10 Best Crypto Day Trading Strategies in 2024

Daily crypto market volatility provides a near-perfect way to trade for short-term profits. But that same volatility can create risk without the proper safeguards in place. In this guide, we’ll cover the 10 best crypto day trading strategies, as well as ways to reduce any underlying risks.

From trend following to arbitrage hunting, crypto day trading strategies offer something for every type of trader. On the safer end of the scale you can find strategies such as arbitrage and range trading. However, for more daring and sophisticated traders, complex strategies such as high-frequency trading (HFT) and countertrend trading can be great options.

The wide scope of day trading strategies for crypto ensures that there’s always a profitable trade available somewhere in the cryptocurrency market.

The Top 10 Crypto Day Trading Strategies

When you take into account the extreme volatility in the cryptocurrency markets, the abundance of new coins launching every day and 24/7 trading hours, crypto markets appear to be a day trader’s dream. While it is true that the amount of opportunities are endless, this does of course come with a higher amount of risk.

While crypto may appear like the Wild West compared to traditional financial markets, consistent and predictable success with day trading still requires a sophisticated approach to ensure long-term profitability. Employing a professional-like approach to your trading can give you a unique advantage, especially with so many rookie traders buying coins without any kind of plan or upper hand..

Crypto day trading strategies vary in complexity and all take a considerable amount of time and experience to master. It is recommended to pick a strategy that aligns with your risk tolerance and individual strengths. Let’s examine some of the most popular day trading strategies for crypto and break down what each of them involve.

1) Scalping – Best for Quick Profits

Scalping or scalp trading refers to making numerous trades, typically taking small profits based on minor price movements. Expect to make several trades per day when scalping. The goal isn’t to make a big profit all at once. Instead, you’re looking to take small profits again and again.

Several chart indicators can offer potential insight into where the price is headed in the short term. These include stochastic oscillations, parabolic SAR, and relative strength index (RSI).

In the 5-minute chart shown above, parabolic SAR signaled an upward trend, and RSI confirmed it. BTC’s price rose about $1,000 following the indications. Many crypto exchanges offer TradingView charts, giving you access to both indicators used above. One-minute and five-minute charts are best suited to quick scalp trades.

Crypto markets can move quickly, so traders often use stop-loss orders and take-profit orders to safeguard trading capital and lock in profits. If you were short-selling Bitcoin, you’d also see at least two opportunities to profit from a downtrend at the end of the chart using these indicators.

Pros

- No need to use leverage

- Easy to understand for new traders

- Multiple chart indicators for confirmations

Cons

- Requires more maintenance when trading for small gains

2) Trend Following – Best for Extended Trades

As the saying goes, the trend is your friend. If you’ve seen the gains on the latest meme coins, you’ve witnessed trend following at work. This strategy revolves around identifying upward trends, buying a position, and then selling when the uptrend breaks. In short, you don’t have to be the first to the trade—but don’t be the last one out of the trade. Ride the wave and take your profit.

Trend following for mega-cap assets like Bitcoin could require longer trades, possibly days long. However, altcoins and meme coins can see daily price movements that offer a wave to ride. Picking the best crypto to day trade is a big part of the decision, as some will inevitably present more opportunities than others.

In the 5-minute BONK chart above, RSI indicated oversold conditions. About 13% later, RSI signaled overbought conditions. RSI missed the exact top of this trend but warned traders to exit the trade before the price changed direction. This was a conservative trade.

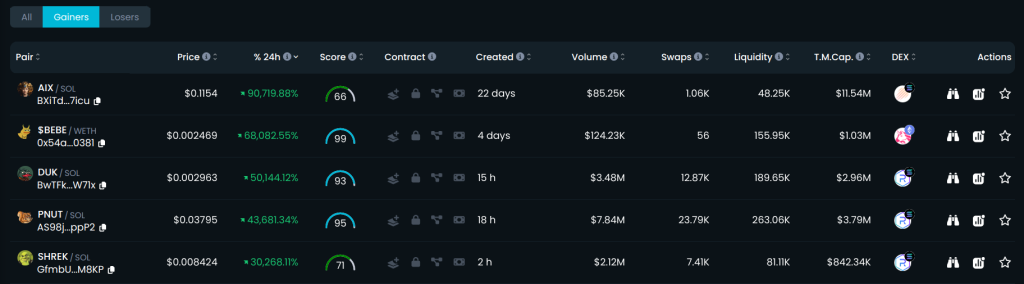

Twitter offers plenty of crypto chatter for trending coins. However, many trending coins are found on decentralized exchanges, which can be more complex than trading on centralized exchanges. Dextools offers a comprehensive roundup of trending crypto plays, many with staggering returns and many just a few days (or hours) old.

However, a glimpse at the “Losers” tab on Dextools shows what can happen if you hold a position too long. Eventually, the majority of meme coins will be likely headed to zero.

Pros

- Tremendous profit opportunities

- Small investments can yield massive profits

Cons

- Often requires trading on decentralized exchanges

- Most trending altcoins will go to zero

3) Range Trading – Best for Consolidation Patterns

Range trading works as its name suggests: you trade within a defined range found during consolidation trends. In this strategy, support marks entry points, preferably with confirmation from other indicators. Resistance marks exit points.

For example, crypto assets often trade sideways for extended periods of time, leaving no room for big gains. However, these range-bound coins and tokens still provide profit opportunities. In the chart above, you can see Cardano (ADA) trading in a tight range, providing four trading opportunities for long trades. Four short trades are available as well, the last of which is much larger.

Consolidation patterns mark uncertainty but can also signal accumulation. As with other crypto day trading strategies, it’s often wiser to use stop-loss and take-profit orders. Market uncertainty can break either way due to news or price moves for other assets.

TradingView indicators for support and resistance can guide your trades, or you can draw your own support and resistance lines for a shorter time frame.

Pros

- Easy-to-spot patterns

- Reduced trading frequency

- Easy to implement on centralized exchanges

Cons

- Trading conditions can change quickly, breaking the range

4) Breakout Trading – Best for Large Percentage Gains

Hunting for price breakouts provides another potentially profitable crypto day trading strategy. In this case, you’re looking for assets ready to run, buying when your indicators say go, and riding the chart up.

Several tools can help you identify a crypto asset ready to break out. For example, in the chart below, ETH rose abruptly against BTC in the pair. The chart pattern that follows forms a falling wedge, also known as a descending wedge. What this suggests is that while ETH is dropping relative to BTC, each leg down tightens the wedge pattern. What often follows is a breakout to heading north.

TradingView offers some paid indicators to identify falling wedge patterns, although this is one of the easier chart patterns to spot. In this example, RSI indicates overbought conditions at the start of the wedge. However, the market was just digesting the gains before running again.

Pros

- No paid tools required

- Easy-to-spot patterns

- Also useful for longer-term trades

Cons

- Requires trading multiple assets to find breakouts

- News can stall breakouts

5) News-Based Trading – Best for News-Aware Traders

If you’ve been following interest rates, you know that when Fed Chairman Gerome Powell speaks, the markets react. Crypto markets allow you to trade the news easily, assuming you correctly guess how the market will react.

For example, interest rate cuts are often considered bullish for crypto. Even the news that rates will remain steady can be good news. Following a recent FOMC meeting during which interest rates remained unchanged, Bitcoin rallied, pulling other cryptocurrencies out of a slump as well.

On the same day, news broke indicating that the US SEC was investigating the Ethereum Foundation and the possibility that ETH might be a security that the agency should regulate. This would be bad news, but the market didn’t care. ETH went up.

However, it’s essential to take market conditions into account as well. RSI indicated an oversold condition in the chart above. This trend could have continued deeper, but the interest rate news put enough upward pressure on crypto markets to trigger a short-term reversal.

Pros

- Provides opportunities to trade quick bumps

- Can be automated if using trend-spotting bots

Cons

- Easy to misread market reactions

- News may be unsubstantiated

6) HFT and Algorithmic Trading – Best for Technically Inclined Traders

We’ve all heard about algorithmic-based trading in the stock market. High-frequency trading (HFT) software makes trades automatically, with the largest financial firms trading millions of times daily.

Now, HFT is available to crypto traders as well. One method is a bit more complicated and requires connecting to the application programming interface (API) of an exchange. This method uses bots, which are automated trading programs. You can hire someone to write one, write your own, or buy one from a provider.

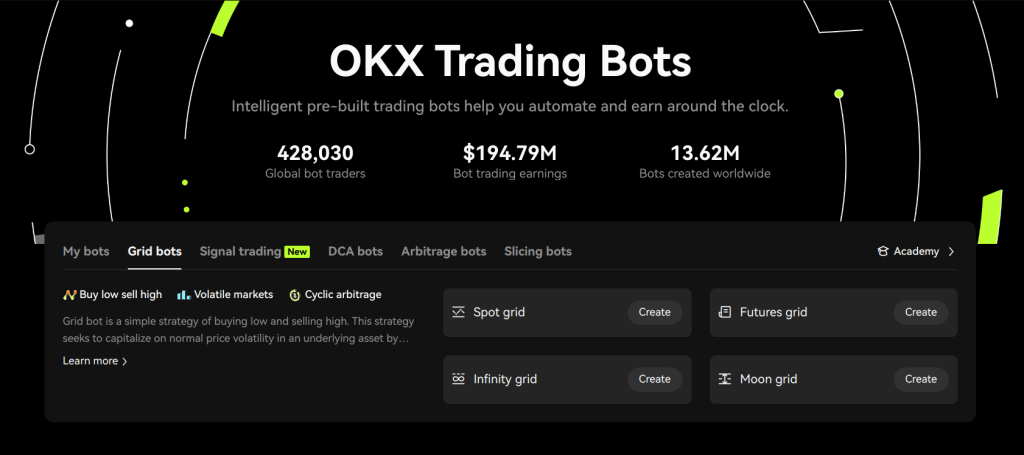

However, a simpler option is to use an exchange that provides bots. OKX and Pionex both offer an assortment of pre-built trading bots. Or, you can build or fine-tune your own. These bots trade 24/7 following defined rules (algorithms) for buying and selling.

HFT or crypto trading bots can rack up trading fees quickly, though. So, it’s important to keep an eye on your profit and loss figures. Also, just like the bots used on Wall Street, black swan events can cause mixed signals that could be costly if your HFT bot runs amok.

Pros

- Hands-off trading

- 24-7 trades to maximize profits

- Historical performance stats (backtesting)

Cons

- More fees due to frequent trades

- Can be unpredictable in fast-moving markets

7) Countertrend Trading – Best for Contrarian Opportunities

Nothing goes straight up or straight down. A countertrend strategy bets on inevitable reversals in trends. The trick is to know when to close your position. Michael Burry famously made a fortune betting against the 2000s up-only trend in real estate. Ultimately, Burry was right, but first, he was wrong for a long time.

To find reversals for countertrends, you can use several types of indicators, including RSI, stochastics, and MACD. However, a change in trading direction may be short-lived. News or macro conditions could cause the original trend to resume. Stop-loss orders can reduce risk if the reversal reverses course again.

In the chart above, KAS breaks a downward trend during which the only way to make money was through short-selling techniques. But just a well-timed trade waiting for a reversal of the downtrend would have earned 28% in trading profits.

Pros

- No paid tools required

- Several indicators to guide trades

- Opportunities for short or long trades

Cons

- Momentum can fizzle, capping gains

- Countertrends may be brief, possibly creating losses

8) Long-Straddle Options Trading – Best for Low Risk

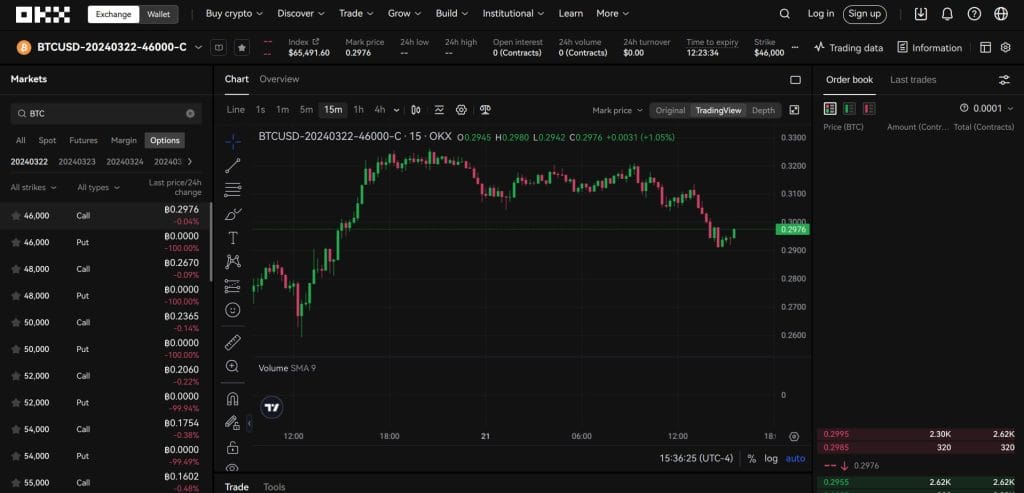

A long-straddle options trade creates a hedge against small market movements but can generate a profit if the market moves significantly. The strategy works by buying a long call (option to buy) and a long put (option to sell) at the same strike price and both with the same expiration date.

Potential profits from big market moves, either up or down, can be substantial. Potential gains if the asset increases in value are infinite. If the asset decreases in value, your earnings potential can be as high as the value needed to take the asset to zero.

However, downside risk in this type of trade is limited to the cost of the options and other trading-related fees. To make a profit, you only need a market move that outpaces the cost of the trade itself.

Long-straddle options trades are well-suited to news-related trades in which you expect a big announcement but aren’t sure how the market will react. Think back to the Bitcoin ETF launch, for example. Was it a sell-the-news event, or would it pump the market higher? A long straddle covers either scenario.

Of note, most crypto exchanges don’t offer options trading. However, OKX, Binance, and Bybit all provide crypto options markets. Also, brokerages with access to the CME exchange may offer ETH and BTC options.

Explore Crypto Options on Binance

Pros

- Low-risk trade

- Potential for outsized gains

Cons

- Best suited for advanced traders

- Few platforms offer crypto options

- Options may expire worthless

9) Market Sentiment-Based Trading – Best for Identifying Trends

Market sentiment, meaning whether the market feels bullish or bearish, offers an indicator that’s helpful for trading. However, sentiment alone offers little accuracy for market timing. It can, however, give you something to investigate and then confirm with other indicators.

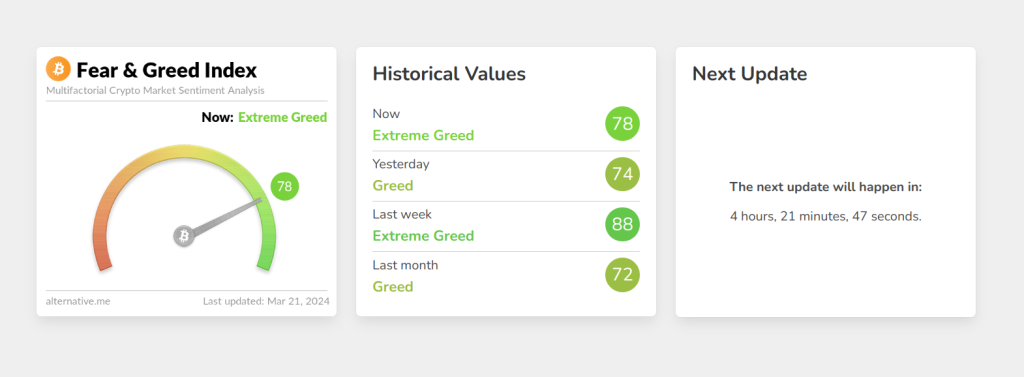

The most famous market sentiment indicator in crypto trading remains the Fear and Greed Index. Several variations on this indicator exist, many of which tweak the criteria used to build the index. However, most seek to divine what’s on the market’s mind. Is the market extremely greedy? Maybe it’s time for a short trade. Extremely fearful? Perhaps a sell-off is overdone and sure for a reversal.

Another useful measure is the altcoin season index, which helps to identify whether altcoins are currently primed to perform well or not. While it is not always indicative of what the near future holds in terms of price movement, it can be a useful indicator to use as part of your trading strategy.

Other tools you can use to research market sentiment include Google search trends and AI-powered tools like Stockgeist.ai. TradingView also offers community-created scripts that can indicate market sentiment alongside live charts.

Before making trades based on market sentiment indicators, do some research on where each gathers its data. It’s also best to backtest for accuracy if possible. TradingView makes this easy if you use the built-in indicators. As with other crypto day trading strategies, incorporate other indicators to confirm market moves before you invest in a trade.

Pros

- Simple to understand trading strategy

- Several free tools available

- Can be used as a basis to investigate trading opportunities

Cons

- Possibly unreliable on its own

10) Arbitrage Trading – Best for Guaranteed Profits

Arbitrage trades seek to profit from market inefficiencies. A crypto asset that costs $10 everywhere else might cost $9.51 on a particular exchange. Price differences are likely smaller in percentages, but it can happen.

The price dislocation can work the other way as well. In 2023, BTC prices were often $200 up to $1000+ higher on Binance.US than on the broad market. The reason? Initial theories involve the loss of a major market maker. Market makers create liquidity.

Although we used the term “guaranteed” earlier, there’s a catch: timing. Prices in crypto markets can change quickly. If you find some undervalued or overvalued spot markets, prices might reconcile with the broad market before you can complete the trade. For example, Kraken estimates up to 40 minutes to complete a BTC deposit. Add the time to withdraw from another exchange, and the arbitrage opportunity might be gone just from daily market volatility.

Perpetual futures exchanges may present another opportunity for arbitrage trades. Investigate the prices and the funding rates; there might be a trade to be had.

Pros

- Profits can reach several percent in some cases

- Easy-to-understand strategy for spot trades

Cons

- Meaningful arbitrage opportunities may be difficult to find

- Can require using several exchanges

What is Crypto Day Trading?

Crypto day trading refers to short-term cryptocurrency trades meant to capitalize on market volatility or market inefficiencies across trading platforms. The term borrows its name from stock market day trading, in which short-term traders close out their positions by the end-of-day closing bell. By contrast, crypto markets never sleep, serving a worldwide audience of traders and offering constant liquidity.

Many of the strategies from stock day trading also carry over to crypto day trading. However, crypto day trading offer several new opportunities and automation tools not available to retail traders in traditional markets. The various methods used when day trading crypto range from scalping, taking a little profit off the top, to breakout trading, and watching patterns that indicate a break from a consolidation trend.

While crypto day trading strategies can be extremely profitable, the practice can be costly, piling up trading fees. Many strategies also favor repeated low-margin trades, which makes it essential to keep losses in check.

Several cryptocurrency day trading strategies utilize technical analysis, including chart patterns and indicators. Others rely on news or market sentiment. A third group seeks to automate trades or use strict trading rules designed to take small profits that add up over time.

What are the Advantages of Day Trading Crypto?

Day trading can be profitable on its own, but many traders use crypto day trading strategies to fund their long-term positions. The number of strategies available makes it possible to thrive whether markets are moving up or down, and crypto’s volatility creates opportunities for quick trades. And, unlike the stock market, you don’t have to trade during business hours; crypto never sleeps.

Potential to Profit in Any Market Condition

Choppiness in crypto markets — even during clear upwards or downwards markets — creates trading opportunities. For example, algorithmic trading (using bots) is well-suited to trading intraday volatility, buying low and selling high around the clock. You can also make similar trades with a scalp-trading strategy, taking advantage of small price runs that occur naturally in crypto markets through the best day trading exchanges.

Most of the strategies outlined earlier focus on long trades. Daily ups and downs provide ample opportunity for well-timed trades. However, you also have the option to short Bitcoin or other cryptocurrencies. Short selling is a bet on a downturn and can be profitable with the proper safeguards in place, such as stop-loss orders and cautious use of leverage.

High Volatility Creates More Opportunities

High volatility in crypto markets is often cited as a disadvantage compared to traditional markets. However that same volatility is responsible for cryptos outsized gains compared to traditional markets and also brings many more ways to trade the daily ups and downs.

Crypto market volatility makes it well suited to range trading and countertrend strategies, as well as trend following and even arbitrage when the opportunity arises.

However, increased volatility creates more risk. Price direction can change in an instant. In just a bit, we’ll discuss some ways to reduce risk and indicators that can help you make the right call more often.

Flexibility with 24/7 Trading Hours

Trading opportunities for traditional markets end when the closing bell rings. Crypto markets are always open. This makes it possible to trade after work, on weekends, or whenever you have time to focus on executing well-planned trades.

What are the Drawbacks of Day Trading Crypto?

Crypto day trading brings some disadvantages as well, making it essential to examine priorities and take a disciplined approach to trades. Topping the list, the risk of loss remains high, even when using multiple indicators to confirm your trading moves.

High Risk of Loss

Earlier, we discussed statistics pointing to failure rates for day traders approaching 95%, according to some sources. Even well-timed and rigorously researched trades turn into a loss if the market changes unexpectedly.

Time Investment and Stress

Learning crypto day trading strategies takes time. Researching and finding the best crypto to day trade also takes time. Many day traders invest up to five hours daily in trading activities, often with additional time invested in learning or practicing. Tools like OKX’s demo account let you practice trading against real-world market prices, and many traders hone their skills for months before making a real-world trade.

Day trading may differ from what you imagine. Trading can be stressful, particularly if you carry a trade for a longer duration. Setting a disciplined trading schedule and using well-structured trades that reduce your downside risk can help make trading more enjoyable and less stressful.

Frequent Transaction Costs

If you choose your trading platform carefully, you can enjoy relatively low trading costs — often 0.26% or lower. However, because day trading requires trading more frequently, costs add up.

For example, automated trading with bots can be particularly costly as trades execute in rapid-fire throughout the day. Leveraged futures trades can also increase trading costs. While fees as a percentage are often lower for perpetual futures, leverage increases the size of the position, thereby increasing trading costs. Be sure to budget for trading fees and funding rates when making your trading decisions.

Risk Management Strategies for Crypto Day Trading

Once you run out of trading capital, it’s game over. You either walk away or find a way to earn money for trading. Preserving capital is paramount, and while it’s not realistic to expect you’ll never lose money, there are several ways to reduce risk and preserve more of your trading funds.

Using stop-loss orders and avoiding high leverage top the list. However, disciplined trading also extends to how much capital to invest in each trade. Excluding some more exotic trades, you can’t lose more than you invest in the trade. Successful day trading often involves many small wins rather than a big score.

Setting Stop-Loss Orders

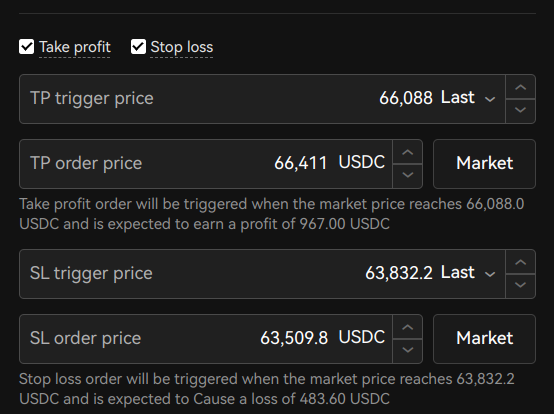

Stop-loss orders offer a way to protect your downside by setting triggers to exit the position if the market turns against you. The best price to set your stop loss depends on the type of trade and market conditions for the particular asset you’re trading.

- Tight stops provide more safety but are also more likely to execute. It’s possible for the market to come down to your stop, take you out of the trade, and then resume its prior direction.

- Loose stops provide less downside protection but are less likely to be taken out by market volatility.

In the example above, the stop loss will trigger (post the order to the order book) at 1% loss relative to a BTC buy price of $64,477. The order will execute at ~1.5% loss, assuming there are buyers at $63509.8. The stop-loss helps preserves capital for the next trade.

In the example, you’ll also see a take-profit order is set. This order caps losses at 1.5% plus trading fees while locking in profits at ~3%, less trading fees.

Should You Use a Market Order for Stops?

You can use either a limit order or a market order for stop-loss orders and take-profit orders on many exchanges. Limit orders let you name your price and often come with lower trading fees. However, stop-loss and take-profit orders are there to help you exit the trade quickly. A limit order might not execute when you need to exit the trade, possibly creating a larger loss.

Calculated Position Sizing

Choosing conservative investment amounts for your trading strategy also helps to manage risk. While investing smaller amounts limits potential gains for a given trade, being more cautious can protect your capital for the next trade. Strategies to manage risk range from percentage-based to fixed amounts, each the goal of reducing loss exposure.

Percentage Risk Rule

The percentage risk rule focuses on limiting losses but basing that number on your account equity (trading capital). For example, if you’ve put aside $10,000 to start day trading, you can afford to lose $100 on a given trade following a 1% risk rule. Some traders use a 2% risk rule. Once you decide which risk rule to follow, set your stop-loss orders accordingly to ensure disciplined trading and contain potential losses to 1%, 2%, or whichever risk rule you choose to use. This rule focuses on potential losses rather than investment amounts.

Fixed Fractional Strategy

A fixed fractional strategy uses a percentage-based system to determine your investment amount. For example, you might choose to invest no more than 2% of your trading capital in a given trade. This strategy can be useful for particularly volatile trades, such as meme coins. In some cases, such as trading on decentralized exchanges, tools like stop-loss orders may not be available, making limiting losses based on investment size essential.

Fixed Dollar Amount Strategy

Sometimes called a fixed amount rule, this trade allocation strategy uses a fixed dollar amount to manage risk. For example, you might limit your trades to $100. Using a fixed amount can be helpful for traders with less available capital. Smaller trading accounts may find percentage-based allocation strategies too restrictive for real-world use.

Trade on an Exchange with Minimal Slippage

Liquidity refers to the ability to trade easily. However, slippage presents another consideration. For assets like Bitcoin, slippage is usually less problematic because orders are often close in price. However, on smaller exchanges or when trading less common cryptocurrencies, slippage can take a bite out of expected profits.

The screenshot below shows the order book for BTC. If you need to sell less than 0.72122 BTC with a market order, you’ll get $63,372.8 per BTC. There’s a buyer for up to that quantity at that price. However, if you need to sell three BTC, your sell order will be filled at five different prices, “slipping” into the next buy order to fill the three BTC order quantity.

For some less common or new crypto assets, slippage can be dramatic if you need to buy in or close out. Whenever possible, look for exchanges with high trading volume, which often comes with lower slippage due to a larger number of traders. However, some assets can be tricky to trade regardless of overall trading volume. Investigate the order book and how slippage could affect profits before entering a trade.

Most Useful Technical Analysis Indicators for Day Trading

Technical analysis can help guide your trading decisions by helping you to identify opportunities or confirm other indicators or market movements. Technical analysis is commonly used on crypto markets often making trading signals more reliable than in traditional markets where cash flows from dollar-cost averaging accounts push indexes higher.

Invest some time in learning how to read candlestick charts and how to read key indicators. Depending on the types of trading you plan to do, some indicators may be more useful than others. Some technical indicators can also be quite complex, making them better suited to advanced traders. Here are some of the more commonly used indicators.

Moving Averages (MA)

Moving averages examine past prices to plot a moving average line on a chart. The most commonly used MA is the 200-day. When an asset is trading above the 200-day, it’s generally considered a bullish sign. Trading below the 200-day suggests a bearish market.

You can see where BTC went down to test the 200-day and then spiked when the price didn’t fall below. However, later in the timeline, BTC crossed below the 200-day, later rising to test the line and failing to cross above. The price of BTC fell afterward.

Another popular indicator based on moving averages, MACD, plots convergences and divergences in moving averages. MACD can indicate oversold or overbought conditions as well as signal trade entry and exit points.

Relative Strength Index (RSI)

Overbought and oversold conditions can lead to short-term reversals. Even if the original trend resumes eventually, trading opportunities often emerge when the market becomes overly bullish or bearish on an asset. The relative strength index indicator can help pinpoint potential entry and exit points for trades based on oversold or overbought conditions.

However, RSI may be best used with other indicators to provide more context. In the example above, RSI signaled overbought conditions as BTC bounced off the 200-day moving average. The upward trend continued. Later, RSI again signaled overbought conditions, this time while well above the 200-day moving average. BTC had room to fall.

Fibonacci Retracement Levels

Fibonacci retracement levels are based on Fibonacci numbers, a series of numbers in which each of the numbers is the sum of the two numbers before it. For example: [0, 1] 1, 2, 3, 5, 8, 13, 21, 34. These number patterns are also related to the golden ratio, a proportional pattern often seen in nature, approximately equal to 1.618.

TradingView offers a way to draw Fibonacci levels on a chart, as shown above. Some traders believe that trading patterns often respect Fibonacci levels, using key levels as targets for pullbacks, tops, and reversals. Because so many crypto traders use Fibonacci indicators, Fibonacci-based trading often provides a reliable price prediction tool.

Best Practices for Crypto Day Trading

Successful day trading entails as much discipline as it does chart reading. In addition to the technical skills and strategies required to be successful at day trading, several other important best practices can contribute to your success.

Develop a Disciplined Trading Routine

Skipping steps in a process can be costly. Consider building a checklist for a trading routine and modifying it as you incorporate new techniques. Should you take a few minutes to study your previous trades? If so, make that a first step in your routine. Perhaps next, jot down some notes for yourself if you see patterns from prior trades. Then, you might do some technical analysis, perhaps using MACD or other indicators you understand well.

Develop a step-by-step process for your trades and trading day. You can change the routine if needed but have a good reason to add or eliminate steps.

Set Realistic Goals

If you see a meme coin that gains 65,000% in 30 days, remember that traders made money throughout the chart—and many lost money. Crypto day trading strategies often only yield a point or two of gain at a time. It’s a game of small victories while minimizing losses.

Manage Your Emotions

Emotion might be the leading contributing factor to day-trading failures. Treat trading like a business and avoid letting emotions to cause you buy or sell at the wrong time. Instead, use stops and take-profit orders to ensure a well-structured trade that puts safety of your capital first.

Keep a Trading Journal

Record your trades in a journal for review. Log any information you think might be helpful later, including entry and exit points, profit or loss, and which strategies or indicators you used for the trade. Feel free to add other notes that might help you divine what works and what doesn’t work as well as hoped.

Often, trading success is the process of eliminating strategies that don’t work for the assets you trade. A trading journal gives you the data to identify strategies that didn’t perform well. Then, you can either fine-tune the process or shift your focus to winning strategies.

Conclusion

Crypto day trading strategies cover a broad range, from spotting reversals in charts to following momentum to more sophisticated options-based strategies. This wide range makes trading accessible to anyone. You can start with simpler strategies and then incorporate more advanced strategies as you learn your way in the trading world.

Whether working with a big account or just getting started, it’s important to stay disciplined. Have a plan, minimize risk with allocation strategies, use stops and take-profit orders, and keep a journal. There’s no better way to learn than by doing it and analyzing your performance. And remember, platforms like OKX let you practice trading with a demo account. You can learn without risking real money.

FAQs

What is the best crypto day trading strategy?

Scalp trading and trend following can both provide reliable profits if you combine the strategies with chart indicators to pinpoint entry and exit points. These trades can also use stop-loss orders to minimize downside risk and protect your capital for the next trade.

Is crypto day trading still profitable?

Yes. Crypto day trading can still be profitable. Crypto markets remain volatile, allowing several daily trading opportunities for most crypto assets.

What is the best crypto to day trade?

Top ten cryptos like BTC and ETH make solid day trading choices because they usually have good liquidity on exchanges, which reduces slippage in trades.

What is the difference between day trading and swing trading?

Day trading focuses on short-term trades that take advantage of market inefficiencies. Trades usually last less than a day, often with several trades within the same day. By contrast, swing trades can last much longer, possibly several days or even weeks, depending on how long the market trends in the direction of your swing trade.

Should you use leverage when day trading crypto?

Leverage trading can amplify gains but also amplify losses. When using 10x leverage, for example, a 3% price move changes your equity in the trade by 30%. Because losses can pile up quickly, leverage often works against the goal of minimizing losses through disciplined trading.

References

- Day Trading Bitcoin: Why 95% of Traders Lose Money and Fail (cointelegraph.com)

- Day Traders Will Have Fun Until They Get Wiped Out (bloomberg.com)

- Bitcoin price rebounds back above $67,000 after Fed holds interest rates (finance.yahoo.com)

- For Investors, It’s a Fine Line Between Being Early and Wrong (bloomberg.com)

- Crypto Fear & Greed Index (alternative.me)

- Buying Bitcoin and Ether on Binance.US? You’ll Pay a Premium (blockworks.co)

- Crypto giant Binance’s US affiliate halts direct dollar withdrawals (reuter.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Kane Pepi

Kane Pepi