experience, they can tailor their crypto day trading strategies to fit their risk tolerance and financial goals.

4. Learn How to Store Cryptocurrency Safely

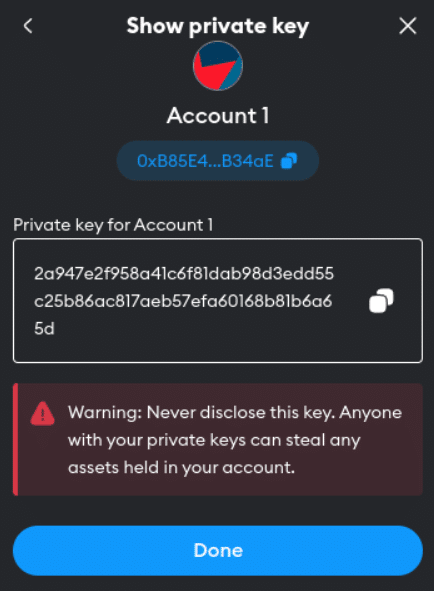

Before buying digital assets, investors and traders should learn about how to store cryptocurrency safely. Tokens are stored in crypto wallets, which essentially have two components:

- The public key is used to create wallet addresses that can be viewed by everyone. It’s made of numbers and letters and can be shared with others to receive cryptocurrencies. Public keys are automatically created when setting up a crypto wallet.

- The private key, on the contrary, is not publicly viewable — it works like a password. Investors need to have this private key to send cryptocurrencies from their wallets.

In addition, new crypto wallets also generate a seed phrase during the initial setup. This seed phrase is used to recover the crypto in the wallet in case the password is lost. Without the recovery phrase, wallet users won’t be able to access their tokens if they lose the password.

This is why it’s always necessary to keep the private key of the wallet safe. Moreover, the safety of the cryptocurrencies will also be determined by the type of digital wallet chosen.

Software wallets

Software wallets come in the form of applications that can be downloaded to a device, such as a laptop, tablet, or phone. This type of wallet comes in both custodial and non-custodial varieties.

- Custodial wallets come integrated with exchanges or brokers like eToro and OKX. They offer convenience and user support but involve third-party control over your assets, risking potential security breaches.

- Non-custodial wallets give you full control and enhanced security but require more user responsibility for managing keys and security.

Hardware Wallets

Hardware wallets are physical devices that store cryptocurrency offline, providing high security for long-term investors who hold assets for months or years.

However, they require physical access to the device for every transaction, which can be less convenient than software wallets. For that reason, hardware wallets are ideal for those with a “buy and hold” strategy, while active traders might prefer the accessibility of software wallets.

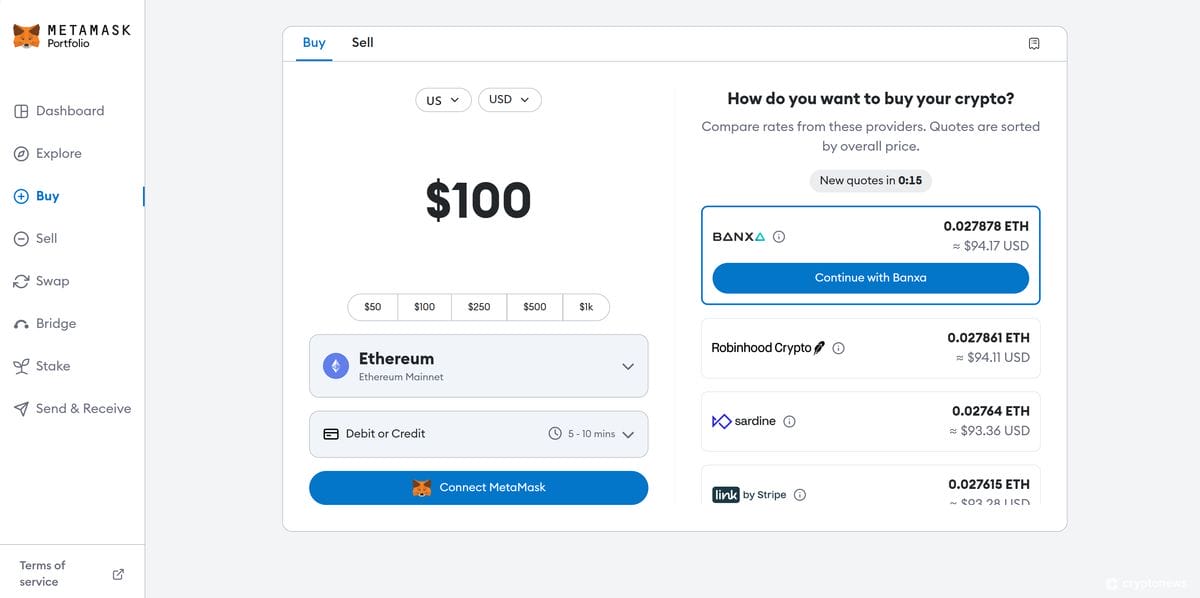

5. Choose an Exchange or Broker

Choosing the right platform is crucial when buying cryptocurrencies. The best cryptocurrency exchanges provide a mix of security, user-friendly interfaces, and a variety of trading options. Examples include:

- Coinbase, known for its beginner-friendly interface and regulatory compliance

- Binance, favored for its versatile trading options and extensive coin selection

- MEXC, which charges no spot trading fees and provides high-speed transactions

- Kraken, known for its professional-grade platform and advanced trading features

- Gate.io, which offers the largest selection of tokens compared to other CEXs

When picking an exchange, consider factors such as transaction fees and the security measures in place. Additionally, consider the liquidity of the exchange, as higher liquidity indicates more seamless transactions without significant price changes.

Lastly, ensure the exchange is compliant with financial regulations in your jurisdiction to safeguard your investments.

In addition to exchanges, you might consider using a cryptocurrency broker, which acts as an intermediary between you and the exchanges.

Unlike exchanges where you trade directly with other market participants, brokers offer a fixed price for cryptocurrencies, usually adding a premium for their services. This setup simplifies the buying process but can come at a higher cost.

When choosing a broker, look for transparency in pricing and reputation for reliability. Ensure they are regulated and offer customer support to assist with any inquiries or issues you may encounter.

6. Diversify Investments

Investing in cryptocurrencies involves inherent risks due to the market’s high volatility. A significant event can drastically reduce the market’s value in just one day. To mitigate these risks, a diversified, balanced portfolio is crucial.

This strategy involves spreading your investment across various cryptocurrencies rather than investing all in one. With a solid crypto portfolio allocation that included established coins and promising new tokens you can limit potential losses.

Additionally, incorporating different asset classes beyond crypto can protect your portfolio from significant losses if one sector underperforms. This approach reduces exposure to volatility and enhances the stability of your investments.

7. Invest With Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy where you regularly invest a fixed amount of money into an asset, regardless of its price at the time. This method reduces the impact of volatility by spreading the investment over several periods.

For example, investing $100 in Bitcoin every month, regardless of the price, averages the investment cost over time. Whether the market is up or down, the strategy prevents large losses due to poor timing and capitalizes on the potential long-term growth of cryptocurrencies.

In addition to reducing the risk of bad timing, it simplifies investing by taking the stress out of deciding the “right” time to buy and minimizes emotional investing, making it ideal for beginners.

8. Gain Exposure to Cryptocurrency Indirectly

If investing in a cryptocurrency directly doesn’t feel like the right choice, there are other ways to gain exposure to the blockchain industry, such as:

- Investing in companies connected to blockchain: Buy stocks in companies that operate in the crypto space like Coinbase, PayPal, or Square.

- Investing in crypto ETFs: This emerging asset class allows investors to gain exposure to multiple digital assets with one investment, providing diversification.

We have a guide on the best crypto ETFs that explains how exchange-traded funds work. As with any investment, crypto stocks and ETFs also carry risk. Investors should always evaluate their goals and financial situation before staking money on any crypto-related asset.

9. Boost Crypto Investments With Staking

Crypto staking is particularly appealing to long-term investors. In simple terms, instead of having the digital assets sitting idle in digital wallets, investors can deposit them into a crypto staking platform and earn interest.

Here is an example of how crypto staking works:

- Suppose that an investor has $1,000 worth of Ethereum, which is one of the best staking coins.

- They can deposit Ethereum into a crypto staking platform offering 10% annual percentage yield.

- Over the course of a year, $1,000 worth of Ethereum would yield $100 in passive crypto income.

The yield offered and the terms of staking vary from one platform to another — and not every cryptocurrency can be staked.

10. Use Leverage Carefully

Leveraging in cryptocurrency means using borrowed money from a broker or exchange to increase the potential size of an investment. For example, with a 1:10 leverage, you only invest $10 to control $100 worth of cryptocurrencies.

This can amplify profits but also magnifies losses if the market moves against you. Due to its high risk, not all exchanges offer leverage trading and it’s generally recommended that beginners avoid using leverage until they are more experienced with the crypto markets.

How to Get Into Crypto Mining

Crypto mining is the process of validating cryptocurrency transactions and minting new coins. Initially, anyone with a powerful computer and technical skills could mine cryptocurrencies profitably. However, today’s crypto mining requires significant investments in specialized hardware, high energy costs, and substantial technical knowledge.

For those seeking a simpler route, using the best Bitcoin mining sites offers a passive approach. These platforms manage the mining operations and provide returns to investors, though these returns can be small and may require a long wait to accumulate substantial cryptocurrency amounts.

Conclusion

Cryptocurrencies have emerged as a sizable force in finance. As our guide has discussed, there are many ways for investors to get into crypto and improve their chances of making profits. One of the best ways to enter the crypto market is by investing in cryptocurrencies that have low entry prices but high potential to grow.

Investors might want to consider purchasing Dogeverse, an innovative multichain meme coin. Since the start of its presale, investors have pledged over $13 million to the project, denoting high interest and momentum. The token can also be staked to earn high annual yields.

FAQs

How can a beginner start in cryptocurrency?

The first step is to learn about cryptocurrency. It’s important for beginners to know how they work and the different ways to profit from them. Once ready, investors can proceed to buy cryptocurrency via an online broker or exchange.

What is the easiest way to get into crypto?

The easiest way to get into crypto is by purchasing it through a reputable cryptocurrency exchange. Choose a platform, create an account, verify your identity, deposit funds, and buy the cryptocurrency of your choice.

How do I start investing in cryptocurrency?

To start investing in cryptocurrency:

- Choose a reputable exchange.

- Create and verify your account.

- Deposit funds.

- Research and select cryptocurrencies.

- Start with small investments to understand market dynamics.

- Consider using a secure wallet for storage.

Can you get rich on cryptocurrency?

While some investors have profited greatly from cryptocurrencies, many have lost money. To get rich with cryptocurrency, beginners need to find the best cryptos to buy and time their investments correctly, which is no easy feat.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Sergio Zammit

Sergio Zammit

Kane Pepi

Kane Pepi

Eric Huffman

Eric Huffman

Alan Draper

Alan Draper