MEXC Review 2024 - Is the MEXC Exchange Safe?

- Diverse selection of crypto

- High liquidity across trading pairs

- Robust security measures

MEXC is a popular crypto exchange, but is it safe enough for new crypto enthusiasts in 2024?

In this MEXC review, we cover MEXC fees, its bonuses, payment methods, customer service, security, staking, and more to save you the time and effort of researching and comparing it with other platforms on your own. So, let’s get started!

Our MEXC Review in a Nutshell

Among so many crypto exchange options, MEXC provides a platform that offers spot and perpetual trading on a multitude of cryptocurrencies at zero fees. It also allows its users to copy-trade its top traders, invest in new and promising crypto projects, and take advantage of its unique bonuses and competitions.

- Wide selection of crypto to choose from

- High liquidity across trading pairs

- Yield farming opportunities

- Strong security measures in place

- Limited fiat support

- Delay in customer service

- Consumer complaints

Where MEXC Excels

Established in 2018, the Seychelles-based MEXC is a centralized cryptocurrency exchange (CEX) that caters to more than 10 million users around the world with localized language support. With billions of dollars in trading volume, the exchange offers deep liquidity to both spot and futures traders. MEXC’s multi-tiered, multi-cluster system architecture boasts a matching engine technology of up to 1.4 million orders per second.

Meanwhile, its wide range of crypto support ensures that traders will find their favorite and trendy coins to take full advantage of the crypto market. If users prefer, they can trade these vast varieties of altcoins on high leverage. In addition to trading, MEXC Global offers flexible and fixed crypto staking options to earn yield. Moreover, there are Launchpad and Kickstarter options for investors to make the most of their funds and join promising projects at an early stage.

MEXC is best for:

- Traders who want to trade a wide and wild variety of crypto assets at an extremely low fee

- Those who want to invest in crypto projects early on

- Those who want to copy trade other experienced crypto investors

An Overview of the MEXC Exchange

| Category | Our Rating (out of 5) | Comment |

| Number of coins | 4.5 | 1,963 |

| Trading fees | 4.5 | 0% for spot Bitcoin trading |

| User experience | 4 | Easy to use |

| Staking | 4 | USDT, BTC, ETH, USDC, and more |

| Features | 4.5 |

|

| Trustworthiness | 3 | Regulatory warnings & Poor reviews |

| Customer service | 4 | Help Center, Email, Chatbot, Submit an Enquiry, Report Abnormal Funds, & Social Media |

MEXC Supported Cryptos

With more than $1 billion in trading volume, MEXC offers deep liquidity, which makes it easier for traders to find the best prices and execute trades quickly. As for supported crypto, this exchange offers a wide range of cryptocurrencies for you to trade. Its total crypto count is close to 2,000, with more than 2,350 pairs available for trading. In this area, MEXC compares well with other popular options such as Binance, Coinbase, OKX, and Kraken, all of which have between 200 and 400 coins listed on their platform.

Similarly, in terms of MEXC crypto trading pairs, it offers far more options than these platforms, which support less than 1,000 pairs, except for Binance, which has over a thousand markets.MEXC’s spot market is pretty vast and diverse, comprising categories like BRC20, Bitcoin ecosystem, Solana ecosystem, Bitcoin inscription, meme coins, GameFi, ZK, RWA, SocialFi, POW, Web3, privacy, metaverse, innovation, Layer 1, Base Chain, stablecoins, NFTs, and more. The exchange also has a native token, MX, which hit an all-time high of $3.70 in early Dec. 2021. MEXC uses 40% of its profits to buy back and burn its exchange token, which is used across its other programs, such as Kickstarter, Launchpad, fee discounts, new token listing voting, and higher commission ratios.

MEXC Spot Trading Fees Explained

To compete in the fast-moving and highly competitive crypto market, MEXC has kept its trading fees considerably low. Both the maker and taker fees for the spot market are zero at MEXC. This zero spot trading fee promotion applies to all spot trading pairs on the exchange. In comparison, the largest crypto exchange, Binance, charges a 0.1% maker and taker fee to its regular customers. While the platform offers discounted fees via its exchange token BNB, its users will still incur a fee of 0.075%. Meanwhile, the publicly-traded Coinbase (COIN) imposes an even higher fee rate, starting from a 0.4% taker fee and 0.6% maker fee. Hence, MEXC users are clearly at an advantage here.

MEXC Futures

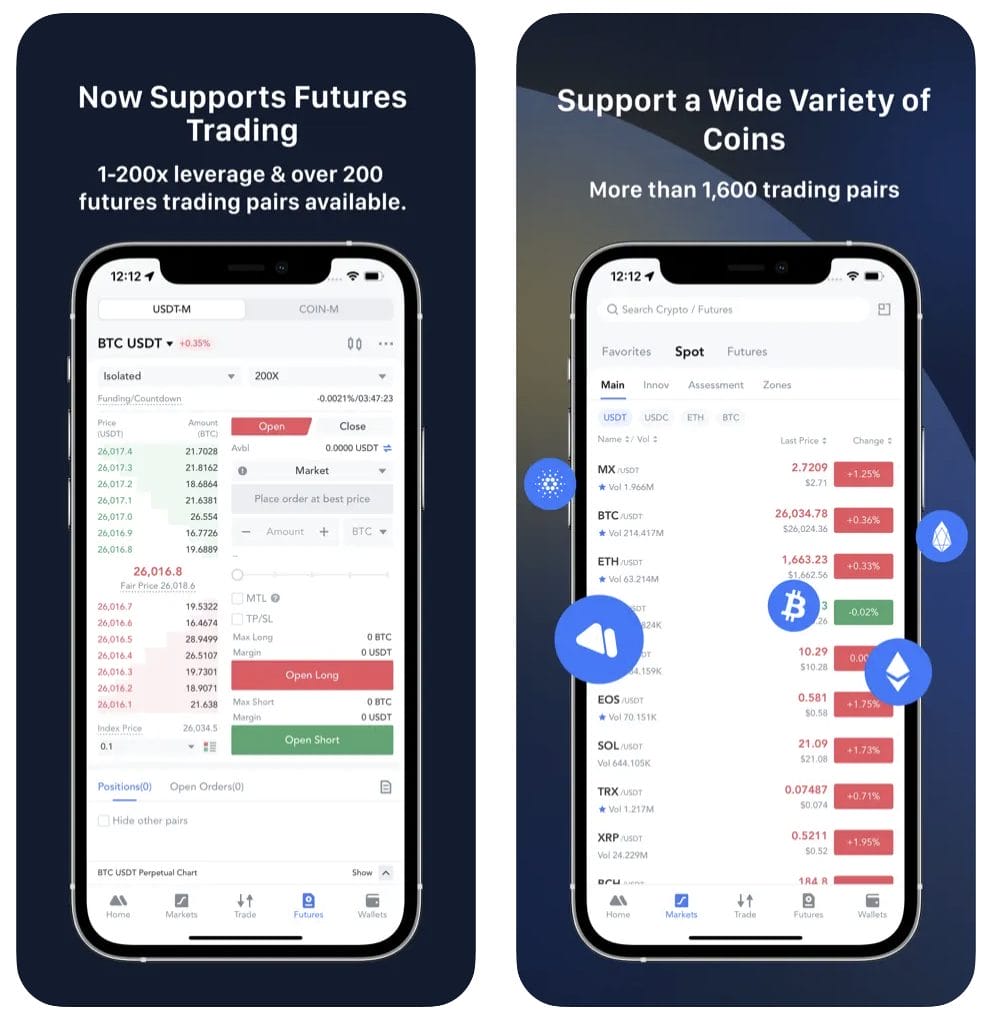

When it comes to futures trading, MEXC has two types of perpetual products: contracts that use USDT as collateral (USDT-M) and contracts that use the underlying crypto as collateral (COIN-M). As of writing, the centralized exchange is handling nearly $7 billion in volume and recording $1.75 billion in open interest. On MEXC, you can receive up-to-the-minute information on futures trades and position status, alongside insights on long/short balance and liquidation events.

Leverage & Demo Trading

MEXC offers the most amount of perpetuals at 399 pairs. Additionally, the platform offers leverage as much as 200x on both short and long positions that you can adjust freely. You can leverage trade anything from SOL, LPT, ENS, AR, DOGE, FIL, MATIC, INJ, SUI, ARB, RNDR, SHIB, TIA, APT, BNB, WIF, JTO, AI, PENDLE, and many more. At MEXC, you can take advantage of the demo trading before putting your hard-earned money into the market. Demo trading simulates real-life futures trading without risking real assets, allowing you to get the hang of the product, exchange, and market.

Futures Fees

MEXC charges no futures trading fees from markets. However, for those placing market or limit orders, MEXC will charge them a taker fee of 0.010%.On top of extremely competitive fees, MEXC offers its VIP members even more exclusive fee rates. Becoming a VIP customer grants users access to OTC deposits and withdrawals, exclusive privileges, and more.

Copy Trade

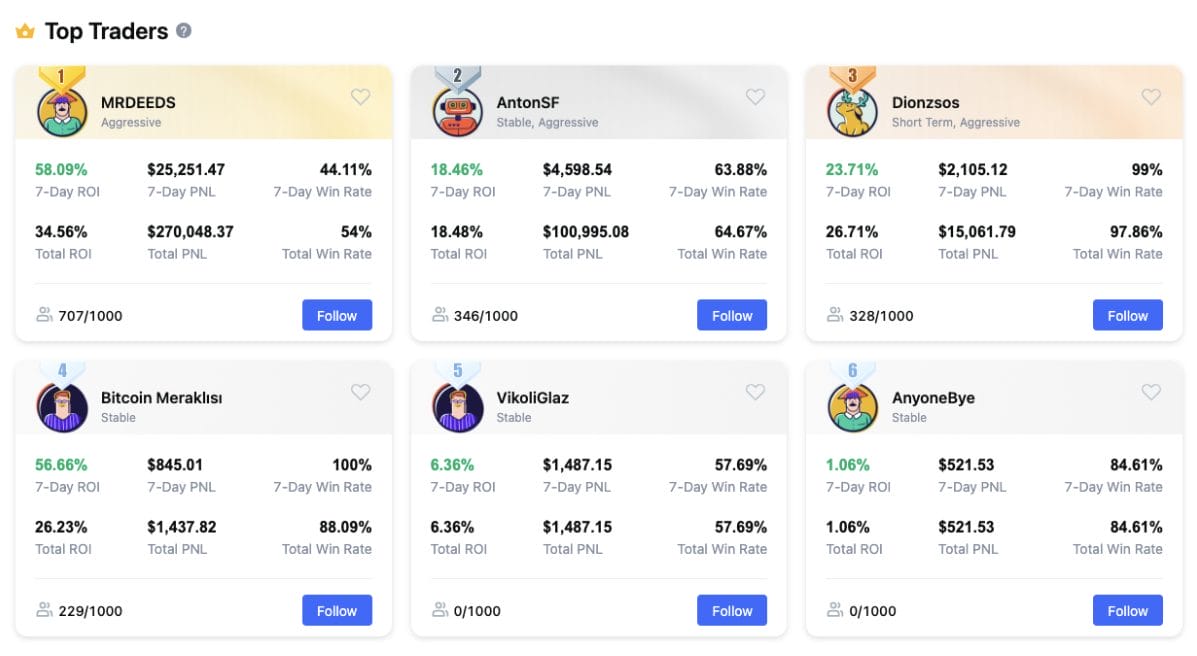

At MEXC, you can copy the trades of other successful traders. You simply have to pick the best trader you want to copy based on their performance. The platform provides a big list of professional traders with their respective 7-Day ROI, 7-Day PNL, 7-Day Win Rate, Total ROI, Total PNL, Total Win Rate, and Followers to make it easy for you to make your choice. While users can benefit from the experience and success of other traders via the Copy Trading feature, by allowing others to copy their trades, traders can earn up to 15% of their followers’ profits.

MEXC Bonuses & Competitions

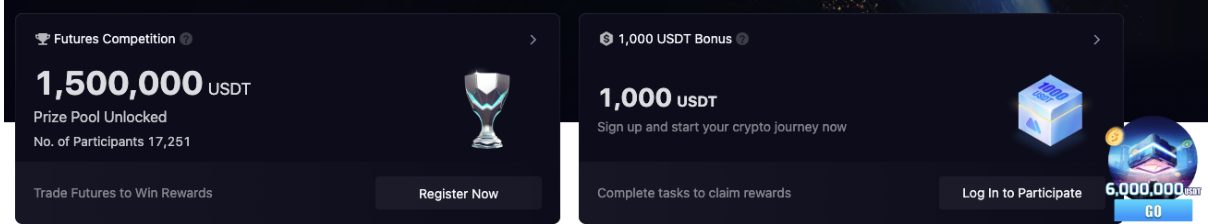

When signing up with MEXC, the exchange offers a 1,000 USDT bonus to start your crypto journey. To claim the bonus, you just have to create an account and complete a series of tasks. However, it is important to note that the 1,000 USDT bonus is actually divided among 15 tasks, with each task offering between 5 to 500 USDT.

These tasks primarily include making a minimum transfer amount and maintaining a particular trading volume. Moreover, you also have to complete your first Flash Close, place a Take Profit & Stop Loss (TP/SL) order, use leverage, and invite new users to complete KYC. Besides the USDT sign-up bonus, MEXC also runs competitions regularly. Currently, the February futures competition is offering a 6 million USDT prize pool. Those with total futures account equity of more than 200 USDT are eligible for this competition.

Is the MEXC app safe?

MEXC is a multi-platform exchange that allows you to trade tokens on the go through its app. The app is available on iOS and Android for mobile devices, while its desktop app is supported for Windows.

Apple device users can download the app from the App Store, where the MEXC app has a rating of 4.0. The app supports iOS 12.0 or later. As for Android users, the app is available on Google Play, where it has achieved more than a million downloads and a rating of 3.8. During our MEXC app review, we found that the MEXC application is pretty clear and intuitive, with both dark and light modes available for users to choose from. On the app, you can easily choose to trade spots and futures, slide your leverage, and open long or short positions by simply clicking on buttons and then filling in the required details.

Moreover, Home, Markets, Trade, Futures, and Wallets options are available at the bottom of the page for easy access. Through this all-in-one digital services platform, you can manage your portfolio easily while enjoying high execution speeds and low fees. Here, you can instantly buy USDT with Visa and MasterCard or purchase crypto via P2P and third parties. You can further try its Launchpad, Kickstarter, PoS pool, MX zone, and other services on the MEXC app.

MEXC Staking Options

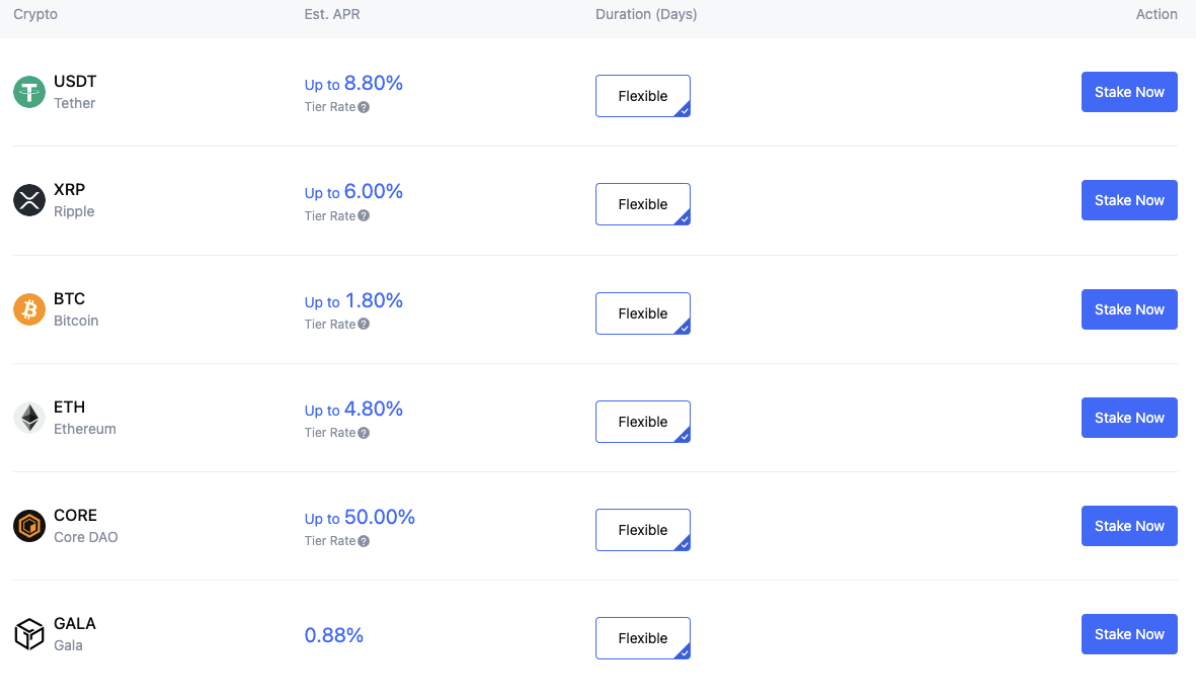

For those looking for yield-earning opportunities, MEXC has a few options for you. These staking options are available via MEXC Savings, under which two types of products are offered: Locked savings and Flexible savings. Under Locked Savings, you stake your crypto for a certain period, and for that specified duration, you can’t trade, transfer, withdraw, or use it in any way. So, those who wish to lock and hold their crypto for the long term can go with this option.

The other option is Flexible Savings, where staked assets automatically generate yield once activated. These locked-up assets can be traded, transferred, or withdrawn at any time. USDT, ETH, BTC, DOGE, SHIB, GALA, DYDX, SHIB, TRX, ETHW, and USDC are supported under flexible savings.

MEXC’s Simple Earn option meanwhile allows you to earn yields on USDC, USDT, ETH, and BTC at 1.25%, 0.95%, 0.55%, and 0.38% APR, respectively, for an extremely low minimum requirement. It has a mandatory minimum 1-day lock-up period. Furthermore, the exchange’s new product, MEXC Loan, allows you to collateralize one cryptocurrency to borrow another for trading or investing. Currently, you can borrow about USDT against TON for a 0.01% daily interest. You have the option to choose among three time periods (30, 60, or 90 days), with no partial repayments allowed.

Additional Earning Opportunities

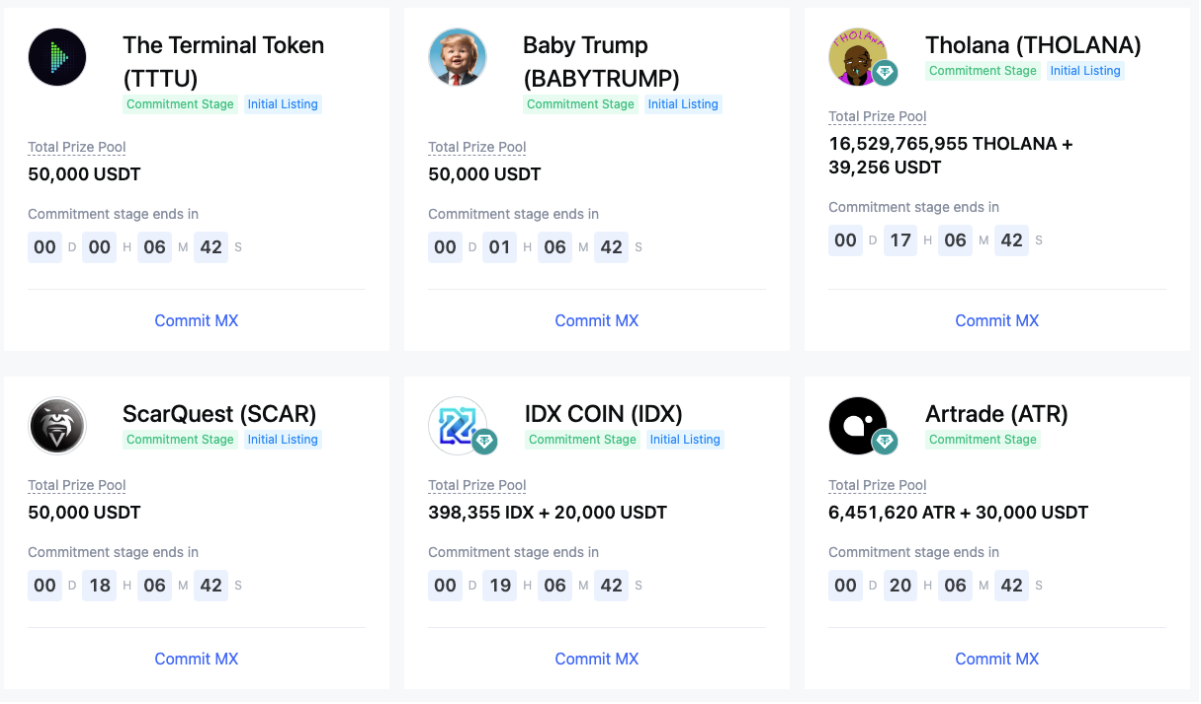

At MEXC, there are other ways to enhance your earnings. For instance, the platform offers exclusive MX events, where customers can use their exchange tokens to participate in exclusive airdrop events and win more rewards. This opportunity is available via Kickstarter and Launchpad.

Kickstarter offers an APY of 102.89% and Launchpad 2.44% APY. In the past 30 days, over 200 projects have launched via MEXC Kickstarter. However, during our MEXC Global review, we found that to participate in either of these events, users need to hold a minimum of 1,000 MX for at least 30 consecutive days.

What Payment Methods Does MEXC Offer?

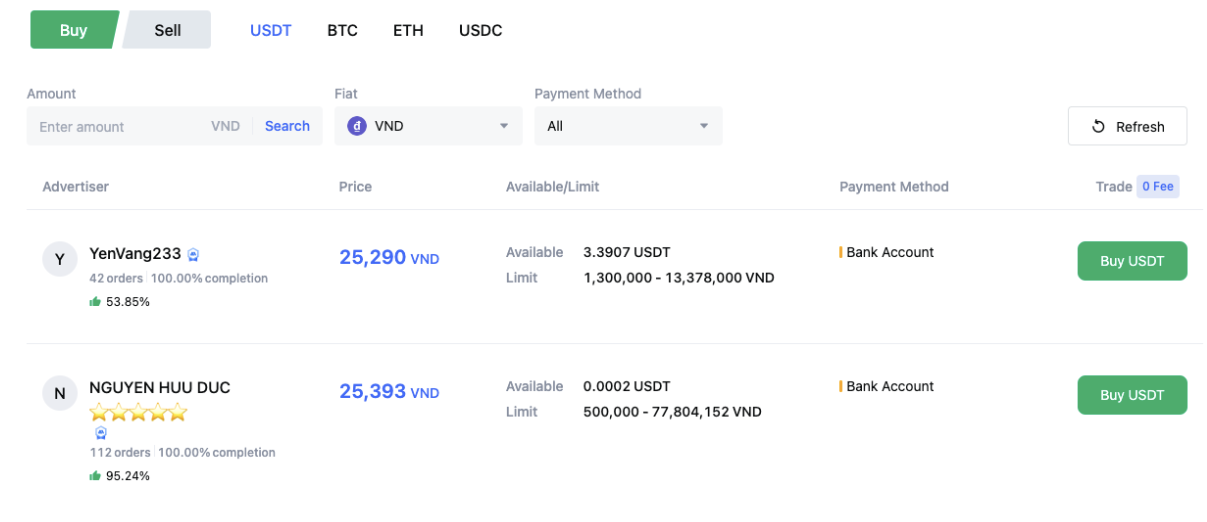

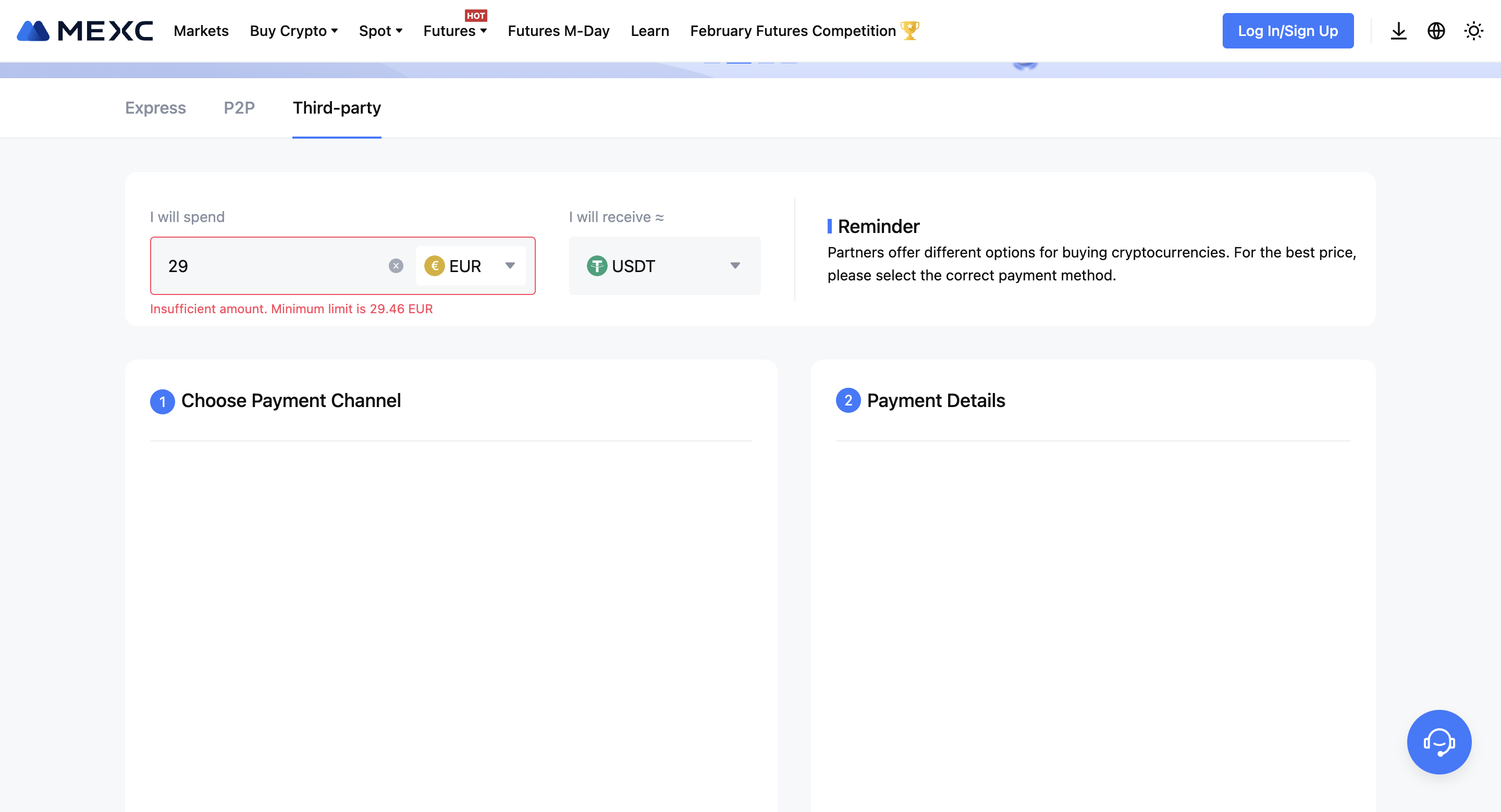

Crypto purchases are supported at MEXC via Express, P2P, and Third-party methods. For the Express option, the fiat services are operated by MEXC Estonia OÜ. Here, you have to select the buy tab, choose the currency to pay, crypto to buy, and the suitable payment method. The peer-to-peer method is supported for USDT, USDC, BTC, and ETH against VND, RUB, and KRW through bank account, MoMo, ZaloPay, and ShopeePay-SEA. MEXC supports P2P trades with zero fees. You simply have to choose the desired price and payment method, pay the seller, and receive your crypto.

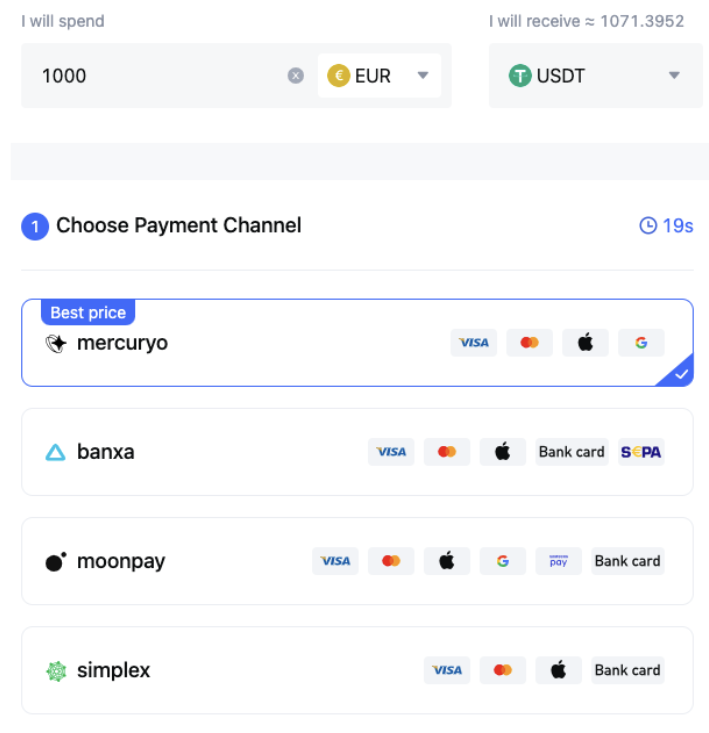

Third-party payments are supported by Mercuryo, Banxa, MoonPay, and Simplex via Visa, Mastercard, Apple Pay, Google Pay, Bankcard, and SEPA. This option supports many fiat currencies like EUR, GBP, USD, VND, BRL, KRW, JPY, KZT, TRY, HKD, AUD, PHP, NGN, INR, TWD, EGP, THB, BDT, CHF, UAH, and IDR.

Minimum Deposit

Deposits at the MEXC crypto exchange are free. When making deposits through a third party, the minimum required amounts are 29.46 EUR, 22 GBP, 50 USD, 60 AUD, and 50 CHF when buying USDT.

For those opting for the Express option, the minimum amount will be 10 EUR, 8.5 GBP, 10 USD, 40,000 KRW, 6,000 JPY, 60 AUD, and 50 CHF when buying USDT.

Withdrawal Times

You can withdraw both fiat and crypto from MEXC. Crypto withdrawals can be made to an external wallet, and fiat withdrawals can be made via P2P. However, bank transfer withdrawals are available only via SEPA for KYC-verified users in the UK and Germany. Meanwhile, P2P selling is available for KYC-verified users in Vietnam, South Korea, and Russia.

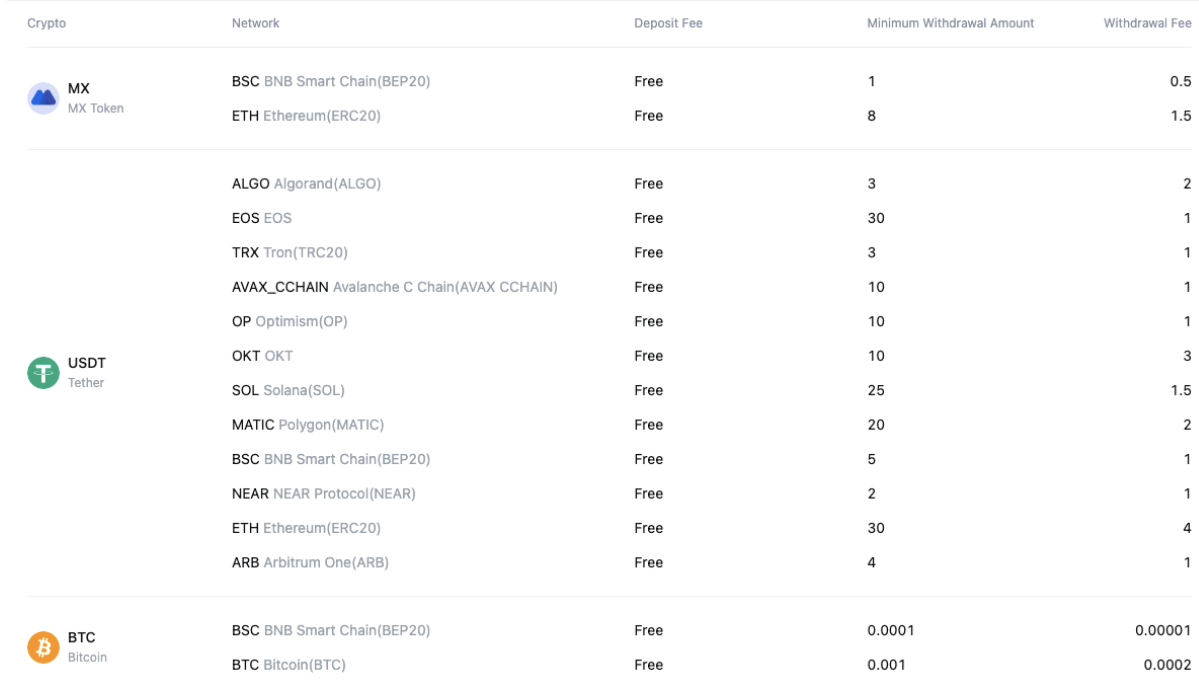

To make crypto withdrawals, visit the website, go to MEXC Wallet, select withdrawal, choose your crypto, fill in the withdrawal address, select the network, and input the withdrawal amount. After successfully entering the email verification and Google Authenticator codes, the withdrawal will be processed. The minimal withdrawal amount and fees differ for each coin.

MEXC Customer Service

Customer support at MEXC is available through various channels. You can explore its extensive Help Center, where you’ll find answers to most of your queries, ranging from platform usage, security, OTC, updates, and related information. If you wish to connect to a human for your questions, you can submit an inquiry or email them at [email protected]. Online support is also available via chatbot. Additionally, MEXC provides a form for reporting abnormal funds, which is for those who believe their stolen or defrauded funds have ended up at the exchange.

MEXC also maintains a presence on social media via Telegram, Twitter, Facebook, Instagram, YouTube, Reddit, Discord, TikTok, Line, LinkedIn, Medium, and TeleType. In terms of customer satisfaction, it has a rating of 1.9 on Trustpilot. This is in line with other top crypto exchange ratings, such as Coinbase, which has a 1.5 rating. However, MEXC does have a trust score of 8 out of 10 on CoinGecko.

Is MEXC a Trusted Platform?

When looking at the trustworthiness of any platform, it’s crucial to start with its location. So, where is MEXC exchange located? It is registered and headquartered in Seychelles, which is known for its less stringent financial regulations. In 2020, the platform obtained a financial service license issued by the AUSTRAC, which allows it to conduct digital currency exchange, wallet, and remittance services. MEXC also has an MSB license in the US as well as an Estonian MTR license to serve European clients.

However, amidst the changing crypto regulatory landscape, MEXC has received several warnings from authorities. In 2023, the British Columbia Securities Commission (BCSC) in Canada, the Austrian Financial Market Authority (FMA), and Germany’s Federal Financial Supervisory Authority (BaFin) issued warnings against the platform. Also, in Nov. 2023, the Estonian FIU revoked the license of MEXC Estonia OÜ. These events highlight the challenges crypto entities face. For security, the exchange uses 2FA and a combination of cold wallets and hot wallets for user fund safety. It has also published its proof of reserves.

Areas Where MEXC Could Improve

As noted in this MEXC review, while the exchange has several positives, there are a few areas where it needs to improve:

- Support for more fiat withdrawals would greatly benefit customers.

- Regulatory approval would help instill confidence in users.

- More customer satisfaction with quick responses and tackling customer withdrawals more efficiently.

Our Methodology

We are committed to assisting our users by providing them with deep insights that they can trust and rely on to make informed decisions when dealing with crypto assets. For our crypto exchange reviews, our team of professionals rigorously evaluates the platform and its various products and services with an unbiased approach. We further ensure that our reviews are research-oriented and up-to-date, providing crypto enthusiasts with the most relevant information for the best experience.

Conclusion

With so many cryptocurrency exchanges out there, it’s pretty difficult to find a platform that allows you to trade trending altcoins and new narratives while offering leverage to maximize but at a low fee. This is exactly where MEXC excels, offering new traders the opportunity to take advantage of altcoins’ volatility and copy-trade other professionals while providing experienced traders high leverage and the ability to earn rewards by offering their expertise.

On top of it all, MEXC users can also stake stablecoins, BTC, ETH, and other altcoins to earn yield. So, if you want to try the most exclusive opportunities offered in the crypto sector, sign up for MEXC and earn a 1000 USDT bonus!

MEXC FAQs

How do I trade with MEXC?

To trade with MEXC, just create an account, sign in, go to the trade tab, choose spot or futures trading, transfer funds, buy crypto, and finally sell.

Can you withdraw GBP from MEXC?

Yes, you can withdraw GBP from MEXC. However, bank transfer withdrawals are only available via SEPA for KYC-verified users in the UK and Germany.

Can I trade on MEXC without KYC?

Yes, you can trade on MEXC without KYC, as there is no mandatory identity verification. However, to increase your withdrawal limit, you have to complete the KYC verification, which is of two types: primary and advanced.

Is MEXC a good exchange?

MEXC is a decent exchange that offers demo trading, low fees, high liquidity, lots of crypto assets, high execution speeds, and several staking options.

Is it safe to keep crypto on MEXC?

You should never keep your crypto assets on any centralized exchange (CEX), including MEXC. If you do, only keep the funds you want to trade with.

Is MEXC better than Binance?

MEXC offers far more crypto assets to trade than Binance, and that, too, at highly competitive fees — zero fees for spot trading and only 0.010% taker fees for futures trading.

Is MEXC exchange safe?

Having operated in the market for six years now, MEXC is considered to be a safe exchange. It utilizes several security measures to assure user fund safety. However, there have been complaints from some of its users about difficulties in making withdrawals, so it’s always advisable to exercise caution when holding funds on a Centralized Exchange (CEX).

References

- MEXC Statistics: Markets, Trading Volume & Trust Score – Coingecko

- What is ‘Leverage’ – The Economic Times

- Copy trading – a road to riches or risk? – Financial Times

- What is a Demo Account? – The Balance

- Cryptocurrency regulation: Rules are in development – Britannica

- Express Check Out Element– Stripe

- Staking Definition – CoinMarketCap