A Beginner’s Guide to NFTs: What You Should Know

Let’s say that somebody gave you a Leonardo Da Vinci painting. At first, you probably wouldn’t believe that it was a Da Vinci original. But if the person who gave you the painting was trustworthy, you might search for the nearest art expert to confirm its authenticity. The expert would go to your home and examine the painting’s composition. If the expert thought it was in Da Vinci’s style, the expert would call a team of appraisers to see if it was a well-painted fake. This might seem over-the-top, but how else are you supposed to know if the painting is an original? With NFTs, non-fungible tokens, the above scenario wouldn’t exist. If an NFT is attached to a work of digital art, you can be 100% sure that the work is the original. If you screenshot a digital artwork with an NFT, that screenshot will never be the original. Quite simply, the screenshot won’t have the cryptographic token, the NFT, attached to it. Anyone can easily identify any copy as fake because it wouldn’t be identified on the blockchain. No team of experts is needed to verify this. This is why a digital artist like Beeple can sell a piece of digital NFT art for USD 69 million. We know for a fact that it is a Beeple original. As long as the token is attached to it, there is no debate. Metavokan can sleep peacefully at night knowing that he owns Beeple’s ‘Everyday: The First 5,000 Days.’ The work will never be misattributed to another artist, like how a Rembrandt painting was thought, for decades, to be a work of his apprentice. Just with this information alone, it’s easy to see why NFTs have exploded onto the world stage. To further understand NFTs, let’s examine how the ecosystem came to be.

Brief History of NFTs

Colored coins on the Bitcoin blockchain are often considered the first NFTs. They were very limited in functionality and far less effective than the NFTs we have today. At the very least, they paved the way for thinking about non-fungible tokens. Colored coins represented multiple assets, including coupons, property, subscriptions, and digital collectibles. Even so, the technology was in its infancy. A regular database was a lot more practical than using colored coins, so it failed to have widespread use. Still, it did make people realize the potential of having assets on a blockchain. It wasn’t until the 2014 peer-to-peer protocol Counterparty, a platform built on top of the Bitcoin blockchain, that NFTs began to take shape. Digital assets and games were put on Counterparty. The game Spells of Genesis and Pepe Memes were popular NFTs on the platform. By the time 2017 came around, Ethereum had begun to take off. The now famous Cryptopunks were put on the blockchain. These 10,000 unique characters soon became digital collectibles. Cryptopunks are simple but were some of the first NFTs minted on Ethereum. Not long after, CryptoKitties made its debut in October 2017, a turning point in the popularity of owning digital assets. Investors like SamsungNEXT and Google Ventures began pouring wealth onto NFTs after seeing the immense possibilities.

In 2018 and 2019, NFT marketplaces like OpenSea and Rarible began gaining ground, allowing anyone to mint their own NFT art. This was in large part due to the Metamask wallet allowing for easier access to the NFT space. Though originally proposed in 2018, the current NFT standard of ERC-721 began to bloom over the next few years. It is through ERC-721 that platforms like Decentraland, Crypto Heroes, Gods Unchained, and a whole slew of current games and applications are made possible. ERC-721 (Ethereum Request for Comments 721) allows for more than just trading cards and collectibles. You can mint event tickets, buy digital land, unique gaming clothing, music, and video clips, and a myriad of other functions that offer a diverse array of creative assets. These are all interoperable in the Ethereum network as well, allowing for some interesting cross-platform functionalities. For example, you can find virtual reality museums on Decentraland of NFT art bought from other platforms. Now that we have an understanding of NFT history let’s discuss the general idea of NFTs.

What does it mean to be fungible?

To better understand non-fungible tokens, we’ll discern what it means to be fungible. Fungibility is usually used in finance to talk about items that are interchangeable and indistinguishable. Fungible items can also be divided into parts. A clear example of this would be currencies. In USD, a USD 5 banknote is interchangeable and indistinguishable from another USD 5 note. Five USD 1 bills are equal to a USD 5 bill, and four USD 5 bills are equal to a USD 20 bill and so forth. These are considered fungible. Although scarce and created with advanced technology, cryptocurrencies are also fungible. One unit of Bitcoin is perfectly exchangeable with another unit of Bitcoin. And 0.02 Bitcoins are fungible with 0.02 Bitcoins.

Non-fungible examples

In all likelihood, your cat is not interchangeable with your neighbor’s cat. Even though your neighbor’s cat might also be the same Siamese breed, maybe your cat is nicer and doesn’t scratch the couch. A rare, limited edition Pokemon card is also not fungible. Even though a 1st edition Pikachu might have the same holographics as another 1st edition Pikachu, one might sell at an auction for USD 40,000 while another sells at an auction for USD 80,000. Your car is also not fungible. Though it might even be the same model, yours might have way more miles or a clean interior, making the value very different than another car with fewer miles and more damaged. Cats, cards, and cars are also indivisible. Separating them into different parts would cause their value to change significantly. You can’t just chop up a baseball card and expect it to have the same value. With fungible assets like the US dollar, you can divide a USD 20 bill into USD 1 bills. These non-fungible assets are distinguishable and not interchangeable. This is what an NFT tries to turn a digital asset into. It uses cryptographic technology to make sure that what you own is original. The token attached to that artwork, collectible, or digital property, is uniquely your own. If you buy a Fewocious artwork, an online collectible card, or digital property in Upland, you can be certain that the digital asset is yours. You don’t need a whole slew of paperwork and verification to make sure that you own that specific piece of digital land. All you need is ownership of the token. That begs the question. Why would somebody spend their hard-earned crypto on these digital assets? Is it more than just trying to exchange these assets to get rich?

Subjective Value

Subjective value is at the heart of what makes NFTs valuable. As long as someone thinks that a digital Super Bowl card of Gronkowski’s is worth USD 1.8 million, then there is a market for that card. In a sense, it is digitally signed by the person who mints the NFT into existence. A buyer owns Grownkowski’s digital signature forever. That has a lot of sentimental value to people who are fans of celebrities. NFTs are also, arguably, far more secure than owning a physical asset, like a rare baseball card. There could be an accident, for instance, like a devastating fire that burns down your house and your card collection. Maybe a thief hears of your one-of-a-kind USD 1 million Babe Ruth card and steals it. With NFTs, this isn’t a problem since the ownership is granted on the blockchain, and every computer in the network can recognize your ownership. This factor greatly raises the subjective value of an NFT.

Brief Rundown of NFT Technology

You might be thinking, “What makes this technology possible?” Using blockchain, it would take an absurd computer to guess and check the hash (the encrypted algorithm) that would gain access to the keys of the token’s ownership. Cracking the code would require insane computational power, making it impractical to break. And when something is off on the digital ledger, it can be clearly seen as invalid by the network. It is what is known as a peer-to-peer platform. These platforms function without a central authority like a government or bank. You would have to wipe out every computer and node in the network to destroy it. You only need one copy of the blockchain’s ledger for all the transactions to be recorded. You might also make it a goal to destroy every node to stop a widely used blockchain network. NFTs are tokens built on blocks of unbelievably complex algorithms. Instead of a fungible cryptocurrency like Bitcoin, NFTs denote uniqueness and immutability, as mentioned previously. Each NFT is a digital signature written with a cryptographic algorithm, adding another dimension of uniqueness and scarcity. Once set to a specific digital weapon, property, creature, card, artwork, you name it, it is immutable. Immutability means the data can’t be changed, forged, or altered. The transaction is encrypted on the blockchain and every single computer, or node, in the network takes note. If you have just node, with the blockchain ledger saved, you’ll have all the previously recorded data. Even if your computer spontaneously explodes, the data will be saved on other nodes. It is extremely useful to have a standardization protocol. The Internet uses HTTP protocol. Website developers don’t have to invent their own version of HTTP to create websites. They can use HTTP. Similarly, blockchain and the Ethereum ERC-721 that most NFTs are built on make it easier to create a standard for NFTs. The problem with this is that if the network has a flaw, everyone feels the effects. A common problem plaguing Ethereum today is the high gas fees needed to create an NFT or sell it, causing newer protocols like Cardano to seem more attractive to investors.

How To Make, Buy, and Sell NFT Art

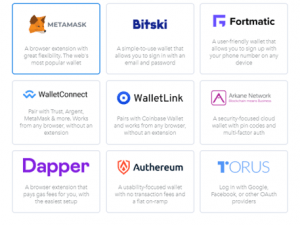

If you’re an artist seeing these digital artists making millions, you might be wondering how you can get in on the action. Although some protocols like Zilliqa, TRON, Flow, or Cosmos, allow you to mint your own NFTs, the standard ones are on the Ethereum network. That is where the jaw-dropping sales numbers happen. The main marketplaces to create these NFTs are Mintable, Rarible, and OpenSea. To create an account, you first have to connect a wallet, the most popular being Metamask. Here are some of the wallets that OpenSea allows you to use.

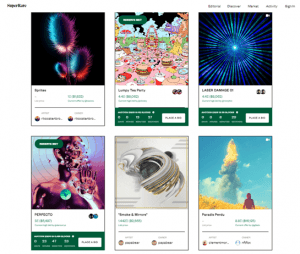

The application will allow you to create your collection to sell. You can either take your NFT from another platform like Rarible or mint an NFT directly on OpenSea. After you create your collection, you can choose the qualities your NFT has. These include how many copies of the NFT there will be in existence. To finally mint the NFT and put it up for auction, you need to pay a gas fee to get it up and running. Other marketplaces like Superrare or Nifty Gateway are selective, like a regular museum gallery. These marketplaces require that you submit your art or are invited to put up a collection on the platform instead of minting it yourself. Whether you’re on a platform that allows you to mint NFTs or on a platform that you need to be invited on, a marketplace on the website allows you to place bids on NFTs. If you win the bid, you own the NFT artwork.

The Future of NFTs

With so many new protocols coming out that will host NFTs, you could say that this is just the beginning. It may seem wild to say that we are only in the beginning stages of NFTs. Artists are already building personal fortunes with their art, but NFTs have only had widespread adoption since 2017, less than four years. This year, NFTs had finally surpassed Ethereum for a brief moment in search volume, but Ethereum is not even a household word yet in comparison to Bitcoin’s omnipresence. As a new protocol for Ethereum is set to reduce the high gas fees in the summer and buyers continue to flip NFTs for hundreds of thousands of dollars, the NFT ecosystem is ever-changing and evolving. Soon, nobody interested in the future of art will ignore this exciting innovation.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.