Best Crypto to Buy Now in April 2024

In this guide, we review and rank the best cryptos to buy now. Before narrowing our list down to the eight top cryptocurrencies to buy, we evaluated 120+ tokens, based on their market performance, utility, community and adoption, development team, security, compliance, and roadmap.

To cater to investors with diverse risk tolerances, in our list of the best cryptos to invest in 2024, we included new tokens with the potential for explosive returns as well as eatablished large cap coins.

The Best Cryptos to Buy Right Now

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode ahead of Doge Day

- ETH

- usdt

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- Send SOL and wait for airdrop - the new way of doing presales

- Over $10M raised, launches April 29

- No hard cap total - first come first served

- Solana

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

- Innovative stake-to-mine project for easy BTC mining

- Presale has raised over $6.5m so far

- Over 90% staking APY during presale

- ETH

- bnb

- usdt

- +1 more

- Access to huge fee revenue through staking

- 50% of 10bn token supply available at presale stage

- 85% of fees go back to the community

- usdt

- bnb

- ETH

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- ETH

- Innovative AI crypto casino offering staking, airdrops and custom games

- $HPLT presale has raised over $400k so far with +60M bets placed by +150k users

- Offers daily staking rewards, hype NFTs and is fully audited by Certik

- bnb

- ETH

- usdt

The Best Cryptocurrencies to Buy in 2024

Here’s our list of the 20 best cryptos to buy now in 2024:

- Dogeverse — Overall best crypto to buy now in 2024

- WienerAI — Best AI-powered meme coin for innovative use cases

- Slothana — Top Solana meme coin offering staking yields

- Mega Dice Token — Leading crypto for casino and sports betting enthusiasts

- 99Bitcoins Token — Innovative crypto with learn-to-earn model

- Sponge V2 — Top play-to-earn crypto offering staking rewards

- Shiba Shootout — Best community-focused coin to buy today

- Gas Wizard — Best utility crypto for gas and EV charging discounts

- Healix — Leading healthcare-focused crypto for decentralized medical benefits

- BlastUp — Top launchpad coin providing exclusive access to new crypto projects

- Clair Meme – AI generated meme avatars for use in the metaverse

- Bitcoin — Best crypto for long-term value preservation

- Ethereum — Best platform for decentralized applications

- XRP — Best cross-border digital payment solution

- Solana — Top choice for high-speed blockchain transactions

- BNB — Best utility token for ecosystem integration

- Dogecoin — Top meme coin with massive community support

- Polygon — Best layer 2 scaling solution for Ethereum

- Chainlink — Leading oracle service for real-world data integration

- Tron — Best for high-throughput decentralized applications

- Avalanche — Top performer in fast and low-cost transactions

Top Cryptocurrencies to Buy Now Reviewed

Below, you’ll find detailed reviews of the 20 best cryptos to invest in 2024 that could deliver market-beating returns during the current crypto bull market.

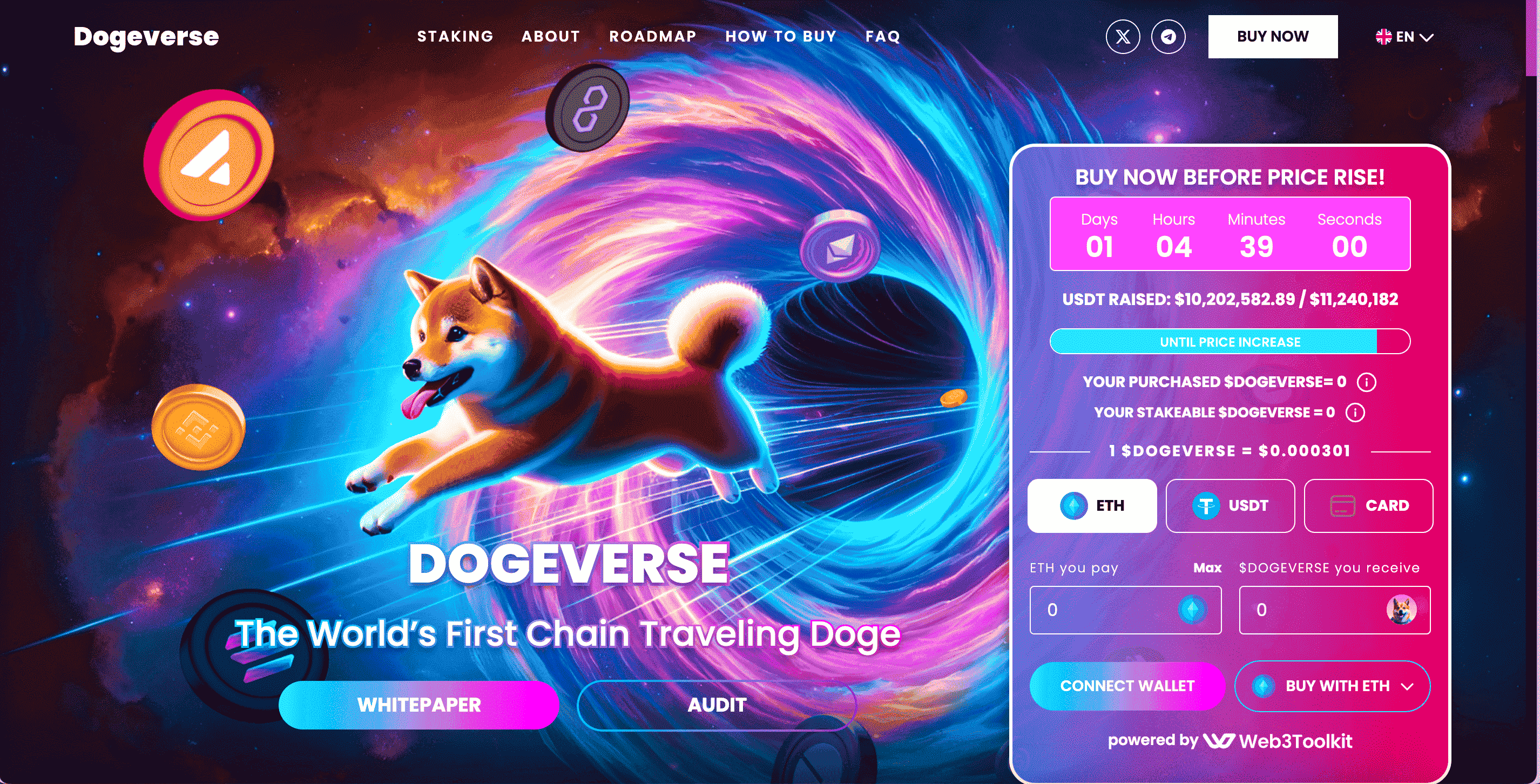

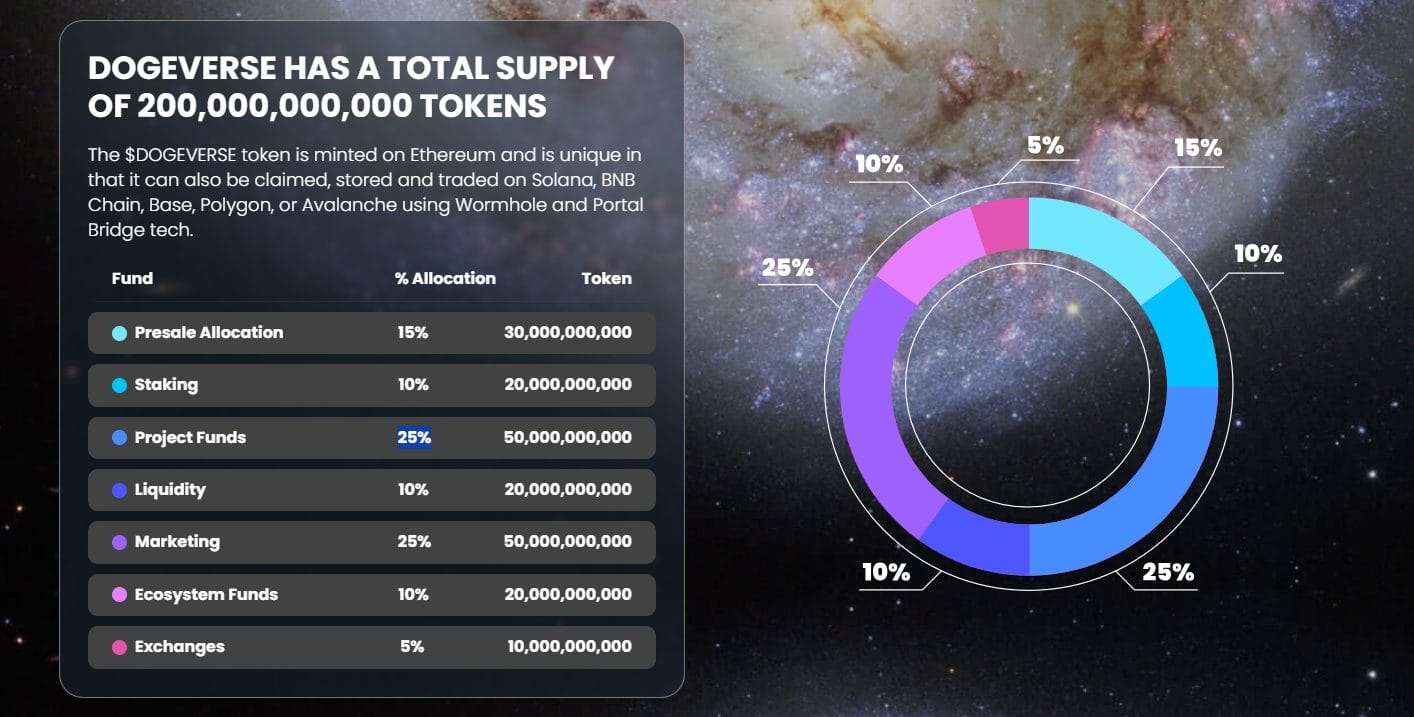

1. Dogeverse — Overall Best Crypto to Buy Now

Dogeverse is making waves as the world’s first multichain meme coin. Deployed across several major blockchains, including Ethereum, BNB Chain, Polygon, Base, Avalanche, and Solana, this coin distinguishes itself by allowing users to seamlessly operate across various ecosystems.

This interoperability enhances its usability and appeal, setting it apart from typical single-chain tokens. Its theme centers around Cosmo the Doge, adding a fun and engaging narrative to the project.

The token’s presale has been a resounding success so far, raising over $250,000 within minutes, over $4 million in a week, and currently standing at $10 million. This early success is a testament to the strong investor interest and confidence in the project’s potential.

Moreover, Dogeverse stands out as one of the best cryptocurrencies to buy right now due to its strategic tokenomics and ambitious future roadmap. The token design encourages holding through incentives and staking rewards, promising a sustainable model that enhances its value proposition over time.

With plans for further expansion into additional blockchains and continuous development, Dogeverse is well-positioned for significant growth in the upcoming years.

Follow Dogeverse on X and join its Telegram channel for the latest updates. For more information, check out the Dogeverse whitepaper.

2. WienerAI — Best AI-Powered Meme Coin for Innovative Use Cases

WienerAI is a unique meme coin, offering users artificial intelligence perks. The goal of this token is to present a gentler, kinder image of AI. Because it’s driven by artificial intelligence, WienerAI infinitely available, paving the way for radically new use cases to be introduced.

The project’s tokenomics are simple. There are 69 billion WienerAI tokens in total, out of which 20% is reserved for staking, 20% for marketing, 10% for community rewards, 10% for DEX listing, and the remaining 40% is for the ongoing presale.

The presale is multi-staged, which means getting in early can give you the highest possible gains. Tokens can be purchased using ETH, USDT, or BNB. However, using BNB won’t allow users to enjoy WienerAI’s staking perks.

The project is receiving considerable attention. Stay updated and join the community by following WienerAI on Twitter and Telegram.

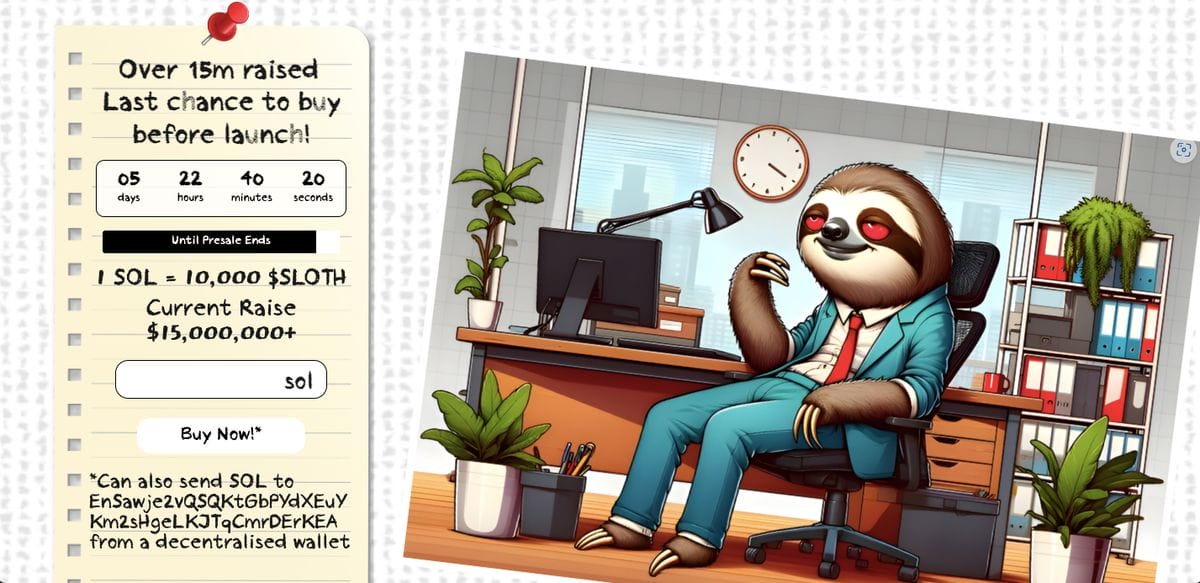

3. Slothana — Top Solana Meme Coin Offering Staking Yields

Slothana is a fresh and humor-filled Solana meme coin, resonating with investors through its unique office sloth theme. The simplicity of its presale mechanism, which allows investors to directly send SOL to a designated address and receive $SLOTH tokens via airdrop, makes it accessible and straightforward.

The presale of Slothana has been a massive success, raising over $15 million quickly. This early achievement demonstrates strong market interest and confidence in the coin’s potential, indicating robust community support and trust.

Its clear focus on community engagement and strategic tokenomics also suggests potential for growth. The roadmap includes plans for enhancing the ecosystem and increasing token utility, positioning $SLOTH as one of the best cryptos to buy for those interested in meme coins with growth potential.

For project updates, follow Slothana on X or join its Telegram channel.

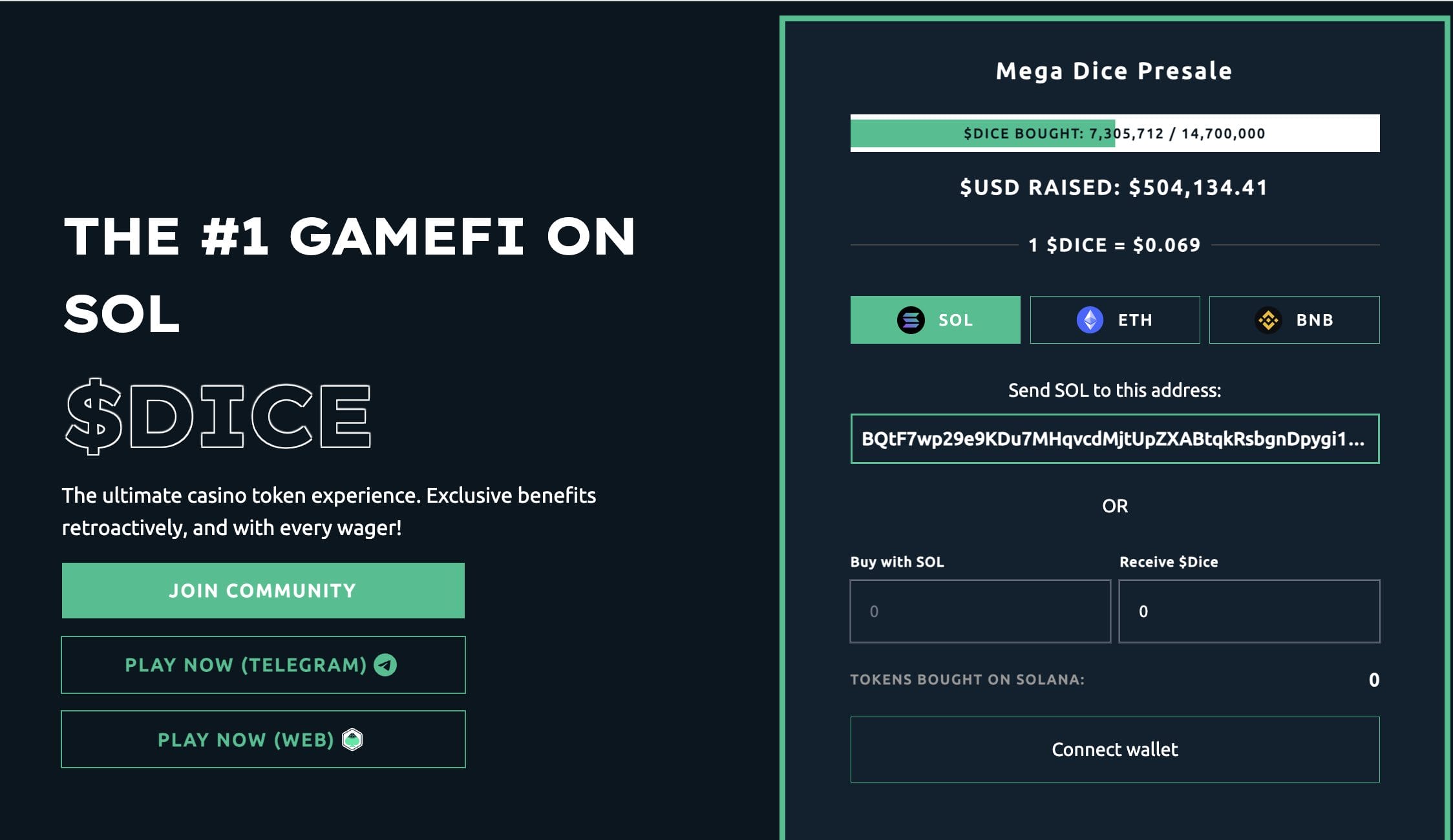

4. Mega Dice Token — Leading Crypto for Casino and Sports Betting Enthusiasts

Mega Dice Token is the native token of Mega Dice’s casino and sports betting platform. Holders benefit from discounts, bonuses, and high staking yields on Mega Dice Casino.

$DICE token holders can stake their holdings on the Mega Dice smart contract and start generating high annual yields. Players can take part in 4,500+ casino games and 50+ sports betting markets on Mega Dice Casino. Depending on their performance, staked token holders can win daily bonuses.

Mega Dice Token has a total supply of 420 million, of which 35% has been allocated to the presale. Early presale investors can also win Early Bird prizes, receiving additional tokens directly in their crypto wallets.

At the time of writing, $DICE is priced at $0.069. It raised more than $500,000 within a week of its presale launch. The strong investor interest demonstrated so far, combined with extensive utility and sound tokenomics make it one of the best cryptocurrencies to buy in 2024.

For more information, read the Mega Dice Token whitepaper and join the exclusive Telegram channel.

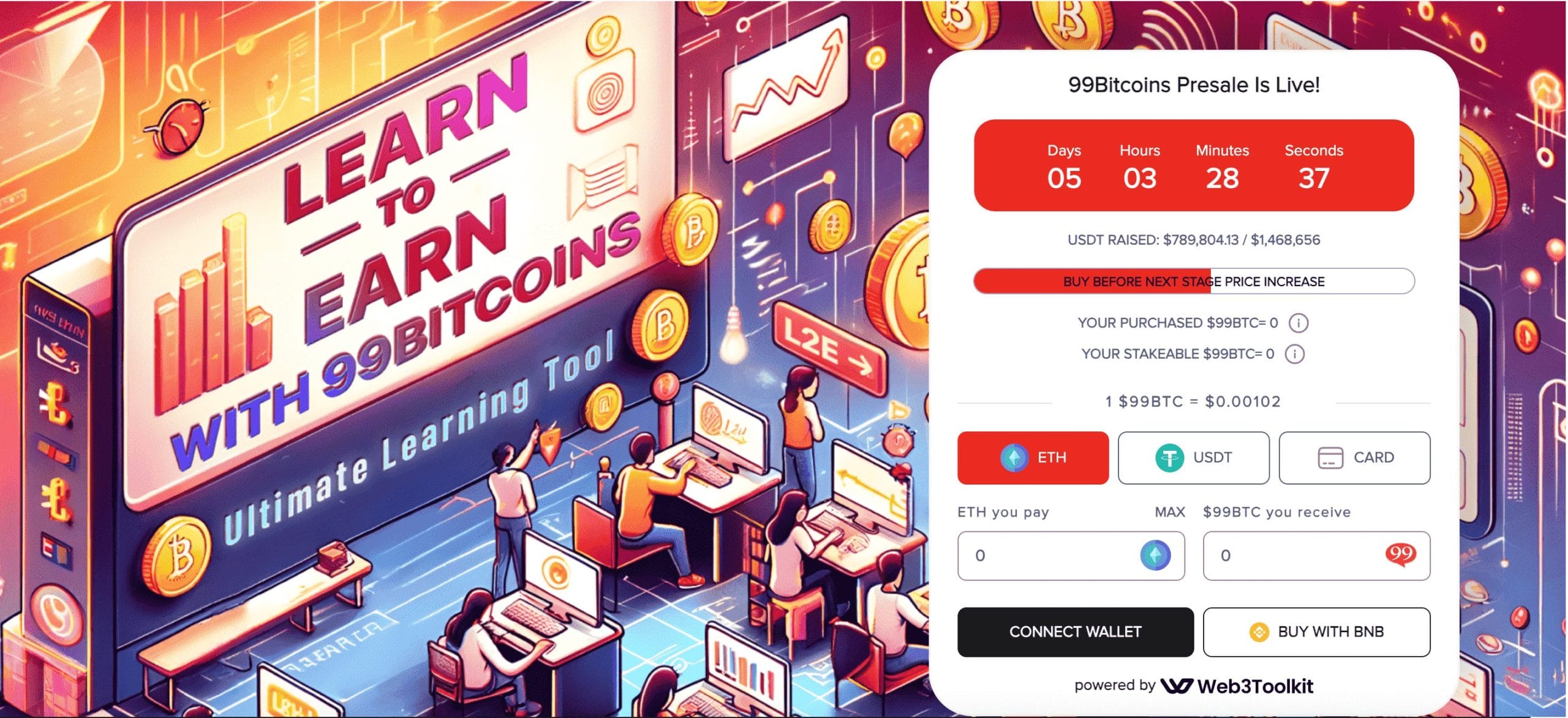

5. 99Bitcoins — Innovative Learn-To-Earn Crypto

The 99Bitcoins Token is revolutionizing crypto education with its learn-to-earn model. By engaging with educational content, users earn 99BTC tokens, adding a practical reward to their learning experience. This innovative approach is coupled with plans to integrate with the BRC-20 standard on the Bitcoin network, enhancing security and expanding utility.

The token’s presale raised over $800,000 so far, signaling strong investor interest. The initial low price of $0.001 per token attracted early investments, particularly from cryptocurrency whales, drawn by the prospect of future value increases. The token now costs $0.00102.

With over 700,000 YouTube subscribers, 99BTC is not just a token but a growing educational platform in the crypto space. Leveraging the brand’s substantial educational influence and community trust, 99Bitcoins stands out as a top crypto buy in 2024.

For more information, go through the 99Bitcoins whitepaper and join the Telegram channel.

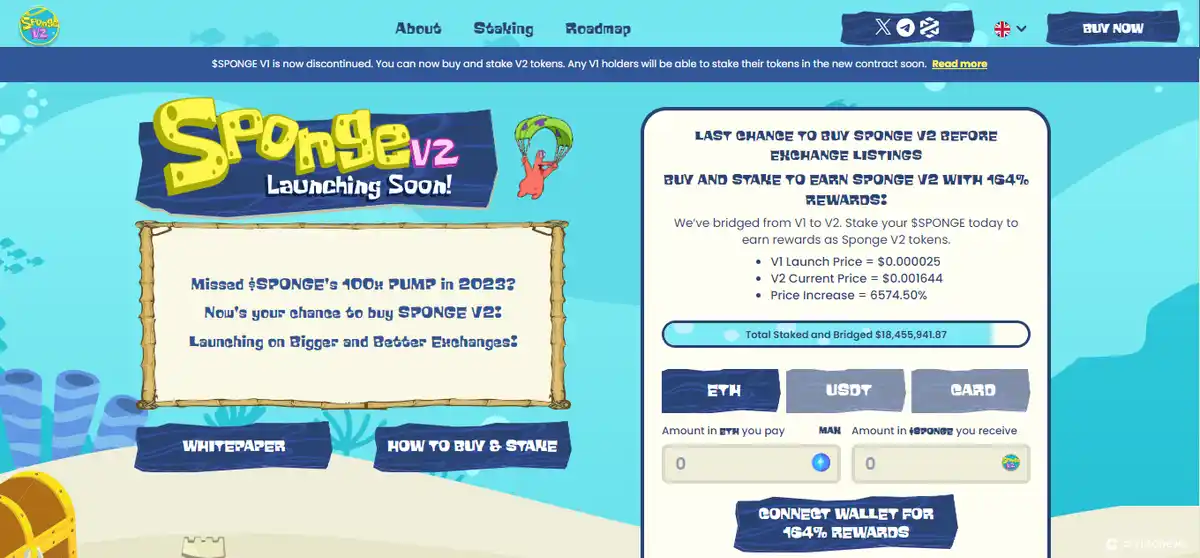

6. Sponge V2 — Top Play-to-Earn Crypto Offering Staking Rewards

Sponge V2 is an updated version of the ultra-popular $SPONGE meme coin, which exploded to a nearly $100 million cap in the spring of 2023. The team behind $SPONGE aims to deliver another 100x return with the V2 token and achieve listings on Tier-1 crypto exchanges like Binance and OKX.

The only way to get Sponge V2 right now is to buy the V1 token and stake it to bridge to V2. Staked V1 tokens will be permanently locked and investors will receive rewards in $SPONGE V2 tokens for the next 4 years.

The relaunch of Sponge includes a play-to-earn game called Racer Game. You can practice the game for free without needing tokens. However, to earn Sponge V2 tokens while playing, you must purchase gaming credits with your Sponge V2 tokens.

$SPONGE has a community of more than 11,500 holders behind it and nearly $8 million worth of $SPONGE has already been staked to bridge to V2. For a limited time, new investors in $SPONGE will receive a 100% purchase bonus in V2 tokens. At the time of writing, Sponge V2 has raised over $18 million in total.

Follow the project on X, Telegram, and Discord for updates about the V2 launch.

7. Shiba Shootout — Best Community-Focused Coin to Buy Today

Shiba Shootout is one of the best cryptos to buy right now aiming to build a vibrant crypto community around it. This captivating meme blends humor and gaming within the crypto landscape. It features a unique Wild West theme and allows token holders to engage in community-driven activities like staking and governance.

The presale has allocated 35% of its total 2.2 billion token supply to early investors, targeting both short-term traders and long-term holders attracted by the token’s narrative and community benefits.

In addition, token distribution includes community rewards, liquidity provisions, marketing, and ongoing development, ensuring a balanced approach to growth and sustainability. Shiba Shootout’s tokenomics foster participation through “Cactus Staking,” where users can earn rewards, and “Lucky Lasso Lotteries,” enhancing engagement.

Beyond typical meme coin features, Shiba Shootout offers “Campfire Tales” and “Savings Saddlebags,” integrating storytelling with financial incentives. This innovative approach could potentially evolve the project beyond its current meme coin status, suggesting a promising future within the crypto gaming sector.

To learn more about the project’s ethos or stay updated, follow its Twitter and Telegram pages.

8. Gas Wizard — Best Utility Crypto for Gas and EV Charging Discounts

Gas Wizard is one of the best crypto to buy now. The starting presale token price is $0.01, which will go up with each presale stage. This token offers something unique: combatting surging gas prices with a blockchain-based loyalty program.

Once the project launches, you’ll be able to pay for gas and EV charging with $GWIZ tokens, earn rewards, get discounts, and even participate in free gas tank giveaways.

You can now buy the token with ETH, BNB, USDC, USDT and WBTC. Unfortunately, there’s no staking live yet. Given how the team has allocated 15% of the total token supply for staking rewards, this feature will probably be live soon.

After the presale ends, only 20% of your tokens will be available for claiming. The remaining tokens will be airdropped at a 10% per month rate.

Make sure to read the Gas Wizard whitepaper for more information. Follow Gas Wizard on X and join its Telegram channel to stay updated.

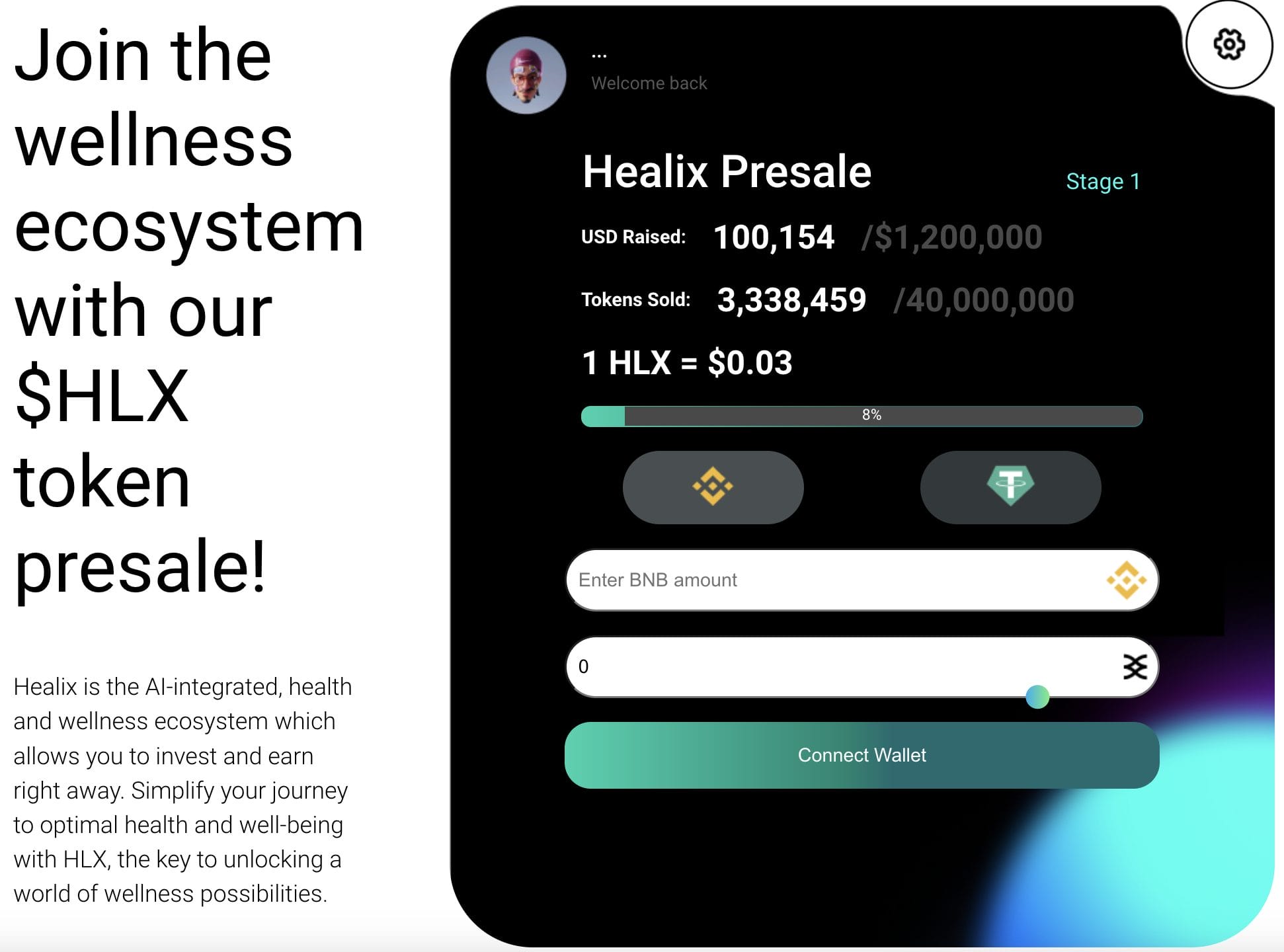

9. Healix — Leading Healthcare-Focused Crypto for Decentralized Medical Benefits

Healix ($HLX) is an innovative cryptocurrency that leverages artificial intelligence protocols to decentralize the healthcare industry. With $HLX, token holders can access premium healthcare products and services and get benefits on the Healix platform.

One of the main features of Healix is the ‘Smart Health Club.’ This is an exclusive opportunity for token holders to extract several healthcare benefits – such as premium access to services and $HLX discounts within the ecosystem.

You get higher benefits, depending on the number of $HLX tokens staked. Other benefits include cashback on token payments with the Healix ecosystem. Healix introduces AI generative models that allow users to access their blood pressure levels by completing a simple face scan on the Healix app.

From a total supply of 1 billion tokens, 10% are being offered through the ongoing presale. At press time, $HLX is priced at $0.03 per token. $100K has been raised since the presale started. For more information, read the Healix whitepaper and join the Telegram channel.

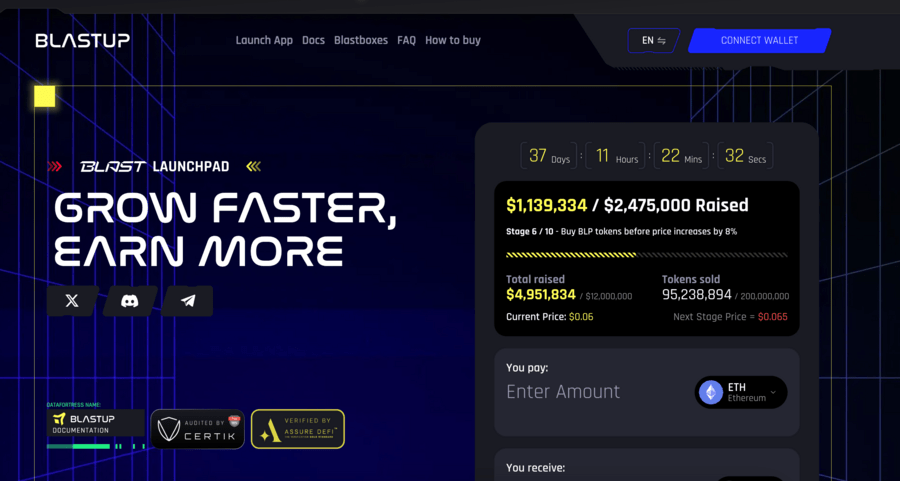

10. BlastUp — Top Launchpad Coin Providing Exclusive Access to New Crypto Projects

The next best crypto to buy right now is BlastUp. It is a promising launchpad that lets you invest in new projects within the exciting Blast ecosystem. It’s the first Ethereum Layer 2 (L2) platform that rewards ETH and stablecoins. The Blast ecosystem reached a total value of $1 billion in just 35 days after witnessing huge community support.

BlastUP helps new crypto projects raise money in a way that’s fair and easy to use. If you buy and hold BlastUP’s native $BLP tokens, you can get exclusive access to token sales on the platform.

Early buyers can get the BLP at press time for only $0.06. However, this price will increase to $0.1 during the expected exchange listings. Staking BLP tokens also gives you other rewards and benefits. You can earn Booster Points, which give you even more benefits in presales and other activities on the platform.

If you stake many BLP tokens, you get weekly drops of special boxes called Blastboxes. These can contain rewards like NFTs, stablecoins, and ETH. you can enter the BlastUp Telegram channel and follow it on X (Twitter) to get the latest updates.

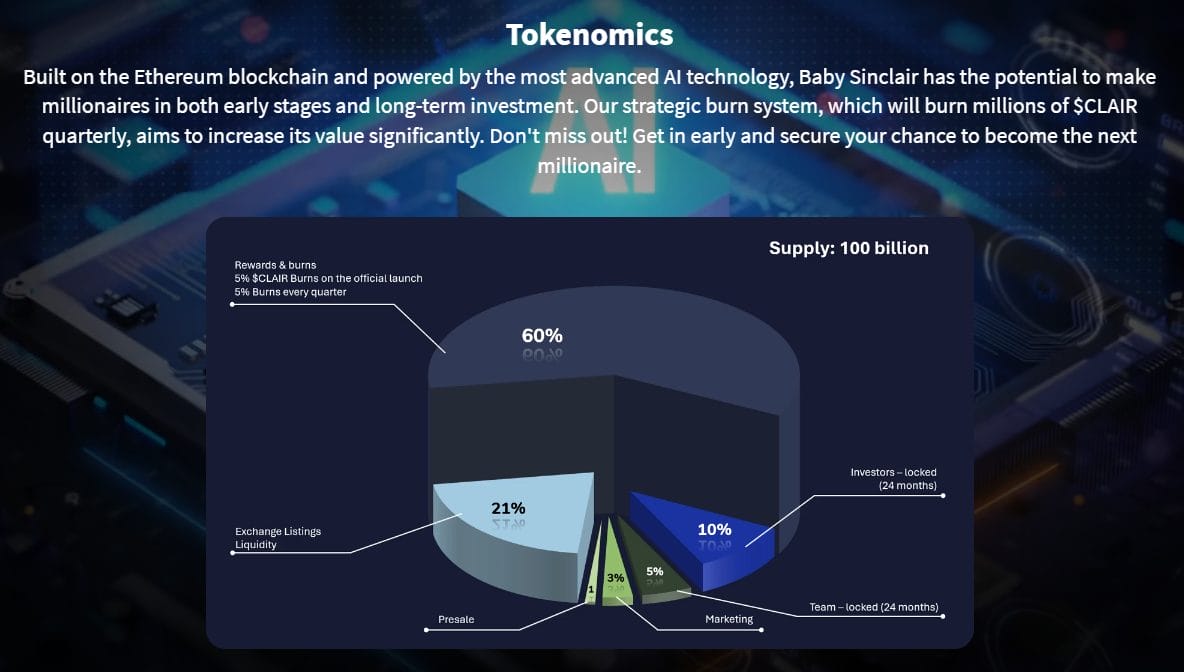

11. Clair Meme – AI Driven Meme Coin With Metaverse Integration

Clair Meme is the latest meme coin project with the potential to explode this summer as we enter the next stage of the crypto bull market.

Through the recent launch of its ICO, Clair Meme raised thousands of dollars within minutes, making hopes high that the token could record big gains in the future.

However, what sets Clair apart from the majority of other meme coins is its integration of the latest AI protocols and hilarious approach to some of the biggest names in crypto. The Clair eco-system allows you to create your own meme avatars and give them your voice allowing you to seamlessly interact with thousands of other users around the world.

Ultimately, your avatar meme becomes your passport to the metaverse and will enable you to engage, compete and earn in a completely new world.

Interestingly, Clair has a unique quarterly token burn mechanism which sees 5% of the total token supply burnt every three months to ensure scarcity and help price discovery. Clair Meme has a total supply of 100,000,000,000 tokens, with 1% (1 billion) available to the presale. You can buy and claim the Clair token on Ethereum.

To keep up to date with all of the Clair updates be sure to follow the project on Twitter and join the exclusive Telegram channel.

12. Bitcoin — Best Crypto for Long-Term Value Preservation

Bitcoin is the world’s oldest cryptocurrency and the largest by market cap by a wide margin. It’s the only cryptocurrency that’s officially recognized by many major governments, including the US, and it’s used as legal tender in countries like El Salvador. Recently, the first spot Bitcoin ETFs began trading on US stock exchanges.

Key Highlights:

- Price as of April 26, 2024: $64,405.51

- Market cap: $1.3 trillion

- Last 24 hours change in price: +0.93%

- All-time high: $73,628.40

- Bitcoin price has increased in the last year with a change of +123.22%

Why Bitcoin made it onto our list:

Bitcoin has been driving the crypto bull market for much of the past year. It’s more than doubled in value in the past 12 months, vastly outperforming major altcoins like Ethereum.

It’s now trading well over the key $42,000 price benchmark set during the 2020-21 crypto bull run. This provides a major psychological boost that’s likely to provide BTC with important momentum over the coming months.

Bitcoin could see even more gains thanks to the upcoming Bitcoin Halving and anticipated interest rate cuts across most major economies. In fact, the Bitcoin price prediction for the end of 2024 is a remarkable $90,000.

13. Ethereum — Best Platform for Decentralized Applications

Ethereum is the world’s second-largest crypto by cap and the most widely used blockchain network for dApp development. The project was the first to introduce smart contracts when it launched in 2015. Ethereum successfully transitioned from a proof-of-work validation mechanism to a proof-of-stake mechanism in 2022.

Key Highlights:

- Price as of April 26, 2024: $3,144.46

- Market cap: $388 billion

- Last 24 hours change in price: +0.37%

- All-time high: $4,867.17

- Ethereum price has increased in the last year with a change of +66.91%

Why Ethereum made it onto our list:

Ethereum remains the most popular blockchain network for developers. It’s where most of the action in the crypto world is happening, including new launches, new play-to-earn crypto games, and advances in DeFi.

There’s a flywheel effect at play here. As Ethereum gets bigger, more developers build on it and encourage even more users to join. All the while, demand for ETH keeps growing and its value continuously rises.

Ethereum successfully fended off challenger blockchains like Cardano and Solana during the last crypto bull market. Now, the focus is on Layer-2 solutions that improve the speed of the Ethereum network and boost Ethereum’s value rather than building new blockchains to try to knock down the smart contract king.

Currently valued at just over $3,000, the most optimistic Ethereum price prediction points to a valuation of over $7,000 by 2025.

14. XRP — Best Cross-Border Digital Payment Solution

XRP is the official crypto token of the Ripple payment network, which was built to make international payments faster and cheaper. The project is coming off a win against the SEC, which alleged that XRP was an unregistered security. XRP is now the 7th largest crypto by market cap.

Key Highlights:

- Price as of April 26, 2024: $0.522

- Market cap: $28 billion

- Last 24 hours change in price: -0.33%

- All-time high: $3.92

- XRP price has increased in the last year with a change of +13.37%

Why XRP made it onto our list:

XRP has been held back for years by uncertainty over whether it would be classified as a security in the US. Now, thanks to its court victory over the SEC, that uncertainty is gone.

That has cleared the way for major banks to try out Ripple’s payment network using XRP. The project has brought on major partners like Bank of America, PNC Bank, Santander Bank, and more.

XRP is up only slightly since its court victory last summer, leading many analysts to think that it is undervalued. More interest in using XRP for international payments during the current crypto bull market could send its price skyrocketing — even the most conservative XRP price prediction points to a 240% value surge by 2025.

14. Solana — Top Choice for High-Speed Blockchain Transactions

Solana is a fast and cheap blockchain created as a challenger to Ethereum. It’s been one of the most successful crypto tokens of the resurgent crypto bull market, rising more than 620% in value over the last 12 months. Solana is now the 5th-largest crypto by market cap.

Key Highlights:

- Price as of April 26, 2024: $144.15

- Market cap: $67 billion

- Last 24 hours change in price: -1.31%

- All-time high: $259.52

- Solana price has increased in the last year with a change of +562.49%

Why Solana made it onto our list:

No cryptocurrency has more momentum than Solana right now. It has been on an uninterrupted winning streak for the past several months, gaining nearly 5x in value and experiencing a surge in developer interest.

Solana’s performance is even more impressive considering where the project was a year ago. It was a favored project of disgraced FTX founder Sam Bankman-Fried, and many analysts thought Solana would simply disappear after FTX collapsed. However, the chain has demonstrated that it’s highly resilient.

While we don’t think Solana will challenge Ethereum for dApp dominance, it’s still one of the best cryptos to buy now, with potential gains of over 120% by 2025, according to our Solana price prediction.

15. BNB — Best Utility Token for Ecosystem Integration

BNB is the official cryptocurrency of Binance, the world’s largest crypto exchange. It offers discounts on trading and benefits like early access to new crypto launches on Binance. It’s the 4th-largest crypto by cap.

Key Highlights:

- Price as of April 26, 2024: $609.60

- Market cap: $89 billion

- Last 24 hours change in price: +0.12%

- All-time high: $689.33

- BNB price has increased in the last year with a change of +84.75%

Why BNB made it onto our list:

BNB’s performance in 2023 wasn’t impressive. For much of the year, it was down because of a US prosecution of Binance and its founder, Changpeng Zhao, for violating anti-money laundering and sanctions requirements.

Binance has now settled that lawsuit and its business has hardly suffered. More important, an investigation into Binance turned up no evidence of fraud—dispelling rumors that Binance could follow the fate of FTX. In other words, the US government determined that the exchange’s financial undergirding is solid.

As such, BNB has seen a remarkable surge in price of over 73% in the last 12 months, with most of those gains being made since February 2024. All in all, Binance is a great business at the center of the crypto world. It’s likely to see continued long-term growth as evidenced in most BNB price predictions.

16. Dogecoin — Top Meme Coin with Massive Community Support

Dogecoin is the original meme coin, launched in 2013. It was mostly unheard of until 2020-21, when it gained the attention of major celebrities including Tesla founder Elon Musk. Since Dogecoin’s explosive gain during the last bull market, it’s inspired thousands of copycat meme coins—including highly successful ones like Shiba Inu.

Key Highlights:

- Price as of April 26, 2024: $0.151

- Market cap: $23 billion

- Last 24 hours change in price: +1.28%

- All-time high: $0.738

- DOGE price has increased in the last year with a change of +89.91%

Why Dogecoin made it onto our list:

Dogecoin has risen over 80% in value in the past 12 months, with the greatest gains coming since late February 2024. Meme coins have always fared well when the crypto market is hot, which it is right now.

In addition, Dogecoin is at this point more than just a meme coin. It’s widely accepted for payments in the crypto world, and increasingly in the real world as well.

Dogecoin has proven that it can fend off challengers like Shiba Inu and Pepe, giving us confidence that this is still one of the best meme coins to buy. While likely still far off, it’s even possible that Dogecoin could get its own ETF one day.

In fact, according to our analysts’ Dogecoin price prediction, it has the highest growth potential in this list, with possible gains of over 660% by 2024 and 1,950% by 2030.

17. Polygon — Best Layer 2 Scaling Solution for Ethereum

Polygon is a Layer-2 solution for Ethereum that makes it faster and cheaper to run transactions on the Ethereum network. It recently initiated a major upgrade to Polygon v2, which includes transitioning the $MATIC token to a new $POL token. $MATIC will be transferable to $POL at a 1:1 ratio.

Key Highlights:

- Price as of April 26, 2024: $0.717

- Market cap: $5.9 billion

- Last 24 hours change in price: +2.36%

- All-time high: $2.91

- Polygon price has decreased in the last year with a change of -27.70%

Why Polygon made it onto our list:

Polygon suffered badly over the past two years as network activity on Ethereum dropped and competing Layer-2 solutions like Eigenlayer, Arbitrum, and Optimism gained traction. Polygon is responding with a massive development effort that includes retooling nearly every aspect of its network.

This effort involves transitioning from the $MATIC token, which is used to pay for transactions on Polygon, to a new $POL token that will offer increased staking rewards. While this transition hasn’t yet had a major impact on $MATIC’s price, we think gains will arrive as Polygon finishes the first milestones on its new roadmap.

On top of that, Polygon stands to benefit from Ethereum’s flywheel. As crypto rebounds and development on Ethereum spikes, transaction volume on Polygon should increase as well.

18. Chainlink — Leading Oracle Service for Real-World Data Integration

Chainlink is a blockchain oracle network. It enables blockchains like Ethereum to collect real-world data, such as stock prices, sports scores, and more. The project’s native token, $LINK, is used to pay for access to data and is the 16th-largest crypto by market cap.

Key Highlights:

- Price as of April 26, 2024: $14.84

- Market cap: $8.4 billion

- Last 24 hours change in price: +1.03%

- All-time high: $52.89

- Chainlink price has increased in the last year with a change of +110.56%

Why Chainlink made it onto our list:

Chainlink’s oracle services are crucial to the smooth functioning of the Ethereum network and the many thousands of dApps built on it. Thanks to Chainlink, smart contracts can collect real-world data required for decentralized finance, sports betting, Internet of Things applications, and more.

Chainlink stands to benefit from renewed development on Ethereum and increased interest in DeFi. The more dApps there are using Chainlink’s data, the more fees the network collects and the more the $LINK token gains value.

Chainlink has more than doubled in value in the last year and has a lot of momentum heading into 2024.

19. Tron — Best for High-Throughput Decentralized Applications

Tron is a blockchain launched in 2017 with the goal of democratizing media consumption and eliminating middlemen on the internet. It’s since morphed into an Ethereum competitor, taking on roles in DeFi and general dApp development. However, Tron remains much smaller than Ethereum, with a market cap of around 1/30th that of Ethereum

Key Highlights:

- Price as of April 26, 2024: $0.117

- Market cap: $10.5 billion

- Last 24 hours change in price: +2.55%

- All-time high: $0.302

- Tron price has increased in the last year with a change of +79.06%

Why Tron made it onto our list:

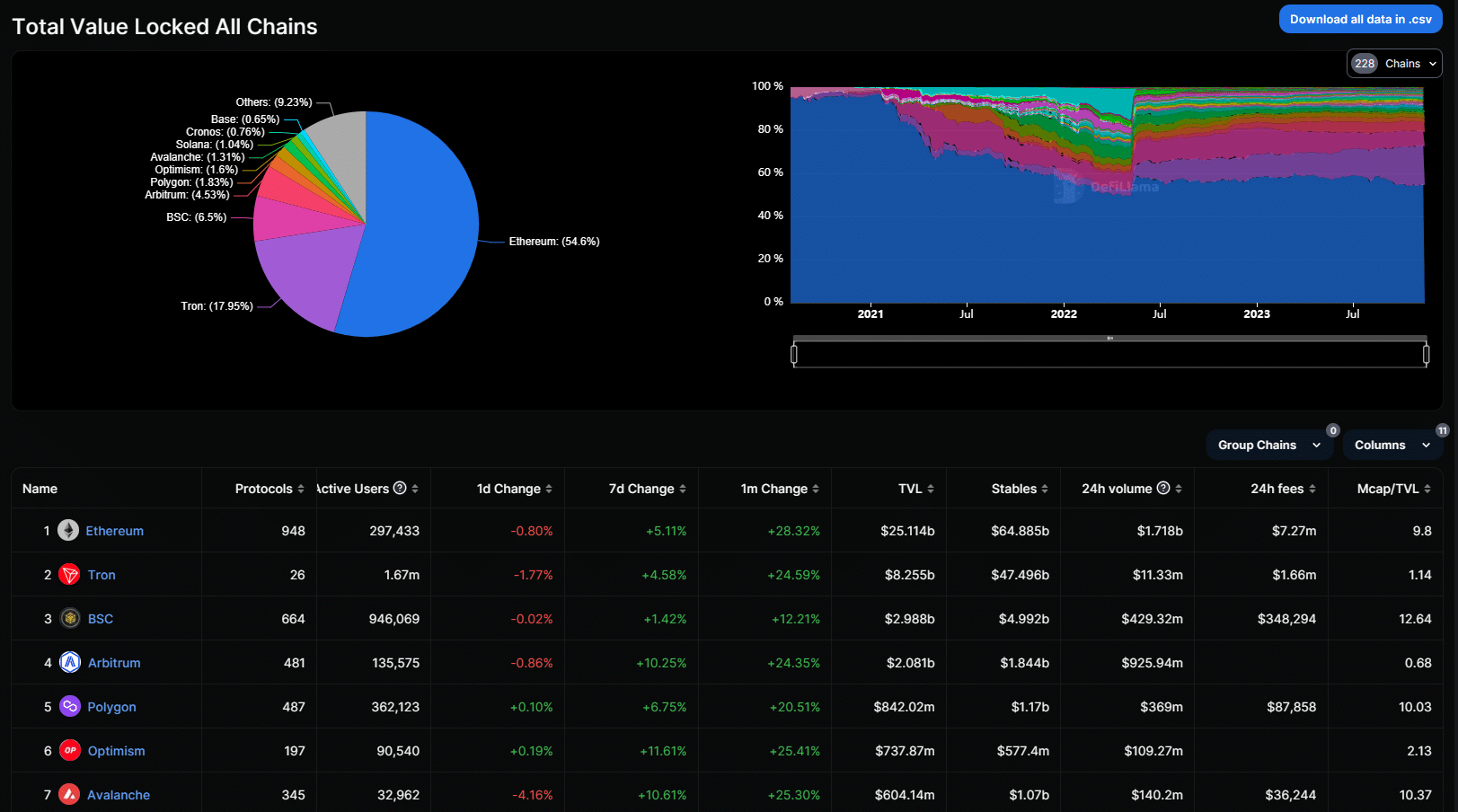

Tron is one of the fastest-growing blockchains, and it’s increasingly important in the world of DeFi. It’s now home to the majority of USDT and USDC stablecoins, which are used for everything from crypto trading to lending and staking.

That has resulted in Tron becoming the second-largest blockchain for total value locked (TVL) behind Ethereum. TVL growth demonstrates a long-term commitment to the Tron blockchain that has translated into significant gains for $TRX.

On top of that, Tron could see massive growth if it achieves its original aim of becoming a hub for decentralized content. Media companies are in turmoil right now, which could present an opening for Tron to step into.

20. Avalanche — Top Performer in Fast and Low-Cost Transactions

Avalanche is an ultra-fast blockchain and Ethereum competitor launched in 2020. It uses smart contracts and a proof-of-stake validation mechanism, similar to Ethereum, but offers more scalability for dApp developers. Avalanche’s $AVAX token is now the 11th-largest crypto by cap.

Key Highlights:

- Price as of April 26, 2024: $35.45

- Market cap: $14.2 billion

- Last 24 hours change in price: +0.59%

- All-time high: $146.18

- Avalanche price has increased in the last year with a change of +103.34%

Why Avalanche made it onto our list:

Avalanche is a high-momentum project that’s nearly doubled in value in the past five months. That momentum shows no signs of slowing down now, which means that even bigger gains could be on the way for $AVAX.

The gains in Avalanche are being driven by strong fundamentals, including more developers flocking to this blockchain. It remains one of the strongest Ethereum competitors, expanding slowly and methodically rather than going through boom and bust cycles like Solana and Cardano.

Avalanche is focused on tokenizing real-world assets and GameFi, which are expected to be leading areas of development in the crypto sphere. So, look for $AVAX to be a standout token over the next 12 months.

Methodology: How We Rated the Best Cryptos to Buy Now

To curate this list of the best cryptos to buy now we looked at various factors including historical performance, potential for growth and long-term potential, current price, utility, and security.

For new projects currently on presale we also analyzed their teams, whitepaper, tokenomics, and roadmap to ensure they are legitimate projects that offer no risk of being a scam. Here’s how we weighted every aspect of the best cryptos to buy now.

Market Performance (25%)

- Recent Price Trend: We assessed the crypto’s price movement over the past three to six months, considering both short-term and long-term trends.

- Market Capitalization: We looked at the overall market value of the cryptocurrency, as it reflects its position and significance in the market.

Utility and Use Cases (20%)

- Practical Applications: We examined how the cryptocurrency is used in real-world scenarios, considering whether it has unique features or applications that set it apart.

- Technological Innovation: We evaluated the underlying technology and any recent innovations that contribute to the cryptocurrency’s usefulness.

Community and Adoption (15%)

- Community Engagement: We analyzed the level of activity on social media, forums, and community platforms as a colorful and engaged community often indicates strong support.

- Adoption Rate: Since higher adoption rates suggest a broader ecosystem, we looked at how widely the cryptocurrency is accepted by merchants, businesses, and other users.

Development Team (15%)

- Team Reputation: We investigated the track record and reputation of the development team. We don’t want to put down any crypto projects from newcomers, but we can all agree that experience and success in previous projects enhance credibility.

- Transparency: We assessed how transparent the team is in sharing project updates, development progress, and any challenges faced. The more the community knows about what’s going on, the more confident they can feel about their crypto purchase.

Security (15%)

- Network Security: We evaluated the security features of the underlying blockchain technology, considering factors like consensus mechanism and resistance to attacks.

- Past Security Incidents: We researched any historical security incidents or vulnerabilities, and analyze how well the team handled and mitigated them.

Regulatory Compliance (5%)

- Compliance with Regulations: We checked if the cryptocurrency complies with legal and regulatory frameworks in the regions where it operates – a crucial factor for long-term sustainability.

Roadmap and Future Plans (5%)

- Development Roadmap: A clear and well-defined roadmap can instill confidence in investors, so we also reviewed the crypto’s future plans, upcoming updates, and milestones outlined in its development roadmap.

Put together, the scores provided a comprehensive view of the cryptocurrency’s overall strength and potential, and allowed us to assign a percentage rating to each of the cryptos recommended on this page.

How to Find the Best Cryptos to Buy

In this section, we explain some of the factors that investors need to take into account when searching for good crypto to buy now for their portfolio. These include:

- Long-term potential

- Crypto presales

- Utility

- Market capitalization

- Competition

- Trading volume, signals, and bots

- Trends

Long-Term Potential

First, it’s wise to consider potential of assets as long-term crypto holdings. For example, Bitcoin will likely remain a ‘store of value’ for most, while Ethereum operates as the de-facto smart contract blockchain for ERC-20 tokens and metaverse coins, making it incredibly useful.

The long-term potential of both Bitcoin and Ethereum looks strong. Analysts at British investment bank Standard Chartered told their clients earlier this year that BTC could reach $120,000 by the end of 2024. A healthy Bitcoin means the rest of the crypto industry is healthy as investment trickles down into riskier tokens.

Similarly, many other established crypto projects should have a bright future ahead of them. For instance, XRP has formed partnerships with over 200 banks as part of its quest to become the world bridge currency.

There are dozens of examples of major brands investing in Web3 and blockchain technology and by the end of the decade, it is expected to become a much larger part of mainstream life. Indeed, ARK Invest CEO Cathie Wood has predicted that the total cryptocurrency market – currently worth just over $1 trillion – will be worth as much as $25 trillion by the end of the decade.

Follow Crypto Presales

Cryptocurrency presales allow early investors to buy a project’s tokens on a first-come, first-serve basis, enabling them to acquire coins before they’re listed on exchanges and available for public trading.

Many investors missed out on the opportunity to buy BTC for less than $100 or Ethereum for less than $1. Fortunately, new high-potential crypto presales pop up weekly, giving investors opportunities to target similar gains.

Investors must be diligent in their research to ensure they only purchase high-potential tokens that have a legitimate chance of being a worthy investment. Research should include investigating the following:

- Read the whitepaper: A whitepaper is a document that outlines the whole project and should give readers a clear understanding of exactly what they are investing in. Poorly written or vague whitepapers should be considered a red flag.

- Read the roadmap: A roadmap is the plan of how a project will develop over the coming months and years. It is easy to promise a $1 billion market cap, but the best projects also outline plans of action and the steps they will take to get to that point.

- Check the smart contract: Unfortunately, the crypto world is rife with scammers and some projects are intended to steal funds from the get-go. There are resources to check smart contracts, while top projects will provide a full audit from a reputable third-party blockchain security firm.

- Check the team: Again, due to the proliferation of scammers in the space, doxxed and public teams will relieve investors as they know exactly who is behind the project. An anonymous team is not necessarily a red flag if other parts of the project (whitepaper/roadmap/audit) are legitimate.

- Check social media sentiment: Social media sentiment and hype are crucial to the success or failure of a project. Interesting projects will fail if they do not catch the attention of the wider marker. Similarly, be wary of projects that use bots/fake accounts to promote their tokens.

Crypto Projects with Utility

Cryptocurrency projects offering high utility are likely to be more sustainable in the long run, since investors can use the tokens within the ecosystem to generate real value.

When searching for one of the top 10 cryptos to invest in, it is wise to focus on projects that have a real-world use case. As we mentioned earlier, Ethereum is a high-quality utility project as it has hundreds of other protocols and thousands of altcoins built on top of its blockchain. This means that its ETH has huge levels of demand as people engage with those projects.

At the time of writing ETH has more than a 50% market share for DeFi chains, with a TVL (Total Value Locked – the value of other projects built on its blockchain) sitting at more than $25 billion, according to DeFiLlama.

Ethereum has more than 950 other protocols built on top of it, more than a third larger than the Binance Smart Chain (664), while the next largest chain by TVL, Tron, is almost 70% smaller with a TVL of around $8 billion.

Market Capitalization

Investors should have a firm grasp of how the market capitalization of a crypto asset works as it will enable the investor to assess what the potential upside looks like. For example, when the price of Bitcoin traded at $16,000 in late 2022 it had limited upside potential because of Bitcoin’s size in terms of market cap. When Bitcoin made new highs above $70,000 in early 2024, this was a move of over 350% in less than two years.

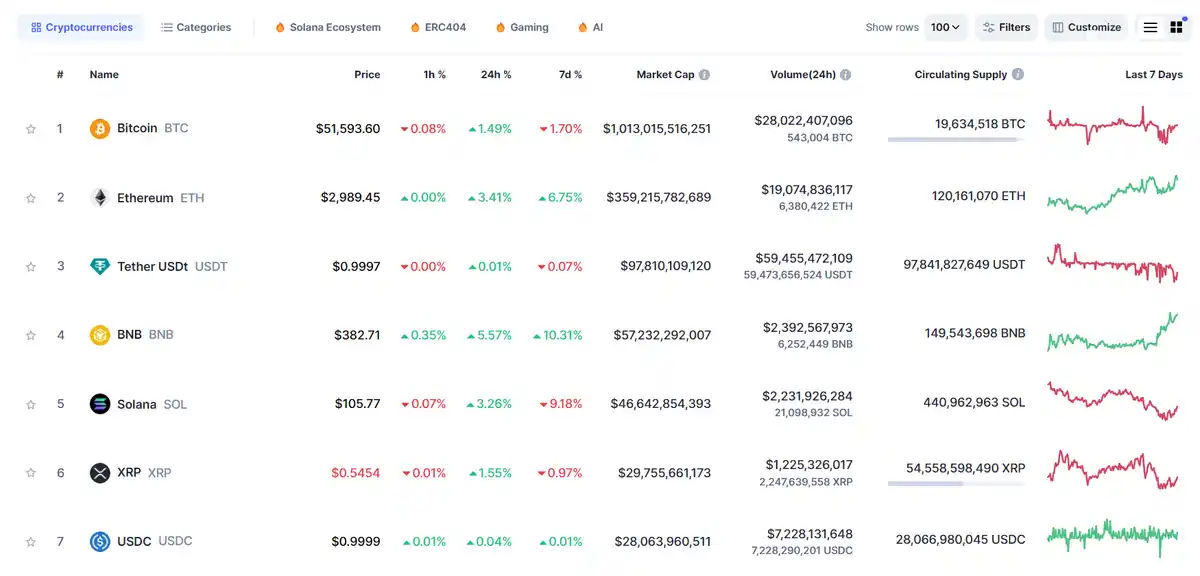

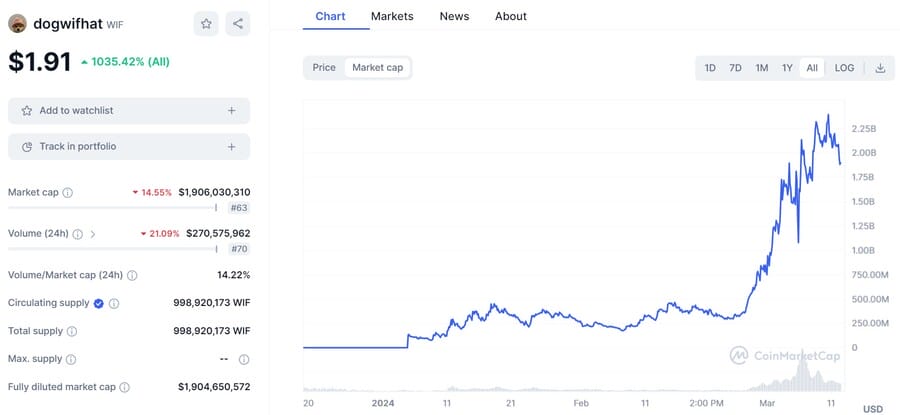

Smaller market caps projects, such as trending meme coins, have much larger room for growth as it doesn’t take so much investment to see their price increase. For example, two meme tokens listed on CoinMarketCap have recently seen higher gains than Bitcoin, namely dogwifhat (WIF) and Dogecoin (DOGE).

Of course, low market cap crypto come with increased risk that have to be priced in when investing. While small cap tokens can see much higher growth in a shorter spell than the more established coins, they are also more likely to plummet in price.

Competition From Other Coins

It is also a good idea to see how much competition the respective crypto asset has. After all, there are now more than 25,000 tokens listed on CoinMarketCap, and even more that lie in waiting. For instance, there are many so-called ‘Ethereum Killers’, each of which claims to offer a faster, cheaper, and more scalable alternative to Ethereum.

Investors will need to decide on whether it is better to invest in Ethereum or a direct competitor such as layer-2 solution Polygon, which is capable of faster speeds and cheaper transactions than Ethereum, but has yet to gain the same footing with consumers.

The same is true of ‘Doge Killer’ coins that promise to one day surpass the market cap of Dogecoin, the biggest and most popular meme coin. Crypto investors often cycle through tokens and trends, with copycat and derivative tokens quickly popping up if one token shows it resonates with investors.

Pepe is one such example. After the meme coin hit a $1 billion market cap in May 2023 it sparked a mini meme coin revival with dozens of copycats, such as Pepe 2.0, AstroPepeX, McPepe, PepeAI and dozens of others being created in its wake.

Trading Signals and Trading Bots

Some investors prefer to integrate the best crypto signals into their trading strategy. This allows them to eliminate emotions from the investing process when deciding the best crypto to invest in.

We have also reviewed the best AI crypto trading bots for traders who want to execute trades 24/7. Considering that the crypto market never sleeps using a crypto trading bot can help eliminate emotions and also automate the entire trading process.

Trends

As mentioned above, trends should not be discounted when deciding which crypto to buy today. Investing in a trending token or theme can prove to be both hugely beneficial if the timing is good – or disastrous should an investor take too long to realize that the trend is no longer popular.

During the 2021 bull run was play-to-earn gaming and the metaverse, which was expected to become a major industry in the 2020s and revolutionize the way people played games and interacted in a virtual world. Games like Axie Infinity, Sandbox, and Decentraland benefited the most with their tokens trading at all-time highs.

In early 2024, meme coins and AI tokens have had the highest returns. For example, the meme coins Bonk and dogwifhat traded mostly flat in 2023, while in February 2024, both had huge growth.

AI tokens like Render (RNDR) traded at a market cap of $500 million before the AI frenzy propelled chip-maker stocks like Nvidia to all-time highs. Riding on the AI stock hype wave, RNDR currently has a market cap of over $4 billion. It took less than two months for RNDR token price to move from $2 to over $11.

Investing in a trending token can bring huge rewards but investors should be diligent and cash out before the trend dies.

Latest Developments in Crypto

March 2024 witnessed a modest uptrend in the crypto market, culminating in a 16% increase in total market capitalization. Bitcoin hit an all-time high of US$73,000 before sharply retracting to a low of US$60,000. Capital inflows into spot BTC ETFs, which have seen over US$12B in net inflows since inception, slowed in the past month.

Ethereum’s Dencun upgrade, launched on March 13, introduced EIP-4844, or proto-danksharding, resulting in a 96.8% decrease in median L2 gas fees. However, Ethereum’s token underperformed Bitcoin, possibly due to reduced expectations of spot ETF approval in the US market.

According to the Grayscale Crypto Sectors, various tokens in the Financials Crypto Sector, including Binance Coin (BNB), MakerDAO governance token (MKR), THORchain (RUNE), 0x (ZRX), and Ribbon Finance (RBN), delivered solid returns.

However, the Consumer & Culture segment was the best-performing market segment in March, driven by high returns for meme coins. The growing popularity of meme coins on the Solana network propelled a surge in activity and a significant increase in trading volumes, rising over 224% month-over-month. Solana occasionally surpassed Ethereum to become the highest-volume network on certain days in March.

Conclusion: What’s the Best Cryptocurrency to Invest in Today?

The large-cap tokens we recommended proved they could withstand the crypto winter and come out with momentum on the other side. The new tokens we covered address new markets and could explode after launching.

Dogeverse is the overall best crypto to buy now in April 2024, while Bitcoin takes first place as the best large cap crypto to invest in.

Frequently Asked Questions (FAQs)

Which is the best crypto to buy?

The best cryptocurrency to buy right now is Bitcoin. It’s the world’s most valuable cryptocurrency, and stands to benefit from the launch of ETFs in the US and a resurgence of interest in the crypto market. Investors who want the best high-risk, high-reward crypto should consider Dogeverse, which has just launched a presale and offers high-staking rewards.

Which cryptocurrency has the best future?

Ethereum has the brightest future of any crypto right now. The largest smart contract network is attracting heavy development and successfully switched to proof-of-stake validation. There is even talk of a spot Ethereum ETF launching in the US.

What are the best new cryptocurrencies to invest in?

The best new cryptos to invest in today include Dogeverse, Slothana, Mega Dice Token, 99Bitcoins, and Sponge V2. These new cryptos are more speculative than established, large-cap tokens, but they also offer potential returns of 100x or more.

Which crypto has the most potential in 2024?

Dogeverse is a new cryptocurrency with the most potential to explode in 2024. This alternative to Dogecoin allows the holders to stake their tokens to achieve passive income.

What is the best meme coin to buy now?

The best large-cap meme coin to buy now is Dogecoin, which has demonstrated it has staying power through all conditions. However, the best meme coin with the most potential right now is Dogeverse.

References

- CoinMarketCap: Solana’s Hottest New GambleFi Presale Mega Dice Has Already Blasted Past $500,000 In First Week

- CoinMarketCap: Multi-Chain Meme Coin Presale Surpasses $10 Million Milestone – Next Best Crypto Presale to Buy Now

- CNBC: AI frenzy puts Nvidia briefly ahead of Amazon in market value

- Grayscale: March 2024: Bitcoin Reaches New High Ahead of the Halving

- Yahoo Finance: Bitcoin ETFs hit record inflows, propel BTC to new highs

- CryptoDaily: SEC Initiates Public Feedback Phase For Three Spot Ethereum ETFs

- Cointelegraph: Ethereum L2s median transaction fees decline as much as 99% post-Dencun upgrade

- CNBC: Bitcoin ETFs begin trading on U.S. exchanges

- TechCrunch: Ethereum switches to proof-of-stake consensus after completing The Merge

- Reuters: Ripple Labs notches landmark win in SEC case over XRP cryptocurrency

- TheBlock: USDT Supply by Blockchain

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman