The Most Popular Cryptocurrency Terms

The crypto world has its own alien language, a haphazard collection of crypto terms, jargon, slang, and abbreviations that can make topics more challenging to understand. If you’re new to the crypto space, crypto terms like HODL and FUD likely add more confusion than clarity.

We created this crypto glossary to explain the most common cryptocurrency terms, offering plain English explanations of cryptocurrency definitions.

Cryptocurrency Terms

Without further ado let’s begin exploring the most popular crypto terms used by experienced and beginner traders in 2024:

All-Time High / All-Time Low

An all-time high refers to the highest price a cryptocurrency has ever reached, whereas an all-time low refers to the lowest price. All-time highs and all-time lows also occur in other investment markets, such as stocks, indexes, and commodities.

Altcoins

The term altcoins refers to cryptocurrencies other than Bitcoin. Altcoins include other well-known cryptocurrencies, such as Ethereum, as well as thousands of lesser-known coins and tokens.

Atomic Swap

Atomic swaps, sometimes called cross-chain atomic swaps, are transactions in which users can exchange tokens from different blockchains in one transaction and without a third-party intermediary. The term atomic refers to the all-or-none nature; the transaction completes in full – or it reverts. The process uses smart-contract “vaults,” computer programs that run on blockchain networks, to escrow the transaction.

Bear Market

A bear market occurs when an asset or asset class falls in value by 20% or more and continue to decline. However, the term is often used more generally when market sentiment is down and the investment community sees further declines on the horizon. Bearish sentiment, for example, describes a pessimistic outlook on the part of investors.

Block

Blocks are containers for transactions or, more simply, groups of transactions. Bitcoin Block 825,353, for example, contains 3,329 transactions. The prior block contained 2,021 transactions. These blocks, along with all prior blocks, connect to form the Bitcoin blockchain.

Blockchain

A blockchain is a decentralized ledger, a way of tracking balances and transactions on a crypto network by linking “blocks” of transactions. Crypto networks use a cryptographic algorithm to generate a hexadecimal (letters and numbers) “hash” value for each block. This hash becomes part of the next block, which connects the blocks to form a (block)chain.

Block Reward

A block reward refers to cryptocurrency awarded to miners or validators that successfully add blocks to the blockchain. Block rewards may include newly minted cryptocurrency or transaction fees paid by network users, depending on the protocol for each blockchain.

Bull Market

When an asset rises in value by more than 20% and continues to rise, it’s called a bull market. The term can refer to individual assets but is more commonly used in the context of asset classes or market segments. Bullish sentiment refers to when investors are optimistic about future prices.

Cold Storage

The crypto term cold storage refers to a method of generating and storing the private keys to a crypto wallet in a way in which the keys are not exposed to the internet. The alternative would be a hot wallet, in which the private keys are stored on a device that connects to the internet, possibly increasing risk.

Consensus

In a crypto context, consensus refers to agreement amongst network nodes (specialized computers) regarding the state of the blockchain and the validity of transactions. Crypto networks use various methods to reach consensus. For example, Bitcoin uses proof of work (PoW) as its consensus mechanism, whereas the Ethereum network uses proof of stake (PoS).

Cross-Chain

Each blockchain is a record of transactions on that network. Cross-chain refers to transactions or interactions between individual blockchains. The Cosmos network, for example, was built as a hub to enable cross-chain transactions between compatible blockchains.

Cryptography

Crypto gets its name from cryptography, which is a way of encoding or “encrypting” information that can’t be easily deciphered. For example, Bitcoin uses a type of encryption called SHA-256, which takes a block or information and converts it into a 256-bit value, expressed as a 64-character string of letters and numbers called a hash.

Cryptocurrency Exchange

Cryptocurrency exchanges are marketplaces where traders can exchange traditional (fiat) currencies for cryptocurrencies or exchange one cryptocurrency for another. Exchanges run by companies, such as Coinbase or Binance, are called centralized exchanges, sometimes abbreviated as CEX.

dApp

A decentralized application, also called a dApp, refers to an application often made of several smart contracts that run on a blockchain network. Because there is no owner, management team, or board of directors, a dApp is considered decentralized. The popular Aave lending app, for example, uses decentralized governance to let AAVE token holders vote on changes to the protocol.

Decentralized

The crypto term decentralized refers to apps or blockchain networks in which the community makes the decisions and or in which validation of transactions is not under the control of one group or person. Decentralized can be a subjective term in crypto, however, measured in degrees rather than absolutes. For instance, an estimated one million plus Bitcoin miners operate worldwide. By comparison, the BNB Chain relies on 21 approved validators.

Decentralized Autonomous Organization (DAO)

A Decentralized Autonomous Organization, often called a DAO, refers to a voting body that governs a protocol. For example, the Arbitrum network is governed by the Arbitrum DAO. People or organizations that hold the ARB governance token can propose changes and vote on proposals.

Decentralized Exchange (DEX)

A DEX, or decentralized exchange, is a platform that allows users to exchange cryptocurrencies without an intermediary. Most DEXs use an automated market maker (AMM) that automatically adjusts the price of tokens in swap pools based on the supply and the amount removed from the pool. In effect, each token costs more than the prior token. If swap pool prices diverge significantly from outside markets, bots take the other side of the trade, capitalizing on the arbitrage opportunity.

DeFi

DeFi is short for decentralized finance, referring to applications that run on blockchain networks that can replicate much of the functionality found in traditional finance, including lending and borrowing. Because these apps run on the blockchain and because they don’t require human intermediaries, they are called decentralized. However, while many well-known DeFi applications are decentralized and run by the community, some dApps may still be controlled by an individual or group.

Distributed Ledger Technology (DLT)

Distributed ledger technology refers to the mechanism at the heart of blockchains, replicating records of transactions on tens, hundreds, or even thousands of computers across the world. A ledger is a record of transactions. Blockchain networks replicate this ledger on individual computers on the network called nodes, distributing the record of transactions rather than storing the ledger on a centralized server.

DYOR

DYOR is short for Do Your Own Research, encouraging others not to take anyone at their word but to instead research a cryptocurrency or protocol independently and reach their own conclusions.

ERC-20

Ethereum Request for Comment 20 (ERC-20) refers to an approved token standard for Ethereum tokens. ERC-20 tokens are fungible, meaning that one token of the same type is interchangeable with any other token of the same type. For example, each Chainlink (LINK) token is the same as the next, similar to how US dollars are interchangeable.

ERC-721

Ethereum Request for Comment 721 (ERC-721) refers to the Ethereum token standard for non-fungible tokens (NFTs). Unlike ERC-20 tokens, ERC-721 tokens are not interchangeable and cannot be divided. NFTs are best known for images, like the Bored Apes NFT collection, but can also represent ownership in nearly any asset.

EVM

EVM stands for Ethereum Virtual Machine. The EVM is the runtime environment on the Ethereum network that executes smart contracts — computer programs written in the Solidity programming language that give Ethereum its advanced capabilities.

Fiat

The term fiat means “by decree,” with roots in Latin, which translates to “let it be done.” In a crypto context, fiat refers to government-issued currencies like the US dollar or the British pound, which are accepted as money because respective governments have declared them to be official currencies.

Fork

A fork in crypto often refers to a copy of existing code to form a new crypto network or protocol. For example, Litecoin was a fork of Bitcoin with some modifications, and the Seamless Protocol is a fork of the popular Aave V3 decentralized lending app. Forks can also refer to splits in blockchains to implement changes or due to community disagreement (or votes). For example, the current Ethereum blockchain came from a hard fork, meaning less than full agreement, following the 2016 DAO Hack. Much of the community voted to fork the chain, erasing the hack, although the original chain still exists as Ethereum Classic.

FOMO

Fear of Missing Out (FOMO) describes the anxiety felt when you might not be included. In a crypto context, it’s common to see additional buying in response to market upticks as investors fear missing out on the next big price move.

FUD

Fear, Uncertainty, and Doubt (FUD), often used intentionally, can cast shadows on a crypto asset, organization, or protocol. The term isn’t unique to crypto, and FUD is seen in other environments as well, where manipulation of opinions may create an advantage. FUD can be used as a manipulative tool or as a way of affirming a losing position by casting doubt on other options.

Fundamental Analysis

Fundamental analysis provides a way to measure the value of a crypto asset. However, crypto fundamental analysis differs from analysis for traditional assets like stocks in which debt, cash flow, and profit play key roles. Commonly considered metrics include adoption rates, revenue, supply and demand, available yields, and how the asset compares against competing projects.

Gas

The term Gas refers to the “fuel” for computational power to run smart contracts or make transfers on Ethereum. However, the term is also used with other blockchains, such as Cosmos Hub. On the Ethereum network, gas fees are paid with ether (ETH).

Gwei

Gwei stands for gigaWei, a denomination of ether on the Ethereum network. One gwei equals one-billionth of one ETH. A wei is the smallest denomination of ETH, with one billion wei in each gwei. Many popular crypto wallets and protocols post gas prices in gwei as a tool to help users understand whether the network is busy. Gas prices increase as more users compete for computing resources, often making it prudent to wait until gas prices decrease.

Halving

A halving often typically refers to Bitcoin’s four-year cycle in which the supply of newly minted bitcoins is cut in half. Bitcoin will continue to cut new supply by half after every 210,000 blocks until 2140 when the protocol will no longer produce new bitcoins. Other cryptocurrencies also use halving cycles, including Litecoin. Dogecoin initially used a halving schedule as well, although later changed to allow an unlimited supply.

Hash Rate

Hash rate refers to the computational power of a cryptocurrency network — better described as its number of “guesses” per second. However, individual mining nodes also have a hash rate. Proof-of-work protocols like Bitcoin, Monero, and Kaspa add new blocks through mining, a process of generating cryptographic hashes until a miner finds the correct hash to reflect the block header and the appended nonce (number used only once).

HODL

Initially just an intentional misspelling of “hold” that became popular on social media, HODL later took on a more specific meaning of “Hold for dear life.” The term is often used amongst Bitcoin and crypto holders, suggesting the asset will be worth much more in the future and that selling now is out of the question, regardless of price moves.

ICO (Initial Coin Offering)

An initial coin offering (ICO) is the initial launch of a cryptocurrency coin or token to raise funds for a proposed project. Unlike similarly named IPOs, in which public stocks launch in an Initial Purchase Offer and can be traded immediately, ICOs take place before coins or tokens reach exchanges.

KYC

is an initialism for Know Your Customer or Know Your Client. The term refers to regulations that require financial institutions to confirm the identity of customers. KYC and anti-money laundering (AML) regulations direct centralized financial platforms to collect a picture ID, such as a driver’s license or passport, as well as name, proof of address, and social security number.

Layer 2 Solutions

Layer 2 (L2) networks like Arbitrum or Base help reduce cost, increase efficiency, or add functionality for layer 1 networks. Ethereum is an example of a layer 1 (L1) network, also sometimes called a base layer. A layer 2 network lets users transact, often with lower costs and faster speeds, later passing the transaction back to the base layer for security. The concept is similar to express lanes on highways that later connect to the main highway.

Ledger

A ledger is a record of transactions, much like a bank statement. Crypto networks use a distributed ledger, meaning it’s stored on multiple computers and records transactions in all accounts. This approach helps prevent double-spending as the ledger is updated with new transactions.

Liquidity

The term liquidity refers to the ability to transact readily. In a cryptocurrency context, liquidity typically refers to supply or open orders. For instance, fixed price limit orders on crypto exchanges provide liquidity because they offer open orders other trades can buy or sell against. On decentralized exchanges, users who supply tokens to “liquidity pools” create swap inventory for other users.

Limit Order

A limit order is a fixed-price buy or sell order used on an exchange. Limit orders are also called maker orders because they make liquidity available for other traders.

Margin Trading

Margin trades use existing balances as collateral to borrow against and make larger trades. While the strategy can amplify gains, as leverage increases, the risk of liquidation also increases if the market direction moves against your trade.

Market Cap

Short for market capitalization, market cap refers to the total value of the circulating supply of coins or tokens for a given project. For example, Bitcoin’s market cap of $835 billion is based on a circulating supply of about 19.6 million bitcoins.

Market Order

Also known as taker orders because they take liquidity off exchanges, market orders use a trading amount rather than a fixed price, buying or selling against existing (fixed-price) limit orders in the order book.

Mining

Mining refers to the process of creating new blocks and validating transactions in a proof-of-work consensus protocol. For example, in Bitcoin mining, computers running specialized software use computational power to solve for a hash, an encrypted value. Once a miner finds the correct hash, it can build the next block of transactions and receive a mining reward paid in bitcoins.

Mining Pool

A mining pool combines the hashing power of a group of miners to increase the chances of earning mining rewards. As mining becomes more competitive, the odds of finding the next block when solo mining becomes less likely. Mining pools aggregate the computing power and then distribute mining rewards based on the hashing power contributed by each miner.

Multisig (Multisignature)

Multisig refers to transactions that require two or more crypto wallet signatures from different addresses to execute. Multisignature wallets are the most common usage, in which users can set a requirement for which wallets can approve transactions and how many signatures are required. While less convenient, multisig wallets offer more security and the ability to share wallets safely.

NFT

NFT stands for non-fungible token. Fungibility refers to interchangeability. For instance, one US dollar is the same as the next, making US dollars fungible. Non-fungible tokens are unique and can’t be divided. However, it is possible to have NFTs that look the same and have similar values. For instance, an NFT series in which individual NFTs only differ by series number may see similar market values. NFTs are most commonly seen as images, such as the Pudgy Penguins NFT collection, but can also represent other types of property, including digital assets in games. Many DeFi protocols, like Uniswap and Aerodrome, use NFTs to represent staked positions on the protocol.

Network Fees

Often called transaction fees, network fees refer to the cost of completing a transaction or using computer resources on a crypto network. In a Bitcoin transaction, for example, users pay a network fee (sometimes called a mining fee for proof-of-work networks) to send bitcoins from one wallet address to another. On Ethereum and some similar networks, network fees are also referred to as gas fees.

Node

If you visualize a network using lines to connect computers, each point on the network is a node, a computer. In a crypto context, nodes are computers that aid in consensus. Some nodes carry a full copy of the blockchain, while others hold a pruned version of the ledger, holding only the most recent transactions.

Nonce

A nonce, short for a “number used only once,” lies at the heart of proof-of-work consensus blockchains like Bitcoin. The nonce is randomly generated and becomes part of a block hash (an encrypted value). Miners attempt to guess the block hash, which includes the nonce as a variable. When a miner succeeds, and the network agrees, the miner bulbs the next block or transactions.

On-Chain Governance

On-chain governance refers to the voting system used by decentralized blockchains to manage the chain or implement changes. However, this process varies amongst blockchains. Ethereum, for example, uses Ethereum Improvement Proposals (EIPs), in which ETH holders can propose and vote on changes to the network. Bitcoin, however, implements changes through Bitcoin Improvement Proposals (BIPs), the Bitcoin Core software, in which individual nodes can choose to adopt a change by updating their Bitcoin Core version to a version that supports the change.

Oracles

In crypto, oracles refer to trusted sources of information from the outside world. Blockchains are limited to the data they contain, typically transactions. When a transaction requires data from another source, an oracle provides the information so the transaction can be completed based on that data.

Paper wallet

No longer in favor, paper wallets refer to a crypto wallet in which the recovery phrase is stored offline, on paper. However, many tools used to generate a paper wallet require online access, turning a cold wallet (not exposed to the internet) into a hot wallet (exposed to the internet).

Peer-to-Peer (P2P)

Peer-to-peer refers to crypto transactions that occur without an intermediary, such as an exchange. Platforms like Bisq offer a popular way to buy bitcoins using traditional currencies or supported cryptocurrencies like ETH, LTC, or XMR.

Private key

Crypto wallets use private keys and public keys, the first of which controls the assets held at a blockchain address. A public key is derived from a recovery seed phrase, a set of words (usually 12 or 24). As the name suggests, a private key (and its recovery phrase) should always be kept secret because the private key allows anyone to send or spend the crypto controlled by the key.

Proof of Stake

Proof of stake (PoS) is a consensus mechanism used to validate transactions on blockchain networks. In proof-of-stake blockchains, node operators and users deposit cryptocurrency as collateral to insure against improper behavior by individual validator nodes. As validators generate new blocks, the validator earns a block reward. On many networks, individual stakers earn a proportional share of staking rewards.

Proof of Work

Proof of work (PoW) refers to the consensus mechanism — used by Bitcoin, Litecoin, and several other cryptocurrencies — that requires miners to invest computational resources to solve for a nonce (number used only once). The process can be costly, making it nearly impossible to change a completed transaction.

Public key

A crypto wallet public key refers to the code used to generate public wallet addresses. These are the addresses shown publicly on the blockchain. Both private and public keys derive from the same source: the seed phrase.

Sats or Satoshis

Satoshis refer to the smallest denomination of bitcoin. Each bitcoin equals 100 million satoshis (sats).

Scalability

In a crypto context, scalability refers to the ability to process transactions with acceptable speed and cost as network demands increase. The term also serves as the base for “scalability solutions,” which refers to various ways to improve throughput by enhancing layer 1 networks or using layer 2 networks that then pass transactions back to the layer 1 for security.

SegWit

Short for Segregated Witness, SegWit refers to a Bitcoin soft fork that improves transaction speed and costs by increasing block capacity. SegWit served as an important upgrade to increase network throughput while setting the stage for Taproot, another soft fork that brought faster transactions and additional features.

SHA-256

SHA-256 (Secure Hash Algorithm 256-bit) is the hashing algorithm at the heart of Bitcoin, Bitcoin Cash, Bitcoin Satoshi’s Vision, and other blockchains. The algorithm takes an input of any size and converts it into a 256-bit, 64-character hash value.

Sharding

Popularized by networks like Cardano and Polkadot, sharding is a scaling solution that splits the main blockchain into interconnected networks, or “shards.” This strategy allows transactions to process in parallel before being stored on the main blockchain ledger.

Smart Contracts

A smart contract is a computer program that runs on a blockchain network. Pioneered by Ethereum, smart contracts bring the ability to perform transactions conditionally, birthing the industries of decentralized finance and decentralized exchanges.

Solidity

Solidity is a programming language designed for writing smart contracts on Ethereum and other EVM-compatible networks.

Stablecoin

A stablecoin refers to a cryptocurrency token that tracks the value of another currency or commodity. For example, USDT (Tether), USDC (US Dollar Coin), and DAI are all pegged to the US dollar. Each token uses asset backing to maintain its peg.

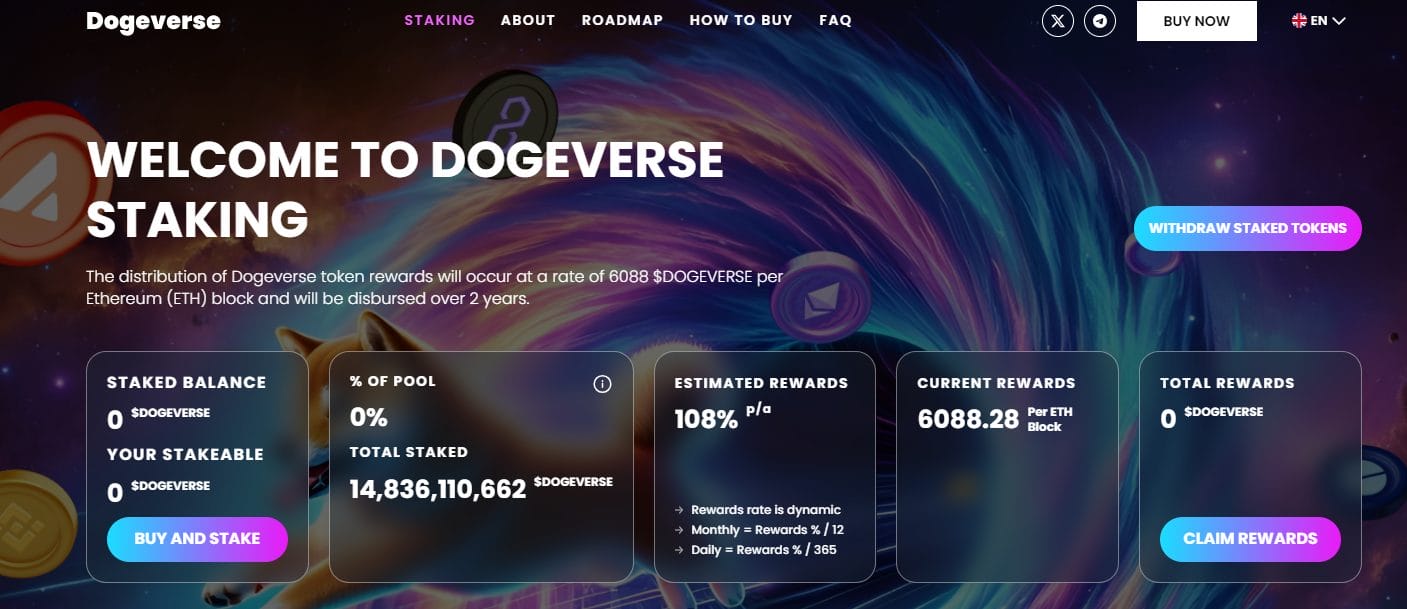

Staking

Staking refers to locking cryptocurrency in a smart contract to support validation on proof-of-stake networks, such as Ethereum. However, the term is also used in connection to certain protocols rather than networks as a whole. For instance, Aave, a popular lending protocol, supports staking to insure losses in the event of rapid market changes. Staking general provides a yield paid in cryptocurrency.

TA or Technical Analysis

Technical analysis describes the use of chart indicators to predict market trends and and potential price moves. The process includes identifying support and resistance price levels as well as patterns that can forecast future price direction.

Testnet

A crypto testnet is a testing platform used by new blockchain projects before launching a mainnet (main network) or to test new features and changes before deploying to an existing mainnet.

Token

Tokens refer to digital assets that represent ownership. Typically, the term refers to assets that depend on a host blockchain rather than the primary asset for the blockchain (a coin). For example, the Aave (AAVE) token depends on its host networks, including the Ethereum blockchain, although the Aave token does not contribute to validation on the blockchain.

Tokenization

In crypto, tokenization refers to the process of using crypto tokens to represent ownership of real-world assets, allowing them to be used on a blockchain. For example, tokenized real estate promises to make properties or property cash flow available in an easily tradable token form.

UTXO

UTXO stands for Unspent Transaction Output. In short, it’s the change left over after making a transaction on Bitcoin or another blockchain that uses UTXOs. If you have one bitcoin that came from a single transaction and spend 0.5 bitcoin to buy a used car, the remaining 0.5 bitcoin is sent back as change in the form of a UTXO.

Validators

Validators are computers running specialized software to verify transactions on proof–of-stake blockchain networks.

Volatility

Volatility refers to the degree of price movement in crypto assets. Most cryptocurrencies would be considered to be high-volatility assets because the price can change meaningfully in a short period of time. However, as crypto markets grow, volatility may decrease as the trading market increases.

Wallet

A crypto wallet is an app or device that holds the private keys that control crypto assets at a specific address on the blockchain. Unlike a real wallet, crypto wallets don’t hold money. Instead, they hold the keys that control the money – or crypto assets in this case.

Whale

A crypto whale refers to a person or entity who controls a significant amount of cryptocurrency, often enough to sway markets.

White Paper

In crypto, a white paper is often the first step to launching a cryptocurrency network. The white paper describes the network, often the problems it aims to solve, and its features and mechanisms.

Wrapped Tokens

A wrapped token is a representation of an asset from outside the blockchain. For example, wrapped Bitcoin (wBTC) allows users to access the value of their BTC on networks that don’t support BTC natively, like Ethereum. The process locks BTC to create an equal amount of wBTC, which can then be used on other networks. Many exchanges also support exchanging BTC for wBTC.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Kane Pepi

Kane Pepi

Viraj Randev

Viraj Randev