8 Best Cryptos to Day Trade in April 2024

Crypto is one of the best markets for day trading. Billions of dollars worth of crypto is traded daily, meaning high volumes, strong liquidity, and plenty of volatility. But what is the best crypto to day trade in April 2024?

In this guide, we explore the most suitable cryptocurrencies for beginners and experienced pros alike. We also explain how to get started with crypto day trading and what factors to consider when choosing a platform.

Top List of Crypto to Day Trade in 2024

When searching for the best crypto to trade, consider the following markets:

- Bitcoin – The largest and most liquid crypto to trade, Bitcoin is ideal for beginners who seek the least volatility.

- Ethereum – Another mega-cap crypto that often outperforms Bitcoin during bull cycles, Ethereum is the second-largest coin by market capitalization.

- Solana – One of the top-performing coins in recent times, Solana has increased by over 800% in the prior year.

- Chainlink – Offering exposure to the Orcales market, Chainlink is a high-growth crypto asset that offers solid trading opportunities.

- BNB – A large-cap crypto that offers exposure to the Binance ecosystem, BNB has the ideal balance between high liquidity and volatility.

- Dogecoin – The leading meme coin by market capitalization, Dogecoin is a volatile crypto asset that should be on every day trader’s list.

- XRP – Ripple’s native coin, XRP, boasts some of the largest 24-hour volumes in the industry, making it ideal for speculative trading.

- Dogwifhat – One of the most recent meme coin success stories, dogwifhat is a multi-billion dollar token with wild pricing swings.

Best Crypto for Day Trading Reviewed – A Closer Look

We’ll now take a closer look at the day trading crypto markets listed above. Key factors to discuss include market capitalization, trading volumes, price performance, and volatility.

1. Bitcoin (BTC)

Bitcoin is the overall best crypto to day trade. It’s the largest crypto by market capitalization and boasts the most daily trading volumes. What’s more, Bitcoin is less volatile than most cryptocurrencies, making it ideal for beginners.

- Price as of April 30, 2024: $61,401.34

- Market Cap: $1.4 trillion

- All-time high: $73,628.40

- Price change last 24 hours: -2.08%

- Bitcoin price has decreased in the last week with a change of -7.27%

Why Bitcoin made it onto our list:

Bitcoin is the de facto crypto of choice. It’s the original crypto and the largest by valuation. To offer some insight, Bitcoin has a market capitalization of $1.4 trillion — meaning it’s worth more than most S&P 500 companies. Over $40 billion worth of Bitcoin was traded in the prior 24 hours.

Bitcoin is listed on most crypto exchanges, allowing you to secure the lowest fees and the tightest spreads. These factors are crucial when day trading crypto. In addition, Bitcoin benefits from significant liquidity. This ensures day traders can easily enter and exit positions without having capital tied up.

Bitcoin is also the best crypto to trade for beginners. While Bitcoin is still volatile when compared to traditional assets, volatility levels are much lower than in other crypto markets. Most day traders opt for the BTC/USD pair, although BTC/USDT works the same.

2. Ethereum (ETH)

Ethereum is the second-largest crypto by market capitalization. This mega-cap coin is also ideal for novice day traders. It offers significant liquidity and trading volumes, not to mention less volatility than most cryptocurrencies.

- Price as of April 30, 2024: $3,025.29

- Market Cap: $428 billion

- All-time high: $4,867.17

- Price change last 24 hours: -4.78%

- Ethereum price has decreased in the last week with a change of -5.19%

Why Ethereum made it onto our list:

Ethereum follows a similar thesis to Bitcoin. It has a mega-cap valuation of $428 billion, so newbies can trade without witnessing wild pricing swings. This is often the case 24 hours per day, 7 days per week. More than $16 billion worth of Ethereum has been traded in the past 24 hours.

Ethereum tends to do well during altcoin season, considering that thousands of projects operate on its network. Put otherwise, investors need ETH to buy ERC-20 tokens. Ethereum trades on all major exchanges. While most traders opt for the ETH/USD pair, crypto-crosses are also worth considering. For example, you can trade ETH against BTC, SOL, and BNB.

3. Solana (SOL)

Solana is one of the best-performing cryptocurrencies in the current market landscape. It has increased by over 800% in the prior year. This has spurred Solana-based meme coins to explode in value.

- Price as of April 30, 2024: $129.85

- Market Cap: $77 billion

- All-time high: $259.52

- Price change last 24 hours: -5.07%

- Solana price has decreased in the last week with a change of -16.08%

Why Solana made it onto our list:

Solana is another top-rated coin that offers suitable day trading opportunities. Long traders have enjoyed a prosperous 2024, with Solana outperforming most large-cap cryptocurrencies. In addition, The network has benefited from the Solana meme coin craze, where the likes of dogwifhat, Myro, BOOK OF MEMES, and Bonk have seen unprecedented growth.

However, Solana often witnesses increased volatility, so there are also opportunities for short-term plays. There are no issues with liquidity; Solana has a market capitalization of $77 billion. More than $3 billion worth of Solana was traded in the prior day, giving Solana a volume/market capitalization ratio of just over 4%.

4. Chainlink (LINK)

Chainlink is an established crypto with a market capitalization of over $10 billion. It’s a lot less susceptible to volatile trading conditions, so could be a good option for risk-averse day traders.

- Price as of April 30, 2024: $13.27

- Market Cap: $10 billion

- All-time high: $52.89

- Price change last 24 hours: -4.95%

- Chainlink price has decreased in the last week with a change of -13.28%

Why Chainlink made it onto our list:

Chainlink is considered one of the best utility tokens to trade. It helps decentralized applications obtain reliable, real-time data from outside of the blockchain ecosystem. Its native token, LINK, has real-world use cases, making it a staple asset for many crypto investors. Moreover, Chainlink isn’t as volatile as other mid-range tokens.

Nonetheless, Chainlink trades on the best crypto exchanges. More than $350 million worth of LINK has changed hands in the prior day. This amounts to 3.45% of Chainlink’s valuation. Chainlink also trades on the leading derivatives platforms. This invites short-selling and leverage. MEXC, for instance, offers 200x leverage of LINK/USDT perpetuals.

5. BNB (BNB)

BNB is the ecosystem coin for the Binance exchange. It’s the fourth-largest crypto asset by market capitalization. While BNB is one of the most volatile large-cap markets, it offers high volume and liquidity. This means BNB is a top choice when day trading crypto.

- Price as of April 30, 2024: $568.10

- Market Cap: $91 billion

- All-time high: $689.33

- Price change last 24 hours: -3.72%

- BNB price has decreased in the last week with a change of -6.21%

Why BNB made it onto our list:

BNB offers exposure to Binance, the leading crypto exchange for volume, liquidity, and account holders. So, when Binance-related news is released by the mainstream media, this can have a major impact on BNB’s value. This is ideal for crypto day traders, especially those who prefer the fundamentals over technical analysis.

BNB can witness enhanced volatility, but trading volumes are sufficient nonetheless. Over the past 24 hours, more than $1.7 billion worth of BNB has been traded. That said, this amounts to just over 1.9% of its $91 billion market capitalization. In addition, BNB isn’t traded on some tier-one exchanges, including Coinbase and Kraken.

6. Dogecoin (DOGE)

More speculative day traders might like Dogecoin. This is the original and largest meme coin by market capitalization. Even so, Dogecoin can be super-volatile, often rising and falling by over 10% in a single day trading session. This makes it perfect for traders who crave volatility.

- Price as of April 30, 2024: $0.135

- Market Cap: $28 billion

- All-time high: $0.738

- Price change last 24 hours: -4.55%

- Dogecoin price has decreased in the last week with a change of -14.39%

Why Dogecoin made it onto our list:

For many, Dogecoin is the best crypto to day trade. For a start, Dogecoin has a solid market capitalization of $28 billion, so there are no issues with liquidity. What’s more, over $2.5 billion worth of Dogecoin was day traded over the prior day. At just over 9%, this offers one of the highest volume/market capitalization ratios in the market.

Dogecoin is also a fan favorite for traders who seek enhanced volatility. It’s considerably more volatile than other large-caps, which invites trading opportunities throughout the day. Dogecoin’s price is heavily influenced by real-world events, such as Elon Musk’s tweets and general meme coin sentiment.

7. Ripple (XRP)

XRP is the native crypto coin of the Ripple network. It’s one of the most traded cryptocurrencies in the market. XRP has a huge market capitalization and it trades on most exchanges. XRP is particularly susceptible to real-world news events, especially concerning US regulation.

- Price as of April 30, 2024: $0.500

- Market Cap: $34 billion

- All-time high: $3.92

- Price change last 24 hours: -2.11%

- XRP price has decreased in the last week with a change of -8.11%

Why XRP made it onto our list:

XRP is also a top choice for crypto day trading. More than $7 billion worth of XRP has been traded in the prior day. Based on a valuation of $34 billion, this means XRP has a volume/market capitalization ratio of over 19%. This is considerably more than Bitcoin, Ethereum, Solana, and most other large-cap markets.

That said, XRP often experiences increased volatility, which is why it’s favored by speculative day traders. For instance, XRP has monthly lows and highs of $0.5636 and $0.7048, respectively. Although many cryptocurrencies have recovered a large percentage of bear cycle losses, XRP trades over 80% below all-time highs.

8. Dogwifhat (WIF)

Launched in late 2023, Dogwifhat is one of the newest cryptocurrencies to day trade. Even so, dogwifhat has a market capitalization of over $3.7 billion. This popular Solana meme coin continues to offer volatile trading conditions.

- Price as of April 30, 2024: $2.50

- Market Cap: $3.7 billion

- All-time high: $4.80

- Price change last 24 hours: -7.05%

- Dogwifhat price has decreased in the last week with a change of -13.57%

Why dogwifhat made it onto our list:

Dogwifhat is considered one of the best Solana meme coins. It offers no use cases and doesn’t have a whitepaper. Nonetheless, since being listed on CoinMarketCap in late 2023, dogwifhat has increased by over 2,000%. While it now boasts a multi-billion dollar valuation, dogwifhat is still highly volatile.

In recent weeks, we’ve seen regular 24-hour price movements of over 20%. Therefore, this is one of the most volatile crypto for day trading. Nearly $600 million worth of dogwifhat has been traded in the prior day. This converts to a volume/market capitalization ratio of over 16%. While dogwifhat isn’t listed on Coinbase, it trades on most other tier-one exchanges.

Best High-Volatility Crypto for Day Trading

The cryptocurrencies discussed above are large and mega-cap projects. This will suit day traders who enjoy volatility but still seek high liquidity and volume.

That said, if you’re looking to venture into super-high volatile markets, you’ll need to consider projects with a much smaller market capitalization. In doing so, you’ll witness extreme pricing swings throughout the day.

Let’s explore some of the most volatile cryptos to day trade in 2024.

Note: The following crypto projects are currently in presale, meaning they’re raising funds from investors. Each token will be listed on exchanges in the coming weeks, meaning you can trade them then.

Top List of High-Volatility Crypto for Day Trading in 2024

If you’re looking for high-volatility crypto to day trade, consider the following presales:

- Dogeverse – Brand new multichain project spanning 6 blockchains with over $2 million raised

- Slothana – Solana meme coin with mysterious presale and over $10 million in funding so far

- Dogecoin20 – Doge meme coin with high staking yields, set to launch on Doge Day

- 5th Scape – Innovative VR & AR project with plans to create hardware and software, aiming to raise $15 million

- eTukTuk – Eco-focused project bringing EV to the tuk-tuk industry, $3 million in early stages of presale

1) Dogeverse (DOGEVERSE)

Dogeverse is a brand-new crypto project that will capitalize on the meme coin trend. Like many meme coins, Dogeverse is based on a Shiba Inu breed. What differentiates Dogeverse from other meme projects is its multi-chain compatibility. It will operate on the six largest networks: Ethereum, Solana, Base, Avalanche, BNB Chain, and Polygon.

This will enable day traders to trade Dogeverse on their preferred network. It also ensures that Dogeverse has access to sufficient volume and liquidity. Although Dogeverse doesn’t have any utility, investors can stake their tokens. The staking pool is currently paying APYs of 669%. Although the Dogeverse presale was recently launched, it has already raised $1.4 million.

Dogeverse has a substantial token supply of 200 billion. This means Dogeverse will trade as a micro-cap token. 10% of the DOGEVERSE supply has been reserved for liquidity. This means that after the ICO, day traders will enjoy optimal market conditions. Those buying Dogeverse during the presale campaign will secure a discount, meaning an immediate day trading upside.

2) Slothana (SLOTH)

Slothana is another meme coin on this list of volatile cryptocurrencies to trade. It has been developed on the Solana blockchain, which is home to some of the fastest-growing tokens in recent months. Slothana is running an airdrop-style presale, which is the new norm in the Solana ecosystem.

First, investors send SOL coins to the Slothana wallet address. This can be found on the Solana website and X page. Once the fundraising stage is over, SLOTH will be airdropped. Make sure you’re sending SOL from a private wallet and not an exchange. You won’t receive the airdropped tokens when opting for the latter.

Although Slothana is an anonymous meme coin project without a Telegram community, it has already raised more than $10 million. It has also secured over 16,500 social media followers. More information about Slothana’s exchange listing will follow. That said, rumors suggest that SLOTH will be listed on April 20th, otherwise known as ‘Doge Day’.

3) Dogecoin20 (DOGE20)

Another presale campaign recently hitting the $10 million threshold is Dogecoin20. This meme coin project is focused on community building. It has thousands of X followers and Telegram group members. What’s more, Dogecoin20 continues to trend on crypto news sites, Reddit, and other platforms.

Even so, Dogecoin20 has no use cases. It’s a meme project based on the original Dogecoin. It leverages the Shiba Inu dog breed as its logo, like many market competitors. Dogecoin20 is an ERC-20 token, so will benefit from Ethereum’s security and market reach. It has a maximum supply of 140 billion tokens.

This will be welcome news to day traders as the risks of token dumps are reduced significantly. Unlike the original Dogecoin, we found that Dogecoin20 supports staking. APYs of 48% are currently being paid. The Dogecoin20 presale is coming to an end. The tokens will begin trading on exchanges on April 20th, 2024. Expect lots of volatility.

4) 5th Scape (5SCAPE)

Another presale that will eventually offer volatile trading conditions is 5th Scape. This presale project has built an ecosystem for VR and AR gaming. Unlike existing providers, 5th Scape is leveraging blockchain technology. This means 5th Scape games will have play-to-earn elements, such as tokenized rewards and NFTs.

This will go hand in hand with 5th Scape’s immersive gaming experience. All 5th Scape games are unique to the ecosystem, meaning they can’t be accessed elsewhere. Some of the confirmed titles include Immersive Kickoff (soccer), Archery Master (archery), Thrust Hunter (racing), and Cage Conquest (strategic combat).

The most promising aspect of the project is its VR/AR gaming headset. This will support high-end visualizations and real-time motion tracking. The 5th Scape presale has raised almost $5 million. On completion, its tokens will be listed on exchanges at $0.01. This is considerably higher than presale prices, so expect volatile trading conditions from the get-go.

5) eTukTuk (TUK)

We also found that eTukTuk could be the best crypto to day trade. This is another presale that’s raising significant capital from growth investors. Nearly $3 million has been raised so far. eTukTuk is revolutionizing the sustainable transportation industry. While most stakeholders are focusing on conventional vehicles, eTukTuk is bringing the EV space to tuk-tuks.

While tuk-tuks are a staple in the Asian economies, they run on internal combustion engines. Therefore, eTukTuk offers a real solution to rising pollution levels. eTukTuk claims its vehicles are more affordable than traditional tuk-tuks. This is crucial if societal attitudes are to change. Moreover, eTukTuk also states that its vehicles are made with sustainable products.

The rollout process could be rapid, as its electric tuk-tuks plug into existing charging networks. After the presale is over, TUK tokens will likely trade on PancakeSwap. This is because TUK follows the BEP-20 standard. High volatility is expected, especially considering its small market capitalization. In the meantime, day traders can buy TUK at a presale discount.

Our Methodology: How to Pick Crypto for Day Trading

We employed a methodology when choosing the best crypto to day trade. We considered the most important factors to day traders, such as volume, liquidity, and volatility.

Let’s take a closer look at our ranking system.

High Volatility – 30%

We’ve established that cryptocurrencies are considerably more volatile than traditional trading markets, such as forex and stocks. However, depending on the crypto pair, there can be a huge disparity in volatility levels. Naturally, volatility is an important factor when day trading. After all, day traders profit from pricing swings.

However, the required volatility range will depend on your skill set and appetite for risk.

For example, if you’re day trading crypto as a beginner, it could be wise to focus on the two mega-caps: Bitcoin and Ethereum. These markets are typically less volatile than other cryptocurrencies. Not only because they’re established but they command significant valuations. This means price movements are smaller when compared to other markets.

That said, if you’re looking to increase the risk spectrum, you might want to trade more volatile cryptocurrencies. In this instance, you might consider meme coins like Dogecoin and dogwifhat. For even more volatility, you’ll need to explore small-cap tokens. These can rise and fall sharply over a very short period of time, so are best left to experienced traders.

Level of Liquidity – 25%

Liquidity should always be considered when assessing the best cryptocurrency to day trade. Large-cap projects like Bitcoin, Ethereum, Solana, and BNB command significant liquidity on hundreds of exchanges. This means day traders can easily enter and exit positions. Even with leverage, your day trading orders are unlikely to make any impact on these cryptocurrencies.

In contrast, small-cap cryptocurrencies often have weak liquidity levels. This is often because they’re new projects, meaning there’s not enough capital flowing through the markets. This can be problematic when crypto day trading. For a start, trading low-liquid pairs means that high slippage will be unavoidable.

Put simply, high slippage means your day trading order can have a substantial impact on the token price. This is more of an issue when cashing out, as you’d need to accept an unfavorable price to get your orders matched. All that said, some day traders are happy to accept high slippage, considering the best micro-cap cryptos can offer rapid returns.

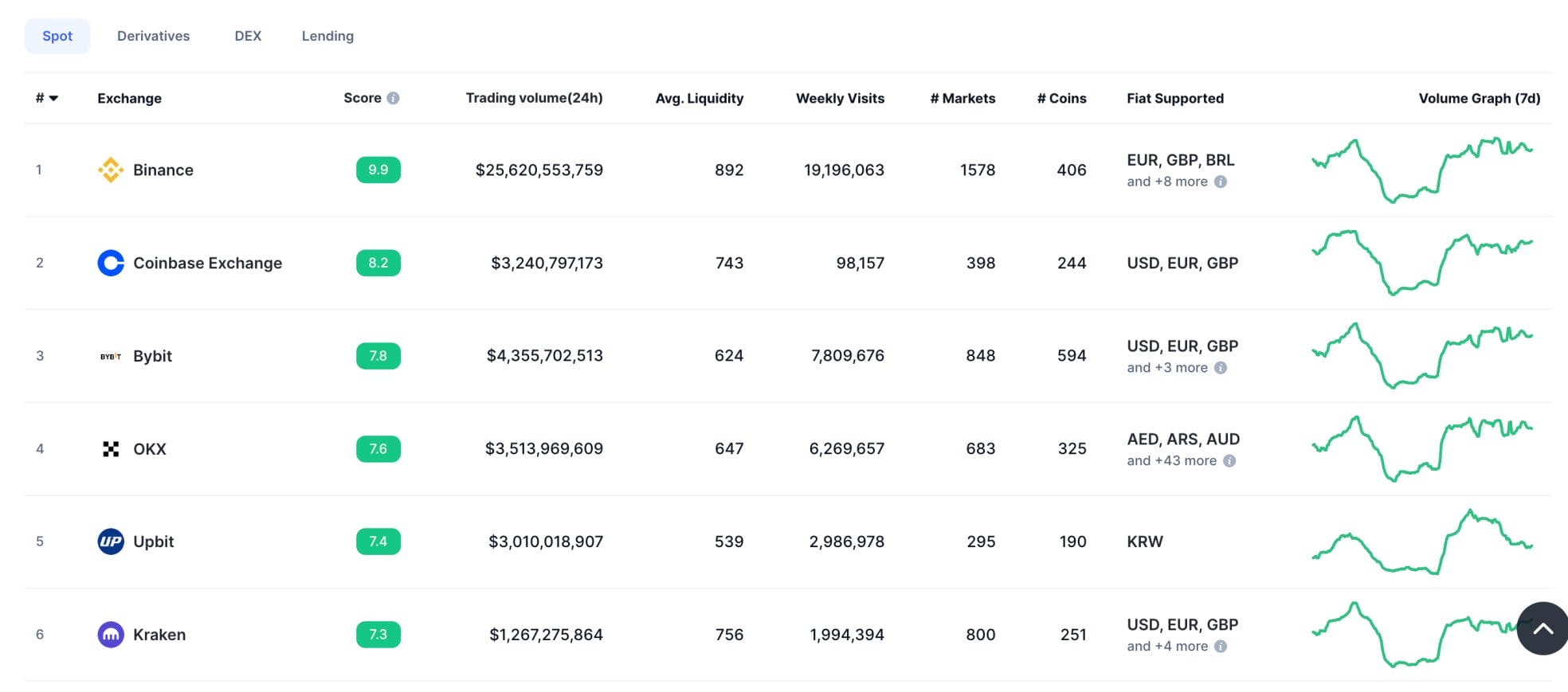

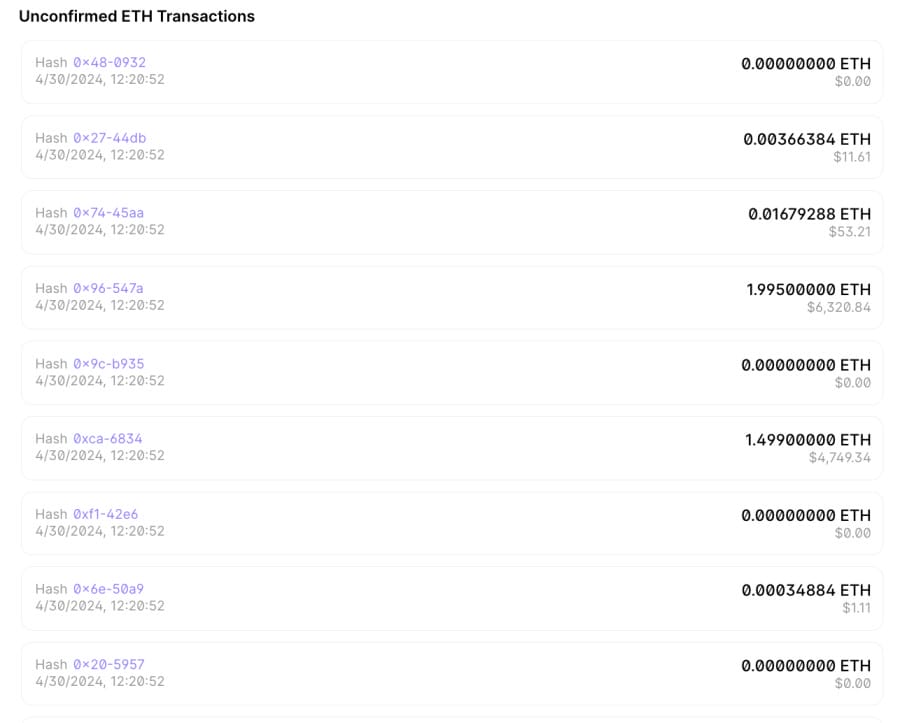

Where can I Check Exchange Trading Volumes?

- CoinMarketCap is the best place to check daily trading volumes.

- First, search for the crypto you want to day trade.

- Then, click on the ‘Markets’ button.

- You’ll now see a list of exchanges sorted by the trading volume.

Exchange Listings – 25%

So far, we’ve explained the importance of volatility and liquidity when picking the best crypto to trade daily. In addition, exchange listings will also impact your ability to make money.

Consider large-cap cryptocurrencies like Bitcoin, Ethereum, Dogecoin, and Solana. These coins are listed on virtually all exchanges, whether that’s eToro, Coinbase, Binance, Kraken, or MEXC. These tier-one exchanges have millions of active traders and attract billions of dollars in daily volume. This means tier-one platforms are highly conducive for crypto day trading.

However, this isn’t always the case with newer, small-cap tokens. For example, new cryptocurrencies often launch on decentralized exchanges. This is because they have a limited track record, so are rarely listed by established, centralized platforms. Decentralized exchanges attract small trading volumes, meaning weak liquidity and increased volatility.

In addition, decentralized exchanges aren’t the most suitable platforms for day trading. They lack advanced charting tools like technical indicators. Plus, there are no order books on decentralized exchanges, as they use the automated market maker (AMM) model. Therefore, crypto day trading is more suitable for large centralized exchanges.

Auditing and Track Record – 20%

This section is relevant to day traders who seek volatile, smaller-cap tokens. In a nutshell, the majority of token launches are scams. Anyone can create a token and list it on a decentralized exchange — no authorization or approval is needed. After listing, a common scam is to withdraw the entire liquidity pool from the exchange.

This means day traders are unable to sell their tokens, as there isn’t any liquidity left. The simple solution is to stick with tokens that have locked liquidity pools. You can check this by pasting the contract address into DexScreener. If the liquidity tab has a lock icon, this means it can’t be withdrawn.

However, the lock might only be temporary, so further checks should be made. In addition, make sure the smart contract has been audited. This reduces the risk of a rug pull, as audits ensure there aren’t any vulnerabilities in the code. An even safer option is to trade tokens that have had the smart contract renounced. This prevents the developer from changing the smart contract.

Is Crypto Good For Day Trading?

Crypto is one of the best asset classes for day traders.

Here’s why:

- 24/7 Trading: Unlike traditional financial markets, crypto is traded 24 hours per day, 7 days per week. This means no matter where you’re based, there are always day trading opportunities.

- Large Volumes: The crypto markets attract huge trading volumes. For instance, more than $92 billion has been traded in the prior 24 hours. This ensures smooth trading conditions for day traders.

- Volatility: The crypto markets are a lot more volatile than forex, stocks, and other traditional assets. This is ideal for day traders, as constant pricing swings mean there’s plenty of profit-making opportunities.

- Market Diversity: There are thousands of tradable crypto pairs, ranging from mega-caps to small-caps. This means that day traders always have something to trade.

- Low Pricing: The leading crypto exchanges offer low trading commissions. This is often just 0.1% of the position size. This is crucial, as crypto day traders often target small profit margins.

How to Start Day Trading Crypto: Step-by-Step

This section will help you get started as a crypto day trader. We explain the core steps required in simple terms. Read on to start day trading crypto in under 10 minutes.

1) Choose a Suitable Crypto to Day Trade

First, consider the best cryptos to day trade. If you’re a beginner, it’s best to stick with large-cap coins like Bitcoin and Ethereum.

These can be traded against USD or USDT on most exchanges. More experienced day traders might dip their toes in small-cap tokens.

2) Select a Crypto Day Trading Strategy

You’ll only make money as a day trader if you have a suitable strategy. Our suggestion is to hone in on one strategy rather than trying to master several.

Some of the best crypto day trading strategies include:

- Breakout Strategy: This strategy looks for key support and resistance zones. Once identified, you can enter a buy position just above the resistance level. If the chart breaks out bullish, you’ll be well positioned. Additionally, add a sell position just below the support zone. If support is broken, you’re also well positioned.

- Fundamental Strategy: While less common in the day trading space, beginners might prefer a fundamental strategy. This means entering positions based on real-world news. Crypto developments happen throughout the day, so there’s always something to trade. For instance, if the SEC announces that it’s approved Ethereum ETFs, you can expect the price of ETH to rise.

- Arbitrage Strategy: This is a low-risk strategy that capitalizes on price discrepancies. For instance, suppose XRP is priced at $0.60 on one exchange and $0.61 on another. You could make a risk-free return by purchasing XRP on the lower-priced exchange and then selling it on the other. However, without the assistance of a bot, arbitrage trading can be challenging.

- RSI Strategy: RSI trading is another crypto day trading strategy for beginners. This technical indicator runs from 1 to 100. It shows whether a crypto pair is overbought (over 70) or oversold (under 30). This often signals a near-term market correction, meaning you can enter risk-averse positions accordingly.

3) Open Accounts on Crypto Exchanges

The next step is to open an account with a crypto exchange. First, you’ll need to ensure the exchange supports your preferred crypto. Next, it should meet some minimum requirements.

For instance, the exchange should offer a safe trading experience, plenty of volume, and low fees. This will ensure you’re day trading crypto in suitable conditions.

Some exchanges enable you to open an account with an email address only. However, it’s best to complete the Know-Your-Customer (KYC) process.

This will enable you to deposit fiat money. Verified accounts also benefit from higher withdrawal limits.

- This beginner’s guide discusses the best crypto exchanges for day trading in a lot more detail.

4) Create a Buy or Sell Limit Order

Once you’ve opened an account and made a deposit, you can place your first day trade. Search for the crypto that you want to trade and choose between a buy or sell order:

- Buy Order: If you believe the crypto pair will increase in value

- Sell Order: If you believe the crypto pair will decrease in value

Next, you’ll need to choose between a market or limit order.

We’d suggest a limit order if you’re day trading. This is because you can set the entry price.

- For example, suppose you’re going long on BTC/USD, which is currently priced at $70,000.

- However, you want to enter the market when it dips to $69,500.

- Simply set the limit order price to $69,500.

- If BTC/USD touches this price, the limit order will be matched by the markets.

- If not, the limit order will remain pending.

5) Set up Stop-Loss and Take Profit Orders

Before confirming a trade, it’s crucial to set up a stop-loss and take-profit order. While not mandatory, these orders ensure you’re trading with risk management in mind.

- Stop-Loss Order: This determines when a losing position should be closed automatically. For instance, suppose you’re placing a buy order at $10. You don’t want to lose more than 5%, so your stop-loss should be placed at $9.50.

- Take-Profit Order: You should also set a take-profit target. Let’s say you want to make 10%. Based on a $10 entry price, your take-profit should be set at $11.

Finally, after reviewing everything, you can place the limit, stop-loss, and take-profit orders.

Conclusion

We’ve explored the best crypto to day trade in 2024. Beginners are best suited for large caps like Bitcoin, Ethereum, and Solana. These cryptocurrencies are less volatile and command significant liquidity.

Those with a higher appetite for risk might consider a small-cap token like Dogeverse. While Dogeverse is currently raising presale funds, it will be listed on exchanges on April 20th, 2024. This will invite high volatility, which some day traders crave.

FAQs

What is the best crypto to trade daily?

The best crypto to day trade is Bitcoin. Other high-volume markets to consider include Ethereum, Solana, BNB, and Dogecoin.

How do you pick a crypto to day trade?

Choose a crypto that aligns with your trading strategy and risk tolerance. If you seek volatility, consider a small-cap token. If you want more stable day trading conditions, choose a large-cap like Bitcoin.

What is the most volatile crypto for day trading?

The most volatile cryptocurrencies for day trading are micro-cap tokens. These cryptocurrencies experience considerable volatility, so are only suitable for experienced day traders.

Is day trading crypto a good idea?

Crypto is ideal for day trading, considering the market’s high volume, deep liquidity, and 24/7 access. However, the crypto markets are also volatile, so ensure you have a sensible risk management strategy in place.

References

- Bitcoin shows its volatility once again in steep overnight decline, now back below $70,000 (CNBC)

- Memecoin mania drives Solana toward all-time highs (Bloomberg)

- Liquidity and Volatility (Drechsler, Itamar and Moreira, Alan and Savov, Alexi)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw