How to Buy Cryptocurrency

In 2010, an early Bitcoin investor paid 10,000 bitcoins for two pizzas. Bitcoin was worth approximately nothing at the time. Fourteen years later, bitcoin reached an all-time high of more than $73,000 — each. Crypto is capable of astounding gains, and specific assets like Bitcoin and Ether (Ethereum) have outperformed traditional investment assets by jaw-dropping margins. In this guide, we explain how to buy cryptocurrency, where to buy crypto, and how to store your crypto safely to protect your investment.

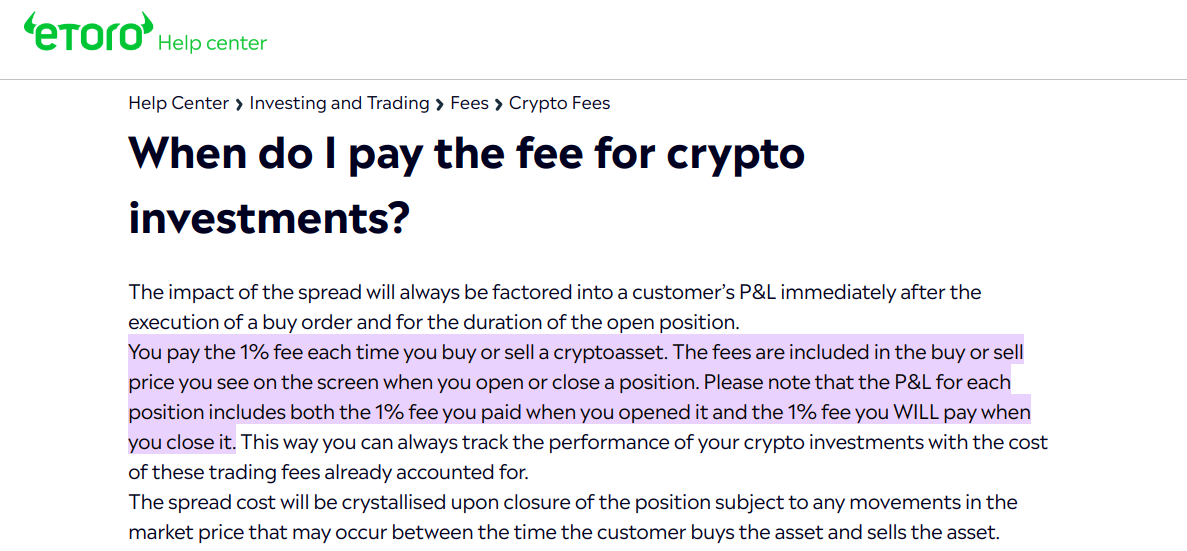

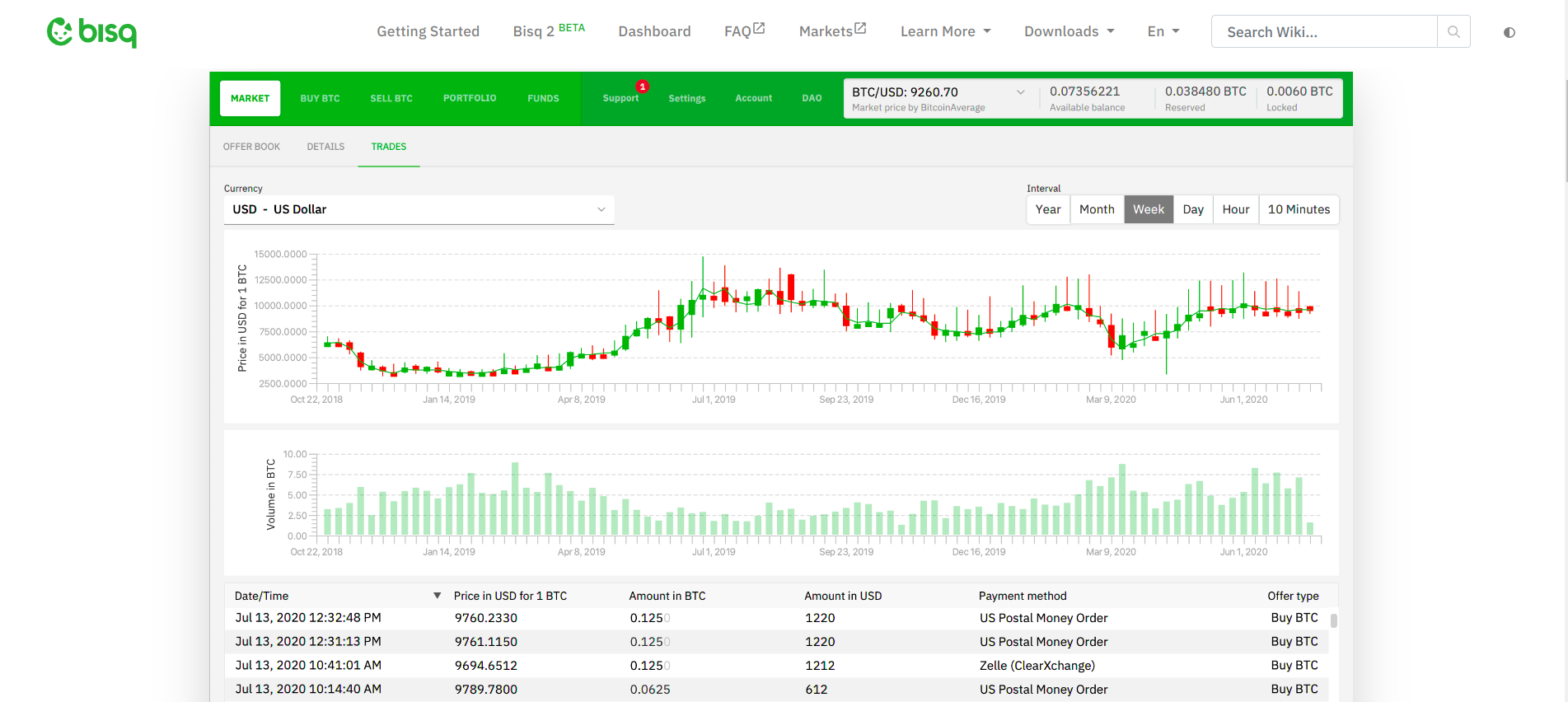

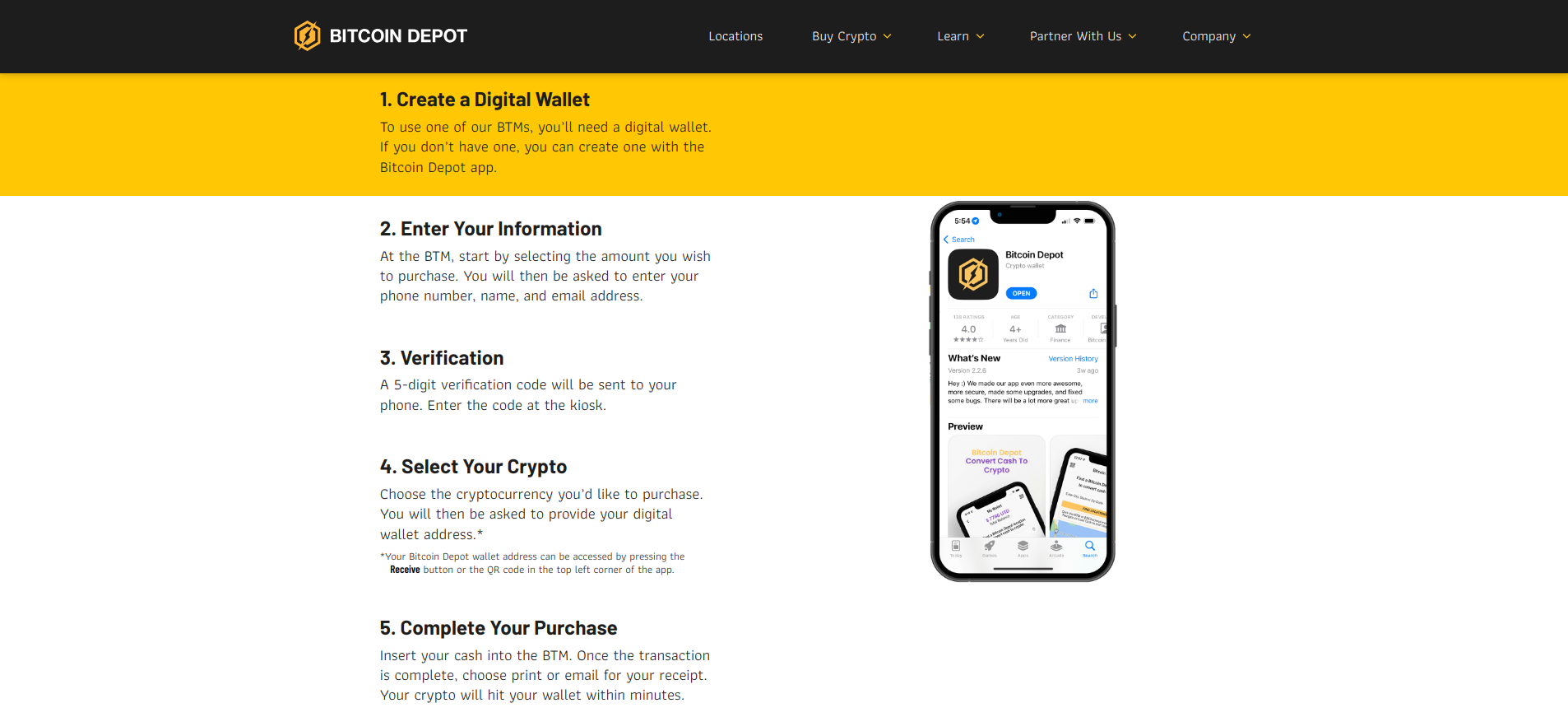

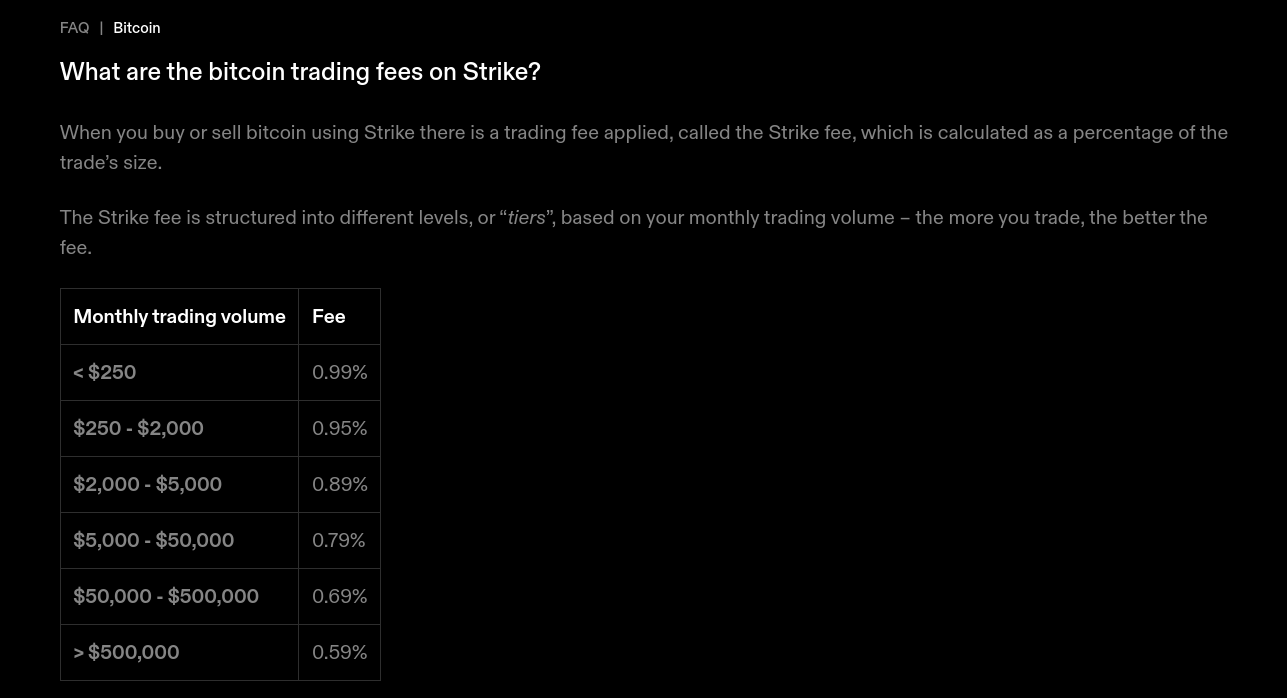

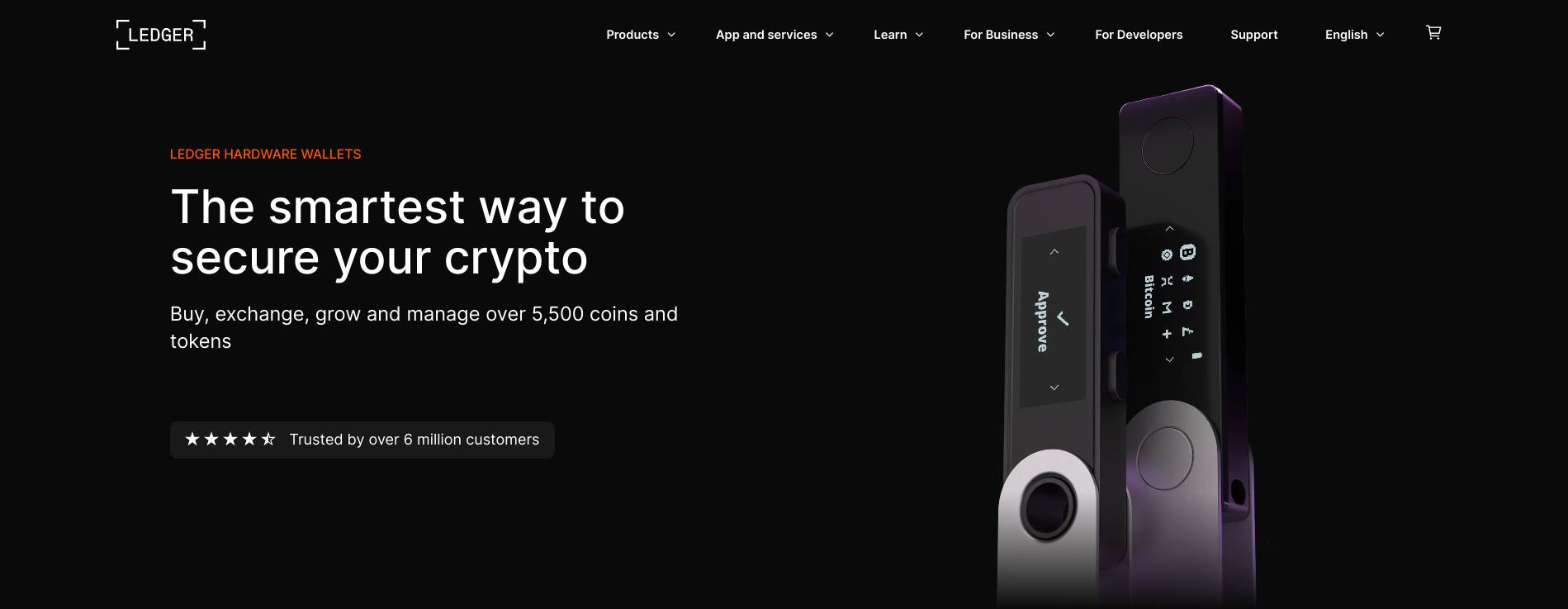

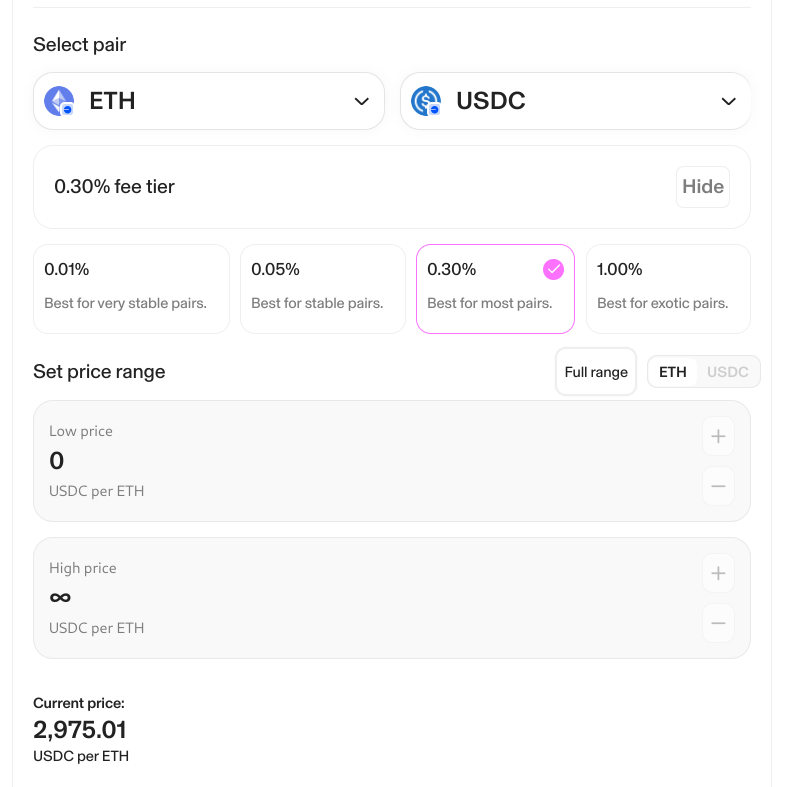

Options vary based on your location, but many major crypto exchanges and brokerages serve most of the world. For example, Coinbase, the largest publicly traded crypto exchange, supports more than 110 countries worldwide. eToro, a leading broker for stocks, exchange-traded funds (ETFs), and crypto, operates in more than 140 countries. To get started with an exchange or broker, open an account via their website or app and then complete the signup process. In most cases, you’ll need to provide basic information, such as your name and address and social security number or tax ID number. However, may also need to complete identity verification by uploading a government-issued ID. This step is to comply with Know Your Customer (KYC) regulations. In the US, for example, the Financial Industry Regulatory Authority (FINRA) defines KYC requirements. While brokers and exchanges serve a similar function and often a similar trading experience for basic trades, the way they operate differs. An exchange can offer true market prices through advanced trading platforms, whereas a broker uses a markup called a spread. Exchanges that offer a simple-trade feature also use spreads. These spreads can vary by cryptocurrency and help trading platforms offer a quoted price. Payment options also vary based on the platform or your location. Most well-known platforms offer bank deposits and debit card support. Often, debit cards can only be used for instant purchases, whereas bank deposit funding can be held on the exchange until you’re ready to buy. Other options could include PayPal or similar payment services. Take note of the fees before trading or making a deposit. Some platforms charge a deposit fee, although this fee is often waived for ACH transactions. If you’re funding your purchase with a debit card, fees can range from 2.5% to 4%. Expect to pay trading fees as well. There may also be a fee to withdraw. In most cases, the best way to buy crypto is to fund your account via a bank deposit and use an advanced trading platform to save on fees. The order shown above comes with a $2.99 fee and uses an ACH bank transfer for funding. If buying with a debit card or PayPal, trading costs jump to $3.84, plus a 1% spread. It’s often worthwhile to learn how to buy cryptocurrency using an advanced trading platform to reduce trading costs. The same order would cost less than a dollar using a limit order and as little as $0.10 on some platforms. After you make a purchase, the trading platform deposits your crypto into your trading account. Under the hood, the crypto showing on your account is stored in a crypto wallet controlled by the exchange or broker. Storing your crypto on a trading platform comes with risks. Crypto exchanges make a tempting target for hackers, as evidenced by several exchange hacks dating back as far as 2011 when the Mt. Gox exchange hack occurred. Between 2011 and 2014, 647,000 bitcoins were taken from the exchange, according to US Justice Department estimates. Exchange insolvency poses another risk to assets held on exchanges. If the exchange goes bankrupt, investors may never see their crypto assets again. To counter platform risks, many cryptocurrency investors choose to store their assets in a crypto wallet that they control. This strategy, called self-custody, eliminates the threat of exchange hacks or insolvencies. We’ll cover ways to secure your crypto with a self-custody wallet in a later section. Crypto investors can choose from hundreds of crypto exchanges worldwide, although availability can be a factor depending on your location. For example, Binance.com, the largest exchange by volume, does not serve users in the US or Canada. CoinGecko, a leading provider of crypto market data, lists exchanges by Trust Score and then ranks them by trading volume. The top exchanges according to those criteria are Bybit, OKX, and Coinbase, all of which offer a wide selection of cryptocurrencies and advanced trading platforms. Trust Score considers several factors, such as liquidity (trading supply), cybersecurity features, proof of assets, and proof of liabilities. Several well-known brokerage platforms also offer crypto trading. These include eToro, Fidelity, Robinhood, Webull, and Interactive Brokers. Brokers typically use a spread (a markup) to provide quotes when buying. If you expect to buy and hold for long-term gains, the extra cost might not matter. However, if you expect to trade often, spread fees can add considerable costs to your trades. You can also buy crypto through a peer-to-peer (P2P) platform. As the name suggests, you buy from other people rather than through an intermediary. Several well-known exchanges offer this feature, including Binance, OKX, and MEXC. However, several independent marketplaces also offer P2P crypto buying and selling. Bisq is one of the best-known P2P platforms and runs as an installable app. Others include Hodl Hodl, Paxful, LocalCoinSwap, and AgoraDesk. Some crypto investors prefer P2P exchanges because they often don’t require identity verification. However, the potential for fraud and higher acquisition costs can make P2P platforms more perilous to use. You’ve likely seen crypto ATMs at gas stations or convenience stores. These handy machines offer yet another way to buy crypto without identity verification, assuming you buy in small amounts. Bitcoin is the most commonly supported asset, but some crypto ATMs also support Ethereum, Litecoin, or Monero. You pay with cash or a debit card, and the company that runs the machine sends crypto to your crypto wallet address. Watch for higher fees and markups, though. While convenient and discreet, crypto ATMs can add 10% to 20% or more to your buying costs. The first US Bitcoin ETFs launched in January 2024, offering an easier way to invest in Bitcoin. The largest of these by BTC holdings remains Grayscale’c GBTC, which had previously operated as a trust. Other leading Bitcoin ETFs include iShares (IBIT), Fidelity (FBTC), ARK (ARKB), and Bitwise (BITB). Exchange-traded funds provide a simple way to invest in Bitcoin without many of the risks associated with exchanges or crypto self-custody. The tradeoff comes in the form of management fees called an expense ratio. Although ETFs are often more cost-effective than many mutual funds that hold stocks, they may still be more expensive than buying BTC through an exchange. GBTC, for example, has a 1.5% expense ratio. This annual administrative charge comes in higher than the trading fees for low-cost crypto trading platforms like Binance or Kraken. On Kraken, for instance, a limit order costs 0.2% for accounts with a 30-day trading volume of $10,000 or less. Accounts with higher trading volume earn even lower fees. Several payment apps now also offer crypto purchases. PayPal and Venmo, both owned by PayPal, offer Bitcoin alongside a selection of popular cryptocurrencies. For Bitcoin-only fans, Cash App and Strike provide an easy way to buy BTC. One drawback to this method of buying crypto comes in the form of higher fees. PayPal, for example, uses a tiered fixed-fee schedule that becomes particularly costly for smaller purchases. A $10 BTC purchase costs $0.99. Venmo mirrors this fee structure. In addition, PayPal uses an exchange rate, a markup called a spread on other platforms. Cash App and Strike only offer BTC, with Cash App using a percentage-based fee based on the trade amount. Strike recently switched from a spread-funded model to tiered fees based on trading volume. The move made Strike competitive with the fees found on many crypto exchanges like Coinbase. Companies like Moonpay, Simplex, and Mercuryo partner with wallet apps, decentralized exchanges, or even centralized exchanges to provide top-up funds. Fees for these services vary, and the crypto selection is often slim. Fees of 4% or higher — plus a spread — aren’t uncommon, particularly for card-funded purchases. As a safer alternative, you can move your crypto to a self-custody wallet. Of note, Bitcoin ETFs don’t support this option. A crypto wallet holds the private keys that control your digital assets on the blockchain. The two main categories of crypto wallets (hot wallets and cold wallets) take different approaches to security versus convenience. A hot wallet stores your wallet’s private keys on a device that connects to the internet. For example, the MetaMask Ethereum-compatible wallet offers a browser extension and a mobile app, both of which store the private key on an internet-connected device. Because the wallet’s private key is stored on a connected device, it could be vulnerable to online exploits. The tradeoff comes in convenience. Hot wallets are apps, so they make it extremely easy to connect to decentralized applications (dApps) and do your crypto thing on the go. By contrast, cold wallets do not store your private keys on an internet-connected device. Cold wallets range from old-school paper wallets used only for storage to separate hardware devices used to authorize transactions. Cold wallets, while less convenient, offer a safer way to store your cryptocurrency. However, in many cases, you can pair a cold wallet with your hot wallet. This strategy allows you to connect to dApps easily while still requiring authorization on a separate device before any funds leave your wallet. Top choices include Ledger and Trezor wallets, both of which support thousands of coins and tokens. If you’ve moved your cryptocurrency to a self-custody wallet, you’ll need to move it to an exchange before you can sell. Some wallets offer a way to sell your crypto from within the wallet itself, but fees and spreads can make this an expensive option. However, selling isn’t your only choice. You may be able to swap one token for another using a decentralized exchange. Alternatively, you can spend your crypto with many leading retailers, including Newegg, Starbucks, Ralph Lauren, and hundreds of others. Cryptocurrency and blockchain are still rapidly growing sectors but are also small when compared to traditional businesses. For example, NVIDIA, a semiconductor company known for its graphics processors, reached a market capitalization of over $2 trillion. That’s more than five times the size of Ethereum, the second-largest cryptocurrency. The relatively small market size of crypto assets makes them much more volatile and arguably more speculative. Digital assets are considered risk-on assets, meaning when investment markets are bullish, more capital flows to speculative investments like crypto. Of course, the opposite is also true. If you plan to invest in crypto, prepare for higher volatility compared to stocks until the market finds more use cases for blockchain assets and market caps grow. Consider starting small and gaining portfolio exposure slowly while learning how to buy cryptocurrency and when to sell. Some experts recommend investing no more than 5% of your total portfolio in crypto. This strategy allows you to gain exposure to a potentially explosive market while dampening the effects of crypto-market pullbacks on your overall portfolio. However, how much you choose to invest in crypto is largely dependent on your risk tolerance. Some investors can stomach the market’s choppy seas better than others. In fact, that’s the basis for one of the crypto community’s oft-used slang terms, HODL (hold on for dear life). Making crypto a smaller allocation within a larger investment portfolio helps diversify your holdings but you can also diversify your crypto holdings as well. If a major flaw is discovered in the Bitcoin protocol that creates an extra 184 billion bitcoins (this happened in 2010), BTC’s price might tank. Chances are good that it will take the rest of the crypto market down with it because this example involves BTC, but other crypto assets in a diversified crypto portfolio may see a smaller drawdown and perhaps a quicker recovery. To diversify your portfolio, you can consider a mix of blue-chip cryptos like BTC and ETH and then complement that with promising up-and-coming blockchain projects. Some investors may also want to target specific crypto sectors, such as AI, GameFi tokens, tokenized real-world assets, or even some meme coins as digital lottery tickets. Cryptocurrency investing in the future will likely follow a similar trajectory to the current offerings, albeit with possible wider availability for some assets through ETFs and continued improvements in the user experience for exchanges themselves. Immediately following the approval of Bitcoin ETFs in the US, BlackRock, Fidelity, ARK Invest, and other firms applied for similarly structured Ethereum ETFs. Speculation surrounds additional crypto ETFs for assets like Solana (SOL) and Cardano (ADA). However, regulation challenges could stand in the way of these products and the viability of other crypto assets as easily traded investments. In the US, for example, the Securities and Exchange Commission has named several popular cryptocurrencies as unregistered securities and has taken enforcement actions against both projects and exchanges. These moves caused many exchanges and brokers to cull these assets from their offering for US customers. Many expect continued growth in the use of decentralized exchanges. These platforms use smart contracts, apps that run on the blockchain, to allow permissionless trading using liquidity pools provided by participants worldwide. Decentralized trading may well be the future, but we still need an onramp to have something to trade. In most cases, that onramp points to centralized exchanges like Coinbase, Binance, and Kraken.

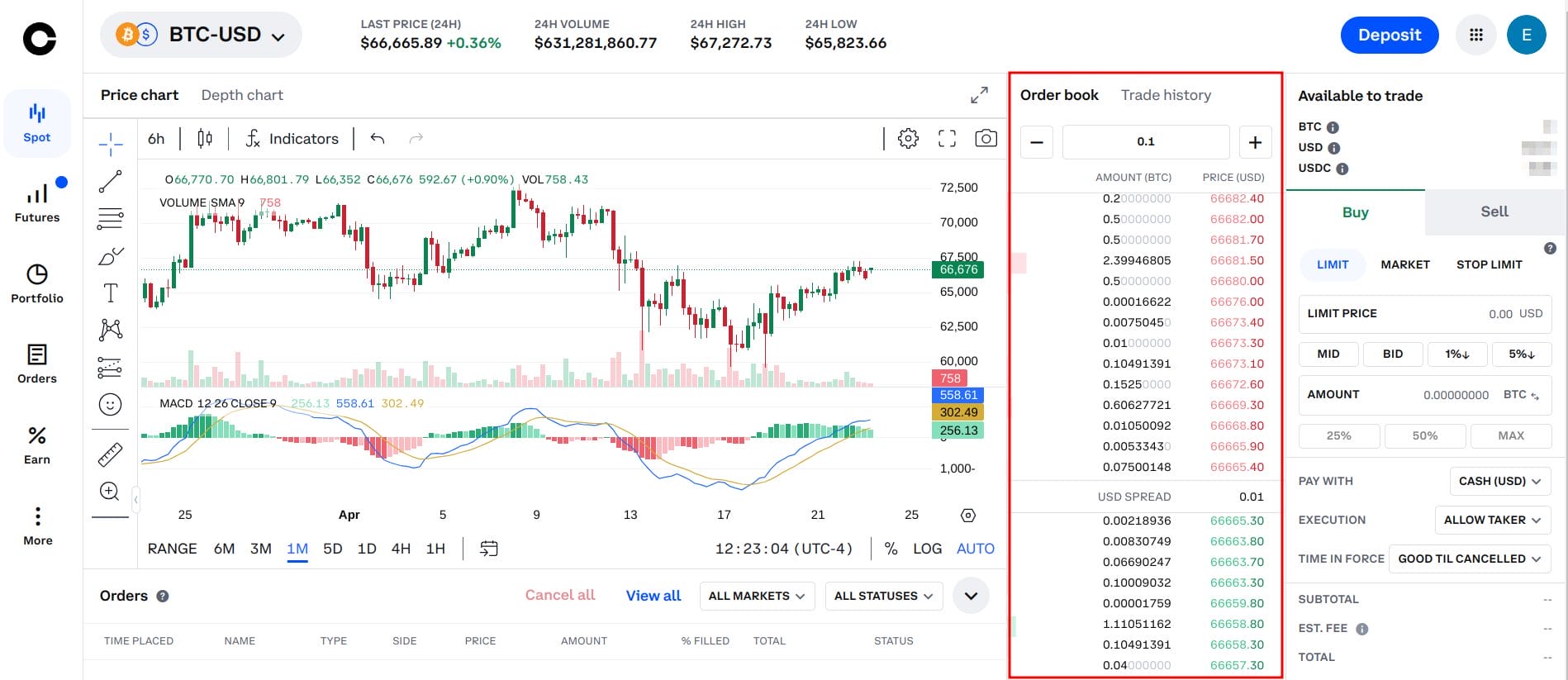

The first cryptocurrency was eCash, created by David Chaum. The concept of eCash began in 1983 with a proposal, but the currency didn’t launch until 1990. DigiCash, the company behind eCash, failed in 1998. Several other smaller projects preceded Bitcoin, which many think of as the first cryptocurrency. Bitcoin was created by an anonymous person or team using the pseudonym Satoshi Nakamoto. Satoshi Nakamoto, the inventor(s) of Bitcoin, is believed to be the largest holder, with an estimated 1.1 million bitcoins held in wallets linked to the project’s creator(s). When fully mined, Bitcoin’s total supply will be 21 million bitcoins. Satoshi’s wealth at today’s Bitcoin value exceeds $71 billion. Many market analysts expect crypto prices to increase throughout 2024 and 2025, possibly extending into 2026. However, crypto market prices are volatile, and large pullbacks may follow or precede upward moves. Potential catalysts to drive markets higher include increased adoption, additional investment demand through mainstream products like ETFs, and continued supply increases for traditional currencies, causing a flight to hard assets like BTC or ETH. Mining in cryptocurrency refers to solving an algorithmic problem to find a new block in which to hold transactions. Miners compete using specialized software to create hashes (algorithmically encrypted values) until they find a qualifying hash to mine a new block. The winning miner earns a block reward, sometimes called a mining reward. The process of mining to find blocks and secure the blockchain is called proof of work. In almost all cases, cryptocurrency investments are not covered by SIPC insurance. The exception would be Bitcoin ETFs, in which buyers enjoy SIPC protection up to $500,000 against the insolvency of the broker (but not the ETF itself). USD deposits on crypto platforms and brokerages may be insured through the FDIC using pass-through insurance from a custodial bank. The safest way to store crypto assets is to use a self-custody wallet rather than leaving crypto assets on an exchange or trading platform. Most crypto wallets use a recovery phrase that you can store as a backup to restore your wallet if needed. This recovery phrase should never be shared and should be stored securely offline. Anyone with access to the recovery phrase can also control your crypto assets. Hardware wallets, a type of cold storage for crypto, store the wallet’s private keys in a device that’s not connected to the internet. This reduces the risk of online exploits. Most crypto wallets walk you through the process of setting up the wallet for first use. When the wallet is first created, you’ll be provided a recovery phrase, also known as a seed phrase or passphrase. This string of words is a human-readable version of the wallet’s private keys, which control your crypto assets on the blockchain. Never share your recovery phrase or private keys. Empty Wallet Example The public wallet address is used as your identity on the blockchain network for sending and receiving. A crypto exchange provides an order book where buyers and sellers can place limit orders, which are fixed-price buy or sell orders for cryptocurrencies. Buyers and sellers can also place market orders, which use the existing limit orders on the exchange to fill orders at market prices. Exchanges allow traders to buy cryptocurrencies using traditional currencies like USD or other currencies, such as BTC. When you buy on an exchange, the exchange holds your newly purchased assets in a crypto wallet controlled by the exchange. When selling crypto for traditional currencies, like USD, the exchange also holds your cash balance. Most well-known exchanges allow users to withdraw both cash and crypto assets, the latter of which requires a crypto wallet.

Key Considerations Before Buying Cryptocurrency

While cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have made millionaires worldwide, the space is still new, and crypto prices are volatile. The bear market in 2022 saw ETH fall from its all-time high of nearly $5,000 in 2021 to less than $900. Price volatility is one consideration. However, you should also weigh other factors before making an investment decision.

How to buy Cryptocurrency in 2024

You’ve weighed the pros and cons, and you’re ready to invest in crypto. Next, let’s learn how to get into cryptocurrency. The most common way to get started involves using a crypto exchange or a broker. The process follows a similar pattern for both. In a later section, we’ll discuss alternatives, such as payment apps that support crypto.Step 1: Selecting a Trading Service or Venue

Broker vs Exchange

Step 2: Connect to a Payment Option

Step 3: Understanding Fees and Costs

Step 4: Placing a Cryptocurrency Order

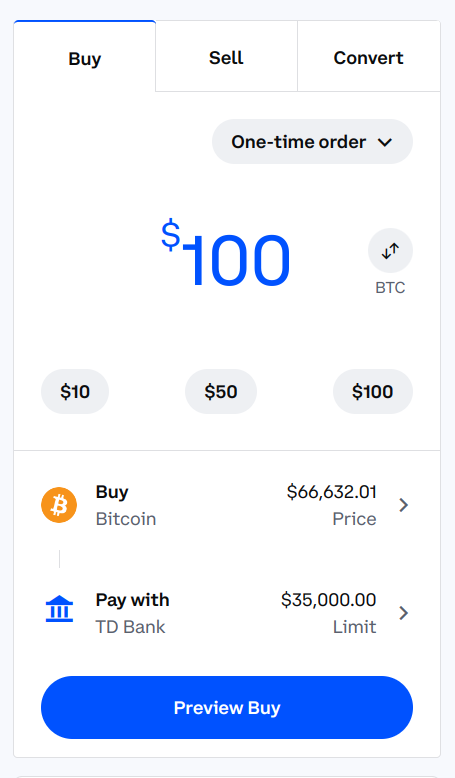

Basic trading platforms like Coinbase Simple Trade make it easy to buy crypto. With a few clicks, you’ve made a purchase.

Step 5: Safe Storage

Where to Buy Cryptocurrency

Along with how to buy cryptocurrency you also have to consider where to buy cryptocurrency. Exchanges and brokers are both common onramps to the crypto trading world. However, you can get started with crypto in a number of ways.Cryptocurrency Exchanges

Traditional Stockbrokers

Peer-to-Peer (P2P) Platforms

Cryptocurrency ATMs

Trusts or Exchange-Traded Funds (ETFs)

Cryptocurrency Apps

Additional Ways to Buy Cryptocurrency

Many crypto wallet apps and decentralized exchanges also offer a way to buy cryptocurrency with USD or other traditional currencies. For example, Trust Wallet supports more than 100 blockchains and allows purchases of leading cryptocurrencies through the wallet using third-party providers.Storing Your Cryptocurrency Safely

Earlier, we discussed the risks associated with holding your crypto with a broker or exchange. If the platform becomes insolvent, gets hacked, or pauses withdrawals (never a good sign), you may lose access to your crypto assets held on the platform.Hot Wallets vs. Cold Wallets

How to Sell Cryptocurrency

Selling cryptocurrency follows a similar flow to buying cryptocurrency. For example, on an exchange, look for the sell button (simple trade) or switch to the advanced platform, if available, to save on trading fees.Advanced Topics in Cryptocurrency Investing

Learning how to buy cryptocurrency gives you the tools and basic knowledge you need to invest. However, there are other considerations, including how much to buy and whether you should buy crypto at all. The answers to these questions differ for each investor.Should You Invest in Cryptocurrency?

How Much Cryptocurrency Should You Buy?

Diversifying Your Cryptocurrency Portfolio

Future of Cryptocurrency Investing

Frequently Asked Questions (FAQs) About Buying Cryptocurrency

Who Started Cryptocurrency?

Who Owns the Most Cryptocurrency?

Predictions: When Will Cryptocurrency’s Value Increase?

Understanding Cryptocurrency Mining

Is a Cryptocurrency Purchase Protected by SIPC?

How to Keep Crypto Assets Safe

Creating a Cryptocurrency Wallet

How Does a Cryptocurrency Exchange Work?

References

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Alan Draper

Alan Draper

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi