Crypto Price Predictions

A cryptocurrency price prediction is a forecast for the future price of a cryptocurrency, which can be for any time frame you want; years, months, days, or even hours. Experts make cryptocurrency price forecasts by taking into account a wide array of factors.

On this page, we’ll take a closer at the cryptocurrencies that we’ve identified as having the greatest future potential, provide a short (2024) and long-term (2025–2035) forecast for the wider crypto market, and finish by detailing how you can create your own price predictions and the tools you can use to do so.

Crypto Price Predictions

When seeking out the cryptos with most potential we take a myriad of factors into account including the current and expected future state of the crypto market, the utility of the token, its potential for price appreciation, and what trends are currently hot in both the crypto and traditional finance worlds.

| Coin | Current Price (24h change) | All Time High | 2025 Prediction | 2026 Prediction |

|---|---|---|---|---|

| Bitcoin | $64,405.51 (+0.93%) | $73,628.40 | $136,751.28 (+112.33%) | $141,084.83 (+119.06%) |

| Ethereum | $3,144.46 (+0.37%) | $4,867.17 | $7,161.45 (+127.75%) | $7,027.75 (+123.50%) |

| Binance Coin | $609.60 (+0.12%) | $689.33 | $1,548.32 (+153.99%) | $1,521.43 (+149.58%) |

| Solana | $144.15 (-1.31%) | $259.52 | $328.30 (+127.75%) | $322.17 (+123.50%) |

| XRP | $0.522 (-0.33%) | $3.92 | $1.91 (+264.73%) | $2.05 (+291.87%) |

| Cardano | $0.468 (-0.26%) | $3.10 | $2.90 (+519.59%) | $3.48 (+643.17%) |

| Dogecoin | $0.151 (+1.28%) | $0.738 | $0.937 (+519.59%) | $1.12 (+643.18%) |

| Shiba Inu | $0.0000258 (+4.06%) | $0.0000881 | $0.00016 (+518.14%) | $0.000192 (+641.77%) |

| Polkadot | $6.86 (+0.18%) | $54.98 | $15.62 (+127.75%) | $15.33 (+123.50%) |

| Smog | $0.0777 (-2.77%) | $0.377 | $1.86 (+2,291.64%) | $3.02 (+3,791.28%) |

| Litecoin | $85.62 (+3.37%) | $410.76 | $107.17 (+25.16%) | $106.10 (+23.92%) |

| Lucky Block | $0.0000311 (-1.69%) | $0.00969 | $0.000149 (+377.83%) | $0.000169 (+441.97%) |

| Bonk | $0.0000266 (+9.87%) | $0.0000451 | $0.000213 (+699.63%) | $0.000272 (+921.12%) |

| Quant | $109.34 (+1.85%) | $424.43 | $249.03 (+127.75%) | $244.38 (+123.50%) |

| Pepe 2.0 | $0.0000000456 (-5.04%) | $0.00000028 | $0. (+-100.00%) | $0.000001 (+2,090.81%) |

| Evil Pepe | $0.0000199 (-0.13%) | $0.000383 | $0.000124 (+521.36%) | $0.000148 (+641.62%) |

| Pi Network | $41.36 (-1.75%) | $299.20 | $94.20 (+127.75%) | $92.44 (+123.50%) |

| Wall Street Memes | $0.00686 (-1.47%) | $0.0771 | $0.0425 (+519.59%) | $0.0509 (+643.17%) |

| Meme Kombat | $0.0956 (-10.80%) | $0.853 | $0.764 (+698.78%) | $0.978 (+922.35%) |

| BTC20 | $0.110 (+0.09%) | $2.55 | $0.681 (+519.59%) | $0.817 (+643.17%) |

| XRP20 | $0.0000229 (0.00%) | $0.000100 | $0.000142 (+517.86%) | $0.000171 (+644.04%) |

| SpongeBob | $0.000739 (-0.14%) | $0.00135 | $0.00458 (+519.63%) | $0.00549 (+643.15%) |

| Tamadoge | $0.00558 (+7.72%) | $0.192 | $0.0345 (+519.59%) | $0.0414 (+643.17%) |

| Dash 2 Trade | $0.00377 (+6.23%) | $0.0529 | $0.0233 (+519.58%) | $0.0280 (+643.16%) |

| Love Hate Inu | $0.0000103 (+2.32%) | $0.000273 | $0.000065 (+525.98%) | $0.000078 (+651.18%) |

| Calvaria | $0.00183 (-2.51%) | $0.0179 | $0.0113 (+519.60%) | $0.0136 (+643.20%) |

| Battle Infinity | $0.000273 (-7.76%) | $0.00554 | $0.00169 (+519.64%) | $0.00203 (+643.20%) |

| Fight Out | $0.00118 (+0.03%) | $0.159 | $0.00731 (+519.57%) | $0.00877 (+643.15%) |

| Big Eyes | $0.000000704 (+10.32%) | $0.0000179 | $0.000004 (+467.86%) | $0.000005 (+609.83%) |

| Metropoly | $0.0167 (0.00%) | $0.243 | $0.103 (+519.59%) | $0.124 (+643.18%) |

Cryptocurrencies With The Most Optimistic Forecasts Reviewed

In the following sections we’ve compiled reviews of each of the tokens for which we provided a crypto price forecast in the table above. We’ve split it into two sections, one focusing on the most promising new cryptocurrencies, and another outlining some of the major cryptocurrencies for which we have created in-depth price predictions. Below is our list of the top cryptos with the greatest potential.

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode ahead of Doge Day

- ETH

- usdt

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- Send SOL and wait for airdrop - the new way of doing presales

- Over $10M raised, launches April 29

- No hard cap total - first come first served

- Solana

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

- Innovative stake-to-mine project for easy BTC mining

- Presale has raised over $6.5m so far

- Over 90% staking APY during presale

- ETH

- bnb

- usdt

- +1 more

- Access to huge fee revenue through staking

- 50% of 10bn token supply available at presale stage

- 85% of fees go back to the community

- usdt

- bnb

- ETH

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- ETH

- Innovative AI crypto casino offering staking, airdrops and custom games

- $HPLT presale has raised over $400k so far with +60M bets placed by +150k users

- Offers daily staking rewards, hype NFTs and is fully audited by Certik

- bnb

- ETH

- usdt

Most Promising New Cryptocurrency Forecasts

Wondering what the next 100x crypto could be? In this section we explore the most promising crypto price predictions that have degens and crypto enthusiasts buzzing in 2024.

Smog – Hottest New Solana Meme Coin

Smog is a new meme coin on the Solana blockchain, launching at the peak of the 2024 meme mania. $SMOG peaked at over 250x 1 month after launch and is still up over 100x. As our Smog price prediction forecasts, there is still a lot of room for this crypto to grow.

Smog was launched through a fair launch, with all the tokens made available on the Jupiter DEX. The token aims to become one of the top meme coins on Solana by prioritizing community and social growth and rewarding users with airdrops. It even claims to offer the “Greatest SOL Airdrop of All Time.”

To earn airdrop points users simply have to buy and hold $SMOG. However, to increase the number of airdrop points they receive users can stake their $SMOG tokens (42% APY) and participate in social activities through Zealy.io. Along with airdrops, the Smog team also plans to manage the supply with strategic token burns.

Key Takeaways:

- Over 250x already achieved, with more room to grow

- Is a meme coin which means its price can be highly volatile

- Strategic burns to manage token supply

- targeting social dominance

- Can simply hold tokens to qualify for airdrops

- More airdrop points can be earned by staking tokens or completing social actions

- Purportedly has the “Greatest SOL Airdrop of All Time”

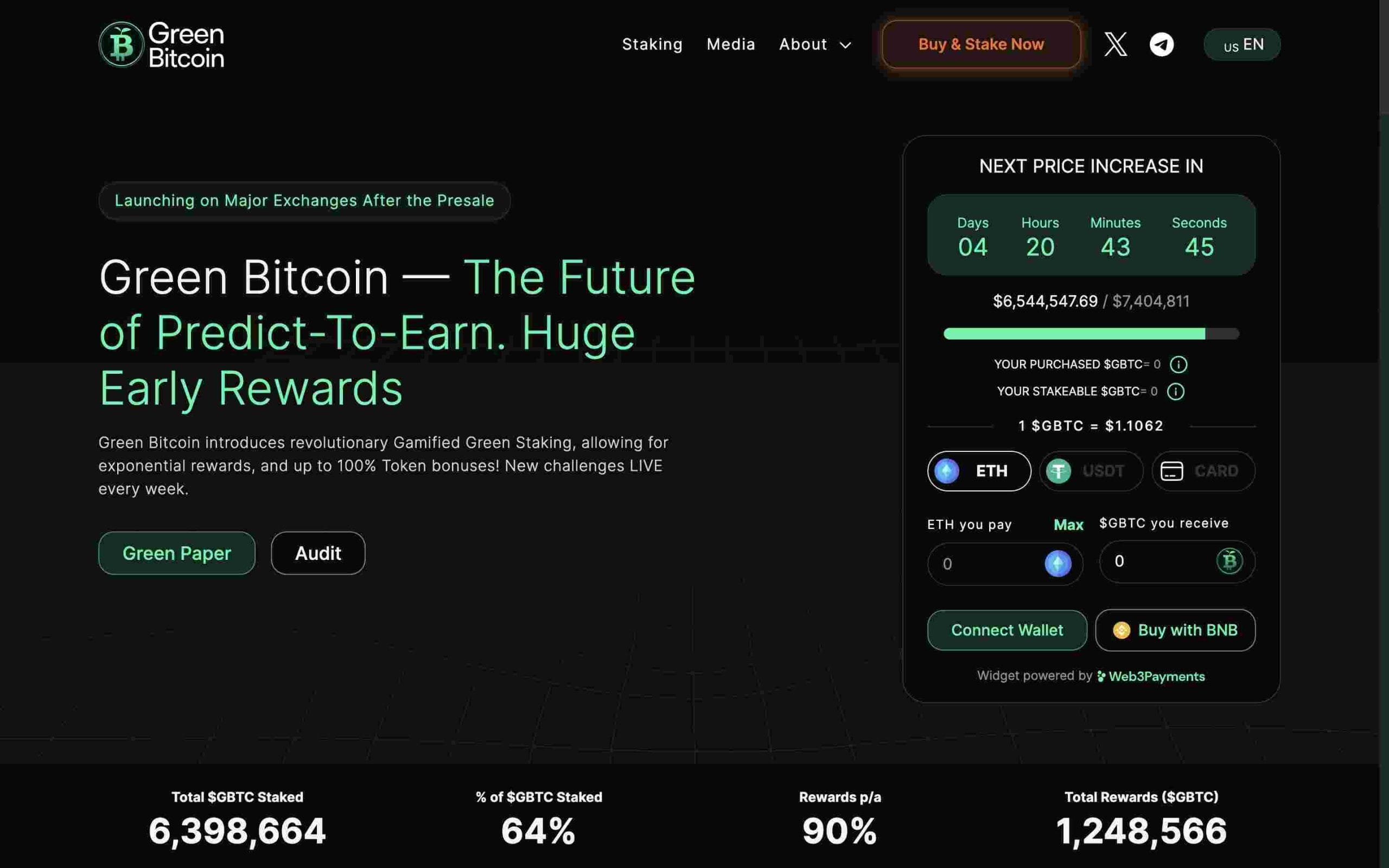

Green Bitcoin – Most Exciting New Gamified Crypto Price Predictions

Green Bitcoin combines Bitcoin’s legacy with Ethereum’s novel, green energy proof-of-stake solution—which uses a minute amount of the energy needed for Bitcoin’s proof-of-work consensus mechanism—to offer users some exciting gamified staking. Just like Bitcoin Green Bitcoin has 21m tokens.

In the Green Bitcoin protocol users will stake their tokens on a prediction for the next day’s Bitcoin price. Those whose predictions fall in a Green Zone around the actual Bitcoin price will earn a percentage of the rewards, and 27.5% of the token supply is set aside for gamified staking rewards.

Green Bitcoin is currently in the presale stage, with 1 $GBTC priced at $1.1062. 50% of the 21m tokens are available in the presale, and early participants can stake their tokens now to receive a variable APY, currently at 90%, before the game launches. In our crypto price forecast for Green Bitcoin, we expect the $GBTC token to be valued between $2–$7 in 2024.

Key Takeaways:

- Stake tokens, predict tomorrow’s Bitcoin price, earn token rewards

- Early participants can stake tokens to earn an APY, currently at 90%

- Ongoing presale offers $GBTC at a discount

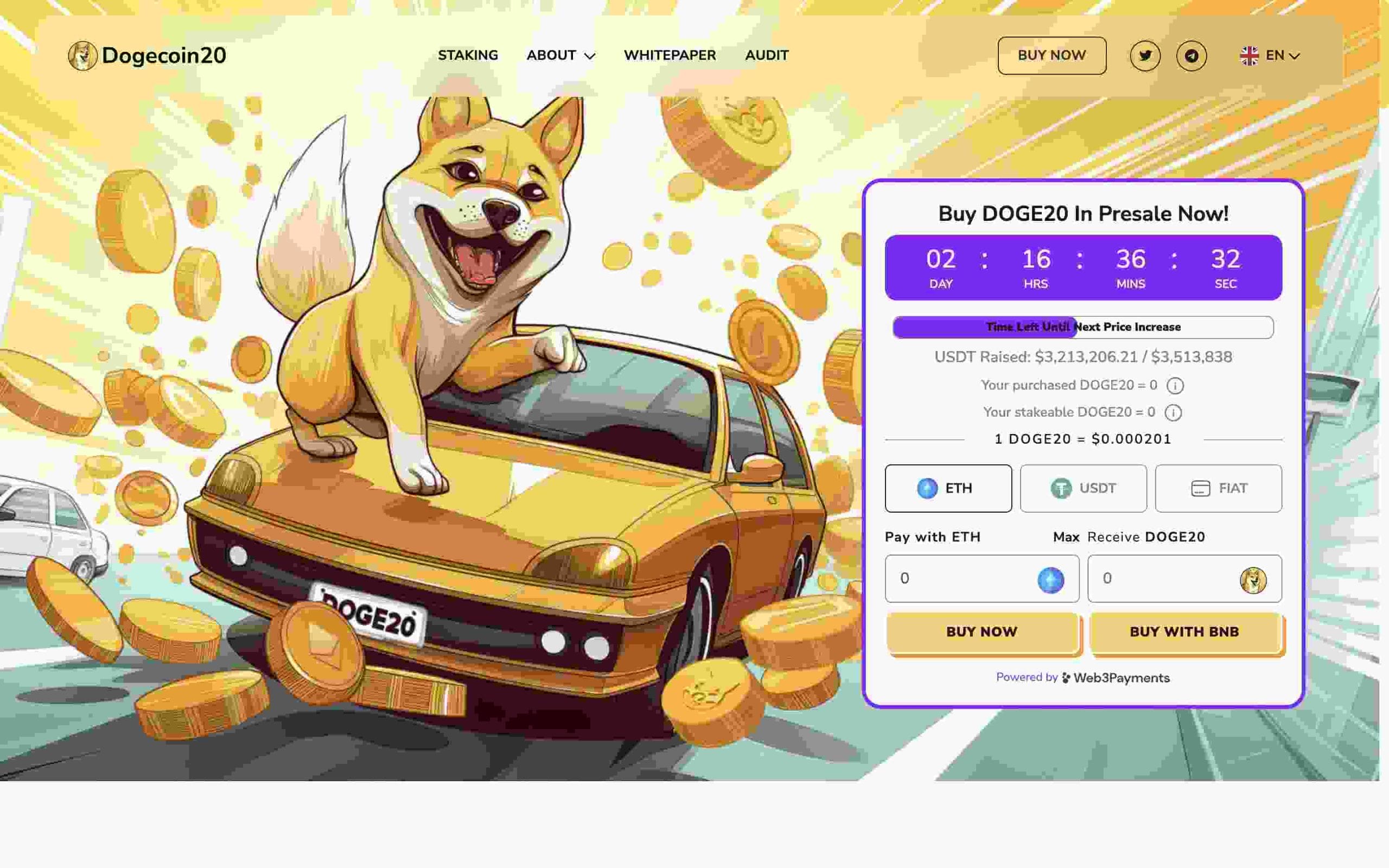

Dogecoin20 – Top New Dog-Themed Meme Coin on Ethereum

Dogecoin20 brings Dogecoin’s early playful principles, and pure meme nature, to the Ethereum blockchain. This also means that it is built on top of the Ethereum proof-of-stake consensus mechanism, an eco-friendly alternative to Dogecoin’s energy-intensive proof-of-work consensus mechanism.

The Dogecoin20 token is currently at the presale stage, with the aim of raising $6m through the sale of 25% of the 140 billion $DOGE20 token supply. A large portion of presale funds will go toward developing a marketing strategy and increasing token awareness and adoption. The presale will take place over 12 stages, with the price increasing from stage to stage.

Early adopters of the token can stake their tokens to earn healthy staking rewards, currently set at 268% p/a. In total, 15% of the tokens supply will be distributed through this staking mechanism. To keep everything fair, presale participants will all receive their tokens at the same time—the same time as the token lists on the Uniswap DEX.

Key Takeaways:

- Combines three well-known crypto elements: Dogecoin, memes, and Ethereum’s proof-of-stake

- Portion of presale funds raised allocated to marketing, awareness, and adoption

- Healthy staking rewards for early adopters

- 25% of token supply offers through presale

- Tokens released to presale participants at the same time as Uniswap DEX listing

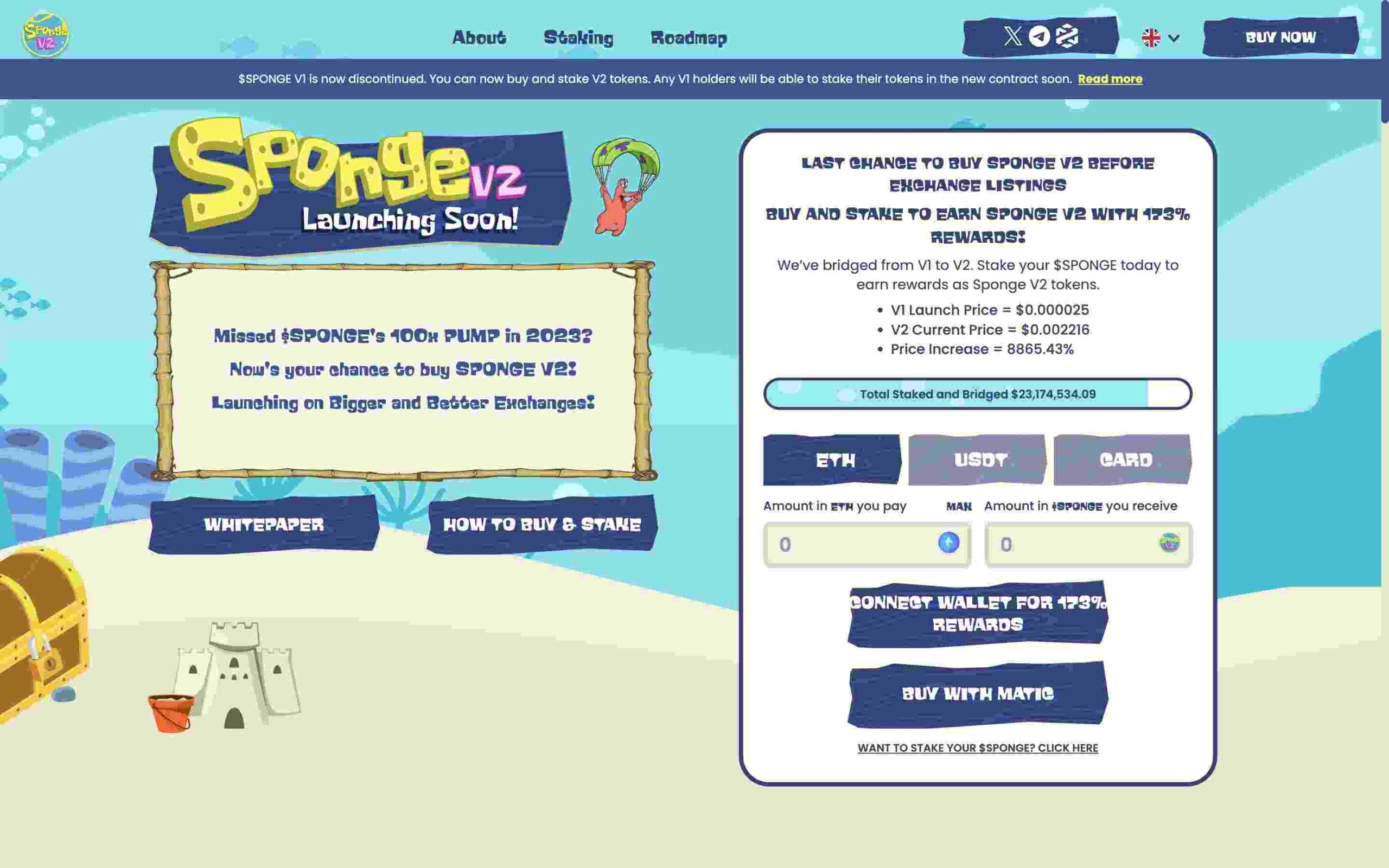

Sponge V2 – Relaunching Meme Coin with P2E Game

Sponge V2 is a reissue of the original Sponge V1 meme coin, which achieved 100x when it first emerged on the market in early 2023. This is being completed through a migration to a new smart contract.

The team behind Sponge V1 is migrating the existing token to a new smart contract, Sponge V2, to increase the utility of one of the best meme coins. In this migration and relaunch, there are also new tokens on offer, and these are available through a presale on the Sponge website.

The price of these Sponge V2 tokens, to keep this token sale fair, will be tied to the market price of Sponge V1. Once users have swapped their existing Sponge V1 tokens for Sponge V2 tokens, or purchased them through the smart contract, then their tokens will automatically be staked to earn a variable reward rate, currently 179% p/a. The extra utility comes in the form of a Sponge P2E Racer game, where users can earn more Sponge tokens in a “wacky new Play-to-Earn game!”

Key Takeaways:

- Relaunch of an already popular meme coin

- Migrating to a new smart contract for increased utility

- Staking APY earnable until token relaunch

- Upcoming play-to-earn game providing utility for this meme coin

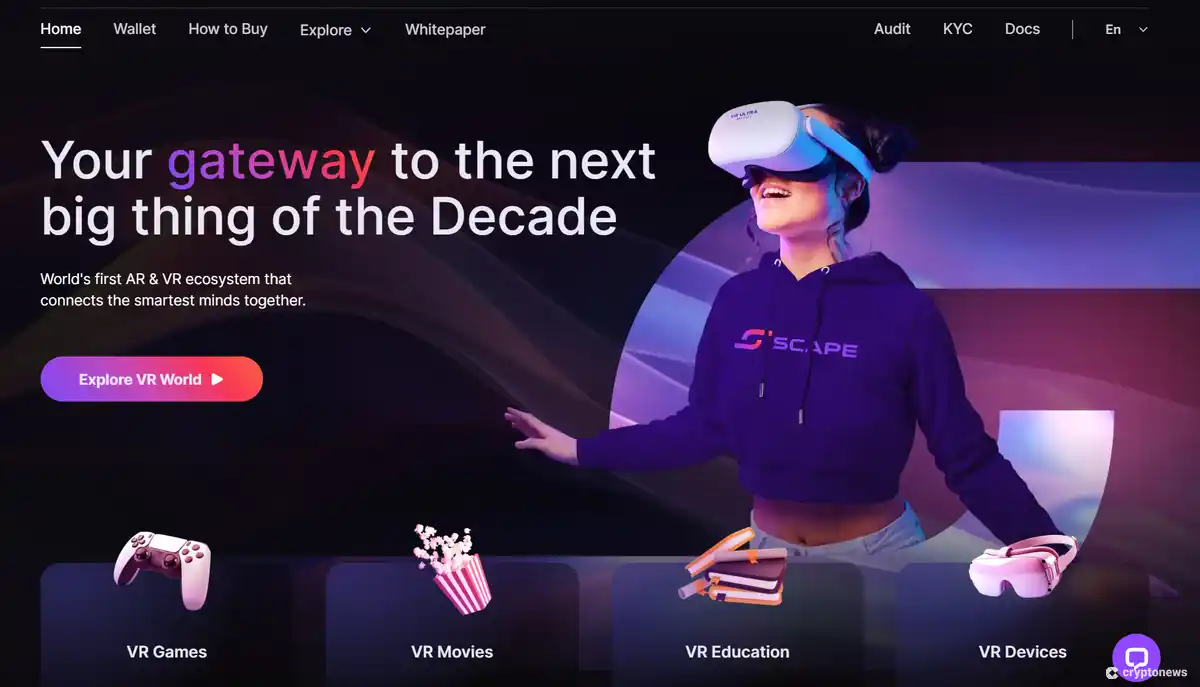

5thScape – Best New Token Launching in the Red Hot VR Market

The 5thScape project focuses on the exciting and emerging worlds of AR and VR, and aims to build a suite of digital offerings alongside numerous pieces of the physical equipment needed to use them.

The initial offerings from 5thScape will focus on an array of VR games, which include an MMA title, a soccer game, an archery game, and more. Alongside this 5thScape also aims to develop its own VR headset and gaming chair.

The VR gaming market is set to grow at a CAGR of 36% between 2023 and 2030, but other industries, such as healthcare and training, are also set to be heavily impacted by VR over the rest of the decade. 5thScape also plans to focus on these markets, to increase the reach of their products and token. The 5thScape token, currently in presale, will be an integral part of the 5thScape world, offering product discounts, access to special features and previews, and special VR content.

Key Takeaways:

- Forecasted huge growth in various VR markets over the next few years

- 5thScape is starting with VR games and then targeting multiple other industries

- Building the equipment needed to access VR

- The 5thScape token will be an integral part of the 5thScape VR ecosystem

Major Crypto Coins Forecasts

Bitcoin – World’s Number 1 Cryptocurrency

As the world’s first and most well-known cryptocurrency, Bitcoin needs no introduction. It is typically the first purchase made by most cryptocurrency investors and has been the subject of an unfathomable number of crypto price predictions.

While it was initially described as a “Peer-to-Peer Electronic Cash System” in the Bitcoin whitepaper, Bitcoin has since been likened to digital gold because it is said to share many of the same properties, mainly that there is a finite supply—”a good store of value” is currently being stress tested.

As a fully decentralized cryptocurrency, created by an individual, or group of people, operating under the pseudonym Satoshi Nakamoto, Bitcoin was distributed in the fairest of fashions, as a reward to those who contributed computer power, in a consensus mechanism known as proof-of-work, to securing the network.

Its status as a first mover, and as a digital gold, along with the fact that it currently has more than a 50% share of the multi-trillion dollar crypto markets, and the fact that this market closely traces the price movements of Bitcoin, all mean that Bitcoin will be on top for some time to come.

Key Takeaways:

- The original cryptocurrency and the only one deemed to be fully decentralized

- Bitcoin has long been likened to a digital gold

- It is often the first coin purchased by those who enter the cryptocurrency space

- It is currently gaining traction with the traditional finance markets after ETF approval in January

- Bitcoin holds an incredible sway over the whole crypto market, with a 50%+ dominance and all other cryptocurrencies tracing its price movements up and down the charts

Read Our Bitcoin Price Prediction

Ethereum – The Most Popular Smart Contracting Platform

Ethereum was launched in 2015 after a young computer programmer, Vitalik Buterin, proposed that the blockchain technology underlying the Bitcoin protocol could be used to support self-executing contracts, called “smart contracts”. A group, now known as the Ethereum cofounders, got together to flush out this idea and the Ethereum protocol emerged from that.

Marketed as a world computer, Ethereum has since been through, amongst other things, a controversial hardfork, a switch to a more energy-efficient proof-of-stake consensus mechanism, and is now focusing on scaling to onboard millions of users.

As the world’s most popular smart contracting platform, Ethereum is home to thousands of dApps which include games, DeFi services, NFT platforms, liquid staking services, and more. It secures more than 55% of all the value locked in DeFi, totaling over $47 billion on the Ethereum chain alone.

As the most popular smart contracting platform, that is also home to multiple layer 2 platforms and a huge number of dApps, it will continue to be a key player as the cryptocurrency market evolves.

Key Takeaways:

- Ethereum was the first global, decentralized platform offering self-executing smart contracts

- It is the world’s #2 cryptocurrency, supporting over 4,00 dApps and securing a DeFi economy worth over $47 billion

- The protocol is actively being scaled to onboard millions of users

- Its continued evolution helps to keep it relevant and, outside of Bitcoin, it is the most household name of all cryptocurrencies

Read Our Comprehensive Ethereum Price Prediction

Shiba Inu – Popular Meme Coin With a Growing Ecosystem

Shiba Inu started life as a meme coin and an experiment in decentralized community building. Since then, its decentralized community has grown to boast over 1.3 million token holders and numerous developments have come to separate it from the world of memes and place it firmly in the world of utility.

The Shiba ecosystem boasts numerous innovations, some live others under development. Below we’ve briefly summarized some of what the Shiba Inu ecosystem offers:

- Shibaswap: a DEX

- Shibarium: an Ethereum layer 2

- SHIB: a Metaverse world

- Shiba Eternity: a play-to-earn game

- NFT Collections: 2 PFP collections and metaverse LAND.

There are there other fungible tokens in the Shiba Inu ecosystem, $BONE, $LEASH, and the yet-to-be-released $TREAT, but $SHIBA is the key token of this ecosystem.

Key Takeaways:

- Shiba Inu started life as a meme coin but has blossomed into a decentralized ecosystem of utility

- $SHIBA is the main token of this ecosystem, which has 3 other fungible tokens

- The Shiba ecosystem contains a DEX, an Ethereum layer 2, blockchain games, and multiple NFT collections

- Shiba is the second most popular meme coin behind Dogecoin

Read Our In-Depth Shiba Inu Price Prediction

XRP – Cryptocurrency Designed for Remittance, Partnered with Global Banking Giants

XRP is the native currency of the XRP Ledger, a blockchain that was created by the founders of Ripple Labs. Its design is focused on improving the speed of international remittance—which can take multiple days—by cutting it down to mere seconds.

This is achieved by using XRP as an intermediary currency between the two currencies being exchanged. This is done on a ledger that is designed to scale to process 1,500 transactions per second.

While the XRP Ledger and Ripple Labs are separate entities, they are inseparably intertwined. Ripple Labs were gifted 80% of all the XRP tokens upon the ledger’s inception. The XRP Ledger creators and core team received the other 20% of the tokens.

Ripple is the company that will be helping to facilitate the blockchain’s use as a remittance solution. To do this, it has already partnered with dozens of global financial institutions including Western, Union, Bank of America Merrill Lynch, HSBC, Banco Santander, and JP Morgan.

Key Takeaways:

- XRP Ledger is a blockchain designed to reduce the time for global remittance from days to mere seconds

- It is designed to scale to process 1,500 transactions per second

- It was built by the founders of Ripple Labs, and while the XRP Ledger and Ripple Labs are different entities they are closely intertwined.

- All XRP was premined, 80% was gifted to Ripple Labs, and 20% was distributed to the Ledger’s creators and core team

- Ripple Labs’ goal is to help facilitate global remittance on the chain and have partnered with dozens of global financial institutions to do so

Read Our Deep-Diving XRP Price Prediction

Solana – Hugely Popular Smart Contracting Platform

Solana is a layer 1 blockchain that has been designed to hit the main criteria for mass adoption: fast and inexpensive to use; while also being energy efficient. It uses a proof-of-stake consensus model, which is supplemented by a proof-of-history model to help offer sub-second transaction finality to users.

The Solana blockchain also, theoretically, has the ability to scale to over 700,000 transactions per second. However, this low-cost, high-speed model comes at the detriment of decentralization and network stability, as it’s extortionately expensive to run a Solana validator and the network is known for its impromptu shutdowns.

The Solana network offers users all the utility of other blockchains including, smart contract based dApps, fungible tokens, NFTs, meme coins, staking protocols, and a burgeoning DeFi ecosystem.

After seemingly disappearing after being embroiled in the FTX scandal of late 2022, Solana roared back into life and up the charts in late 2023 to attain a position in the top 10 of all cryptos by market cap.

Key Takeaways:

- Solana offers a high-speed, low-cost blockchain that can, theoretically, scale to hundreds of thousands of transactions per second

- This comes at a loss in the areas of decentralization and protocol stability

- Solana offers users smart contract based dApps, NFTs, meme coins, and has a thriving DeFi ecosystem

- Solana “died” in late 2022 as the FTX scandal took down all who were associated with it

- Despite this, Solana roared back to life in 2023 and regained a position in the top 10

Read Our Complete Solana Price Prediction

Litecoin – Top Crypto for Payments

Litecoin was released back in 2011 and is one of the oldest altcoins that remains popular amongst users. It was designed to supplement Bitcoin, and act as a means of instant, low-cost payment between individuals and for purchasing goods—it is accepted by hundreds of merchants around the world.

The creator of Litecoin, a former Google engineer called Charlie Lee (now the Director of the Litecoin Foundation), created Litecoin by forking Bitcoin. While many aspects of the protocol remained the same, he changed some notable elements:

- Increasing the token hard cap to 84 million (4x that of Bitcoin)

- Reducing the block time to 2.5 minutes (1/4 that of Bitcoin)

- Changing the mining algorithm to make it easier to mine from a computer

The Litecoin network still undergoes a Halving every 4 years, just as Bitcoin does, but it does so around 8 months before Bitcoin.

On top of being a payment solution, Litecoin also offers users optional private transactions, ordinals, a layer 2 for smart contracts, NFTs, and tokens, and a Lightning Network.

Key Takeaways:

- Litecoin is a fork of Bitcoin designed to offer faster, low-fee transactions and act as a method of payment

- It was created by Charlie Lee, a former Google engineer who is now the Director of the Litecoin Foundation

- The Litecoin network has a Halving every four years, just like Bitcoin

- Litecoin offers users optional transaction privacy and access to the Lightening Network

- Litecoin also has ordinals and a layer 2 solution with smart contracts, NFTs, and fungible tokens

Read Our Detailed Litecoin Price Prediction

Dogecoin – Number 1 Meme Coin Building a Payment Stack

launched in 2013, Dogecoin is the original meme coin. Its creators, two IBM software engineers, made the token as a “joke: in just a few hours, and it was an attempt to make fun of the wild speculation that was happening in the crypto markets at the time.

Dogecoin existed for seven years before, during the crypto bull market of 2021, it skyrocketed up the charts. An event that cemented it in meme coin and cryptocurrency lore.

Dogecoin continues to hold the status as the world’s most popular meme coin and its success has spurred a whole ecosystem of meme coins and dog-themed spinoffs. Throughout its lifespan, it has also received attention from some notable folks, most famously Elon Musk, whose Tweets on the currency have previously influenced the markets.

The development team behind Dogecoin now has a more serious outlook and is developing the tools to make Dogecoin an easily accepted form of payment.

Key Takeaways:

- Dogecoin, initially created in 2013, was the first meme coin and has resulted in a whole ecosystem of spin offs

- Dogecoin shot to fame during the 2021 bull market, and is still the preeminent meme coin

- Elon Musk is a high profile fan of the token and his tweets and actions have previously affected the price

- Dogecoin’s developers are now focused on turning the currency into a form of payment and developing the tools for easy integration by merchants

Read Our Well-Informed Price Prediction

Cardano – Top Third-Generation Blockchain, Based on Peer-Reviewed Research

“Cardano is an open platform that seeks to provide economic identity to the billions who lack it by providing decentralized applications to manage identity, value and governance.” — Charles Hoskinson

Cardano was launched in 2017, after multiple years of development, and is the brainchild of Ethereum cofounder Charles Hoskinson. It is built using an extending UTxO model, taking Bitcoin’s model and improving on it to bring users native dApps, NFTs, fungible tokens, on-chain governance, and a DeFi ecosystem.

It is the only one of the top blockchains to offer native liquid staking. Its proof-of-stake consensus model, the first provably secure proof-of-stake protocol, consists of over 3,000 community-run stake pools securing the network.

Cardano was developed in stages, gaining functionality incrementally. It is one of the only blockchains to be based on peer-reviewed research and is backed by over 200 scientific paper. However, its lack of initial functionality earned it the nickname “ghostchain” from the rest of the blockchain community, a name it has now outgrown.

Key Takeaways:

- Cardano has a philanthropic mission to elevate the livelihoods of those who are economically disenfranchised through its decentralized and open-source platform

- Cardano was developed methodically and is the most popular blockchain backed by peer-reviewed scientific research

- Cardano is the only top blockchain to offer native, liquid staking

- Over 3,000 community-run stake pools secure the Cardano blockchain

- Cardano offers native dApps, NFTs, fungible tokens, on-chain governance, and a DeFi ecosystem to its users

Read Our In-Depth Cardano Price Prediction

Quant – Best Blockchain Interoperability Solution for Enterprises

Launched in June 2018, Quant is a blockchain agnostic platform that is focused on fostering blockchain interoperability. Specifically, Quant is designed as a solution targeting businesses and financial service providers who wish to incorporate blockchain technology into their operations. It offers these organizations plug-and-play access to existing decentralized blockchains, which allows them to connect their existing infrastructure to these public ledgers.

Quant’s Overledger Platform connects to all forms of distributed ledger technology (DLT), not just blockchains. It allows for multi-DLT dApps and tokens that can operate and be used across multiple chains. Quant’s Overledger was also the technology used in the Bank of England’s CBDC pilot project for retail.

The Quant token is the utility token of the Quant ecosystem and is locked by businesses to secure a license to use the Quant platform. It is also required to gain access to dApps launched on the Quant network.

Key Takeaways:

- Quant is a blockchain agnostic platform that helps businesses and financial service providers to connect to existing blockchains

- It offers plug-and-play functionality that allows businesses to easily incorporate decentralized blockchains in their existing infrastructure

- The technology created by Quant connects to all DLTs, not just blockchains

- Quant’s Overledger technology allows for multi-chain dApps and tokens

- The Quant token is the network’s utility token and is required to secure licenses to use the platform

- Quant’s Overledger technology was used in a pilot CBDC project by the Bank of England

Read Our Quant Price Prediction

Crypto Market Forecast for the Rest of 2024

The crypto markets have enjoyed an excellent start to 2024, gaining 47% and climbing back above $2 trillion to be valued at $2.47 trillion at the time of writing. This is on the back of Bitcoin ETF approval, which has brought a considerable amount of money into the markets.

Looking forward, the most anticipated Bitcoin Halving in history set to happen in mid-April, an event that some see as a catalyst for more price growth, yet other see a post-Halving drop in Bitcoins future. Whatever happens to Bitcoin here, the rest of the crypto market historically follows in the wake of the leading cryptocurrency.

Outside of Bitcoin-based events, the Federal Reserve announced in mid-March that they still expect to make three interest rate cuts this year. This is a change from the start of the year when many expected much more, but is still a positive sign, for crypto and the wider markets. However, cryptocurrencies are volatile assets, and if the macroeconomic situation worsens over the course of the year, and cuts don’t happen, we might see an outflow of funds from the crypto markets toward the end of the year.

Finally, and only a minor factor, cryptocurrency regulations continue to evolve around the globe. Specifically for 2024, Europe’s MiCA (Markets in Crypto assets) regulations are expected to come into force later this year. While this might boost adoption and utilization, the true effects, if any, of this are not expected to be felt until at least next year.

Crypto Market Forecast 2025 – 2035

Looking further out than this year, 2025 comes with the potential effects of the Bitcoin Halving—which has historically produced new all-time highs 12–18 months after the event itself. If 2024 is not a year when the Fed eases rates, then 2025 is, all things going to plan, when rates are expected to come down, as the global macroeconomic outlook continues to improve.

Looking further out, and compared to the last decade, the adoption of cryptocurrencies is expected to continue, with Statista predicting almost 1 billion users by 2028, and another report expecting the value of the market to grow at a CAGR rate of 30.80% between 2022 and 2030. This all looks positive, and many expect this growth to continue into 2035 and beyond.

As we look into the next decade, the evolution of crypto regulations in nations around the globe is going to have a direct impact on the value and evolution of the market. The introduction of crypto regulations is expected to happen sooner rather than later as nations are expected to want to protect their citizens from the “wild west” nature of the crypto world and to capitalize on the economic benefits that the business of cryptocurrencies can bring to their nations. This means that we expect regulations that secure the financial side of crypto yet don’t stifle innovation—a positive development.

Finally, the world of blockchains and distributed ledger technology is fast evolving, and in the last few years we’ve seen an energy-based narrative of PoS vs PoW, the emergence of RWA, the growth of blockchain games, and the continued growth of layer 2s and ZK technology.

A decade ago the only three of today’s top ten cryptos that existed were Bitcoin, XRP, and Dogecoin. Meme coins had just come into existence and smart contracting platforms were not yet launched. Who knows what the next decade may hold?

Can You Trust Crypto Price Predictions?

The internet, X, and YouTube are full of people and platforms making cryptocurrency price predictions. Some price predictions are trustworthy, others will fall into the category of “definitely don’t trust.” Here are three factors, and questions, that you can use to determine which category a particular price prediction might fall into:

- Bias: Does the price prediction’s creator, or the platform it is hosted on, have a particular affinity for or against a particular project that would affect the price prediction they provide? Bias can be personal or profit orientated.

- Level of Knowledge: Does the person or platform providing the price prediction demonstrate a good level of understanding of cryptocurrencies and market fundamentals that show that their prediction is worthy of your trust?

- Evidence: Does the person or platform providing the price prediction back it up with qualitative or quantitative evidence, for more fundamental analysis, or provide the charts on which they conducted their analysis, for technical analysis?

Relying on price predictions from others for your trades makes life much easier, as you don’t have to spend the time conducting an analysis yourself—especially useful if you’re getting expert information and you’re not an expert. However, this does mean that decisions involving your finances are being made based on the words of someone who you, very often, don’t know.

Here it is also important to remember that what is being provided is a prediction. Meaning that they are never going to be correct all the time. All-in-all, this means that a level of judgment is still required on the part of the reader as to whether or not they should trust that specific prediction.

How to Predict Crypto Prices

As a result of its high volatility, the crypto market has proven to be hugely profitable for many people—equally, many people have also lost a lot of money. It is the tantalizing draw of getting rich quickly that brings investors into the crypto markets; rather than the revolutionary technology that underpins the protocols that use these tokens.

To have a chance at succeeding in their moon and Lambo dreams, cryptocurrency investors must attempt to figure out which direction a crypto asset is going to move in. This involves making a crypto price prediction.

Crypto price predictions can be split into two elements, technical analysis and fundamental analysis. Below, we delve deeper into how each of these elements impacts crypto predictions, and how you can use them to create your own, informed coin price prediction.

Technical Analysis and Crypto Price Predictions

Conducting technical analysis of a cryptocurrency involves analyzing charts that display the historic price and price activity of a token to try and create an informed prediction of that token’s future price and price activity. These charts will look familiar to anyone who has researched crypto predictions before. A Bitcoin candlestick chart is displayed as an example below.

The world of technical analysis is awash with indicators and techniques that can be used to find trends and predict the future price of an asset. Over time, each analyst will develop a set of indicators that they trust to give them the highest chance of correctly predicting an asset’s future price.

Due to the youthfulness of the crypto market, its highly volatile and speculative nature, along with the fact that tokens often lack the requirements for a more formal fundamental analysis, technical analysis is extremely popular in the crypto markets. In such a market it is also the best way to predict short-term price moves, and all of this combines to make technical analysis the major tool for making price predictions.

Fundamental Analysis and Crypto Price Predictions

Fundamental analysis is a technique used by stock and securities analysts that involves using economic and financial factors to provide a valuation for an asset. This valuation is then called its fair market value and is compared to its actual market value to see if the asset is under or over-priced.

While it can, and is, applied to cryptocurrencies, the traditional model of fundamental analysis is hard to apply to cryptocurrencies. This is a result of numerous factors, namely: the speculative nature of the markets, the crypto company model’s deviance from the traditional company model, and the fledgling nature and wild variety of cryptocurrency businesses.

As a result of the market’s lack of maturity and focus on price speculation, the fundamental analysis of cryptocurrencies tends to focus on a token’s potential price over a much longer time frame, typically years. It involves looking at factors that affect both the token itself and the wider market, and this can include on-chain data, tokenomics, token and protocol utility, the macroeconomic environment, ongoing development activity, the token’s level of adoption and, probably most importantly, its potential for future adoption in a mature market.

What Affects Crypto Prices?

the price of an asset is driven by supply and demand. So the factors that affect a crypto’s price will have either a positive or negative effect on the supply and demand. Below we’ve detailed the major items that affect crypto prices and price predictions.

- Market Sentiment: As said, the crypto markets are highly speculative, and the overall market sentiment toward cryptocurrencies will drive buy and sell pressure, which will cause tokens to trend in a particular direction, up, down, or sideways. Market sentiment can be applied on several levels, it can be in terms of the whole market, specific areas of the market, like meme coins or AI tokens, or for a specific coin itself.

- Adoption: An increase in the adoption of a particular cryptocurrency will result in an increased demand. Adoption can be driven by market sentiment, but it can also be driven by a need and desire for the utility of that token, e.g., a game token used to purchase in-game items.

- Roadmap Items: The accomplishment of roadmap items can mean many things. They’re almost always good news for a cryptocurrency’s price as they typically mean progress and the release of new utility, or a step toward it. This can spur demand in the form of real need for the token or speculation by market participants.

- Token Halving: This cuts token emissions by half for some of the biggest proof-of-work coins and quite significantly reduces the number of tokens entering the market—decreasing supply while the demand remains steady.

- Token Burns: Many projects, most commonly meme coins, will burn tokens for one of a variety of reasons. Large burns can reduce the token supply, therefore affecting supply and demand. However, it is worth noting that many of these events use tokens that are not live on the market, meaning that it is often speculation that drives the price, not the burning of tokens itself.

- Token Vesting: Many projects allocate a percentage of the token supply to team members and early-round funders. These are often put on a vesting schedule, where they are unlocked after a period of time, typically 1–3 years. When these unlock, it can mean the unlocking of 10%+ of the token supply at one time. This can negatively affect the price if the recipients decide to start selling off their tokens.

- Governance Votes: Some tokens allow users to vote on protocol parameters, next development steps, and other elements of the protocol. Some of these can be divisive and others can be positive. Because of their variety, governance actions can have a myriad of effects on token prices.

- Event Speculation: Some of the above: roadmap events and those to do with the token supply; are events that can be predicted ahead of time, and such a list includes predictable news events that can have one or two outcomes, like the launch of ETFs or the outcome of a trial between the SEC and a crypto entity, or the announcement of crypto regulations in a major world economy.

Many investors will try to get ahead of the game in anticipation of these events and speculate on the price. Which can lead to a lot of “buy the rumor sell the news” style events. Bitcoin’s ETF approval is a perfect example of this, as the Bitcoin price gained over 70% in the months leading up to the expected announcement, but lost 14% in the two weeks after it.

Unforeseen News Events and Crypto Prices

Not all news events, like Bitcoin ETF approval, can be anticipated and speculated on, such as the SEC suing Binance and Coinbase on back-to-back days in June 2023, which led to an almost 10%, $100 billion, loss in the crypto market cap over the next 10 days.

Such news events come with the territory of crypto being a young, unregulated, and volatile industry, and, while they affect price, they cannot be anticipated. They are, however, why many of the best crypto exchanges offer mobile apps and the ability for investors to set price alerts along with take profit and stop loss levels, to prevent themselves from getting rekt by such events.

Best Resources for Crypto Price Prediction

In the list below we’ve outlined the best places for finding crypto price predictions. We’ve also included some of the tools you can use to corroborate the price predictions you’ve found or to make your own.

- Cryptonews: Our experts keenly watch the crypto markets and news to provide the best up-to-date price forecasts for cryptocurrencies.

- X (Twitter): This is where most of crypto happens, and is awash with users posting their crypto price predictions.

- Telegram: This messaging app is where many of the best crypto signals groups are located. Free and paid ones are both available.

- YouTube: Here is where you can find videos of people, professionals and amateurs, posting videos of their technical analysis of tokens.

- Trading Platforms: Some trading platforms have adopted social trading aspects that allow traders to converse about tokens and their expectations.

- CoinMarketCap: A growing community section on this price-tracking website allows users to interact and share predictions. Also good for token data.

- TradingView: This platform gives you access to the charts and charting tools necessary to perform technical analysis. Also features a social element where users can share their charts.

- On-Chain Explorers: These allow you to gather and view data about a token right from the source. Popular ones include Dune, Glassnode, and IntoTheBlock.

- dApp Trackers: These tell you how popular a particular dApp is, among other statistics. The most popular one is DappRadar.

.similar-news{display:none;}

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Kane Pepi

Kane Pepi