Solana Price Prediction 2024, 2025, 2026 – 2034

Solana has, seemingly, come back from the grave through 2023 and 2024, and is now one of the blockchains on everyone’s lips. Utilizing a unique proof-of-history layer Solana manages to validate hundreds of thousands of transactions per second, but critics point to its high level of centralization and continued outages as a large concern. As of April 29, 2024 Solana price has is trading at $135.42 which is on the way to it’s all-time high of $259.52.

Here is some quick data on the current Solana performance:

| Coin Name | Solana |

| Solana Symbol | SOL |

| Solana Price | $135.42 |

| Solana Price Change 24h | ▼ -5.39% |

| Solana Price Change 7d | ▼ -12.12% |

| Solana Market Cap | $60,571,645,271 |

| Circulating Supply | 447,282,339 SOL |

In this Solana price prediction, we dive into Solana’s price history and uncover what has happened before, before looking to the protocol and the future to make SOL price predictions for each year between 2024 and 2030.

Solana Price Prediction Overview

- Solana was first conceptualized in 2017 and utilizes a unique proof-of-history concept which allows it to increase transaction throughput to up to 700,000 transactions per second.

- The network was launched in 2020, with a first recorded price of $0.9511. Despite its technical claims, Solana has had multiple network outages each year since its inception—however, the price impact of these is negligible.

- In 2021 Solana hit its all-time high (ATH) of $260.06 amid a market-wide bull run, before spending 2022 declining as a result of multiple outages, wider market conditions, and the collapse of FTX and Alameda Research, which were closely tied to Solana.

- After being declared dead by many at the end of 2022, SOL staged a miraculous comeback in 2023, rising from under $10 at the start of the year to finish the year at $109.55—a gain of 997%.

- Our Solana price prediction expects SOL to hit new ATHs of $298 in 2025 on the back of the Bitcoin Halving effect.

- We don’t expect it to revisit these levels until 2029 when we expect Solana to hit a high of $380.

The table below summarizes our Solana price predictions for each year between now and 2034.

Solana Price Predictions 2024-2034

| Year | Potential Low (ROI) | Average Price (ROI) | Potential High (ROI) |

|---|---|---|---|

| 2025 | $304.21 (124.64%) | $308.42 (127.75%) | $312.68 (130.89%) |

| 2026 | $293.45 (116.69%) | $302.66 (123.50%) | $310.93 (129.60%) |

| 2027 | $283.48 (109.33%) | $296.91 (119.25%) | $309.43 (128.49%) |

| 2028 | $273.42 (101.91%) | $291.15 (114.99%) | $308.02 (127.45%) |

| 2029 | $264.11 (95.03%) | $285.39 (110.74%) | $307.12 (126.79%) |

| 2030 | $253.57 (87.25%) | $279.63 (106.49%) | $305.19 (125.37%) |

| 2031 | $242.86 (79.34%) | $273.87 (102.24%) | $305.19 (125.36%) |

| 2032 | $234.07 (72.85%) | $268.12 (97.99%) | $302.20 (123.15%) |

| 2033 | $223.67 (65.16%) | $262.36 (93.74%) | $299.55 (121.20%) |

| 2034 | $212.73 (57.09%) | $256.60 (89.48%) | $299.20 (120.94%) |

In the sections below we dive deeper into our Solana price prediction for each year remaining in this decade and detail the reasons as to why we’ve come to the conclusion we have for each year.

Solana Price Prediction For 2024

2024 has already gotten off to a good start for the cryptocurrency markets, with Bitcoin ETF approval, and the subsequent demand for Bitcoins, pushing the market back above a $2 trillion valuation. The first half of 2024 has three more events planned that could affect the price of Solana.

The first of these is the Dencun upgrade for Ethereum, Solana’s biggest competitor, which is scheduled for mainnet deployment on March 13th. This will reduce fees and optimize scalability for layer 2s on the network—impacting the two aspects where Solana is considered to be superior to Ethereum.

The second event is the Bitcoin Halving event, scheduled for April. While these typically don’t result in price action, this year could be different, as institutional investors, as well as individual traders, enter into the market on the back of rising prices.

There’s also the potential for Ethereum ETF approval, with the first deadline set for May 23rd. Bitcoin ETF approval led to a 9% leap in the Ethereum price, as investors speculated on which cryptocurrency would be next to get an ETF—the same may happen to Solana.

In the world of Solana for 2024, more token extensions being introduced to the network, increasing the utility of tokens on the network, and a variety of validator clients are under development which can hopefully prevent Solana network outages.

Finally, there is the dark cloud hanging over Solana, and many of the top altcoin, which is them being categorized as a security by the SEC in its lawsuits with 3 of the top crypto exchanges. All three exchanges have asked for the judges to dismiss the case, saying that the SEC is overreaching by making these distinctions. This could deter many investors—however, Solana’s deeply entrenched roots with venture capital firms and big business may help it here.

All this taken into account it seems like SOL is going to have a positive 2024. This leads our Solana price prediction for 2024 to read as so:

- 2024 Potential High: $200

- 2024 Average Price: $150

- 2024 Potential Low: $80

Solana Price Prediction For 2025

If 2024 is the year of the Bitcoin Halving then, if we continue to follow historical patterns, 2025 is the year many predict that Bitcoin will hit new ATHs, dragging the rest of the market up with it.

2025 is also the year when, on the back of a 2024 that thrust cryptocurrencies into the mainstream, we expect to get some regulatory clarity for cryptocurrencies in some of the world’s biggest economies—a hugely positive move.

This year may also be the last year that Solana suffers an outage, with new validator clients having come online this year and the year before. While important, just as it doesn’t now, any outage probably won’t dampen investor sentiment.

As a result, our Solana price prediction for 2025 contains a high of $298, a low of $120, and an average price of $200.

Solana Price Prediction For 2026

If the Bitcoin Halving induces highs in 2025, then 2026 is the year when there is expected to be a fallout from that event. This fallout will, however, be cushioned by a globally improving regulatory landscape for cryptocurrencies that are receiving increasing institutional adoption. Solana’s close connections to companies will help it weather the Halving fallout storm better than others.

This will especially be true as Solana has its first year ever without suffering a major outage, as the now diverse network of blockchain clients helps to keep the network operational when one of the clients suffers an outage.

As a result, our Solana price prediction for this year is more optimistic than it might be for other coins, containing a high of $220, a low of $100, and a median price of $160.

Solana Price Prediction For 2027

As the global economy continues to strengthen after its post-pandemic recession scares, the adoption of cryptocurrencies and blockchain networks for a variety of use cases continues to grow, and regulatory frameworks around the globe continue to improve for cryptocurrencies.

With the growth of the regulatory framework for cryptocurrencies, 2027 could also be the year that decentralization becomes a major part of the cryptocurrency conversation, as the citizens of the world become more confident storing their funds and transacting on the strong decentralized networks, as they lose confidence in the existing system.

Solana, with its centralized validator set and history of a close relationship with authorities, institutions and conglomerates, will not fare well once this discussion starts.

This year’s Solana price prediction is a high of $180, a low of $80, and an average price of $130.

Solana Price Prediction For 2028

As we gaze into our crystal ball of cryptocurrency predictions, the future becomes less and less clear the future we look. However, we do know that 2028 will be the year of the 5th Bitcoin Halving. Will this still affect other coins or will Bitcoin, as crypto’s alternative to gold, now only grow in size when there is market uncertainty and other coins shrink?

Here we predict that it will still have a pull on the market, though nothing like before. With 2028 being the year of the Halving a small rise is expected as more users look to buy a share of Bitcoin in anticipation of next year’s halving event.

With that said, our Solana prediction for this year is a high of $260, a low of $160, and an average price of $210.

Solana Price Prediction For 2029

With the Bitcoin Halving happening last year, and crypto adoption continuing to grow, Bitcoin’s rise in price prompts users to begin buying up other layer 1 and layer 2 tokens in the ecosystem. As per our talk of a move toward decentralization, Solana doesn’t fare as well as its counterparts, but still climbs up to new all-time highs.

Our Solana price prediction for 2029 holds a high of $380, a low of $220, and an average price of $290.

Solana Price Prediction For 2030

If 2029 is the year that we see new all-time highs from the Bitcoin Halving then 2030 is going to be the year where, as before, the fallout from these highs comes in. However, with cryptocurrencies now wholly mainstream the losses are much lower than for previous Halving events, and this one mainly helps to consolidate prices.

As a result, our Solana price prediction for 2030 features a high of $320, a low of $280, and an average price of $295.

Historical Performance of Solana

The Solana mainnet was launched on March 17th, 2020, and the first price data for Solana on CoinMarketCap comes from April 10th, 2020, where the token was worth $0.9511.

From here it declined, hit its all-time low of $0.5052 on May 11th, and traded between $0.50 and $0.70 until July. In July, SOL started climbing, reaching above $1 for the first time. As interest in the token and network continued to grow SOL continued to climb peaking at a yearly high of $4.4217 at the end of August.

From here the token declined, finding tentative support at $2.50 on the way down, before bottoming out at $1.3251 at the end of the year.

2021: The Rise of Solana

The crypto market rallied into 2021 and Solana followed suit, climbing from $1.8456 at the start of the year, to peak at $49.50 at the start of May, just as Bitcoin was touching $60k for the first time. Nevertheless, this was a 2,582% increase and an impressive 11x increase on its high of last year.

SOL then settled into a trading range between $25 and $50 until the middle of August, when it started to climb the charts. It stalled in early September as the first partial outage hit the network, but continued to hit a high of $187.61, before retracing to $132, a decline that included Solana’s first major outage on September 14th, lasting 17 hours.

SOL bounced off this price and almost doubled in value between then a early November, as it hit its all-time high of $260.06 on November 6th—just as the rest of the crypto market was also peaking.

From here the price of SOL declined in line with the rest of the crypto market. Finishing the year at $178.53.

2022: A Year of Hurt for Solana

Solana declined into 2022 with the rest of the crypto market, fresh off Bitcoin Halving fueled highs. But it also started the year plagued by its own issues. All-in-all Solana suffered six serious outages in January 2022, along with three minor outages, which resulted in a network uptime of 96.43%. All the outages for 2022 are marked on the chart below in blue.

While the price remained steady through the first week of outages, it quickly declined once the network was properly back up and running, and by the end of the month, it had lost 44% of its value and dipped back below $100 to be priced at $99.50.

The Solana price then found support around the $80 mark through February and into March. In late March, following the rest of the crypto market in a brief rally, SOL climbed above $132 before returning to continue its descent, Dropping below $40 at the beginning of June and finding support at $30 in the same month.

SOL traded between $30 and $45 for the summer of 2022, moving to a tighter range between $30 and $35 in September.

At the beginning of November, the FTX collapse started with the CEO of Binance, CZ, announcing that the exchange would be liquidating its supply of FTX’s FTT token on November 6th.

Solana, of which FTX and Alameda Research were funders and supporters—and also owned over 10% of the total supply of SOL—suffered immediately from this announcement, and promptly lost over 60% of its value in 4 days.

SOL found support at the $13 level and then closed 2022 at just under $10—a 94.4% year-on-year loss.

2023 to Present: An Unbelievable Recovery

With crypto pundits claiming that Solana was now dead, the data analysts were quick to point out that on-chain activity was holding strong into the start of 2023. Indeed, by the end of January, Solana had gained an incredible 161%.

$20 became support for SOL in the first half of 2023, and Solana largely traded between this mark and $25 for the first half of the year—also shaking off an almost 19 hours network outage in February with minimal price impact.

However, in June, in lawsuits against Binance and Coinbase, and a subsequent lawsuit in November against Kraken, the SEC labeled SOL as a security. This caused SOL to lose 33% of its value in the following days, sinking to below $15.

From here, however, the token began to climb, briefly reaching above $25 in July before a false report of Bitcoin ETF approval in mid-October spurred the beginning of a market rally. The creation of the BONK meme coin—now the third best meme coin in the whole market—started a meme mania on Solana, and, combined with the wider market rally, this helped to push SOL up the charts, blasting back into the CoinMarketCap top 10 in spectacular fashion. SOL posted gains of 88% in December to find a yearly high of $126.36.

Over the course of 2023 Solana gained 997%, finishing the year at $109.55.

With SOL now back in the top 10 the coin was more subject to the ebb and flow of the wider market than ever and followed the market through its speculative motions as Bitcoin ETF approval came.

It struggled against the psychological barrier of $100 for a while and, to no consequence, suffered a 5 hour outage on February 6th—it actually gained 24% in the 8 days after this event, climbing above $100 for the first time in 2024.

At the time of writing SOL had surged above $130, following Bitcoin’s surge above $60,000.

Current State of Solana

Despite a spectacular fall from grace in 2023, and continuing problems with network outages, Solana has roared back into life; a life it seemingly never lost, as a growing active wallet count and new token accounts can attest to.

Since October last year, Solana has also seen a surge in the creation of new tokens, with many new meme coins springing up in the meme mania that followed the Bonk mania of late 2023. There have also been a large number of new NFTs created on the network.

Below we’ve collated some stats to show the current state of Solana and its market position.

- 230 dApps, ranking it #12 (DappRadar)

- $2.5 billion in TVL, ranking it 5th with 2.83% of all DeFi TVL (DeFiLlama)

- 1,615 active developers, ranking it in 8th (Developer Report)

- $5 billion in NFT sales, ranking it #2 (CryptoSlam)

- 68% of available SOL staked (Coinbase)

- 23 days since last network outage (Solana Labs)

Market Position and Performance

After its meteoric gain of 414% in Q4 of 2023 put it back in the top 10, Solana sits comfortably in 5th place, between BNB and XRP. The price of SOL is currently around the $130 mark, and, as can be seen from the chart below, its recent rise is a mirror image of that of Bitcoin.

If then, we are to look at SOL’s near future it is dominated by movements in the price of Bitcoin, as both press toward resistance of $138 and $63k respectively; SOL’s future will likely be largely be decided by the path Bitcoin takes in the coming days and weeks, and, around that there is a lot of speculation.

What is Solana and What is it Used For?

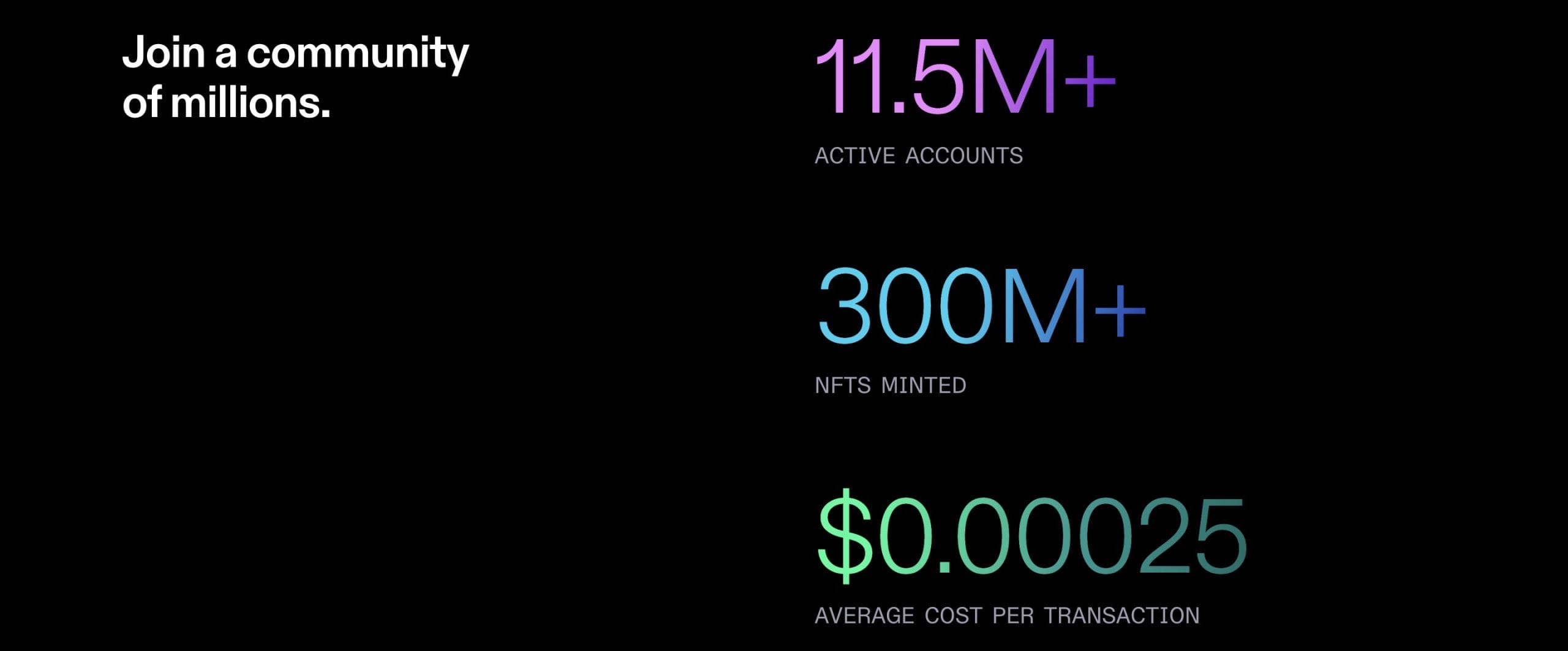

Solana is an open source, third generation, layer 1 blockchain designed for mass adoption by being energy efficient, fast, and inexpensive to use. It uses a proof-of-stake consensus model, which is topped with a proof-of-history model to increase the speed of transaction validation and offer users sub-second finality.

The Solana network supports an ecosystem of smart contract based dApps, along with tokens and NFTs, and can, theoretically, process over 700,000 transactions per second.

The Solana blockchain was first conceived with the launch of the first version of the Solana whitepaper in 2017, authored by Anatoly Yakavenko. In it, he describes how a reliable clock can significantly simplify the synchronization of a decentralized network, enabling an increase in throughput that is then only limited by the network’s bandwidth.

Together with some former colleagues from Qualcomm—a company that focuses on telecom equipment and semiconductors where Anatoly was an executive—development began on the project, which was initially launched as Loom before changing its name to Solana (after the town Solana Beach, where several of them lived while working at Qualcomm).

Solana evolved through various iterations and displayed its transaction processing potential on multiple testnets before hosting an ICO in March 2020, and then launching mainnet in the same month. It is developed by the Solana Labs company and ecosystem growth is overseen by the Solana Foundation.

How Solana Works: Proof-of-Stake and Proof-of-History

Solana was designed as a layer 1 that does not require scaling solutions like the layer 2s relied on by other blockchains—specifically its main competitor Ethereum.

Like Ethereum and many other top layer 1 blockchain projects, Solana uses a proof-of-stake (PoS) consensus model to provide security for the network. Here, validators stake tokens to be eligible to validate blocks, and their stake is slashed if they are found to be a bad actor.

What Solana does differently from others, is to add a proof-of-history (PoH) layer on top of this, implementing a cryptographically repeatable clock into the protocol, which then allows validators to cryptographically timestamp each event (transaction) and, consequently, add verifiable passage of time to the network.

Note that this PoH does not form a part of the consensus mechanism for the chain, it only helps to choose which blocks should be added to the chain and helps to increase the transaction throughput.

For a distributed system like a decentralized blockchain, this addition of verifiable time allows for nodes in the network to independently verify a transaction’s validity without the need to rely on communicating with the other nodes in the network, as it knows that each other node would give the same answer to the transaction as it would.

This implementation of time removes the concept of software performance as a bottleneck and allows transaction throughput to scale proportional to bandwidth—it is in this manner that the figure of 700,000 transactions per second was reached, achievable when using a 1 gigabit connection.

Solana and the Blockchain Trilemma

The blockchain trilemma was first talked about by Vitalik Buterin, and states that a public blockchain has three core features: security, scalability, and decentralization. But in order to increase two of them the other must be sacrificed.

Solana, in its goal of increasing throughput to improve the user experience, has sacrificed decentralization, by requiring high-level computing resources to run a validator—some estimates put it at $20,000 worth of equipment, before you even get to buying the SOL needed for staking.

In addition to this cryptographic clock, Solana also uses validator clusters, which can be given specific purposes in the network, to divide up tasks and help to scale the blockchain.

Solana Staking and Transaction Fees

Solana validators must stake tokens to run validator services, with this stake being slashed if they are found to be a bad actor. Users can delegate their stake to a validator to boost that validator’s chance of getting selected to validate blocks. In return, the delegator receives a share of the newly released SOL.

Like on Ethereum, native staking is illiquid, meaning that, once staked, these tokens are locked and cannot be used. To resolve this problem, as on Ethereum, multiple Solana liquid staking protocols now exist to allow users to stake their tokens and earn rewards.

Transaction fees on Solana are incredibly low, costing an average 0.000033234 SOL ($0.004) at the time of writing. Transaction fees have a minimum base fee, 0.000005 SOL ($0.0005) that is then increased by a computation fee, which is relative to what the sender wants to do on the network, e.g., using a smart contract requires a computation fee but just send SOL will be charged the base fee.

In addition to this users can add a nominal prioritization fee to have their transaction executed faster. Note that transaction fees are deducted regardless of whether a transaction succeeds or not.

50% of a Solana transaction fee is automatically burned, with the rest going to the validator who confirmed the transaction.

Those staking SOL to a validator receive a portion of the number of new SOL tokens generated for that block. The number of tokens received is calculated on the network’s current inflation rate, the number of SOL staked on the network, and their chosen validator’s uptime and fee.

Solana’s Network Shutdowns

As shown in the price history section above, Solana has had multiple major downtime incidents, 6 in total, combined with numerous partial outages that have affected block production or other elements of the network. The most recent outage was caused by a bug identified back in April 2022.

These have led many to criticize the network for its unreliability and its centralized nature, with these events shining the light more brightly on this aspect of the chain with each occurrence. However, as noted, these seem to have an negligible effect on the price of SOL.

Venture Capital and Developing on Solana

Solana’s popularity persists despite these outages, and this is, in part, due to the fact that it is heavily backed by large venture capital firms—which is widely condemned by decentralized blockchain purists. 48% of the network’s tokens were set aside for these investors.

Another reason why Solana potentially persists in its popularity despite these outages is the fact that developers can write smart contracts in the popular Rust, C, and C+ programming languages, allowing for the creation of a range of smart contracts. Users can also use a Solang compiler to create Solana smart contracts from Solidity, the world’s most popular smart contracting language.

Such accessibility makes Solana a draw for developers and a large number of hackathons, with large prizes and pre-seed funding potential help to continually draw developers to the network. The ninth hackathon held by the Solana foundation has prizes of over $1 million.

What is Solana’s Native SOL Used For?

SOL is the native currency of the Solana blockchain and is required for interacting with the network. The SOL coin has multiple use cases:

- Paying network transactions fees

- Staking to run a validator

- Delegating to a validator to earn rewards

- The main token pair in Solana DeFi

- Used to buy Solana NFTs

On-chain governance is a feature that has been proposed for Solana, and as utility for the SOL coin, however, this is yet to be implemented in any meaningful way, and the final say still rests with Solana Labs.

Factors Influencing Solana’s Price

Those wondering “Will Solana go up” must take multiple factors inside and outside the Solana ecosystem into account when looking to answer this question. Here we’ve summarized the major factors affecting the SOL price, and any Solana price prediction.

- Wider Market: Cryptocurrencies are their own asset class and what affects one is likely to affect another. There is also no cryptocurrency that wields a greater influence than Bitcoin, and movements in Bitcoin’s price are likely to define market momentum for a long time to come.

- Regulations: SOL is currently labeled as a security by the SEC, and this will affect its ability to attract institutional usage in the USA, and maybe other countries. There is also the regulation of the overall crypto market that needs to be taken into account, with very few countries having a framework for these unique assets to operate in. As these frameworks are implemented prices will react accordingly, with moves and their direction dependent on how favorable these regulations are.

- Outages: While the most recent network outages haven’t affected the Solana price their continued occurrence, especially after the implementation of multiple validator clients on the network, could signal that the PoH concept is not viable. It could also deter institutions and businesses from relying on it due to its unreliable nature.

- Demand for Decentralization: The Solana blockchain is quite centralized, with a high validator setup cost—stretching into tens of thousands before you’ve even bought the necessary SOL, purportedly 45,000+ SOL (~$5.8 million at today’s price). As time moves forward, and blockchains become more mainstream, the public could favor decentralized solutions that are independent of the institutions that have failed them in the past—not a good thing for Solana.

- Solana’s Roadmap and Developments: There is no definitive roadmap for Solana, and this makes it difficult for investors to get excited about new developments before they happen. However, as developments are announced and then rolled out we can expect the market to react accordingly.

Solana Price Predictions by Other Experts and Analysts

With Solana’s increasing popularity, as a result of its resurrection in 2023, many analysts have stepped forward and offered their Solana price predictions for others. Here we’ve collated a wide array of these together to provide diversity as you read through our Solana price prediction.

Jake Gagain’s Solana Prediction

On X (Twitter) the cryptocurrency content creator and investor Jake Gagain predicts that Solana will hit highs of $750 in the next bull run.

Tyler Hill’s Solana Prediction

As a guest on the My Financial Friend YouTube channel, Tyler Hill, from Tyler Hill Investing predicts that Solana will hit $669 in this bull run but states that $2,230 is technically not off the cards as it is the top of a Fibonacci retracement.

The Wolf of Crypto Street’s Solana Prediction

On the X social media platform, the Wolf of Crypto Street predicts that Solana will hit a high of $500 in 2025.

VanEck’s Solana Prediction

The VanEck investment management firm provided a report on the future of digital assets based on a base, bull, and bear scenario. This report predicts lows of $9.81 by 2030 in the most bearish scenario, and highs of $3,211 by 2030 in the most bullish scenario.

How to Buy Solana?

As one of the top coins in the crypto markets, Solana is available on almost every cryptocurrency exchange—despite being called a security by the SEC last year, exchanges around the globe are unperturbed and continue to offer it to users.

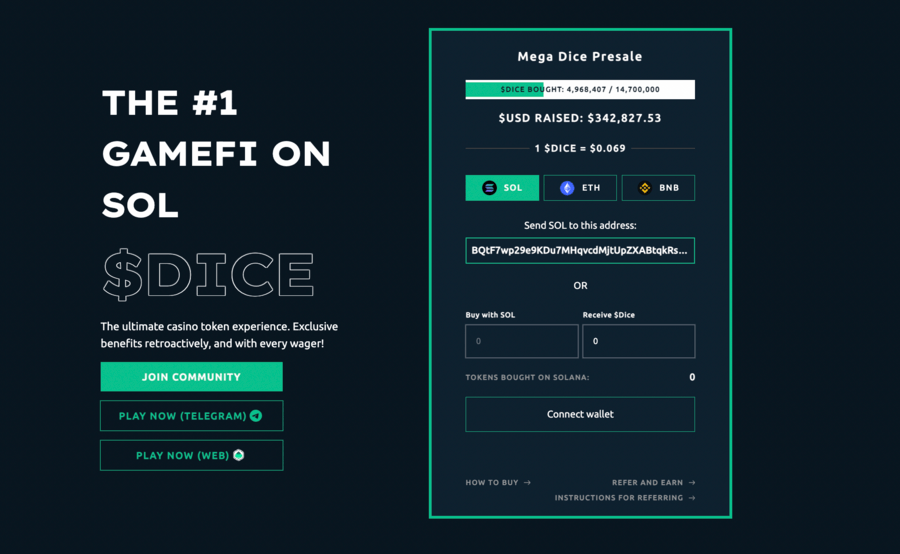

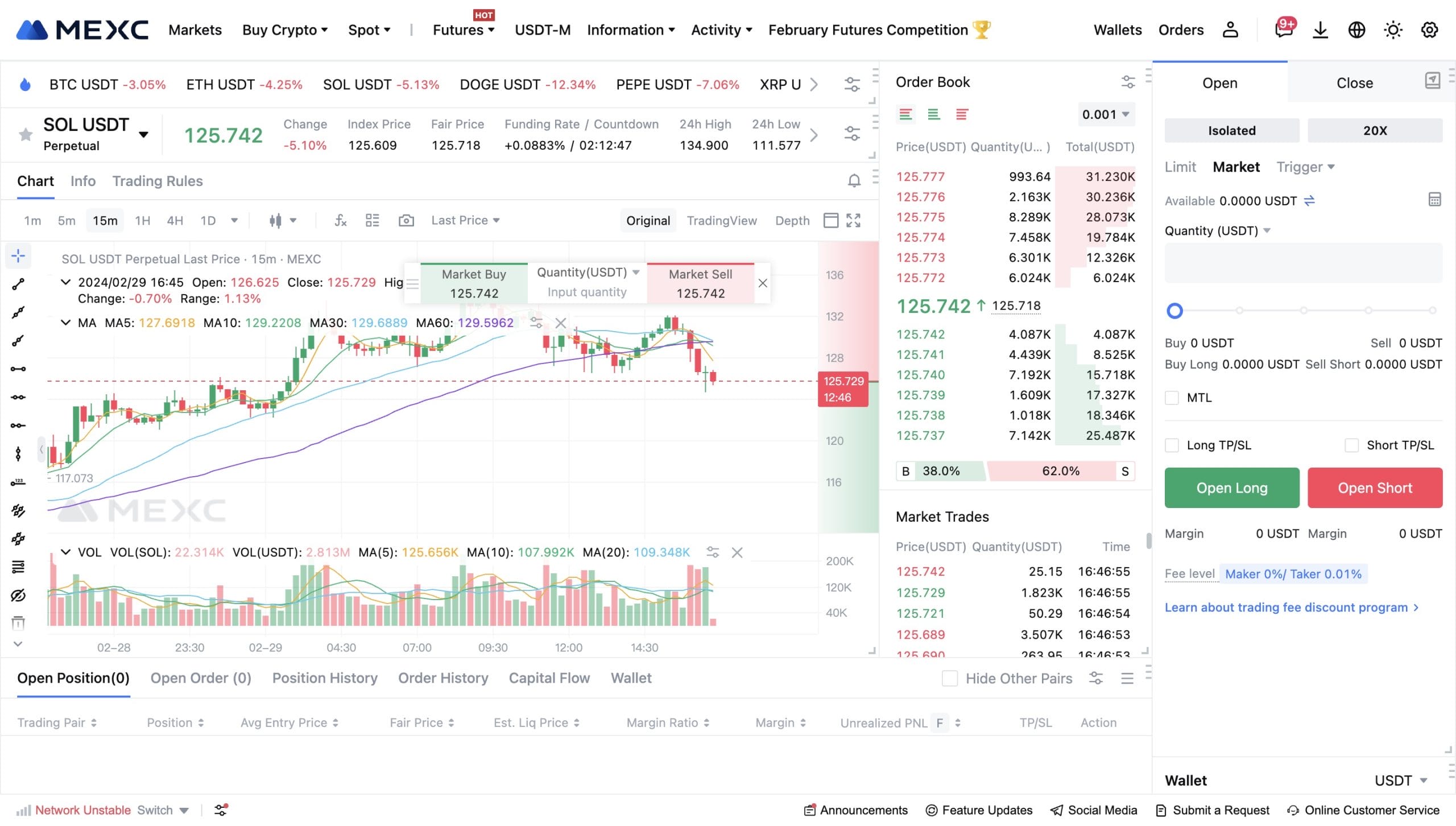

While it is available on so many platforms, we recommend the MEXC exchange as the place to buy SOL.

Why You Should Consider Using the MEXC Exchange for Buying SOL

Founded in 2018, MEXC is available in over 170 countries and its crypto trading services are used by over 10 million people. The MEXC exchange was developed by experts from the banking industry to provide users with a world class trading platform and experience. As a result, users of MEXC have access to all the tools they need to analyze charts, integrated from TradingView, and execute their strategies.

Those using MEXC’s spot trading markets can benefit from 0% fees, and users of the futures and margins markets can access leverage of up to 100x.

With daily trading volumes regularly topping $1 billion users of MEXC can always find the liquidity they need to make trades on the top tokens, such as SOL. They can also trade on-the-go through the MEXC mobile app, available for Android and iOS.

How to Buy Solana ($SOL) on MEXC

- Open your free MEXC account

- Deposit funds into your account through one of the methods available to you: debit/credit card, bank transfer, P2P purchases, or a third-party vendor.

- Visit the Spot Market page on MEXC

- In the search bar in the upper right-hand corner search for SOL, and choose your preferred trading pair

- Enter your order into the left-hand side of the module at the bottom of the page, and hit “Buy SOL”

Bottom Line for Solana Price Prediction

Solana may have fallen from grace in 2022, but in 2023 it completed an almost magical revival and seems to have come back stronger than before, with on-chain metrics showing that the network continues to grow in popularity.

This is all in the face of regular network outages, the SEC calling SOL a security, and the network’s widely known high level of centralization. But it seems like users don’t seem to care, they just want the cheap and fast transactions that Solana offers them, and Solana’s close connection with big companies means that it could fare very well once crypto regulations start to take shape around the globe.

FAQs

Will Solana Recover?

Solana is well on the road to recovery after a dismal 2022, gaining almost 1,000% in value in 2023, and blasting into 2024 with the rest of the crypto market. Many experts expect the Solana renaissance to continue through 2024 and into 2025.

Is Solana a Good Long-Term Investment?

High levels of usage along with favorable metrics—cheap transactions with an extremely high throughput—have many experts saying that Solana is a great long-term investment. However, more pragmatic investors point toward its regular outages, securities label, and high level of centralization as things to also be cautious of.

Risks and Considerations in Solana Investment

regular network outages, along with high market volatility, and a security label from the SEC are all risks that investors need to consider when investing in Solana. Another point that many blockchain purists point to as an issue is the network’s high level of centralization.

Will Solana Be The Next Bitcoin?

While it is high performing and has come a long way since the lows of 2022, very few experts expect Solana to follow in the path of Bitcoin.

References

- Global Live Cryptocurrency Charts & Market Data – CoinMarketCap.com

- SEC likely to approve spot Ethereum ETFs on May 23: Standard Chartered Bank – TheBlock.co

- What Solana Devs Can Look Forward to in 2024 – Solana.com

- Solana – CoinMarketCap.com

- Solana Promises ‘Detailed Post-Mortem’ After 17-Hour Outage – Bloomberg.com

- Solana Uptime – Solana.com

- 8 Days in November: What Led to FTX’s Sudden Collapse – CoinDesk.com

- CZ vs. SBF tweet exchange is no ‘fight,’ Binance CEO claims – Yahoo.com

- Solana Ecosystem Facts Related To FTX Bankruptcy – Solana.com

- Messari Status – Twitter.com

- US SEC crackdown on Coinbase, Binance puts crypto exchanges on notice – Reuter.com

- SEC Identifies 16 Crypto Tokens as Securities in Kraken Lawsuit – Bitcoin.com

- Bitcoin Jumps to $30K, Then Dumps, as False Spot ETF Approval Report Circulates – CoinDesk.com

- Out of 11 New Bitcoin ETFs, Which Looks Best Fit for Investors? – Yahoo.com

- Solana Back Up Following Major 5-Hour Outage – CoinDesk.com

- Solana Analytics – SolScan.io

- Top Blockchains – DappRadar.com

- Total Value Locked All Chains – DeFiLlama.com

- Explore Developer Data – DeveloperReport.com

- Blockchains by NFT Sales Volume – CryptoSlam.io

- Solana SOL – Coinbase.com

- Solana Whitepaper – Solana.com

- Liquid Staking TVL Rankings – DeFiLlama.com

- Solana outage caused by a previously identified bug, devs say – Blockworks.co

- Solana, the Venture Capitalist Scam – Medium.com

- Getting started with Solang – Solana.com

- The Solana Foundation Kicks Off Ninth Hackathon, Renaissance – Yahoo.com

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Viraj Randev

Viraj Randev