What is a Smart Contract in Blockchain? Explained Simply

In the blockchain ecosystem, smart contracts are programmable agreements that automatically execute when specific conditions are met. These self-executing contracts carry out predefined actions with the terms of the agreement directly written into code.

Smart contracts facilitate transparent transactions without intermediaries, legal tenders, or jargon. This guide will break down what is a smart contract and explore its advantages and disadvantages.

Summary: What is a Smart Contract?

Coined by Nick Szabo in the 90’s, a smart contract is simply a digital contract that operates using blockchain technology. It automates the execution of contractual agreements and enforces the terms of those agreements without the need for a third party.

Once actioned, the terms of the contract cannot be altered and can be tracked by the parties involved, as well as the wider community. Although the transactions are anonymous, the smart contract is visible on the blockchain. As such, transaction addresses are usually traceable once the smart contract has been deployed to the blockchain.

However, not all blockchains support smart contracts, for example, Bitcoin which uses the computer programming language Script. Scripting is intentionally limited in its functionality compared to other blockchain platforms like Ethereum. Ethereum was the first blockchain to successfully integrate smart contracts and bring them into mainstream usage.

Here is a list of the main blockchains that support smart contracts:

- Arbitrum

- Avalanche

- Base

- BNB Chain

- Ethereum

- Solana

- Polkadot

One example of a smart contract is DeFi lending, where crypto traders can borrow and lend assets to each other anonymously. A smart contract ensures that the lender receives their interest and that their assets are returned at the end of the loan period without having to use a loan company. Compound and Uniswap are projects that use smart contracts for this purpose.

How Do Smart Contracts Work?

Now that you understand a little bit about what they are, let’s explore how smart contracts in blockchain work. The first step is to create the contract by writing the code, which will include the predetermined conditions that must be met before execution.

Once the various terms have been coded and defined, the smart contract is then deployed onto the blockchain. Should the set of terms that govern the agreement be achieved, then the smart contract will self-execute and get added to the blockchain, where it can be tracked. Let’s break down each step of this process in slightly more detail.

Writing the Code

Initially, a developer will write the terms and conditions of the contract in code. This code contains instructions on the actions that need to be performed and the conditions under which they should be executed. This is often referred to as the “if/when…then…” logic.

Smart contract codes and conditions are typically written using programming languages such as Solidity for Ethereum. To give you an example of a condition that could be coded, let’s say the smart contract says that the developer will receive 1 ETH from the counterparty once they deliver a software product.

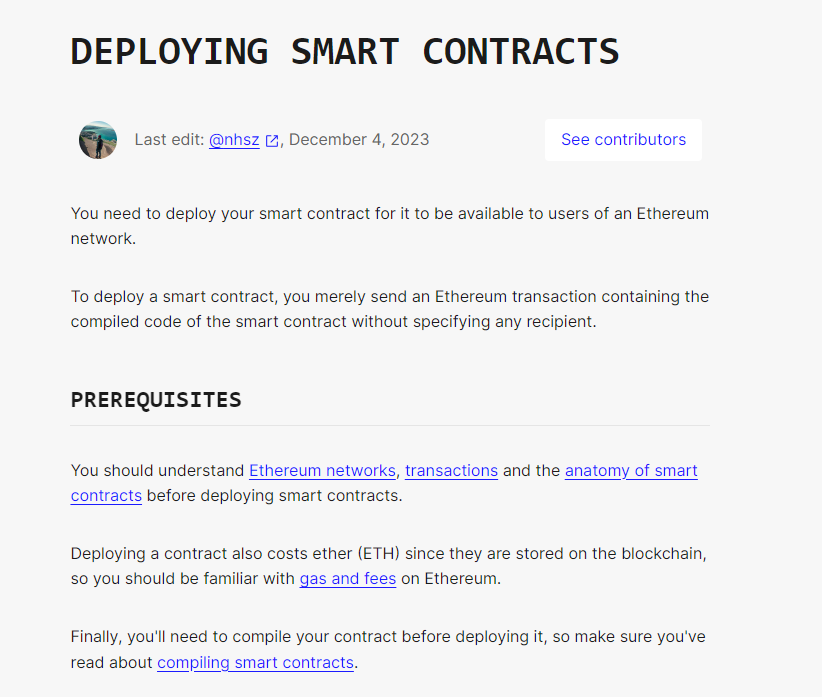

Deploying the Smart Contract

Once the code is written and verified, it can then be deployed. The smart contract is deployed directly onto the blockchain network (Ethereum), where it becomes immutable and tamper-proof. This means that the conditions cannot be altered or compromised, giving both parties guarantees of transparency.

This is one of the key elements that make smart contracts popular, as it protects those involved in the contract without the need for any legal or financial intermediaries to govern the transaction.

Execution and Recording on the Blockchain Ledger

Following its deployment, the smart contract automatically executes the specified actions when predetermined conditions are met. The execution of the contract is recorded on the blockchain ledger, providing transparency and immutability.

Transactions and contract interactions are visible to all participants on the blockchain network, ensuring trust and accountability. So, to go back to the example above, the smart contract will self-execute once the developer has sent the finished product, and the developer will receive their 1 ETH payment.

The Advantages of Smart Contracts

As seen above, there are various advantages of this programmable agreement, including transparency, automation of the contract, and immutability. These factors help to power the DeFi ecosystem by providing an infrastructure for secure transactions as well as governance without the need for any centralized operators.

Smart contracts essentially power Web3 by enabling participants to feel secure in knowing that there are structures in place to prevent a counterparty from exploiting the terms of an agreement.

Let’s look closer at the advantages of a smart contract in crypto.

Complete Automation

Smart contracts automate the execution of agreements, reducing the need for manual intervention and streamlining processes. This saves the time needed to verify conditions, making the transaction more efficient independently.

Full Transparency

Secondly, all transactions executed through smart contracts are transparent and traceable on the blockchain, enhancing trust and accountability. Due to the immutable nature of blockchain smart contracts, the conditions that govern them can never be doctored.

Decentralization and Trustlessness

Smart contracts operate on decentralized applications (dApps) and blockchain networks, meaning that there is no need for intermediaries. By eliminating the middleman, smart contracts foster trustless interactions between parties.

Most transactions on the ecosystem are usually between anonymous parties who do not know each other, for example, on a P2P exchange or decentralized lending platform. As such, the need for predefined and autonomous agreements is highly valued.

The Drawbacks of Smart Contracts

While there are obvious advantages to smart contracts, they also have disadvantages attached to them. The nature of smart contracts means that they are complex in nature, meaning that only experienced users can partake. Also, should a mistake be made, it is impossible to alter or change the conditions of the contract.

So despite the positives and the benefits they have on the ecosystem, this can come with drawbacks, especially for beginners. Here are some of the main ones of note.

High Complexity

One of the main drawbacks is the complex nature of this agreement. Writing and deploying smart contracts require technical expertise, making them inaccessible to those without programming skills. Creating a smart contract can be highly difficult for beginners in the space.

Immutability (Not Easy to Correct)

If you have managed to deploy a smart contract, this should be done as accurately as possible. Smart contracts are immutable and cannot be easily modified or corrected, posing challenges if errors are discovered after deployment.

Susceptible to Hacks and Exploits

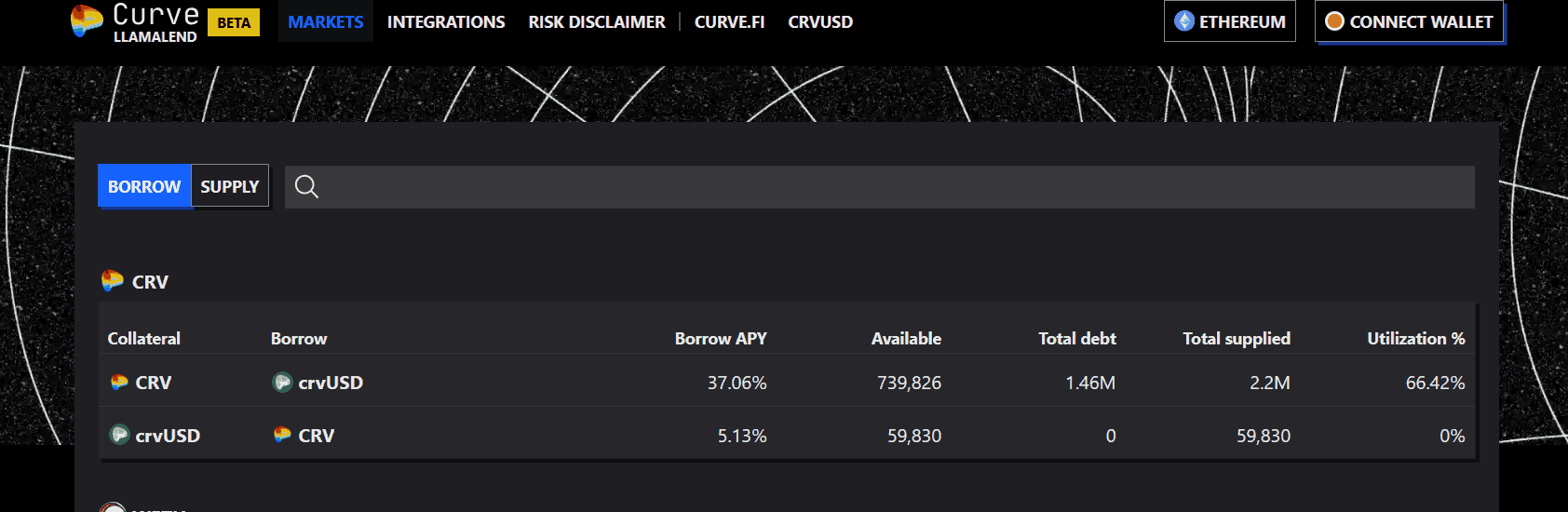

Smart contracts can be susceptible to vulnerabilities and exploits in their code, leading to potential security breaches that could lead to financial losses. This happened back in July 2023 when hackers stole $24 million worth of crypto by exploiting the Curve DeFi liquidity pool.

Types of Smart Contracts

There are many different types of smart contracts. Each offers an alternative set of use cases on the blockchain. Let’s go through them, as well as some real-world examples of how they are currently being implemented.

Financial Contracts – Lending and Borrowing

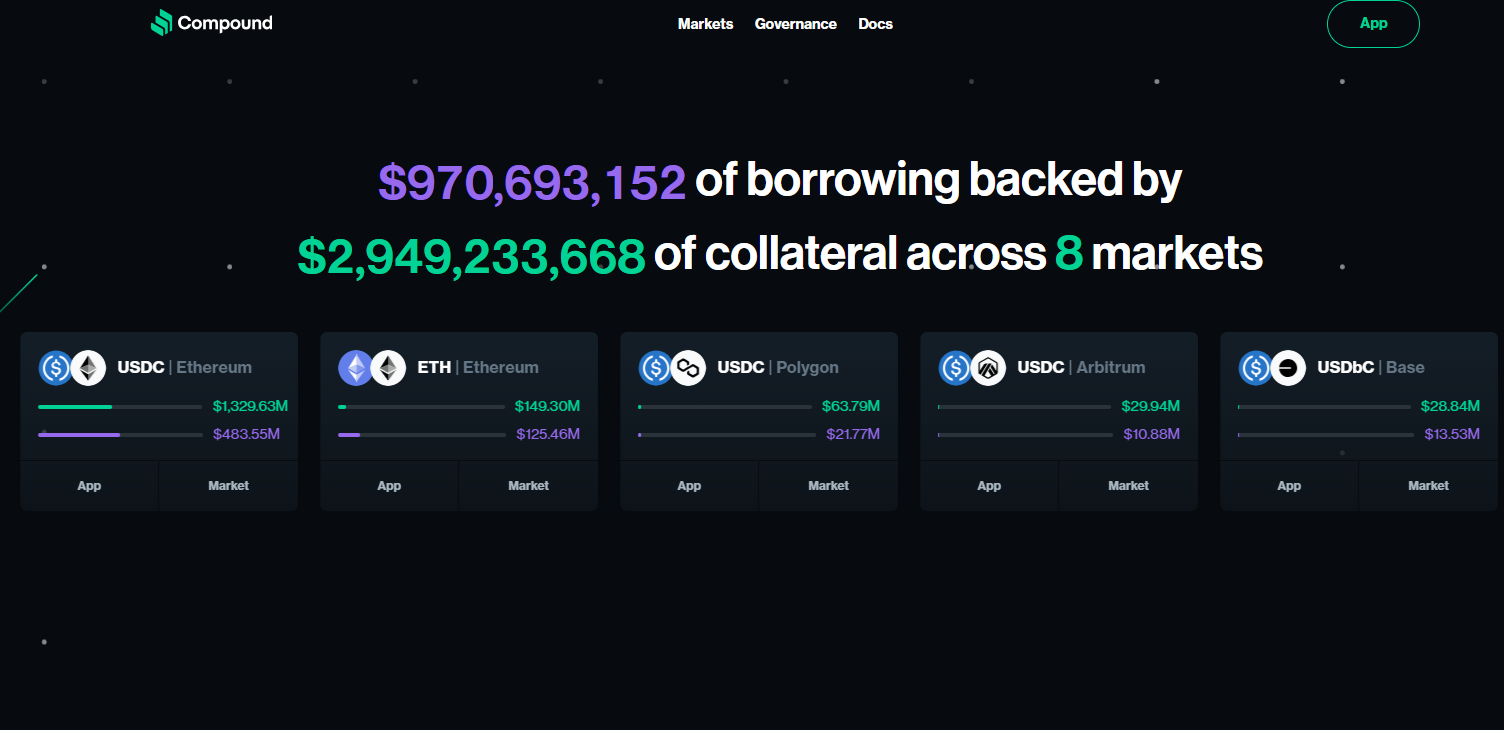

Financial contracts facilitate lending and borrowing activities without the need for intermediaries. These contracts automate the lending process, including interest rate calculation, collateral management, and repayment terms. One example of this type of smart contract project is Compound Finance, which is a decentralized lending protocol on the Ethereum network.

Compound allows users to lend and borrow various cryptocurrencies, earning interest or paying it based on market demand. The team behind Compound is launching a new project that bridges DeFi and traditional finance.

Tokenization Contracts – Representing Assets on Blockchain

Tokenization contracts represent physical or digital assets as tokens on a blockchain. These contracts tokenize assets, making them tradable and accessible on blockchain platforms.

Tether (USDT) is a good example of tokenization, as it is a stablecoin bringing liquidity to crypto by pegging to the value of the US dollar. Tether tokens are issued on various blockchain networks, providing users with a digital representation of fiat currency.

Supply Chain Contracts – Product Tracking

The next type of smart contract are supply chain contracts, which enable transparent and traceable tracking throughout the supply chain process. These contracts keep a record of product-related information on the blockchain, such as origin, manufacturing, shipping, and delivery details.

VeChain (VET) is a leading platform on the blockchain that focuses on supply chain management. VeChain’s technology allows businesses to track and authenticate products, ensuring quality control and combating counterfeiting.

Decentralized Finance (DeFi) Contracts

One of the most notable types of smart contracts is those centered around Decentralized Finance (DeFi). These contracts power a range of financial services without traditional intermediaries. They also facilitate activities like trading, lending, borrowing, and yield farming.

Uniswap, a decentralized exchange (DEX), is a good example of the use of DeFi contracts. Uniswap allows users to swap various ERC-20 tokens directly from their wallets without the need for centralized exchanges or governance. The U.S. SEC has targeted such exchanges and attempted to enforce regulations.

Governance Contracts – Organization Management

Finally, governance contracts manage organizational decision-making processes in a decentralized manner. These contracts define rules for voting, proposal submission, and protocol upgrades within decentralized autonomous organizations (DAOs).

MakerDAO, a decentralized lending platform and stablecoin issuer, operates with governance contracts that allow MKR token holders to vote on system parameters and changes.

How to Create Smart Contracts Without Coding

Throughout this smart contracts explained guide, it is clear that they are predominantly created using code; however, there are some alternatives. If you want to create a smart contract without coding, you can do this by using a smart contract platform or generator

Smart contract platforms

Some platforms offer easy-to-use interfaces for creating smart contracts without coding. These platforms give templates and drag-and-drop solutions, allowing users to design and deploy smart contracts with ease. Examples include Ethereum’s Remix IDE and Truffle before its sunset.

Additionally, you can add their desired contract specifications, such as token details, contract terms, and functionality requirements, and the generator produces the corresponding smart contract code for you.

Conclusion

After reading this guide, it should be clear that smart contracts represent a revolutionary advancement in blockchain technology, enabling the automated and transparent execution of agreements and transactions.

While traditional smart contract development requires coding skills, user-friendly platforms, and tools have simplified the creation process. These allow non-developers to also participate in the blockchain ecosystem and the world of DeFi. As smart contract adoption continues to grow, new platforms like Uniswap and Tether will be formed, creating a massive opportunity for early investors.

FAQs

What is a smart contract in simple terms?

A smart contract is a self-executing digital contract that operates on blockchain technology. The contract is executed when specific conditions are met.

What is an example of a smart contract?

An example of a smart contract is a digital agreement for the automated transfer of funds when predetermined conditions are fulfilled.

What is the point of a smart contract?

The main purpose of a smart contract is to automate and enforce the terms of a contractual agreement without the need for intermediaries or governance agencies.

What are the disadvantages of smart contracts?

Smart contracts can be complex, and they cannot be changed once they have been deployed. They can also be susceptible to hacks and exploits due to vulnerabilities in the code.

References

- Compound Finance launches new DeFi platform (Fortune)

- Stablecoins bringing liquidity into crypto (CNBC)

- SEC targets unregistered DeFi exchanges (Reuters)

- Attackers steal $24 million worth of crypto (Yahoo Finance)

Kane Pepi

Kane Pepi