What Is Altcoin Season and When Is It Coming?

The start of the year has seen cryptocurrency markets trending upwards, with both Bitcoin and altcoins providing profitable opportunities to investors. Despite Bitcoin hitting new highs, most new traders have been focused on altcoins to seek profits. As such, understanding the “altcoin season” concept has become increasingly important.

Altcoin season is the period within the market cycle when alternative cryptocurrencies, or altcoins, experience significant price surges and outperform Bitcoin in terms of value gained. This phenomenon often accompanies a surge in trading volume and overall market activity, driven by increased investor interest in exploring alternative investment opportunities beyond Bitcoin.

In this guide, we will break down the alt season, when it is expected to occur, and explore how to take advantage of it.

Summary: What Is Altcoin Season?

Altcoin season typically occurs when the prices of alternative cryptocurrencies soar significantly higher and outperform Bitcoin. Typically, a surge in market activity, trading volume, and overall bullish sentiment toward altcoins summarize the beginning of the altcoin season. It is important to note that altcoin season is not a fixed event and can vary in duration and intensity.

While altcoin season can offer investors lucrative profit opportunities, it does come with increased risks and market volatility. In order know what the best altcoins to buy are, you will need to fully understand the various dynamics of altcoin season, its triggers, and general indicators.

Altcoin Season vs Bitcoin Season

It is important to note that altcoin season and Bitcoin season represent two distinct phases in the cryptocurrency market cycle.

Firstly, Bitcoin season refers to periods when Bitcoin’s price experiences significant growth and dominance over altcoins. Bitcoin recently surged to a record high in March 2024 following the launch of several Bitcoin ETFs. The move saw Bitcoin almost double in value in just under two months, outperforming alternative cryptos in the process.

In contrast, altcoin season occurs when altcoins surpass Bitcoin in terms of price appreciation and market capitalization. While Bitcoin season is often associated with a more stable market environment, altcoin season is characterized by heightened volatility and trading activity.

Tokens like Solana and meme coins like Dogwifhat have seen substantial growth in recent months. However, the overall trading activity has been skewed toward Bitcoin as a result of the U.S. Securities and Exchange Commission approving several Exchange-Traded Funds products.

History of Previous Altseasons

Previous altcoin seasons have witnessed remarkable surges in various altcoin prices, with some experiencing exponential growth within relatively short periods. Examples of notable altcoin seasons include the bull runs of 2017-2018 and 2020-2021.

These historical precedents serve as valuable reference points for understanding the dynamics of altcoin seasons and their potential impact on the cryptocurrency market. Let’s take a look at them in more detail.

2017-2018

This altcoin season was spurred by a huge drop in Bitcoin dominance, going from 86.3% in late 2017 and then falling to a low of 38.69% at the start of 2018. During that period, the price of Bitcoin went from a then-record high above $20,000 to trading under $6,000 a few months later.

The surge in altcoins outperforming Bitcoin came as the initial coin offering (ICO) market was in full swing in 2017-2018. Many blockchain projects launched ICOs to raise funds by issuing their own tokens. These include EOS, which raised over $4 billion, making it one of the most successful presales in history. Tezos was another strong-performing altcoin during this period after raising $232 million for its ICO.

2020-2021

The altcoin season of 2020-2021 came during the coronavirus pandemic and as retail traders and crypto degens looked for investment opportunities outside of Bitcoin. This resulted in the birth of modern meme coins, with Dogecoin and Shiba Inu recording historic levels of growth.

Non-fungible tokens (NFTs) were also boosting the altcoin markets, helping to increase sentiment around the wider crypto and blockchain market. During this time, Bitcoin dominance plunged from 70% to 38%, while the market value held by altcoin doubled from 30% to 62%.

Signs That a New Altcoin Season Has Begun

After seeing examples of previous cycles, you may be asking, “When is the next altcoin season?” Getting to invest in next altcoin season coins is an exciting prospect for cryptocurrency enthusiasts, as it often leads to significant price gains.

However, identifying the onset of an altcoin season requires a strong understanding of market cycles and trends. Let’s explore some key signs that may signal the beginning of a new altcoin season.

Increase in Altcoin Dominance

One of the primary indicators that signal the start of an altcoin season is a noticeable increase in altcoin dominance within the overall cryptocurrency market. Altcoin dominance refers to the collective market capitalization of all cryptocurrencies, excluding Bitcoin, expressed as a percentage of the total cryptocurrency market cap.

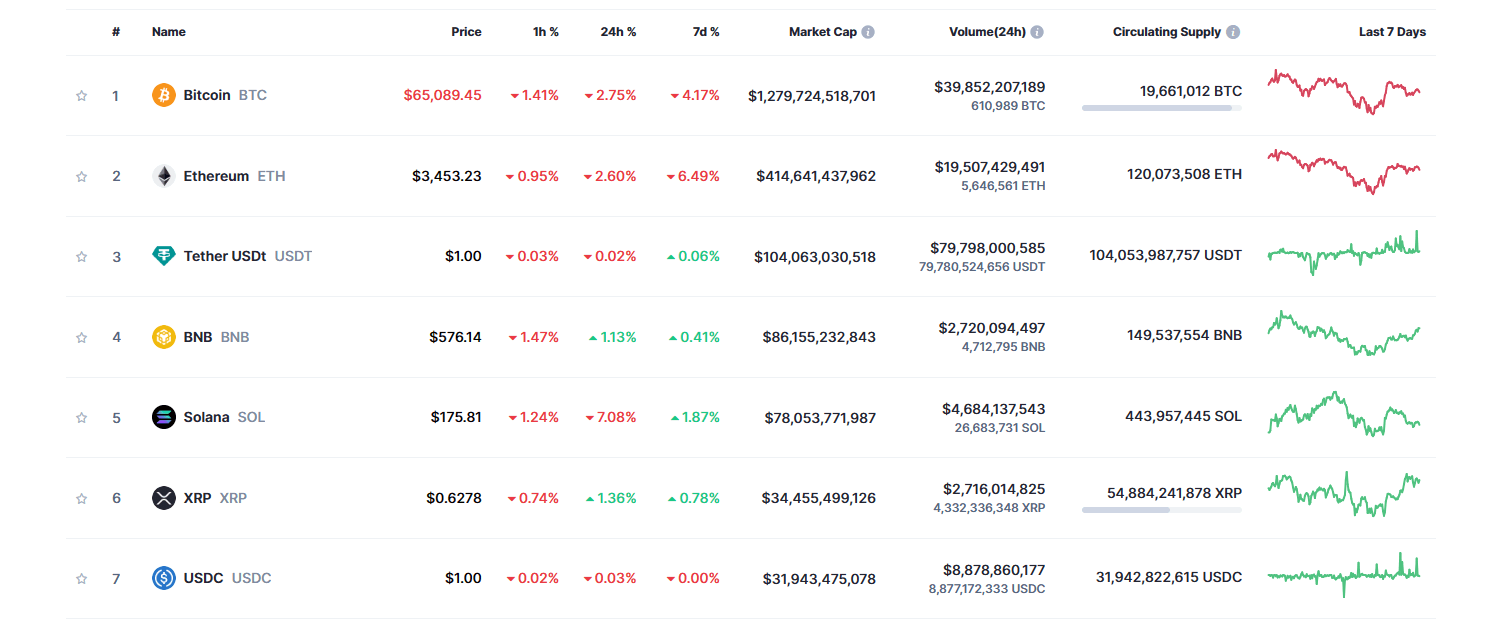

According to CoinGecko, Bitcoin’s market dominance stands at 50.15% of the total market capitalization. When altcoin dominance begins to rise, it suggests that crypto investors are increasingly allocating capital to alternative cryptocurrencies, indicating a potential shift in market sentiment towards altcoins and the beginning of altcoin season.

Rising Trading Volumes

Another significant sign of the start of altcoin season is a surge in trading volumes across various altcoins. Increased trading volumes indicate heightened crypto market activity and investor interest in altcoins, leading to greater liquidity and price volatility.

By monitoring trading volumes you can gain valuable insights on sentiment in the market and the strength of an emerging altcoin season. The Tether (USDT) stablecoin usually has the highest trading volume due to it being used as an exchange currency, followed by Bitcoin and then Ethereum.

Altcoin Season Index

Some cryptocurrency analytics platforms offer specialized indices designed to track and measure the performance of altcoins relative to Bitcoin.

An altcoin season index aggregates data from the top 50 altcoins and analyzes their price movements to determine whether an altcoin season is underway. Investors can use these indices as a tool to gauge the overall health and momentum of the altcoin market, helping them make informed investment decisions.

Typically, when the altcoin index is at a reading of 75% and above, it is a sign that an altcoin season has started. Currently, it is at 69%, according to the Blockchain Center.

Coin Price Breakouts

Finally, significant price breakouts and upward momentum in the prices of various altcoins are clear indicators of the onset of an altcoin season. As investors flock to altcoins in search of potential opportunities, prices may experience sharp and sustained increases, breaking through key resistance levels and forming new highs.

Solana is a good example of this and has recently broken out of its $200 resistance level. However, it remains below a record high at $260. Monitoring price breakouts like this and identifying potential bullish trends can serve as early indicators of an impending altcoin season.

Is It Altcoin Season Now in 2024?

Although there have been strong performances from several altcoins like Solana and Dogwifhat, as well as various successful crypto presales, altcoin season hasn’t yet started in 2024.

However, as the Bitcoin halving approaches, altcoins are poised for a resurgence. K33 Research identified a pattern resembling past altcoin rallies, hinting at their imminent rise and suggesting the onset of a brand new altcoin season.

Moreover, analysts anticipate Ethereum hitting $4,500-5,000 and altcoins yielding significant returns. With historical trends and recent dynamics aligning, the crypto market braces for an altcoin season, offering investors promising opportunities.

When is the Next Altcoin Season Coming?

It is hard to predict the timing of the next altcoin season due to the unpredictable nature of the cryptocurrency market. Factors such as regulatory developments and macroeconomic trends can influence the timing and duration of altcoin seasons. However, the next altcoin season seems closer than ever.

One key factor that could be the trigger to the next altcoin season will be interest rate cuts by the U.S. Federal Reserve. As seen during the last altcoin season in 2021, markets surged as a result of lower interest rates, meaning investors deployed capital away from banks and looked for higher-return investments.

The Fed expects to cut rates up to three times this year, which could help trigger the start of altcoin season. So, for those asking, “Is it altcoin season?” keep a close eye on crypto market trends and stay informed about industry developments.

How to Take Advantage of Altcoin Season

As the next altcoin season approaches, it is important to know how you can capitalize on potentially profitable opportunities. Let’s explore some of these points to consider below.

1) Research and Diversify Holdings

Firstly, research is key when navigating and participating in the market during an altcoin season. Take your time and thoroughly analyze the fundamental and technical aspects of potential investments to find the best altcoins to buy.

Once you do so, you will also need to diversify. Exploring different altcoins can help spread risk and maximize potential returns and ensures not all of your eggs are in one basket. By conducting thorough research and diversifying your portfolio, your overall chances of success will greatly increase.

2) Time Your Entries and Exits

Another important point is timing. Consider using technical analysis tools like support and resistance, and relative strength index (RSI) to identify optimal entry and exit points for trades.

These can be good altcoin season indicators and will help you monitor price trends and crypto market sentiment before deciding to buy. Experienced investors use such tools to make informed investment decisions, like when to take profits. Setting clear entry and exit strategies can be vital in minimizing losses and maximizing gains during periods of heightened volatility.

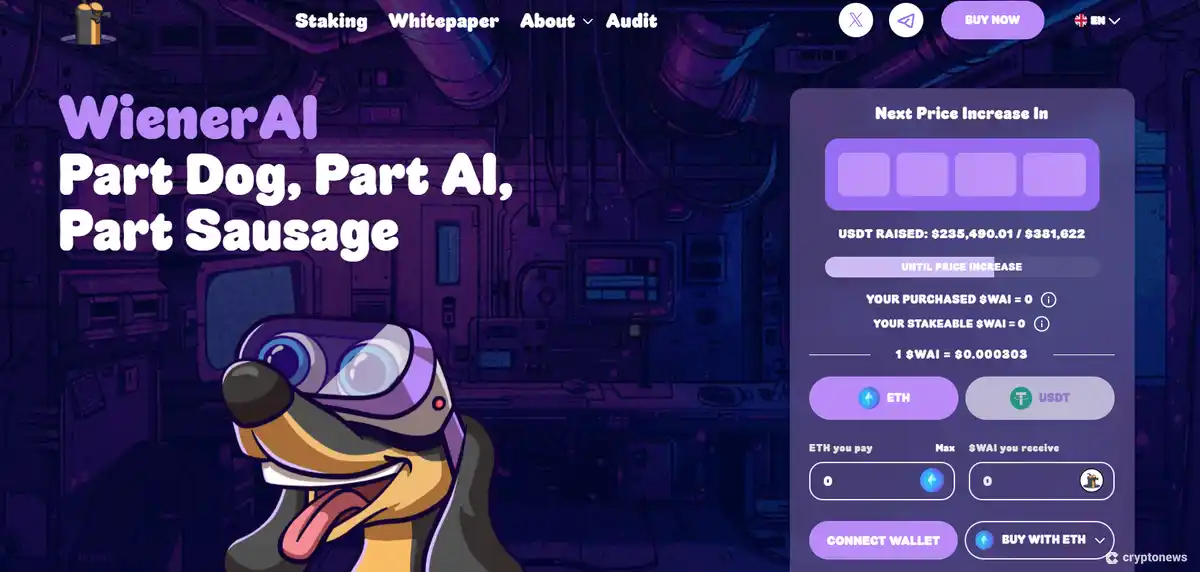

3) Buy New Altcoins in Presale

Participating in presale events for new altcoins can offer early access to promising projects at discounted prices. Research upcoming initial coin offerings (ICOs) and presale opportunities to identify innovative projects with strong growth potential.

Investing in presale altcoins allows you to secure positions in projects before they gain widespread attention, potentially leading to substantial returns as the project develops and matures. Wiener AI, Dogeverse, Smog, and Sponge V2 are examples of the best presales in the market.

Risks of Trading During Altcoin Season

While altcoin seasons present lucrative opportunities, it can also carry inherent risks that you should be mindful of:

1) Extreme Volatility

Altcoins are known for their extreme volatility, with prices often experiencing rapid and unpredictable fluctuations. This volatility can lead to significant gains but also exposes investors to the risk of substantial losses. It’s essential to exercise caution and employ risk management strategies to mitigate the risks of investing in high volatility crypto. This is where diversification can come in handy.

2) Pump and Dump Coins

Some projects may be pump and dump schemes or rug pulls, so it is important to know how to avoid these. This is where prices are inflated by coordinated buying activity before being rapidly sold off, resulting in substantial losses for unsuspecting investors.

An example of this is EthereumMax, which used Kim Kardashian to help promote its brand prior to defrauding investors. Be wary of projects exhibiting suspicious price movements or overly aggressive marketing tactics.

3) Buying at Overvalued Prices

FOMO (Fear of Missing Out) can lead investors to buy altcoins at overvalued prices during periods of market excitement. However, buying at inflated prices increases the risk of losses if prices subsequently correct, which is typically a 30-40% drop. You must stick to investment strategies that are based on thorough research and analysis.

Conclusion — Is It Altcoin Season?

Investors are gearing up for the next altcoin season, and with a 69% reading on the altcoin season index, it is clear why. Although it offers profit opportunities, investors should exercise caution, conduct thorough research, and be prepared to navigate the risks associated with volatile market conditions.

Stay informed with market trends and build sound investment strategies when the next cycle begins; you can potentially capitalize on the opportunities.

FAQs

Is it currently altcoin season?

Although it is close, we are not quite yet in altcoin season. According to the altcoin season index, 75% of the top 50 altcoins need to be outperforming Bitcoin for the new cycle to begin.

How long does alt season last?

Altcoin seasons can last anywhere from several weeks to several months. This depends on the market conditions at the time.

What was the last altcoin season cycle?

Q4 of 2023 was the last altcoin season, with $WIF, $PEPE, $SOL, and lesser-known altcoins making significant gains as markets responded to the optimism of the U.S. SEC approving crypto ETFs.

What is the altcoin season index?

The altcoin season index is a metric used to assess the overall strength and activity of the altcoin market relative to Bitcoin.

References

- Bitcoin surges to new record high above $63,000 (CNBC)

- Two jobless brothers become millionaires following meme coin investment (CNN)

- This Week in Crypto: Market Exuberance (K33 Research)

- U.S. Federal Reserve interest rate cut looms (USA Today)

- Kim Kardashian pays fine following endorsement of pump and dump (BBC)

Michael Graw

Michael Graw

Eric Huffman

Eric Huffman