Best Crypto Exchanges and Trading Platforms in April 2024

After reviewing dozens of crypto trading platforms, we’ve put together a list of the best crypto exchanges in 2024, based on their coin selection, trading fees, trading tools, user experience, security, reputation, and more.

Additionally, we’ll discuss everything you need to know about crypto exchanges, including how they work, the differences between centralized and decentralized exchanges, and how to choose the best crypto trading platform for you. Let’s dive in.

The Best Crypto Exchanges and Trading Platforms in April 2024

Listed below are the top crypto exchanges and trading platforms in April 2024:

- eToro — Overall best crypto exchange

- Kraken — Best for experienced crypto traders

- Gate.io — Best for niche tokens

- Coinbase — Best for beginners

- MEXC — Best for spot trading with 0% fees

- OKX — Offers a feature-packed crypto wallet

- Binance — Best for wide selection of order types

- Bybit — Best for instant trade execution

- PrimeXBT — Best for margin trading

- Margex — Best for no-KYC sign-up

- KuCoin — Best for crypto staking

- BingX — Best crypto social trading network

Top Crypto Exchanges and Trading Platforms Reviewed

To select the best crypto exchanges and trading platforms in 2024, we rated them based on the number of available coins, trading fees, trading tools, user experience, security, reputation, and more.

1. eToro — Overall Best Crypto Exchange

- Tradable Coins: 80+

- Minimum Deposit: $10

- Transaction Fees: 1% + spread

- Trading Limits: Yes

Why We Chose It

eToro is our pick as the overall best crypto exchange because it has over 80 cryptocurrencies available, covering all major coins, comes with a proprietary wallet, and offers users a handy copy trading tool. Plus, with over 30 million users, it’s an established and secure crypto trading platform.

Overview

Founded in 2007, eToro gives you access to over 80 cryptocurrencies, as well as stocks and ETFs. In addition, this crypto trading platform has a well-designed interface that’s easy to navigate and ideal for beginners and experienced users alike.

In total, eToro gives you access to over 5,000 financial products, including its famous CopyTrader tool. This award-winning technology allows you to copy the portfolio of successful crypto traders. It can also help you sharpen your trading skills with a $100,000 demo trading account.

eToro has a minimum deposit of just $10 and a flat fee of 1% for crypto spot trading, making it easy to start trading right away, without having to grasp complex trading fee structures.

Finally, when it comes to security, privacy, compliance, and customer service, eToro maintains some of the highest standards in the industry. With over 30 million users, it’s one of the most established crypto exchanges.

Pros

Cons

2. Kraken — Best for Experienced Crypto Traders

- Tradable Coins: 200+

- Minimum Deposit: $1

- Transaction Fees: 0% to 0.4%

- Trading Limits: Yes

Why We Chose It

We chose Kraken as the best crypto exchange for experienced users thanks to its professional-grade trading platform, Kraken Pro. It also offers margins and futures trading, advanced order types, and some of the lowest trading fees in the industry.

Overview

Established in 2011, Kraken was a pioneer in the industry. It allows you to purchase over 200 tokens using nine fiat currencies, at lower instant buy fees than most crypto exchanges.

Its main platform caters to users of all levels, but Kraken Pro is ideal for experienced and professional traders. The Pro dashboard provides you with:

- High-speed execution

- 13 order types

- Order books with detailed information

- Customizable chart analysis tools

With Kraken, you can do crypto margins trading with up to 5x leverage and execute crypto derivatives trading strategies. It also offers 100+ multi-collateral futures contracts and API integration, allowing you to automate your trading strategies with custom bots.

Kraken has built a reputation for robust security and adherence to regulatory standards. With features like two-factor authentication, cold storage for the majority of funds, and regular security audits, it ensures your crypto assets are safeguarded.

Pros

Cons

3. Gate.io — Best for Niche Tokens

- Tradable Coins: 1,700+

- Minimum Deposit: $1

- Transaction Fees: 0% to 0.1%

- Trading Limits: Yes

Why We Chose It

Gate.io is one of the best crypto exchanges, giving users access to the widest variety of cryptocurrencies. With over 1,700 tokens available, including emerging tokens and popular assets, like BTC and ETH, Gate.io caters to all traders, from newcomers to seasoned investors seeking niche assets.

Overview

Launched in 2013, Gate.io has a reputation for reliability and safety, with over 10 million registered users worldwide. Its comprehensive services extend beyond trading, encompassing decentralized finance, research, venture capital, and wallet solutions.

With a daily trading volume exceeding $4.6 billion, Gate.io offers an expansive range of over 1,700 cryptocurrencies, making it one of the most diverse exchanges in the industry.

Additionally, the platform prides itself on industry-leading security measures, including audits demonstrating 100% proof of reserves and compliance with regulatory standards across 224+ countries.

Gate.io’s commitment to security extends to its innovative GateChain, a next-generation public chain focusing on asset security and decentralized transactions.

This crypto trading platform caters to both newbies and experienced traders with its user-friendly interface and advanced trading features, including leveraged trading, futures contracts, and copy trading.

Pros

Cons

4. Coinbase — Best for Beginners

- Tradable Coins: 200+

- Minimum Deposit: $2

- Transaction Fees: 0% to 0.6%

- Trading Limits: Yes

Why We Chose It

Coinbase stands out as the best crypto exchange for beginners. Its user-friendly interface simplifies the buying, selling, and trading process. With robust security measures and educational resources to guide new users, Coinbase offers a secure and informative platform to start your crypto journey.

Overview

Coinbase is the best crypto trading platform for beginners due to its simplicity and extensive support system. Founded in 2012, it has evolved into a publicly traded, decentralized exchange serving over 100 countries and facilitating access to over 200 cryptocurrencies.

Its platform mirrors the intuitive navigation of online banking apps, making it easy for new users to get into crypto trading. Coinbase also comes with robust security measures, including FDIC insurance for U.S. dollar balances and digital fund insurance.

Trading fees, though competitive, can be steep for small-scale traders, ranging up to 0.60% depending on your trading volume. Beyond trading, Coinbase offers an NFT marketplace and opportunities for passive earning on over 100 assets.

Pros

Cons

5. MEXC — Best for Spot Trading With 0% Fees

- Tradable Coins: 1,700+

- Minimum Deposit: $1

- Transaction Fees: 0%

- Trading Limits: Yes

Why We Chose It

MEXC stands out with its 0% maker and taker spot trading fee, 0% futures maker fee, and 0.02% taker fee. In addition, with a vast selection of over 1,700 tokens and 2,600 trading pairs, MEXC caters to the needs of traders worldwide.

Overview

With its 0% spot trading fees, MEXC merges user-friendliness with unbeatable cost-efficiency. This crypto trading platform offers a selection of over 1,700 tokens and 2,600 trading pairs, while boasting a transaction capability of up to 1.4 million operations per second.

At the heart of MEXC’s appeal is its fee structure, offering 0% fees for both ‘maker’ and ‘taker’ trades in spot trading, and an attractive 0% futures maker fee with a mere 0.02% taker fee. Beyond spot and margin trading, MEXC offers ETF listings, futures, and more.

The platform also stands out in futures trading, supporting up to 200x leverage in USDT-M perpetual futures, with a highly capable trading engine underpinning its performance.

For those new to trading or looking to practice, MEXC offers a demo trading feature, alongside a variety of staking and DeFi services for passive income.

Security-wise, MEXC has comprehensive measures in place to protect users’ funds and data, while also offering non-KYC accounts to those who prioritize anonymity.

Moreover, the platform’s mobile app replicates the website’s functionality, ensuring a seamless trading experience on the go. While MEXC excels in many areas, there’s room for improvement in educational resources for beginners and direct fiat currency exchanges.

Pros

Cons

6. OKX — Offers a Feature-Packed Crypto Wallet

- Tradable Coins: 320+

- Minimum Deposit: €1

- Transaction Fees: 0.08% to 0.1%

- Trading Limits: Yes

Why We Chose It

OKX made it into our list of the best crypto trading platforms and exchanges due to its feature-packed crypto wallet. Supporting 77 blockchains, OKX provides easy access to DeFi apps and offers extensive trading options with over 320 cryptocurrencies available.

Overview

OKX is a leading crypto exchange, renowned for its low fees, extensive selection of over 320 cryptocurrencies, deep liquidity, and low-cost spot trading fees. Catering primarily to advanced traders, OKX offers several trading options and tools.

Founded in 2017, the platform has rapidly become the world’s second-largest crypto derivatives trading exchange by trading volume. But where OKX truly shines is in its feature-packed crypto wallet, which supports 77 blockchains and provides easy access to DeFi apps.

Its focus on advanced traders is evident in its offering of powerful tools such as futures trading, trading bots, and margin trading. Yet, OKX also caters to newer traders by providing a generously funded demo account and copy trading features.

Pros

Cons

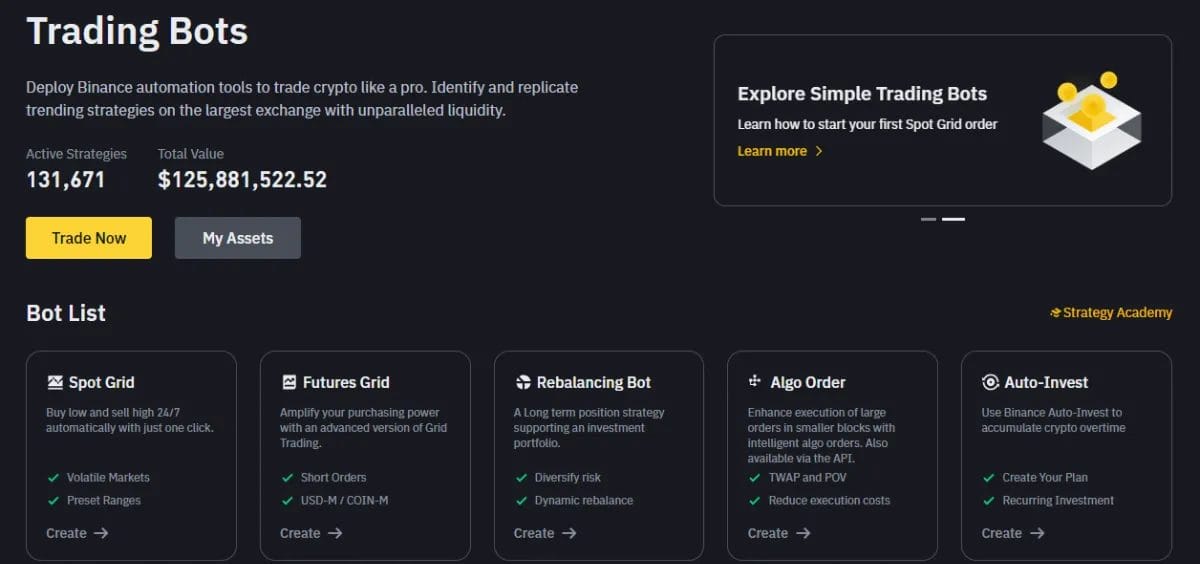

7. Binance — Best for Wide Selection of Order Types

- Tradable Coins: 350+

- Minimum Deposit: $15

- Transaction Fees: 0% to 0.6%

- Trading Limits: Yes

Why We Chose It

Binance stands out as a top crypto exchange for traders seeking a wide selection of order types and trading options. From basic market and limit orders to more advanced options, like stop-limit orders and trailing stop orders, Binance provides tools to execute advanced trading strategies with precision and flexibility.

Overview

Binance is the world’s largest cryptocurrency exchange. Established in 2017, Binance offers over 350 cryptocurrencies globally, though its US version, Binance.US, has a more limited selection of 150 coins.

Thanks to its wide range of order types — from limit orders to trailing stop orders — Binance provides traders with several options for executing precise trading strategies.

While the platform’s complexity may intimidate newcomers, its low fees, global accessibility, and abundance of features appeal to experienced investors. Despite its prominence, Binance faces regulatory challenges, particularly in the US, where it’s under investigation.

Pros

Cons

8. Bybit — Best for Instant Trade Execution

- Tradable Coins: 1,120+

- Minimum Deposit: $10

- Transaction Fees: 0.1%

- Trading Limits: Yes

Why We Chose It

With its famous ultra-fast matching engine, Bybit is the best crypto exchange for instant trade execution. Its advanced technical analysis charts and perpetual futures products make it an attractive option for seasoned traders.

Overview

Headquartered in the UAE, Bybit is a major player in the crypto and derivatives trading world; and renowned for its instant trade execution.

Navigating the platform is intuitive, whether accessed via web or mobile. The integration of advanced charts from TradingView simplifies technical analysis for seasoned traders. However, beginner crypto traders may find its interface overwhelming.

Security is a top priority at Bybit, evident in its dual wallet mechanism that segregates funds into cold and hot wallets. This ensures that the majority of user assets remain offline, safeguarding against online threats.

While Bybit excludes certain jurisdictions like the USA, Syria, and Quebec in Canada, it has still grown rapidly since its launch in 2018.

Pros

Cons

9. PrimeXBT — Best for Margin Trading

- Tradable Coins: 30+

- Minimum Deposit: No minimum

- Transaction Fees: 0.05%

- Trading Limits: Yes

Why We Chose It

PrimeXBT is the best crypto exchange for margin trading. It offers advanced traders several financial instruments, superfast execution speeds, and high leverage.

Overview

As the best margin trading crypto exchange, PrimeXBT has been catering to a global audience since its inception in 2018. It offers a wide range of financial instruments, including crypto CFDs, commodities, indices, and forex.

Additionally, it boasts high liquidity levels and top-tier trading tools. Its platform is highly customizable, allowing users to tailor their trading experience according to their preferences and objectives.

With average order execution speeds of less than 7.12 ms, PrimeXBT ensures swift and reliable trade executions, thanks to its integration with Amazon AWS servers and numerous liquidity providers.

Traders seeking high leverage and advanced trading features will find PrimeXBT particularly appealing. It offers leverage of up to 200x on Bitcoin and Ethereum CFDs, and up to 100x on altcoins and indices.

The platform’s proprietary copy trading solution further enhances the trading experience, enabling beginner traders to learn from experienced investors and replicate their trades.

Despite its unregulated status and limited fiat support, PrimeXBT remains a top choice for margin traders.

Pros

Cons

10. Margex — Best for No-KYC Sign-Up

- Tradable Coins: 35+

- Minimum Deposit: $10

- Transaction Fees: 0.019% to 0.2%

- Trading Limits: Yes

Why We Chose It

Margex is a top crypto exchange, prioritizing privacy and convenience. With its no-KYC sign-up process, Margex simplifies the onboarding process, allowing users to begin trading without cumbersome verification requirements.

Overview

Margex is one of the best no KYC crypto exchanges. Since its inception in 2020, Margex has facilitated derivatives trading, supporting various crypto-USD pairs for leveraged trading.

The platform’s MP Shield AI system sets it apart, shielding users from price manipulation and ensuring fair trading conditions. With support from twelve liquidity providers, Margex offers high liquidity, enhancing trading efficiency.

Offering leverage options from 5x to 100x, Margex empowers traders to execute their strategies effectively. In addition, it caters to diverse preferences by allowing users to deposit crypto, stablecoins, or purchase Bitcoin with Visa/Mastercard.

Despite its unregulated status, Margex prioritizes security, implementing measures such as 2FA and cold storage wallets. Customer support is robust, available 24/7 via live chat and email. Margex’s no-KYC policy simplifies the onboarding process, appealing to anyone who values privacy and anonymity.

Pros

Cons

11. KuCoin — Best for Crypto Staking

- Tradable Coins: 700+

- Minimum Deposit: $10

- Transaction Fees: 0.1%

- Trading Limits: Yes

Why We Chose It

Unlike other exchanges, the staking options at KuCoin include both flexible and locked staking with varying APYs, catering to a wide range of risk preferences. KuCoin’s extensive staking offerings and feature-rich platform make it a top crypto exchange for advanced and aspiring traders.

Overview

KuCoin is the best crypto exchange for staking. With over 700 cryptocurrencies available for trading and a global presence spanning over 200 countries, the platform offers traders ample opportunities to stake assets and earn passive income.

Its extensive selection of staking options, including both flexible and locked staking with varying APYs, caters to a wide range of risk preferences.

For instance, the platform’s High Yield staking products, such as the Shark Fin structured investment, provide users with the potential for higher returns, albeit with increased risk.

Additionally, KuCoin’s Low Risk staking options offer a straightforward way to earn rewards on a diverse range of cryptocurrencies. Compared to other exchanges, KuCoin’s staking offerings stand out for their flexibility and variety.

However, KuCoin is still lacking beginner-friendly features, like demo accounts and copy trading. Still, the platform’s robust mobile app, rapid token listings, and feature-rich trading platform continue to attract traders seeking comprehensive tools for trading and staking.

Pros

Cons

12. BingX — Best Crypto Social Trading Network

- Tradable Coins: 550+

- Minimum Deposit: Varies

- Transaction Fees: 0.4%

- Trading Limits: Yes

Why We Chose It

We selected BingX as one of the best crypto trading platforms in 2024 for its exceptional social trading features, which simplify the trading process by enabling users to copy successful traders.

Overview

BingX, established in 2018, is a significant player in the cryptocurrency exchange market with over 10 million global customers. It ranks as the 19th largest exchange worldwide, handling approximately $1.7 billion in daily trades.

BingX is licensed by reputable regulatory authorities in Australia and Lithuania, ensuring a secure trading environment.

Setting up an account on BingX is straightforward and doesn’t require a KYC process, appealing to users who prioritize privacy. However, unverified accounts are limited to basic trading functionalities and have capped trading volumes.

A standout feature of BingX is its social trading capabilities. The platform offers copy-trading options that allow beginners to mirror the transactions of successful traders, simplifying the learning curve for new investors.

Additionally, BingX supports the trading of stocks, forex, and indices, making it an attractive option for traders looking to diversify their investments across various financial instruments.

Pros

Cons

The Best Crypto Trading Platforms and Exchanges Compared

Below, is a table comparing the number of tradable coins, minimum deposit, crypto trading fee, and trading limits of the best crypto exchanges and trading platforms in April 2024.

Company

Tradable Coins

Minimum Deposit

Spot Trading Fee

Trading Limits

eToro

80

$10

1% + spread

Yes

Kraken

200+

$10

0% to 0.4%

Yes

Gate.io

1,700+

$1

0% to 0.1%

Yes

Coinbase

200+

$2

0% to 0.6%

Yes

MEXC

1,700+

$1

0%

Yes

OKX

320+

€1

0.08% to 0.1%

Yes

Binance

350+

$15

0% to 0.6%

Yes

Bybit

1,120+

$10

0.1%

Yes

PrimeXBT

30+

No minimum

0.05%

Yes

MargeX

35+

$10

0.019% to 0.2%

Yes

KuCoin

700+

$10

0.1%

Yes

BingX

550+

Varies

0.4%

Yes

Methodology: How We Rated the Best Crypto Exchanges and Trading Platforms

To rate the best crypto trading platforms and exchanges, we evaluated eight key factors, scoring them on a scale of 1-10. We then weighted the categories to determine an overall score for each exchange; and tallied the final scores to rank the top crypto exchanges.

Instruments and Tradable Coins (20%)

We considered the cryptocurrencies and spot trading pairs available at each crypto exchange. This evaluation included whether an exchange has a launchpad for new tokens and discovery tools to help you find new coins to trade.

In addition, we examined other instruments offered by each trading platform, such as crypto futures contracts and options contracts. We also considered whether margin trading and OTC trading are available.

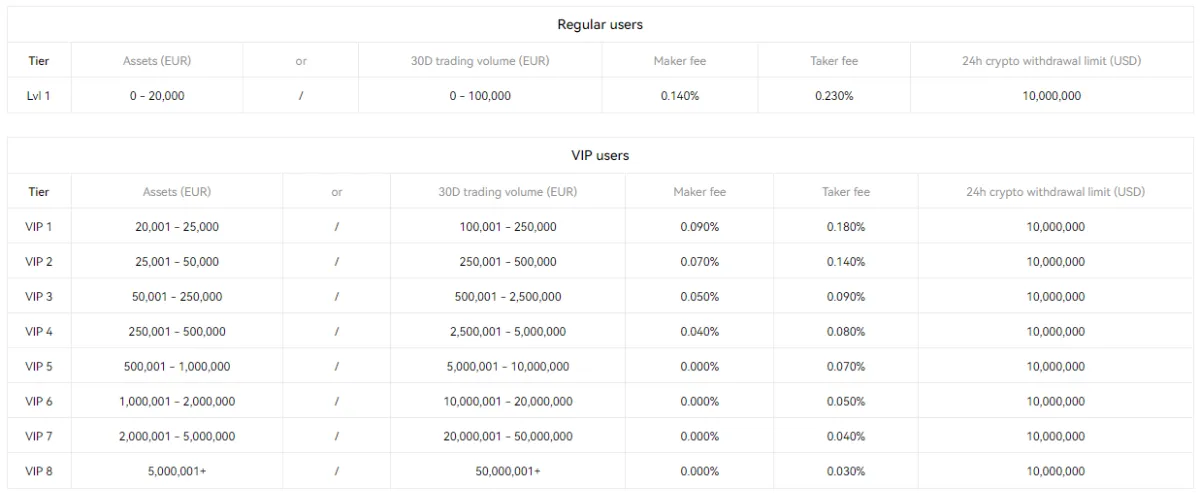

Trading Fees (20%)

We looked into each crypto exchange’s fee structure in detail to determine what an average user would pay to instantly buy or sell crypto, spot trade popular cryptocurrencies, and trade crypto futures. We also weighed in other fees, such as withdrawal and wallet fees.

Many crypto trading platforms offer fee discounts for volume or holding the exchange’s native token; we also factored these discounts into our evaluation.

Trading Tools (15%)

Trading tools include an exchange’s charting and analysis platform, risk management features, and trade planning tools. We also looked into whether crypto exchanges offer:

- Trading bots

- Copy trading

- Level 2 order book data

- The option to create custom technical indicators

- Third-party software, like MetaTrader

User Experience (15%)

We based our user experience evaluation on how easy or difficult it is to use a given crypto trading platform.

For example, exchanges offering streamlined product menus and responsive trading platforms ranked highly in this category; while crypto exchanges with confusing fee structures, glitchy interfaces, or difficult registration procedures ranked lower.

We also considered an exchange’s mobile app as part of its user experience. We assessed whether all online features were available in the app, including instant buy tools and charts.

Regulation and Security (10%)

Some crypto exchanges are lightly regulated, while others do business in highly regulated jurisdictions like the US. We considered the authorities an exchange answers to and whether it makes financial information public.

We also looked into each exchange’s security measures, such as cold storage and multifactor authentication.

Additional Services (10%)

Many exchanges offer additional crypto services such as P2P trading, NFT marketplaces, Web3 wallets, and staking.

We considered the additional services available at each crypto trading platform, since they allow you to branch further into the crypto world without having to move funds across platforms.

Reputation (5%)

Because many crypto exchanges are private and lightly regulated, the best indicator of their trustworthiness is often their reputation among its users.

We looked into customer reviews to see what users say about the exchanges we evaluated, and whether these platforms have been hacked or in legal trouble.

Customer Support (5%)

Lastly, we considered the channels each crypto exchange offers for customer support, the time availability of their support team, and the level of user satisfaction with their support services.

What Are Crypto Exchanges and Trading Platforms?

Crypto exchanges are online platforms where you can buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum. Essentially, they’re digital marketplaces where you can exchange one cryptocurrency for another or for fiat currency, like dollars or euros.

The terms “crypto exchange” and “crypto trading platform” are often used interchangeably, because they facilitate cryptocurrency trading. You can use them to execute trades, monitor market trends, and manage your crypto portfolio.

However, crypto trading platforms provide a wider range of services. They typically offer crypto exchanges, as well as additional tools like trading bots, advanced charting features, and portfolio management tools.

Are Crypto Exchanges Worth It?

Crypto exchanges are one of the simplest and most affordable ways to buy cryptocurrency with fiat and vice versa. By using a crypto exchange or trading platform, you’ll be able to:

- Access a wide range of cryptocurrencies for trading or holding

- Buy and sell crypto securely

- Utilize real-time market data and analysis tools

- Diversify your investment portfolio

Alternatively, you can purchase crypto through a traditional stockbroker, but you won’t be able to do anything with your tokens besides holding and selling them.

It’s also possible to buy and sell Bitcoin using P2P trading platforms and Bitcoin ATMs. However, these options are significantly more expensive than exchanges.

The one drawback to using these platforms is that you can’t buy crypto anonymously. In addition, fees can be high in centralized exchanges, leading some users to switch to decentralized exchanges.

Different Types of Crypto Exchanges

Centralized and decentralized exchanges are the two main types of crypto exchanges. Here, we’ll go over their differences and benefits.

Centralized Exchanges (CEXs)

Centralized crypto exchanges, also known as CEXs, are intermediaries that facilitate trades between buyers and sellers. When you enter an order, the CEX serves as the counterparty for the trade and provides liquidity to fulfill the order.

In other words, if you buy Bitcoin, it’ll come directly from the CEX rather than another user who’s selling Bitcoin at that moment. By doing this, CEXs take on some risk; they charge higher fees to account for this risk.All the platforms we reviewed above are centralized crypto exchanges.

Advantages of Centralized Exchanges

- CEXs typically have higher liquidity, allowing for faster and more efficient trading.

- They employ robust security measures to protect against fraud and hacking.

- They adhere to regulatory requirements, assuring that your activities are legal.

- Most CEXs securely hold your assets through custodial services.

- They often provide more features than decentralized exchanges, including customer support.

Decentralized Exchanges (DEXs)

Decentralized exchanges, also known as DEXs, work without a central authority. Instead, transactions occur directly between users through smart contracts on blockchain networks. This means that if you buy Bitcoin, it comes directly from another user who’s selling Bitcoin at that moment.

While some DEXs offer direct fiat-to-crypto or crypto-to-fiat trading pairs, many don’t support these conversions directly. Still, some have integrated with third-party services or decentralized finance (DeFi) protocols that enable these transactions.

Examples of decentralized exchanges include Uniswap, PancakeSwap, and SushiSwap.

Advantages of Decentralized Exchanges

- DEXs offer a wider range of crypto tokens than centralized exchanges.

- They charge lower trading fees compared to CEXs.

- They allow you to convert cryptocurrencies anonymously.

- With DEXs, you maintain custody over your cryptocurrency.

Global Crypto Exchanges

Global crypto exchanges are CEXs that operate in most jurisdictions around the world, rather than a single country or region. All the crypto trading platforms we reviewed above are global crypto exchanges, since they’re available in 170+ countries.

Are you curious about the best crypto exchanges in a particular region? Take a look at some of our other guides:

How Do Cryptocurrency Exchanges Work?

Crypto exchanges allow you to buy, sell, and trade cryptocurrencies, like Bitcoin and Ethereum. To get started, simply create an account and deposit funds.

When you place an order to buy or sell a cryptocurrency:

- A DEX matches you with an opposite order from another user, and carries out the order by transferring cryptocurrency from the seller’s account to the buyer’s account.

- A CEX does the same; but if there isn’t a matching order, it facilitates the transaction through other mechanisms.

This process usually happens instantly, especially on centralized exchanges. In addition, crypto exchanges typically provide you with Web3 wallets to store your cryptocurrencies.

These platforms employ security measures like encryption, two-factor authentication (2FA), and cold storage of assets, to protect your funds from hacking and unauthorized access.

In exchange for these services, crypto trading platforms may charge fees for executing trades, depositing or withdrawing funds, or accessing certain features.

Crypto Exchange Fees

Cryptocurrency exchanges charge various fees for their services, including trading fees, withdrawal fees, and other account fees. Let’s break them down.

Trading Fees

Crypto exchanges may charge trading fees when you buy, sell, or trade cryptocurrencies. These fees vary between exchanges and can be calculated in different ways, such as a percentage of the transaction amount or a fixed amount per transaction. For example:

- If an exchange charges a 0.1% buy fee, and you purchase $100 worth of Bitcoin, you’d pay a fee of $0.10 for that transaction. But if you buy $1,000, you’d pay $1.

- If a platform charges a fixed fee of $0.99, you’d pay that same fee, no matter whether you bought $100 or $1,000 worth of BTC.

Fixed fees are rare, though. Most crypto trading platforms charge tiered percentage fees, based on whether you’re adding liquidity to the market (i.e., when you sell) or reducing liquidity (i.e., when you buy), as well as your trading volume.

For instance, OKX categorizes its users into tiers by their 30-day trading volume and total asset balance: Crypto futures trading and margin trading fees are typically lower than spot trading fees, but similarly tiered. They vary based on additional factors, such as the level of leverage used in a trade.

Crypto futures trading and margin trading fees are typically lower than spot trading fees, but similarly tiered. They vary based on additional factors, such as the level of leverage used in a trade.

Withdrawal Fees

Some crypto exchanges charge withdrawal fees when you withdraw fiat or cryptocurrency from your account.

Fees vary based on the withdrawal method for fiat — bank transfers are often free, but wire transfers or payments to a credit/debit card are not. Expect a $10-$25 fee per withdrawal using these methods.

For crypto, withdrawal fees vary based on the coin being withdrawn. In addition to the exchange’s withdrawal fee, you need to pay blockchain gas fees for transferring tokens to another wallet. These fees are typically small but vary by blockchain.

Other Fees

Most crypto exchanges don’t charge any additional fees. However, some platforms charge custody fees for holding your crypto assets or deposit fees for payment methods like wire transfers.

How to Choose a Crypto Exchange

In this section, we’ll delve into the five most important factors to consider when choosing the best crypto exchange for you.

Accessibility

Not all crypto trading platforms are available in all countries. In fact, many exchanges don’t accept US customers. While US users may be able to access these platforms with a VPN, exchanges are increasingly cracking down on this practice to avoid trouble with US regulators.

Out of our list of the best cryptocurrency exchanges, the following are available in the US:

Security

Security is crucial to protect your funds from hacking or theft. When choosing a crypto exchange, assess the following factors:

- Regulation: Look for exchanges regulated by reputable authorities, as they are required to adhere to strict security standards.

- Encryption: Ensure the exchange uses strong encryption protocols to safeguard sensitive data and transactions.

- Two-Factor Authentication (2FA): Opt for exchanges that offer 2FA to add an extra layer of security to your account.

- Cold Storage: Check if the exchange stores the majority of funds in cold storage wallets, which are offline and less vulnerable to hacking.

- Track Record: Research the exchange’s history of security incidents and how they were handled to gauge their reliability.

Available Coins

A wide selection of coins allows you to diversify your investment portfolio, spreading risk across different assets. This is why the number of coins available in a crypto exchange is essential.

In addition, more coins means more trading pairs, giving you more flexibility to execute trading strategies and capitalize on market opportunities. Besides, some crypto trading platforms list newer or lesser-known coins with potential for growth, giving you more investment options.

Finally, you should assess whether an exchange offers specific cryptocurrencies you want to trade or invest in.

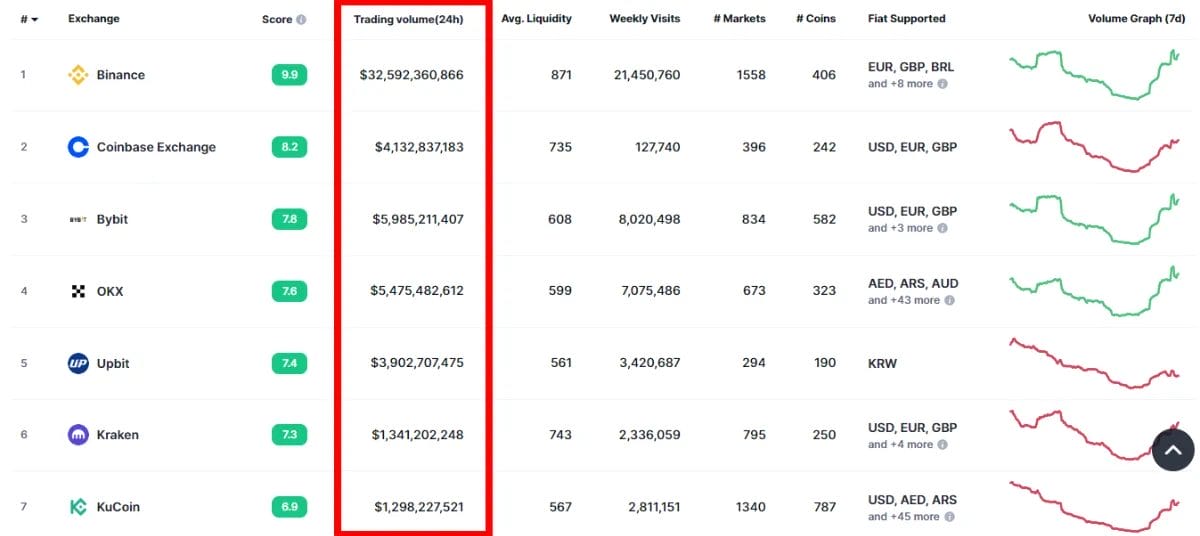

Trading Volume

An exchange’s trading volume impacts liquidity for trading. The more trading volume a crypto exchange has, the easier it’ll be to buy and sell tokens at the current market price without slippage.

Additionally, more active trading pairs on high-volume exchanges typically result in more accurate and competitive pricing, benefiting you with better execution prices.

Lastly, crypto trading platforms with consistently high trading volumes are often more stable and reliable, with robust infrastructure to handle peak trading periods and minimize downtime.

Educational Resources

Cryptocurrency trading can be complex, especially for beginners. High-quality educational resources can shorten the learning curve and empower you to make informed decisions.

Many platforms offer detailed guides on:

- Different tokens, explaining what they do and what causes their prices to move

- Trading strategies, including both basic and advanced techniques

- Features of the crypto trading platform, such as order types, charting tools, and risk management options

For instance, Kraken has a 12-article series for beginners, covering crypto basics and the most well-known coins, as well as how to buy and use cryptocurrency. In addition to the exchange’s educational resources, you can learn by engaging with the platform’s community, being active on forums, and attending webinars.

In addition to the exchange’s educational resources, you can learn by engaging with the platform’s community, being active on forums, and attending webinars.

How to Create a Crypto Exchange Account

Opening a crypto exchange account is similar to signing up for an online brokerage — you’ll need to provide personal and financial information. To create an account, follow these steps:

- Create an account: Enter an email address and password. Prove you own that email address by following the instructions on the confirmation email you’ll receive.

- Upload personal information: Input your full name, address, and phone number. Upload a government-issued photo ID, such as your driver’s license or passport.

- Complete identity verification: Some exchanges may require additional steps, like taking a selfie with your ID to prove the documents you submitted are yours.

- Fund your account: Choose a deposit method, fund your account, and start trading.

Exchanges often offer tiered verification for different levels of access and limits. User verification times vary, ranging from minutes to days.

Conclusion: What Is the Best Cryptocurrency Exchange?

eToro is our pick as the best crypto exchange in 2024 due to its extensive offerings and user-friendly interface. With over 80 cryptocurrencies available, including all major coins, proprietary wallet, and copy trading tool, it provides you with everything you need to start trading crypto easily.

Additionally, its robust security measures, privacy protocols, and stellar customer service underscore its reliability. Boasting over 30 million users, eToro stands as a secure and established platform, making it a top crypto exchange in 2024.

FAQs

What is the most popular crypto trading platform?

Binance is the most popular crypto trading platform globally, boasting the highest trading volume and user base. It offers a wide range of cryptocurrencies, competitive fees, extensive trading options, and innovative features, like its unique order types.

What is the easiest crypto exchange to use?

Coinbase is the easiest crypto exchange to use. With a user-friendly interface akin to online banking apps, it simplifies buying, selling, and trading. Its robust security measures and educational resources provide a secure environment for newcomers.

Which crypto exchange has the lowest fees?

MEXC has the lowest spot trading fees among all exchanges, charging a 0% fee for both makers and takers.

What is the safest crypto exchange?

Gemini is the safest crypto exchange due to its robust security protocols, including hot wallet insurance and SOC 2 certification. It prioritizes user protection by enforcing two-factor authentication and device approval. Gemini’s track record of zero major hacks back up its reputation as the most secure crypto trading platform.

What is the best crypto exchange for trading?

eToro is the best crypto exchange for trading. With 30 million users, it boasts an extensive selection of over 80 cryptocurrencies, including all major coins, along with a proprietary wallet and award-winning copy trading tool. Its user-friendly interface and $10 minimum deposit make eToro accessible to all traders.

What is the best Bitcoin exchange?

Gemini is one of the best Bitcoin exchanges due to its emphasis on security. It boasts robust protocols, insurance for user funds, and SOC 2 certification, making it a trusted choice for storing and trading Bitcoin.

Are cryptocurrency exchanges regulated?

Yes, cryptocurrency exchanges are regulated in many countries to ensure compliance with financial laws and protect users. Regulations vary by jurisdiction; some countries have comprehensive regulatory frameworks, while others have limited oversight. For example, exchanges in the US are subject to regulations from the SEC, FinCEN, and other agencies.

References

- CoinMarketCap: Top Cryptocurrency Spot Exchanges

- Gate.io: 100% Proof of Reserve Report

- MEXC: The Complete Guide to USDT-M Perpetual Futures on MEXC

- OKX: Everything You Need to Know About OKX Wallet’s Smart Account Feature

- Reuters: Binance, SEC Face Off Over Regulator’s Crypto Oversight

- Trading View: Bybit Integrates TradingView to Simplify Crypto Market Analysis

- KuCoin: Introducing KuCoin Shark Fin

- OKX: Trading Fees

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman