Bitcoin vs. Ethereum: Which is The Better Buy?

Bitcoin and Ethereum are the two largest cryptocurrencies by market capitalization. Together, these popular cryptocurrencies command a valuation of over $1 trillion. But that begs the question: Which is the best investment, Bitcoin or Ethereum?

In this guide, we settle the Ethereum vs Bitcoin debate. We cover the key investment thesis, including upside potential, risks, use cases, adoption, and key market developments.

What Are The Buying Narratives for Bitcoin and Ethereum?

Choosing between Bitcoin and Ethereum is no easy feat. From an investment perspective, there’s a lot to consider. Not only in terms of the fundamentals but the long-term upside.

Investors should also assess the current entry price, as this can determine whether or not your investment represents good value. Let’s break down the key points when comparing Ethereum vs Bitcoin.

Bitcoin: The Pioneer of Cryptocurrencies

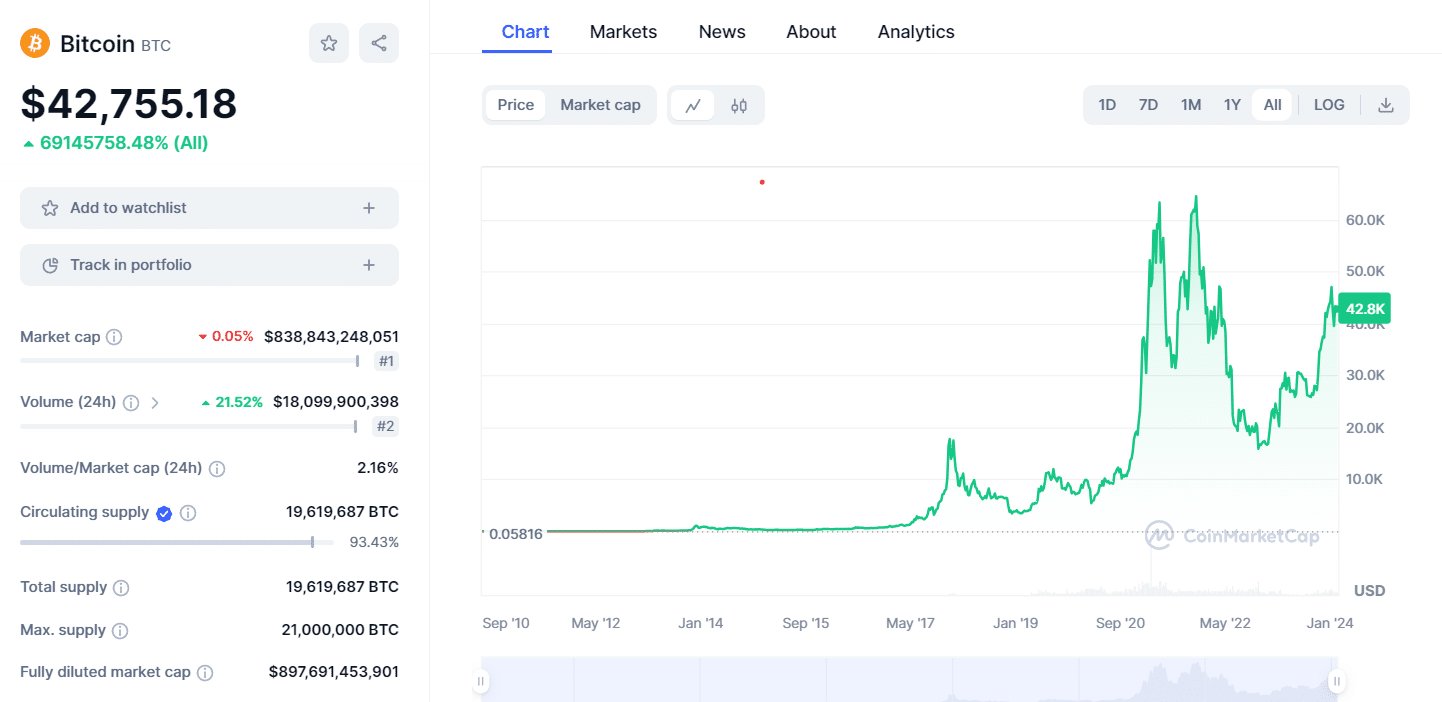

Bitcoin (BTC) is the original cryptocurrency. It was founded in 2008 and launched in January 2009. The real identity of Bitcoin’s developer, known as ‘Satoshi Nakamoto’, remains a mystery to this date. Nonetheless, Bitcoin is the largest cryptocurrency by market capitalization. It’s the most recognized cryptocurrency globally and boasts the most wallet holders.

As per the Bitcoin whitepaper, Bitcoin was created as an alternative to the global monetary system. It enables users to store, send, and receive digital assets without needing a third party. This is in contrast to traditional banks, which have the power to block transactions and freeze customer-owned funds. Bitcoin, on the other hand, is decentralized.

This means Bitcoin transfers are made on a peer-to-peer basis, directly between senders and receivers. And unlike fiat money, Bitcoin isn’t backed by a government or central bank. What’s more, the Bitcoin supply is fixed by immutable code. No more than 21 million Bitcoins will ever exist. Until this cap is reached, new Bitcoins enter circulation every 10 minutes.

Taking all of this into account, Bitcoin is best viewed as a store of value. Its finite and predictable supply is similar to gold. But unlike gold, Bitcoin is easily stored, transferred, and fractionized. Bitcoin is also a lot more liquid than other stores of value. It trades in a 24/7 marketplace and attracts billions of dollars in daily volume.

Key Takeaways on Bitcoin

- The original and de-facto cryptocurrency of choice

- Limited and predictable supply of 21 million Bitcoins

- Not controlled or backed by any governments or central banks

- Easily stored, transferred, and fractionized

- Boasts millions of holders worldwide

- Completely decentralized

- Benefits from regulated futures and ETF markets

Ethereum: A Platform for Decentralized Applications

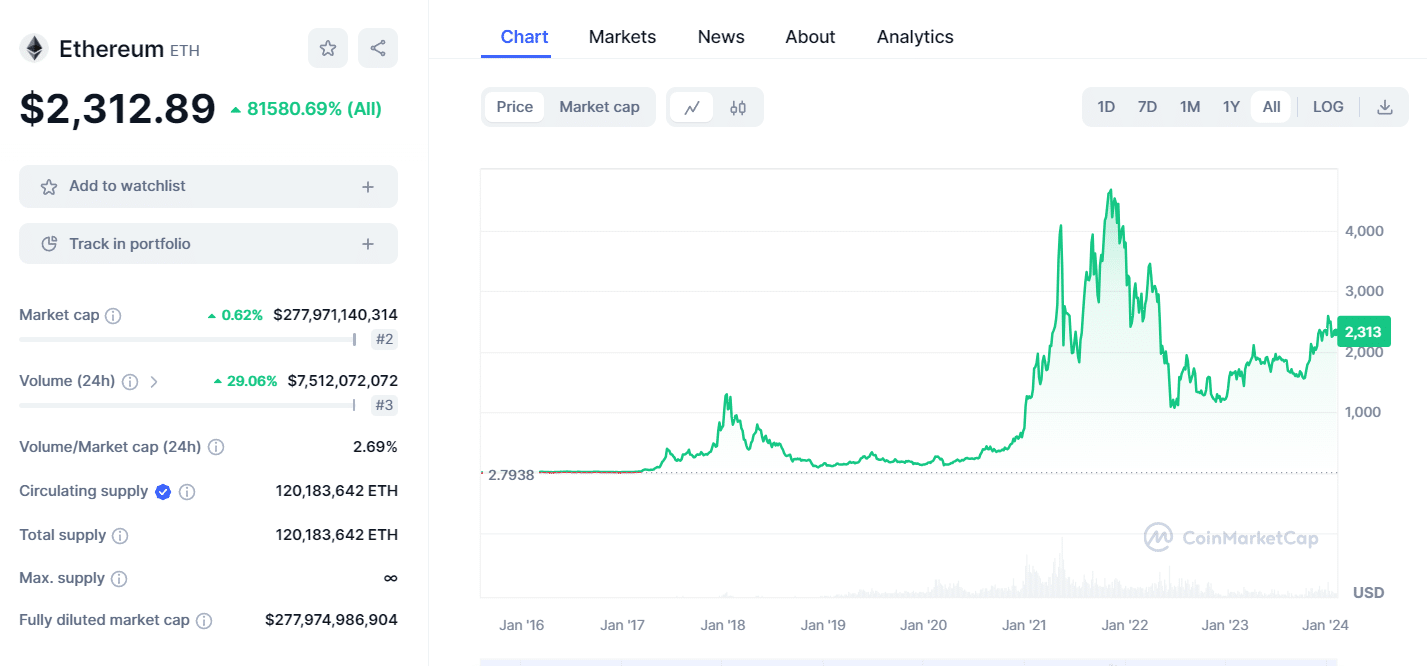

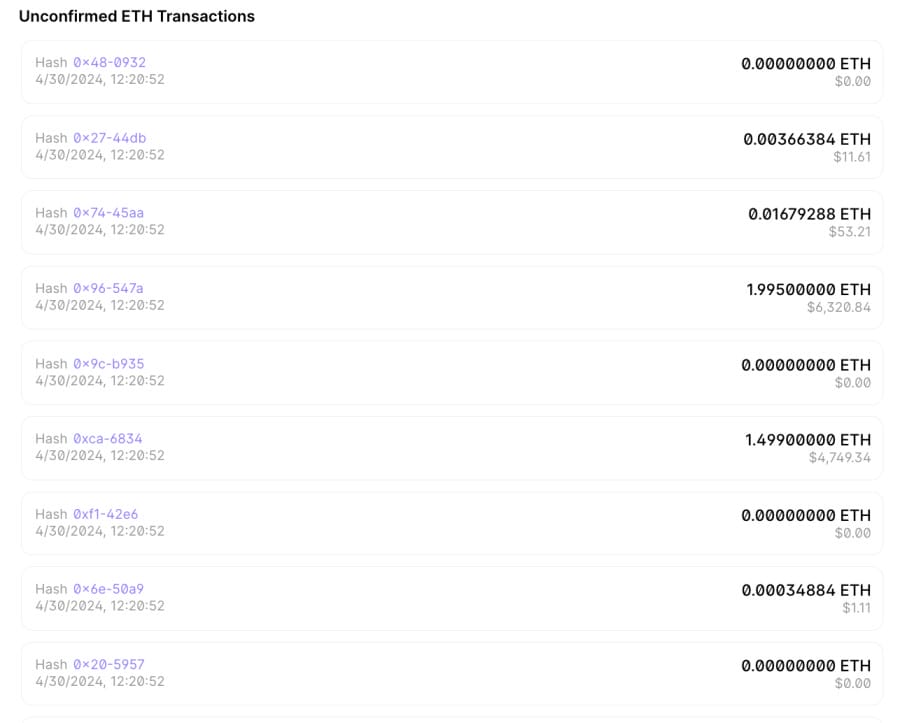

While Ethereum (ETH) isn’t the original altcoin, it’s the largest by market capitalization. Founded in 2014, Ethereum brought a new dynamic to the cryptocurrency markets; smart contracts. Put simply, the Ethereum blockchain enables developers to run decentralized projects. There are no requirements for centralized intermediaries, as smart contracts are autonomous.

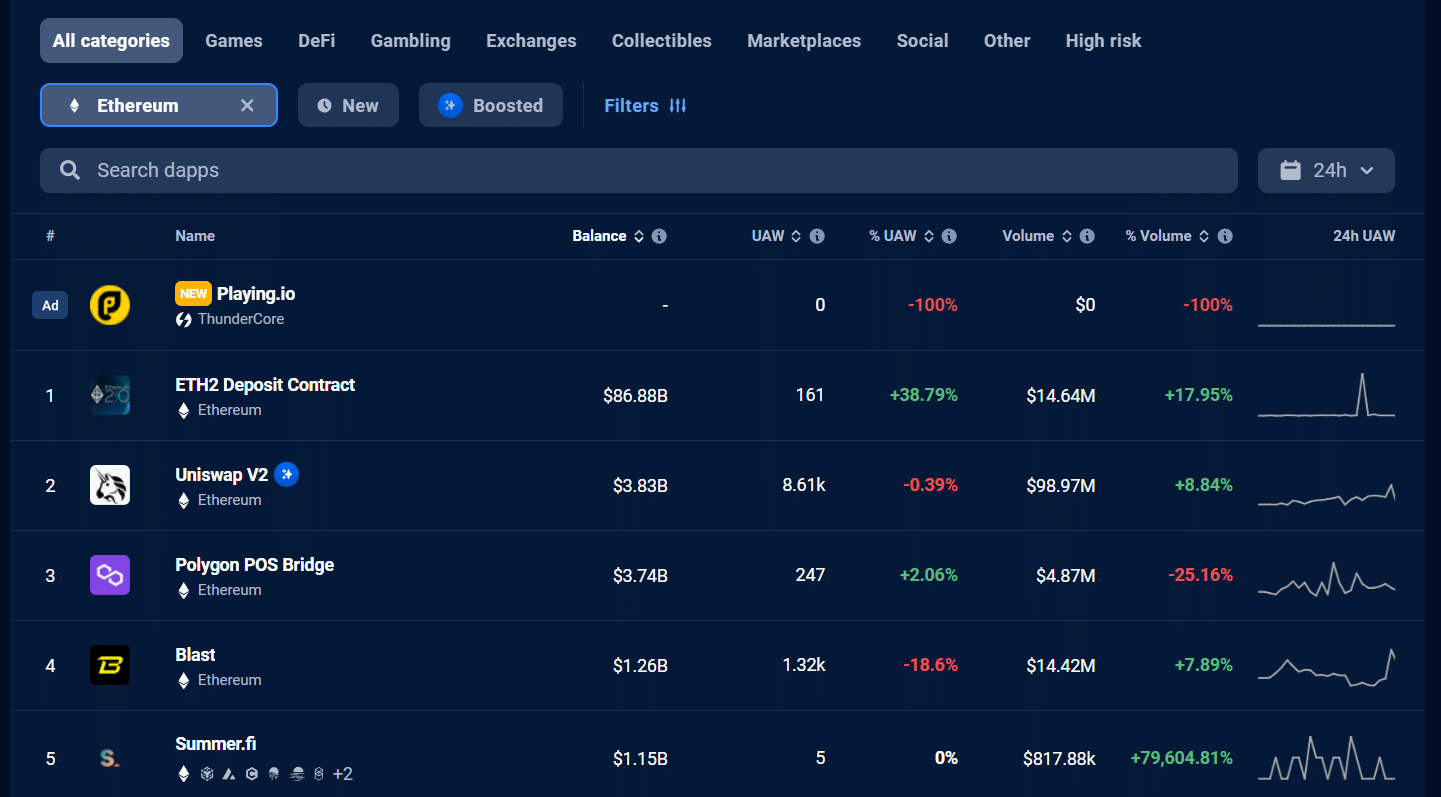

Smart contracts are trustless agreements between two or more parties. They’re executed only when the terms of the agreement are met. For example, consider a decentralized exchange like Uniswap, which operates on the Ethereum blockchain. Buyers and sellers can swap tokens without centralized order books. Whenever a swap is requested, the smart contract deducts the cryptocurrency from the user’s wallet.

It then deposits the new cryptocurrency into the user’s wallet automatically. The smart contract cannot deviate from the agreed terms, meaning the underlying code is immutable. Exchanges are just one type of decentralized application (dApp) that Ethereum can handle. Other examples include decentralized lending, staking, play-to-earn games, metaverses, NFTs, and prediction markets.

As of 2024, there are thousands of dApps on Ethereum. Most importantly, as more dApps join its ecosystem, Ethereum benefits greatly. This is because dApps follow the ERC-20 standard, meaning smart contract fees are paid in ETH. Put otherwise, ETH is needed by thousands of projects every time a transaction is executed. This will create long-term demand for ETH for as long as Ethereum is relevant.

Key Takeaways on Ethereum

- Founded in 2014 and launched in July 2015

- The first cryptocurrency to introduce smart contracts and dApps

- Known as ERC-2o tokens, thousands of projects operate on Ethereum’s blockchain

- Use cases include metaverses, exchanges, peer-to-peer lending, and gaming

- ETH is required whenever smart contracts are executed

- Recently upgraded to the proof-of-stake mechanism

- Does not have a maximum supply

What are The Key Differences Between Bitcoin and Ethereum?

This section takes a much closer look at the Ethereum vs Bitcoin debate. We compare both cryptocurrencies for key metrics like consensus validation, scalability, and supply dynamics.

Read on to determine whether Bitcoin or Ethereum is right for your investment portfolio.

Transaction Validation: Proof of Work vs Proof of Stake

First, let’s explore the ‘transaction validation’ process used by Bitcoin and Ethereum. This determines how the blockchain reaches consensus before validating and confirming transactions.

Crucially, this ensures that Bitcoin and Ethereum remain decentralized without compromising on security. That said, each cryptocurrency project uses a different validation method.

Bitcoin: Proof of Work

Bitcoin uses the proof-of-work (PoW) mechanism. This requires ‘miners’ to solve cryptographic equations before a block of transactions is posted to the blockchain. These equations are so complex that they take about 10 minutes to solve. This is with the aid of advanced hardware devices, known as Application-Specific Integrated Circuits (ASICs).ASICs cost thousands of dollars to buy.

- One ASIC alone isn’t enough to solve the PoW puzzle.

- Furthermore, due to the complexity of PoW, ASICs consume significant amounts of electricity.

- This is why Bitcoin is considered bad for the environment.

- Nonetheless, Bitcoin mining has never been more competitive.

- After all, the first person to solve the cryptographic puzzle wins the newly minted Bitcoin.

Right now, that’s 6.25 BTC, valued at over $250,000. This process repeats itself every 10 minutes. From April 2024, the mining reward will be reduced by 50% to 3.125 BTC. Ultimately, the drawback of Bitcoin’s PoW mechanism is that the network is very energy-intensive. It’s also more expensive and less scalable than other models. However, PoW is considered the most secure and decentralized option.

Ethereum: Proof of Stake

When Ethereum first launched in 2015, it also leveraged the PoW mechanism. That said, Ethereum used a different form of PoW known as Ethash. In contrast, Bitcoin uses SHA-256. The key difference was that Ethash enabled transactions to be processed in just 15 seconds. While Bitcoin’s SHA-256 takes 10 minutes.

- All that said, Ethereum upgraded its blockchain to the proof-of-stake (PoS) mechanism in 2022. This was for several reasons.

- For a start, PoS is significantly more environmentally friendly.

- According to Bloomberg, Ethereum’s PoS upgrade reduces energy consumption levels by over 99%.

- Moreover, PoS offers a fairer validation system that isn’t dominated by large-scale miners with huge resources.

- This is because PoS offers everyone a chance to earn ETH rewards.

Put simply, Ethereum holders deposit their ETH into a staking pool, which helps keep the network stable and secure. In return, users earn ETH rewards passively. This is based on the amount of ETH being staked, rather than the amount of computational power generated.

PoS also offers cheaper and more scalable transactions than PoW. However, Ethereum isn’t quite where it needs to be yet. Even with PoS being implemented, transactions are still capped at about 29 per second. Moreover, Ethereum fees are often high. During busy periods, fees can average $10-$40. Ethereum’s PoS mechanism is also considered less secure than Bitcoin’s PoW.

Winner: Ethereum

We’d argue that Ethereum’s proof-of-stake mechanism wins for several reasons. Not only does it offer faster and more scalable transactions, but it’s much better for the environment.

Moreover, proof-of-stake offers ETH holders a fair chance of earning passive rewards. All that said, Bitcoin’s proof-of-work model is considered more secure and decentralized. This needs to be taken into account when making the Ethereum vs Bitcoin comparison.

Scalability: Lightning Network vs Ethereum 2.0

Scalability refers to the number of transactions a blockchain network can handle at any given time. This is usually measured by transactions per second (TPS). This is a very important metric to consider when comparing Bitcoin and Ethereum.

After all, if their networks can’t handle demand, this creates a wave of side effects. This includes network congestion, higher fees, and longer waiting times. In contrast, sufficient scalability means a smooth and efficient network with competitive fees and speedy transactions.

- Bitcoin can handle about 7 TPS. This is considered low, especially as Bitcoin adoption continues to increase.

- Ethereum can handle about 29 TPS. While four times more scalable than Bitcoin, this is also considered problematic.

After all, other blockchain networks, such as Solana, Binance Smart Chain, and Cardano, can handle thousands of TPS. Now, we should note that scalability is a lot more important for Ethereum than Bitcoin. As we mentioned, thousands of dApps are built on the Ethereum blockchain. Every time a smart contract is executed by a dApp, it requires a new transaction.

For Ethereum to retain its status as the de-facto smart contract network, it must improve its scalability capabilities. This is something that Ethereum is actively working on. It aims to reach over 100,000 TPS in the future. However, when or even if this happens remains to be seen. Nonetheless, Ethereum must find a solution fast, as there are many other smart contract ecosystems in the market.

Going back to Bitcoin, we should also mention the Bitcoin Lightning Network. Put simply, the Lightning Network is a layer 2 solution for Bitcoin. It enables transactions to be executed off-chain. This means transaction times are reduced from 10 minutes to seconds. What’s more, the Bitcoin Lightning Network offers a theoretical throughput of up to 1 million TPS.

However, a very small percentage of Bitcoin transactions go through the Lightning Network. Until adoption rates increase, we won’t know whether this is a viable solution. Similarly, there are also layer 2 solutions for Ethereum, including Arbitrum and Polygon. These also offer faster and more scalable transfers while keeping transactions off-chain.

Winner: Tie

When it comes to scalability, both Bitcoin and Ethereum need to improve. Many other blockchain networks can scale thousands of transactions per second. Bitcoin and Ethereum are capped at just 7 and 29 respectively.

Ethereum is actively working on improving this, although this has been the case for several years. While Bitcoin does have the Lightning Network, adoption rates are minute.

Supply Limit: 21 Million Fixed vs No Hard Limit

It’s also crucial to consider the overall supply when comparing Bitcoin vs Ethereum long-term. The reason is simple; fiat currencies like the US dollar and the euro suffer from unfavorable central bank policies. This is because ‘money printing’ creates inflation. This devalues the currency, which increases the cost of living. It also reduces the value of people’s savings.

In contrast, Bitcoin is a finite cryptocurrency with a maximum supply of 21 million BTC. This solidifies Bitcoin’s status as a store of value. Bitcoin’s maximum supply is estimated to be reached in 2140. Until then, a fixed supply of new Bitcoins enters circulation every 10 minutes. This can help Bitcoin’s price increase organically over time.

In comparison, Ethereum doesn’t have a maximum supply. Every year, new ETH is added to the circulating supply. This is used to fund staking rewards. While this isn’t necessarily an issue in the short term, investors might lose confidence if a cap isn’t eventually added. After all, every new ETH issuance dilutes existing holders.

Winner: Bitcoin

Bitcoin’s predictable and fixed supply wins hands down. Investors know exactly how many new Bitcoins enter circulation. Moreover, the 10-minute mining reward is reduced by 50% approximately every four years. This further reduces the rate at which new coins enter the market.

Ethereum, however, has no cap on the maximum supply. All that being said, Ethereum notes that since its PoS upgrade, inflation stands at just 0.52% per year. Nonetheless, Bitcoin’s capped supply is undeniably the better option.

Real-World Use Cases: Which Has More Utility?

In this section of our Ethereum vs Bitcoin comparison, we’re going to focus on use cases. This is an important metric for investors. Cryptocurrencies with a clear use case will appeal to a broader audience, rather than just price speculation.

This is because people have a solid reason to buy, hold, and use the coins. In contrast, if a cryptocurrency doesn’t have any use cases, people will only buy it in the hope it increases in value. This is unsustainable in the long run – especially during bearish cycles.

Bitcoin: Digital Payments and Store of Value

Bitcoin was originally designed as a medium of exchange. However, Bitcoin isn’t fit for this purpose. After all, Bitcoin transactions take 10 minutes to settle. This is far too long to pay for everyday goods and services. Moreover, even at around $1, Bitcoin transaction fees are too high to be a medium of exchange.

This is because micro-transactions wouldn’t be possible. There’s also the issue of scalability. With Bitcoin capped at 7 transactions per second, this won’t be enough to fuel a global economy.

Instead, Bitcoin is now regarded as a store of value. As we mentioned, Bitcoin is a finite digital asset with a predictable and fixed supply. Bitcoin is also ideal as a store of value as it’s easily stored, transferred, and fractionized. This is especially important in regions that have historically suffered from high inflation levels.

Ethereum: Decentralized Finance, NFTs and More

Ethereum is neither a store of value nor a medium of exchange. Instead, it offers a fully-fledged ecosystem for dApps. Developers build their cryptocurrency projects on Ethereum to benefit from its secure and decentralized framework. dApps are backed by smart contracts, which enables them to operate autonomously.

The use cases are endless. For example, Ethereum supports metaverse projects like the Sandbox and Decentraland. Whenever a user buys virtual goods or invests in metaverse land, a smart contract is executed. This requires transaction fees, which are paid in ETH. In another example, Ethereum is also home to the top decentralized exchanges.

Whether that’s SushiSwap, Uniswap, or 1inch, each buy or sell order requires a smart contract. Similarly, Ethereum is also popular with play-to-earn games like Axie Infinity. Not to mention decentralized finance platforms offering loans and savings accounts. In addition, Ethereum allows developers to create and issue non-fungible tokens (NFTs).

Unlike traditional cryptocurrencies, each NFT is unique from the next. NFTs can be backed by real-world and virtual assets, providing ownership on the blockchain. NFTs are also easy to transfer. Each NFT transaction also requires an Ethereum smart contract, meaning fees are paid in ETH.

What is the Ethereum Price vs Bitcoin?

According to the Bitcoin vs Ethereum chart, 1 BTC is currently worth 18.45 ETH. This Bitcoin to Ethereum ratio will rise and fall based on broader market conditions. That said, during extended bull markets, ETH has historically increased at a faster rate than Bitcoin.

Summary: Should You Buy Bitcoin or Ethereum?

Having analyzed the Ethereum vs Bitcoin debate, we conclude that both cryptocurrencies are solid long-term investments. Similar to buying Apple and Google stock, your portfolio can benefit by having exposure to both projects.

Bitcoin is the de-facto cryptocurrency and a borderless store of value. While Ethereum is the smart contract leader with unparalleled use cases. Just make sure you consider the risks; there’s no guarantee that Bitcoin or Ethereum will produce financial returns. On the contrary, you could lose money.

References

- Bitcoin: A Peer-to-Peer Electronic Cash System

- Ethereum Whitepaper

- Bloomberg: Ethereum’s Energy Revamp Is No Guarantee of Global Climate Gains

- The Guardian: Bitcoin is terrible for the environment – can it ever go green?

- CNBC: Crypto execs say the bull run is underway and could lead to $100,000 bitcoin in 2024

FAQs

What is the difference between Bitcoin and Ethereum?

Bitcoin and Ethereum are cryptocurrencies with different use cases. While Bitcoin is a store of value, Ethereum allows developers to deploy smart contracts and dApps.

Should I buy Bitcoin or Ethereum?

Bitcoin is the de-facto cryptocurrency and a solid store of value. Ethereum is also a worthy investment, as it’s the leading blockchain for decentralized applications.

Are Bitcoin and Ethereum dead?

Those asking if Bitcoin and Ethereum are dead couldn’t be more wrong. They’re still the largest cryptocurrencies by market capitalization, respectively.

Will Bitcoin or Ethereum perform better in the long term?

Both Bitcoin and Ethereum offer long-term upside potential. Both have their own use cases and target audiences, which is why seasoned investors will typically buy both cryptocurrencies.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Elliott Lee

Elliott Lee

Michael Graw

Michael Graw

Eric Huffman

Eric Huffman