How to Buy Bitcoin

Over the last decade, bitcoin has experienced incredible growth, evolving from the first mainstream cryptocurrency to a widely recognized digital asset. By the end of 2023, bitcoin had reclaimed its position among the top 10 global assets with an $850 billion market capitalization.

With increasing institutional acceptance, fuelled by the SEC’s decision in early 2024 to allow bitcoin spot ETFs, more people than ever are wondering how to buy bitcoin.

Despite the complexity of blockchain technology and the mainstream confusion that often comes with buying Bitcoin, it has never before been easier to purchase. That being said, first-time buyers should consider where and when to buy the cryptocurrency, as well as secure storage methods and any potential risks.

Key Considerations Before Buying Bitcoin

The question of ‘How do you buy bitcoin?’ should go hand-in-hand with an investor’s risk management strategy, with cryptocurrencies considered a high-risk investment for both new and experienced buyers. This is due, in part, to the decentralized infrastructure in which cryptocurrencies operate.

Peer-to-peer (P2P) exchange is a core concept, with cryptocurrencies and crypto companies focusing on removing centralized control from the process. This shift introduces new privacy and security risks that are not present within traditional finance. The removal of third-party intermediaries requires investors to assume control of the security, privacy, and protection of their assets, exposing them to increased vulnerabilities.

Bitcoin also operates in a highly volatile market and experiences sudden price fluctuations that can be difficult to predict or navigate. Legal and regulatory considerations add additional complexity, with cryptocurrencies operating in a widely unregulated and ever-evolving legal environment, making customer protection challenging. Read more about Bitcoin Price Prediction.

Bitcoin investments are also taxable and subject to country-dependent rules. Profits from sales, trades, or payments will typically trigger capital gains taxes, while bitcoin earned through methods such as mining or staking is immediately taxable. Although privacy is an attractive feature of cryptocurrency and bitcoin-specific investments, failure to report earnings can result in penalties and fines.

You can read more about Why Crypto Down Today

How to Buy Bitcoin

Step 1: Selecting a Trading Service or Venue

The first step for anyone considering how to buy bitcoins is to choose a suitable platform. There are many available, from traditional online brokers to dedicated crypto exchanges.

Step 2: Connect to a Payment Option

The next step for those considering how to purchase Bitcoin is to connect a payment option to the platform in question to fund the Bitcoin purchase. Users may need to provide personal details, such as legal identification or employment information, depending on the platform.

Most exchanges accept direct connections to bank accounts, and debit or credit cards, although some banks may restrict or request additional information for crypto transactions.

Step 3: Understanding Fees and Costs

Different exchanges have different fees and terms of service that may impact Bitcoin investments. Before investing, individuals should research deposit, transaction, and withdrawal fees to understand the conditions of the exchange. Some exchanges or brokers will waive fees for those buying Bitcoin for the first time.

Step 4: Placing a Bitcoin Order

Most crypto exchanges emulate features of traditional market investments, including the choice between one-time deposits or dollar-cost averaging over days, weeks or months. Users can also set stop-loss and take-profit orders to mitigate risk.

Step 5: Safe Storage

Once a user has purchased Bitcoin, it is important that they secure their assets by understanding safe storage methods. Cryptocurrencies are typically stored in wallets that facilitate the connection between a user and their public and private keys.

While most exchanges provide custodial hot wallets for automatic storage, long-term holders are advised to transfer assets to a non-custodial wallet for total ownership and control.

Where to Buy Bitcoin – An Overview

Deciding how to get bitcoins is the first step for those looking to invest. It is important to be aware of the options available, and assess these in line with your goals, risk appetite, and wider investment strategy.

Cryptocurrency Exchanges

Cryptocurrency exchanges are widely considered the best way to buy Bitcoin. While some exchanges offer thousands of cryptocurrencies, others focus only on those that are most popular. Centralized exchanges (CEXs) are operated by a centralized entity, whereas decentralized exchanges (DEXs) rely on blockchain technology to operate without intermediaries, instead using smart contracts to facilitate the automatic execution of transactions.

Traditional Stockbrokers, Trusts or Exchange-Traded Funds (ETFs)

While only a few traditional brokers currently offer cryptocurrency transactions, the landscape is evolving. Robinhood was the first traditional broker to offer bitcoin trading, and Proshares introduced the first bitcoin-linked ETF in October 2021.

Some ETFs are linked to bitcoin through holdings in cryptocurrency-related companies, while Fidelity included bitcoin investing in 401k accounts in 2022.The SEC approval for spot bitcoin ETFs in early 2024 also signals growing institutional adoption.

Cryptocurrency Apps

For those asking, ‘How do I buy bitcoin?’, it is possible to buy bitcoin directly through a cryptocurrency app, which will often take the form of a crypto wallet. Using blockchain technology, users can purchase digital assets within the project’s wallet or software.

It is vitally important that investors differentiate between custodial and non-custodial wallets to determine whether they will retain control of their own assets or whether they will need to rely on third-party management.

Peer-to-Peer (P2P) Platforms

Peer-to-peer platforms facilitate direct Bitcoin transactions between users, eliminating the need for exchanges. Users can post requests to buy or sell Bitcoin, and these platforms often utilize a reputation system based on transaction history, rather than identity. While this offers users the opportunity to compare Bitcoin prices for the best deal, it lacks the anonymity of decentralized exchanges.

Where to Buy Bitcoin

In this guide, we’ll discuss how to buy Bitcoin, including the best places to buy BTC. The most common options include cryptocurrency exchanges and brokers. Exchanges provide a platform for traders to transact with each other – or with each other’s orders more accurately. Brokers transact with the trader directly. The end transaction, however, often looks very similar because both offer a way to buy or sell Bitcoin.

Best Places to Buy Bitcoin

- MEXC: Best Crypto Exchange With 0% Spot Trading Fee and Over 1,000 Cryptocurrencies

- OKX: Crypto Exchange With Trading Bots and Bot Marketplace, and 350+ Cryptocurrencies

- Binance: World’s Largest Crypto Exchange With 350 Cryptocurrencies and Futures Trading

- Bybit: Easy-to-Use Crypto Exchange with Advanced Trading Options

Read More: How to Invest in Bitcoin UK

1. MEXC: Best Overall Crypto Exchange

MEXC is the best crypto exchange not only to buy Bitcoin but to buy over 1,000 other cryptocurrencies that aren’t listed on other major exchanges like Coinbase and Binance. Buy or trade cryptocurrencies with a 0% spot trading fee and trade crypto futures with a 0% fee for limit orders and 0.02% fee for market order. This is by far the lowest fees you can find with a crypto exchange.

Moreover, MEXC offers advanced trading tools and charts, including integrated TradingView charts, as well as order book view, which should be more than enough to cater to seasoned crypto traders.

Of course, this doesn’t mean that beginners aren’t welcome. On the contrary, beginners can easily buy Bitcoin or any other cryptocurrency either via bank or SEPA transfer, depending on the country, or by purchasing crypto with card or Apple and Google Pay via third-party services like Moonpay and Mercuryo.

Grow your crypto portfolio with MEXC Savings. This is similar to crypto staking where you lock your coins for a certain period of time to accrue interest in the form of more coins. For example, USDT has an APR of up to 8.8%, while Bitcoin has up to 1.8% APR. There are some amount limitations, though, such as you earn the maximum APR on amounts up to $300 for some coins. Make sure to read about them before you lock your coins.

Hands-off investors who don’t want to actively participate in the market and trade crypto themselves can use the copy trading feature where you can follow successful traders and let them trade your funds on your behalf. This could be a useful tool to potentially increase your portfolio in addition to buying and holding Bitcoin.

MEXC Fees and Pricing

| Trading Fee | 0% |

| Cost to buy $100 worth of Bitcoin | $0 |

| Debit card or PayPal fees | Depends on the third-party provider |

| Minimum Deposit/Trade | $50 minimum deposit via third-party providers |

Pros

- Beginner-friendly Bitcoin investing

- Over 1,000 cryptocurrencies available

- MEXC Savings with up to 8.8% APR on USDT

- Copy trading to follow successful traders

- Advanced charts and tools

Cons

- Not available in all countries

- Can’t withdraw fiat

2. OKX: Best for Earning Rewards While HODL

OKX is the second largest crypto exchange based on derivatives trading volume. This means that not only OKX is an excellent exchange to buy Bitcoin, but to trade Bitcoin and derivatives as well because of OKX’s low trading fees.

Those looking to buy Bitcoin can buy it directly on OKX with a card, Apple Pay or Google Pay once you open an account and verify it.

You can then hold it on the exchange and maybe even use OKX Earn where you lock your coins for a select period of time and earn rewards in the meantime. Currently, you can get up to 5% APR on Bitcoin with a flexible lock. This means you can unlock whenever you want.

OKX is also one of the best exchanges for spot and derivatives trading as it comes with 0.08% spot trading fee for limit orders and 0.1% for market orders. If you hold OKB coins or have a certain amount of assets in USD, you can further lower the fees.

The exchange is also famous for its bot marketplace. This means you can subscribe to trading bots or build your own and sell it to subscribers to earn additional income.

OKX Fees and Pricing

| Trading Fee | 0.08%-0.1% maker/taker fee |

| Cost to buy $100 worth of Bitcoin | $0.08-$0.1 |

| Debit card or PayPal fees | Depends on third-party providers |

| Minimum Deposit/Trade | Depends on the deposit method |

Pros

- Low-cost fees for Bitcoin purchases

- Over 350 cryptocurrencies available

- Trading bot marketplace

- High APR with OKX Earn

Cons

- Not available in all countries

- Limited customer support

3. Binance: Cheapest and Largest Crypto Exchange

The cheapest way to buy Bitcoin in this roundup is through the Binance exchange.

However, location plays an important role. In the US, traders can only access Binance.US, which has transitioned to a crypto-only exchange. To buy Bitcoin on Binance.US, you have to first load your account with USDT (a popular stablecoin valued at $1) through a third-party provider, which you can then trade for BTC (with zero trading fees). We priced this out, and the cost was close to $112 to buy $100 worth of USDT. Fees may vary based on region and network demand.

While Binance.US is easy to use, the extra step of buying crypto off-platform before you can buy Bitcoin makes it less attractive for US users than exchanges like Kraken.

If there’s a downside to Binance’s Advanced Trade, it might be that there are too many advanced features if all you need to do is buy BTC. Advanced Trade is loaded with trading tools, including margin trading, so you can trade with leverage (borrowing against your investment capital).

Other advanced features include trading bots, which can make trades for you automatically, and futures trading, which allows you to speculate on the future price of Bitcoin or other crypto assets.

But for power users, it isn’t easy to match the trading options available on Binance.com

Binance Fees and Pricing

| Trading Fee |

|

| Cost to buy $100 worth of Bitcoin |

|

| Debit card or PayPal fees | Up to 3.5% for debit card transactions |

| Minimum Deposit/Trade | $15 minimum trade |

Pros

- Low fees for simple and advanced trades

- Futures and leverage trading

- Trading bots

- Wide selection of trading pairs

Cons

- Many features not available in the US

- Can be overwhelming for newer traders

- Regulatory concerns

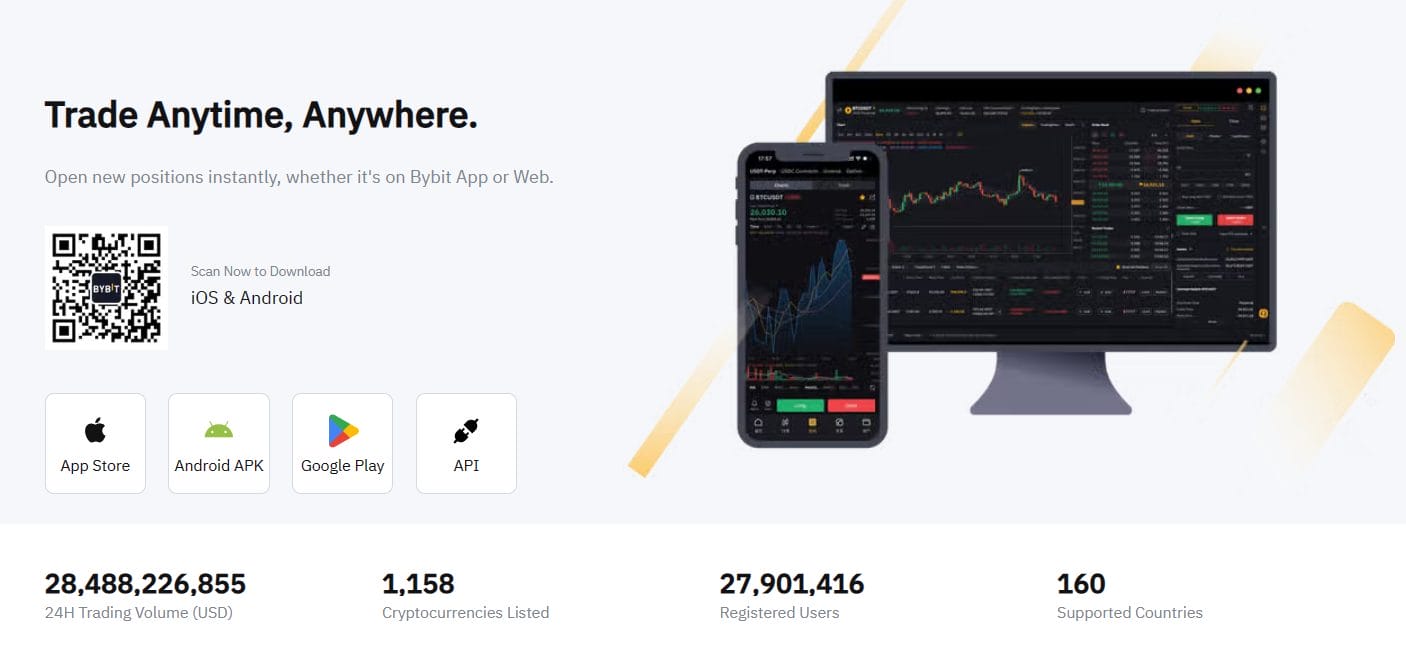

4. Bybit: Best for Advanced Trading

The Bybit exchange offers a user-friendly platform with low fees and good-quality customer service. It offers advanced trading options, including derivatives, detailed trading charts, and useful market data. The exchange supports 1,158 different cryptocurrencies, and over 20 million customers use it worldwide.

Other features include trading bots, which can automate your trading. These are even available for futures and DCA (Dollar-Cost Averaging) and use AI algorithms to find the best trading options. The exchange is a popular and reputable platform for buying Bitcoin with deep liquidity. $1,853,460,747 worth of Bitcoin has been traded on the platform in the past 24 hours.

Bybit features an Earn program with different options, including savings account, staking, dual asset, launchpool, and DeFi mining options. Currently, Bitcoin holders have three earning options:

- Flexible Savings with a 2.5%

- Dual Asset with a 95% – 997% return

- Liquidity Mining with a return ranging from 2.62% to 20.62%

It’s important to note that these accounts each have their own risks, and you should always research them properly to understand the risks.

The exchange is currently not available to users in the US, the UK, mainland China, Singapore, and Korea.

Bybit Fees and Pricing

| Trading Fee |

|

| Cost to buy $100 worth of Bitcoin |

|

| Debit card fees | Depends on the third-party provider |

| Minimum Deposit/Trade | 1 USD for Bitcoin |

Pros

- Low fees for simple and advanced trades

- Futures and leverage trading

- Free fiat deposits

- Over 1,100 cryptocurrencies

Cons

- Not available in several countries

- Some trading features are more suitable for experienced investors

Additional Ways to Buy Bitcoin

The cryptocurrency landscape is constantly evolving, and alternative ways to buy Bitcoin are regularly introduced.

Buy Bitcoin with PayPal

Users can buy bitcoin with PayPal in various ways, whether that’s by depositing funds into a cryptocurrency exchange using PayPal, or by funding their account and purchasing Bitcoin directly on the platform. The latter may be a preferred method for those familiar with PayPal’s user interface.

Alternatively, the PayPal application offers a “Checkout With Crypto” feature, enabling users to make online purchases with Bitcoin.

Buy Bitcoin with Credit Card

Investors may choose to buy bitcoin with a credit card, but this usually incurs higher transaction fees than other methods, often making it less preferable. While it has not always been widely accessible, many exchanges and credit companies now support cryptocurrencies.

Buy Bitcoin with Cash

To buy Bitcoin with cash, individuals can deposit into a Bitcoin ATM. These function like normal ATMs but connect users to a wallet, rather than a bank account to facilitate the transfer of Bitcoin.

It’s important to understand how to use a bitcoin ATM or teller service, as the process has a few more nuances than using a normal ATM. Users should always ensure they know what fees they will be charged. As is true with traditional cash machines, these can be high.

Buy Bitcoin with eToro

eToro is a trading platform that lets you invest in all major cryptocurrencies, including Bitcoin. First, you have to create and verify an account on eToro. Then, from the navigation bar on the left-hand side, click on Deposit Funds. Choose which currency you want to deposit with, insert your payment details, and click Deposit.

Then, head over to the Bitcoin page and click Invest. You can choose to Trade, which means you’ll be buying bitcoin at its current price, or Order, which means you’re placing an order to automatically buy bitcoin once its value reaches a level you choose. eToro also has a crypto wallet where you can store your Bitcoin.

Storing Your Bitcoin Safely

Anyone buying Bitcoin will need a safe place to store it. Cryptocurrency can be stored in two kinds of wallet: hot or cold. A hot wallet is typically digital, while a cold wallet is physical.

Hot Wallets vs. Cold Wallets

A hot wallet is a digital storage solution accessible through an internet browser or web-based application. Custodial hot wallets involve a third-party intermediary, such as a crypto exchange, automatically storing purchased crypto. Non-custodial hot wallets grant users complete control over their assets, including security responsibility.

Conversely, cold wallets are physical storage options. These can be encrypted portable devices or “paper wallets” (physical documents containing private and public key information). While no one wallet is fundamentally better than another, each comes with unique advantages and disadvantages.

Hot wallets are likely better for quick and proactive management of crypto assets, so are more suitable for those interested in short-term investments.

On the other hand, cold wallets offer greater long-term security. Non-custodial wallets will offer users more control over their assets, whereas custodial wallets are perhaps more beginner-friendly and come with third-party support, such as wallet or account recovery in the event of a lost private key.

How to Sell Bitcoin

Bitcoin functions as both an investment and a medium of exchange, allowing investors to spend, trade, or hold it. Unless an individual is planning to “HODL” for the long term or is interested in knowing where to use Bitcoin, having an exit strategy, typically involving selling Bitcoin, is essential.

Generally, selling bitcoin mirrors the buying process. A cryptocurrency exchange can facilitate an instant sale, while a peer-to-peer platform will allow a user to specify the desired price at which they wish to sell.

Most platforms impose a percentage fee upon selling crypto, and exchanges usually have withdrawal limits. Investors can choose to exchange bitcoin for another cryptocurrency, transfer it to a stablecoin to steady the price, use it for purchases or convert it to fiat currency for a “cash out” option.

Read more about How to Sell Bitcoin.

Bitcoin Minetrix – Innovative Stake to Mine Protocol Provides Easy Access to Bitcoin Mining

Bitcoin Minetrix ($BTCMTX) is an innovative new platform that allows $BTCMTX token holders to mine Bitcoin without having to invest in all the necessary expensive hardware.

By purchasing and staking $BTCMTX, token holders are rewarded with credits which can then be spent on cloud mining time. This means practically no barrier to entry, small upfront costs, no fixed contracts or hidden fees and investors have access to their tokens at all timers.

Alongside exposure to the accumulative price of Bitcoin, token holders also earn passive staking rewards of up to 59%.

With a mobile application currently in development, there has never been a better time to invest in the project and get your money working for you. Tokens can be unstaked at any time giving you complete contr0ol over your investment. Once unstaked, token can then be transferred to an exchange for sale, if you so wish.

Although cloud mining is nothing new, Bitcoin Minetrix eschews the need for large mining pools and expensive infrastructure.

Investing in the project is easy and within minutes you can secure your very own $BTCMTX tokens. For more information, head on over to the Bitcoin Minetrix official site.

| Presale Started | September 2023 |

| Purchase Methods | ETH, USDT, BNB, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

Final Thoughts on Bitcoin Investing

The future looks bright for investing in bitcoin. As the cryptocurrency industry moves closer towards institutionalization and decentralized finance enters mainstream consciousness, investing in bitcoin is likely to get easier and more accessible in the future.

Keep in mind that diversification is essential for risk management when investing in cryptocurrency. A well-balanced portfolio should extend further than just Bitcoin to span various coins and tokens with diverse use cases, blockchain networks, and market caps. This approach effectively spreads investments across the entire crypto market.

We have also reviewed a Bitcoin alternative – Bitcoin Minetrix ($BTCMTX). This is a quick and hassle free to get exposure to Bitcoin Mining that removes the need for large scale investment and expensive hardware.

FAQs About Buying Bitcoin

Should I Invest in Bitcoin?

Consider your investment style, personal goals, overall strategy, and risk appetite when deciding how to buy bitcoin, or even whether you should buy bitcoin. Remember, although bitcoin is less volatile than other cryptocurrencies, the bitcoin price is far more likely to fluctuate significantly compared to traditional assets.

How Much Bitcoin Should I Buy?

Bitcoin’s all-time price high reached $68,000 in 2021. Investors do not need to purchase a whole bitcoin and fractional shares allow for flexible investment. Sensible strategies involve incorporating bitcoin into a broader investment plan, perhaps buying incrementally or dollar-cost averaging to smooth price fluctuations.

When Will Bitcoin’s Value Increase?

Many investors anticipate a rise in bitcoin’s value in 2024, coinciding with the fourth halving event. Historical patterns suggest a post-halving bull run, which will likely drive Bitcoin’s price up. Moreover, many believe that the SEC approval of bitcoin spot ETFs will introduce the asset to a whole new realm of investors, and thus further increase its value.

What is Bitcoin Mining?

Bitcoin mining involves validating blockchain blocks by solving cryptographic puzzles. Miners receive bitcoin rewards upon reaching a correct solution, for helping to secure the network. This is also how new bitcoin is introduced to the circulating supply.

Read more about: What is Bitcoin

Are Bitcoin Purchases Protected by SIPC?

Historically, cryptocurrency has not been protected by the Securities Investor Protection Corporation (SIPC). However, recent SEC approval of spot bitcoin ETFs traded through SIPC-insured brokers may provide protection in case of broker bankruptcy.

What’s the Best Way to Keep Crypto Assets Safe?

Investors should take every precaution to ensure the safety of their crypto assets, including secure wallet storage. As with any form of investment, do not give away passwords or personal information, and always have a safely stored written copy of any private keys.

How do I Create a Bitcoin Wallet?

There are multiple ways to create a wallet. Exchanges often offer custodial hot wallets automatically, while other hot wallet software may require a user to install software or download an application, create an account, and safeguard their private key. Cold wallets (physical storage) require an initial hardware purchase and come with specific setup instructions.

How Does a Bitcoin Exchange Work?

Exchanging bitcoin can be accomplished through a wide variety of methods and platforms, such as a cryptocurrency exchange (a digital marketplace upon which to buy and sell bitcoin), peer-to-peer platforms, or by exchange for goods and services.

References

- Bitcoin Halving: How it works and Why it matters

- Bitcoin (BTC) price per day from October 10, 2020 to April 2024

- Bitcoin ETFs, Coinbase, And Real World Assets: 2024 Intersecting Trends

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell