16 Best Altcoins to Buy Now in May 2024

Although Bitcoin is the largest and most well-known cryptocurrency on the planet, investing in alternative cryptocurrencies may also yield high returns. After reviewing over 60 top altcoins, we narrowed down our list to the 17 best altcoins to buy now in May 2024.

In addition to exploring the best altcoins to invest in, we’ll go over what altcoins are, why they make good investments, and how you can purchase these tokens. Let’s get started.

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode ahead of Doge Day

- ETH

- usdt

- Brand new South Park-inspired seal-themed SOL meme coin

- Ideal coin to buy in presale ahead of the expected summer meme coin frenzy

- Thought to be by the team that was also behind the viral SLERF coin

- Solana

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

- Access to huge fee revenue through staking

- 50% of 10bn token supply available at presale stage

- 85% of fees go back to the community

- usdt

- bnb

- ETH

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- ETH

- Innovative AI crypto casino offering staking, airdrops and custom games

- $HPLT presale has raised over $400k so far with +60M bets placed by +150k users

- Offers daily staking rewards, hype NFTs and is fully audited by Certik

- bnb

- ETH

- usdt

Top 16 Altcoins to Buy May 2024

Below, we’ve rounded up some of the best altcoins to invest in right now and provided a short description of each. In the following section, we dive deeper into the specifics, providing a mini-review of our selected assets.

- Dogeverse — The best altcoin to buy in May 2024

- WienerAI — Dog-themed AI meme coin with staking utility

- Mega Dice Token — Native token of a crypto casino. $320K raised in one day.

- 99Bitcoins — Learn2Earn cryptocurrency platform. $100K raised in under 24 hours.

- 5th Scape — New VR and AR gaming ecosystem, raised over $2 million so far.

- Sponge V2 — Sponge V1 did 100x since its presale and now V2 aims to outperform it.

- Smog — New meme coin offers 42% staking APY and massive airdrop rewards.

- eTukTuk — Eco-friendly platform builds electric tuk-tuks, raised over $1.4 million.

- Slothana — New meme cryptocurrency with no hard cap and over $12 million raised.

- Insanity Bets — Hot new Casino.Fi token looking to shake up the gambling industry.

- Shiba Shootout — Western-themed meme coin with rewards for community engagement.

- Mollars — Decentralized exchange and gaming eco-system.

- Healix — Innovative crypto decentralizing the healthcare space using AI models.

- Gas Wizard — New crypto project designed to lower your gas and EV charging bills.

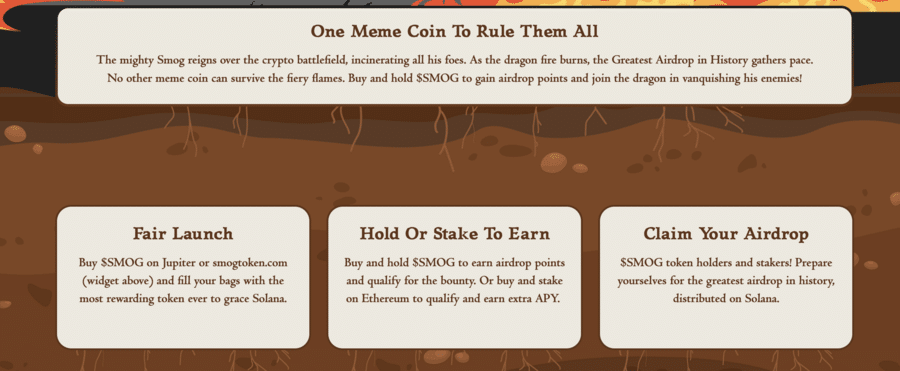

- BlastUp – Popular community launchpad with high staking rewards. Raised $4.9M+

- Clair Meme – AI driven avatar meme coin for use in the metaverse.

Top Altcoins to Invest in Reviewed

Looking for the top altcoins to buy now, while the altcoin bull market is just getting warmed up? Now that we have an understanding of each altcoin project and its offerings, let’s dive into the reviews.

1. Dogeverse — The Best Altcoin to Buy in May 2024

Dogeverse is the best altcoin to buy in May 2024 and the first-ever multichain meme coin, featuring the iconic Cosmo the Doge. Dogeverse raised $254,000 within minutes of its launch, demonstrating early investor enthusiasm. It has now raised over $11 million.

The token’s allure extends beyond its presale rush; holders can stake $DOGEVERSE on Ethereum, reaping additional tokens over time. Cosmo’s ambition transcends chains, envisioning Dogeverse on six prominent blockchains, and promising seamless interconnectivity and negligible gas fees.

The roadmap paints a picture of ambition, from audits to exchange listings, supported by a robust token allocation strategy. With a 200,000,000,000 token supply, Dogeverse allocates resources across staking, liquidity, marketing, and ecosystem development.

Joining Dogeverse is straightforward: visit the website, connect your wallet, select your preferred network, purchase tokens, and await trading instructions across DEXs and CEXs.

| Presale Started | April 2024 |

| Purchase Methods | ETH, USDT, card |

| Chain | Multichain |

| Min Investment | None |

| Max Investment | None |

2. WienerAI — AI Meme Coin with Staking Utility

WienerAI ($WAI) is a new altcoin in the meme coin niche. Its official whitepaper describes it as part dog, part AI, and part sausage. The aesthetic appeal of this token has allowed it to raise more than $200k within a short time. It is now advancing to the next stage of its presale.

The whitepaper describes this project as a groundbreaking AI token that combines the aesthetics of comedic memes with AI fundamentals. Its mission is to become the “top dog” in the meme coin space and one of the top-ranking tokens in terms of market capitalization.

Aiming towards a kinder, gentler future where AI is synonymous with companionship, the project says that it wants to remove the fear humans have of AI.

One of the project’s key USPs is its upgradability, which the whitepaper describes as a result of WienerAI’s focus on artificial intelligence.

Another key feature of this token is staking, which promotes long-term holding. Upwards of 300 million $WAI have been staked to date, with an estimated reward rate of 3434%.

The project is also very active on social media and has accumulated over 1000 followers on Twitter within a short span of time. interested parties can visit wienerdog.ai to participate in this project.

To keep up with its updates, we recommend following WienerAI on Twitter and Telegram.

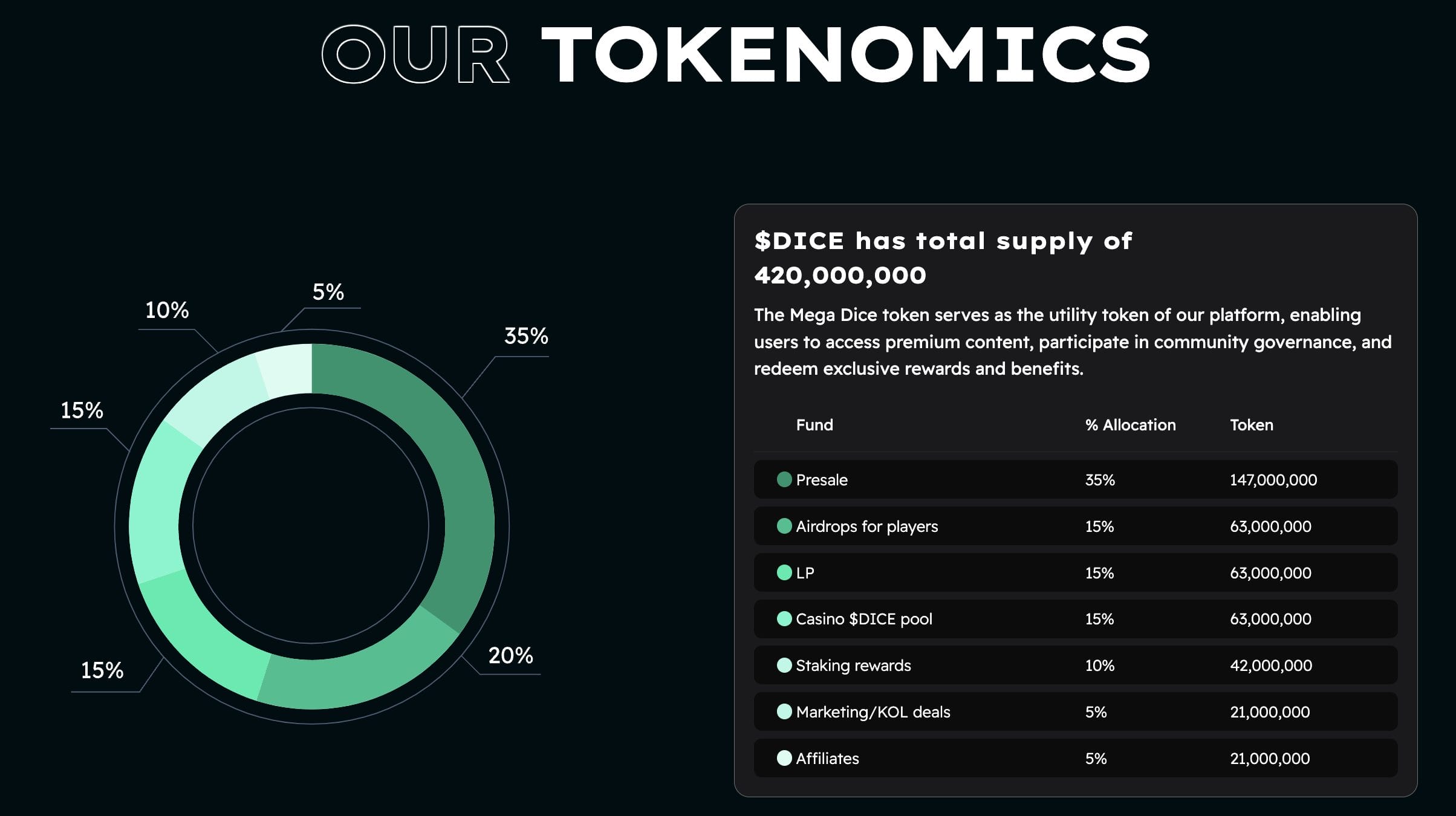

3. Mega Dice Token — CasinoFi Altcoin Offers In-Game Rewards and NFTs

Mega Dice Token ($DICE) is a new altcoin powering the Mega Dice Casino. The casino features over 4,500 online games and is used by over 50K players. With the integration of the $DICE token, users can now access in-game rewards, staking benefits, and daily bonuses.

Built on the Solana blockchain, Mega Dice Token benefits from the network’s high scalability and fast transaction speeds. The crypto transactions are instant, and users can connect directly to the platform via Telegram.

One of the best altcoins, $DICE can be staked to generate high annual yields. Once you have staked the token, you stand a chance to earn high daily bonuses within the casino and sports betting platform.

Certain $DICE token holders can also earn limited edition NFTs, used to gain exclusive privileges on Mega Dice Casino. Currently, $DICE is priced at $0.069 per token during the first presale round. From a maximum supply of 420 million, 35% is allocated for the presale.

Early presale investors will be rewarded with additional $DICE tokens. In the long term, 10% of the supply will be offered through staking rewards. Mega Dice Token will offer $2.25 million through airdrops to lucky presale participants.

For more information, read the Mega Dice Token whitepaper and join the Telegram channel.

| Presale Started | April 2024 |

| Purchase Methods | SOL, ETH, BNB |

| Chain | Solana |

| Min Investment | None |

| Max Investment | None |

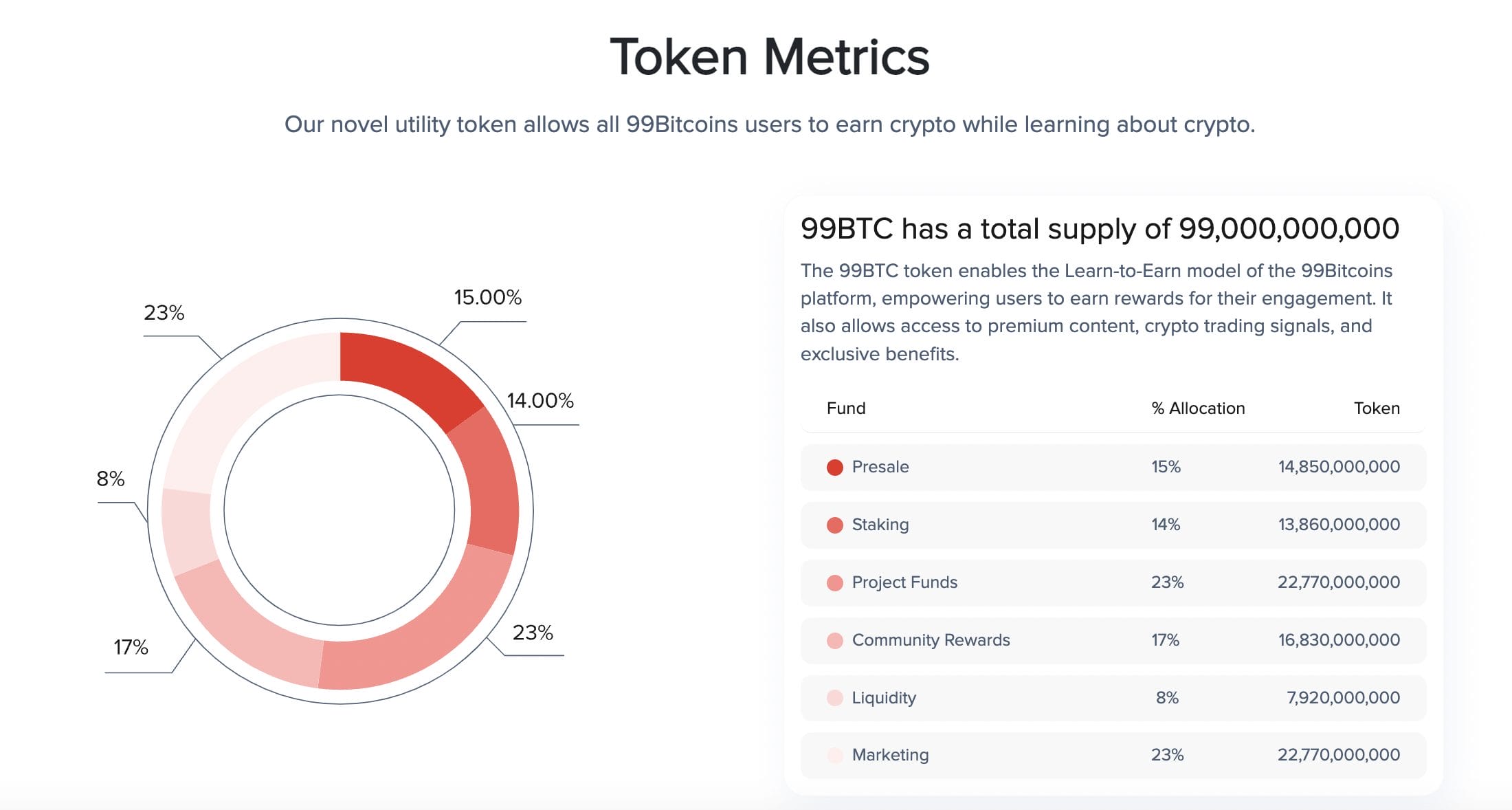

4. 99Bitcoins – Learn to Earn Crypto Platform Offers 70,000% Staking Yields

Another one of the top altcoins to watch in 2024 is 99Bitcoins ($99BTC). 99Bitcoins is a crypto-based educational platform with over 700K users. Now, 99Bitcoins has tokenized into a Learn-to-earn ecosystem, where members are rewarded with crypto.

99Bitcoins offers engaging learning content in the form of quizzes, seminars, and assessments. As you move through the curriculum, you are rewarded with $99BTC tokens. Existing $99BTC token holders are rewarded with exclusive access to special tutorials and quizzes.

You also receive trading signals from experts and can communicate with like-minded individuals through a VIP group. This altcoin can offer further rewards through its community initiative scheme. You earn tokens for content creation and engaging in peer support forums.

The 99Bitcoins Token can be staked on the smart contract to generate high APYs (Annual Percentage Yields). Currently, you can earn 70,000% APYs for staking $99BTC. The yield will reduce as more tokens are locked on the smart contract.

99Bitcoins has a total supply of 99 billion – of which 15% is currently being distributed through the presale. Another 14% will be offered as staking rewards over the next two years. In under 24 hours, the presale has raised more than $115K.

Stay tuned for more project updates by reading the 99Bitcoins whitepaper and joining the Telegram channel.

| Purchase Methods | ETH, USDT, BNB, Card |

| Chain | Ethereum (Will bridge to Bitcoin) |

| Min Investment | None |

| Max Investment | None |

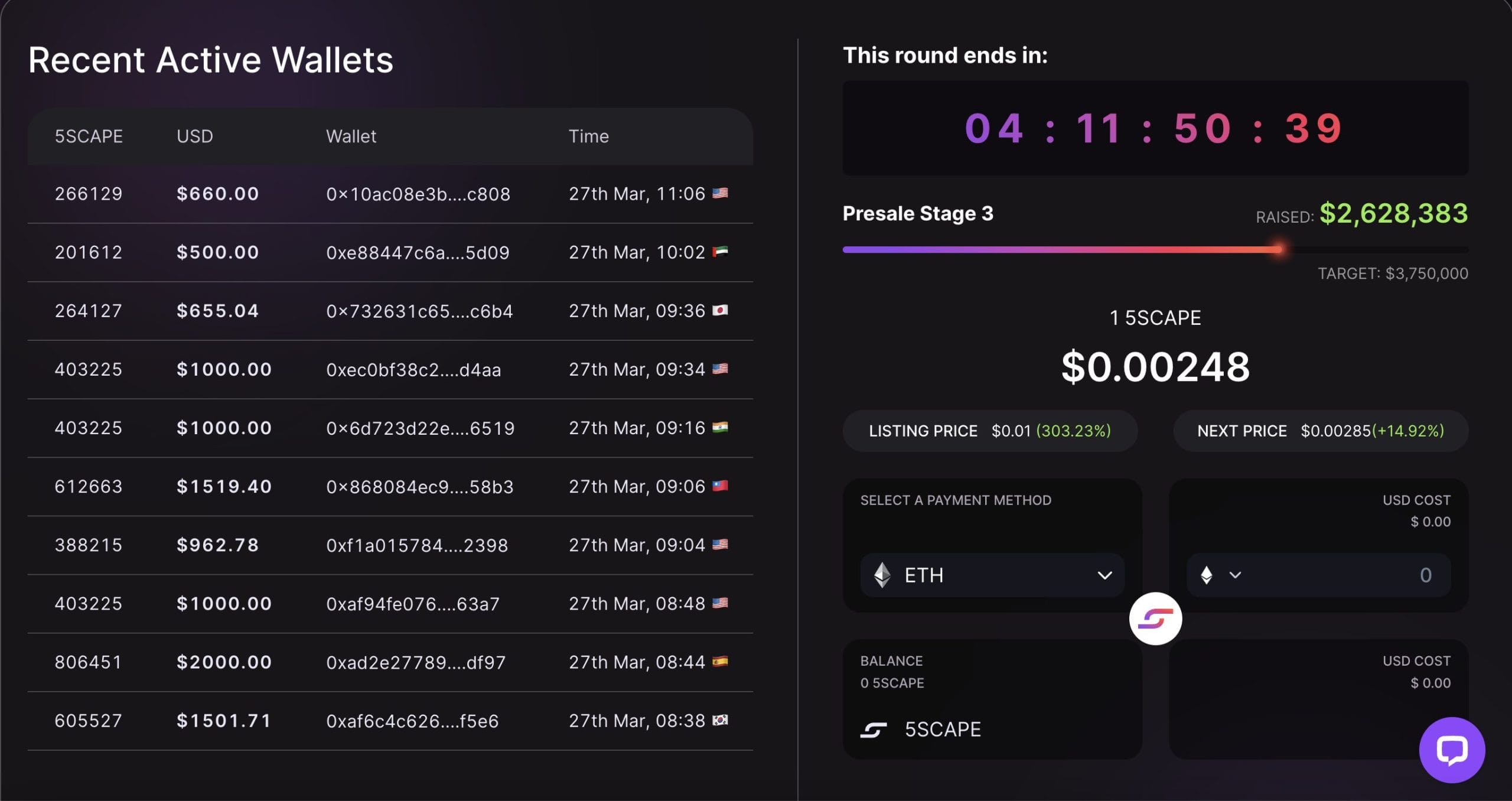

5. 5th Scape — New Altcoin Linked to a VR Gaming Ecosystem

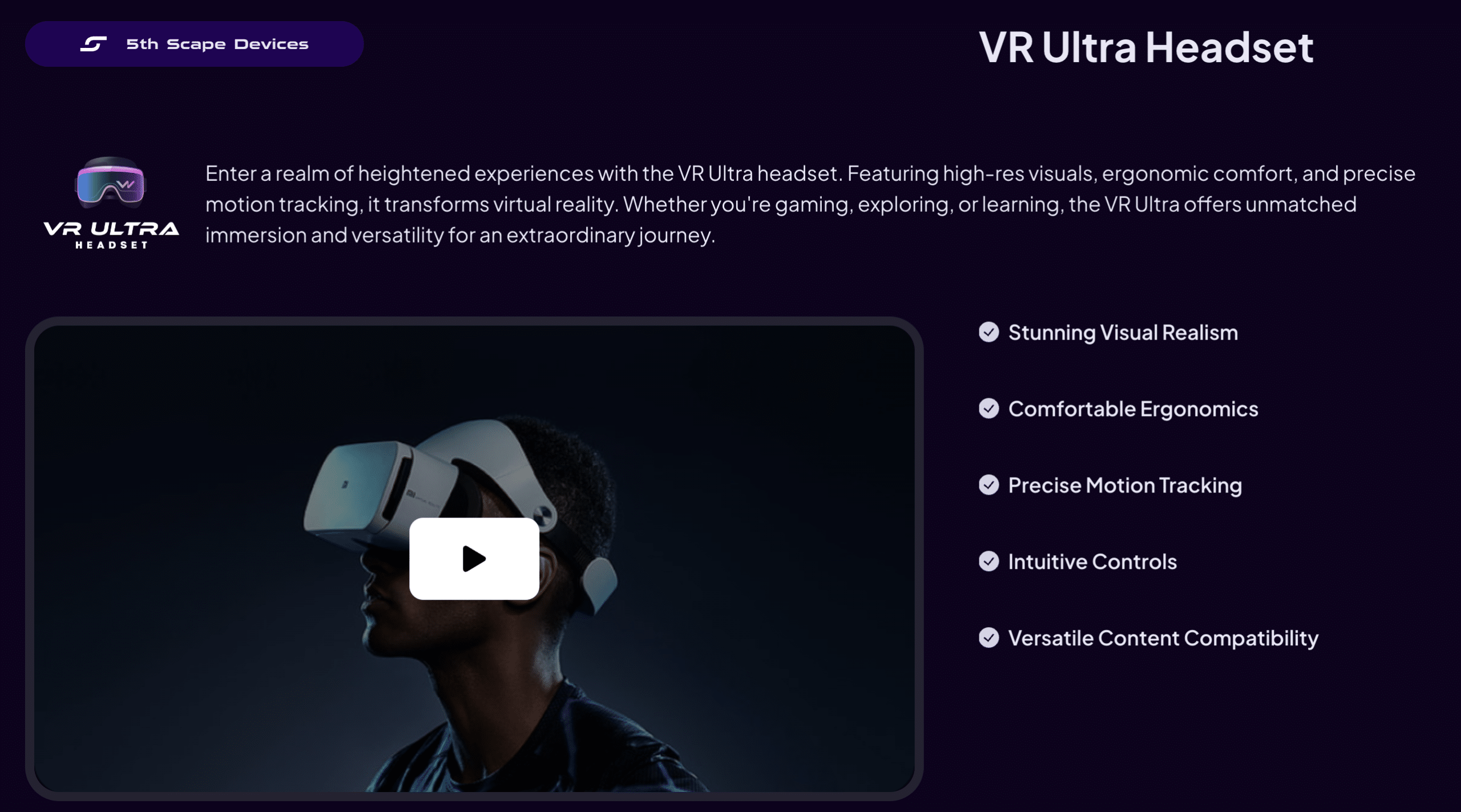

A brand new immersive virtual reality ecosystem, 5th Scape lets players experience a hyper-realistic world full of limitless possibilities. The 5th Scape ecosystem comes equipped with the necessary products to provide gamers with a realistic VR gaming experience – including VR headsets and ergonomically designed VR chairs.

$5SCAPE, the native token, can give you access to the basic gameplay modes on 5th Scape. According to the platform roadmap, 5th Scape will launch five new VR games – ranging from MMA-focused themes to Cricket and Soccer-based gameplay modes.

$5SCAPE token holders get access to these gameplay modes and discounts on all 5th Scape products. With the token, you can also engage in educational content via tutorials and modules.

This new altcoin is priced at $0.00187 during the first presale round. The presale will run for 12 rounds – across which 80% of $5SCAPE’s 5.21 billion token supply will be allocated. By the final round, the price will increase to $0.0087 – a 303% price increase from current levels.

The $5SCAPE listing price is set at $0.00248 per token. Read the 5th Scape whitepaper and join the Telegram channel to stay updated with this new altcoin.

| Presale Started | January 2024 |

| Purchase Methods | USDT, BNB |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

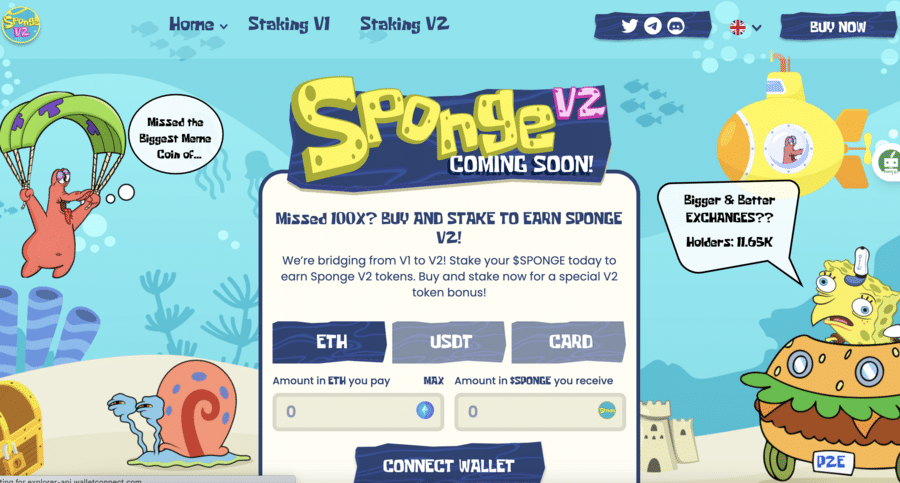

6. Sponge V2 — Emerging Altcoin With a P2E Game and a Stake-to-Bridge for High APYs

A trending new upgrade, Sponge V2 builds on the remarkable success of the original $SPONGE. The first version caught the market’s attention, rising to a $100 million market cap and producing a staggering 100x return to early investors.

With over 11,500 holders and a stable $16 million market cap, Sponge V2 is set to take this legacy forward with innovative features and a strong community focus.

Key Developments in Sponge V2:

- Stake-to-Bridge Model: Sponge V2 offers a Stake-to-Bridge model, allowing users to transition from V1 to V2 by staking their original tokens. This model ensures a smooth upgrade and solidifies long-term community commitment by locking V1 tokens for four years and offering V2 tokens as rewards.

- Play-to-Earn Gaming: To improve utility and user engagement strategically, Sponge V2 integrates a play-to-earn game. This game is a fun addition and a practical way to earn $SPONGEV2 tokens.

- Exchange Listing Plans: The team behind Sponge V2 is potentially looking at listings on major exchanges like Binance and OKX. Such a move could mirror the success of other recently listed meme coins, potentially exploding SPONGEV2’s value.

The total supply of $SPONGEV2 is capped at 150 billion, with a significant portion allocated for staking rewards and the P2E gaming ecosystem.

This allocation strategy emphasizes rewarding active participants and enhancing the token’s utility.

Building on the success story of Sponge V1, Sponge V2 aims to leverage its strong 30,000-member community base for broader outreach and adoption.

Investors have a unique opportunity to double their holdings by purchasing V1 tokens and staking them for V2, with additional bonuses offered for a limited time. This model offers an attractive proposition, especially for those who missed the initial wave of Sponge’s growth.

Potential investors and community members looking to stay informed can follow Sponge on social media platforms like X (Twitter) and enter its Telegram channel.

These platforms offer real-time updates on Sponge V2’s rollout, exchange listings, and other critical developments.

| Presale Started | Dec 2023 |

| Purchase Methods | ETH, USDT, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

7. Smog — New Altcoin Offers 42% Staking APY and Massive Airdrop Rewards

Solana-based utility token Smog ($SMOG) launched on the Jupiter DEX in February 2024, and has quickly emerged as a leading altcoin. Starting with a market cap of $2 million, Smog saw remarkable growth, currently standing at $94 million.

Smog’s airdrop campaign is a key feature, rewarding holders for social media engagement and completing online challenges. It aims to offer the ‘Greatest SOL airdrop of all time.’

Over 6,500 participants have participated in multiple challenges, showing strong community involvement. With 490 million tokens set aside for airdrops, Smog focuses on long-term engagement.

Additionally, Smog offers a staking mechanism with 42% annual yields, attracting investors looking for passive income. Around 9 million tokens have already been staked, showing high investor confidence.

This combination of active engagement rewards and staking benefits highlights Smog’s commitment to providing more than speculative value.

Smog’s fair launch model, absence of a presale, and plans for cross-chain expansion and upcoming exchange listings show its dedication to accessibility and liquidity.

Interested users can find more information in the whitepaper and stay updated through its Telegram group and X (Twitter) account.

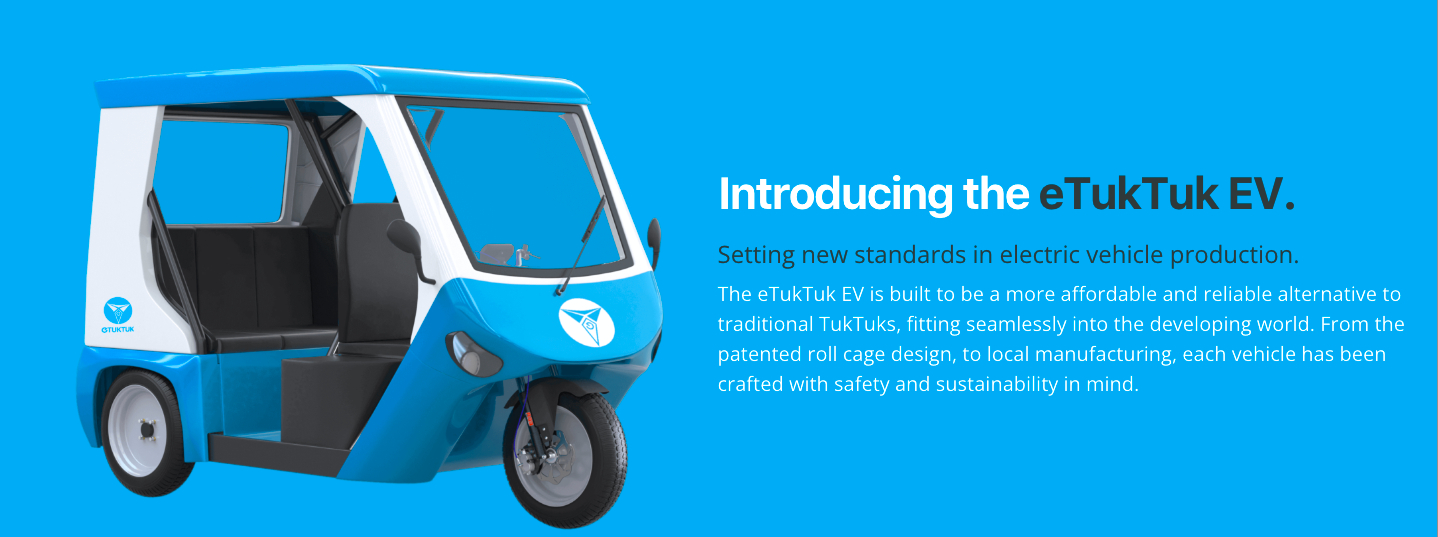

8. eTukTuk — Altcoin Aiming to Reduce Carbon Emissions in the Developing World

The eTukTuk crypto project is a new eco-friendly initiative based on the BSC blockchain, prepares for launch in Sri Lanka with a twofold mission — environmental protection and financial inclusion.

This project aims to replace traditional fossil fuel-reliant TukTuks with their electric counterparts, mitigating carbon emissions while offering economic advantages. The presale has already raised more than $2.8 million with buyers able to earn a high staking APY of 94%.

Electric TukTuks bring significant cost reductions in operation and maintenance, potentially boosting driver income by an impressive 400%. Sri Lanka, home to a vast fleet of millions of TukTuks, can provide a solid base for eTukTuk’s journey to kick off.

With the strong backing of The Capital Maharaja Group, a significant conglomerate in Sri Lanka, eTukTuk’s goal of affordable and accessible electric vehicles and charging stations have become more feasible.

Incorporating blockchain tech, eTukTuk promotes financial inclusion by assigning digital identities, narrowing the economic divide. As per the eTukTuk whitepaper, It doubles as a socio-economic tool, aiming to make a mark beyond transportation.

Token holders can support charging station operations by staking their tokens, earning annual yields in return. This unique staking method sets eTukTuk apart, further showing its innovative approach.

eTukTuk seeks to create a future where transportation and economic growth harmoniously coexist without affecting the planet’s health. You can join the eTukTuk Telegram group for the latest information.

9. Insanity Bets — Hot New CasinoFi Token Offering a Share of Platform Fees

Insanity Bets is the latest Casino.Fi token aiming to shake up the $280 billion dollar gambling industry. Once fully operational, the Insanity Bets platform will offer a range of crypto gaming options with an emphasis on community involvement and a share of profits.

The platform is providing early investors with an opportunity to buy the native $IBETS token before it goes on wider public sale. By purchasing the token, holders will then be able to access a share of the fees generated by the platform.

A massive 85% of all fees generated are redistributed to $IBET holders. 35% to those who stake and 50% to those who choose to burn. You can also use USDT to buy $ILP token to receive 90% of all wins and losses.

As you can see, the platform has been designed to give something back to the community. What’s more, because Insanity Bets has been audited by both SolidProof and CyberScope you can be assured of fairness and transparency.

By embracing some of the core concepts of DeFi, the team behind Insanity Bets are revolutionizing the online crypto gambling industry. Furthermore, by taking on some of the biggest names in the industry, the platform is committed to giving back to the community.

The presale is currently ongoing and easy to take part. Interested parties should head over to the official website and enter their details. To keep up to date on all the latest news, you can join the exclusive Telegram channel and follow the project on X.

| Presale Started | March 2024 |

| Purchase Methods | Register for more details |

| Chain | Arbitrum |

| Min Investment | None |

| Max Investment | None |

10. Shiba Shootout — Western-themed Meme Coin with Rewards for Community Engagement

Shiba Shootout has made a name for itself as one of the best altcoins in the market through a combination of unique lore, short-term upsides, long-term benefits, and unique gaming utility.

The essence of this project lies in the Western Frontier, where every Shiba Inu is an anthropomorphized cowboy with a bone to pick with others. Equipped with a town, a saloon, and a bunch of activities, this project will be appealing to Western movie lovers as well as crypto enthusiasts. This backdrop plays a major role in highlighting each “cowboy Shiba Inu”, who is out and about hunting for bounties and sharing memes.

This lore serves as a way to provide unique perks to the community. The first one among them is “Campfire Stories”. Much like how Dogecoin was offered to those who talked positively on social media websites, Shiba Shootout has created a group where sharing meme coin investment stories and encouraging positive engagement will reward users. Staking and gaming are also a perk associated with this project.

Being a meme coin gives it a unique combo of short-term upsides and long-term benefits that could boost its value in the long run. For those who are interested in this project, we recommend keeping up with its social media posts on Twitter.

| Presale Started | April 2024 |

| Purchase Methods | ETH, BNB, and USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

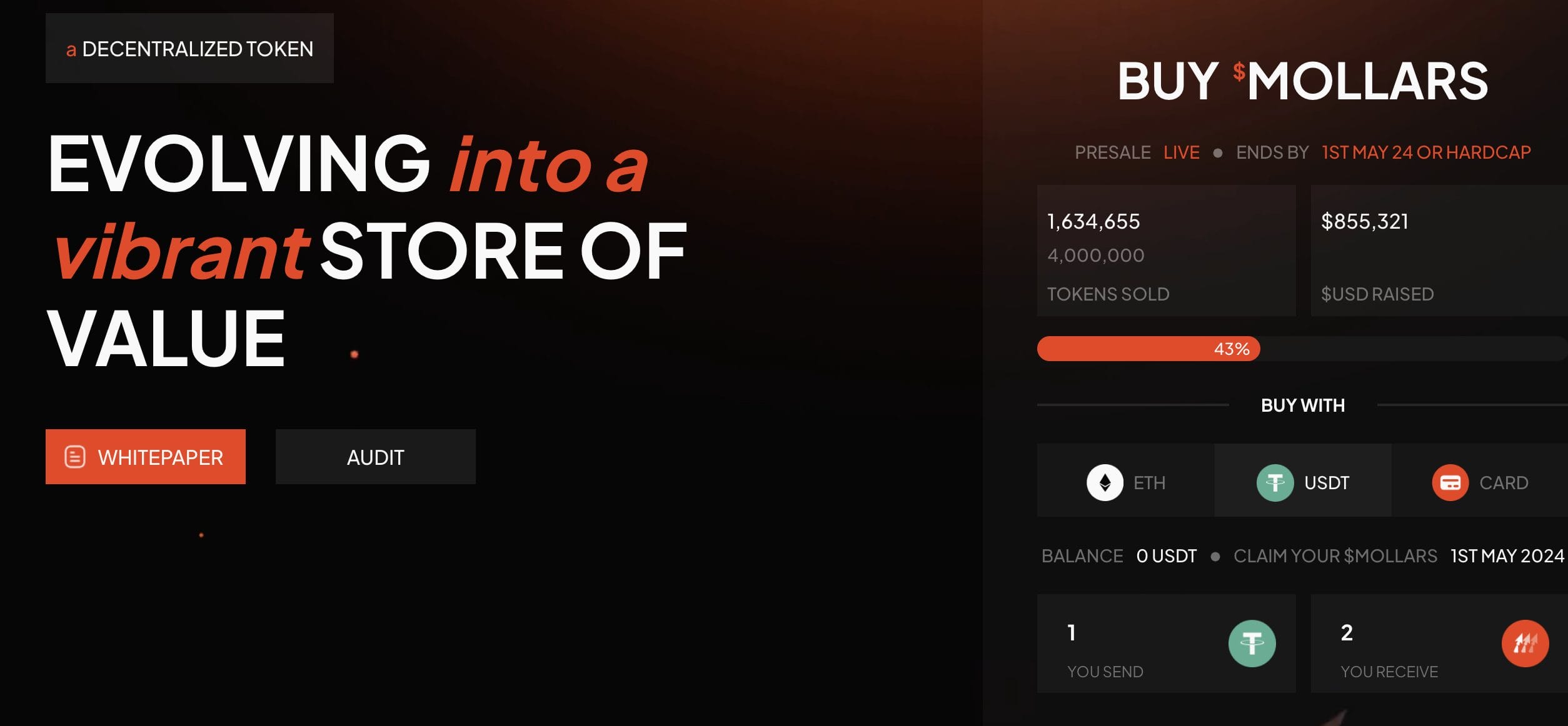

11. Mollars — Decentralized Crypto Burns 1% of All Transactions, $850K Raised on Presale

The next top altcoin in our list is Mollars ($MOLLARS), a decentralized cryptocurrency platform. Mollars may be an ideal investment opportunity for investors seeking decentralization and autonomy.

The company founders will renounce ownership of the contract code after $MOLLARS officially launches on exchanges. This will symbolize the official transfer of power from the founders to token holders. $MOLLARS holders can also get access to the platform’s DAO and make crucial decisions about the crypto’s future.

Post the platform launch, Mollars will launch a decentralized exchange and gaming ecosystem. This altcoin has a total supply of 10 million, 40% of which is allocated for the ongoing presale. Another 20% will be used for ecosystem funds and future centralized exchange listings.

Nearly a quarter of the supply will also be distributed through a rewards program. Interested investors can purchase $MOLLARS for $0.5 through the ongoing presale round. In a few months since the presale started, Mollars has raised over $850K. There will be a 3% tax levied per transaction. This will be distributed among the DAO, used for technological advancements, and for community initiatives.

To keep the token price competitive in the long term, 1% of all tokens will be burned per transaction. Read the Mollars whitepaper and join the Telegram channel for more information.

| Token Symbol | MOLLARS |

| Presale Supply | 4,000,000 MOLLARS |

| Token Type | Ethereum |

| Payment Method | ETH, USDT, Card |

| Listing Price | N/A |

12. Gas Wizard – New Altcoin Presale That Aims to Lower Your Gas and EV Charging Station Bills

Gas Wizard is an exciting new crypto project that aims to build a blockchain loyalty program to combat surging gas prices. The way it will work is you use Gas Wizard on partner gas and charging stations and you earn discounts and rewards.

All of this will be powered by the project’s native token $GWIZ. The only way to buy the token at the moment is via presale where you can use ETH, BNB, WBTC, USDT and USDC to complete the purchase.

Only 20% of your $GWIZ tokens will be unlocked after the presale ends, while the remaining tokens will be airdropped in 10% of your total amount monthly. The goal is to limit the sell pressure on the token while the team builds the platform.

Once the project goes live, you can earn $GWIZ tokens on your gas and EV charging purchases, you can earn by adding fuel prices to help other users find the cheapest gas near them, and you can earn the token by playing a variety of games on an upcoming play-to-earn game. Use your $GWIZ to pay for gas at partner stations.

Check out the Gas Wizard whitepaper for more information. Also, follow Gas Wizard on X and join the Gas Wizard Telegram channel for the latest updates.

| Token Symbol | GWIZ |

| Presale Supply | 150,000,000 GWIZ |

| Token Type | Ethereum |

| Payment Method | ETH, BNB, USDT, USDC, WBTC |

| Listing Price | N/A |

13. BlastUp – Popular Community Launchpad With High Staking Rewards

BlastUp (BLP) is next on our list of the best altcoins to buy. It is a popular community-focused launchpad that helps you invest in early-stage projects.

It makes sure that only the best projects are shown to its community. It does this by carefully checking each project and helping them prepare all the necessary documents through the ‘Launchpad Accelerator.’

BLP token holders can also stake their tokens to earn passive income. Holders can also participate in token sales, earn rewards, and get special loyalty benefits during Initial DEX Offerings (IDOs).

The platform already has over 12,000 holders and has raised over $4.9 million in just a few days of its launch. Early investors can get the $BLP tokens for only $0.06 at press time.

If you hold tokens and refer other people to the platform, you can earn Booster Points. These points increase your share in future airdrops and help you get weekly drops of Blastboxes (which contain a mix of NFTs, stablecoins, and more).

The platform also has a growing community on social media platforms like Twitter and Telegram. BlastUp is also audited by Certik and is KYC-approved by Assure DeFi.

| Token Symbol | BLP |

| Presale Supply | 1,000,000,000 |

| Token Type | Ethereum |

| Payment Method | ETH, BNB, USDT and Matic |

| Listing Price | N/A |

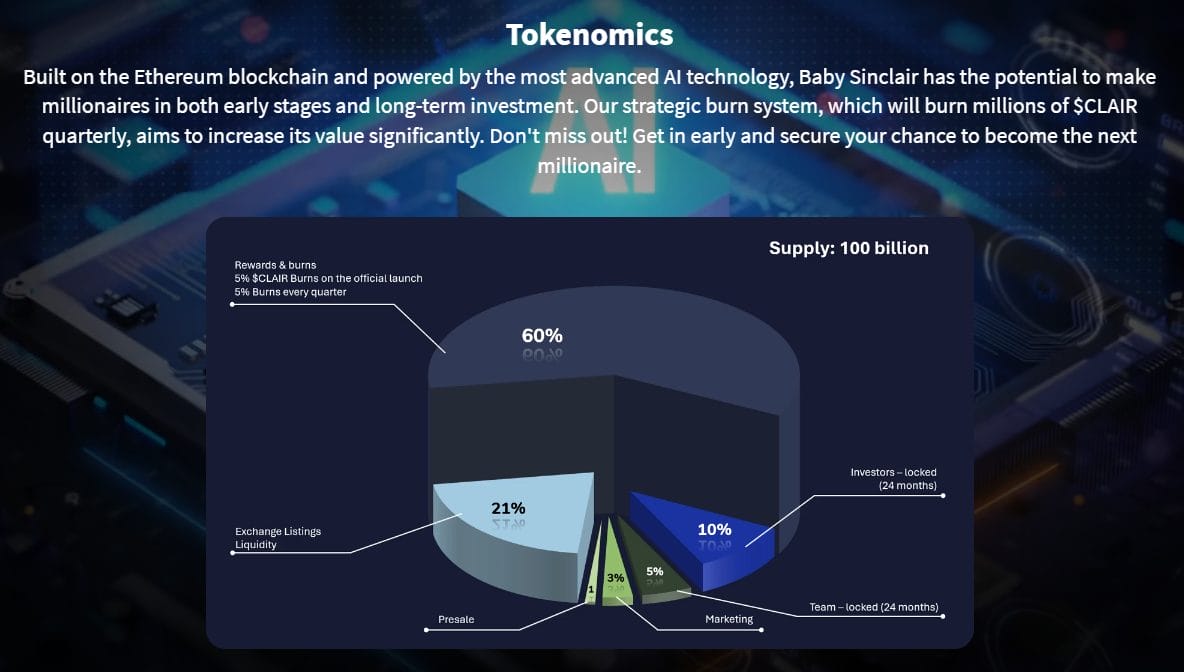

14. Clair Meme – Hilarious Generative AI Driven Meme Token With Metaverse Integration

Clair Meme is the latest altcoin with massive potential to explode this summer. After the recent launch of its first ICO, the Clair Meme token raised thousands of dollars in mere minutes. The team behind the project has high hopes that Clair Meme could see big returns in the near future.

However, Clair is More than just a meme coin. The Clair eco-system gives token holders the opportunity to devise their own meme coins which can then be used as avatars in the metaverse. Thanks to the integration of AI protocols, you will soon be able to give your avatar your own voice and use it to engage, compete, and earn with others in the same space.

Clair adopts a quarterly burn mechanism which seems 5% of the total supply burnt each quarter to ensure token scarcity and price discovery. Furthermore, in close collaboration with Shiba Inu, 10% of every $CLAIR token sold after the presale will be dedicated to burning $SHIB.

There is a total supply of 100 billion tokens with just 1% available for presale. Built on the Ethereum blockchain you can purchase $CLAIR with either ETH, USDT, or USDC. For all the latest information you can follow Clair on Twitter and Telegram.

| Token Symbol | CLAIR |

| Presale Supply | 1,000,000,000 |

| Token Type | Ethereum |

| Payment Method | ETH, USDT and USDC |

| Listing Price | N/A |

What Is an Altcoin?

An altcoin is any cryptocurrency other than Bitcoin. These alternative coins were developed to offer features or capabilities that differ from Bitcoin’s original proposal.

Common examples include:

- Ethereum, which supports smart contracts and decentralized applications

- Ripple, which is designed for high-speed, low-cost cross-border payments

- Cardano, which offers a secure and scalable blockchain environment

- Solana, which is known for fast processing times and low transaction costs

During altcoin season, these tokens experience significant price increases, often outperforming Bitcoin. This usually happens when investors look for potentially higher returns by diversifying their crypto holdings beyond Bitcoin.

The Advantages of Investing in Altcoins

Adding altcoins to a well-balanced crypto portfolio offers unique advantages. Below, we discuss the main three: enhancing portfolio diversification, tapping into the potential for substantial price increases, and gaining exposure to different blockchain networks.

Increase Portfolio Diversification

Diversifying a crypto investment portfolio spreads risk across different assets, reducing the impact of any single cryptocurrency’s volatility on overall investment performance.

There is a huge variety of altcoins available, across several crypto and real-world sectors. As such, they can make for an excellent diversification tool.

Bigger Potential for Price Increases

While Bitcoin is regarded as being a safer, less volatile crypto, its larger size means it’s more difficult for the price to move substantially in either direction. Altcoins have lower market caps, meaning that it’s easier for prices to fluctuate.

That’s why altcoins are excellent growth vehicles, provided the proper due diligence is done prior to investing.

Additionally, the innovative and unique features of some altcoins can drive higher demand and speculative interest, potentially leading to greater price increases compared to the more established Bitcoin.

Exposure to Other Blockchain Networks

Investing in altcoins provides exposure to various blockchain networks, each with distinct technologies and use cases.

This exposure diversifies investment risks and unlocks opportunities in different sectors, enhancing potential returns as different blockchains may succeed independently of each other.

The Risks of Investing in Altcoins

Investing in altcoins comes with risks, including a higher probability of failure, potential scams, and competition from emerging coins. In this section, we explore how each of these risks can affect their long-term viability and market value.

Higher Probability of Failure

Investing in altcoins carries a higher probability of failure due to their experimental nature, smaller market presence, and lower liquidity compared to Bitcoin. These factors make altcoins more susceptible to market fluctuations and operational challenges, posing risks to investors.

Increased Risk of Scams

Altcoins often lack the scrutiny and regulatory oversight seen with major cryptocurrencies, making them attractive targets for scams. Investors may encounter fraudulent projects or deceptive practices that promise high returns, but ultimately result in financial losses.

Competition From New Coins

Altcoins face competition from new coins constantly entering the market, each with potentially superior technology or more innovative features. This saturation can dilute investor interest and capital among many options, making it harder for individual altcoins to maintain their value and attract sustained investment.

How to Choose the Best Altcoins to Buy Now

With there being so many different altcoins on the market, an investor needs to narrow down their search criteria to find worthwhile projects. Sometimes you need more than just the best crypto signals to know which crypto project is worth investing in. We’ll be sharing a few quick tips to help decide which altcoins to invest in.

Analyze the Whitepaper

Learning how to buy altcoins starts with assessing each whitepaper carefully. One of the most effective techniques to weed out lackluster projects is thoroughly reviewing a project’s whitepaper. The best altcoins to buy will always feature a well-written whitepaper that clearly explains exactly what the project does as well well as its plans for the future. If a cryptocurrency makes a lot of promises without explaining how they will be achieved, it’s best avoided.

See What Social Media is Saying

Taking a look at social media can be a great way to determine how investors feel about a project and whether it has a strong community. While stats like followers can be easily purchased online, it’s much harder to fake an active community consistently commenting and sharing so these are both factors to look out for when trying to find the best altcoins for 2024.

Look for Projects with Genuine Utility

While it’s possible for some projects to perform well and offer great returns through hype alone, it’ll never be conducive to long-term growth. Instead, it’s better to look out for utility-focused projects that provide a useful service or product. These altcoins will always have a demand regardless of hype or the market, making them far safer long-term crypto investments.

Our Methodology: How We Ranked the Best Altcoins to Buy Now

Cryptonews developed a ranking methodology for evaluating the top altcoins to buy now, with each factor weighted at 20%. This allows investors to gain a comprehensive view of the potential of different altcoins and make informed decisions based on their preferences and risk tolerance.

Innovation (20%)

We assessed how innovative each coin is, looking at its underlying technology and novel features. This included a detailed look at its scalability, security measures, consensus mechanism, smart contract capabilities, and potential for further innovation.

Use Cases and Adoption (20%)

We gauged each altcoin’s adoption level and tangible applications, emphasizing partnerships, integrations within existing infrastructure, utility in decentralized applications, and the role it might play in various industries.

Community Strength (20%)

Our team assessed the size and engagement level of each altcoin’s community. Moreover, we paid close attention to developer involvement, community updates, and vibrant discussions across forums, social media channels, and developer platforms.

Market Resilience and Liquidity (20%)

We scrutinized the altcoin’s market resilience and liquidity, considering factors such as market capitalization, trading volume, and liquidity across major exchanges. We also looked into the stability of trading pairs and accessibility across different trading platforms.

Regulatory Alignment (20%)

We analyzed the altcoin’s alignment with regulatory frameworks in prominent jurisdictions, navigating through any potential legal or compliance hurdles. Our assessment factored in past regulatory challenges, adherence to evolving regulatory standards, and the overall risk landscape.

Conclusion: What Is the Best Altcoin to Buy in May 2024?

Dogeverse is the best altcoin to buy right now, having raised over $250,000 within minutes of its presale launch — currently standing at over $11 million.

In addition to being an innovative multichain meme coin, Dogeverse offers a unique staking mechanism that has captured invertors’ attention. With the ability to operate across six prominent blockchains, negligible gas fees, and robust token allocation, Dogeverse promises utility and huge growth potential.

Best Altcoins to Buy Now — FAQs

What is an altcoin?

An altcoin is an alternative cryptocurrency to Bitcoin. As such, the vast majority of cryptos can be considered altcoins, with the term transcending category or intended purpose.

What is the best altcoin to buy now?

Dogeverse is the best altcoin to buy now. Boasting multichain capabilities, unique staking features, and expansive blockchain plans, it promises utility and significant growth prospects. It’s currently in its presale stage.

Which altcoins have the most room for growth?

While all the projects we’ve reviewed have plenty of room for growth, Dogeverse stands out with even higher potential. With a rapid $250,000 presale raise and plans to expand across six blockchains, it offers unique staking features and multichain utility, promising substantial growth.

How many different altcoins are available?

It’s impossible to provide an exact number of available altcoins as new crypto projects are released daily. Currently, there are over 2,000,000 altcoins on the market, with this figure continually growing.

How can I invest in altcoins?

There are several ways to invest in altcoins. The best altcoin to buy, Dogeverse, can be purchased on its website during the presale stage. Other top altcoins can be easily bought in a crypto exchange.

What is the top new altcoin?

Dogeverse emerges as the top new altcoin with its impressive presale raise of over $250,000 in minutes. Offering multichain utility and unique staking features, it presents a promising investment opportunity.

Are altcoins worth buying?

Yes, altcoins are worth buying as they offer diverse investment opportunities beyond traditional assets. With careful research and risk management, investors can capitalize on the potential growth and utility of altcoins.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi

Dassos Troullides

Dassos Troullides