Types of Cryptocurrency

The world changed in 2009 when Bitcoin first launched, but we didn’t yet realize the parabolic growth that cryptocurrency would see, nor did we foresee how many types of cryptocurrency would evolve. Today, nearly 10,000 cryptocurrencies exist – and an ever larger number have ceased to exist.

In this article, we’ll explore the various types of crypto, including a summary of the leading projects and what sets them apart from the thousands of others. First, let’s examine why so many crypto projects exist.

Why Are There So Many Types of Cryptocurrency?

One key reason why there are so many cryptocurrencies largely rests on the idea of coins versus tokens. We’ll discuss the differences in just a bit, but tokens make up a large part of the crypto market, and these crypto assets don’t have their own blockchains. Instead, they rely on the infrastructure of other blockchains.

Bitcoin was the first cryptocurrency to make it past the theoretical stage and see active use. The 2008 Bitcoin whitepaper led to the 2009 launch of the blockchain. In 2011, Litecoin launched. The project was a fork of Bitcoin’s code and sought to address some of Bitcoin’s perceived inefficiencies, primarily focused on transaction speed. Litecoin creates new blocks four times as fast as Bitcoin, with a target block time of 2.5 minutes compared to Bitcoin’s 10 minutes.

This improvement theme also carries over to other projects. Many of today’s crypto projects seek to address shortcomings of existing projects or add new features not present in existing projects.

Ethereum offers a powerful example of cryptocurrency innovation that brings new features. In its original form, Ethereum used a consensus mechanism similar to that of Bitcoin; both projects used proof of work. However, where Ethereum diverged significantly was in its ability to support smart contracts, which are computer programs that run on the blockchain network.

Bitcoin and Litecoin performed the simpler function of being a store of value. In short, these cryptocurrencies serve are digital money. By contrast, Ethereum offers the ability to build applications that run on the network. Bitcoin didn’t have programmability and may not ever rival today’s smart contract chains. To build additional functionality, the world needed another cryptocurrency type, a new blockchain; Ethereum launched its Genesis Block in 2015

How Many Types of Cryptocurrency Are There?

Estimates put the number of current crypto projects at about 10,000. Coingecko lists more than 24,000 different types of cryptocurrency. However, nearly 60 percent of projects listed on the crypto data site have died. Most of these ill-fated projects launched during the unbridled optimism of the 2020 to 2021 bull run.

But Ethereum itself, while still the largest smart-contract crypto network, faces several persistent challenges. These include scalability, meaning the ability to process thousands of transactions per second (TPS), and cost; transactions on the network become expensive when usage spikes.

The market responded with new projects that address scalability and cost. Solana, Polygon, and Cardano all stand out as newer smart contract-capable networks that can process more transactions per second at a lower cost per transaction.

Transactions Per Second for Leading Smart-Contract Networks:

- Ethereum ~20 TPS

- Solana 45,000 TPS

- Polygon 65,000 TPS

- Cardano 1,000 TPS

The crypto ecosystem thrives on competition and innovation while still sharing technology. Most projects publish their code to open-source repositories where others can fork the project or use bits of code.

What is Open-Source Code?

Open-source code refers to computer code that is made available for viewing by others. Many programs are closed-source, meaning we don’t always know what a program is doing or what data is collected. Open source provides transparency and, in many cases, allows others to copy and modify the code. Litecoin famously did this with the Bitcoin code, and then Dogecoin “forked” the Litecoin code, creating new blockchains in both cases.

Many new projects seek to improve existing projects’ features and capabilities. Open-source code makes that possible while also making the project transparent for users.

Understanding the Basics

Let’s explore some basics that make the breadth of crypto projects easier to understand.

Definition of Cryptocurrency

A cryptocurrency is a digital currency that uses cryptography for security and record keeping. Transactions are stored on a distributed ledger made up of hundreds or thousands of computers worldwide.

Crypto networks like Bitcoin and Ethereum use their native cryptocurrencies as a way to pay for transactions on the network. However, these digital assets also function as a store of value and a unit of account. In short, they are money, assuming the other party in the transaction also sees them as money.

Crypto Coins vs. Tokens

While often used interchangeably, coins and tokens differ.

- Coins: A coin is the native cryptocurrency for a specific blockchain. For example, bitcoins are the currency of the Bitcoin blockchain network. Likewise, ether is the native cryptocurrency of the Ethereum blockchain. Coins are a specific type of money needed to transact on a specific blockchain network.

- Tokens: A token is a representation of ownership but exists on a host blockchain. For example, the Aave token is used on the Ethereum blockchain to vote on project proposals and to provide an insurance fund for users of the Aave lending and borrowing protocol. However, Aave does not have its own blockchain.

When you see the number of cryptocurrencies measured in tens of thousands, it’s important to know that most of these are tokens rather than independent blockchains.

Blockchain: The Technology Behind Cryptocurrencies

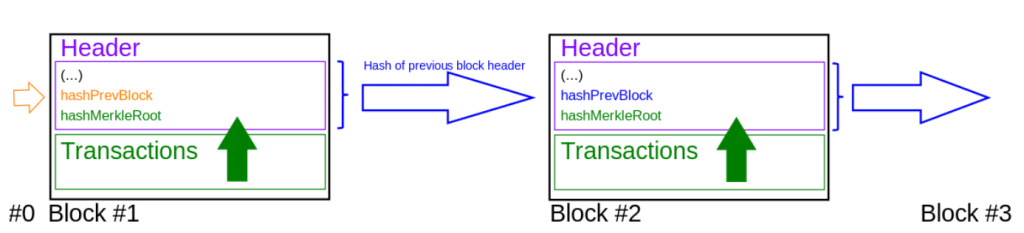

The term blockchain gets its name from the structure of blockchains. Crypto networks group transactions into blocks. These blocks are connected using a cryptographic hash — an encoded value — that links a parent block to a child block, forming a chain.

In practice, these blockchains form a ledger, a record of transactions, which is then distributed to other nodes on the blockchain network. For example, Bitcoin has an estimated 53,000 bitcoin nodes worldwide, each with a copy of the blockchain.

Several high-profile crypto projects, including Avalanche, Hedera, IOTA, and Kaspa, use a Directed Acyclic Graph (DAG) rather than a traditional blockchain. DAGs differ in that they group transactions in silos called vertices. These vertices are connected and the DAG is able to “keep time,” ordering transactions, but without a strict chain structure.

Whether blockchain or DAG, crypto networks maintain a record of transactions of which there may be thousands of copies.

What is Decentralization in Crypto?

Decentralization in crypto refers to the notion of a network with no center. However, decentralization speaks to three key areas.

- Data storage: Blockchain transactions are replicated on nodes, which are individual computers on the network.

- Validation: When the nodes that verify transactions are managed by independent node operators that do not have disproportionate influence, the network is considered decentralized.

- Management: Decentralized projects use a voting system to make project decisions rather than a management team.

- Fair distribution: Projects in which the community rather than developers and venture capitalists hold most or all of the tokens are considered decentralized.

Of note, not all crypto networks are fully decentralized, and some are working toward decentralization. Cardano, for example, is working toward decentralization with its planned Voltaire era.

Altcoins and Their Role

The term altcoin, short for alternative coin, usually refers to cryptocurrencies besides Bitcoin. For example, Ether, the cryptocurrency for the second largest crypto project in the world, is still considered an altcoin by some.

However, many in the crypto community group ether and bitcoins together, with the 10,000+ other cryptocurrencies, including tokens, considered altcoins.

The term provides a contrast against Bitcoin. For example, “altcoin season” refers to when other coins and tokens see a renewed interest following a significant rise in Bitcoin’s price.

Many of the coins and tokens that see the biggest percent rises comprise lesser-known cryptocurrencies. Leading altcoins that have seen meteoric rises include the following:

| Cryptocurrency | Price at Launch | 01/24 Price |

| Ether (ETH) | $0.74 | $2,375.30 |

| Cardano (ADA) | $0.02 | $0.52 |

| BNB (BNB) | $0.15 | $309.99 |

| Solana (SOL) | $0.75 | $104.95 |

| Chainlink (LINK) | $0.11 | $15.62 |

We’ll cover these cryptocurrencies and others in more detail shortly.

Cryptocurrency Tokens Explained

Cryptocurrency tokens fall into two primary categories: utility tokens and security tokens. These tokens are fungible, meaning each is the same as the next token of the same type. A third category, non-fungible tokens (NFTs), represent ownership. NFTs, however, are each unique.

Utility Tokens

Utility tokens grant access to a protocol or company’s goods and services.

For example, the Curve Finance protocol uses the CRV utility token as an incentive for liquidity providers. Users who provide cryptocurrency to liquidity (swap) pools can earn CRV tokens. For this reason, utility tokens are also often called utility tokens.

In another example, the Radiant Capital protocol uses the RDNT tokens to incentivize users on the lending and borrowing platform. Users who provide trading liquidity for the RDNT token can also earn a share of the protocol’s revenue.

The CRV and RDNT tokens also double as governance tokens, meaning holders can vote on changes to these respective protocols.

Security Tokens

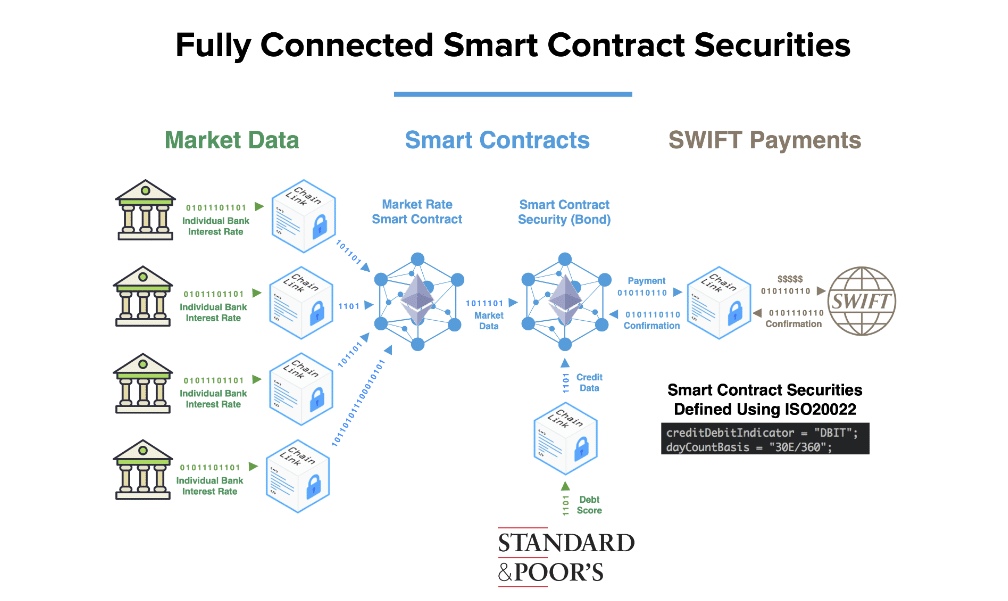

A security token represents ownership of an asset, such as a real estate share or a share in a company. Unlike utility tokens, security tokens are subject to oversight by regulatory agencies like the US Securities and Exchange Commission (SEC). In 2021, INX became the first security token registered with the SEC.

Security tokens are still in their infancy, but many expect these tokens to revolutionize traditional stock markets and other financial markets by moving transactions onto the blockchain.

Security tokens are still in their infancy, but many expect these tokens to revolutionize traditional stock markets and other financial markets by moving transactions onto the blockchain.

Main Types of Cryptocurrency

With over 10,000 cryptocurrencies available, knowing where to invest can be challenging. Below, we summarize several leading cryptocurrency types and what sets them apart.

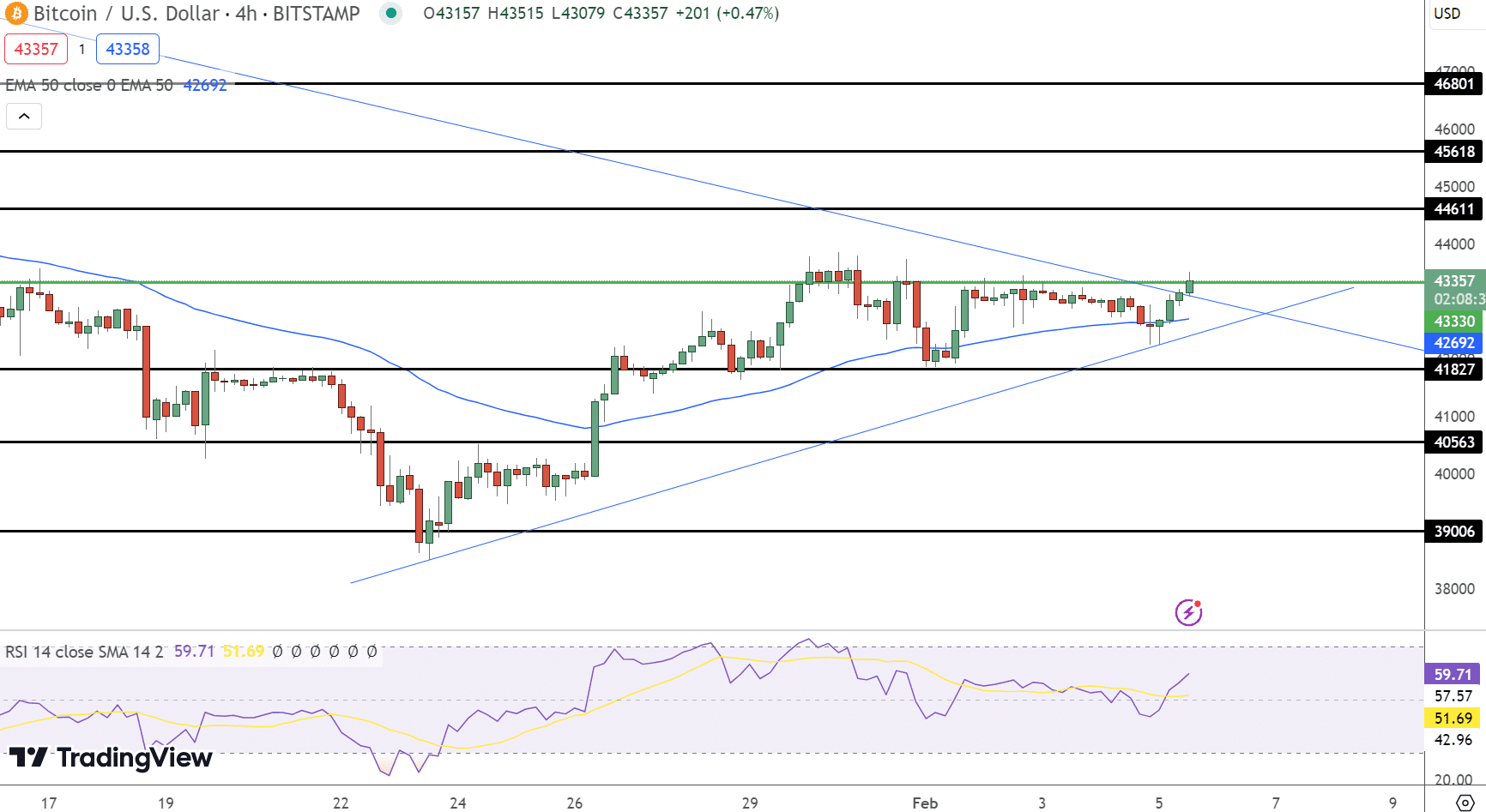

Bitcoin (BTC)

Now a household name, Bitcoin was the first cryptocurrency to reach widespread use. The Bitcoin network uses proof of work (PoW) to secure transactions by requiring miners to solve a cryptographic hash to build the next block. When a miner is successful, that miner builds the block and earns the block rewards.

Bitcoin’s supply is limited to 21 million bitcoins, most of which have already been mined, although supply is expected to grow towards that cap until about 2140. Bitcoin’s scarcity — combined with the energy required for mining — lead many to refer to Bitcoin as digital gold.

Ether (ETH)

Ether powers the Ethereum network, which is sometimes called the world computer. Launched in 2015, Ethereum was the first blockchain network to enable smart contracts. These computer programs run on the Ethereum Virtual Machine (EVM), a secure environment on network nodes that executes conditional commands; if this happens, then do that.

While ether does not have a fixed supply, the ETH supply has become slightly deflationary in recent months. Ethereum uses proof of stake (PoS) and provides staking rewards for using ETH as collateral to secure the network. At the same time, the network burns base transaction fees, sending base fees to an unrecoverable address.

Binance Coin (BNB)

First launched by Binance as a tool to save on trading fees, BNB has taken a much larger role. Binance Coin now powers the BNB Smart Chain, a popular alternative to the Ethereum network that offers EVM compatibility combined with faster transactions and lower fees.

As a caveat, many consider BNB Smart Chain to be less decentralized than Ethereum. The BNB Smart Chain uses 56 validators compared to Ethereum’s one million-plus validators.

Solana (SOL)

Built for speed, the Solana Network uses the Rust programming language to enable smart contracts with transaction speeds of up to 65,000 TPS. Like Ethereum, Solana uses proof of stake, an energy-friendly alternative to proof of work. Although a recent arrival launched in 2020, Solana now ranks 5th overall for total value locked (TVL), a measurement of funds locked in smart contracts.

Solana’s total supply is not capped; instead, Solana uses an annual inflation rate that varies year by year.

Ripple (XRP)

The brainchild of Ripple Labs, Ripple (XRP) has become an extremely popular cryptocurrency used to transfer funds across borders with minimal cost. The Interledger Protocol, launched in 2016, makes XRP one of the most coveted cryptocurrencies due to the RippleNet network’s interoperability with different currencies.

Cardano (ADA)

Co-founded by one of Ethereum’s co-founders, Charles Hoskinson, Cardano is known for its deliberate development that focuses on building the network to be performant rather than building it quickly. Although the blockchain launched in 2017, Cardano first implemented support for smart contracts in 2021.

ADA, Cardano’s native cryptocurrency (named after the first programmer, Ada Lovelace), powers transactions on the Cardano network. ADA’s maximum supply is capped at 45 billion tokens.

Dogecoin (DOGE)

The popular Dogecoin cryptocurrency, launched in 2013, was created as a fork of Litecoin, which was itself a fork of Bitcoin. However, unlike Litecoin and Bitcoin, Dogecoin has no maximum supply. Instead, Dogecoin uses a fixed yearly issuance of five billion dogecoins.

This fun project began as a joke but proved to have staying power with its impish Shiba Inu mascot and a growing army of loyal DOGE holders. When launched, a single dogecoin traded at $0.0002. Today, DOGE trades at $0.08 and has reached as high as $0.74.

TRON (TRX)

With about 25% of the TVL found on Ethereum, the TRON network boasts the second-largest TVL in the crypto space at $7.863 compared to Ethereum’s $32.302 billion. The project started in 2018 as an Ethereum token before developing its own blockchain. Now, the TRON network focuses on the digital content industry, building a decentralized entertainment economy for the internet community.

Tron’s native cryptocurrency, Tronix (TRX), powers the network.

Tether (USDT)

The Tether stablecoin token, designed to track the value of the US dollar, remains the most commonly used stablecoin in the world. Tether Operations Limited issues the token, assuring users that every USDT is backed 100% by Tether’s reserves.

Rather than being an investable cryptocurrency, Tether and similar stablecoins offer a convenient way to pay for USD-denominated purchases or as a way to hold a stable value between investments.

US Dollar Coin (USDC)

Similar to Tether, US Dollar Coin (USDC) maintains a peg to the US dollar. Circle, the company behind USDC, backs the stablecoin token with 1:1 reserves of USD or cash equivalents, such as US Treasuries and overnight US Treasury repurchase agreements. Circle focuses on transparency, using a fund managed by BlackRock for its reserves.

Chainlink (LINK)

When blockchain smart contracts need data from the outside world, they use an oracle, a trusted source of data. Chainlink is the undisputed leader in the field, using a decentralized network of nodes to bring real-world data for use in smart contracts. For example, Aave, the leading decentralized lending platform, depends on oracles to work properly. In this example, Aave brings in real-world price data to determine loan-to-value ratios.

DAI (DAI)

Like USDC and USDT, the DAI stablecoin tracks the value of the USD. However, the protocol uses a different strategy. Rather than using a centralized entity to hold and manage reserves, the Maker Protocol issues DAI to borrowers who deposit ETH, wBTC, USDC, and other supported cryptocurrencies.

Maker’s process is completely decentralized and governed by the community of MKR token holders through MakerDAO, a decentralized autonomous organization (DAO).

Uniswap (UNI)

Traditional crypto exchanges act as fiat on and off-ramps, letting traders buy or sell crypto with USD or other traditional currencies. Uniswap is the leading decentralized exchange (DEX), offering a way to “swap” cryptocurrencies without an exchange as an intermediary.

The Uniswap DEX uses the UNI token as a governance token, which allows holders to vote on proposed changes to the platform. Since its launch at $0.4699, the UNI token has skyrocketed in value to $6.03.

Conclusion

The crypto space continues to evolve, and while many projects have failed, the future still looks promising for this emerging technology. As we’ve already seen, existing blockchains form a template for newer blockchains, with projects borrowing ideas and time-tested methods from each other.

Early projects like Bitcoin and Ethereum benefited from the network effect of large user bases and name recognition. Will these projects lead us into the future? It’s difficult to know. Newer projects may offer some advantages, and existing projects may adopt the improvements developed by others. Despite its occasional rifts, the cryptocurrency community creates a synergy that is difficult to find in other industries.

Knowledge is essential when investing in cryptocurrency. Research projects you’re considering carefully and build a strong knowledge base before investing. Crypto prices are volatile, and over half of all projects have died or disappeared. Never invest money you can’t afford to lose.

References

- Bitcoin: A Peer-to-Peer Electronic Cash System (bitcoin.org)

- Etherscan Block 0 (etherscan.io)

- Dead Coins: Over 50% of Cryptocurrencies Have Failed (coingecko.com)

- Global Bitcoin Nodes (bitnodes.io)

- Voltaire -Cardano Roadmap (roadmap.cardano.org)

- Understanding CRV (resources.curve.fi)

- Dynamic Liquidity (dLP) (docs.radiant.capital)

- INX Limited Prospectus Supplement (sec.gov)

- Proof Of Work (developer.bitcoin.org)

- Ultra Sound Money – ETH Supply Change (ultrasound.money)

- Ethereum Burn Address (etherscan.io)

- BNB Smart Chain Validator FAQs (docs.bnbchain.org)

- Statistics & Charts – Mainnet Beacon Chain (beaconscan.com)

- Network Performance Report: July 2023 (solana.com)

- About Hard Forks (docs.cardano.org)

- Dogecoin Inflation (dogecoin.com)

- Transparency (tether.to)

- Circle Reserve Fund (blackrock.com)

- Maker Governance Voting Portal (vote.makerdao.com)

- Uniswap Governance (app.uniswap.org)

Nick Pappas

Nick Pappas

Eliman Dambell

Eliman Dambell

Kane Pepi

Kane Pepi