How to Buy Avalanche (AVAX) in 2024: Step-by-Step Guide

When it launched in 2020, the Avalanche blockchain quickly emerged as a low-cost, faster alternative to Ethereum. However, Avalanche also supports additional chains, called subnets, allowing application-specific chains to run at lightning speeds. The AVAX token acts as both fuel for the network, paying for transactions, and the cryptocurrency used to secure the Avalanche blockchain.

In this guide, we’ll explain how to buy Avalanche (AVAX) and where to buy Avalanche. Then, we’ll learn what Avalanche is and how the Avalanche blockchain works.

How to Buy Avalanche in 5 Easy Steps

Buying AVAX on a crypto trading platform like eToro follows a simple process. However, availability may vary based on location. For example, eToro does not support AVAX in the US but allows purchases from other jurisdictions.

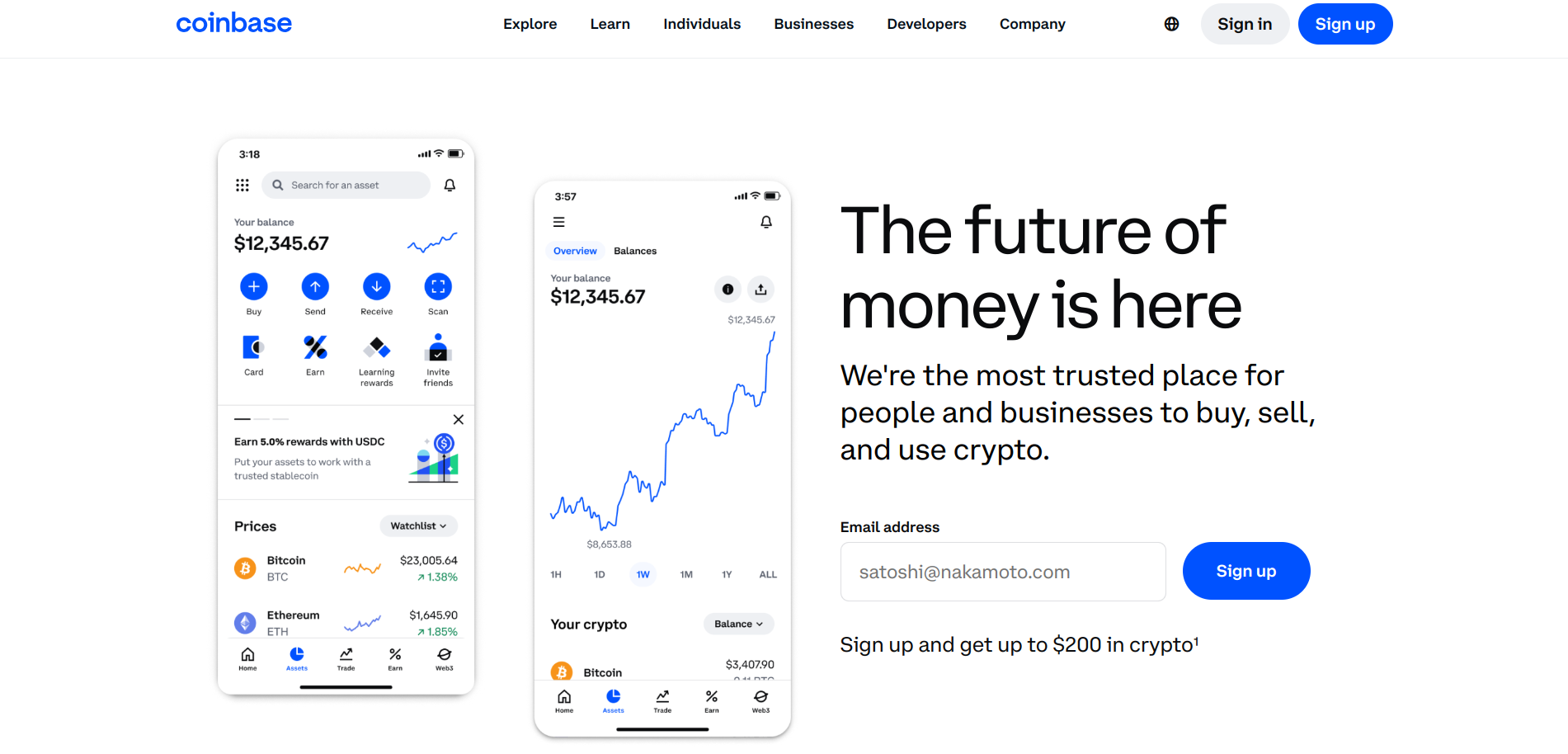

If you’re in a restricted jurisdiction, you may still be able to buy AVAX through another exchange. For example, Coinbase supports AVAX and provides an alternative for buyers who want to transfer their AVAX off the platform.

Most well-known platforms use a similar process to buy AVAX and other cryptocurrencies. Let’s get started.

1) Select an Exchange

Choose a trusted exchange that supports AVAX in your jurisdiction. Buying AVAX is legal in most countries, but some platforms restrict access to specific cryptocurrencies or prohibit trading in specific jurisdictions.

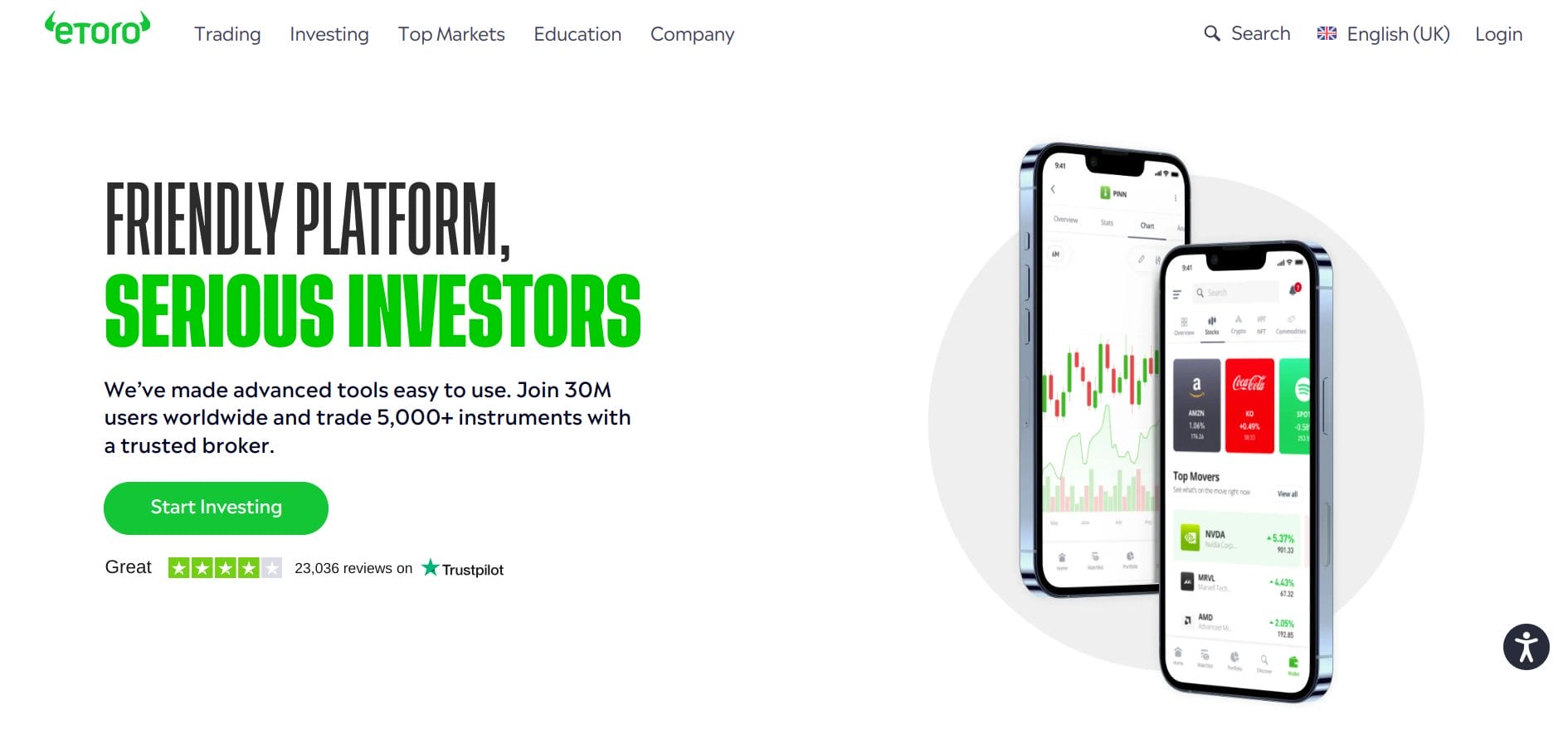

We’ll use eToro for this walkthrough. The platform offers one of the easiest onboarding experiences and is licensed or registered with several regulatory agencies worldwide, including the UK’s Financial Conduct Authority (FCA) and the Financial Crimes Enforcement Network (FinCEN) in the US. Coinbase provides an alternative for countries not supported by eToro and also offers an easy way to get started.

Visit eToro to open an account.

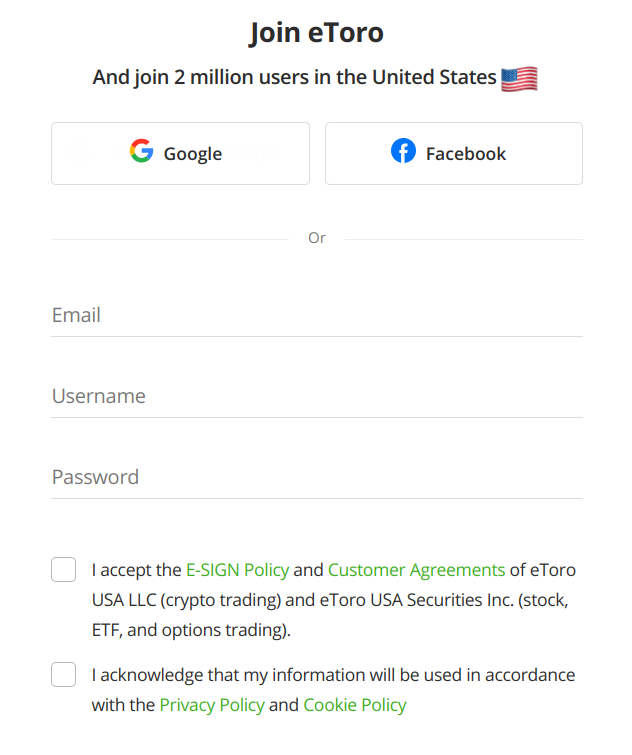

Provide your information as guided, including your email address. Then, choose a username and password.

In later steps, eToro will also ask for your name and address as well as your social security number or equivalent government ID number, depending on your location.

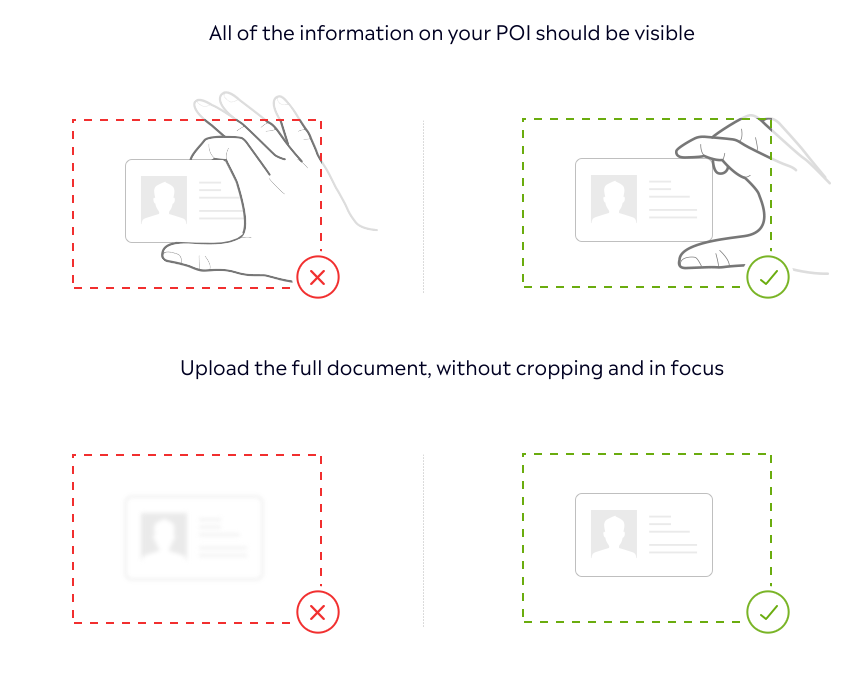

2) Complete KYC Verification

Most major exchanges now require identity verification to comply with Know Your Customer (KYC) regulations. You’ll need to upload a picture of an approved government-issued ID, such as a driver’s license or passport. eToro also requires proof of address.

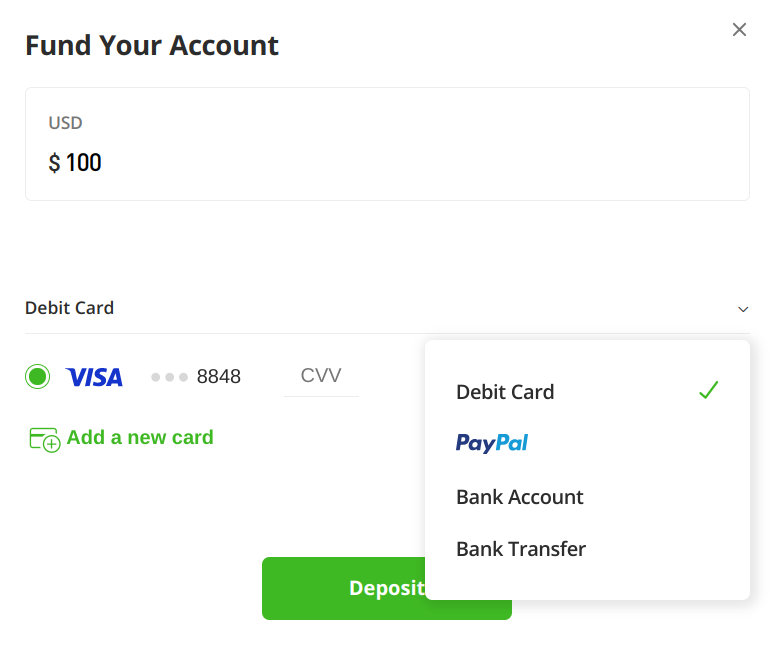

3) Deposit Funds

Wait for an email to confirm you’ve completed KYC. Then, you can make a deposit for trading. Supported payment methods vary by platform and region. For example, eToro supports debit cards, ACH bank transfers, and PayPal in the US. In some other regions, you can use Neteller or Skrill.

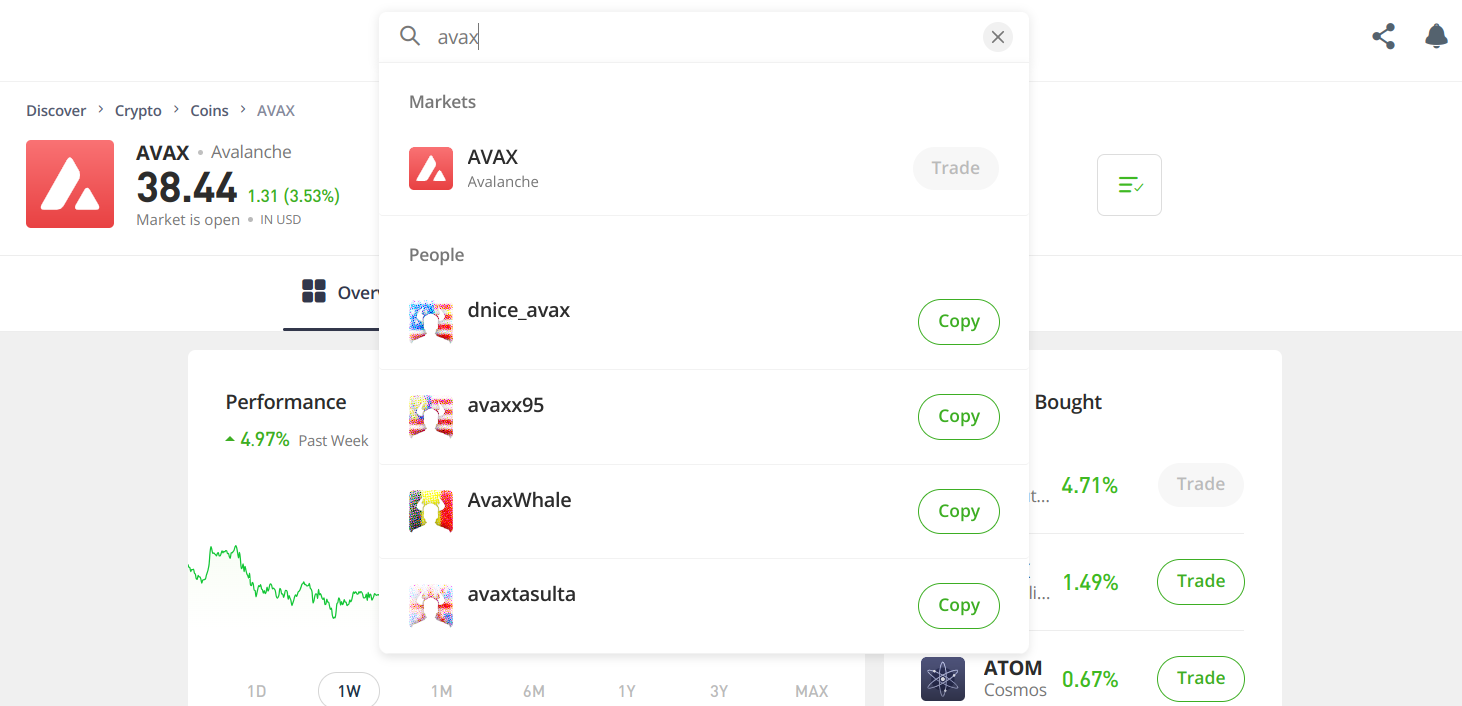

4) Select AVAX Trading Pair

Use the search feature to find AVAX. On eToro, this brings you to a detail page with a chart as well as a trade button.

5) Buy Avalanche

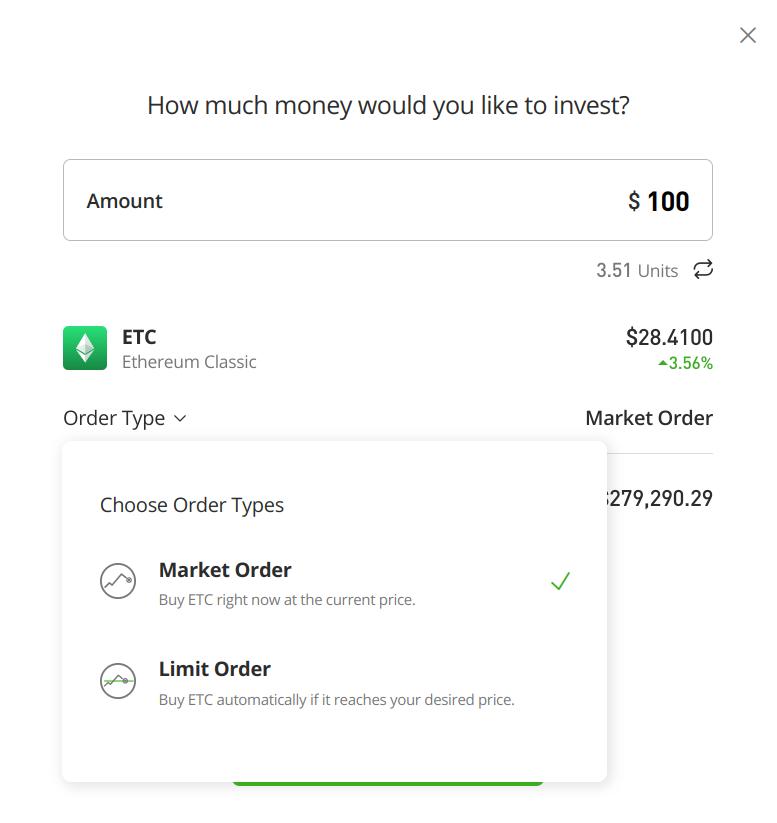

Choose an investment amount. By default, eToro uses a market order, but you can change this to a limit order for more precise control. A market order fills immediately at the market price, while a limit order lets you set a price for your order.

After your order fills, you can find your newly purchased AVAX tokens in the Portfolio tab.

What is Avalanche (AVAX)?

Launched in 2020, Avalanche is a public ledger (a record of transactions) similar to the Ethereum blockchain. The Avalanche C-Chain, where many of Avalanche’s top protocols operate, is even Ethereum Virtual Machine (EVM) compatible, making it relatively easy for builders to port existing projects to the chain.

Where Avalanche differs from Ethereum and many other popular blockchains is in its structure. Traditional blockchains store transactions in blocks (groups), connecting each new block to its preceding block using a hash (an encrypted value).

This proven architecture works well but has its drawbacks. For one, it’s often slow. Instead, Avalanche uses a directed acyclic graph (DAG). A DAG still (casually) orders transactions but allows more efficient transactions because each transaction doesn’t have to wait for a new block in the chain. In simple terms, each node can still identify the cause and effect for each transaction without waiting to bundle all the transactions into a block.

The result is a network that’s faster and cheaper to use than many well-established networks, like Ethereum. However, because Avalanche is EVM-compatible, users of protocols on the chain won’t see a functional difference compared to using the same protocol on other networks.

Avalanche’s Three-Chain Structure

The Avalanche project is actually three chains rather than one, with the last of these, the P-Chain, able to host multiple application-specific chains, called subnets.

- X-Chain (Exchange Chain): The X-Chain is used for the basic sending and receiving of AVAX tokens, the fuel token for the Avalanche network. However, the X-Chain is not used for Avalanche decentralized finance (DeFi) protocols.

- C-Chain (Contract Chain): The C-Chain supports smart contracts, which are computer programs that form the heart of DeFi applications. Popular apps like GMX or Aave use the contract chain on Avalanche.

- P-Chain (Platform Chain): Avalanche’s P-Chain supports subnets, allowing specialized applications like Citi’s Forex platform, a private ledger built for one application. Subnets allow more customization but also avoid bottlenecks that can occur on busy, shared public ledgers.

The AVAX token is at the heart of it all, acting as fuel for the network as well as the token used in Avalanche’s proof-of-stake consensus mechanism. AVAX is now a top-twenty cryptocurrency by market capitalization. Next, let’s look at how to buy Avalanche crypto (AVAX).

Where to Buy Avalanche in 2024? The Best Places

Dozens of crypto exchanges support AVAX purchases, making how to buy Avalanche and where to buy Avalanche largely a matter of preference. If you need advanced trading features and you’re in a supported jurisdiction, you can use powerful trading platforms like MEXC, Binance, or OKX.

However, if you’re new to crypto investing, you might prefer a simpler platform like eToro or Coinbase. We compare three top picks below, weighing the pros and cons of each as well as their features.

1. eToro – Easy-To-Use Platform With Demo Trading and Copy Trading

Known for its social trading, eToro lets you follow the moves of top traders on the platform through a feature they call copy trading. This makes the platform well-suited to newer traders and offers a way to learn by watching successful trades.

eToro also offers a virtual account. Each account gets $100,000 in virtual currency to use in practice trades against real-market prices. Hone your trading skills or test your trading strategies before trading with real funds.

If there’s a caveat to buying AVAX with eToro, it’s that the platform does not support withdrawals of AVAX to a self-custody wallet for storage or use on the Avalanche network. However, if you just want price exposure to AVAX and other cryptocurrencies, stocks, and ETFs, eToro lets you build a winning portfolio.

| Payment Methods | Bank transfer, debit card, PayPal, Neteller |

| Minimum Purchase | $10 |

| Self-Custody Withdrawals | eToro supports withdrawals for BTC and ETH. AVAX withdrawals are not supported |

| Standout Feature | Demo Trading – Practice trading with a $100,000 virtual trading portfolio |

Pros

- Newbie-friendly trading interface

- Copy trading

- $100,000 Demo account

- Fixed 1% trading fees for crypto

Cons

- AVAX withdrawals not supported; sell to exit position

- AVAX is not supported for US traders due to regulatory concerns

- Higher fees compared to advanced platforms

2. Coinbase – Leading Crypto Exchange With More Than 260 Cryptocurrencies

Coinbase is the world’s largest publicly traded crypto exchange and offers more than 260 cryptocurrencies for trading, including AVAX, alongside other popular assets like BTC and ETH. Coinbase’s wider selection means you’ll also have access to tokens for smaller projects and even a vetted selection of Avalanche meme coins.

Like eToro, Coinbase caters to newer traders, making basic trading features easy to use. However, Coinbase also offers an advanced trading platform that offers advanced charts and advanced order options as well as futures trading in select markets.

The platform also supports staking for select cryptocurrencies (but not AVAX) and a crypto debit card that lets you spend your crypto (or cash) like cash and earn crypto rewards for making everyday transactions.

| Payment Methods | Bank transfer, debit card, PayPal |

| Minimum Purchase | $10 |

| Self-Custody Withdrawals | Withdraw to Coinbase Wallet, MetaMask, Ledger, or other compatible wallets |

| Standout Feature | Staking – Use cryptocurrencies like ETH and SOL to earn yields of up to 9% |

Pros

- User-friendly onboarding process

- Wide selection of cryptocurrencies

- Withdraw AVAX to Coinbase Wallet

Cons

- Higher trading fees for simple trades

- Limited staking support (AVAX not supported)

3. Kraken – Advanced Trading Features With Proof of Reserves

The Kraken exchange launched in 2011 as a safer alternative to early exchanges like Mt Gox (which failed). Today, Kraken is still regarded as one of the safest exchanges in the world, partly due to the exchange’s commitment to transparency. Kraken provides an account-level proof of reserves, a way of proving the exchange has the crypto showing on your account dashboard.

Kraken boasts over 200 cryptocurrencies, including AVAX, BTC, and ETH. New users will find Kraken easy to use. However, the exchange also offers an advanced platform called Kraken Pro with support for advanced trades, margin trades, and futures trading in select markets.

| Payment Methods | Bank transfer, debit card, PayPal |

| Minimum Purchase | $10 |

| Self-Custody Withdrawals | Withdraw to MetaMask, Ledger, Coinbase Wallet, or other compatible wallets |

| Standout Feature | Leverage trading: Kraken offers margin trading for qualified accounts |

Pros

- Easy onboarding

- Proof of reserves

- Support for AVAX withdrawals

Cons

- Expensive simple trades

- No staking support for AVAX (15 other cryptos supported)

How We Ranked The Best Places to Buy AVAX

We considered several factors when ranking the best places to buy Avalanche. These included trading liquidity and trading fees. We also weighed ease of use as a starting point.

Highest AVAX Trading Volume – 25%

The ability to trade in and out of a position with reasonable spreads is key to profitable trading. We looked at exchanges with high liquidity and sustained trading volume.

Support for Avalanche Network – 25%

Support for the Avalanche network includes both the ability to purchase AVAX in a wide range of jurisdictions as well as support to move AVAX to a self-custody wallet. Non-custodial storage of crypto assets helps reduce platform-related risks.

Lowest AVAX Trading Fees – 25%

Most crypto trading platforms charge higher fees for simple trades. We weighed the availability of lower fees but also considered how the platforms structured fees and how well that served newer or occasional investors.

Most Ways to Buy AVAX – 25%

Supported payment methods also played a role in our ranking. We considered platforms with multiple funding methods, using native support for bank transfers and debit cards as a minimum criterion.

What is the Best Way to Store Avalanche?

When you buy AVAX on an exchange, the exchange provides custodial storage, holding your crypto in a crypto wallet controlled by the exchange itself. However, this crypto storage strategy can put your crypto at risk. If the exchange suffers a liquidity crunch, gets hacked, or becomes insolvent, you can lose access to your crypto.

Crypto investments don’t offer the same consumer protections available in some markets, such as FDIC insurance for deposits or SIPC insurance against brokerage insolvencies. Instead, taking self-custody of your crypto offers the safest option.

Several popular crypto wallets support the Avalanche network, offering a way to store your AVAX and transact on decentralized applications (dApps).

- Hot Wallets: MetaMask and Coinbase Wallet both support AVAX. These wallets are free, easy to use, and support both desktop and mobile.

- Cold Wallets: If you have a larger balance, you may want to invest in a hardware cold wallet. These wallets store the wallet’s private keys on a separate device that’s not connected to the internet. Popular choices include Ledger and Trezor wallets, both of which have a proven history dating back to 2014.

What Can You Use AVAX Tokens for?

AVAX tokens serve two primary purposes on the Avalanche network: paying for transaction fees and staking to secure the network. However, the token can also be used in DeFi protocols.

- Staking: Avalanche uses proof of stake as its consensus mechanism to validate transactions. Staking refers to using tokens as collateral to help ensure proper validation. Yields for staking AVAX tend to be higher than Ethereum, for example, making AVAX a popular choice for crypto passive income.

- Network fees: The AVAX token pays for transaction fees on the network. Sending tokens from W Wallet A to Wallet B or executing a smart contract both use AVAX to pay the transaction fee.

- DeFi applications: As a proven digital asset, AVAX can also be used in DeFi applications. For example, the Aave lending and borrowing app supports AVAX as collateral to borrow AVAX or other assets like ETH or popular stablecoins like USDC or USDT.

Conclusion

The AVAX token has grown in popularity to become a leading cryptocurrency, and subnet deployments like Citi’s FX platform bode well for the future of the project.

To buy AVAX, the process follows similar steps on most exchanges. Choose which platform works best for you, create an account, and complete KYC. Then, make an initial deposit and finalize your purchase. eToro offers the easiest way to get started if you’re new to crypto trading and offers a demo account where you can practice trading risk-free. If you’re in the US or need to store your AVAX in a self-custody wallet, you can also consider Coinbase or Kraken.

References

- Directed Acyclic Graph (DAG) Definition (coinmarketcap.com)

- Deposit Insurance (fdic.gov)

- What SIPC Protects (sipc.org)

FAQs

Where is the best place to buy Avalanche?

eToro offers the easiest way to get started with buying AVAX. However, the platform doesn’t support US trades for AVAX or wallet withdrawals. Other choices include Coinbase and Kraken, both of which support US trades and wallet withdrawals.

Can I buy AVAX on Coinbase?

Yes. Coinbase supports purchases for AVAX in most jurisdictions around the world.

How do you buy Avalanche in the US?

To buy AVAX in the US, you need to choose an exchange that supports both AVAX and US traders ( specifically for AVAX). Both Coinbase and Kraken support AVAX for US traders.

Can I buy AVAX with a debit/credit card?

Yes. Coinbase, Kraken, and eToro all support debit card purchases for AVAX in many parts of the world.

How can I invest in Avalanche?

To invest in Avalanche, choose a trading platform that supports your country and the AVAX token. Open an account and complete identity verification. Then, fund your account and buy AVAX, the native token for the Avalanche network.

Alan Draper

Alan Draper

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi