Bitcoin History

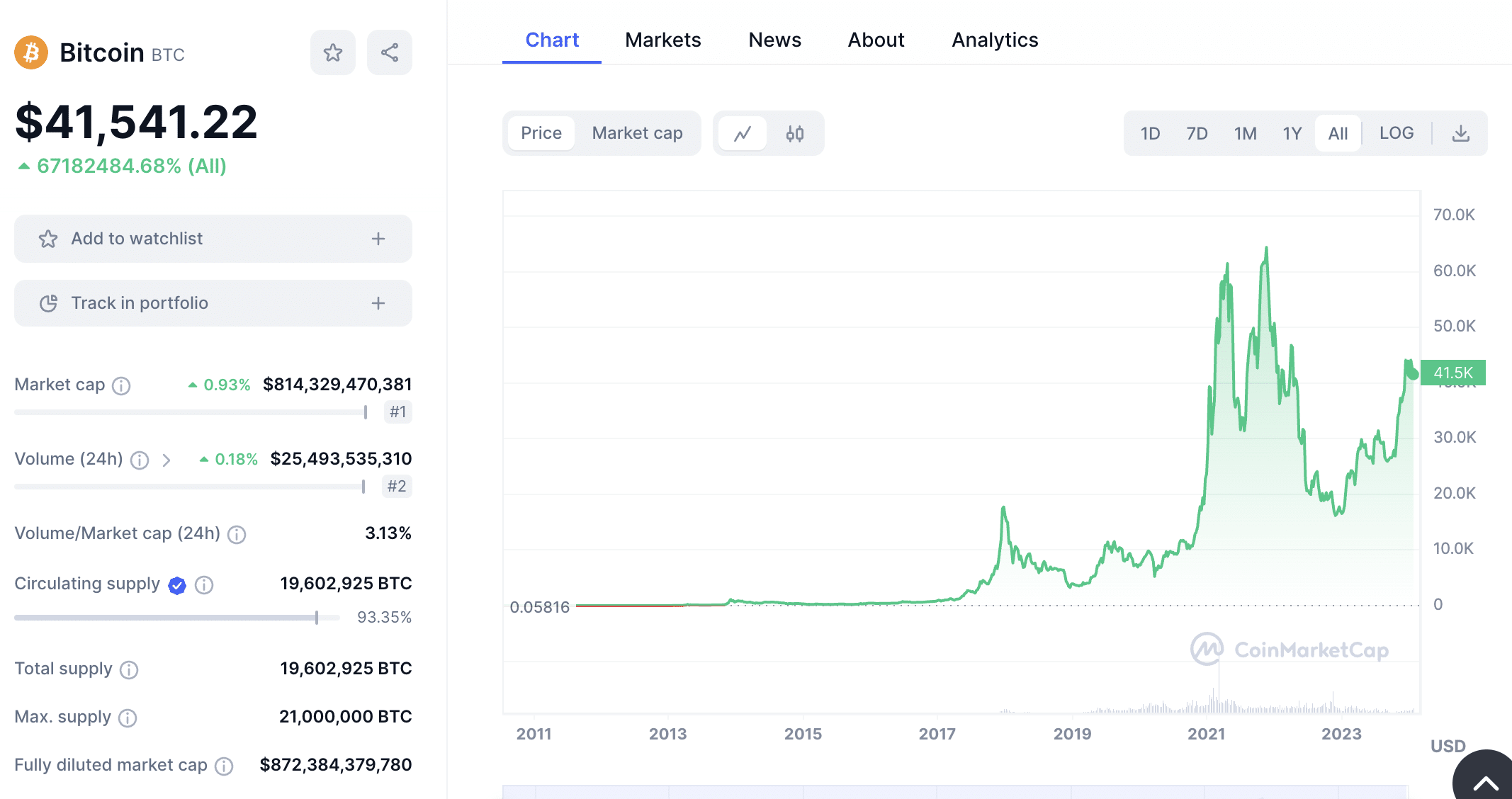

When the Bitcoin network was launched in 2009, it was merely a cryptographer’s pipedream. Fast forward to 2024 and Bitcoin has since surpassed a market capitalization of over $700 billion.

In this guide on Bitcoin history, we unravel its historical timeline. Read on to discover Bitcoin’s most notable milestones and achievements since its inception.

The Origins of Bitcoin

Let’s start with an overview of how Bitcoin began.

How Bitcoin Started

In October 2008, a revolutionary whitepaper was released to the cryptographic community; Bitcoin: A Peer-to-Peer Electronic Cash System. The whitepaper outlined the Bitcoin vision, where centralized financial systems could be replaced by digital assets. Unlike traditional currencies, Bitcoin would not be controlled or backed by any governments or central banks.

On the contrary, decentralization is at the forefront of Bitcoin. This means that no single person or entity has control over the Bitcoin network. The whitepaper explained that Bitcoin transactions will be conducted on a peer-to-peer basis, backed by an innovative ledger called the blockchain.

The Bitcoin blockchain ensures security and transparency; all transactions are posted to the public ledger. The Bitcoin whitepaper also focused on the importance of scarcity. New Bitcoins enter circulation every 10 minutes. They’re distributed to ‘miners’ who successfully verify a block of transactions.

Approximately every four years, mining rewards are reduced by 50% – known as the Bitcoin halving. This fixed supply mechanism will continue until there are 21 million Bitcoins in existence. After that, no more Bitcoins will be created. This means that Bitcoin has the characteristic of a medium of exchange and a store of value.

Bitcoin: A New Form of Money

Here’s a summary of why Bitcoin has revolutionized traditional finance:

- Bitcoin is a digital asset, meaning it doesn’t exist in physical form like fiat currency.

- Transactions are conducted on a peer-to-peer basis. This means Bitcoin can be transferred between two people without relying on intermediaries like banks.

- The Bitcoin supply is fixed. Originally, 50 BTC entered circulation every 10 minutes. This reduces by 50% approximately every four years. Today, the Bitcoin mining reward is 6.25 BTC.

- Bitcoin fees are purposefully low. They’re based on network demand rather than the value of the transaction. This makes Bitcoin ideal for cross-border transfers.

- All Bitcoin transactions can be viewed on the blockchain, ensuring complete transparency.

- Due to Bitcoin’s limited supply of 21 million BTC, it’s a deflationary asset. This makes it attractive as a store of value.

- Each Bitcoin can be split into 100 million smaller units – known as ‘Satoshis’. This also makes Bitcoin suitable as a medium of exchange.

The Mysterious Founder

The Bitcoin whitepaper was written by its pseudonymous founder, Satoshi Nakamoto. Even to this day, nobody knows Nakamoto’s true identity. According to CNBC, Nakamoto holds over 1.1 million Bitcoins to this day. At Bitcoin’s peak of over $68,000, this values Nakamoto’s holdings at over $74 billion.

However, Satoshi Nakamoto’s Bitcoin wallet has remained inactive since 2010. As a result, some segments of the Bitcoin community believe that Nakamoto is no longer alive. That said, several people have claimed to be the real Satoshi Nakamoto. One of the most infamous examples is Craig White.

According to the Guardian, Craig White is an Australian computer scientist who first claimed to be Nakamoto in 2015. Although White has been involved in several legal cases about his claims, the broader Bitcoin community remains skeptical. Ultimately, until we see Nakamoto’s wallet become active, the assumption is that we’ll never know their true identity.

The Timeline of Bitcoin History

We’ll now run you through the Bitcoin history timeline; from inception to the present landscape.

Bitcoin Infancy: 2008 – 2009

Let’s start with August 2008, which is when the Bitcoin.org domain name was registered. In October of the same year, the Bitcoin whitepaper was published. As we mentioned, this outlined the Bitcoin vision and how decentralization would revolutionize traditional finance.

The Bitcoin network was officially launched on January 3, 2009. This was rubber-stamped by the first-ever Bitcoin block to be mined. This is now known as the ‘legacy’ block. On January 12, the first Bitcoin transaction was conducted by Satoshi Nakamoto. 10 BTC was transferred to Hal Finney, a cryptographic developer and early Bitcoin adopter.

Back then, 10 BTC was practically worthless. Today, 10 BTC is valued at over $420,000. Nonetheless, this transaction was revolutionary; it proved that the medium of exchanges could take place with centralized intermediaries. The 10 BTC transaction was confirmed in just 10 minutes without any third-party involvement.

Bitcoin Original Price

- Regarding the Bitcoin price history, a notable milestone occurred in October 2009.

- Early adopters agreed on Bitcoin’s first exchange rate; $1 = 1,309 BTC.

- This means that in late 2009, Bitcoin was valued at just $0.0007.

- This valuation was far from arbitrary; it was based on the electricity costs for every 1 Bitcoin minted.

Early Stages: 2010 – 2012

Moving onto 2010, the first ‘commercial’ Bitcoin transaction took place on May 5, where BTC was exchanged for physical goods. According to US News, Laszlo Hanyecz paid 10,000 BTC for two pizzas. The seller purchased the pizza from Papa John’s on behalf of Hanyecz, costing just $25. This means the 10,000 BTC transaction valued Bitcoin at just $0.0025.

Based on BTC/USD exchange rates today, the same 10,000 BTC would be worth over $420 million. The infamous transaction means that May 5 will forever be known as Bitcoin Pizza Day.

Another notable event happened in July 2010, with the foundation of Mt. Gox. This is considered the world’s first functional Bitcoin exchange, allowing users to buy and sell BTC with fiat money. At its peak, Mt. Gox handled more than 70% of Bitcoin trading volumes.

- In August 2010, Bitcoin witnessed a significant security breach, known as the ‘Value Overflow Incident’

- In a nutshell, the vulnerability resulted in 184 billion BTC being mined.

- This far exceeded Bitcoin’s limited supply of 21 million BTC.

- Bitcoin’s core developers quickly resolved the issue with a blockchain ‘fork’.

- This allowed Bitcoin to remove the fraudulent block from its network. This means the transaction is no longer stored on the Bitcoin blockchain.

In November 2010, Bitcoin reached another new milestone; it surpassed a market capitalization of $1 million for the first time.

Just three months later, Bitcoin reached parity with the US dollar. This spurned Bitcoin’s first bull run, reaching highs of nearly $32 in June 2011.

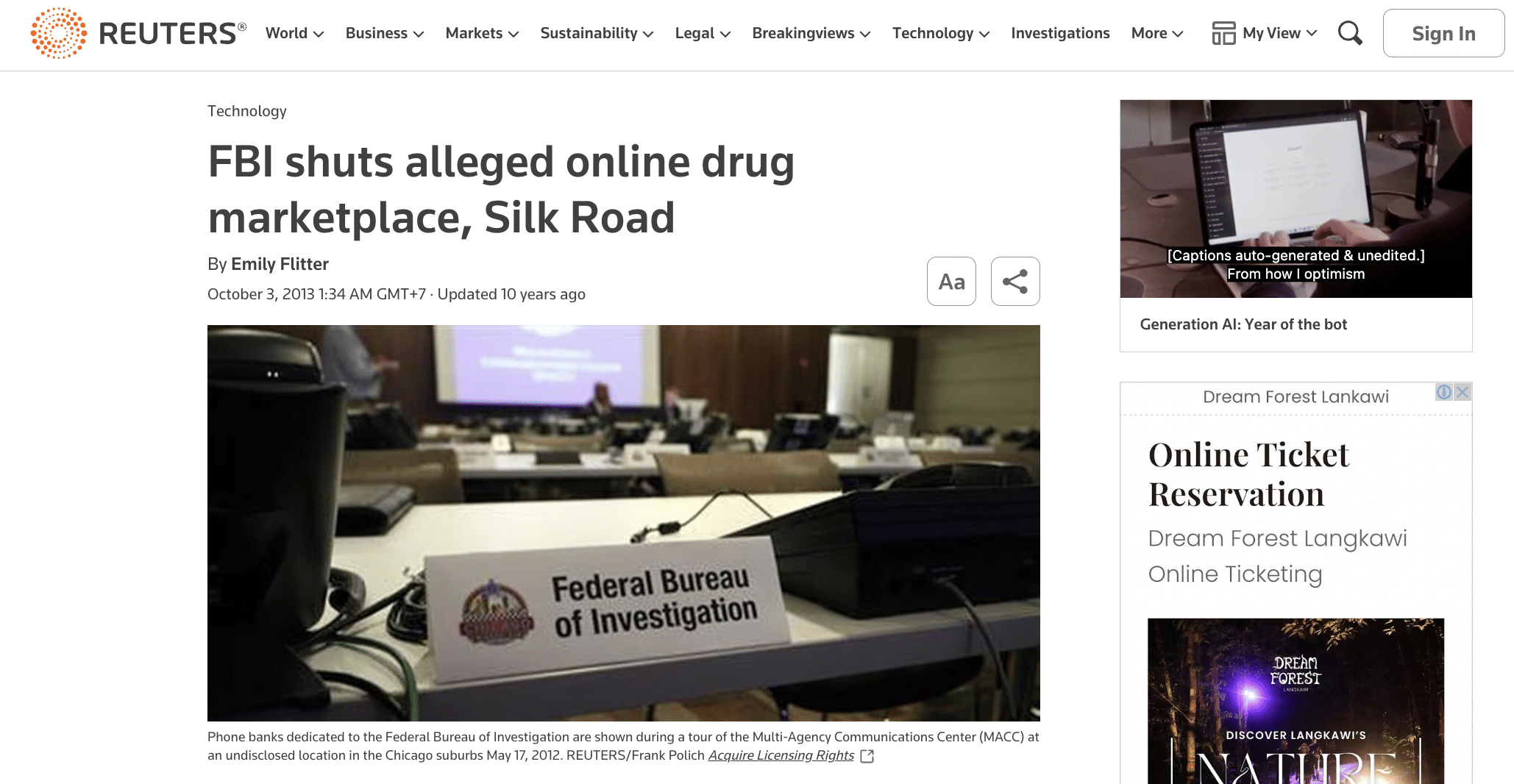

We should also mention the October 2011 emergence of Silk Road, an online marketplace for illegal products and services. Silk Road’s primary currency of choice was Bitcoin. Billions of dollars worth of Bitcoin changed hands on Silk Road until it was shut down by the FBI in 2013.

In September 2012, the Bitcoin Foundation was created. This is a non-profit organization formed to secure and protect Bitcoin. Two months later, the first Bitcoin halving took place. This reduced the 10-minute mining reward from 50 BTC to 25 BTC.

Regulatory Action Start: 2013 – 2014

The Bitcoin evolution centered on regulatory developments between 2013 and 2014. For instance, in March 2013, the Financial Crimes Enforcement Network (FinCEN) issued its first guidance notes on Bitcoin. FinCEN noted that Bitcoin exchanges will be treated as money service businesses under FinCEN’s regulations.

In May 2013, U.S. authorities seized bank accounts linked to Mt. Gox. The U.S. Department of Homeland Security claimed that Mt. Gox was operating as an unlicensed money transmitter. In August, the German Finance Ministry classified Bitcoin as a ‘Unit of Account’. This meant that Bitcoin could be used as a medium of exchange and to settle tax affairs.

In October 2013, the FBI shut down the Silk Road platform. As we mentioned, Bitcoin was the primary currency used to buy and sell illegal goods and services. News of the shutdown resulted in a major price decline for Bitcoin.

To close 2013, China announced that financial institutions were prohibited from handling Bitcoin transactions. This also resulted in a significant price decline, considering the size of China’s consumer marketplace. Moving into February 2014, Mt. Gox – then the world’s largest crypto exchange, filed for bankruptcy.

Mt. Gox revealed it has been hacked for 850,000 BTC. Based on today’s market price, this values the hack at over $35 billion. US authorities subsequently seized Mt. Gox’s remaining assets. It wasn’t until a decade later that victims of the hack began receiving compensation.

The next milestone in the Bitcoin history timeline occurred in March 2014; the IRS classified Bitcoin as property. While this gave Bitcoin a stamp of approval, this also meant that gains would now be taxed the same as other assets like stocks and funds.

Wider Adoption: 2015 – 2019

The next phase of Bitcoin’s history centered on wider adoption. This included a significant rise in Bitcoin exchanges, allowing first-time buyers to enter the market more seamlessly. We also saw major blue chips like IBM and Goldman Sachs express interest in Bitcoin, with investments made in blockchain-related startups.

2015 was also notable for the broader blockchain space, with Ethereum becoming the first project to facilitate smart contracts. This proved that crypto assets could be used for more than just financial transactions. Ethereum has since solidified itself as one of the best altcoins.

Moving into 2016, Bitcoin’s second halving event took place. This reduced the mining reward from 25 BTC to 12.5 BTC. This spurned a prolonged bull cycle for Bitcoin. In early 2017, Bitcoin was trading at $1,000. By the end of the year, a new Bitcoin all-time high of $20,000 was recorded.

2017 also saw a sizable increase in initial coin offerings (ICOs). ICOs enabled new crypto projects to raise funds without going through traditional regulatory hurdles. This is because funds are raised in crypto assets rather than fiat money. This included a year-long ICO from EOS, which raised more than $4 billion.

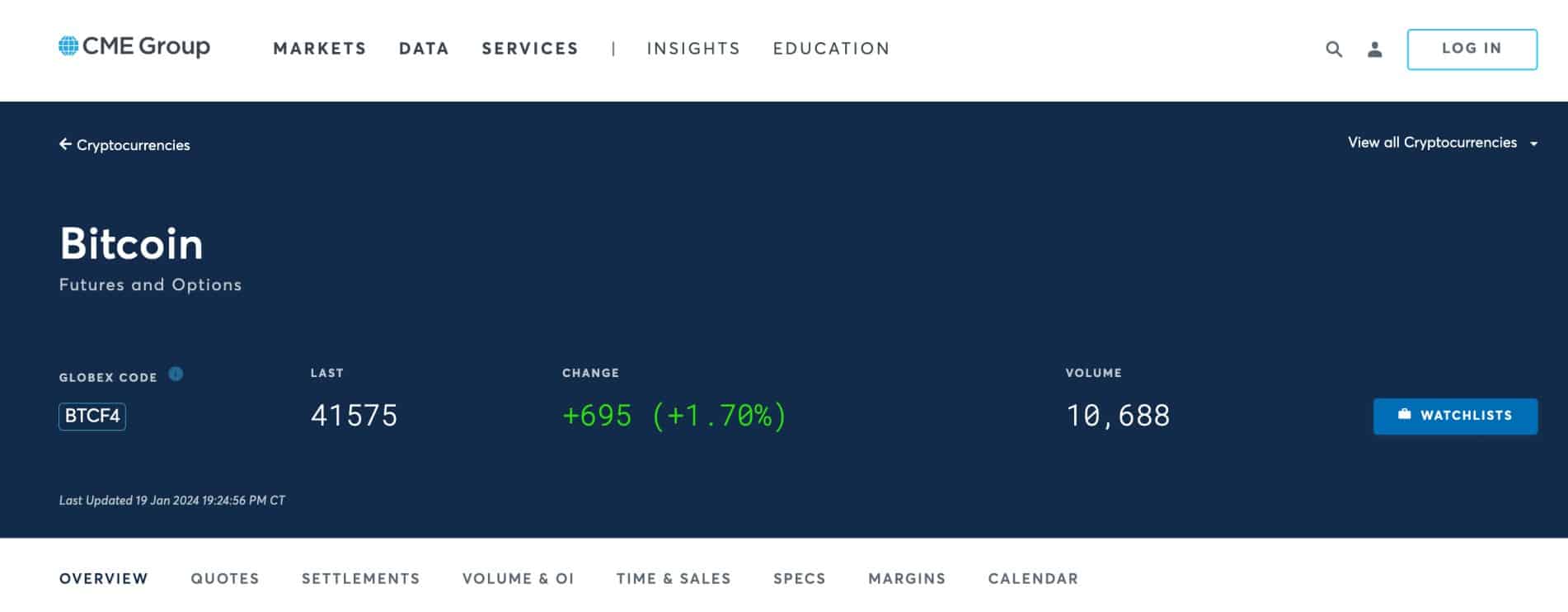

December 2017 was also a huge milestone for Bitcoin; the world’s first regulated Bitcoin futures market was launched by the CME Group. This provided institutional investors with exposure to Bitcoin in a regulated environment. In terms of price action, Bitcoin entered a prolonged bear market after peaking at $20,000.

By the end of 2018, Bitcoin had dropped to lows of almost $3,000 – a decline of 85% from its prior all-time high. This proved to be one of the best opportunities for investors to accumulate cheap Bitcoin.

In 2019, Facebook announced plans to launch its own native crypto asset – Libra. This spurned significant global coverage, considering Facebook’s billions of monthly users. However, due to increased regulatory pressures, Facebook eventually scrapped the Libra project.

2020 – Present

In May 2020, the third Bitcoin halving took place. This reduced the mining reward from 12.5 BTC to just 6.25 BTC. Similar to previous halving events, this spurned the start of a new bull market. By the end of the year, Bitcoin returned to its former all-time high of $20,000. Bitcoin’s bull cycle continued throughout 2021.

BTC All-Time High

The Bitcoin price peaked in November 2021, recording all-time highs of over $68,000. 12 months after peaking, Bitcoin declined to $16,000 – a 75% drop. Bitcoin has since hit 52-week highs of almost $49,000 – a 200% increase from its $16,000 low. This mirrors previous cycles.

Importantly, the next Bitcoin halving is expected to occur in April 2024. This will reduce the mining reward from 6.25 BTC to 3.125. Many commentators expect this to be the start of the next Bitcoin bull market. That said, just remember that past performance isn’t guaranteed to repeat itself.

Bitcoin ETF Approval

In addition, 2024 saw the SEC approve its first batch of Bitcoin ETF applications. This includes a Bitcoin ETF from BlackRock, the world’s largest asset management firm.

After years of SEC rejections, this will provide institutional investors with exposure to Bitcoin, without needing to trade futures. Many believe that this could attract huge waves of institutional money into the industry. The timing couldn’t be better, considering the next Bitcoin halving event is approaching.

Bitcoin Adoption

For many years, Bitcoin was labeled with terms such as ‘scam’ and ‘Ponzi scheme’. Bitcoin was also viewed as the currency of choice for criminals. After all, Bitcoin transactions are not tied to the user’s real-world identity. This level of anonymity meant that illegal marketplaces like Silk Road relied on Bitcoin payments to operate.

Broader skepticism came from major financial institutions, governments, and central banks. For example, JP Morgan CEO Jamie Dimon famously called Bitcoin a ‘fraud’ in 2017. Similarly, legendary stock investor Warren Buffet referred to Bitcoin as a “gambling token” without “any intrinsic value”.

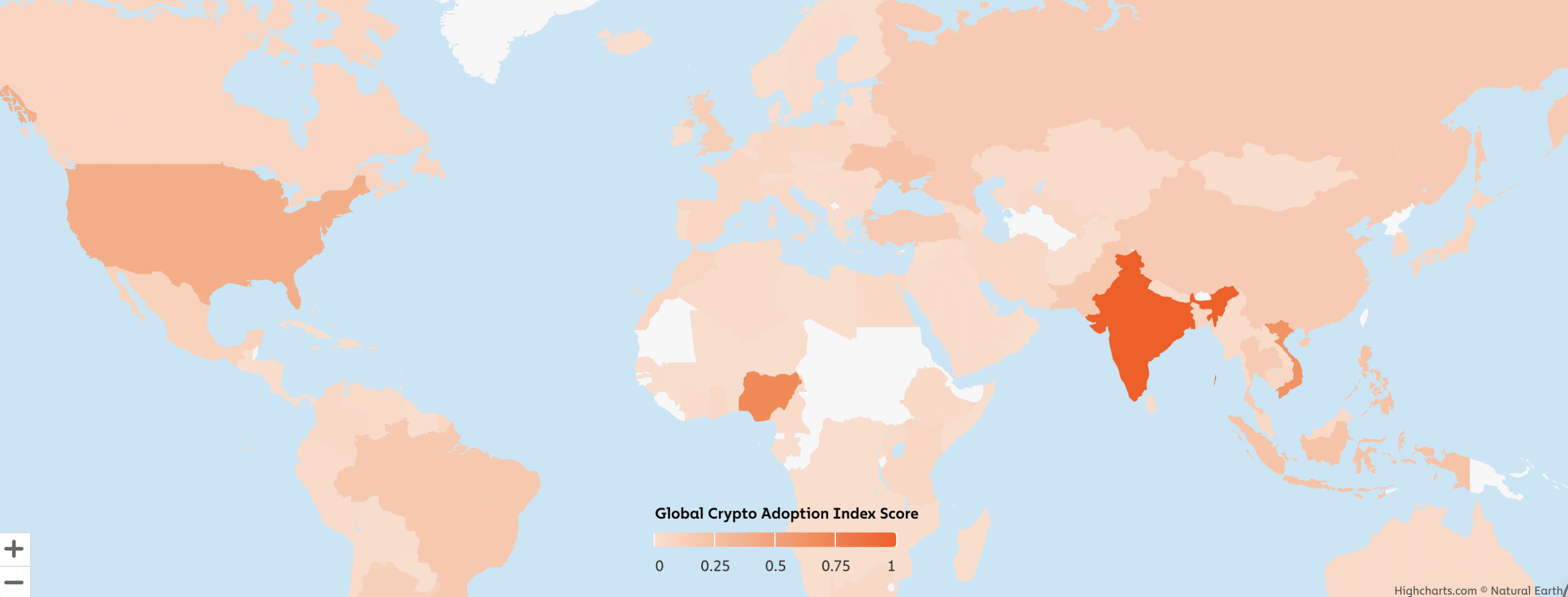

And then there’s the Chinese government, which placed an outright ban on crypto assets in 2021. All that being said, Bitcoin continues to defy regulatory hurdles. Although estimates vary, a Crypto.com study found that over 106 million people have exposure to crypto assets. This figure continues to increase as each year passes.

While Bitcoin is now viewed as a store of value, it’s increasingly being used as a medium of exchange. Especially in countries suffering from hyperinflation and unfavorable central bank policies. In fact, Bitcoin is now legal tender in two countries; El Salvador and the Central African Republic.

This means that Bitcoin must be accepted as a payment method, regardless of the merchant. And then there’s Bulgaria, which has Bitcoin reserves of over 213,000 BTC. Based on current prices, Bulgaria’s Bitcoin stash is worth almost $9 billion. Ultimately, while Bitcoin adoption is still in its infancy, the digital asset revolution can no longer be ignored.

Who Owns the Most Bitcoin?

- Satoshi Nakamoto – Bitcoin’s pseudonymous founder, holds over 1.1 million BTC. However, the Bitcoins haven’t moved since 2010.

- The largest individual Bitcoin wallet is owned by Binance. The Binance cold wallet holds over 248,000 Bitcoins, currently valued at over $10 billion.

What the Future Holds for Bitcoin

So now that we’ve covered the Bitcoin history, what does the future hold? Well, 2024 is set to be a huge year for Bitcoin. Not only has the SEC approved its first batch of Bitcoin ETFs, but the next Bitcoin halving will take place in April. As we mentioned, Bitcoin halvings have historically been the start of an extended bull rally.

In terms of Bitcoin price predictions, investors will be aiming for a return to previous all-time highs of $68,000. After that, the next psychological target will be the $100,000 level. In the long term, it remains to be seen how valuable Bitcoin will become. According to ARK Invest CEO Cathie Wood, Bitcoin could hit $1.5 million by 2030.

This is up from Wood’s previous forecast of $1 million. If Bitcoin were to hit $1.5 million, this would require a market capitalization of over $28 trillion. Wood’s price prediction is bold, considering it’s more than double gold’s market capitalization of over $13 trillion.

Conclusion

In summary, Bitcoin’s historical journey has been full of highs and lows. But the future certainly looks bright, considering increased consumer and institutional adoption.

And based on current prices, Bitcoin could be worth just a small fraction of its true potential. Keep an eye on the upcoming Bitcoin halving too, which has historically spurned an extended bull cycle.

References

- https://www.cnbc.com/2021/04/24/uk-bitcoin-copyright-lawsuit-the-mystery-behind-bitcoins-creation.html

- https://www.theguardian.com/technology/2016/may/02/craig-wright-bitcoin-founder-satoshi-nakamoto-claim

- https://www.binance.com/en/feed/post/1273711

- https://money.usnews.com/investing/articles/the-history-of-bitcoin

- https://www.reuters.com/article/idUSBRE9910TR/

- https://www.fincen.gov/sites/default/files/shared/FIN-2013-G001.pdf

- https://www.cnbc.com/2020/12/16/bitcoin-breaks-above-20000-for-the-first-time-ever.html

- https://www.wsj.com/articles/exchange-giant-set-to-launch-bitcoin-futures-after-rival-stumbles-1513432800

- https://fortune.com/crypto/2023/04/13/warren-buffett-bitcoin-gambling-token/

- https://assets.ctfassets.net/hfgyig42jimx/5u8QqK4lqjEgL506mOx4m3/d44d8e204aecfc75a839e2a9d505f5d1/Crypto.com_Data_Report_-_On-chain_Market_Sizing.pdf

- https://www.nasdaq.com/articles/a-seized-bitcoin-stack-could-be-bulgarias-golden-ticket

- https://markets.businessinsider.com/news/currencies/bitcoin-price-forecast-cathie-wood-kevin-oleary-us-economy-crash-2024-1

FAQs

How much was the highest Bitcoin price ever?

According to CoinMarketCap data, the highest-ever Bitcoin price was $68,789.63. This was recorded on November 10, 2021.

How much was Bitcoin in 2009?

In October 2009, an exchange rate of $1 = 1,309 Bitcoin was agreed by early adopters. This means that Bitcoin was valued at just $0.0007.

What was the Bitcoin price in 2012?

Bitcoin price history shows that BTC was valued at $5.13 in January 2012. Bitcoin was worth $13.50 by the end of the year.

How much was Bitcoin in 2010?

The Bitcoin price history from 2010 is limited, considering that the project was still in its infancy. That said, 10,000 Bitcoins were exchanged for $25 worth of pizza in May 2010. This would have valued Bitcoin at $0.0025.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman