Ethereum Price Prediction 2024 – 2030

Ethereum ETH +0.37% is the world’s #2 cryptocurrency (by market cap) and the world’s most popular smart contracting platform. It was designed to operate as a world computer and has overcome many hurdles in its short, 8 year existence—some self-induced, others put there by those threatening to stifle innovation.

In this Ethereum price prediction, we dive into what Ethereum is aiming to accomplish through its development roadmap, what has happened to it in the past, and how all this has, and will, affect Ethereum’s price in the future. We’ll also look at the myriad of factors that affect the Ethereum price. At the time of writing this article (April 26, 2024), Ethereum’s price has increased with a change of +0.37% in the past 24 hours, and trading at a price of $3,144.46.

What lies ahead for Ethereum and the ETH price at this crucial moment in Ethereum’s history?

Ethereum Price Prediction Overview

- The Ethereum network was launched in 2015, and ETH’s first registered price is $1.2222

- Through 2017 Ethereum gained an astounding 17,970.6%, rising from $8.10 to peak at $1,463.72

- Ethereum lost value after The Merge, the biggest network upgrade in its history

- We predict that Ethereum will get its first 5 figure all-time high (ATH) of $10,200 in 2029, as a result of the Bitcoin Halving Event in the prior year

- Bitcoin, regulators, the global economic picture, network upgrades, and institutional usage rates are all factors impacting the price of Ethereum

- Ethereum’s roadmap lays out how it is going to scale to 100,000 transactions per second and onboard thousands of users—we discuss how these upgrades will affect the price of ETH

Ethereum Price Prediction for the Next 30 Days

With Bitcoin being at the center of attention recently with its new all-time high, Ethereum crypto is also aiming to beat its price record set in November of 2021. Our analysts predict the following outcome for ETH prices in the next 30 days:

| Date | Potential Low | Average Price | Potential High |

|---|---|---|---|

| April 27, 2024 | $3,164.54 | $3,190.09 | $3,203.79 |

| April 28, 2024 | $3,183.64 | $3,235.73 | $3,264.53 |

| April 29, 2024 | $3,206.95 | $3,281.37 | $3,324.57 |

| April 30, 2024 | $3,228.77 | $3,327.01 | $3,384.60 |

| May 1, 2024 | $3,252.33 | $3,372.64 | $3,441.82 |

| May 2, 2024 | $3,272.42 | $3,418.28 | $3,504.68 |

| May 3, 2024 | $3,297.22 | $3,463.92 | $3,564.71 |

| May 4, 2024 | $3,309.12 | $3,509.56 | $3,622.49 |

| May 5, 2024 | $3,327.47 | $3,555.19 | $3,680.98 |

| May 6, 2024 | $3,362.69 | $3,600.83 | $3,746.24 |

| May 7, 2024 | $3,362.68 | $3,646.47 | $3,803.31 |

| May 8, 2024 | $3,409.31 | $3,692.11 | $3,868.29 |

| May 9, 2024 | $3,399.13 | $3,737.74 | $3,926.77 |

| May 10, 2024 | $3,449.98 | $3,783.38 | $3,983.00 |

| May 11, 2024 | $3,449.47 | $3,829.02 | $4,038.66 |

| May 12, 2024 | $3,485.69 | $3,874.66 | $4,093.75 |

| May 13, 2024 | $3,498.58 | $3,920.29 | $4,153.08 |

| May 14, 2024 | $3,501.55 | $3,965.93 | $4,227.66 |

| May 15, 2024 | $3,544.95 | $4,011.57 | $4,287.84 |

| May 16, 2024 | $3,551.15 | $4,057.21 | $4,345.19 |

| May 17, 2024 | $3,607.95 | $4,102.84 | $4,393.37 |

| May 18, 2024 | $3,613.65 | $4,148.48 | $4,446.63 |

| May 19, 2024 | $3,600.74 | $4,194.12 | $4,515.56 |

| May 20, 2024 | $3,656.30 | $4,239.76 | $4,578.57 |

| May 21, 2024 | $3,634.22 | $4,285.39 | $4,624.20 |

| May 22, 2024 | $3,718.30 | $4,331.03 | $4,709.09 |

| May 23, 2024 | $3,726.98 | $4,376.67 | $4,746.40 |

| May 24, 2024 | $3,706.88 | $4,422.31 | $4,797.82 |

| May 25, 2024 | $3,726.97 | $4,467.94 | $4,856.87 |

| May 26, 2024 | $3,747.05 | $4,513.58 | $4,920.15 |

Ethereum Price Prediction for the Next 10 Years

If you are more of a long term investment, you are probably wondering what dollar amount would the Ethereum coins that you are holding would amount to in the next 10 years. While we might not feel as bullish about Ethereum’s future performance as we do about Bitcoin Price Prediction, we believe that ETH is a strong cryptocurrency to hold as well.

| Year | Potential Low (ROI) | Average Price (ROI) | Potential High (ROI) |

|---|---|---|---|

| 2025 | $7,055.51 (124.38%) | $7,161.45 (127.75%) | $7,261.35 (130.93%) |

| 2026 | $6,813.84 (116.69%) | $7,027.75 (123.50%) | $7,229.55 (129.91%) |

| 2027 | $6,600.70 (109.92%) | $6,894.06 (119.25%) | $7,196.76 (128.87%) |

| 2028 | $6,340.70 (101.65%) | $6,760.37 (114.99%) | $7,140.23 (127.07%) |

| 2029 | $6,091.91 (93.73%) | $6,626.68 (110.74%) | $7,101.50 (125.84%) |

| 2030 | $5,875.71 (86.86%) | $6,492.99 (106.49%) | $7,098.39 (125.74%) |

| 2031 | $5,646.27 (79.56%) | $6,359.30 (102.24%) | $7,037.90 (123.82%) |

| 2032 | $5,386.27 (71.29%) | $6,225.61 (97.99%) | $7,009.06 (122.90%) |

| 2033 | $5,165.99 (64.29%) | $6,091.92 (93.74%) | $6,937.69 (120.63%) |

| 2034 | $4,888.68 (55.47%) | $5,958.23 (89.48%) | $6,947.43 (120.94%) |

Historical Evolution of Ethereum

The idea for Ethereum was first conceived in 2013 by a young programmer, Vitalik Buterin, after his father introduced him to Bitcoin. Vitalik authored the initial Ethereum whitepaper, outlining the idea that blockchain technology could be used for more than just the transfer of value—as Bitcoin is.

More specifically, Vitalik proposed that blockchain technology could be used to host contracts (what we today call “smart contracts”) that could perform a whole host of functions and that the distributed network could function as a world computer.

Ethereum’s Beginnings

In 2014, Vitalik took his idea to the North American Bitcoin Conference, in Miami, where he outlined his vision in a 25 minute speech. After this address, Vitalik and a few others from the conference, now considered the cofounders of Ethereum, who were excited by the idea, rented a house to work on the idea.

One of these individuals, Gavin Wood (creator of Polkadot), then wrote the Ethereum Yellow Paper, which defines the Ethereum Virtual Machine (EVM)—the operating environment that makes smart contract execution possible.

In the summer of 2014, the Ethereum Foundation was created, as a non-profit to oversee the development of Ethereum. Funds for this development were raised through a crowdsale—which was one of the first initial coin offerings (ICOs)—where Ethereum tokens were sold for Bitcoin—raising more than $18 million.

Over the next 18 months, the initial Ethereum protocol was developed, multiple testnets were run and the network was officially launched on July 30th, 2015, with the creation of the Ethereum genesis block.

Like Bitcoin, Ethereum was initially a proof-of-work network. Unlike Bitcoin, Ethereum had an uncapped supply, which made it an inflationary asset.

The DAO Hack and DAO Hard Fork Controversy

An important part of Ethereum’s history is often glossed over as it is considered a stain on the world’s #2 cryptocurrency’s reputation.

In 2016 a group, containing many members of the Ethereum Foundation, proposed a project simply called The DAO. The DAO’s goal was to become a crowdfunded venture capital firm to invest in new projects building on Ethereum.

However, after the crowdsale had concluded, a bug was found in the DAO’s smart contract that allowed someone to drain funds from the contract. A hacker noticed it first and made away with 30% of all the raised funds before well-intentioned hackers stepped in to secure the other 70%.

To solve the problem of stolen funds a soft fork was proposed and implemented on the network. However, a bug was quickly found in the soft fork and the miners rejected it, forcing the need for another solution.

A hardfork was proposed which, controversially, would return all the funds from the hacker’s account to The DAO. A short, and also controversial, vote was held to authorize the fork, which was subsequently implemented 5 days later.

Prior to this incident, the mantra “code is law” was one of Ethereum’s calling cards, meaning that whatever happens on the blockchain cannot be changed—regardless of its origin. There are those who vehemently disagreed with the idea of the hard fork on these grounds, and its implementation can be seen as an evolution in the network’s principles.

The Birth of a Classic (Ethereum Classic)

After the hardfork was implemented it was thought that just one chain would exist, and the unchanged chain would disappear. However, some miners continued to support the original chain. Two exchanges gave this chain price discovery and rebranded it to Ethereum Classic, which is still its name today.

The DAO hack and subsequent infighting is a long story with many twists and turns. If you want to know more, this post tells the in-depth story of the DAO hack and subsequent community divisions, and this timeline offers a chronological overview of events.

Hardforks and Network Evolution

The DAO fork was not the first or last hard fork on the Ethereum blockchain, as hard forks are how the Ethereum protocol is upgraded. There have been multiple in Ethereum’s history, some of which are more consequential in the history of Ethereum than others, these we’ve summarized in the table below:

| Hardfork Name | Date | Most Significant Impact |

| Byzantium | October 2017 | Allowed for the creation of layer 2s to scale the network |

| Constantinople | February 2019 | Initial setup for move to proof-of-stake (PoS) |

| Istanbul | December 2019 | Improved layer 2 and smart contract functionality |

| Beacon Chain | December 2020 | The initial deployment of the PoS chain for Ethereum |

| London | August 2021 | Introduction of fee burning mechanism reducing the inflation rate and increasing the chance of ETH being deflationary |

| Bellatrix | September 6th 2022 | Second upgrade to the Beacon chain, preparing it for The Merge |

| “Paris (The Merge)” |

September 15th 2022 | Proof-of-work (PoW) was switched off, PoS was switched on, completing The Merge and Ethereum’s switch to proof-of-stake consensus |

As said, this isn’t a complete list, and each hardfork introduced more than just the significant impact we’ve stated here. Those looking for a deeper dive into each hardfork and the technical evolution of the Ethereum blockchain can read this complete history of Ethereum hardforks.

CryptoPunks, CryptoKitties, and NFTs

Here it is worth noting another important step in the evolution of Ethereum and the cryptocurrency world, NFTs.

In 2017 a revolution started on Ethereum with the launch of CryptoPunks. CryptoPunks were one of the earliest examples of NFTs on Ethereum, and have continued to remain relevant; the current lowest price for a CryptoPunk is just under 60 ETH, around $150,000. This collection of 10,000 algorithmically generated pixel characters were not actually NFTs, but they did help to spur the creation and implementation of the ERC-721 NFT standard on Ethereum.

Later on in 2017, the cats began to take over Ethereum, with the rise in popularity of the CryptoKitties game. In this game, users take NFT kittens and breed them together to create new, unique kittens that draw on the traits of their parents. This game grew so popular that it took up 20% of Ethereum’s computation and drastically increased transaction costs. This hastened the need for scaling solutions, because who’s going to want to use a network that can be put out of action by a viral cat game?

Ethereum, The Merge, and Proof-of-Stake

The Merge was an event almost 5 years in the making, and it was the talking point of the cryptocurrency ecosystem for a long time before, and even after, it happened. Ethereum cofounder, Joe Lubin, said to Time that the Merge “may end up being more significant” than the genesis day.

The Merge combined the existing Ethereum PoW blockchain with the PoS Beacon chain that had been running alongside it since December 2020. This merging of the two chains meant that the Ethereum network didn’t lose any of its history as it switched from PoW to PoS—all without affecting the users at all.

There are several reasons Ethereum switched to a POS consensus model:

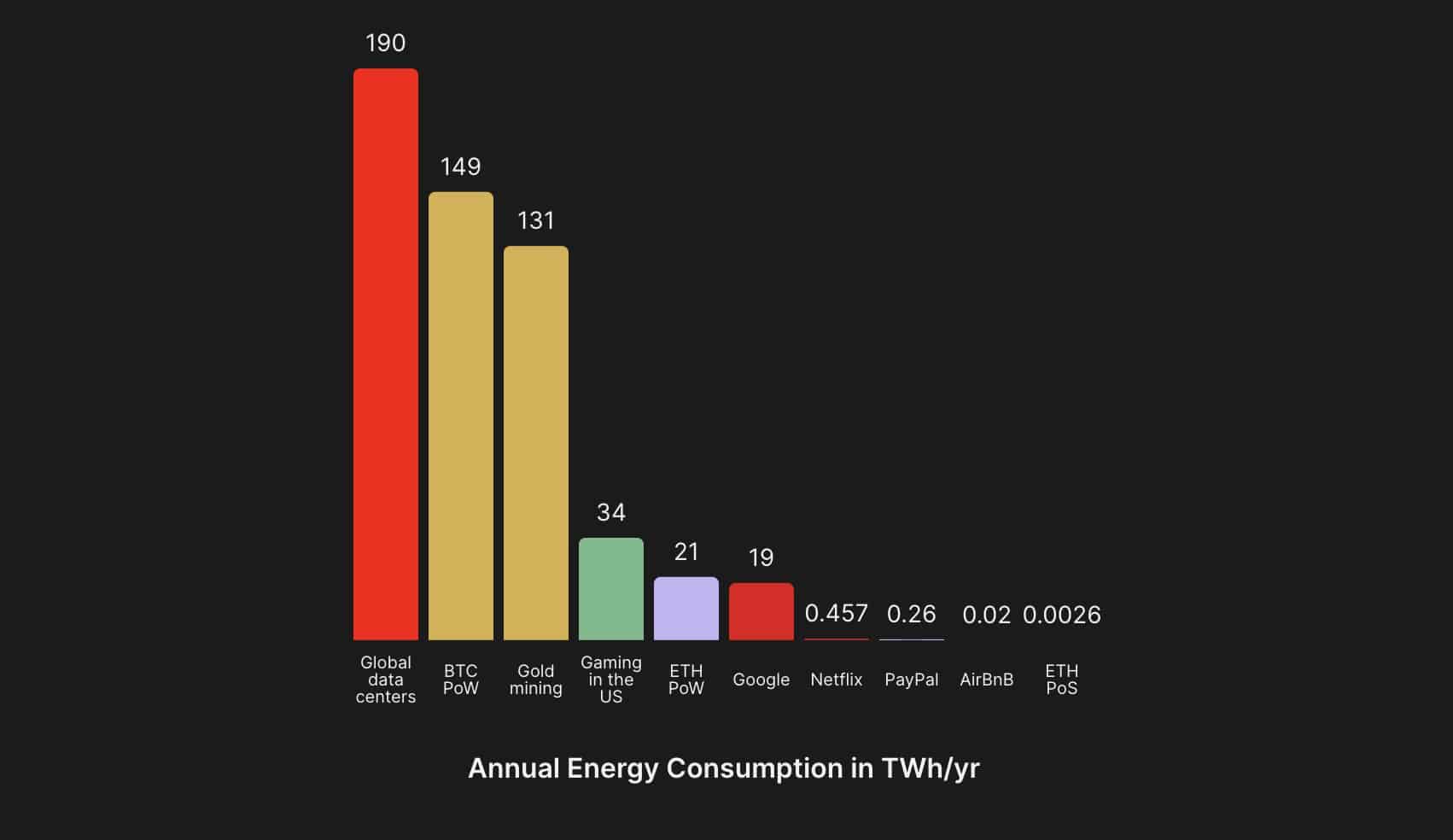

Reduced Energy Consumption: Ethereum’s energy consumption was reduced by over 99% after the switch to proof-of-stake, and some even stated that “the merge will reduce worldwide electricity consumption by 0.2%”. This was all coming at a time when passions around climate change were high and the power consumption of blockchains was one of the pieces of vitriol being thrown at them.

Deflationary Potential: Prior to The Merge around 13,000 ETH was issued per day. With the switch to PoS this shrank to around 1,700 ETH per day—significantly reducing ETH inflation.

The London hardfork also introduced a burning mechanism that removes the minimum fee attached to each transaction from circulation. If a single day has an average gas price of more than 16 gwei then the burned amount of ETH exceeds the issuance limit and results in deflation of ETH in that day.

Staking Interest: Ethereum users can now stake their ETH to help secure the network and earn interest (in newly issued ETH) for doing so. A user requires a minimum of 32 ETH to operate a validator and earn this reward.

Lower Barrier to Entry: Mining is an expensive operation that requires massive amounts of energy, limiting the number of people with the resources and capacity to secure the network. Staking made it easier for more people to participate in securing the network, making it more decentralized in the process. However, at current prices, a user needs over $88,000 worth of ETH to run a validator node.

New Scaling Possibilities: Moving to a PoS consensus mechanism allows for future scalability upgrades that are not possible when using a PoW consensus mechanism. This allows Ethereum to scale to meet the needs of a global, digital society.

Current State of Ethereum

Ethereum is a fully functioning, decentralized proof-of-stake blockchain that works as a global computer where people can interact and transact in a permissionless manner, from anywhere in the world. It is used by individuals and enterprises for a wide variety of functions, from transferring value to taking out loans to storing data in an immutable fashion.

The Ethereum ecosystem contains many of the world’s most popular dApps and some of the biggest technological transformations to come from the cryptocurrency movement, including NFTs, DeFi, zero-knowledge privacy solutions, and layer 2 scaling networks. Here’s a quick look at the Ethereum blockchain in numbers:

- Over 4,500 dApps, #2 overall (DappRader)

- Over 7,800 developers working in the Ethereum ecosystem, #1 overall (DeveloperReport)

- Over 65.5 million smart contracts on-chain (Dune)

- $56.62 billion in DeFi TVL, #1 overall with over 58.5% of total TVL (DeFiLlama)

- Over $43 billion in NFT sales volume, #1 overall (CryptoSlam)

- Over 26% of all ETH is currently staked

Alongside these stats, the Ethereum network processed an average of more than 1 million transactions per day over the past year, a number that is only expected to grow as the number of unique addresses and daily active addresses continue to increase.

While these numbers are impressive there are also more than 8 layer 2 networks posting their transactions to Ethereum and taking the load off the main chain, and many more in the pipeline to be launched—meaning the number of transactions secured by the Ethereum layer 1 is much higher than the counts expressed above.

There has also been the launch of an application-specific (for gaming) layer 3 on top of the Arbitrum layer 2.

Market Position and Performance

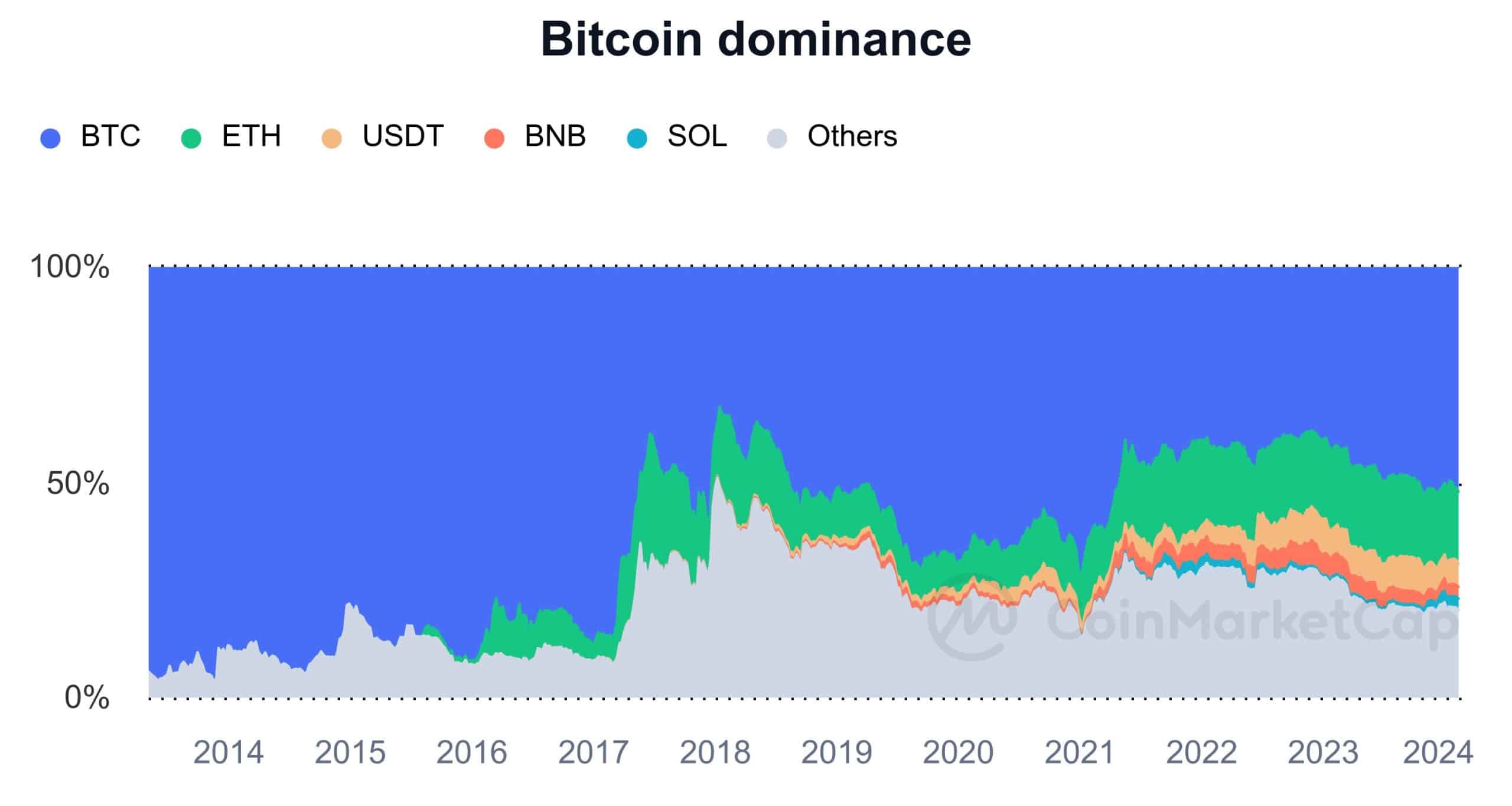

Ethereum is sat at #2 on CoinMarketCap’s ranking of coins by market cap, as it has been since 2016. In the same article linked above, it is also pointed out that Ethereum is the third best performing asset in the CoinMarketCap top 100 since 2013, with a more than 700x increase.

In the past year, the price of Ethereum has seen a more than 158% increase in price, from $1,680.30 on March 12th, 2023, to $3,975.93 on March 12th, 2024. The total supply of available ETH has also been slowly decreasing since the introduction of The Merge in September 2022 making Ethereum a deflationary asset, a move that Vitalik said was giving Ethereum “legitimacy” as “ultra sound money”.

Overall, Ethereum’s recent performance has been strong through the Crypto Winter of 2022–2023. Its market dominance of 17–19%, also held strong through the Bitcoin ETF speculation-fueled price rises, a sudden and sustained surge by Solana in early 2024, and the growth of the meme coin market and increased speculation on altcoin.

Finally, before we dive into our Ethereum price prediction, Ethereum is the only cryptocurrency that is currently available to institutional investors as a futures contract, approved in October 2023 by the SEC. It is also seen as the next candidate for ETF approval, reflected in the markets the day after Bitcoin ETF approval with a 9% ETH price pump. There are already 7 Ethereum ETF spot applications registered with the SEC, with the first approval deadline set for May 23rd, 2024. Despite initial high expectation of approval, analysts have now revised down the chance of Ethereum ETF approval from 60–70% to 30%.

Ethereum Price Predictions 2024-2030

Here we take a look at what is in store for the Ethereum network in each of the coming years, along with the impact it could have on the price of Ethereum, and we make an Ethereum price prediction for each year.

ETH Price Prediction for 2024

2024 is shaping up to be an exciting year for the world of cryptocurrencies, especially Ethereum.

Looking at the technical indicators on the weekly chart for Ethereum, we find that the 50-day simple moving average (SMA) has now broken above the 200-day SMA after coming down to tangle with it in Q2 of 2023. The last time this happened was in late 2020, when a similar “golden cross” movement resulted in ETH making the move upwards to achieve its current ATHs 12 months later.

Ethereum rise has also resulted in the breakout from a long-term trading channel, and it is now touching on heavy resistance at $4,000, both historically and psychologically. This comes as the whole crypto market is rallying and Bitcoin is recording new ATHs. If the current rally is sustained, with the upcoming ETH upgrade, we could have the same scenario as in 2020–2021 on our hands, with the potential of new all-time highs if Ethereum doesn’t meet too much resistance at $4,000.

Many things could help to spur more upward momentum for the Ethereum price, not just market sentiment built on technical indicators. Other factors include the upcoming deadline for Ethereum ETF approval in May, increasing investor confidence if the Federal Reserve cut interest rates, and the release of the Dencun upgrade for the network, on March 13th, that will make Ethereum more secure and introduce faster operations for layer-2 scaling solutions.

All-in-all, our Ethereum price prediction 2024 is a low of $2,200, a high of $4,600, and a median price of $3,600.

ETH Price Prediction for 2025

It is widely predicted that the cryptocurrency narrative in 2025 will be dominated by the effects of the 2024 Bitcoin Halving event. These Halving events typically induce new ATHs for Bitcoin and many altcoins 12–18 months after they’ve occurred, meaning that these gains are expected to arrive in 2025.

There is also the possibility that interest rate cuts may come late in 2024 and continue into 2025. If this happens we can expect the positive effect of these cuts to be felt in 2025. If, however, interest rates don’t get cut then the imminence of a recession could scare traders out of crypto and into what are are perceived to be less volatile assets.

As a result, our ETH price prediction 2025 is a new ATH high of $6,600, a low of $3,400, and an average price of $4,200.

ETH Price Prediction for 2026

If the expected narrative is correct, and we feel the positive price effects of the 2024 Bitcoin Halving in 2025, then 2026 is when we’ll be coming down off these highs.

However, with Crypto prices prominent in the news last year thanks to new ATHs, we can expect governments around the world to be well on the way to implementing cryptocurrency regulations. So long as these are positive and foster the continued evolution of crypto, which we expect them to and be and do, then we can expect the bleeding to be somewhat restrained by these positive developments.

Add to this the fact that scaling developments should be implemented onto the Ethereum network by this point, greatly increasing its utility, and we are mutedly bullish for Ethereum in 2026, with no new ATH predictions but sustained highs of $5,800, lows of $3,500, and an average price of $4,500.

ETH Price Prediction for 2027

Not every year is going to be as exciting as the others, and 2027 might be that year for Ethereum. Many big regulatory moves have already been made, no Halving events are affecting the price, and the global economy should be chugging along nicely after everything has settled from the recession scares of 2022 and 2023.

Institutional use of the Ethereum protocol will hopefully continue to grow into 2027, increasing demand for ETH. However, this demand will be countered by technical improvements that make ETH cheaper and easier to use.

As a result, we may find that prices have contracted into a smaller range for 2027, with highs of $5,200, lows of $3,900, and an average price of $4,400

ETH Price Prediction for 2028

2028 will be the year of the 5th Bitcoin Halving event, and with cryptocurrencies now mainstream and, with investors knowledgeable of the Bitcoin Halving cycle and the expected increase in cryptocurrency prices, we can expect rises in the price of Ethereum based on investors speculation. However, will the Ethereum and Bitcoin prices have decoupled by this point? It is unlikely, and ETH will still be at BTC’s mercy.

This is why we predict highs of $6,300—close to the ATHs set in 2025 as no one wants to buy higher than this just yet. We also predict lows of $4,200, and a high median price of $5,800.

ETH Price Prediction for 2029

In 2029 we can expect most of Ethereum’s planned upgrades to either be complete or very close to implementation. Here we’re likely to see growing institutional and public use of the network for all sorts of business and personal use cases that greatly impact the way we conduct commerce and value transfer.

On top of this, while everyone thought the Bitcoin Halving event was priced in, prices continue to climb and Ethereum, if it retains the title of the most used and most popular smart contracting platform in the world, could see its first 5 figure ATH of $10,200, a low of $7,100, and an average price of $8,800.

ETH Price Prediction for 2030

If Ethereum has retained its place as the top altcoin then we could see it decouple from the Bitcoin price, and the fallout from the Bitcoin Halving event, if it does hit the crypto market at all, will hardly impact the Ethereum price, helping to bring greater price stability to ETH.

We should also be in, or close to, the Splurge section of the Ethereum roadmap, where developers are tidying up the existing code and fine-tuning the Ethereum protocol. It is also highly likely that new ideas will be under development by this point, and may even be close to implementation—with the possibility of taking blockchain technology and cryptocurrencies to new heights.

With all that said, 2030 could bring much more stability to the Ethereum price with people looking to the future for it to be a major part of society. This is why we’re predicting a much tighter range, with highs of $9,600, lows of $8,800, and an average price of $9,000

Factors Influencing Ethereum’s Price

There are numerous items that affect the price of Ethereum. The most important of those have been detailed here.

Bitcoin: Arguably the biggest influence on any altcoin is the price of Bitcoin and the happenings on the Bitcoin network. The price action of Ethereum, just like any other altcoin, is closely tied to that of the world’s #1 cryptocurrency.

Here we must also mention the Bitcoin Halving, which has historically driven Bitcoin and all altcoins to new ATHs 12–18 months after the event occurs. The next Bitcoin Halving event is due to happen in April of 2024 and investors are already eyeing this event with keen interest as Bitcoin creates pre-Halving ATHs.

Regulator’s Definition of Ethereum: In June of 2023, the SEC separately sued both Coinbase and Binance, labeling Ethereum as a security in both lawsuits (prompting large drops in the price of Ethereum). The New York General Attorney also called Ethereum a security in 2023, in a lawsuit against the KuCoin exchange.

Until these regulators remove this label, the presumption that ETH is a security will keep downward pressure on the price. However, when, or if, this is cleared up, we could likely see the price of Ethereum skyrocket. The approval of an Ethereum ETF by the SEC will also go a long way to quell these thoughts and help to pump the price of Ethereum—maybe just as much as it has done Bitcoin.

Regulatory Landscape: Changing the stance on Ethereum as a security is one thing, but once regulators around the globe begin enacting regulations for cryptocurrencies there’ll be a lot clearer picture for retail investors about what will happen to them if they use or interact with cryptocurrencies.

Regulations permitting and clarifying the use of crypto will likely result in positive price action, whereas those decrying and restricting crypto are likely to drive negative price action.

Institutional Usage Rate: If Ethereum is accepted under a regulatory framework in some of the world’s biggest economies then this gives institutions and corporations the green light to begin using it for products and services—which could include everything from identity solutions, to tokenized assets and supply chain tracking.

The news of big companies or institutions choosing to use Ethereum is sure to drive price action, while the increase in network traffic brought by such use will also drive demand for ETH, increasing the price.

Protocol Upgrades: The Ethereum roadmap is discussed below and there we discuss the connection between network upgrades and price movements. In short, until the price of Ethereum decouples from that of Bitcoin, protocol upgrades are unlikely to have a large and sustained price impact.

However, if, or once, Ethereum’s price does decouple from that of Bitcoin, then protocol upgrades will have a much larger impact, expected to result in a net-positive, on the price of Ethereum.

The Macroeconomic Environment: At the moment, cryptocurrencies are seen as a monetary asset and speculative asset class. These are traditionally only popular during times of economic growth and stability. The global economy has been quite chaotic since the global pandemic, with interest rates hitting new highs as the Fed tries to avoid a recession in the USA.

While, the worst is said to be behind us, the Fed have put off reducing interest rates twice so far in 2024 and the expectation is that they will continue to do—potentially for the whole year. If a recession does occur in the USA then this could have a knock-on effect in other economies around the world, and cause many to pull out of the crypto market. However, a reduction in rates will signal a return to normal and could potentially see a positive inflow for cryptocurrencies, with Ethereum, as one of the most popular cryptocurrencies expected to benefit greatly from this.

Supply and Demand: When it switched from a PoW to a PoS network, the Ethereum network’s daily reward rate was greatly reduced—and there is now the potential for it to be a deflationary asset. According to the Ether Supply Growth Chart on Etherscan, the total supply of ETH has been steadily decreasing since The Merge.

This might only be a 0.33% decrease over the course of 18 months, but as network usage grows, the supply is expected to continue decreasing. The increase in network usage will also increase demand for ETH, and these two factors combined will put upward pressure on the price of ETH.

Ethereum Price Analysis and Historical Sentiments

Ethereum was officially launched on July 30th, 2015, and the first price information for Ethereum on CoinMarketCap is from August 12th, 2015, where it was valued at $1.2222 per coin. Here we’ll briefly cover the history of Ethereum and its price action from Launch thought to today.

Historical Price Movements

In its first few months of existence, Ethereum traded below $2 and also hit its all-time low of $0.4209 on October 21st, 2015. Then, at the beginning of 2016, Ethereum started to climb, and hit local highs of $18.36 in mid-June 2016. This climb existed alongside Bitcoin’s price rise back in 2016—showing just how long altcoins, even new altcoins, have been tracking Bitcoin’s price movements.

However, any further positive price movement was halted by the news of The DAO hack. ETH lost almost half its value over the next few months, trading as low as $7.2764.

2017 was when a larger part of the world really heard about cryptocurrencies, as Bitcoin climbed from ~$900 at the beginning of the year to peak just below $20,000 in December 2017. Ethereum was one of the altcoins that faired best in this time, rising from an opening price of $8.10 on January 1st, to peak at $1,463.72 just over a year later, on January 13th, 2018—a meteoric gain of 17,970.6% that made it one of the fastest growing cryptocurrencies of the time and firmly placed it as the world’s most popular altcoin.

Like Bitcoin and all other cryptocurrencies, Ethereum’s price then plummeted, reaching lows around $80 in 2018, and finding critical support at $120. Ethereum then bumbled along slowly and didn’t see prices above $1,000 again until January 4th 2021, spending most of its time between 2018 and 2021 under $400.

The last Bitcoin halving happened in May 2020 and is widely said to be responsible for the price action that started in the crypto markets in 2021, resulting in new ATHs for the majority of cryptocurrencies. Ethereum is included in that list, rallying 563% from an opening price of $737.60 at the start of 2021 to its current ATH of $4,891.70 on November 16th.

From here the price of Ethereum steadily declined along with the rest of the crypto market as the Crypto Winter of 2022 set in—all assisted by the collapse of Luna and the Terra (UST) in May—to hit local lows of $880 in June 2022, an 82% decrease, before quickly establishing support at $1,000 and $1,275.

Ethereum remained at these levels for a month, until the 13th of July when it bounced off a low of $1,005.61 to start a price rise in anticipation of The Merge event, now scheduled for September 2022 after numerous delays. This culminated in highs of just over $2,000 in August.

On September 6th, the Belatrix hardfork successfully upgraded the Beacon Chain causing ETH to 15% in anticipation of The Merge on September 15th with the Paris upgrade. However, by this date Ethereum had lost these gains and was trading in the same range as it was for the Belatrix hardfork on the day of The Merge—a day where, despite the success of Ethereum’s biggest ever upgrade, ETH lost 8.29% of its price.

Ethereum’s Performance Post-Merge

Ethereum’s poor start to life as a PoS blockchain continued, as further losses throughout the remainder of September and October saw it lose another 19.74% of its value and hit lows of $1,181.76. It then traded sideways before rallying to above $1,600 for the beginning of November 2022.

November 2022 saw the collapse of FTX and Alameda Research, which shook the crypto markets to its core, and caused huge sell-offs. Ethereum lost over 34% of its value before finding support at $1100.

From here Ethereum has recovered well, starting 2023 with a three week rally that saw it gain 40%, and retake the same price levels as before the collapse of FTX.

However, from here regulatory scrutiny, and vagueness, around the case of whether ETH is a security, by both the New York Attorney General, Gary Gensler, and the SEC, caused some wild individual day drops in the Ethereum price throughout 2023—some of over 15%.

Despite all this regulator-induced FUD, the price of ETH continued to rise throughout the year—showing hugely positive sentiment from investors. ETH also ended 2023 on a high, thanks, in part, to gains driven by the expected approval of a Bitcoin ETF—closing 2023 at $2,282.89 with YoY gains of 91%.

2024 has so far been hugely positive, and the approval of 11 Bitcoin ETFs in January 2024 saw ETH pump 9% (while Bitcoin remained stable) on expectations that it might be the next cryptocurrency to have an ETF approved. Since then the crypto market has rallied, and in late February ETH charged through $3,000—a price level not seen since April 2022—and up the charts.

The Ethereum price, like that of many top cryptos, saw a large correction on March 5th, losing 11.72% of its value over 5 hours. However, this loss was quickly recovered it and regained it initial price point of $3,805.70 within 24 hours and continued its upward trajectory to briefly break through $4,000 on March 11th as Bitcoin posted new ATHs above $72,000.

Ethereum Price Predictions by Experts and Analysts

Ethereum’s position as the world’s #2 cryptocurrency by market cap and the world’s most popular smart contracting platform, means that there’s no shortage of ETH price predictions from experts and analysts. Here we’ve summarized Ethereum price predictions from some expert analysts.

Cathie Woods’ ETH Prediction

Cathie Woods, the Ark Invest CEO, has stated that she expects Ethereum to reach a $20 trillion market cap by 2030. If the circulating supply of ETH remains relatively stable between now and then, then that equates to a $160,000 to $180,000 valuation for a single ETH.

Bill Barhydt’s ETH Prediction

Bill Barhydt, the CEO of the Abra platform for private and institutional investment in cryptocurrencies, predicts that Ethereum could reach prices as high as $40,000, albeit, without specifying a timeframe. He also states that he is more bullish on Ethereum than he is on Bitcoin.

Finder’s ETH Prediction

A panel of experts at Finder.com, a renowned comparison website, offers an ETH price prediction that sees the world’s #2 cryptocurrency hit $5,824 by 2025 and $14,411 by 2030. Notably, this is a slight reduction in their predictions, previously given in July 2023.

VanEck’s ETH Prediction

The VanEck investment management company predicts that ETH will hit a token price of $11,800 by 2030. This, they state, will be driven by “improving functionality, lower take-rates and an ethos of inclusivity.”

Geoff Kendrick’s ETH Prediction

Geoff Kendrick, analyst and Head of Crypto Research at the Standard Chartered Bank, predicts that Ethereum could hit $8,000 by 2026. But labeled this as only a “stepping stone” on the way to a larger valuation of $26,000–$25,000, with no timeframe given for this larger valuation.

Bonus Prediction: While they have not predicted the price, at the end of 2023 JP Morgan said that they expect Ethereum will outperform Bitcoin in 2024 as a result of the release of proto-danksharding on the network.

What’s Next for Ethereum?

The Ethereum development roadmap lays out the future of the Ethereum network and how developers plan to upgrade it in the near and distant future. At the Ethereum Developer Conference in July 2022, Vitalik Buterin shared that Ethereum would only be about 55% complete after the Merge.

In the same talk, Vitalik described the next steps—which rhyme—for Ethereum’s growth, these are called the Surge, the Verge, the Purge, and the Splurge. The most updated roadmap was shared by Vitalik at the end of 2023 on X—with an added step called the Scourge. Here we’ll take a closer look at what these upgrades involve, and their potential impact on the Ethereum price.

Upcoming Developments and Roadmap

The Surge:

A focus on scaling and getting Ethereum to 100,000 transactions per second using a combination of scaling solutions like sharding and layer 2s like rollups. This stage, specifically the development of rollup technology, is well underway, with numerous layer 2s already deployed on the network, and a rollup friendly network update scheduled for March 13th.

The Scourge: According to Vitalik, this is “about fighting economic centralization”, specifically that caused by liquid staking platforms—issues which he raised in a blog post—like Lido, which, at the time of writing, controlled 31.61% of all the staked ETH securing the network.

The Verge: Introduces Verkle trees, which, in short, will allow for stateless clients to exist—a stateless client is a node that validates blocks but doesn’t have to store the state of the entire blockchain—lowering the hardware requirements for nodes and increasing decentralization.

The Purge: This will simplify the protocol by allowing the existence of nodes that only store the last year of data, significantly reducing their storage requirements, reducing network congestion, and making it easier to participate in the network.

The Splurge: The tinkering phase, where developers are making sure that everything already done is working smoothly, and adding upgrades to fine-tune all the elements of the protocol.

Potential Impacts on ETH Price

These protocol upgrades will happen over a course of 5–10 years, and it is likely to be closer to the higher end of that period before we’re near the Splurge. If we look back at the most significant protocol upgrades in Ethereum’s history, detailed in the Historical Evolution of Ethereum section earlier, and the price action around them, we find little to no correlation between the release of these upgrades and price movements in either direction.

Indeed, Ethereum seems to correlate much more tightly with movements in the price of Bitcoin and the wider crypto market than it does with any calendar of previous protocol upgrades.

As an example, the two hardforks, Belatrix and Paris, that initiated The Merge—the biggest and most anticipated event in Ethereum history—happened in the first half of September 2022. Over the course of that month Ethereum saw gains of just 1.57%.

As a result, it is unlikely that upgrades to the Ethereum protocol will significantly impact its price. That is, at least until it has decoupled from tracking the price of Bitcoin.

Bottom Line for Ethereum Price Prediction

Price predictions are just that, predictions, and those that you’ve read here should not be taken as gospel. There are many Ethereum price predictions out there and this one, looking at technical indicators for the short term, and diving deep into the many technical, economic, and regulatory factors for the long term, has returned a positive price prediction for the future of Ethereum

If we’re to look to the other end of the scale, for balance, we need to look no further than the words of successful investor Warren Buffet, who is one of the world’s 10 richest people: ”In terms of cryptocurrencies generally, I can say almost with certainty that they will come to a bad ending.”

FAQs

Will ETH Price Cross Key Milestones? (e.g., $4,000, $5,000)

According to our comprehensive Ethereum price prediction, Ethereum will be back above $4,000 in 2024, with highs of $4,600 and will climb above $5,000 to hit new ATHs of $6,600 in 2025. Furthermore, we expect Ethereum to reach $10,000 in 2029.

Is Ethereum a Good Long-Term Investment?

In our in-depth Ethereum price prediction, which takes into account a myriad of factors, we find that Ethereum is indeed a good long-term investment as the price of Ethereum is likely to increase multiple-fold between now and 2030—making it a solid pick for any investor.

Risks and Considerations in Ethereum Investment

Those investing in Ethereum should know that it comes with many risks and price influences. These include regulatory scrutiny, price volatility, and close ties to the macroeconomic climate. We dive into these elements in detail in our Ethereum price prediction for 2024-2030. Investors also have to consider exchange hacks and how they should store their coins.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Viraj Randev

Viraj Randev