What is DePIN? Defining Decentralized Physical Networks in Crypto

Decentralized Physical Infrastructure Networks (DePINs) represent a novel concept within the realm of decentralized finance (DeFi) and blockchain technology. These networks integrate physical infrastructure with decentralized protocols, enabling the seamless exchange of value and services in the real world.

Unlike traditional centralized systems, DePINs operate on blockchain networks, promoting transparency, security, and efficiency in various industries. In this guide, we will further provide in-depth answers to “What is DePIN?” and explore its advantages and disadvantages within the crypto ecosystem.

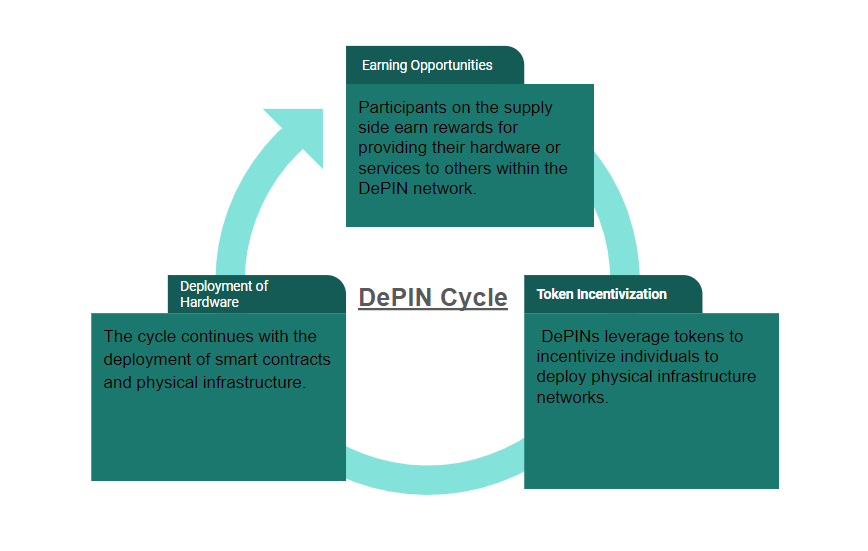

By decentralizing structural bottlenecks, DePINs aim to reduce reliance on centralized authorities and intermediaries, offering greater autonomy and control to users. DePINs encompass various types of decentralized infrastructure networks, each tailored to specific industries and use cases. From renewable energy grids and systems, to supply-chain operations. Then, IoT devices are equipped with sensors and connected to the same blockchain network, collecting real-time data on asset utilization, performance, and maintenance needs. Lastly, protocols in the form of decentralized governance models allow network participants to collectively make decisions regarding asset management, protocol upgrades, and resource allocation. So now you have a better understanding of what is DePIN in crypto, let’s explore how exactly they are used. In logistics, DePINs can enhance supply chain visibility and traceability, reducing inefficiencies and mitigating counterfeiting risks. Additionally, DePINs can facilitate decentralized communication networks, enabling secure and censorship-resistant communication channels. Here are some examples of how DePINS are used: Step 1: Token Incentivization – DePINs leverage tokens to incentivize individuals to deploy physical infrastructure networks. These tokens act as rewards for participants who contribute hardware or resources to the distributed network itself. Step 2: Deployment of Hardware – The cycle continues with the deployment of smart contracts and physical infrastructure such as energy grids, transportation systems, or supply chain tracking devices. This hardware forms the backbone of the decentralized infrastructure network and provides services to other off-chain network participants. Step 3: Service Provision – The deployed hardware offers services to other participants within the DePIN ecosystem. For example, energy grids may offer peer-to-peer energy trading, transportation systems may provide ride-sharing services, and supply chain devices may enable product tracking and verification. Step 4: Earning Opportunities – Participants on the supply side earn rewards for providing their hardware or services to others within the DePIN network. These rewards come in the form of tokens, which can be exchanged or used within the ecosystem. Since DePINs operate without intermediaries, interactions between participants are direct and transparent. By eliminating intermediaries and optimizing resource allocation, goods, and services within the DePIN ecosystem are often cheaper and faster than traditional models. This affordability and efficiency attract more participants and drive further growth within the network. Power Ledger energy trading platform that’s driven by blockchain technology. It allows users to buy and sell renewable energy via a peer-to-peer system. The platform enables decentralized energy trading, and grid optimization, and incentivizes renewable energy generation. Utilizing this approach of decentralization gives priority to renewable energy adoption, reduces reliance on traditional energy providers, and incentivizes individuals to invest in solar panels or other renewable energy sources. According to a recent article by Forbes, Power Ledger’s innovative platform has gained significant traction, with pilot projects and partnerships established worldwide. Its native token POWR has a market capitalization of $148 million and a daily trading volume of $12 million. POWR operates on the Ethereum blockchain as an ERC-20 token. Next, we have VeChain, which is a blockchain platform focused on supply chain management and product traceability. The VeChainThor blockchain enables businesses to track and verify products throughout the supply chain, ensuring authenticity and quality assurance. By leveraging blockchain technology, VeChain enables businesses to enhance supply chain efficiency, combat counterfeiting, and build trust with consumers. An article published by CoinDesk highlights VeChain’s partnership with Walmart China, demonstrating its effectiveness in real-world applications and its potential to transform various industries through decentralized infrastructure. According to DePIN Hub, Vechain could hit an all-time high in 2024. Currently, the VET token is trading at $0.039, which is roughly 85% away from its previous record high of $0.2782. IOTA is a distributed ledger technology designed for the Internet of Things (IoT) and machine-to-machine communication. The IOTA Tangle facilitates decentralized data transfer and microtransactions, enabling applications in smart cities, transportation, and energy management. With its feeless transactions and scalability, IOTA empowers smart cities, transportation systems, and energy management networks. According to a recent report by TechCrunch, IOTA’s innovative approach to decentralized infrastructure has garnered attention from industry leaders and researchers, positioning it as a key player in the emerging IoT landscape. The IOTA native token is a top 100 cryptocurrency and currently has a market capitalization of $752 million. At its peak, one token was priced at $5.69. At the time of writing, IOTA is trading at $0.2332. In a nutshell, DePINs offer unparalleled decentralization, cost efficiency, and incentivization, making them a disruptive force in the crypto landscape. However, scalability challenges and regulatory uncertainty pose significant obstacles to their widespread adoption and long-term viability. So for those looking to participate within this ecosystem, both these advantages and potential drawbacks must be taken into consideration. Popular DeFi applications include lending protocols like Compound and decentralized exchanges like Uniswap, which enable users to borrow, lend, and trade assets without intermediaries. Read our guide to learn more about some of the best decentralized exchanges currently in the market. In contrast, DePINs extend the scope of decentralization beyond finance to encompass physical infrastructure networks. These networks facilitate peer-to-peer interactions and resource sharing in areas such as energy trading, supply chain management, and IoT connectivity. For example, Power Ledger employs blockchain technology to enable peer-to-peer energy trading, allowing users to buy and sell renewable energy directly. Similarly, VeChain leverages blockchain for supply chain management, ensuring transparency and authenticity throughout the product lifecycle. While DeFi focuses on financial services, DePINs address broader infrastructure challenges, offering solutions that transcend traditional boundaries. Despite their differences, both DeFi and DePINs represent innovative approaches to decentralization, driving the adoption of blockchain technology across various sectors. On the other hand, DeRENs targets the real estate industry, aiming to revolutionize property transactions through transparency and efficiency. Using the blockchain’s immutable ledger, DeRENs facilitate secure and transparent property transactions, eliminating the need for intermediaries like real estate agents and lawyers. Propy, for instance, offers a blockchain-based platform for real estate transactions, streamlining the buying and selling process while reducing costs and fraud risks. While both DePINs and DeRENs embrace decentralization, their applications cater to distinct market needs and challenges. DePINs address broader infrastructure concerns, while DeRENs target specific pain points within the real estate sector. Together, they exemplify the transformative potential of blockchain technology in reshaping traditional industries and driving innovation in decentralized networks. As the ecosystem continues to evolve, DePINs are poised to play a pivotal role in driving the adoption of decentralized technologies and reshaping traditional business paradigms.

The DePIN narrative centers around the concept of Decentralized Physical Infrastructure Networks (DePINs), which represent a fundamental shift in how physical infrastructure networks are owned, operated, and shared. An example of DePIN in crypto is Power Ledger, a blockchain-driven energy trading platform that offers P2P energy trades, supporting renewable energy and grid optimization. Coins associated with DePIN projects include Power Ledger’s POWR token and Filecoin’s FIL token, which power their respective blockchain networks for energy trading and supply chain management. Top DePIN networks include projects like Filecoin, Render, Power Ledger, Theta Network, and IOTA, which offer innovative solutions for energy trading, supply chain management, and IoT connectivity, respectively.

What are Decentralized Physical Infrastructure Networks (DePINs)?

DePINs are decentralized physical infrastructure networks that leverage blockchain technology to manage and facilitate physical infrastructure (hardware). Communities are incentivized with tokens to collaborate and build real-world solutions. These physical resource networks utilize smart contracts, decentralized applications (DApps), and distributed ledger technology to automate processes, verify transactions, and ensure trust and transparency among network participants.How Do DePINs Work?

DePINs operate through a combination of blockchain technology, Internet of Things (IoT) devices or Off-chain networks, and decentralized governance protocols. Firstly, smart contracts are deployed on blockchain networks to automate the management of physical assets and infrastructure, such as energy grids, transportation systems, and supply chains.

What are DePINs Used For?

DePINs have a wide range of use cases across real world services and industries, including energy, logistics, telecommunications, and urban planning. In the energy sector, DePINs can optimize the distribution and consumption of electricity through peer-to-peer energy trading and decentralized grid management.

The DePIN Cycle

The DePIN cycle encompasses the lifecycle of decentralized physical and digital infrastructure networks. From the incentivization to create them, to their initial deployment and ongoing operational maintenance. Let’s explore this cycle in a step-by-step format.

Examples of DePINs

The most prominent examples of DePIN projects currently in the market are Filecoin, Render, and Graph. However, there are some lesser-known DePIN coins and projects that play a pivotal role in the ecosystem. Let’s take a look at some.1. Power Ledger – Pioneering Energy Revolution

2. VeChain – Transforming Supply Chain Dynamics

3. IOTA – Revolutionizing IoT Connectivity

Advantages and Disadvantages of DePINs

As we dive deeper into the DePIN narrative the advantages and disadvantages are somewhat clearer. However, let’s break them down below.Advantages

Disadvantages

DePINs Pros and Cons

DePINs vs DeFi

DePINs and DeFi (Decentralized Finance) both harness the power of blockchain and decentralization but serve distinct purposes within the crypto ecosystem. DeFi predominantly revolves around financial services, offering decentralized alternatives to traditional banking and investment platforms.DePINs vs DeRENs

Similarly, DePINs and DeRENs (Decentralized Real Estate Networks) leverage blockchain technology to disrupt traditional industries, albeit in different domains. As established above DePINs focus on decentralized physical infrastructure networks. These networks democratize access to essential services, digital resources, and infrastructure, fostering greater inclusivity and sustainability.Conclusion – The Role of DePIN in Crypto

Now that you have a better idea of what is DePIN crypto, let’s conclude. DePINs represent a groundbreaking innovation in the crypto space, offering decentralized solutions to real-world infrastructure challenges. Despite facing scalability and regulatory hurdles, DePINs hold immense potential to reshape industries ranging from energy and supply chain management to IoT connectivity.DePIN Crypto FAQs

What is DePIN narrative?

What is an example of DePIN in crypto?

What coins are DePIN?

What are the top DePIN networks?

References

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eric Huffman

Eric Huffman

Alan Draper

Alan Draper

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi