Avalanche is one of the unique and fastest-growing coins available on the cryptocurrency market. Its consensus model makes it a great choice for active investors looking to shape the future of crypto. It’s also a great choice for passive investors who just want to make some money and be a part of a unique and modern crypto model.

This guide will break down what makes Avalanche so unique, tell you the current Avalanche price, examine the price history, and so much more.

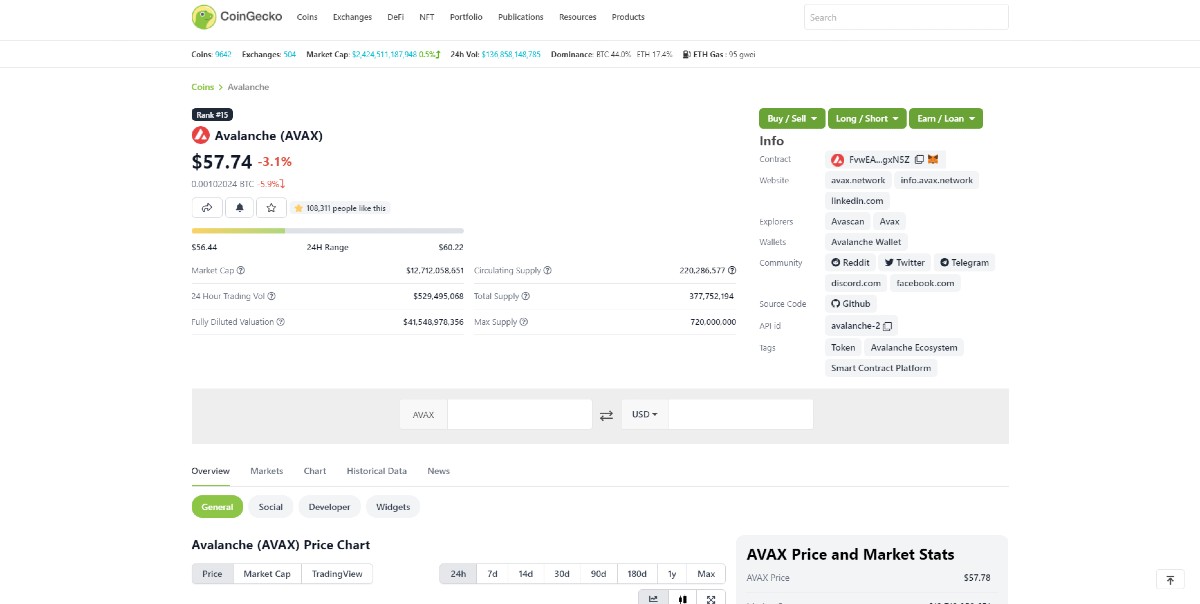

Avalanche Price

See the table above for the current Avalanche price and the history of this crypto’s value.

Avalanche launched in late 2020 and promised to be a competitor to the major coins, like Bitcoin and Ethereum. It was initially worth almost nothing, but in just a few months, the Avalanche price had jumped to $30 a coin. After a year, Avalanche’s value hit the $100 mark. It finally peaked at $134.87 in November of 2021. Today, at time of writing, Avalanche’s price is $35.99.

The major changes in Avalanche price have been largely due to outside investment. Avalanche price spiked following a $230 million cash injection from a consortium led by Three Arrows Capital. More recently, Avalanche’s parent company has net a partnership with Amazon.

What is Avalanche (AVAX)?

Like so many other projects that are labelled the “potential Ethereum killer”, Avalanche is also a blockchain platform that lets users create their own blockchains with their own ecosystems, but also decentralized applications (dapps) of all sorts. It calls itself “blazingly fast, low cost, and eco-friendly.”

The Avalanche platform is made up of three separate blockchains. The first, called the Exchange Chain and shortened to X-Chain, lets people create and trade tokens, including AVAX. The Platform Chain (P-Chain) serves to coordinate transactions, but also to enable the creation of new blockchains. Finally, the Contract Chain (C-Chain) lets users create and trigger smart contracts. The three blockchains are interoperable, and this approach improves speed and scalability, all of which makes Avalanche a unique project in the space.

While the Exchange Chain uses the Avalanche consensus protocol, the other two chains use a modified version of it, called the Snowman. They are an adaptation of the Proof of Stake (PoS) consensus protocol. To learn more about the technical side of how Avalanche works, you can read their whitepapers here. They offer detailed documents on different aspects of the platform, including their consensus protocols, token dynamics, a stablecoin design classification framework, and a whitepaper on the way the platform itself works.

Read more: What is Proof-of-Stake?

The idea behind Avalanche was born in May 2018, when a file called “Snowflake to Avalanche: A Novel Metastable Consensus Protocol Family for Cryptocurrencies” was shared on IPFS by a pseudonymous group of enthusiasts going by the name “Team Rocket”. The document outlined the fundamentals behind Avalanche, explaining how the family of consensus protocols works together to ensure security and trustlessness, while maintaining high throughput and scalability—something that has plagued the blockchain world ever since its inception.

The development of Avalanche was later led by a dedicated team of researchers from Cornell University, with professor Emin Gün Sirer at the head. He was assisted by two doctorate students, Maofan “Ted” Yin and Kevin Sekniqi. After completing the required research, they founded a startup company to develop the blockchain network, which was meant to meet the demands of the increasingly complex financial industry. In March, 2020, the AVA codebase (Developer Accelerator Program or AVA DAP) for the Avalanche consensus protocol became open-source and available to the public.

The team raised funds for the project through an initial coin offering (ICO) that ended in July 2020, where they raised USD 42m. The mainnet launched in September 2020, along with the native AVAX token.

Learn more: Why Invest In An ICO?

How Does Avalanche Work?

Other cryptocurrencies use Proof-of-Stake (PoS) consensus models to validate blocks and create more tokens on the blockchain. This typically requires a big buy-in to participate in the validation process and it requires many validators.

Avalanche uses a process called subsampled voting, which involves randomly selecting groups of Avalanche owners who’ve volunteered to be validators. These groups can approve or reject transactions. Then, a thing called network gossip occurs where these groups compare notes and constantly debate whether to validate transactions.

This subsampled voting process allows the Avalanche consensus model to be faster and more secure than POS and other popular consensus models. For example, you would need to own 80% of all Avalanche tokens to attack and maliciously manipulate the Avalanche blockchain. You’d only need to own 51% of all Ethereum.

AVAX Token and Staking

The AVAX token represents the backbone of the network. This utility token is used to stake and pay network fees, and as it is usable across all blockchains and subnets within the Avalanche ecosystem, it is a common usable asset for all of them. It has a capped supply of 720 million tokens. Like bitcoin (BTC), this creates scarcity, which means the token won’t suffer from the continuous dilution through inflation. An additional deflationary effect is achieved through the burning of all AVAX tokens used for fees.

To be a validator on the network, you have to stake at least 2,000 AVAX. If you can’t afford it, or do not want to be a validator for any reason but would like to stake your AVAX anyway, you can support another validator, which makes you a delegator. Validators can earn up to 11% Annual Percentage Yield (APY) and set a custom percentage fee of the reward they keep from delegators who back them.

If you’re not sure how much you’re willing to stake, regardless of whether you want to become a validator or delegator, the Avalanche website offers a handy calculator. Here, you can enter the amount you want to stake and see the APY, but also a daily and monthly percentage yield, as well as its value in US dollars—at least according to the current AVAX price.

Additionally, tokens staked on the Avalanche network are never at risk of slashing. This practice, often used by Proof-of-Stake networks to punish validators who work against the health of the network, is simply not part of their modus operandi. Emin Gün Sirer stated that the decision to exclude slashing was controversial when it was first introduced, but that it is simply not required for security. On the other hand, slashing can hurt nodes that are not misbehaving, but are encountering bugs or other issues.

Finally, as Avalanche uses a type of Proof-of-Stake protocol, participating in the network does not require any special hardware, making it overall more accessible.

Who Created Avalanche?

The Avalanche consensus model was created in 2018 by an anonymous team of developers who went by the name “Team Rocket.” Once Team Rocket laid the groundwork for Avalanche, developers at Cornell University took over the product with the goal of creating the fastest and safest cryptocurrency network ever. Avalanche went live in September 2020 and is now one of the biggest cryptocurrencies on the market.

Avalanche Market Performance

Avalanche is the ninth most popular cryptocurrency by market capitalization. At the time of writing, Avalanche’s market cap is just over $13 billion. At its peak, Avalanche’s market cap was over $30 billion.

How to Buy and Store Avalanche

Here’s everything you need to do to buy, sell, and store Avalanche.

- Create an account with a cryptocurrency exchange platform. If the exchange you choose has a crypto wallet you are comfortable using, skip ahead to Step 3.

- Open a crypto wallet. Obtaining a crypto wallet will allow you to store your Avalanche and other cryptocurrencies you buy.

- Complete your cryptocurrency exchange platform’s identity checks. Doing this is essential to take advantage of all major platform features.

- Deposit fiat currency into your crypto exchange account.

- Use the fiat currency you just deposited to buy Avalanche.

- If you chose to use a third-party wallet, you need to send the Avalanche you just purchased to your wallet from your exchange account.

As you can see, buying Avalanche is a quick and easy process that anyone can do. Selling Bitcoin is just as easy. All you need to do is reverse the process and use your crypto exchange to sell your Avalanche for fiat currency. If you have an external wallet, you’ll need to send your Avalanche back to your exchange first.

Risks and Challenges

The biggest challenge to Avalanche’s growth is the competition. Avalanche’s market cap is around $13 billion. Their main competitor, Ethereum, has a market cap over $300 billion.

If you asked a crypto fan “What are Avalanches?” even they might start talking about snow and not about cryptocurrency. Avalanche is fast, secure, and run by ambitious leadership, but it still has a long way to go when it comes to name recognition.

As for risks, all cryptocurrency is risky. Investing in Avalanche is just as risky as investing in any of the other best cryptocurrencies in the world. You should do your research and never invest more than you are willing to lose.

Regulatory and Legal Aspects of Avalanche

Like all other top cryptocurrencies, Avalanche is an unregulated digital currency. The decentralized nature of cryptocurrency also makes the industry vulnerable to fraud and manipulation. With all that being said, Avalanche is one of the most secure cryptocurrencies on the market.

The Avalanche consensus model and subsampled voting process for blockchain verification makes it more secure than other top cryptocurrencies. Avalanche’s blockchain network is harder to attack than other networks. Avalanche also has the backing of major companies like Amazon, which is a promising sign about the future and safety of this coin.

Community and Ecosystem

The Avalanche community is more experienced with crypto and the finer details of the technology behind crypto than other communities of other coins. This is because of the Avalanche blockchain network.

Not only does Avalanche allow for faster and more secure transactions than other top cryptocurrencies, its network also is well suited to dApp creators and tech entrepreneurs who use smart contracts and other cutting edge decentralized finance tools.

Comparing Avalanche to Other Cryptocurrencies

Avalanche is one of the top cryptocurrencies on the market right now, but there is a big gap between it and the big names in the crypto world. Bitcoin and Ethereum have market caps over 100 times larger than Avalanche’s. At time of writing, Bitcoin’s market cap is $844 billion and Etherum’s is $311 billion. Avalanche’s is just $13 billion.

Overall, Avalanche has the tenth biggest market cap. Cardano is just above Avalanche in eighth place with a market cap of $18.9 billion. Dogecoin sits below Avalanche in eleventh and has a market cap of $11.6 billion. Compared to these coins, Avalanche has more potential for growth, but it’s still way too early to say whether Avalanche will ever hit the heights many crypto experts think it will.

How to Stake AVAX for Validators

To become a validator, you will have to stake at least 2,000 AVAX for at least two weeks. However, keep in mind that you can’t stake your funds for longer than a year at any given time. Once you decide to start validating, you will have to stake your funds and set parameters like when you’re starting and when you’re stopping, the address you will use to receive any rewards, and your delegation fee rate (2% minimum). None of these parameters can be changed once you issue the transaction to add a node as a validator, so be sure to double check everything.

For all the specifics on running a validator node, Avalanche has detailed guides in their developer documentation. In order to receive any rewards you’re eligible for, you will have to stay online and responsive for at least 80% of the time you spend in that role. Once you’re done validating, you will receive your stake back, as well as the aforementioned rewards, if applicable.

How to Stake AVAX for Delegators

Being a delegator is significantly more straightforward than being a validator. However, while it comes with fewer responsibilities, it also does not include the same rewards as the more complex position. The length of time you can stake your funds for to support another validator is the same as for validators (e.g., two weeks minimum, one year maximum), but it cannot get outside the bounds of your chosen validator’s parameters. In other words, if your chosen validator is staking for half a year, you cannot choose to stake for longer than that.

The minimum amount you must stake as a delegator is 25 AVAX. Once you’ve set your parameters and issued the transaction, there is no way to change them. You will receive any rewards after the staking period of your validator has run out, but only in case your validator qualifies for the rewards as well. However, the validator that you delegate to keeps a portion of your reward—specified by the validator’s delegation fee rate.

You can learn more about the steps required to participate in the Avalanche network in the developer documentation. Here, you can find tutorials for everything from running a node, to staking, to upgrading existing nodes. The site is also being regularly updated, which means any new issues or approaches will be documented and explained in an easy to understand manner within a short timeframe.

AVAX Wallets

Avalanche offers its own wallet, called simply the Avalanche Wallet, on its website. Here, users can simply access their existing wallet, or create a new one if they need it. However, this is far from the only option for storing AVAX and related assets. Users who have other coins may want to keep all their holdings in one place. Some of the other wallets that support AVAX include:

- Ledger Nano X. You will still need an actual Avalanche Wallet, but it can be integrated with the Ledger Nano X hardware wallet for an extra level of security. In the Ledger Live, install the Avalanche App from the App Catalog and set it up by following the steps.

- MetaMask. Yes, the Ethereum (ETH) browser extension wallet can also be configured to use it to receive and manage AVAX C and access DApps made on the Avalanche network. However, while the MetaMask extension is very handy and easy to use, setting it up does require some basic technical skills.

- Coin98. This wallet can be used both as a browser extension and a mobile app, making it doubly useful to AVAX holders. The mobile version also has an integrated DApps browser for Avalanche.

- Coinomi. While the desktop version of this wallet does not support AVAX yet, the mobile one does.

Still, unless you have a pressing reason not to use Avalanche’s proprietary wallet for storing their tokens, it is still by far the best choice—plus, it is both safe and non-custodial, so there should be no security issues when using it.

Where to Buy AVAX

In order to store AVAX, you first need to have some. Luckily, many exchanges have already listed this project, so finding a trading pair you like should not be an issue. However, for those who are looking for the top exchanges listing it, we have compiled a list of five great options.

- Binance. As the largest exchange by 24-hour trading volume, it should come as no surprise that Binance also hosts the highest volume of AVAX trading. Additionally, the exchange is available almost globally (regulations permitting), is easy to use and straightforward, and accepts multiple payment options.

- Gate.io. This exchange, one of the oldest in the industry, is still going strong and also offers great AVAX pairs. You can even use your account without KYC, but be warned that you will still need to go through the process if you want to trade higher volumes.

- Coinbase. A beginner-friendly exchange that only lists vetted projects, Coinbase offers one of the most straightforward ways to purchase AVAX. On the other hand, it has slightly higher fees than most of its competitors, so the simplicity does come at a cost.

- KuCoin. KuCoin has an incredible selection of altcoins with small market caps, which means you will be able to trade a wide selection of other tokens aside from AVAX. The exchange is also privacy-friendly, which means there are no forced KYC checks, but it doesn’t support any fiat trading pairs.

- Bitfinex. This formerly professional-only exchange still has an air of exclusivity around it, so trading here offers something of a VIP air. Bitfinex offers many different coins and trading options, but its fees are somewhat higher than on other exchanges, and it is still best suited to those who trade large volumes on a daily basis.

Of course, this list is far from exhaustive, but it offers a good starting point for anyone who needs it.

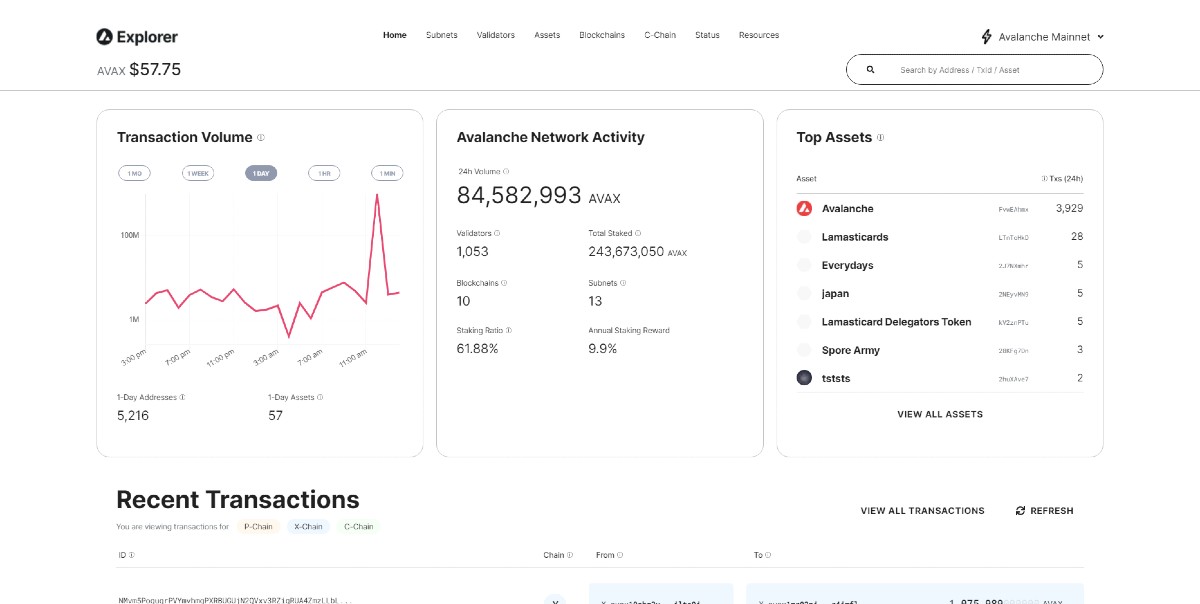

Avalanche Block Explorer

Another useful tool that most blockchains have is a block explorer. Knowing how to use it is a prerequisite for making the most of the network. On Avalanche, their block explorer is especially useful, as it offers insight into AVAX, but also all other blockchains and their tokens that were created on the platform. At the top, the explorer shows the transaction volume on the platform, the number of validators as well as the total amount currently staked, the number of active blockchains and subnets, and the staking ratio plus annual staking reward.

You can see all recent transactions on the landing page, but also search by address, transaction ID, or asset. Other tabs include subnets, validators, assets, blockchains, C Chain, Status (for the entire network), and resources, which will lead you to any documentation you may need. In other words, their explorer is the best place to start if you need any specific information about the Avalanche platform.

FAQs

If you’ve read all of this guide, you should be well informed about what is Avalanche, what makes it so unique, and why you should or should not invest in this token. However, we know that you might still have some lingering questions. Here are some of the most commonly asked questions about Avalanche.

How much is 1 Avalanche to buy?

Avalanche price changes by the second. Right now, at time of writing, 1 Avalanche costs $35.99.

Is Avalanche actually safe?

Yes, Avalanche is safe. Investing in Avalanche is just as safe as investing in any other cryptocurrency. However, you should keep in mind that investing in crypto comes with unique risks that other investments do not have. Do not invest more than you are willing to lose.

What is AVAX?

AVAX is the trade symbol of Avalanche. They mean the exact same thing. For the sake of simplicity, we referred to Avalanche as Avalanche, but don’t be surprised if you see people more commonly using AVAX in other crypto discussions.

Where can I buy Avalanche?

Avalanche is available on all major crypto exchange platforms, including Coinbase and Binance. Most of these platforms also have dedicated crypto wallets where you can store your Avalanche as well.