14 Best Crypto ICOs to Invest in 2024

An initial coin offering, or ICO, is a popular way for crypto projects to generate publicity and raise capital. Much like crowdfunding, ICOs allow the community to have a tangible impact on a project’s growth – while also providing scope for investors to realize substantial returns in the future.

ICOs have the potential to generate substantial returns. As brand new projects, ICO cryptos often have no established market to fall back on while their utility is unproven, even if the potential of the solution they offer is high. Investors need to understand that even the best active ICOs are not guaranteed to deliver immediate returns or success for the investor.

This article discusses the best crypto ICOs available, covering what they are and why they are so highly regarded, before exploring the key factors to bear in mind when making an ICO investment decision.

Best Crypto ICOs in 2024

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode ahead of Doge Day

- ETH

- usdt

- Brand new South Park-inspired seal-themed SOL meme coin

- Ideal coin to buy in presale ahead of the expected summer meme coin frenzy

- Thought to be by the team that was also behind the viral SLERF coin

- Solana

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- ETH

- Innovative AI crypto casino offering staking, airdrops and custom games

- $HPLT presale has raised over $400k so far with +60M bets placed by +150k users

- Offers daily staking rewards, hype NFTs and is fully audited by Certik

- bnb

- ETH

- usdt

The Best ICO Crypto to Invest in Right Now

Listed below are some of the best ICO cryptos available to investors, derived through in-depth research and analysis. We’ll discuss the top ICO list in the following section, providing the information needed to make an informed investment decision.

- Dogeverse (DOGEVERSE) – First multi-chain doge meme coin, 15,000% staking APYs.

- WienerAI (WAI) – Dog themed meme coin with impressive staking rewards.

- Sealana ($SEALANA) – Trending new meme token on Solana that could go viral.

- Mega Dice Token (DICE) – Native token of a casino gaming platform. Over $850K raised.

- 99Bitcoins (99BTC) – New learn-to-earn token offers over 70,000% staking APYs.

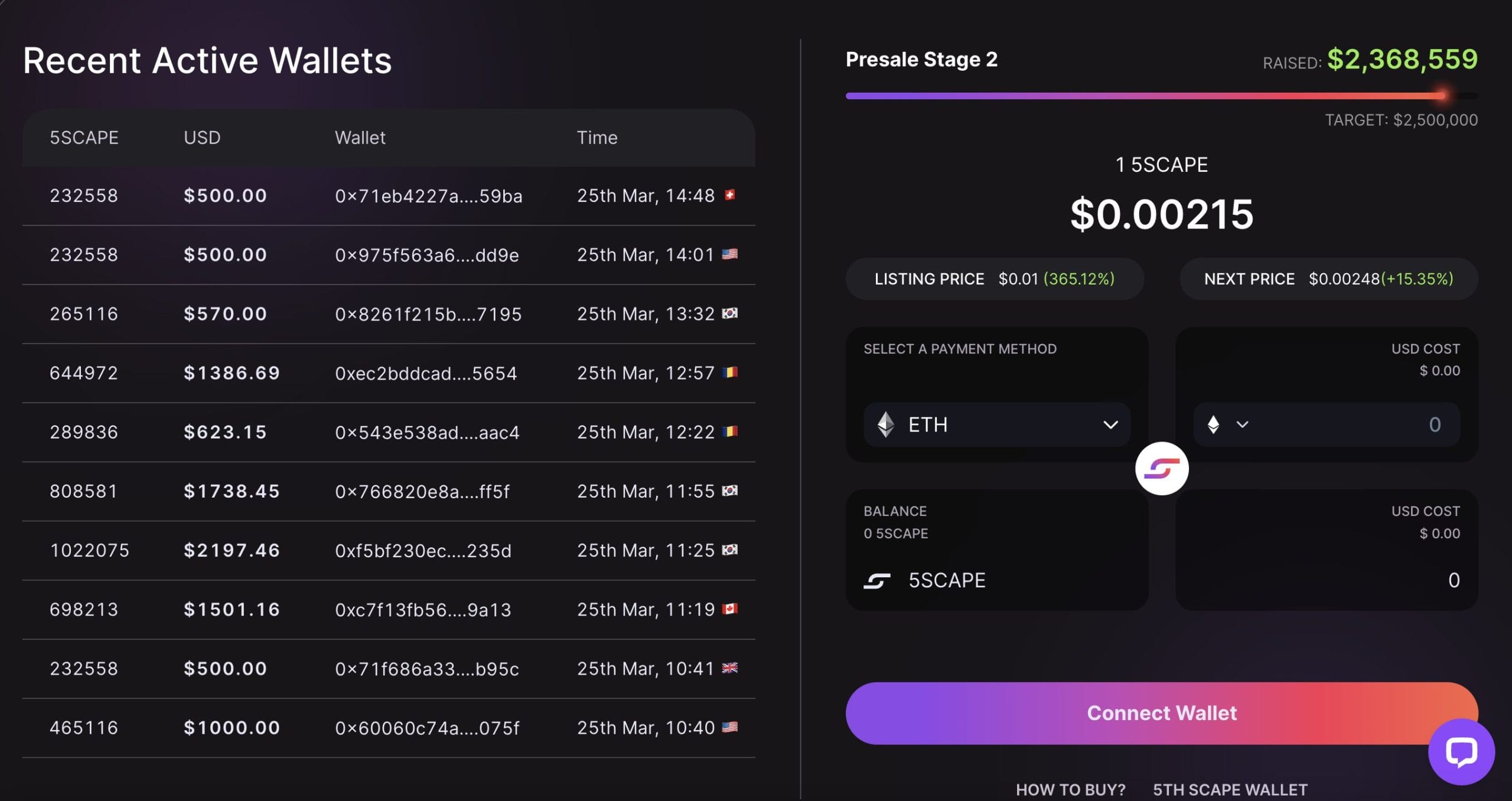

- 5th Scape – VR gaming cryptocurrency has raised over $4.5M on presale.

- Sponge V2 (SPONGE) – New meme token is offering 198% in staking yields.

- Smog (SMOG) – Best alternative to ICOs. Meme coin is offering 42% staking APYs.

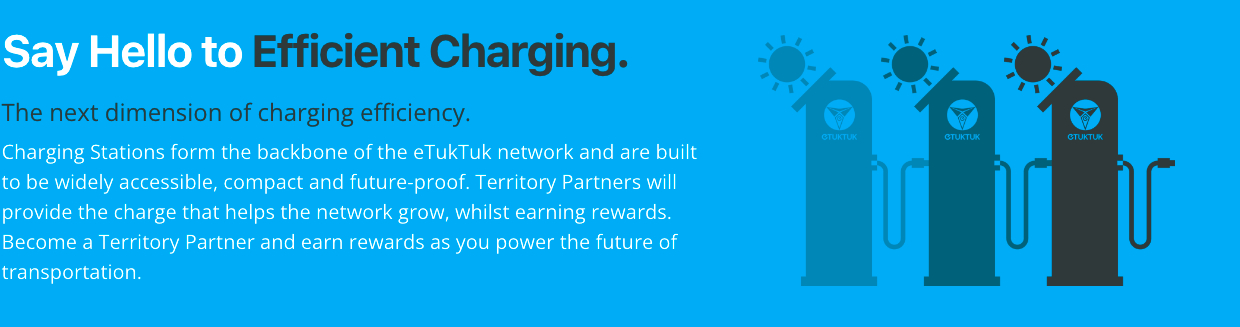

- eTukTuk (TUK) – Sustainable crypto offers up to 232% staking yields.

- Shiba Shootout ($SHIBASHOOT) – New ICO crypto offering lucrative staking rewards

- Mollars (MOLLARS) – Exciting DeFi ICO with gaming and Web3, over $850K raised.

- PlutoSwap.ai (PLUTO) – AI-Powered DEX aggregator, priced at $0.102 on ICO.

- Healix (HLX) – New crypto decentralizing the healthcare space, over $100K raised.

- Heroes of Mavia (MAVIA) – Base building crypto game, $122 million market cap.

The Best ICO Crypto Projects Reviewed

Investing in an ICO can be risky, given that the project in question will still be in its infancy and is not yet established. However, those with a higher risk tolerance level can benefit from improved ROI potential. The two often go hand in hand.

With that in mind, let’s take a closer look at the best crypto ICOs listed above, exploring why they are so sought-after:

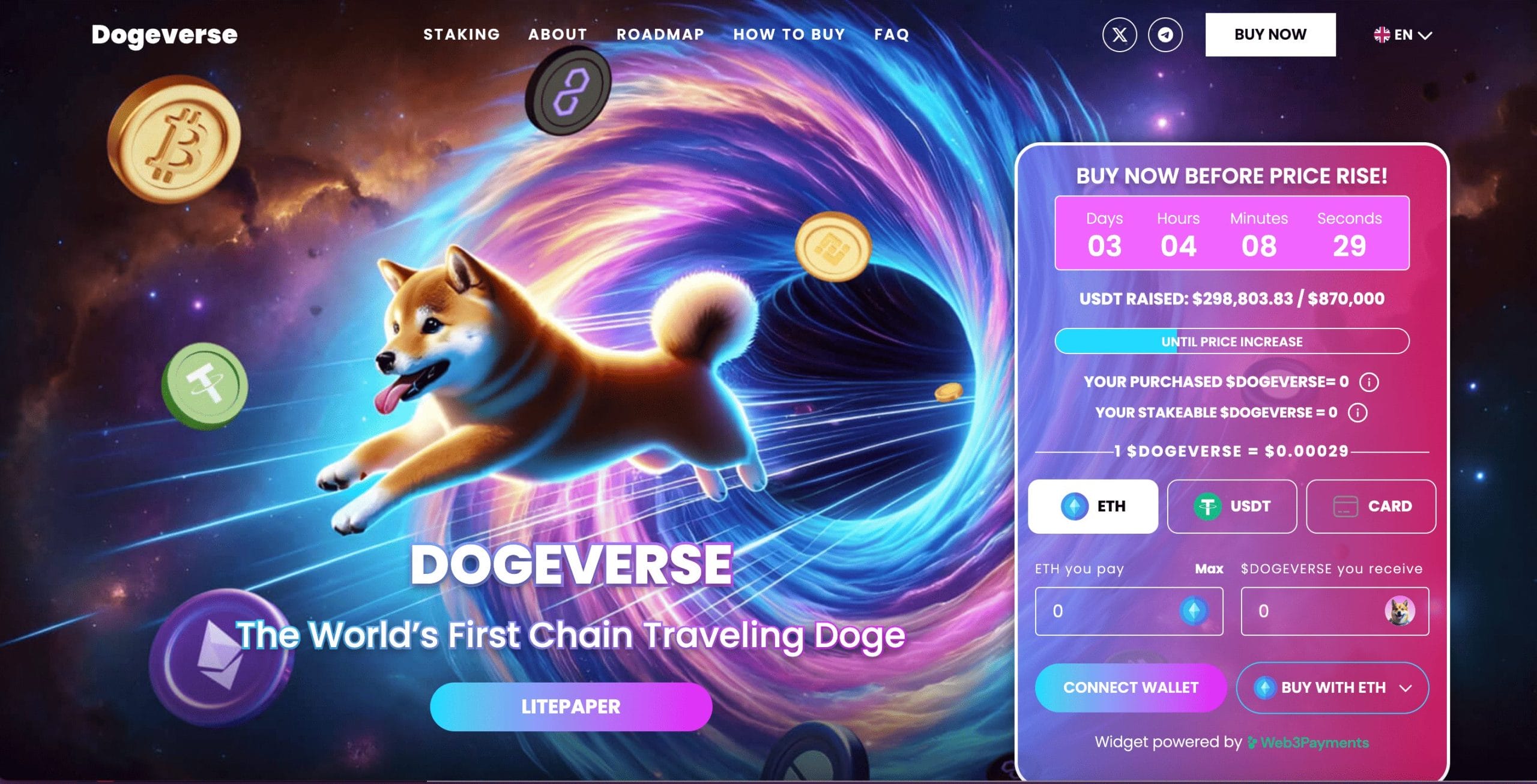

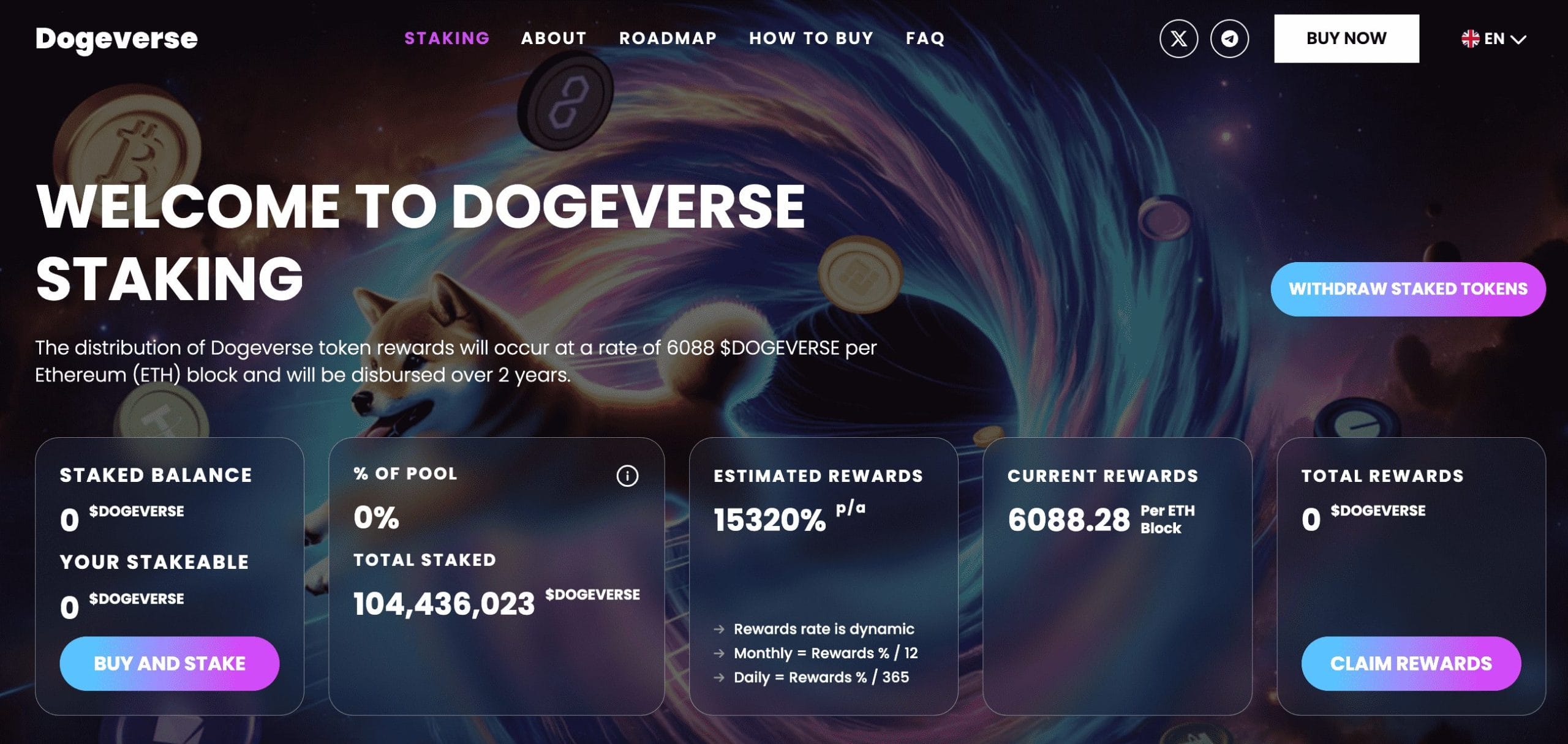

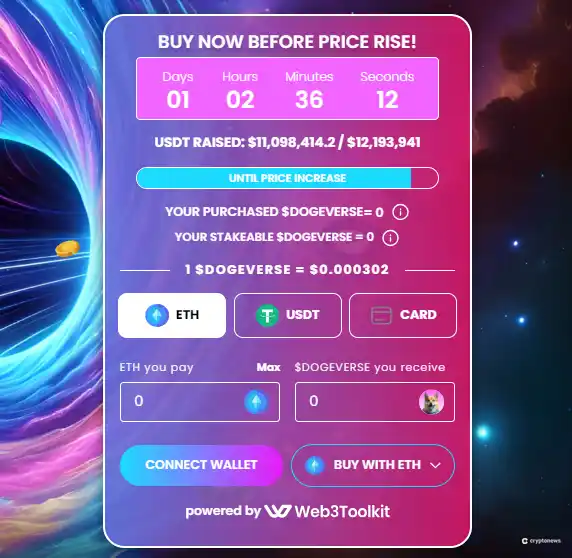

1. Dogeverse – Best Multi-Chain Meme Coin ICO, Over $12Million Raised in Presale

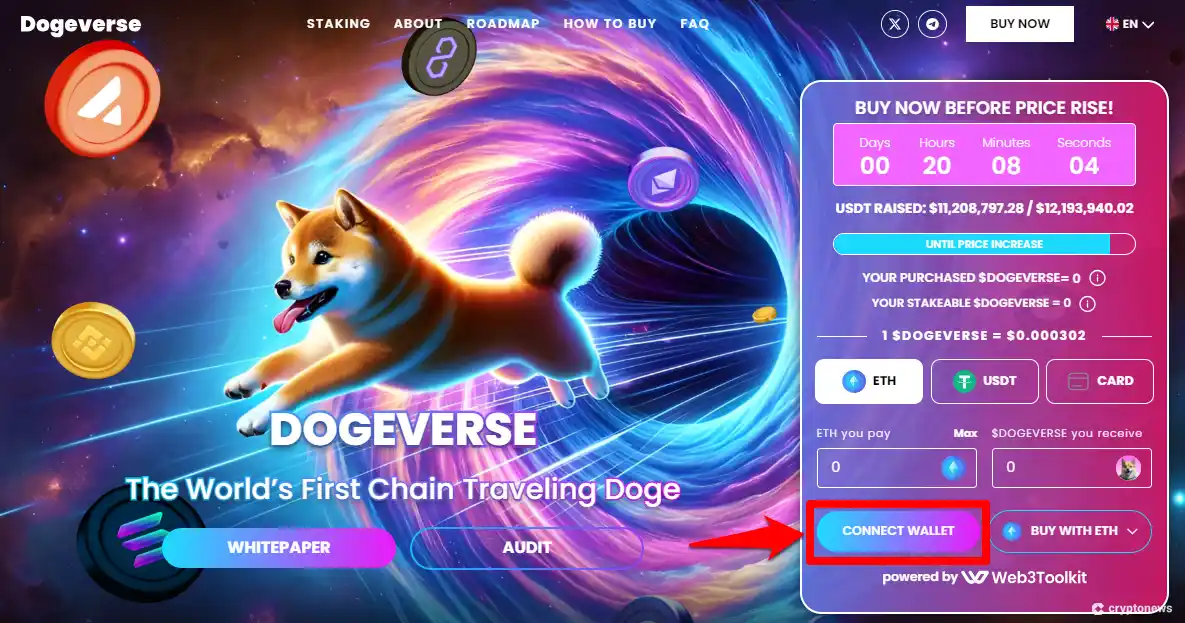

At the top of our list of the best cryptocurrency ICOs is Dogeverse ($DOGEVERSE). This innovative project is the first multi-chain meme cryptocurrency. While Dogeverse will initially be launched on the Ethereum blockchain for security and wider adoption, it will be available on Binance, Polygon, Avalanche, Solana, and Base.

Cosmo the Doge, is Dogeverse’s central figure, travelling the crypto universe to promote seamless connectivity and provide freedom to token holders. Dogeverse will solve the issue of high costs and low transaction speeds while maintaining high levels of security.

The popularity of Dogeverse has been witnessed instantly – with the new initial coin offering campaign raising $300K in less than 24 hours. From a total supply of 200 billion tokens, Dogeverse has allocated 30 billion for the ICO. At the time of writing, $DOGEVERSE can be purchased for only $0.00029 per token. By the end of the ICO, Dogeverse aims to raise a hard cap of $17 million.

This meme coin also offers huge passive income earning opportunities. Through its staking mechanism, $DOGEVERSE holders can lock their holdings and generate up to 15,000% APYs (Annual Percentage Yields). Over a 100 million tokens have already been locked on this ecosystem.

We also believe that the Dogeverse ICO could witness a further boost in momentum as we are coming closer to Doge Day (April 20th). For all these reasons, Dogeverse may become one of the top ICOs and meme cryptocurrencies to purchase right now. Stay tuned for more project updates by reading the Dogeverse whitepaper and join the Telegram channel.

| Presale Started | April 2024 |

| Purchase Methods | ETH, USDT, Card |

| Chain | Ethereum, Binance, Polygon, Solana, Avalanche, Base |

| Min Investment | None |

| Max Investment | None |

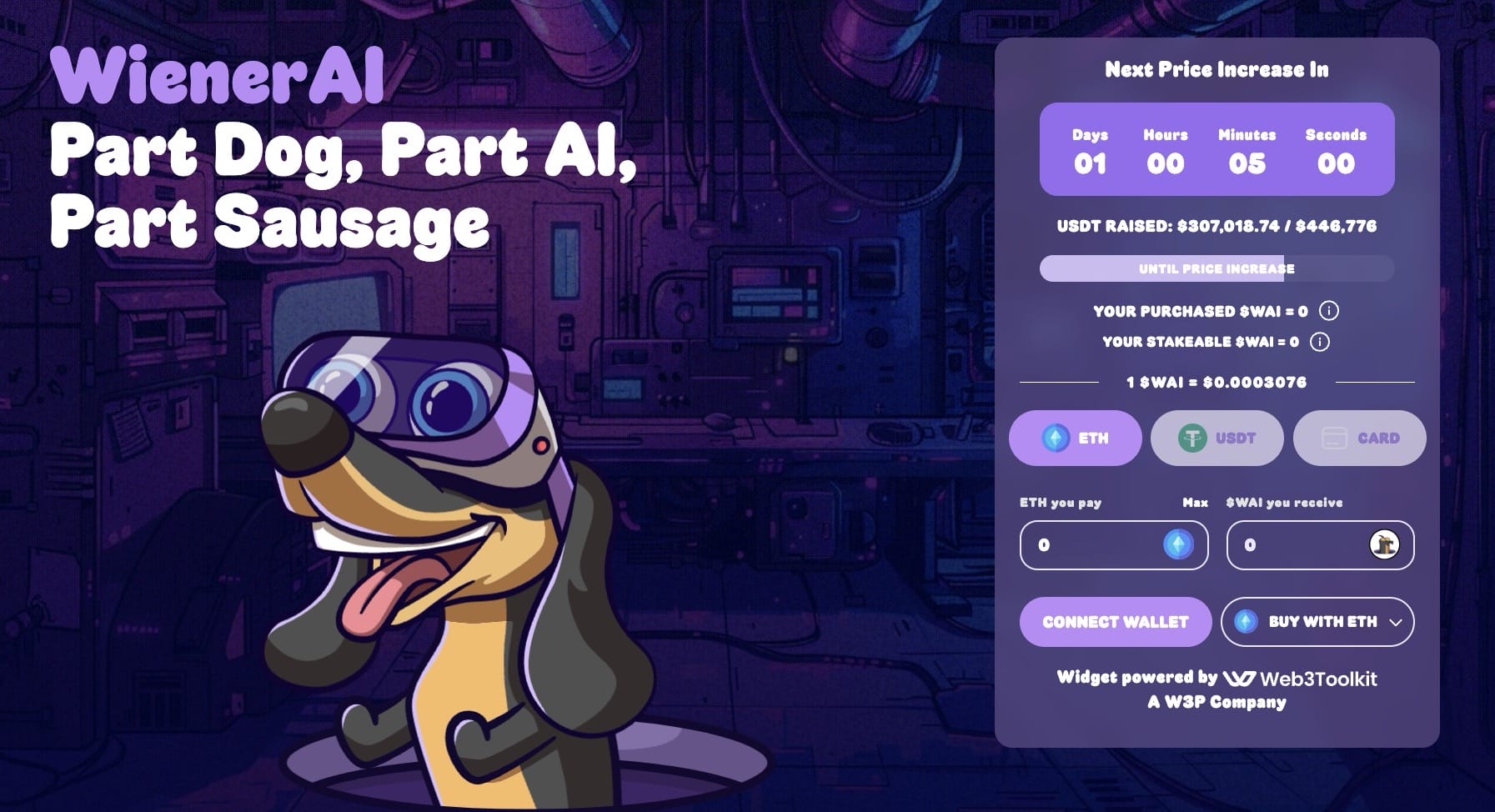

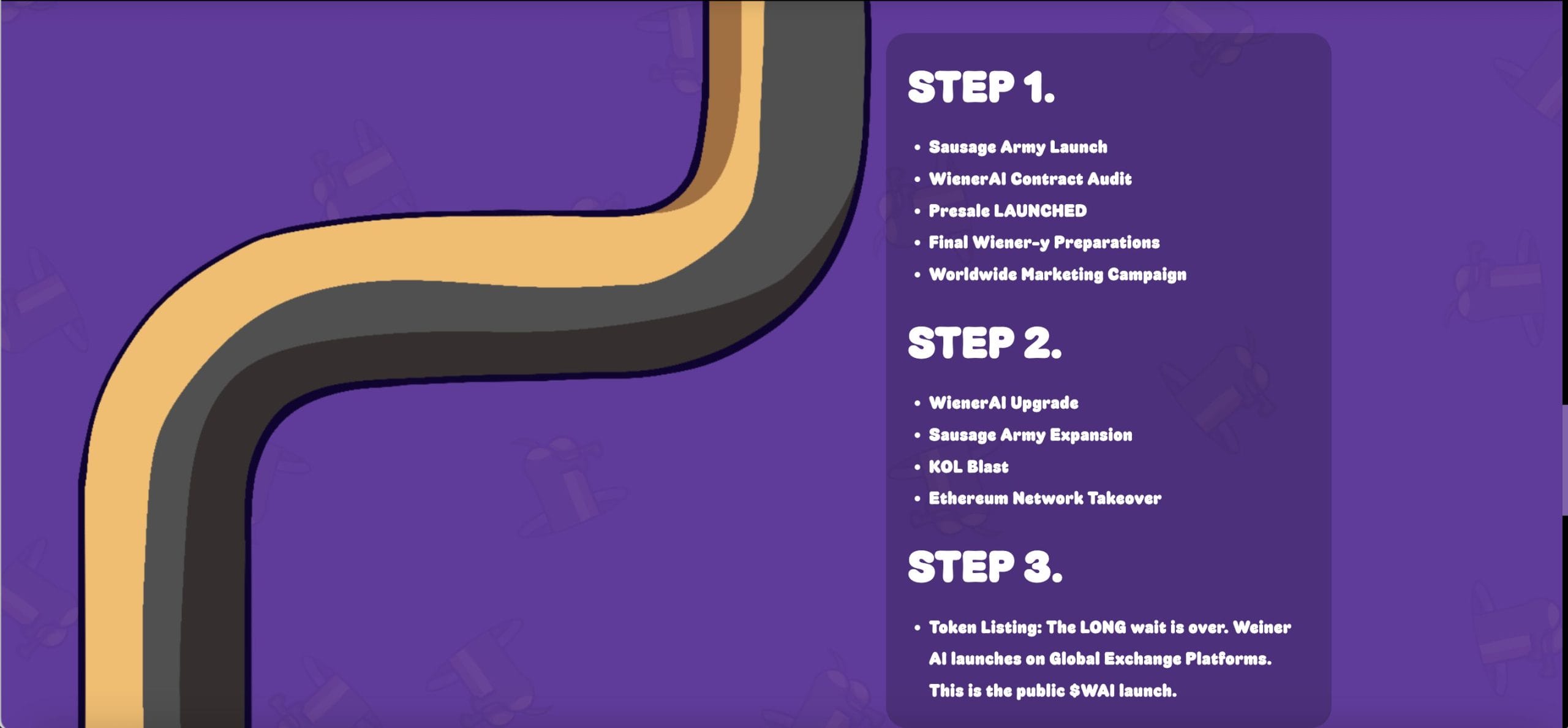

2. WienerAI – Dog Themed Meme Coin Offering Impressive Staking Rewards

WienerAI is the latest meme coin that looks set to make a splash in 2024. Looking to get to the top among other dog-themed meme coins, WienerAI also offers token holders very impressive staking rewards. Despite the name, WeinerAI is just a meme coin with no intrinsic value at heart. That said, should native token $WAI make similar returns to $Bonk or $Pepe, early investors wont care. The team behind the project are looking to create massive online hype and send the meme coin viral. To buy the token, head to the official website and connect your favourite wallet. BNB, ETH, MATIC and USDT are all accepted. Furthermore, $WAI token holders can put their investment to work and immediately start earning staking rewards. A huge 40% of the total token supply (69 billion) has been reserved for the presale.

Despite the name, WeinerAI is just a meme coin with no intrinsic value at heart. That said, should native token $WAI make similar returns to $Bonk or $Pepe, early investors wont care. The team behind the project are looking to create massive online hype and send the meme coin viral. To buy the token, head to the official website and connect your favourite wallet. BNB, ETH, MATIC and USDT are all accepted. Furthermore, $WAI token holders can put their investment to work and immediately start earning staking rewards. A huge 40% of the total token supply (69 billion) has been reserved for the presale. With dog inspired meme coins proving to be extremely popular this year, the team expect the project to sell out quickly. For more information, head over to the official website and download the WienerAi whitepaper.

With dog inspired meme coins proving to be extremely popular this year, the team expect the project to sell out quickly. For more information, head over to the official website and download the WienerAi whitepaper.

| Presale Started | April 2024 |

| Purchase Methods | ETH, MATIC, BNB, USDT, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

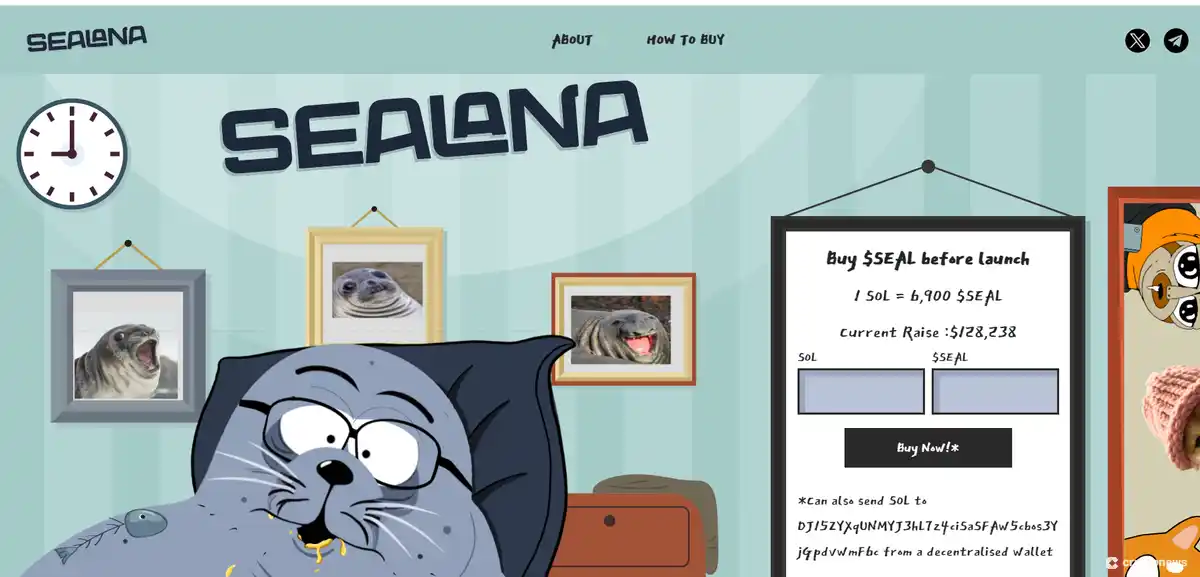

3. Sealana ($SEALANA) – Trending New Meme Token On Solana That Could Go Viral

Sealana ($SEAL) is next on our list of best ICOs. It combines the appeal of Solana-based meme tokens with fun pop culture references in a unique way. Inspired by a well-known character from the TV show South Park, Sealana appeals to people who love crypto and fans of American satire.It has a funny story about a seal trading his way out of his mom’s basement. Such a story has the potential to go viral and resonate with investors. The project opts for a simple ‘Send to Wallet’ presale system. This system allows you to directly participate in the presale by sending SOL to a specific wallet address in return for $SEAL.Such a method also makes buying tokens easy and accessible to a wide audience, even for those unfamiliar with complicated crypto trading systems.You can also connect a Solana-based wallet using the buying widget on Sealana’s presale site to buy $SEAL. Buyers can receive 6,900 $SEAL for just one 1 SOL at the time of writing.Sealana’s marketing strategy is also well-designed to attract more users over time. You can follow Sealana’s X (Twitter) handle and enter Its Telegram group to get the latest updates on its progress.

The project opts for a simple ‘Send to Wallet’ presale system. This system allows you to directly participate in the presale by sending SOL to a specific wallet address in return for $SEAL.Such a method also makes buying tokens easy and accessible to a wide audience, even for those unfamiliar with complicated crypto trading systems.You can also connect a Solana-based wallet using the buying widget on Sealana’s presale site to buy $SEAL. Buyers can receive 6,900 $SEAL for just one 1 SOL at the time of writing.Sealana’s marketing strategy is also well-designed to attract more users over time. You can follow Sealana’s X (Twitter) handle and enter Its Telegram group to get the latest updates on its progress.

| Presale Started | May 2024 |

| Purchase Methods | SOL |

| Chain | Solana |

| Starting Price | $0.01932 |

| Listing Price | N/D |

| Raised So Far | $130,000+ |

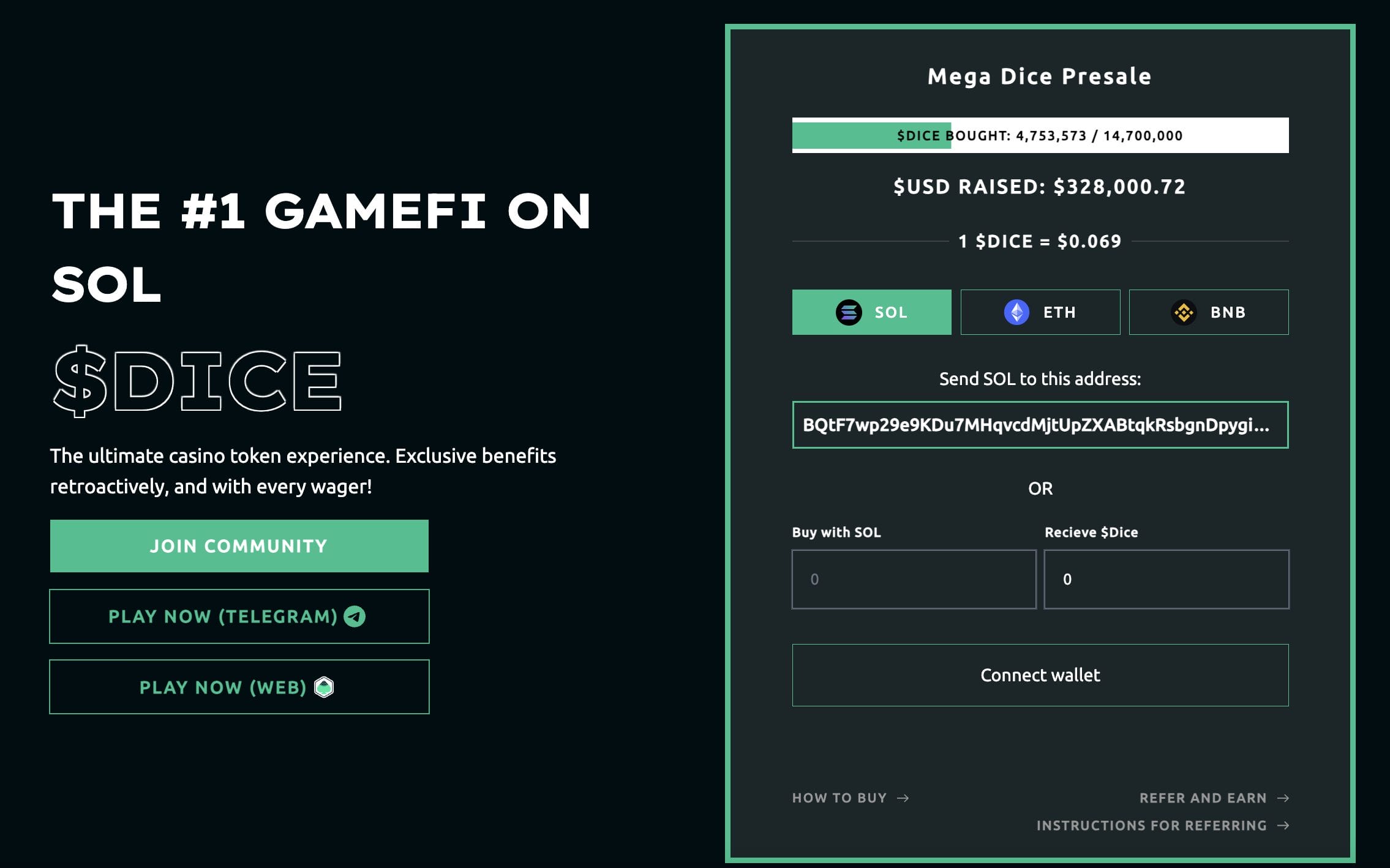

4. Mega Dice Token – New Solana Token Powering a CasinoFi Gaming Ecosystem

Mega Dice Token ($DICE) is a new cryptocurrency that powers Mega Dice Casino’s gaming ecosystem. Players can leverage $DICE tokens to access various discounts and bonuses on over 4,500+ casino games and 50+ sports betting markets.  Built on the Solana blockchain, Mega Dice Token offers high scalability, transparency, and low gas fees. From a total supply of 420 million tokens, 35% have been allocated for the recently launched ICO. Within the first day of the ICO launch, Mega Dice Token raised more than $320K. At the time of writing, $DICE is priced at $0.069 per token. In the long-term, Mega Dice will buyback tokens and conduct burning events to reduce the token supply. Token holders can stake $DICE on the smart contract to earn high annual yields. Staked token holders are also entitled to daily bonuses at the casino, varying depending on their past casino performance.

Built on the Solana blockchain, Mega Dice Token offers high scalability, transparency, and low gas fees. From a total supply of 420 million tokens, 35% have been allocated for the recently launched ICO. Within the first day of the ICO launch, Mega Dice Token raised more than $320K. At the time of writing, $DICE is priced at $0.069 per token. In the long-term, Mega Dice will buyback tokens and conduct burning events to reduce the token supply. Token holders can stake $DICE on the smart contract to earn high annual yields. Staked token holders are also entitled to daily bonuses at the casino, varying depending on their past casino performance.  This utility token can also be used to access limited edition NFTs, which can be traded on Mega Dice. Early ICO investors will get free $DICE as part of an Early Bird bonus incentive. Due to all these reasons, Mega Dice Token is one of the top-performing ICOs in 2024. Read the Mega Dice Token whitepaper and join the Telegram channel to learn more about this cryptocurrency.

This utility token can also be used to access limited edition NFTs, which can be traded on Mega Dice. Early ICO investors will get free $DICE as part of an Early Bird bonus incentive. Due to all these reasons, Mega Dice Token is one of the top-performing ICOs in 2024. Read the Mega Dice Token whitepaper and join the Telegram channel to learn more about this cryptocurrency.

| Presale Started | April 2024 |

| Purchase Methods | SOL, ETH, BNB |

| Chain | Solana |

| Min Investment | None |

| Max Investment | None |

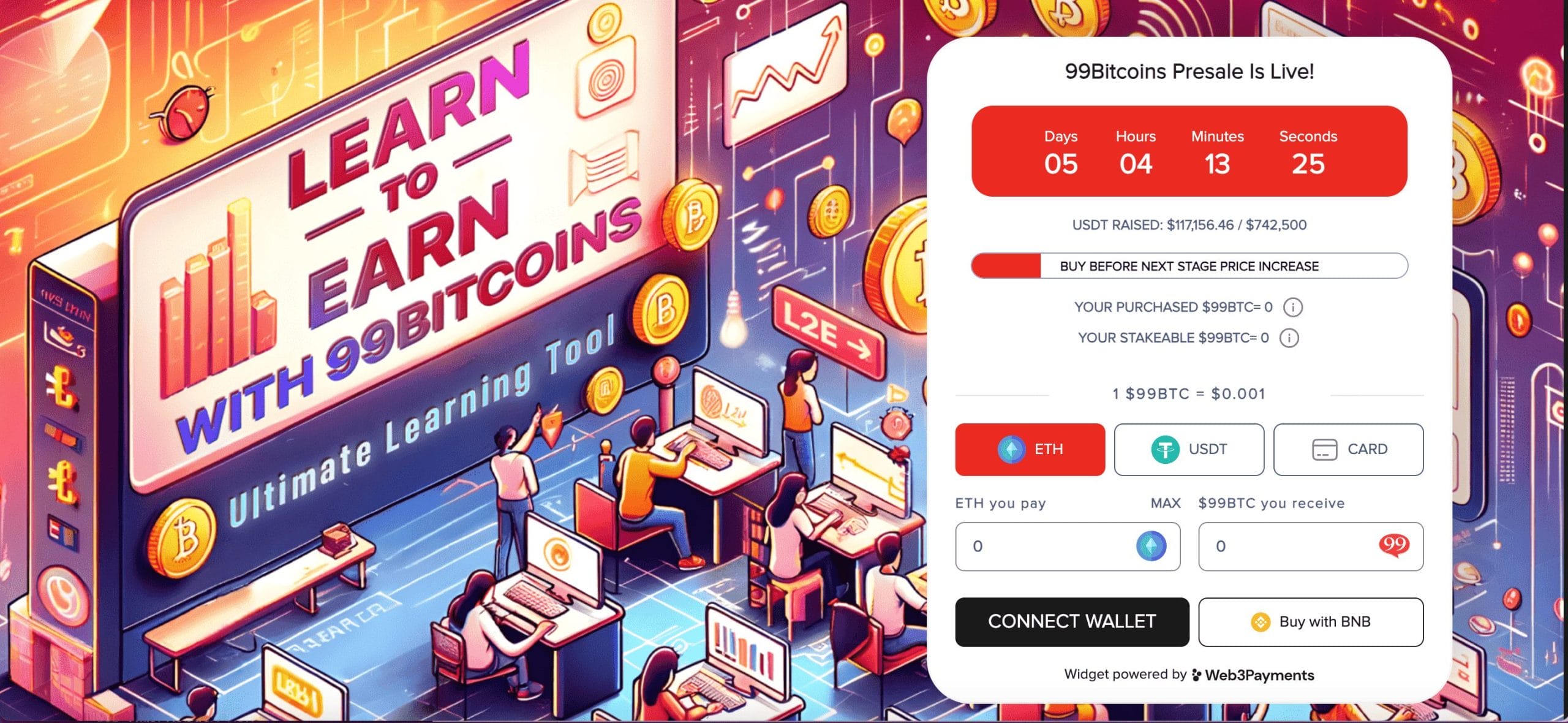

5. 99Bitcoins (99BTC) – Learn2Earn Crypto ICO, Will Bridge From Ethereum to the Bitcoin Blockchain

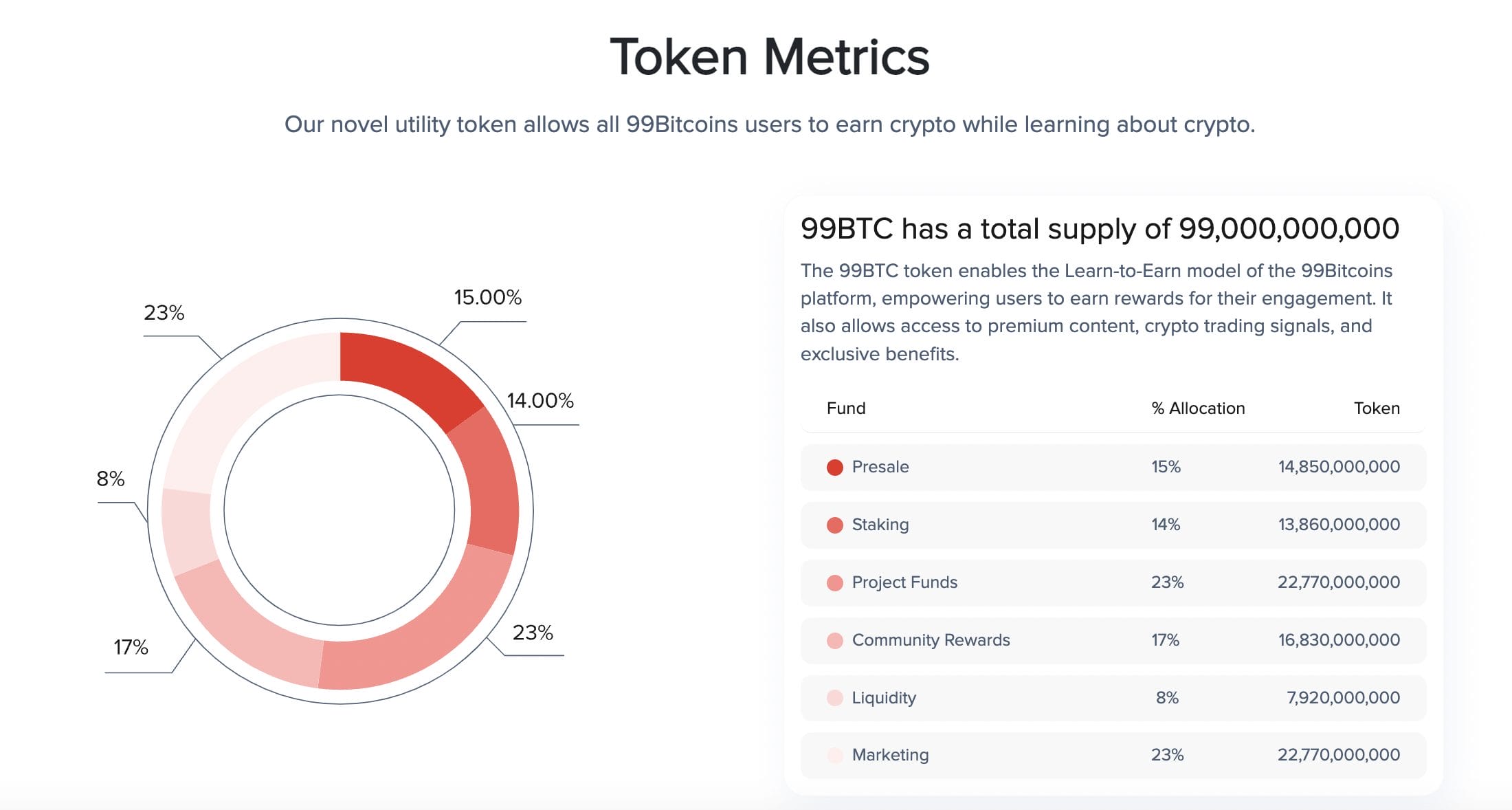

99Bitcoins ($99BTC) is a learn-to-earn cryptocurrency platform rewarding users for increasing their knowledge about digital assets and the blockchain. The $99BTC token has recently launched on ICO and has raised over $117K in only a few hours.  While 99Bitcoins was established during the early 2010s, it has recently tokenized to a learn-to-earn ecosystem. The cryptocurrency is built on the Ethereum blockchain but will eventually migrate to Bitcoin, adopting the BRC-20 blockchain standard. Token holders get to increase their knowledge on basic and advanced crypto topics and earn $99BTC tokens for their progress. You can earn the rewards by engaging in quizzes and assessments. 99Bitcoins offers exclusive access to VIP groups and trading signals to token holders. You can also earn tokens for community engagement through content creation and peer support forums. Due to these benefits, $99BTC has been soaring since the ICO launched.

While 99Bitcoins was established during the early 2010s, it has recently tokenized to a learn-to-earn ecosystem. The cryptocurrency is built on the Ethereum blockchain but will eventually migrate to Bitcoin, adopting the BRC-20 blockchain standard. Token holders get to increase their knowledge on basic and advanced crypto topics and earn $99BTC tokens for their progress. You can earn the rewards by engaging in quizzes and assessments. 99Bitcoins offers exclusive access to VIP groups and trading signals to token holders. You can also earn tokens for community engagement through content creation and peer support forums. Due to these benefits, $99BTC has been soaring since the ICO launched. 15% of the total 99 billion tokens are being distributed for the ICO round. Currently, $99BTC is priced at $0.001 per token. Early investors can also generate more than 70,000% in annual yields by staking tokens on the smart contract. For more project updates, go through the 99Bitcoins whitepaper and join the Telegram channel.

15% of the total 99 billion tokens are being distributed for the ICO round. Currently, $99BTC is priced at $0.001 per token. Early investors can also generate more than 70,000% in annual yields by staking tokens on the smart contract. For more project updates, go through the 99Bitcoins whitepaper and join the Telegram channel.

| Purchase Methods | ETH, USDT, BNB, Card |

| Chain | Ethereum (Will bridge to Bitcoin) |

| Min Investment | None |

| Max Investment | None |

6. 5thScape (5SCAPE) – Best Virtual Reality ICO Project

The 5thScape crypto project offers an innovative mix of blockchain technology and virtual reality. The team will offer VR games, a VR headset and a VR chair, while using the native token 5SCAPE as a currency within the ecosystem. The token holders will also get benefits such as exclusive access and discounts on VR products.

To fund the development, the team is launching a presale of its token 5SCAPE with the goal of raising $15 million. And that is the only way to get your hands on the token. All you need is an Ethereum wallet to connect to the website and ETH or USDT coins to complete the purchase.

There will be 12 presale rounds where each round will see a token price increase. This means buying as early as possible could be the best option to get the token for a low price. During the second round, the token is priced at $0.00215 apiece, while in the last round it will be $0.0087.

You can claim a portion of your tokens once the presale ends, while the remaining tokens will have a vesting period, per the 5th Scape whitepaper. There should also be a lucrative APY for staking your tokens launching soon. So far, the presale has raised over $2.3 million.

Follow 5th Scape on X and join the 5th Scape Telegram channel for the latest information. Also, check out the 5th Scape Discord if you want to engage with the community.

| Presale Started | Jan 2023 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

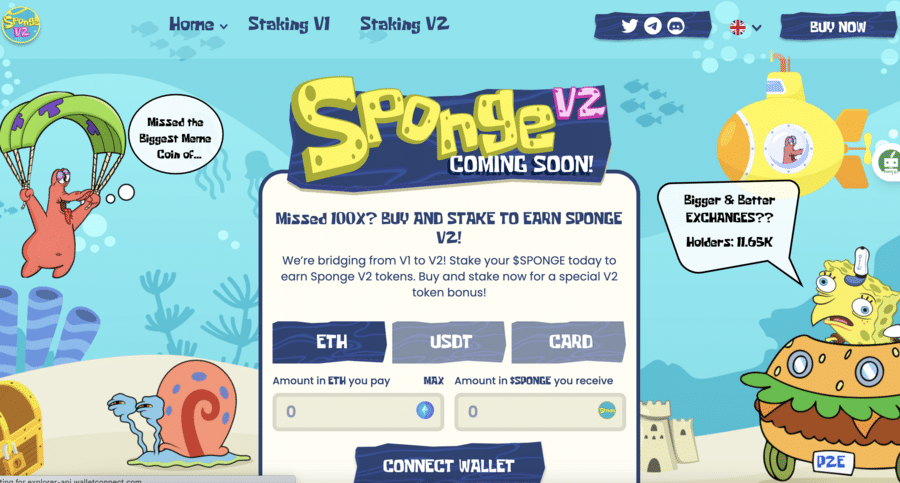

7. Sponge V2 (SPONGE) – Best New ICO Crypto Project With A P2E Game And Staking APY Of 40%

is a new, upgraded version of the $SPONGE meme coin, which saw significant success in 2023, including a 100x surge from a $1 million market cap.

This new version transitions from a simple meme coin to a more utility-focused asset, introducing a play-to-earn (P2E) game and aiming for listings on major exchanges like Binance and OKX.

Innovative Staking and Earning Mechanism

- Stake-to-Bridge Model: A unique Stake-to-Bridge model facilitates the transition from Sponge V1 to V2. Staking V1 tokens allows users to seamlessly transition to the V2 tokens, locking in the V1 tokens permanently.

- Rewards and Incentives: The staking mechanism offers a live APY of 198%, incentivizing long-term holding. Early investors in V2 receive immediate purchase bonuses, and V1 holders can stake to earn V2 rewards.

Sponge V2 integrates a P2E game, where users can use their V2 tokens to play and earn additional tokens, improving user engagement.

The project has a total token supply of 150 billion, with a significant portion, 43.09%, dedicated to staking rewards.

Additionally, 8% of the total supply is reserved for rewards in the P2E gaming segment, further motivating active participation within the Sponge ecosystem.

With an existing community of 30,000, Sponge V2 aims to expand its reach through aggressive marketing campaigns and leveraging the success of Sponge V1.

Interested buyers can follow Sponge on social media platforms like Twitter and join the Telegram channel for the latest news and updates on the V2 rollout and exchange listings.

| Presale Started | Dec 2023 |

| Purchase Methods | ETH, USDT, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

8. Smog (SMOG) – Best Alternative to ICO Cryptos, Get Airdrop and Staking Rewards

We have picked Smog ($SMOG) as the best alternative to cryptocurrency ICOs. Unlike the other tokens on our list, $SMOG was launched straight on the Jupiter decentralized exchange. This is a new meme coin – which is built on the Solana blockchain.

The platform creators want $SMOG to become the best SOL meme coin in the long-term, and are running one of the most lucrative airdrop campaigns to attract more investors. From 1.4 billion token supply – 490 million $SMOG tokens will be offered through airdrop rewards.

Investors can start earning airdrop points by simply holding the token, staking $SMOG, and by completing daily, weekly, and monthly online challenges. For instance, you can follow Smog on Twitter and Telegram, and earn airdrop points. Investors can also generate up to 42% in staking annual yields by locking $SMOG in the smart contract. So far, more than 1 million tokens have been staked on Smog.

In February 2024, $SMOG launched at a price of $0.001419 per token, with a market cap of just $2 million. Within a few days, the token is trading around the $0.044 mark – with a market cap of more than $61 million. This new meme coin has the potential to offer similar gains as Pepe Coin – which soared to a $1 billion market cap within weeks of launch.

Another 50% of the supply will be used for marketing purposes, while 15% has been set aside for CEX and DEX listings. Read the Smog whitepaper to stay updated with this new meme cryptocurrency.

9. eTukTuk (TUK) – Best ICO With a Social and Environmental Purpose

The next cryptocurrency on our list is $TUK, the native token of eTukTuk. This is the first-ever automotive project based on the Binance Smart Chain.

eTukTuk wants to help tuk-tuk drivers start adopting electric vehicles (EVs) and will build charging stations and set up electric vehicle supply equipment (EVSE).

According to the World Health Organization (WHO), 99% of the population breathe polluted air. There are 270 million TukTuks that operate on Internal Combustion Engines (ICEs), which run on non-renewable sources such as fossil fuels. These contribute to more pollution than cars.

As ICEs are slowly becoming obsolete, TukTuk drivers struggle to make a minimum wage to support their families. Therefore, eTukTuk will set up EV charging stations in urban and suburban areas of developing countries.

The EVSEs and charging stations will be set up in different ‘territories.’ Each territory will be operated and set up with the help of local manufacturers, known as territory partners. This helps limit the cost of production. The platform will let drivers make payments at the charging stations with $TUK tokens.

Since the cryptocurrency is based on the Binance Smart Chain, there are low fees and high scalability. According to the eTukTuk whitepaper, drivers will take home 400% more in revenue by using this platform.

Territory partners will be rewarded, as they get a commission for each transaction on the charging stations. Token holders can stake $TUK to earn passive income. eTukTuk has raised more than $930K since the start of the presale.

Join the eTukTuk Telegram channel for more information.

10. Shiba Shootout – New crypto ICO offering lucrative staking rewards

Shiba Shootout ($SHIBASHOOT) has emerged as one of the hottest crypto ICOs to invest in right now. With its extensive features, Shiba Shootout has totally distinguished itself from other meme coins. According to its whitepaper, Shiba Shootout is inspired by a Wild-West theme, combining creativity, competition, and camaraderie” to provide unique experiences.

At the heart of Shiba Shootout lies the principles of community engagement and rewards. The unique ICO project has already put in place a lineup of offerings that will position its community members for fantastic rewards. First, it comes with a savings feature, “Savings Saddlebag.” Users can leverage this feature to save their holdings in a dedicated wallet and earn more tokens.

Another rewarding program that users will find on Shiba Shootout is called “Posse Rewards.” This is a referral program that allows users to earn more Shiba Shootout tokens for inviting their friends to join the community.

Adding to its appeal is its staking mechanism, offering lucrative APY to reward early participation. Since Shiba Shootout is just launching its ICO, buying and staking the tokens right now will position you for massive rewards. Don’t forget that as more tokens are being staked, the reward is expected to drop.

Overall, Shiba Shootout is fast becoming one of the most popular investment opportunities in the market right now. Raising close to $200k within a few days of going live is enough indication of investors’ trust and optimism in its short and long-term potential.

| Presale Started | April 2024 |

| Purchase Methods | ETH, USDT, BNB, CARD |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

Visit Shiba Shootout ($SHIBASHOOT)

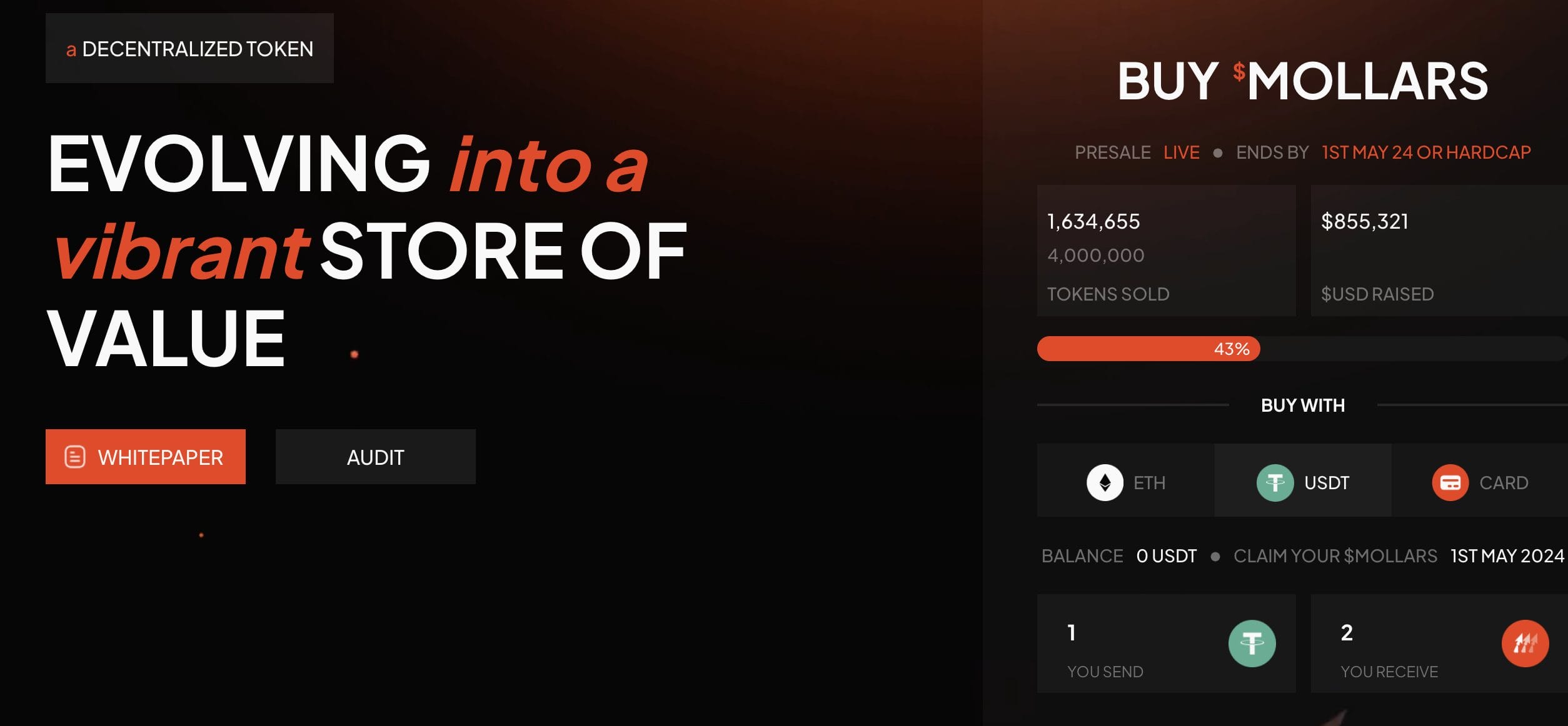

11. Mollars (MOLLARS) – Best DeFi ICO With Gaming and Web3

is a hot new DeFi ICO combining gaming and Web3 applications. It aims to revolutionize user interaction with digital assets by blending gaming and Web3 products to offer utility and encourage community participation.

Currently, Molars is in its presale phase, where early buyers can grab the tokens for a discounted price. The platform has already raised over half its hard cap of $1.6 million in just a few weeks, showing massive community trust.

Mollars is also focused on sustainable growth and community-driven governance. It has a total token supply of 10 million, focusing on user engagement and contribution. A significant portion is allocated to the presale, and a portion is reserved for future decentralized applications and exchanges.

Post-launch, Mollars intends to transition to a governance model where token holders can influence the platform’s direction. The ecosystem has a 3% transaction tax to reinvest into the platform and a 1% burn rate to improve token value over time.

Investors interested in this project can read the Mollars whitepaper to learn more. They can join the Mollars Telegram group and follow it on X (Twitter) for the latest updates and discussions.

| Token Symbol | MOLLARS |

| Presale Supply | 4,000,000 MOLLARS |

| Token Type | Ethereum |

| Payment Method | ETH, USDT, Card |

| Listing Price | N/A |

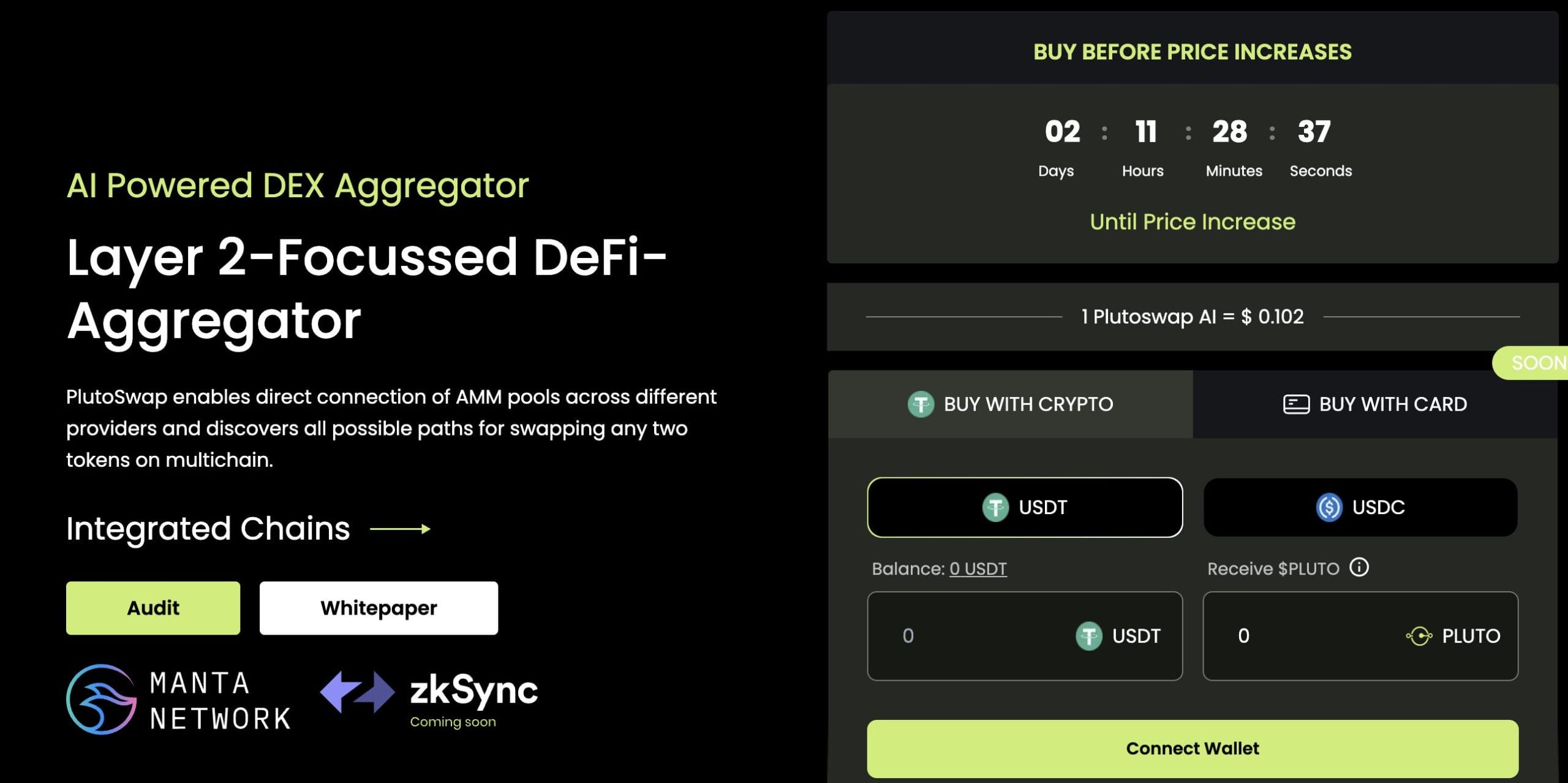

12. PlutoSwap.ai (PLUTO) – Best Crypto DEX Aggregator and Token Swapping Platform ICO

The next top cryptocurrency ICO is being conducted by PlutoSwap.ai ($PLUTO). This is a new decentralized exchange (DEX) aggregator powered by artificial intelligence.

PlutoSwap.ai enables direct connections of AMM (Automated Market Makers) pools across different providers. The main goal is to offer the best potential price when supporting token swaps on the blockchain.

The platform is integrated with the MANTA network, and will soon integrate with zkSync, BASE, Arbitrum, Ethereum, and the Binance Smart Chain. Users can connect their crypto wallets to the PlutoSwap DApp and choose the tokens they wish to swap.

PlutoSwap.ai uses its AI-powered pathfinder algorithm to send single trade transactions across multiple DEXs. Once the best price is found, the swap is executed. The $PLUTO token offers voting rights within the ecosystem. Token holders can conduct platform upgrades and determine the future of the cryptocurrency.

From a total supply of 300 million, 60 million tokens have been allocated for the ongoing ICO. At press time, $PLUTO is priced at just $0.102 per token. In the future, the platform will also offer staking rewards through the token. For more information on this new ICO, read the PlutoSwap.ai whitepaper and join the Discord.

| Token Symbol | PLUTO |

| Presale Supply | 60,000,000 PLUTO |

| Token Type | Ethereum |

| Payment Method | ETH, USDT, USDC, Card |

| Listing Price | N/A |

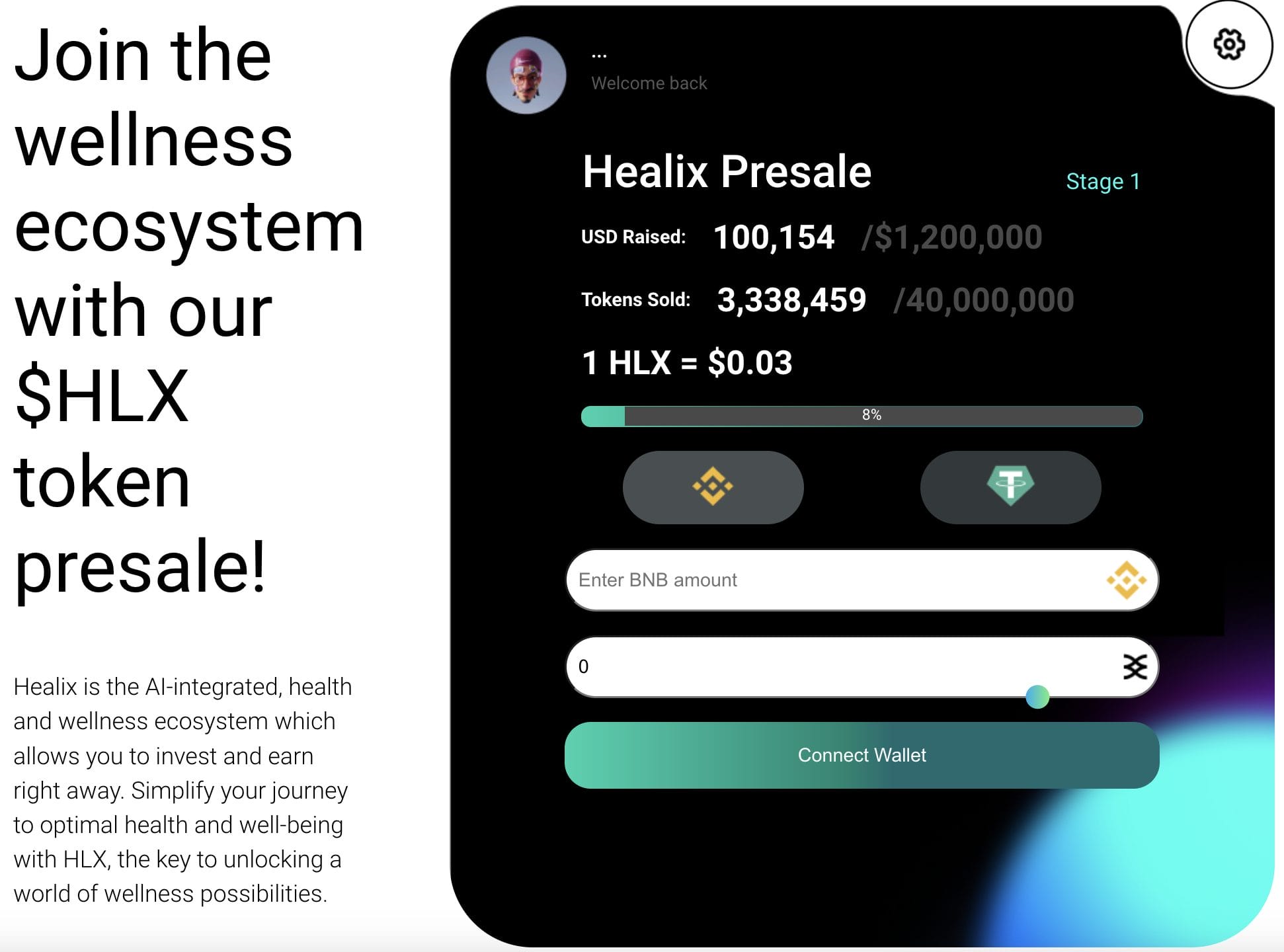

13. Healix – New Crypto Decentralizing the Healthcare Industry, $100K Raised

Healix ($HLX) is a new cryptocurrency platform that decentralizes the healthcare space. The project uses several artificial intelligence-based models to help empower global healthcare accessibility with its decentralized ecosystem. $HLX, the native token, has recently launched its ICO. From a total supply of 1 billion, 100 million tokens are being allocated for the ICO round. At the time of writing, $HLX is priced at $0.03 per token.  According to the Healix whitepaper, the token will be used to schedule appointments, buy nutritional supplements, and access premium healthcare services. $HLX token holders get access to the ‘Smart Health Club’ – which offers premium benefits and rewards. The rewards range from $HLX cashback within the ecosystem to discounts on healthcare products, as well as annualized token bonuses. The benefits differ depending on how many tokens you have staked on the ecosystem. Using AI generative models, Healix lets users track their blood pressure with a simple face scan through the Healix app. All these reasons have helped Healix raise over $100K since the launch of its presale. Join the Healix Telegram channel to learn more about this project.

According to the Healix whitepaper, the token will be used to schedule appointments, buy nutritional supplements, and access premium healthcare services. $HLX token holders get access to the ‘Smart Health Club’ – which offers premium benefits and rewards. The rewards range from $HLX cashback within the ecosystem to discounts on healthcare products, as well as annualized token bonuses. The benefits differ depending on how many tokens you have staked on the ecosystem. Using AI generative models, Healix lets users track their blood pressure with a simple face scan through the Healix app. All these reasons have helped Healix raise over $100K since the launch of its presale. Join the Healix Telegram channel to learn more about this project.

| Token Symbol | HLX |

| Presale Supply | 100 Million |

| Token Type | BEP-20 |

| Payment Method | BNB, Tether |

| Listing Price | N/A |

14. Heroes of Mavia (MAVIA) – Best Battle-Builder Game ICO

Heroes of Mavia could be one of the best crypto ICOs in the blockchain gaming niche due to its appealing ‘base building’ features.

Within the Heroes of Mavia ecosystem, players can create their own armies and conquer enemy bases – allowing them to earn Ruby tokens in the process.

Ruby tokens can then be used to upgrade a user’s base, strengthen their army, and solidify defenses.

However, aside from the battle mechanics, Heroes of Mavia also has a built-in NFT marketplace, live battle streaming features, and even a ‘Base Partnership Manager’ for users to collaborate and generate passive income.

Like many of the best ICO cryptos, Heroes of Mavia has already attracted massive attention from prospective investors on social media.

The game is backed by leading entities like Binance Labs and Animoca Brands – meaning all eyes will be on Heroes of Mavia ahead of its Beta phase launch in Q4 2022.

Methodology: How We Ranked the Best ICOs

Our team follows a methodical approach to rank the most promising ICOs. This section outlines the criteria and respective weights used in our evaluation.

Fastest Selling ICOs (25%)

Fast selling ICOs reflect market enthusiasm and investor confidence. Selling quick often signals strong community support and a high demand for the token. We analyzed the speed at which ICOs are reaching or have reached their funding goals. This metric helps identify ICOs that attract attention and likely maintain momentum post-launch.

Best Entry Price (25%)

We assessed ICOs by comparing their launch prices to projected market values and historical performance of similar tokens. A lower entry price can significantly enhance potential returns, making it a crucial factor for investors seeking value.

Widespread Media Coverage (25%)

We analyzed the extent and nature of media attention each ICO received across major financial and crypto-specific news platforms. High-quality coverage from reputable sources tends to indicate a project’s legitimacy and broader interest, potentially leading to a more robust investor base. This metric helps differentiate ICOs with significant exposure and trust from those with limited or negative publicity.

Compelling Use Cases (15%)

We evaluated each ICO by examining the practicality and innovation of their proposed solutions to current market needs. ICOs that address genuine problems with effective, innovative solutions are more likely to succeed and provide value to investors.

Audited Tokenomics (10%)

We assessed ICOs by verifying if their tokenomics had been reviewed and validated by reputable third-party auditors. An audited token model provides transparency, reduces the risk of manipulation, and builds investor trust. This criterion filters out ICOs with well-structured economic foundations from those that may pose higher risks due to unchecked or flawed token distribution strategies.

What Is a Crypto ICO?

A crypto Initial Coin Offering (ICO) is a fundraising method for blockchain projects, similar to a stock exchange IPO. During an ICO, a project sells tokens at a discounted price to raise funds and build a community before launch.

For example, Ethereum’s ICO in 2014 sold ETH tokens for just $0.31 each; Ethereum tokens are now worth over $3,000.

ICOs are unregulated, posing higher risks, and require investors to perform thorough due diligence. Success is not guaranteed, though the potential returns can be substantial for risk-seeking investors.

The History of ICOs

Ethereum marked the first major success in ICO history by raising $16 million in 2014, catalyzing the growth of decentralized finance (DeFi) and decentralized applications (dApps).

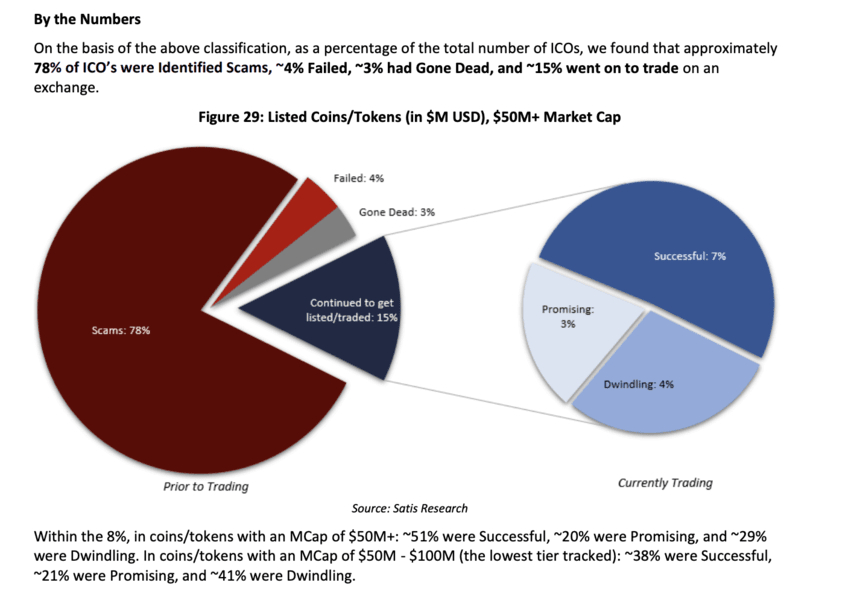

However, by 2017, the ICO landscape shifted dramatically due to numerous scams, leading to only a fraction of ICOs achieving significant liquidity on centralized exchanges.

This prompted a regulatory crackdown, notably from the U.S. Securities and Exchange Commission (SEC), which scrutinized these offerings for potential securities violations.

As a result, Web3 fundraising has diversified into safer and more regulated forms to accommodate the evolving complexity of the ecosystem, including:

- Security Token Offerings (STOs)

- Initial Exchange Offerings (IEOs)

- Initial DEX Offerings (IDOs)

How Do Initial Coin Offerings Work?

Initial Coin Offerings are timed fundraising events set by a project’s team who determine both the start date and the fundraising goals. These events typically feature a soft cap, indicating the minimum funds desired, and a hard cap, the maximum allowed.

To participate, investors visit the project’s website, where the token price and accepted currencies (often ETH or BNB) are listed. Investors send funds to a provided wallet address and then receive ICO tokens in return to their own wallets. Buying ICO tokens requires owning a crypto wallet and some digital currency beforehand.

ICO, STO, IEO, IDO: What’s the Difference?

As cryptocurrency has evolved, traditional fundraising methods such as bank loans and venture capital have been supplemented by digital token sales. These sales allow companies to raise funds by offering cryptocurrencies in exchange for digital or fiat currencies, often on the Ethereum network as ERC-20 tokens.

Each type of token sale offers different advantages and suits various investor needs, from the highly regulated STOs offering asset-backed securities to the more speculative and decentralized IDOs.

As the digital asset landscape continues to mature, the lines between these methods blur, with platforms adapting to offer hybrid models that cater to a broader range of regulatory preferences and investment risks.

Initial Coin Offerings (ICOs)

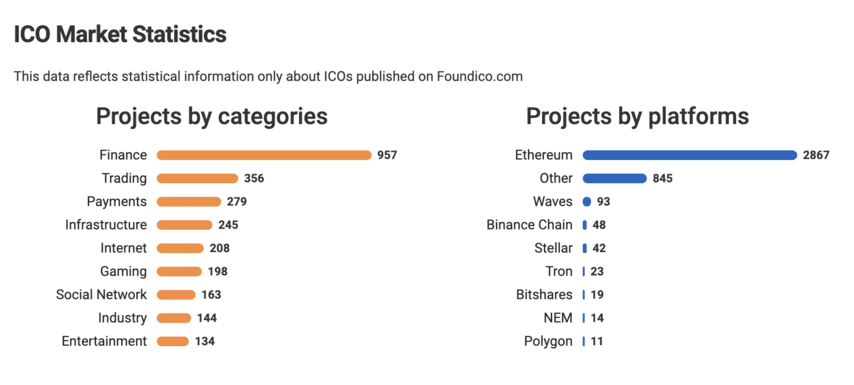

ICOs have been a popular method since 2014, driven initially by significant interest in new cryptocurrencies like Monero, Litecoin, and Ethereum.

However, due to numerous scams and lack of regulation, ICOs came under heavy scrutiny. Investors considering ICOs should conduct comprehensive due diligence, reviewing the project’s team, whitepaper, and roadmap.

Successful ICOs typically lack formal KYC checks and rely heavily on the transparency and long-term commitment of the project founders.

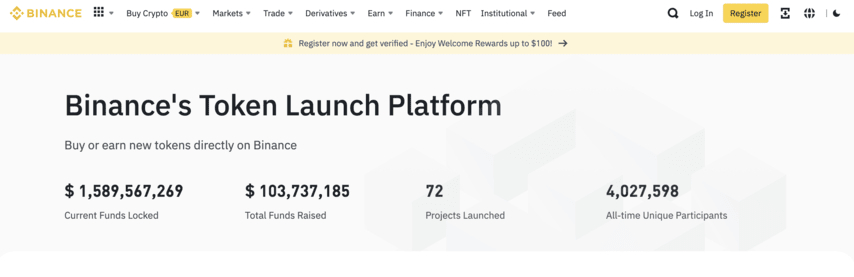

Initial Exchange Offerings (IEOs)

are hosted on centralized cryptocurrency exchanges and use the exchange’s user base for immediate liquidity and trading.

Exchanges like Binance enhance trust through stringent due diligence and compliance with KYC norms. Often, projects launching IEOs experience significant price surges post-listing, benefiting from what is sometimes referred to as the Binance Effect.

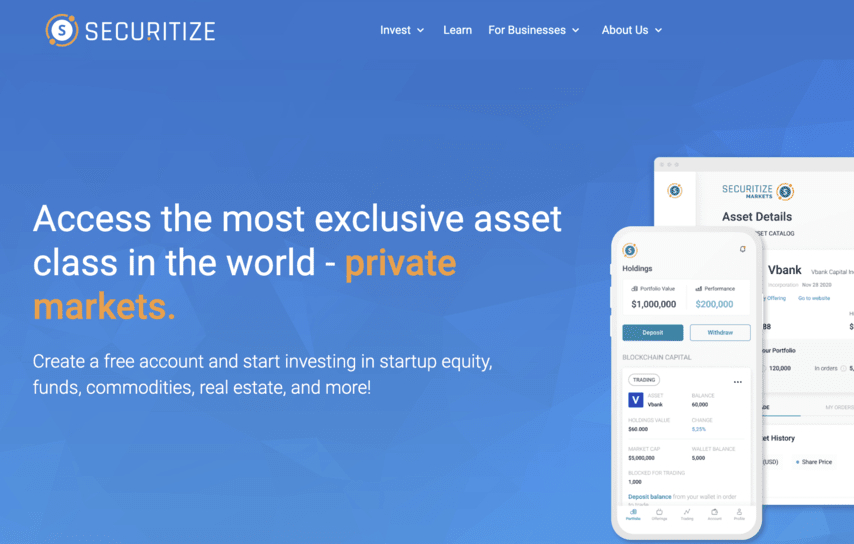

Security Token Offerings (STOs)

represent a regulated alternative to ICOs, adhering strictly to anti-money laundering and securities regulations. They offer security tokens that are tradable financial assets, ensuring investor protection and enhanced liquidity.

Platforms like Securitize facilitate the entire lifecycle of these digital securities, supporting compliance and integration with established financial practices.

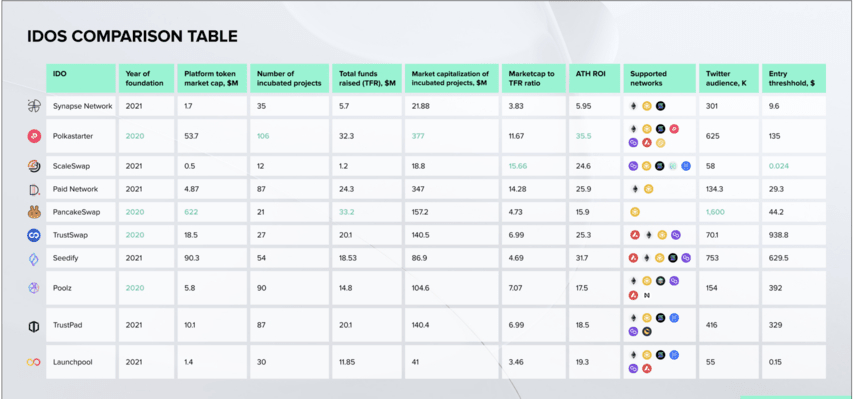

Initial DEX Offerings (IDOs)

Initial DEX Offerings are decentralized and unregulated token sales conducted directly on decentralized exchanges (DEXs). They allow for immediate token pricing post-circulation, avoiding pre-mines that favor founders.

However, IDOs carry more risk due to minimal regulatory oversight and often lack comprehensive KYC procedures. Platforms like Ethereum’s DAO Maker and Binance’s BSCpad are prominent in hosting IDOs, offering innovative sale formats and supporting a variety of projects.

How to Find the Best New ICO Cryptos

Finding the best new ICO cryptos requires thorough research. Key indicators of a promising ICO include:

- A transparent and verifiable development team (though some meme projects may have anonymous developers)

- A clear roadmap and whitepaper

- An active social media presence

However, always verify social engagement to ensure it’s genuine and not inflated by bots or spam accounts. Conducting detailed research is essential before investing to distinguish potentially successful projects from less viable ones.

Below, we’ll go over three ways to find and vet new crypto ICOs worth investing in.

1. Take Advantage of Social Media

Using social media is a vital strategy to discover and assess new crypto ICOs:

- X: Follow key influencers, founders, blockchain projects, and Cryptonews for the latest announcements and discussions. Use hashtags like #ICO, #CryptoICO, and #TokenSale to find posts related to new ICOs. Watch for genuine engagement and beware of accounts that might use bots to inflate interaction numbers.

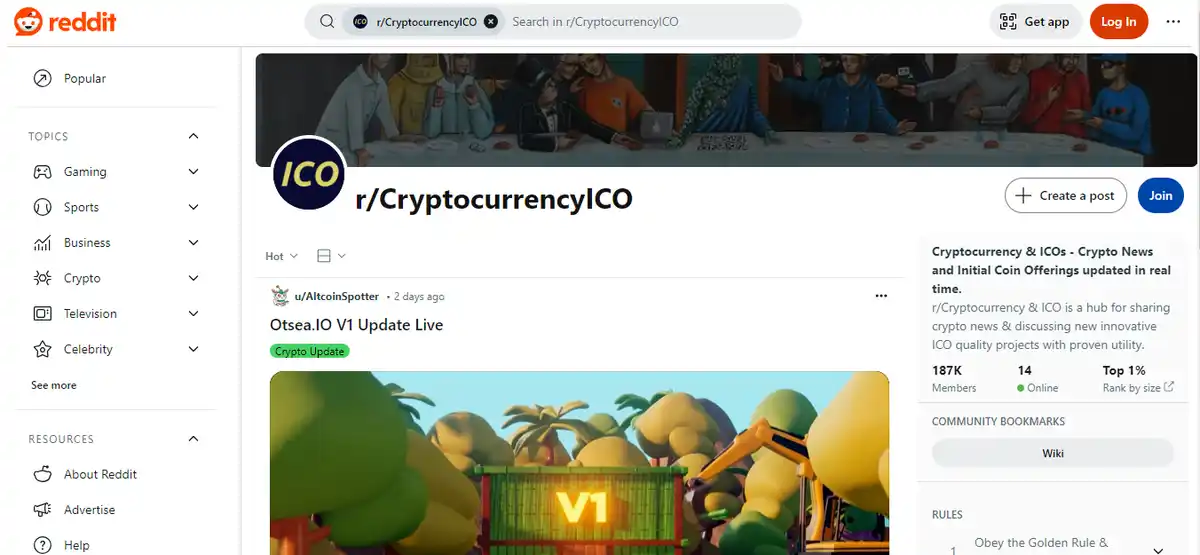

- Reddit: Join subreddits like /r/CryptocurrencyICO, r/ICO, and r/CryptoMarkets. These communities offer discussions, firsthand user experiences, and updates on upcoming ICOs. Always cross-reference information and check for user testimonials to gauge sentiment and potential red flags.

- TikTok: Follow Cryptonews as well as influencers and content creators who specialize in ICOs and cryptocurrency trends. Use hashtags like #ICO, #CryptoNews, and #CryptoInvestment to find educational content about new ICOs.

- Telegram: Many ICO projects host official Telegram channels where they share updates, engage with potential investors, and provide direct access to the team. Join Telegram groups to ask questions directly and receive timely updates.

- Discord: Similar to Telegram, Discord serves as a hub for community interaction and is increasingly popular for real-time project discussions and ICO news.

- YouTube: Subscribe to channels that specialize in cryptocurrency analysis and ICO reviews, such as Cryptonews, Jacob Crypto Bury, and Boxmining. They often provide detailed evaluations of ICO projects, team backgrounds, and tokenomics.

2. Use an ICO Calendar

ICO Calendars are essential tools for identifying upcoming ICOs, offering key details like industry focus, start and end dates, blockchain used, and fundraising targets.

Using an ICO calendar helps streamline your investment process by enabling you to pre-register for early-stage projects at lower prices, avoiding impulsive investments and optimizing financial planning.

Websites like ICO Drops and CoinCodex’s ICO Calendar allow you to filter ICOs based on your preferences, such as blockchain type or presale status, enhancing your search specificity.

3. Get Involved in Web3

Engaging directly with Web3 and ICOs can significantly enhance your understanding of new crypto offerings.

One approach is to start small by investing a minimal amount, such as $20, in several ICOs to track and compare their performance. This strategy allows you to diversify risk rather than committing a large sum to a single, unproven project.

Alternatively, consider working with a Web3 startup. Positions range from smart contract developers to roles in marketing, content creation, network engineering, and legal consultancy.

Hands-on experience provides deep insights into the ICO process and offers opportunities to observe successful practices and potentially participate in early investments.

What Are the Risks of ICO Investments?

Investing in ICOs carries risks, primarily due to lack of regulation which can lead to scams and financial loss. Many ICOs fail to deliver on promises, resulting in worthless tokens.

The absence of oversight means fewer safeguards against fraud, compared to regulated offerings like IPOs. Market volatility can also dramatically affect token values.

Before investing, thorough due diligence is essential to assess the project’s legitimacy, the team’s credibility, and the realistic potential of the underlying technology.

Lack of Regulatory Oversight

One of the primary risks of ICOs is the lack of regulatory oversight, unlike regulated IPOs. This absence of regulation makes investors vulnerable to scams, including fraudulent projects and market manipulations like rug pulls and pump-and-dump schemes.

In a rug pull, developers might drain a token’s liquidity, leaving it worthless, while pump-and-dump involves inflating a token’s value through hype and then selling off at the peak.

The unregulated nature of the crypto markets facilitates these schemes, attracting scam artists who exploit the lack of enforced KYC procedures and transparency. Investors should be cautious and seek transparency in ICO operations to avoid fraudulent activities.

Unrealistic Expectations Leading to Severe Losses

Many ICOs are launched with only a whitepaper and lack a working product or proven track record, leading investors to fund projects based on mere speculation and promises rather than tangible evidence of success.

This results in significant financial risk as many projects fail to deliver, never materialize, or have poor token distribution and governance.

Additionally, ICOs often allocate a large portion of tokens to founders, creating potential conflicts of interest and decision-making that may not align with investor interests.

Unrealistic claims made by projects, like those claiming to be “Ethereum killers,” often fail to materialize, further risking investor capital.

Volatility & Market Manipulation

The cryptocurrency market is notoriously volatile, which poses a significant risk for ICO investors. Even Bitcoin, the most stable cryptocurrency, experiences high volatility.

This volatility is even more pronounced in ICO tokens, which often have lower trading volumes. Tokens with small market capitalizations can be easily manipulated with relatively small amounts of money compared to larger volume cryptocurrencies.

Additionally, unlike traditional financial markets, which are heavily regulated to protect against market manipulation, the cryptocurrency market has weaker regulations, making it more susceptible to price manipulation, especially during the earlier days of ICO popularity.

How to Invest in an ICO

Investing in an ICO token is quite straightforward. By and large, tokens are a lot easier to invest in than other financial instruments. But you still need to get familiar with the process so you can keep your funds securely stored.

Step 1: Choose Your ICO

We have already been over this step, but just to reiterate: you need to find the best ICO that’s legit and has a strong chance of success. Check an ICO calendar to see which ones match your preferences.

Once you have decided on a suitable ICO, you can visit the page to see which type of tokens you need to invest in the project. You will want to buy a crypto that is accepted/required by the ICO. USDT and ETH are commonly accepted. If it’s a Binance-supported ICO, you might need BUSD or BNB.

The official page should also tell you key information about the project, including theme, industry, token price, and vesting period. This is key information is needed to decide whether it’s worth the investment or not.

Step 2: Buy Crypto

Now, you need to acquire crypto funds, most likely ETH or an acceptable stablecoin such as USDT, USDC, or BUSD. You can check what tokens the ICO accepts on its official presale page.

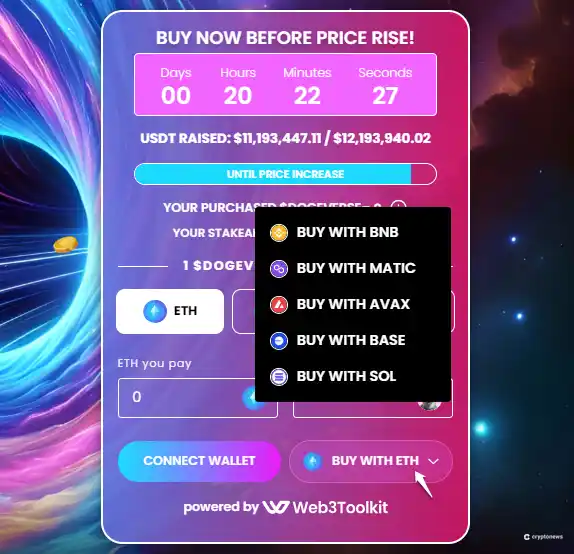

For this example, we selected Dogeverse, which can be purchased using USDT, ETH, BNB, AVAX, MATIC, BASE, or SOL.

Head over to your preferred crypto exchange, such as Binance, Coinbase, or Kraken, and purchase tokens the ICO accepts.

Step 3: Send Funds to Your Web3 Wallet

Once you have purchased your crypto on your chosen platform, you will need to send it to a Web3 wallet. MetaMask and Wallet Connect are two of the most popular options.

Simply go to the MetaMask website, download its free browser extension, and set up your account — remember to store your private keys securely.

Once you’ve set up your MetaMask wallet, head over to the crypto exchange where you purchased crypto, and send those funds to MetaMask.

Step 4: Purchase ICO Tokens

Click “Connect Wallet,” and select your Web3 wallet. In this case, the available options are MetaMask, Best Wallet, Wallet Connect, and Coinbase Wallet.

Next, type in your password to successfully connect your wallet to the ICO website. Once it’s connected, you can select the cryptocurrency you wish to use, and either input the crypto amount you want to spend or the number of Dogeverse tokens you want to purchase. Finally, click “Buy Now” to finalize the transaction.

Are ICOs a Good Investment?

Although ICOs are undoubtedly a widespread phenomenon within the crypto market, can they be considered a good investment? There are definite reasons why they can be a noteworthy investment:

- Become Part of a Growing Community – Taking part in an ICO allows investors to become part of a growing community at the very beginning of the project’s life cycle. This has the added benefit of enabling like-minded people to interact with each other and form relationships whilst also providing feedback to the project’s development team.

- Huge Returns Potential – Naturally, one of the main benefits of investing in an ICO is the vast returns potential that they can offer. Since most ICOs offer tokens at a reduced price point, early investors are in a great position to benefit if/when the token is listed on a major exchange. Projects offer discounted prices to kick-start development or generate publicity and attention – which then means more investment and a higher probability of success.

- Exclusive Perks – Many ICO cryptos will offer exclusive benefits to entice early investors. The specific benefits can vary wildly but may include premium NFTs or access to merchandise. There may even be private Discord servers that only ICO investors can join, providing an incentive to participate.

Again, it is essential to note that ICOs do not guarantee profits even if the fundamentals of the project are solid and the potential is high – ultimately the market will decide success or failure.

It is also important for investors to understand their own tolerance for risk as ICOs are substantially more risky and volatile than investing in established top cryptos such as Bitcoin or Ethereum.

Best Crypto ICOs – Conclusion

In summary, this article has taken an in-depth look at the best crypto ICOs to launch in 2024, covering what they offer and why they have generated such high momentum. Thanks to the innovative use cases displayed by these projects, investors remain eager to see how well they can perform in the weeks and months ahead.

Investors will do well to remember that risk should be given equal weight to the potential rewards. This can help to avoid many of the ICO projects that turn out to have no long term viability. Returns are not guaranteed, especially when it comes to the volatile cryptocurrency markets.

One of the best crypto ICOs right now is Dogeverse ($DOGEVERSE). This is the first ever multi-chain meme coin project. Dogeverse will be available across six blockchains, improving interconnectivity and lowering transaction costs. The $DOGEVERSE token offers high staking yields and has raised over $300K within the first day of its presale campaign.

Crypto ICO FAQs

How does an ICO in cryptocurrency work?

When an upcoming ICO is announced, early investors will have the opportunity to buy tokens using a ‘bridge’ cryptocurrency – such as ETH or BNB. The project’s team will provide a crypto wallet address to send funds to in return for tokens, with the token price being either fixed or variable, depending on demand.

Is investing in ICO crypto a good idea?

Investing in upcoming ICOs is inherently risky since projects are still in the early stages of their lifespan, so nobody knows for certain whether they will be successful. However, investors with a higher risk appetite can often generate considerable returns when an ICO crypto is listed on a major exchange since they will have been able to acquire tokens at a discounted price.

How do I buy crypto ICO?

Participating in an ICO is as simple as heading to the project’s official website and connecting a crypto wallet. Following this, investors will be able to buy tokens using a bridge currency (e.g. ETH, BNB), after which the project’s team will send the relevant number of tokens to the investor’s wallet.

Was Ethereum an ICO crypto?

Yes – Ethereum started as an ICO in 2014, raising over 7,000,000 ETH (around $2.2 million) in the first 12 hours of tokens going live. By the end of Ethereum’s presale, the development team had raised a remarkable $18.3 million for the project.

What are the best crypto ICOs to buy in 2024?

Out of all the projects we’ve reviewed, Dogeverse, Slothana, and Mega Dice Token offer the most intrinsic value and upside potential. Dogeverse ($DOGEVERSE) is our pick for the best ICO crypto alternative. This is a multi-chain meme token, that offers staggering annual yields.

References

- Wall Street Journal: The New Rules of FOMO

- CoinCodex: Binance IEO List

- Yahoo Finance: ‘Binance Effect’ Means 41% Price Spike for Newly Listed Tokens

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Goran Radanovic

Goran Radanovic

Kane Pepi

Kane Pepi

Sergio Zammit

Sergio Zammit