XRP Price Prediction 2024, 2025, 2026 – 2030

XRP has been all over the news in the past year because the SEC brought a lawsuit against 2 executives at Ripple Labs. Despite this negative publicity XRP has managed to maintain its place in CoinMarketCaps top ten, a position it has held since the inception of the rankings. At the moment of this writing (April 27, 2024), Ripple (XRP) price is $0.521, with a 24 hour change of -0.51% which decreased from previous day.

Here we’re going to dive deep and make an XRP price prediction for the next 10 years, look at what XRP and Ripple are (and how they differ), and discuss what affects the price of XRP and how to buy it in 5 simple steps.

XRP (Ripple) Price Prediction Overview

Current XRP Price

At the moment of this writing (April 27, 2024), Ripple (XRP) price is $0.521, with a 24 hour change of -0.51% which decreased from previous day.

XRP Price Prediction for the Next 30 Days

XRP continues being one of the top stablecoins in crypto world. It comes as no surprise that we see XRP outlook as being positive in the next 30 days as well as in the near future.

| Date | Potential Low | Average Price | Potential High |

|---|---|---|---|

| April 28, 2024 | $0.525 | $0.531 | $0.534 |

| April 29, 2024 | $0.529 | $0.540 | $0.546 |

| April 30, 2024 | $0.535 | $0.550 | $0.558 |

| May 1, 2024 | $0.537 | $0.559 | $0.571 |

| May 2, 2024 | $0.543 | $0.568 | $0.584 |

| May 3, 2024 | $0.545 | $0.578 | $0.595 |

| May 4, 2024 | $0.551 | $0.587 | $0.609 |

| May 5, 2024 | $0.555 | $0.597 | $0.621 |

| May 6, 2024 | $0.557 | $0.606 | $0.635 |

| May 7, 2024 | $0.566 | $0.616 | $0.645 |

| May 8, 2024 | $0.567 | $0.625 | $0.657 |

| May 9, 2024 | $0.575 | $0.634 | $0.673 |

| May 10, 2024 | $0.580 | $0.644 | $0.684 |

| May 11, 2024 | $0.580 | $0.653 | $0.694 |

| May 12, 2024 | $0.581 | $0.663 | $0.708 |

| May 13, 2024 | $0.593 | $0.672 | $0.720 |

| May 14, 2024 | $0.595 | $0.682 | $0.734 |

| May 15, 2024 | $0.594 | $0.691 | $0.745 |

| May 16, 2024 | $0.598 | $0.700 | $0.755 |

| May 17, 2024 | $0.606 | $0.710 | $0.773 |

| May 18, 2024 | $0.604 | $0.719 | $0.785 |

| May 19, 2024 | $0.613 | $0.729 | $0.797 |

| May 20, 2024 | $0.618 | $0.738 | $0.812 |

| May 21, 2024 | $0.624 | $0.748 | $0.824 |

| May 22, 2024 | $0.632 | $0.757 | $0.831 |

| May 23, 2024 | $0.636 | $0.766 | $0.844 |

| May 24, 2024 | $0.639 | $0.776 | $0.854 |

| May 25, 2024 | $0.647 | $0.785 | $0.870 |

| May 26, 2024 | $0.645 | $0.795 | $0.879 |

| May 27, 2024 | $0.648 | $0.804 | $0.898 |

XRP Price Predictions 2024-2034

Below we look at what the future holds for XRP, looking to answer the question “will XRP go up”, and, as we do so, making XRP price predictions for each year between now and 2034. As you will see from the table below, we do believe that XRP has a strong future ahead.

| Year | Potential Low (ROI) | Average Price (ROI) | Potential High (ROI) |

|---|---|---|---|

| 2025 | $1.78 (240.70%) | $1.90 (264.73%) | $2.05 (293.61%) |

| 2026 | $1.80 (244.29%) | $2.04 (291.87%) | $2.35 (350.22%) |

| 2027 | $1.81 (246.91%) | $2.19 (319.00%) | $2.64 (406.53%) |

| 2028 | $1.80 (245.15%) | $2.33 (346.13%) | $2.99 (472.57%) |

| 2029 | $1.80 (245.83%) | $2.47 (373.27%) | $3.30 (532.83%) |

| 2030 | $1.81 (247.47%) | $2.61 (400.40%) | $3.56 (582.76%) |

| 2031 | $1.83 (250.82%) | $2.75 (427.53%) | $3.90 (646.67%) |

| 2032 | $1.86 (256.59%) | $2.89 (454.66%) | $4.20 (705.10%) |

| 2033 | $1.91 (265.52%) | $3.04 (481.80%) | $4.43 (749.87%) |

| 2034 | $1.86 (256.49%) | $3.18 (508.93%) | $4.78 (815.90%) |

XRP Price Prediction For 2024

2024 looks to be an exciting year for the cryptocurrency market with a Bitcoin Halving event set for late April, the potential approval of Ethereum ETFs in May, and a scaling-friendly upgrade to Ethereum, all set to draw attention, and potentially funds, to the markets. With XRP a staunch member of CoinMarketCap’s top 10, it is likely that any influx of investors to the market could also positively impact the XRP price.

The ongoing court case between Ripple and the SEC, however, could keep many investors away until there is more certainty around Ripple. A court date is currently set for April, but many predict that proceeding will drag on into the second half of the year—keeping new investors out of XRP, and preventing institutions from interacting with it.

The XRP Ledger saw a 336% jump in transaction volume at the beginning of 2024, but this had continued to follow the price chart in its decline and now sits not far above the levels held before its increase. It is also worth considering here that there is no roadmap for the XRP Ledger, giving investors little to get excited about besides the results of the above-mentioned court case. However, development does continue, as can be seen in the version releases on the XRP Ledger Blog.

Finally, we cannot make a price prediction for 2024 without looking at the effects the current bull market may have on the XRP price. While its price action has been notably subdued as Bitcoin has gone to repeatedly post new all-time highs and the Meme coin market flourishes there could yet be time for XRP to pump this cycle.

But, with its seemingly singular use case, centralized control over token emissions, and without being able to accurately predict the outcome of the trial with the SEC, making an accurate XRP price prediction for 2024 is difficult. However, we do predict that XRP will reach lows of $0.30 in 2024, along with highs of $0.98, should Ripple win its case against the SEC. The median price for XRP in 2024 is predicted to be $0.60.

XRP Price Prediction For 2025

Many in the crypto world believe that 2025 is going to be dominated by the effects of the Bitcoin Halving. Historically, Bitcoin has produced new ATHs 12–18 months after a Bitcoin Halving has occurred. If this happens then we are likely to see new ATHs for Bitcoin in 2025, as this period falls right in the middle of 2025.

When this happens the rest of the crypto market typically traces Bitcoin up the charts, and XRP is no exception.

During the 2nd Halving cycle, XRP skyrocketed and attained its current ATH, but during the last one it did not get close to this ATH—although the announcement of the SEC’s lawsuit just a few months before is likely to have suppressed price action. While many still expect the Bitcoin Halving effect to be felt in 2025, some are saying that the bull run and ATHs induced at the beginning of 2024 have broken the pattern of 4 year, Halving-induced bull runs, while other still think this narrative remains.

We can also expect crypto regulations to have progressed by 2025, with Treasury Secretary Janet Yellen encouraging the US Congress to enact legislation in early 2024. A regulatory framework for cryptocurrencies in some of the world’s lead economies will be a green light for XRP and Ripple, now free of the shackles of an SEC lawsuit, and the financial institutions Ripple has partnered with to begin implementing money remittance solutions. While it is not expected that this will be rolled out immediately the idea that this will soon be a possibility will have a hugely positive effect on the price of XRP as investors speculate on its future.

As a result, we expect XRP to hit new ATHs in 2025, with our XRP price prediction for 2025 containing a high of $4.12, a low of $0.80, and an average price of $2.30.

XRP Price Predictions 2026-2034

Here we’ve summarized our XRP price predictions for each year between now and 2034 in a neat and easy-to-read table.

XRP Price Prediction For 2026

2026 is expected to be the calm after the storm of the dizzying ATHs induced in 2025, and, previously, these periods have seen significant declines in digital asset prices—with prices settling about 75% down from their highs but still up from their pre-Halving-mania valuation.

This Halving, however, may well be different and we may see higher prices sustained for longer as regulatory bodies around the globe continue to implement frameworks for cryptocurrencies to exist in, helping them to sustain higher valuations.

For XRP this improved regulation is a good sign because as more and more countries implement regulations more and more of their partner financial institutions will be open to using Ripple’s services on the XRP Ledger, a use case we should continue seeing growing in the Ripple ecosystem in 2026 as money remittance increasingly becomes the main utility of the Ripple Ledger and XRP currency.

By this period we can also expect the development and testing of CBDCs to have continued growing in some nations, and we may even see the rollout of CBDCs by some nations. Ripple already offers CBDC services and is currently in talks with over 20 countries on implementing CBDCs. With the transaction volume of CBDCs predicted, by Juniper Research, to grow from $100 million in 2023 to $213 billion by 2030, these advancements are good news for Ripple and XRP, helping to combat the downward price pressure from the fallout of the Bitcoin Halving.

These positives mean that our XRP price prediction for 2026 contains a relatively stable valuation for XRP, with a high of $3.80, a low of $1.98, and an average price of $2.90.

XRP Price Prediction For 2027

As we gaze further into the future it becomes more difficult to predict XRPs price. However, in 2027, we expect the continued uptake of digital currencies, including CBDCs, and blockchain technology.

XRP is well placed to fare well as the institutional use of cryptocurrencies grows, with Ripple at the helm steering institutional money onto the chain, creating more and more value transfer utility and, as a consequence, increasing demand for XRP.

2027 is also when it is expected that the final distribution of tokens from Ripple’s huge, 55 billion XRP escrow cache is expected to happen. This will mean that the full supply of XRP will finally be circulating in the digital economy. With this, XRP can now take on its true deflationary status, as transaction fees continue to be burned on the network. It is worth noting, however, that Ripple continue to re-lock a part of the supply in each month that it unlocks, which is likely to extending this date out later into 2027 or even into 2028.

As a result, 2027 is likely to be a year when XRP witnesses continued growth and adoption, adding overall upward pressure to the token price, not necessarily resulting in new highs for XRP, but a tighter trading range. That’s why our 2027 price prediction features a high of $4.00, a low of $2.30 and a median price of $3.15.

XRP Price Prediction For 2028

2028 is the date for the 5th Bitcoin Halving. While many would say that Bitcoin and the markets will continue to follow previous cycles, the growing adoption of cryptocurrencies, along with increased utility that we cannot predict yet, are likely to have partially broken the effectiveness of these cyclic predictions.

The now regular use of digital assets might even fuel a buying spree for Bitcoin before the Halving Event, but XRP, and other cryptocurrencies, might have decoupled from the price of Bitcoin and be on their own trajectory.

We can also look to the continued adoption of CBDCs, RippleNet, and the XRP Ledger, along with the continued deflating of the XRP token supply to put upward pressure on the price of XRP.

This leads us to predict highs of $4.40 for XRP in 2028, along with greater price stability and a median price of $3.80, and a low of $3.20.

XRP Price Prediction For 2029

If the cyclic nature of Bitcoin continues to be true, 2029 will see new ATHs for Bitcoin and digital assets—yet these are not predicted to be the same aggressively large gain as witnessed in years past.

Despite its partial decoupling from the Bitcoin price a couple of years ago, the price of XRP will still be dragged upward, reaching highs of $5.02, hitting a low of $3.98, and having a median price of $4.20.

XRP Price Prediction For 2030

While 2030 is when we will likely see the fallout of the previous year’s Bitcoin Halving this will be nowhere near as severe as before—with global regulatory frameworks for digital assets firmly in place and adoption and utility at an all-time global high.

Ripple, using the XRP Ledger, could have greatly improved global remittance, an industry that is expected to be valued at $213 billion by this year—alongside the other financial products and utilities that have been brought to the XRP Ledger between now and 2030.

While it is impossible to predict the pace at which digital currencies and their utilities will grow and evolve our XRP price prediction concludes with what would be deemed a successfully stable XRP price prediction for 2030, with a high of $4.80, a low of $4.20, and an average price of $4.40.

Historical Performance of Ripple

| Coin Name | XRP |

| XRP Price | $0.521 |

| XRP Price Change 24h | ▼ -0.51% |

| XRP Price Change 7d | ▲ 0.05% |

| XRP Market Cap | $28,819,372,974 |

| Circulating Supply | 55,235,913,166 XRP |

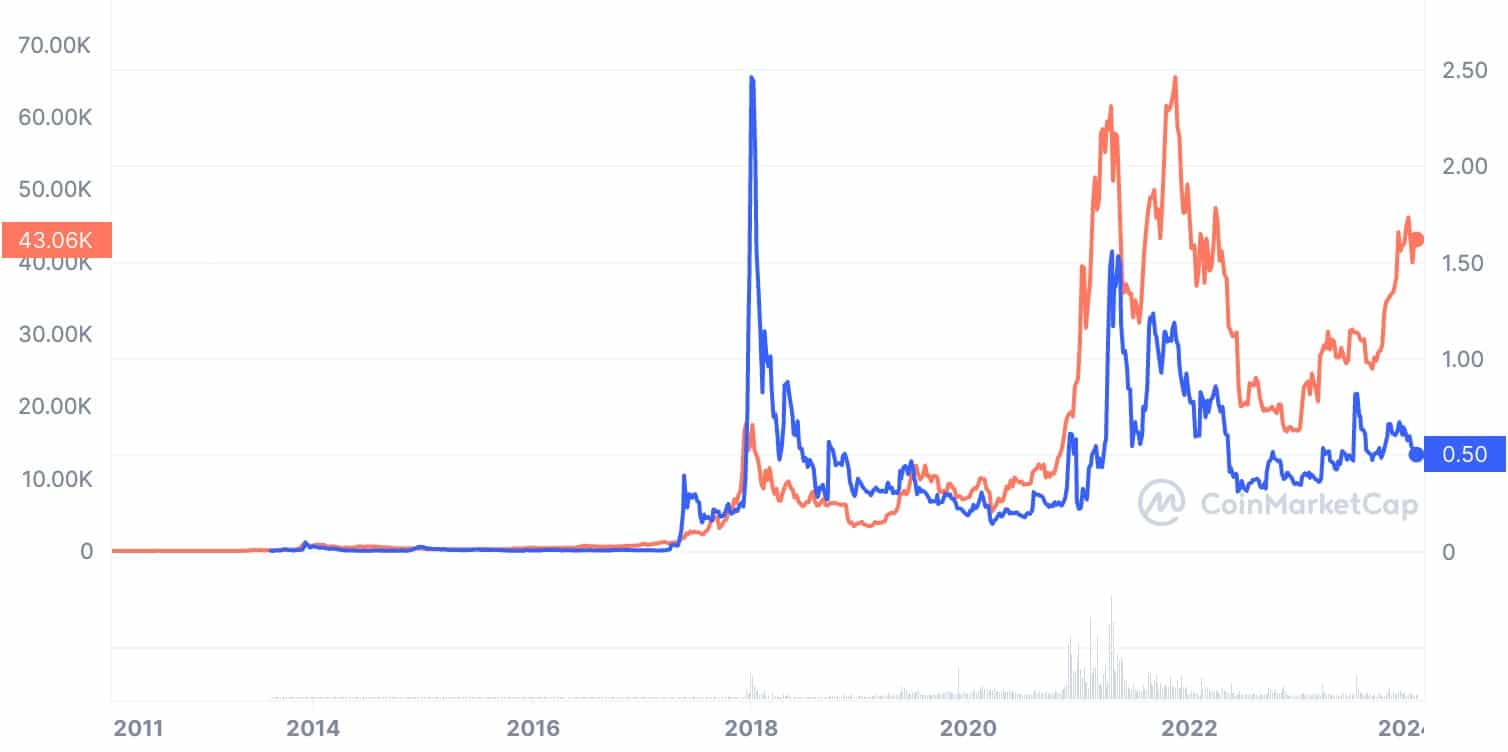

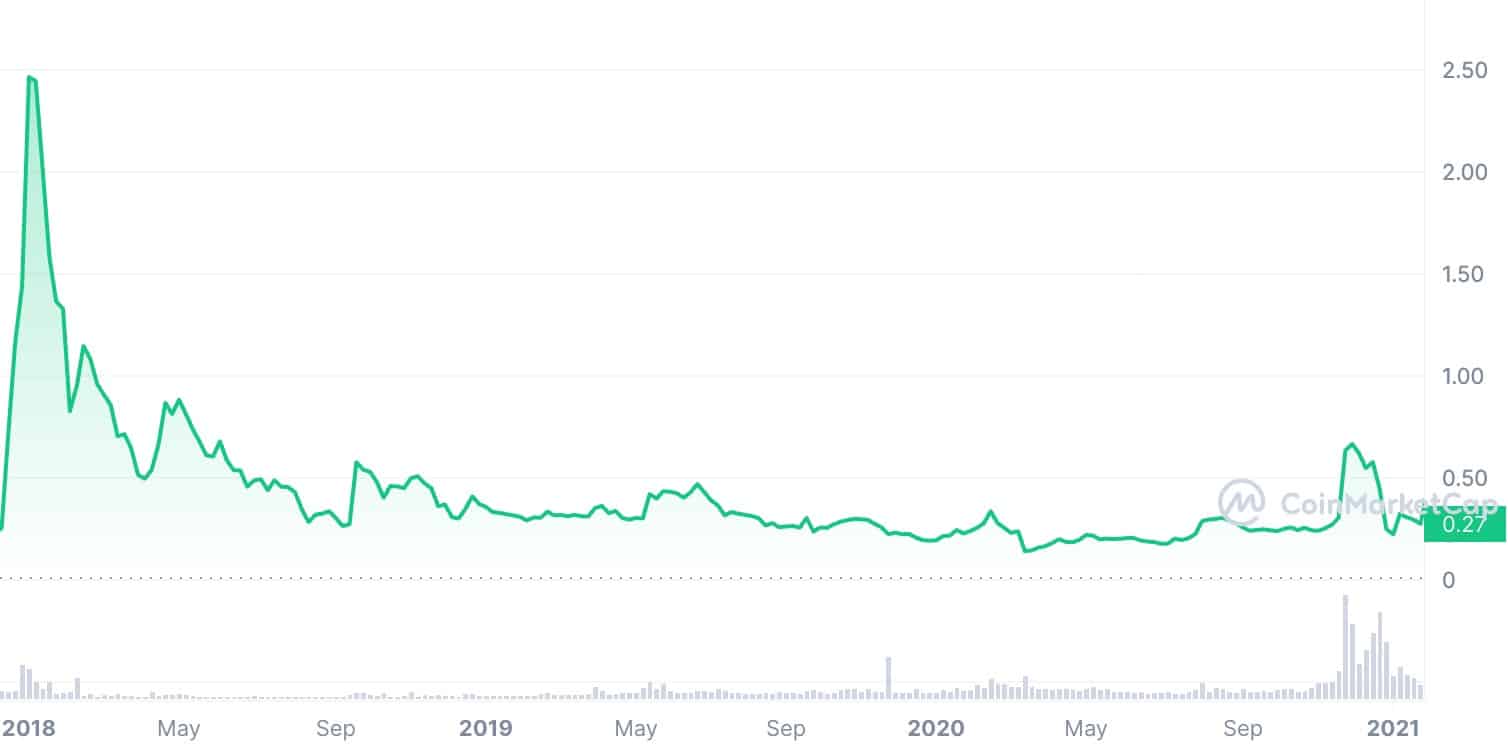

The XRP Ledger was launched in 2012, and data for the XRP token on CoinMarketCap starts from August 4th, 2013, where XRP tokens were priced at $0.005875—less than a penny.

From there the token almost doubled in price over 6 weeks before spiking over two weeks at the end of November, climbing 408% to a high of $0.04855.

Through the start of 2014, the value of XRP declined, falling back below the $0.01 mark at the end of March, and continuign to fall to hit its all-time low of $0.002802 in July. From here—excluding a spike above $0.02 at the end of 2014 and one above $0.01 in June of 2015—XPR continued to trade hands below the penny valuation, in a range between $0.0042 and $0.009, until the Bitcoin Halving induced and ICO boom fueled bull run kicked off in early 2017.

2017: The Year of XRP

XRP started 2017 priced at $0.006523, a little more than double its all-time low. From here XRP climbed steadily, first peaking in May, at $0.3949, and briefly flipping Ethereum to become the second largest coin by market cap for a short period.

XRP then receded and found support at $0.15 and resistance at $0.25. This resistance, however, only lasted until the beginning of December, where XRP climbed from $0.2326 on December 6th to hit its all-time high (ATH) of $3.84 on January 4th, 2018—a gain of 1,550% in under 1 month and over 58,000% since the beginning of 2017. A surge that had many raising questions about Ripple Labs and its controversial relationship with the XRP Ledger.

2018–2021: When it Gets Difficult for XRP

After the bull market highs at the end of 2018, when Bitcoin was also peaking around $20,000, the next few years proved difficult for a lot of the crypto market, XRP included—and the extra scrutiny brought on by its close relationship with the supposedly separate Ripple Labs didn’t help matters.

The Price of XRP declined steeply at the beginning of 2018, losing 78% of its value in less than a month, to dip below $1. XRP continued to steadily decline for over a year, before finding support at the $0.3 mark in late 2019.

However, this only lasted so long, and in the latter half of 2019 XRP, out of step with the majority of the crypto market, started posting lower highs and lower lows, and the longtime support of $0.3 now started acting as resistance. XRP continued trending downward into 2020 where it eventually found a local low of $0.1405 on March 12th, 2020, as the whole world was thrown into turmoil as the World Health Organization declared COVID-19 a pandemic.

From here the price of XRP climbed incrementally upward. Before following a market-wide rally at the end of 2020 to peak at $0.6645 on November 30th—gains of 373% from its March low.

Then, on December 22nd, the SEC charged Ripple and two of its executives with selling unregistered securities, causing XRP to lose 50% of its value by the beginning of January 2021.

2021–Present: Ripple and XRP Bounce Back

Despite this awful news at the turn of 2021 XRP joined in the bull run at the start of that year, hitting highs of $1.5635 in May as Bitcoin began posting new ATHs above $60,000.

Ripple dropped in step with the rest of the market, and then rose again later in the year, not as high as before, as Bitcoin posted its ATH above $68,000.

The price of XRP continued to drop in lockstep with the market, finding new support at $0.60 throughout 2021 and into 2022.

In early 2022, however, XRP broke through this support and bounced off strong support of $0.30 in June. From here it trended upward throughout 2022 and into 2023, posting higher highs and higher lows, finding resistance at $0.50.

The next big price move for XRP then came in July of 2023, as a U.S. Judge ruled that XRP was not sold as a security, resulting in a 73% spike in price to a local high of $0.8162.

The price then declined and bounced off support at $0.5. It was then announced in October that the SEC was dismissing charges against the Ripple executives, and this helped the price climb again, peaking just above $0.7.

From here the price retracted finding support at $0.60 throughout November and December before dipping below this level in early 2024, and declining to hit support at $0.50 in early February.

From this point the XRP price climbed and has regained a price level above $0.60

The Current State of Ripple

Ripple Labs is not out of the woods yet, as, while the July 2023 verdict was considered a success for both the company and the crypto industry, it still found that Ripple violated securities laws when it sold XRP directly to institutional clients—as opposed to the sale of assets on an exchange which did not violate the law.

In early February a judge then ruled that Ripple must share financial statements and contracts surrounding institutional sales of XRP since the initial lawsuit was filed in 2020. Meaning that this issue will continue to evolve throughout 2024.

Market Position and Performance

XRP currently sits 6th in CoinMarketCap’s rankings and, compared to other assets, did not perform well over late 2023 and into 2024, unable to hold on to many of the gains made over the past year—likely because of Ripple’s legal issues.

In terms of technical analysis, XRP seems to be trading in a range between long term support at $0.50 and resistance at $0.65. While its recent gains seem good when viewed on their own, 17% over the last month, they pale in comparison to all the other coins in the top 10, who have all posted gains varying between 34% and 250%+ over the same period—at least double that of XRP. This, could be due both to the ongoing trouble surrounding Ripple Labs, the centralized nature, and singular functionality of this token that make it different from the rest of the crypto market.

In addition to all this, the 50-day moving average (green line) has again crossed below the 200-day moving (gold line) for the second time in 5 month, a trading signal known as the “death cross”, and typically an indicator of bearish sentiment for an asset. This adds further strength to the case that XRP could see suppressed positive momentum in a crypto market that is currently very positive.

What is XRP and What is it Used For?

XRP is the native currency of the XRP Ledger, created by the founders of Ripple Labs Inc., which is designed to facilitate the fast and efficient transfer of funds between different currencies across geographical and regulatory borders.

In 2022, a total of $150 trillion was transferred in cross-border transactions, $2.2 trillion was paid in fees on these transfers, and the majority of these transactions took 2–5 days to settle in the recipient’s bank account. Quite an astoundingly set of facts considering we live in a global digital economy and value efficiency and cost effectiveness in almost everything we do.

The XRP cryptocurrency, and the ledger it was built on, are designed to change this and enable low cost ($0.000005 at the time of writing) and near-immediate settlement (3–5 seconds) for cross-border payments and transactions—specifically those between two different currencies.

The XRP Ledger facilitates such transfers by using the XRP currency as an intermediary between the two different currencies at opposite ends of the transaction, one is converted into XRP and that is then converted into the other currency on the other end—all in less than 5 seconds. XRP Ledger has also been designed to do so at the capacity required by today’s digital society, with the ability to scale to process 1,500 transactions per second.

Ripple Vs XRP: What’s the Difference?

The names Ripple and XRP are typically used interchangeably by members of the crypto space, however, they are actually entirely separate entities.

- XRP: The currency of the public, permissionless, and open sourced XRP Ledger, which was launched in 2012 by three developers. It can be built on by anyone, and the XRP ecosystem is currently home to over 1,500 apps and exchanges.

- Ripple: A.k.a. Ripple Labs Inc., a company founded later in 2012, by the same three developers and Chris Larsen, former co-founder of multiple consumer financial services websites.

What is Ripple Labs?

Ripple Labs uses the XRP Ledger to facilitate cross-border payments between financial companies and the consumers who use their services. It was originally called Opencoin, but rebranded to Ripple Labs in 2015.

Ripple Labs has partnered with over a hundred financial institutions and remittance providers around the globe, many of which you may be familiar with:

- Western Union

- Banco Santander

- Bank of England

- Bank of America Merril Lynch

- NAB National Australia Bank

- JP Morgan

- HSBC

- Singapore Exchange

So, while Ripple Labs attempts to distance itself from the XRP Ledger, there seems to be a close-knit relationship between the two since their inception. This is further visible in the tokenomics of the XRP Ledger.

XRP Tokenomics

Overall the total supply of XRP is 100 billion. This amount of tokens was pre-mined at the inception of the XRP Ledger and distributed as follows:

- 20% (20 Billion XRP Tokens) were distributed to the creators and core team.

- 80% (80 Billion XRP Tokens) were gifted to Ripple Labs.

This, understandably, has been the cause for much concern, debate, and discussion in the crypto-verse and beyond. Of their 80 Billion tokens, Ripple has locked 55 billion in escrow using smart contracts on the XRP Ledger. These are released over the course of 55 months at a rate of 1 billion per month.

The last of these token releases will, currently, happen in April 2027. However, this date is largely expected to change, as with each token release Ripple returns a large amount of the tokens to escrow to maintain control over the market supply of XRP and, possibly, to prevent a significant drop in its price.

Interestingly, Ripple’s CEO, Brad Garlinghouse, admitted in an interview with the Financial Times that Ripple would not be profitable were it not for the sale of XRP tokens.

Note that, while small, 0.00001 XRP, all transaction costs on the network are burned, resulting in a steady reduction of the supply of XRP.

XRP Ledger Consensus

Unlike the majority of blockchains, which use proof-of-work (PoW) or proof-of-stake (PoS) to achieve decentralized consensus, and utilize mining or staking to reward network validators for validating the network, the XRP Ledger uses a federated consensus mechanism.

This federated consensus mechanism utilizes trusted validators to achieve consensus on the validity of a transaction. It is this use of trusted validators—who gain their trusted status, which is measured by a variety of metrics, over time—that allows the network to settle transactions in a matter of seconds.

Each validator on the network keeps its own list of trusted Unique Node List (UNL), which it believes won’t defraud it. For new validators, Ripple offers a default UNL, dUNL, list of 35 validators to help them join the network, but validators are still free to choose their own UNL.

Currently, the XRP Ledger has over 100 validators, and 80% of these validators must agree on the validity of a transaction for it to be settled on the network. This concept of trusted lists leads XRP to be considered to be more centralized than other major blockchains, which is why many crypto maxis don’t deem XRP to be a proper cryptocurrency.

In addition to this, there are no validator rewards for securing the network. This is because you must run essentially the same server to participate in the network, i.e. send and receive transactions, and adding a validator to this is a minimal load addition. Users of the network must establish trust lines with gateways to the network to be able to offer, hold, and transact in XRP.

What Else Can Be Done on the XRP Ledger Network?

While Ripple Labs might be focusing on using the XRP Ledger for enhancing cross-border payments and, potentially, for helping banks implement CBDCs, there are others building on the XRP Ledger.

Developers can build on the XRP Ledger in Java, Python, and Javascript, three of the world’s most popular programming languages. Over 1,500 apps and exchanges have purportedly already been built on the network, in some of the most popular categories, including:

- Games

- DeFi

- NFTs

- Wallet

Users of these apps and exchanges will use XRP to pay transaction fees and have a compatible wallet. Notably, the XRP ecosystem does not compare in size to that of any of the other top blockchains, which have extensive and diverse ecosystems.

Factors Influencing Ripple’s Price

When making an XRP price prediction there are numerous factors that need to be considered, some of these can have price effects that move it both up and down, while others may not even happen but must be weighed in by price analysts.

- Ripple Lawsuit: The outcome of the SEC vs Ripple lawsuit is certain to have an impact on the short-term price XRP. In a worst case scenario Ripple may face too large a fine and have to shutter its business—meaning that XRP will lose its biggest backer and upside potential. If the decision is decisively in Ripple’s favor then XRP will see healthy gains.

- Escrow Releases: Each month 1 billion XRP is released from Ripple’s escrow and some of it hits the market—with the rest of it being returned to escrow. So far Ripple has controlled these token releases to ensure that it doesn’t impact the price of XRP too much, but that’s not to say this will always be the case

- Adoption of RippleNET: Ripple’s RippleNET, built on top of the XRP Ledger, offers a platform for near instant settlement of cross-border, inter-currency payments. If this is utilized by its banking partners then more demand is created for XRP.

- Adoption of CBDCs: CBDCs are currently in the very early stages, and many governments are treading carefully with them, making sure they understand the implications of implementing such a technology—especially around individual privacy. Ripple is in talks with 20 countries about CBDCs, and if they are adopted this means more activity on the XRP Ledger and increased demand for the XRP token.

- Crypto Markets and Bitcoin: All tokens track closely to the price movements of Bitcoin and XRP will continue to do so until the market has matured enough that tokens can initiate price action from their own use cases.

- Crypto Regulations: The ability of Ripple to implement its solution in countries around the world depends on their stance on cryptocurrencies and the regulations they eventually put in place. The more countries that offer favorable crypto regulation, the more of Ripple’s partners who will be happy to use RippleNET and increase the demand for XRP.

- Global Economic Climate: If, at any point in the future we enter a global recession the quantity of money transferred across borders is likely to drop a substantial amount, leading to a large drop in demand for Ripple’s services, and a decreased demand for XRP. It is believed that Bitcoin and the crypto movement are rooted in their ability to be an alternative to banks and centralized monetary policy and control. Ripple’s services, and XRP’s main utility, are tied to the banking system. Another recession that leads to greater distrust of banks could lead to greater adoption of cryptocurrencies, which would not be good for Ripple, and XRP, because of their implicit ties to this legacy system.

- Cryptocurrency Adoption: Cryptocurrencies can, and already are, performing the services that Ripple is offering—Ripple is just tying the functionality into the legacy financial system. Similar to the point made above, if crypto becomes the norm over the existing system then XRP, with its ties to the “old system”, is likely to fall out of favor.

- Growth of XRP Ecosystem: While developers can build on top of the XRP Ledger, very few are doing so (even though it is said that 1500 apps and exchanges are built on it). Cryptocurrencies and the technology behind them are still in their infancy and this could all change and XRP could have a blossoming ecosystem. However, with the centralization concerns raised by many in the crypto ecosystem this is unlikely to happen.

Ripple Price Predictions by Other Experts and Analysts

XRP’s prolonged presence in the CoinMarketCap top 10 and Ripple’s ongoing troubles with the SEC mean that many analysts have weighed in and provided their XRP price predictions. Here we’ve summarized some of the most notable ones for you.

Shannon Thorp XRP Prediction

Shannon Thorp, a former Operational Specialist at Citi, a US banking provider, predicted last year that an XRP price rally would have the token hitting between $100 and $500—although a time frame was not mentioned this is all based around an increase in the use of XRP by banks.

Egret Crypto XRP Prediction

The popular Egret Crypto analyst on X has suggested that XRP could go as high as $220, drawing this conclusion from a technical analysis. There was no time frame given for this prediction.

Thomas Kralow XRP Prediction

Thomas Kralow, a Hedge Fund Manager and YouTuber who focuses on crypto, analyzing markets, and educating others, gives a medium to long-term price target of $8-10 for XRP.

Crypto Patel XRP Prediction

The Crypto Patel technical analyst predicted on X that XRP could hit a valuation of $10 by 2026, mirroring its 2017 pump and gaining 40,000% in the process. They cite 4 targets of $0.90, $1.95, $4, and $7 between now and then.

How to Buy Ripple?

As one of the most visible cryptocurrencies due to its market position, XRP is available on almost every exchange and market imaginable—it is also available from select stock brokers through the 21Shares Ripple XRP ETP (Exchange Traded Product).

That all said, the way we recommend purchasing XRP is through a reputable cryptocurrency exchange, and we recommend Binance. It is the world’s biggest exchange, with over $10 trillion in average daily trading volume and support for over 400 coins and tokens across 1400+ markets.

Here we’ll go through the steps of buying XRP on Binance, from setting up an account to purchasing your XRP tokens—all possible in 5 easy steps.

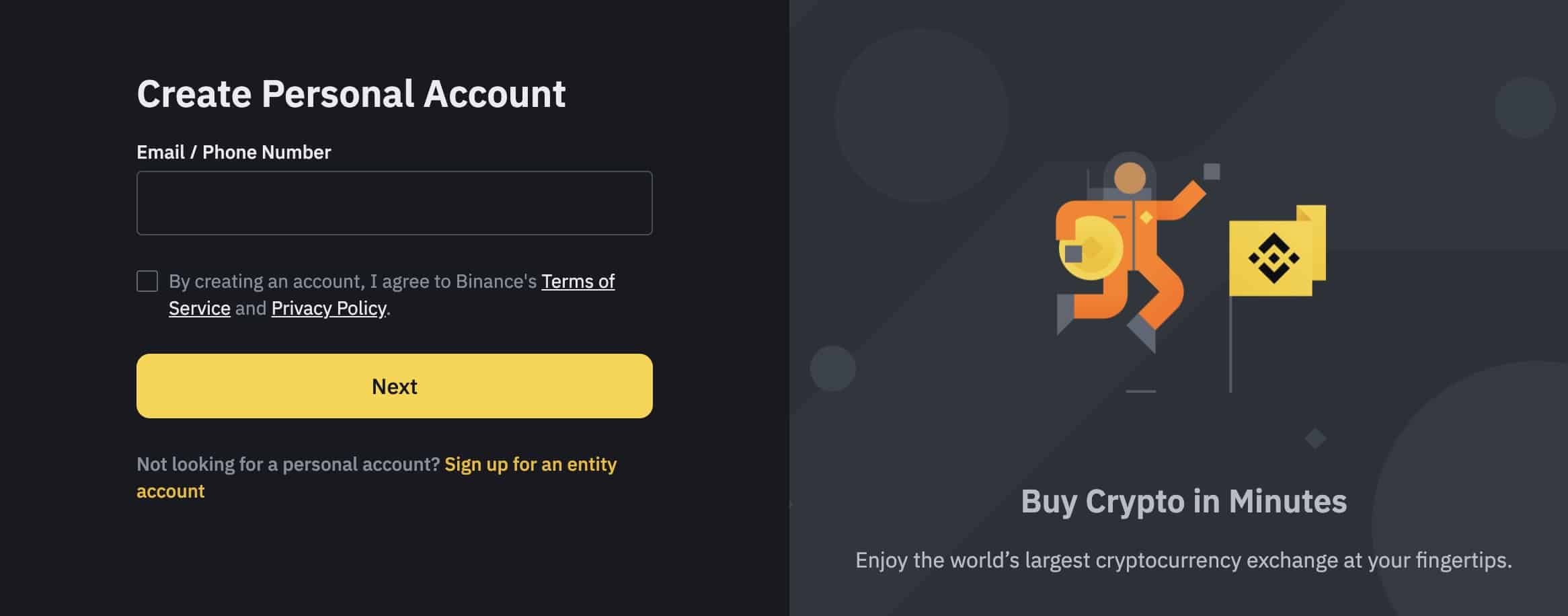

Step 1: Setup a Binance Account

For those who don’t have one already, follow this link to Binance, enter your email address or phone number, and accept the terms and conditions and privacy policy to begin the setup process.

Complete the setup by entering the confirmation code and creating a strong password.

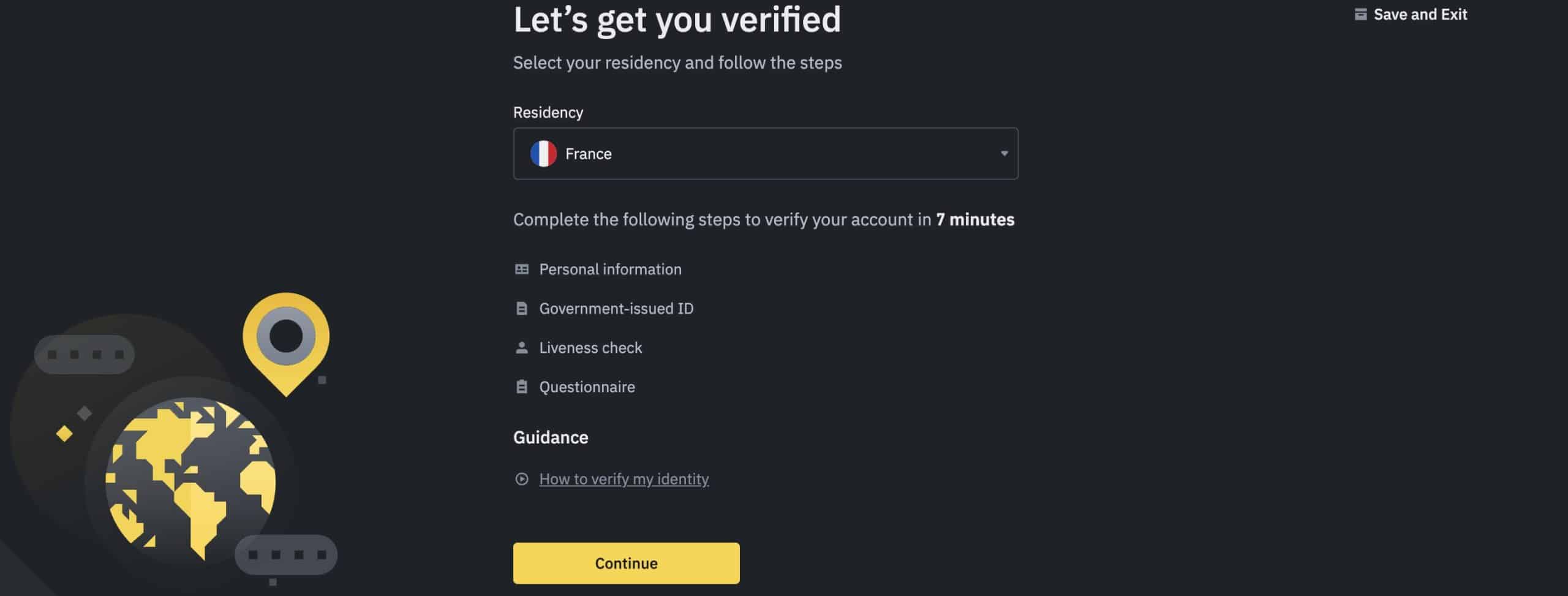

Step 2: Complete KYC Process

To use Binance users must first complete the KYC process. This requires providing personal information, a government issued ID (passport or driver’s license), taking a selfie, and filling out a questionnaire. If you have everything to hand this can be done in under 7 minutes.

Note that this process requires using the Binance App on a smartphone in addition to a web browser.

Once completed, identity verification can take up to 48 hours, sometimes longer.

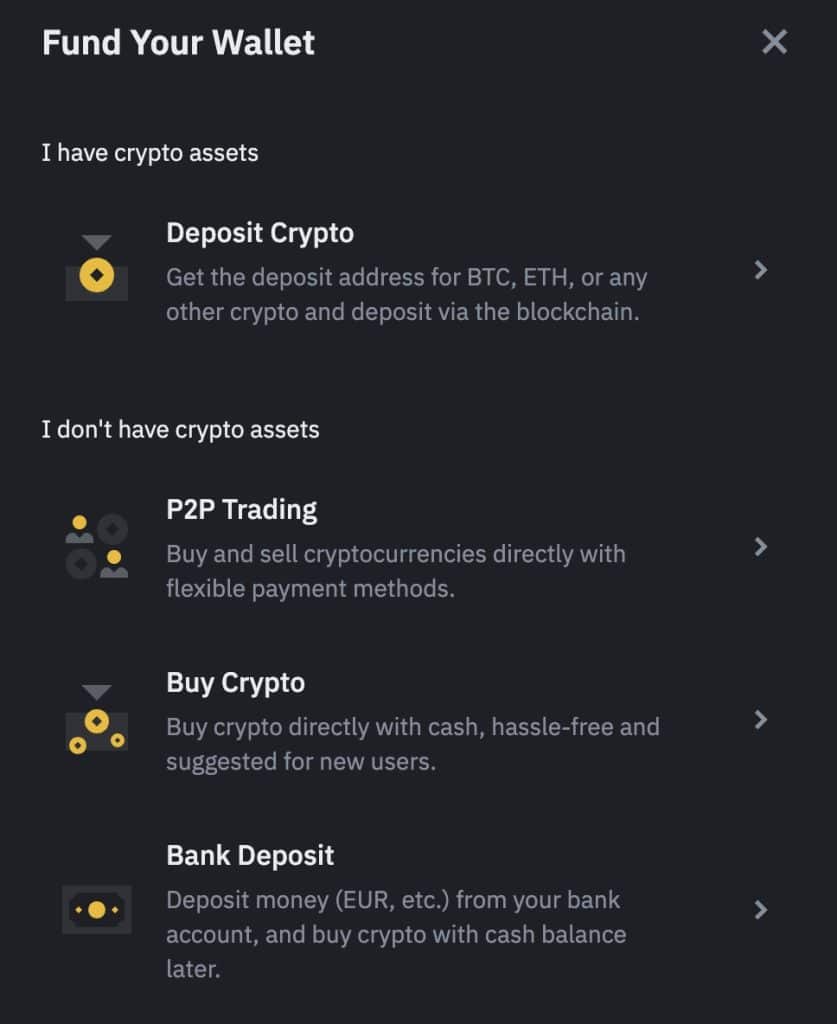

Step 3: Fund Your Account

Once you’ve verified your identity click the yellow “Deposit” button in the header and select how you want to fund your wallet you can fund it by depositing crypto, buying crypto through Binance, buying crypto peer-to-peer, or depositing funds in one of over 30 fiat currencies.

Whichever method you use, follow the instructions ensuring that you enter the right address or account number, and that you enter the correct transfer amount before confirming your transaction.

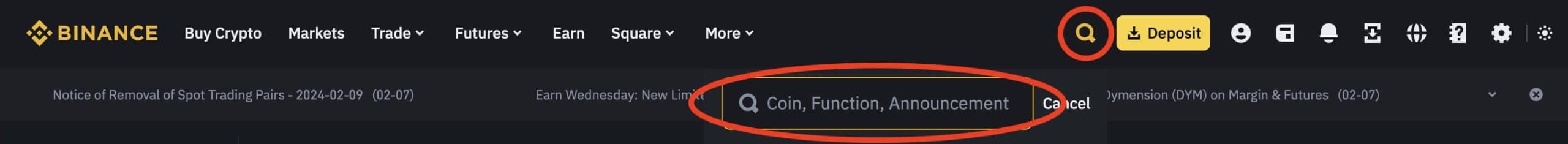

Step 4: Search for XRP on Binance

There are multiple ways to find XRP on the Binance exchange, however, the fastest way is to head to the magnifying glass in the header, search for XRP, and find the trading pair you will be using—XRP trades on over 10 markets on Binance, against fiat currencies and other top cryptocurrencies.

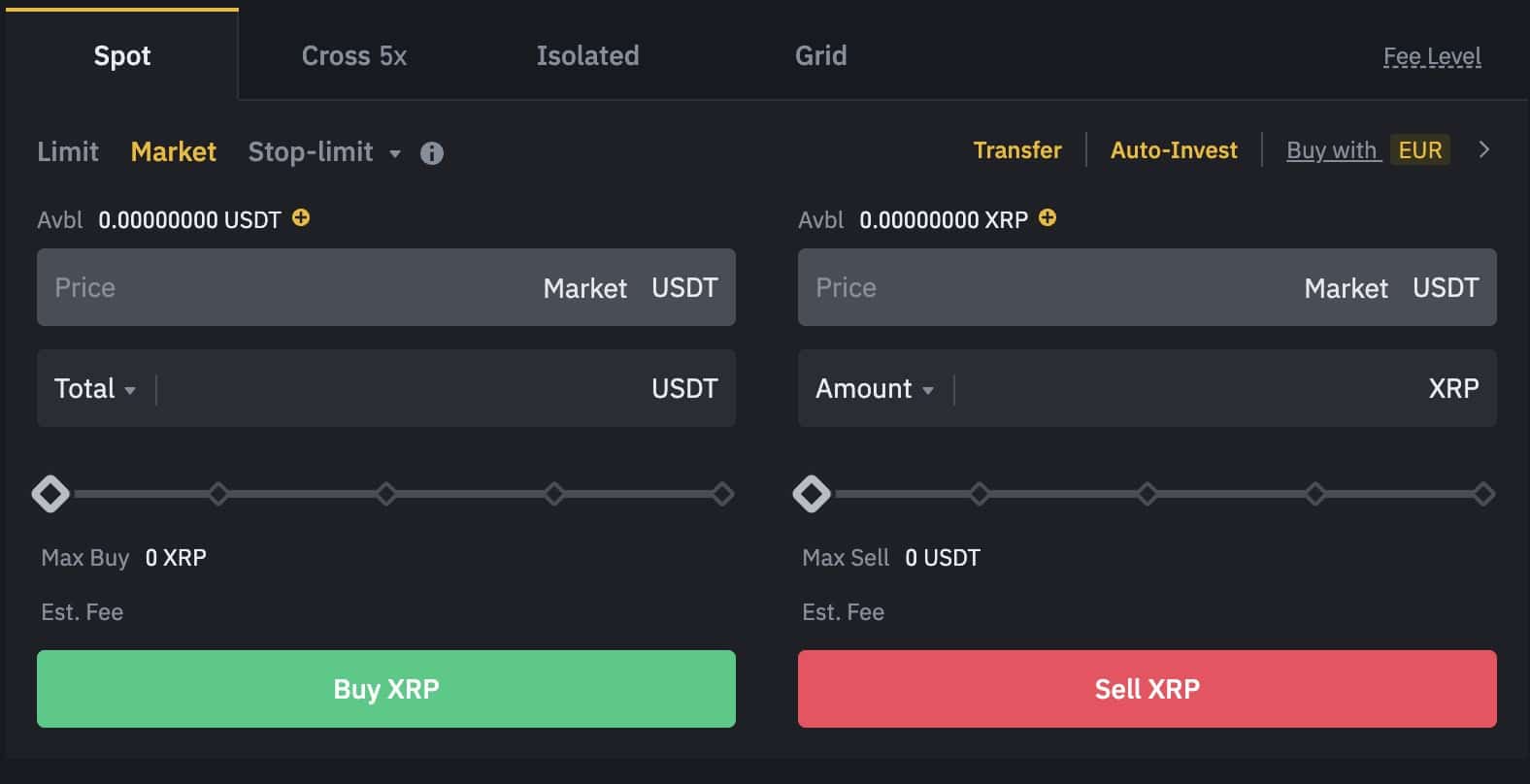

Step 5: Buy XRP

On the market page for XRP you’ll be presented with a wealth of trading tools and charts. On the bottom of this page is the purchase box.

In this box select “Market” in the top left-hand corner, this means that you’ll be paying the market price for your XRP and that your order will execute immediately. Next enter the amount you want to spend on XRP and click the “Buy XRP” button at the bottom to execute your trade. The funds will appear in your account as soon as the trade is finished—which should be almost immediately.

Ripple Price Prediction: Conclusion

XRP has been a member of CoinMarketCap’s top ten cryptocurrencies ranked by market cap since the rankings started, losing ground only to stablecoins, Binance’s token, Ethereum, and Solana—an excellent record.

While executives of the company Ripple Labs might be facing the SEC in court, this does not affect the running of XRP and the XRP Ledger. However, those who oppose XRP see its close connections to Ripple and the banking industry as flouting the values of the cryptocurrencies and propagating a system that needs fixing through decentralization.

But, with its deep connections to Ripple, and the services Ripple is looking to provide to their partners in the money remittance sector and central banks—in the form of instant transfers and CBDCs—many predict XRP has a bright future ahead of it.

While both of these opinions may be right in their own way, our XRP price prediction, after analyzing the different avenues the future could take, is a largely positive one, predicting steady growth and adoption of this cryptocurrency, alongside Ripple’s services and the implementation of regulatory frameworks for cryptocurrencies.

FAQs

Is Ripple a Good Long-Term Investment?

Ripple (XRP) has numerous partnerships in the banking sector and offers a compelling use case for greatly improving global remittance services, leaving many to mark Ripple as a great long-term investment. That being said, cryptocurrencies are volatile assets and investors need to be ready to ride the waves of the market with their investment.

Risks and Considerations in Ripple Investment

The price of XRP can vary wildly through the year, and can even rise or fall dozens of percentage points in a single day—making it a high-risk investment. Ripple’s involvement in both the cryptocurrency and banking sectors is a factor to consider—as one is highly regulated, and the other not so. Finally, Ripple is currently in a court battle with the US security regulator, the SEC.

Will XRP be the Next Bitcoin?

Bitcoin birthed the cryptocurrency movement and Ripple (XRP) has emerged from this movement. While Ripple could likely see large gains in its price, it is highly unlikely that it will follow in Bitcoin’s path.

References

- Ripple Briefly Overtakes Ethereum as The No. 2 Crypto (BusinessInsider.com)

- $100 Billion Controversy: XRP’s Surge Raises Hard Questions for Ripple (CoinDesk.com)

- WHO Director-General’s opening remarks at the media briefing on COVID-19 (who.int)

- SEC Charges Ripple and Two Executives with Conducting $1.3 Billion Unregistered Securities Offering (SEC.gov)

- Bitcoin Hits New All-Time High Above $68,000 as Cryptocurrencies Extend Rally (CNBC.com)

- Ripple Labs Notches Landmark Win in SEC Case Over XRP Cryptocurrency (Reuters.com)

- SEC Asks Judge to Dismiss Charges Against Ripple Co-Founder, CEO (Bloomberg.com)

- Ripple Must Share Financial Statements Requested by SEC, Court Rules (CoinDesk.com)

- Ethereum ETF Approval Expected in May, Standard Chartered Predicts (Bloomberg.com)

- Ethereum’s Dencun Upgrade Is a Step Toward a Scalable Settlement Layer: Goldman Sachs (CoinDesk.com)

- Today’s Cryptocurrency Prices by Market Cap (CoinMarketCap.com)

- XRP Ledger Metrics (XRPScan.com)

- XRP Ledger Blog (XRPL.org)

- Treasury Secretary Janet Yellen Warns of Crypto Risks (CoinDesk.com)

- CBDCs and Stablecoins (Ripple.com)

- Ripple Enhances CBDC Platform (Ripple.com)

- CBDC Transactions to Exceed $213bn by 2030, as Pilots Accelerate Rapidly (JuniperResearch.com)

- AWS Partner Profile: Ripple (Amazon.com)

- On the Cusp of the Next Payments Era: Future Opportunities for Banks (McKinsey.com)

- The XRP Ledger (GitHub.com)

- XRPL Ecosystem (XRPL.org)

- An Explanation of Ripple’s XRP Escrow (Ripple.com)

- Network State (XRPScan.com)

- Comparing Tag Trends with Our Most Loved Programming Languages (StackOverflow.blog)

- XRP Price Could Hit $220 With Gamma-Ray Burst: Crypto Analyst (TradingView.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Viraj Randev

Viraj Randev