12 Best Utility Tokens to Invest in 2024

Utility tokens refer to crypto projects that offer real-world value, insofar as they grant access to a particular product or service. An example of this is MANA, which enables holders to buy virtual real estate within the Decentraland metaverse. In this guide, we offer an in-depth analysis of the best utility tokens to buy right now, including newer projects.

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode in 2024

- ETH

- usdt

- Brand new South Park-inspired seal-themed SOL meme coin

- Ideal coin to buy in presale ahead of the expected summer meme coin frenzy

- Thought to be by the team that was also behind the viral SLERF coin

- Solana

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- ETH

- BlockBets is the future of cryptocurrency gaming with casino, sportsbook and poker offerings.

- Offers 1000x leverage trading with over 20 top cryptos supported with no bid-offer spreads and competitive fees.

- Early presale investors get daily passive staking rewards, the chance to win a share of 5% of all buybacks, as well as BlockBets credits.

- ETH

- usdt

- bnb

The Best Utility Coins to Buy

The list below highlights the top utility tokens that we identified during the research process.

- Dogeverse – Top multi-chain meme utility coin, compatible with six blockchains. Over $10 million raised.

- WienerAI – New AI-powered meme coin building a crypto trading bot. Nearly $2M raised on presale.

- Mega Dice Token – CasinoFi token powers a casino and sportsbook. Get presale bonuses and buy NFTs.

- eTukTuk – Sustainable transport solution built on the Cardano blockchain. Raised more than $1.3 million.

- Healix – AI cryptocurrency is decentralizing the healthcare space. Get premium benefits and staking yield.

- Decentraland – Established metaverse project that enables you to purchase and trade virtual real estate.

- Ethereum – The world’s 2nd largest crypto and the go-to place for Smart Contract development.

- XRP – Veteran cross-border payment solution looking to revolutionize overseas remittance.

- BNB – Native token of the Binance Smart Chain. $58 billion market cap.

- Cardano – Decentralised Proof of Stake blockchain with a focus on social justice and network efficiency.

- Chainlink – Decentralised oracle network converting external information into blockchain ready data.

- Polygon – Ethereum scaling solution featuring modular architecture to create an ‘internet of blockchains’.

The best utility coins come from a variety of crypto niches. From cross border payments to the metaverse, to P2E gaming to sustainable transport, we discuss every utility coin in more detail in the following sections.

Reviewing the Crypto with the Best Utility

Unlike meme coins, which are largely focused on speculation and hype, utility tokens have an actual use case. Alongside paying for transaction fees, by holding utility tokens, investors can gain access to exclusive products and services and even get to vote on crucial eco-system decisions. Ultimately, utility tokens have a much greater chance of surviving over the long haul.

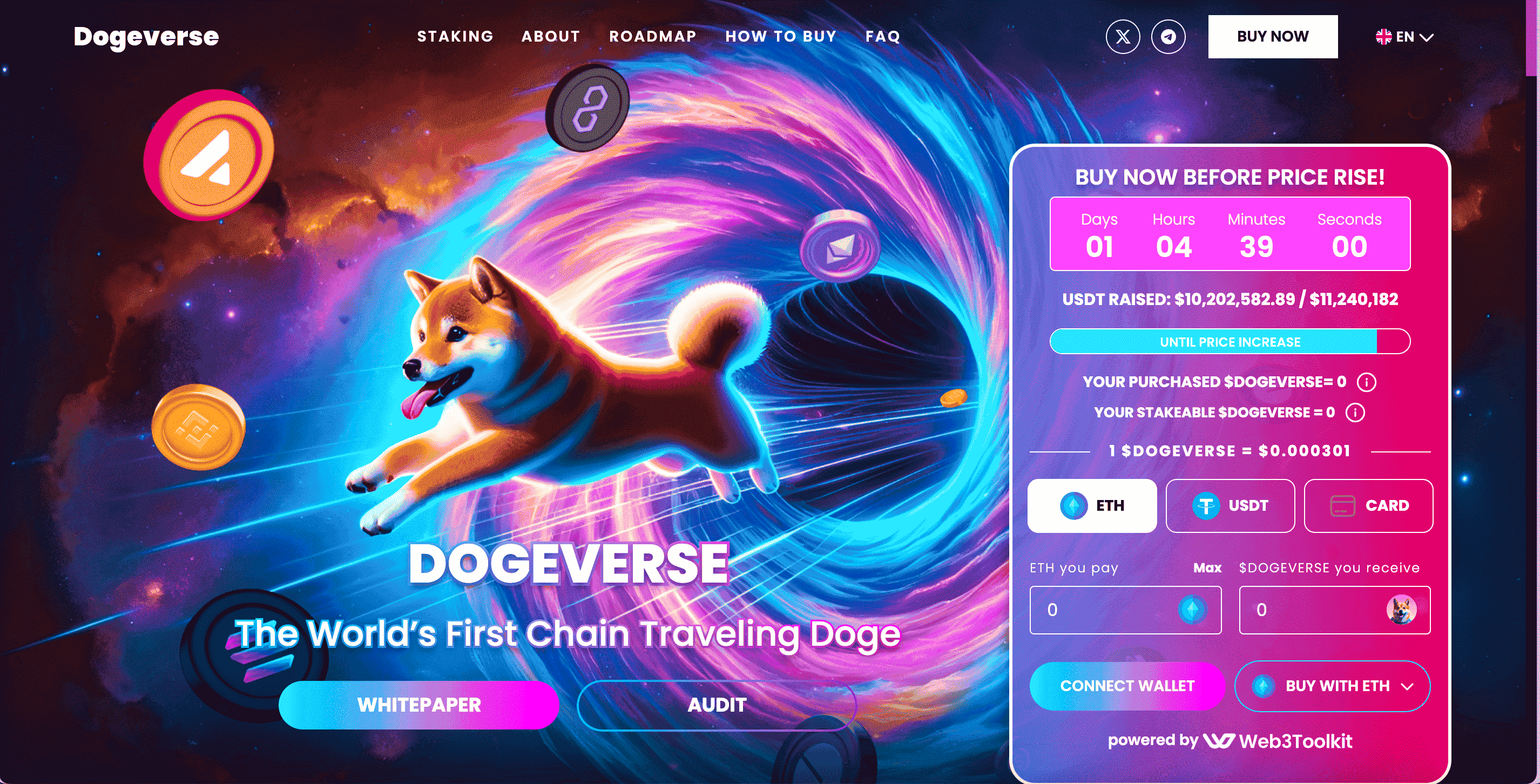

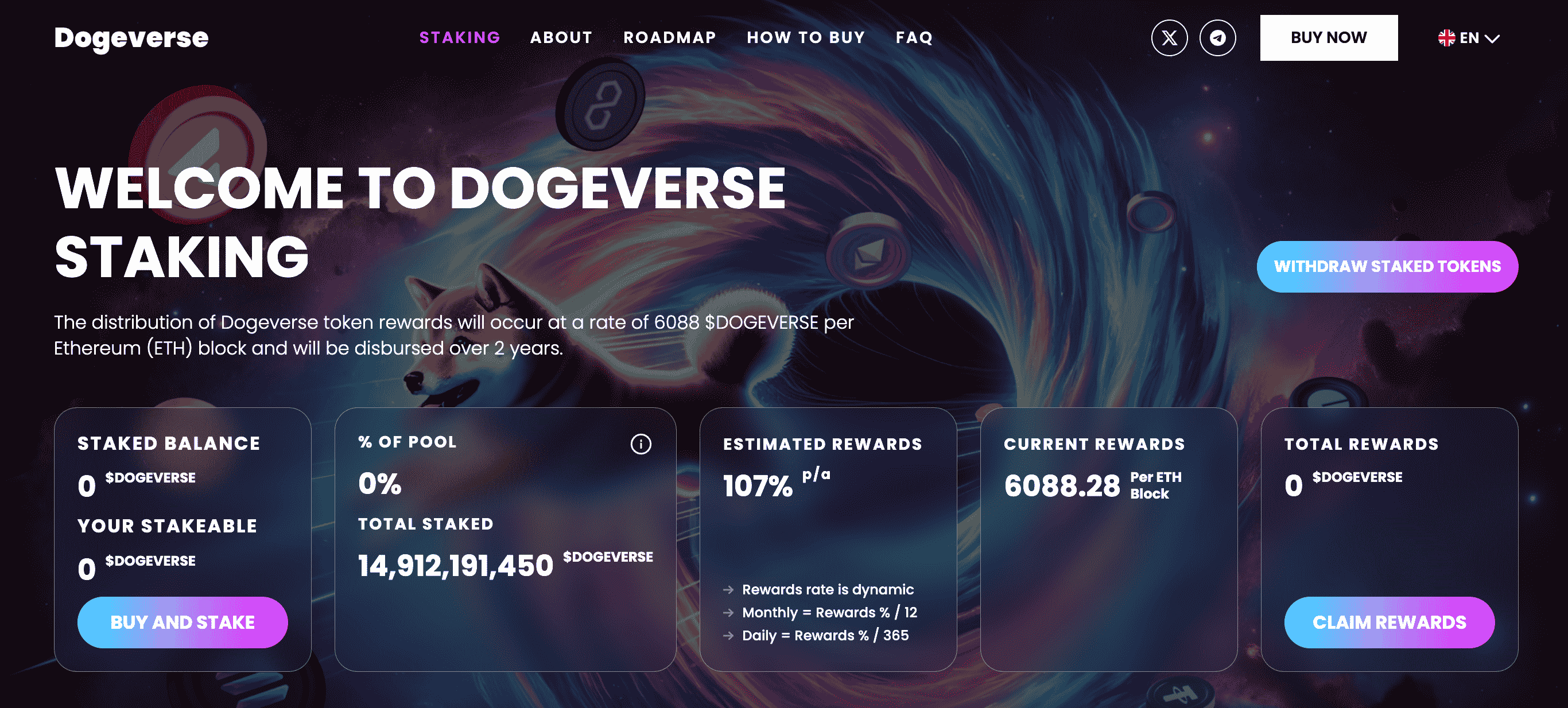

1. Dogeverse – Multi-Chain Meme Coin Offers High Staking Yield

We have picked Dogeverse ($DOGEVERSE) as one of the best utility tokens in 2024. This is the first-ever Doge-themed meme coin that is compatible with six different blockchains. Furthermore, $DOGEVERSE can be staked to generate a high annual yield.

Using Wormhole and Portal Bridge technology, Dogeverse will be compatible with six blockchains – Ethereum, Solana, Binance, Polygon, Avalanche, and Base. Therefore, token holders can seamlessly navigate across different networks, which offer the lowest gas fees and fastest transaction speeds.

This multi-chain meme coin follows the journey of Cosmo, the chain-hopping Doge. Cosmo jumps from one blockchain to another, symbolizing the interconnection of the crypto universe. Similarly, Dogeverse wants to offer token holders freedom and accessibility in its ecosystem. Loyal token holders will also be rewarded with high APY (Annual percentage yield) from the smart contracts. At press time, you can stake $DOGEVERSE and generate 107% APY on the staking mechanism.

Dogeverse has a total supply of 200 billion, of which 30 billion tokens are being allocated through the ongoing presale. In only a few weeks, the presale has raised more than $10 million. Another 20 billion tokens will be offered as staking rewards. For more information, read the Dogeverse whitepaper and join the Telegram channel.

| Presale Started | April 2024 |

| Purchase Methods | ETH, USDT, Card |

| Chain | Ethereum, Binance, Polygon, Solana, Avalanche, Base |

| Min Investment | None |

| Max Investment | None |

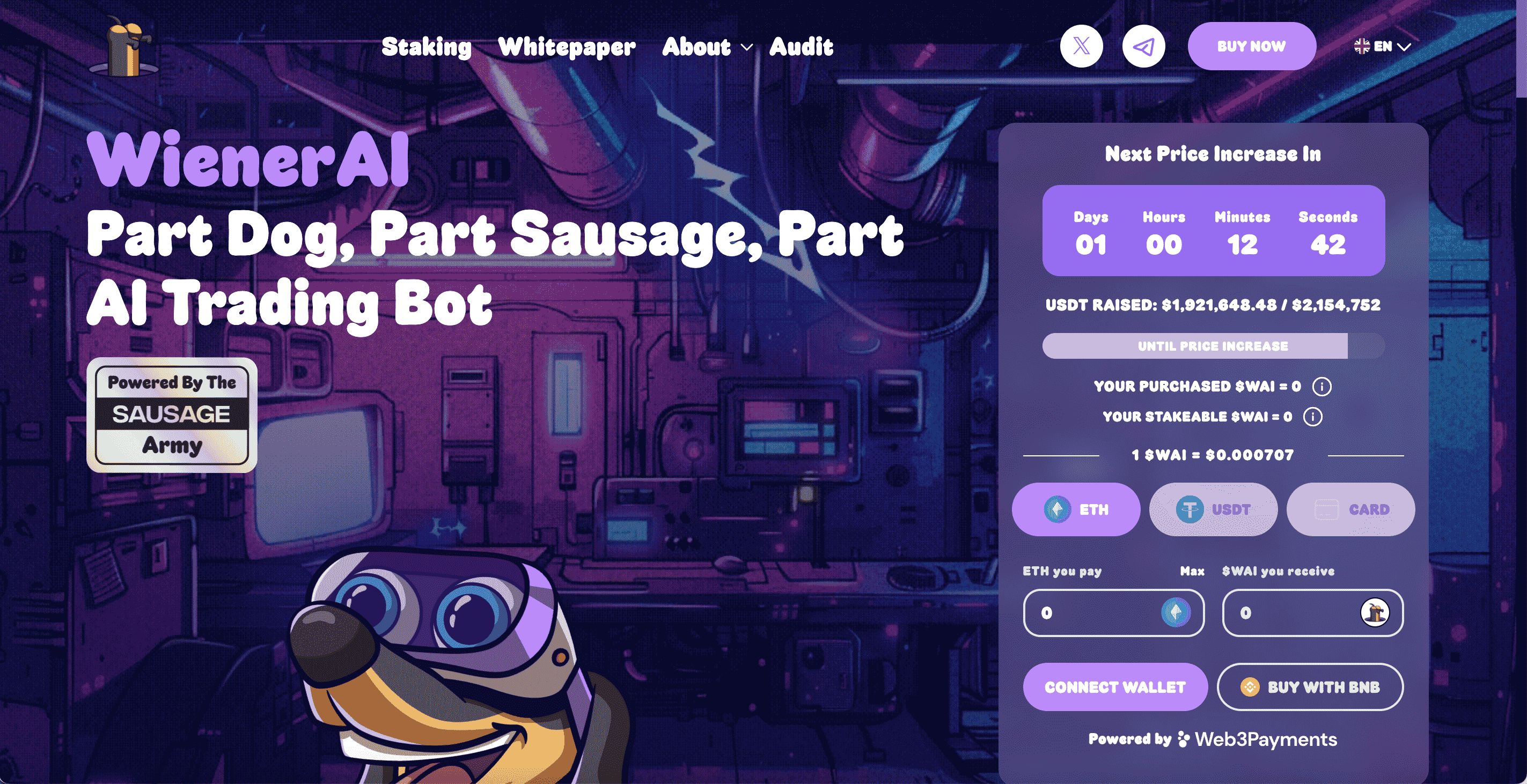

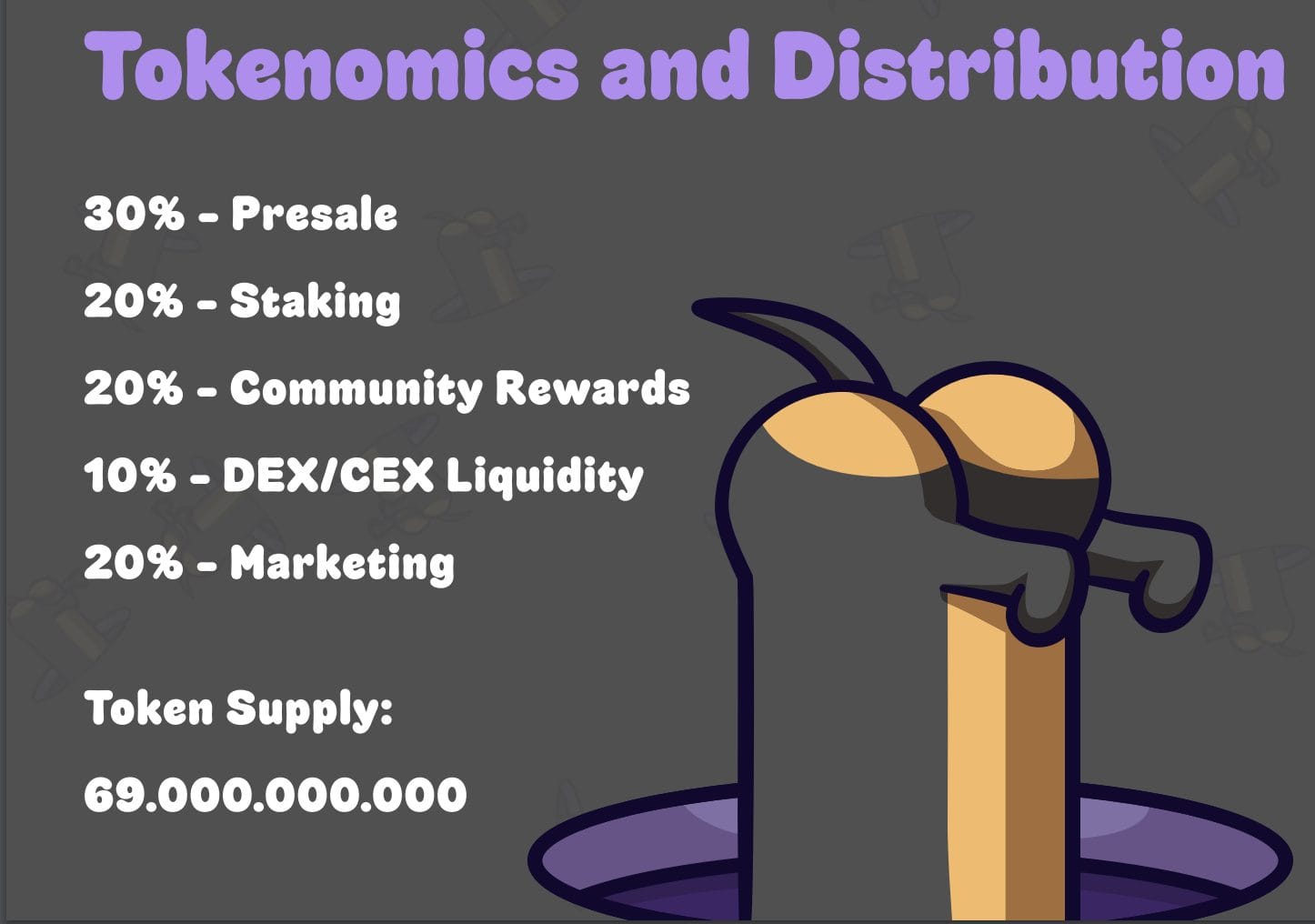

2. WienerAI – New Meme Token Offering an AI-Powered Trading Bot

WienerAI ($WAI) is a new meme cryptocurrency that offers token holders utility through its AI-powered trading bot. Currently, WienerAI is in the development stage of its beginner-friendly and instant crypto bot.

$WAI token holders will be able to input crypto-related queries on the bot and access trading signals. The trading bot will use AI algorithms such as predictive analysis to scan the markets for potential trades.

WienerAI will study the historical prices of different digital assets and track real-time price movements to stay a step ahead of the volatile markets. Thus, WienerAI wants to increase the profitability of traders seeking high returns in the cryptocurrency space.

This utility token also offers a staking mechanism through which $WAI token holders can lock their holdings and earn a high annual yield. At press time, the APY (Annual percentage yield) is 495%.

From a total supply of 69 billion tokens, 13.8 billion will be rewarded to staked token holders. Another 20.7 billion tokens are being distributed through the ongoing presale. Since the presale launched, WienerAI has raised nearly $2 million.

For more information, go through the WienerAI whitepaper and join the Telegram channel.

| Presale Started | April 2024 |

| Purchase Methods | ETH, USDT, BNB, MATIC, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

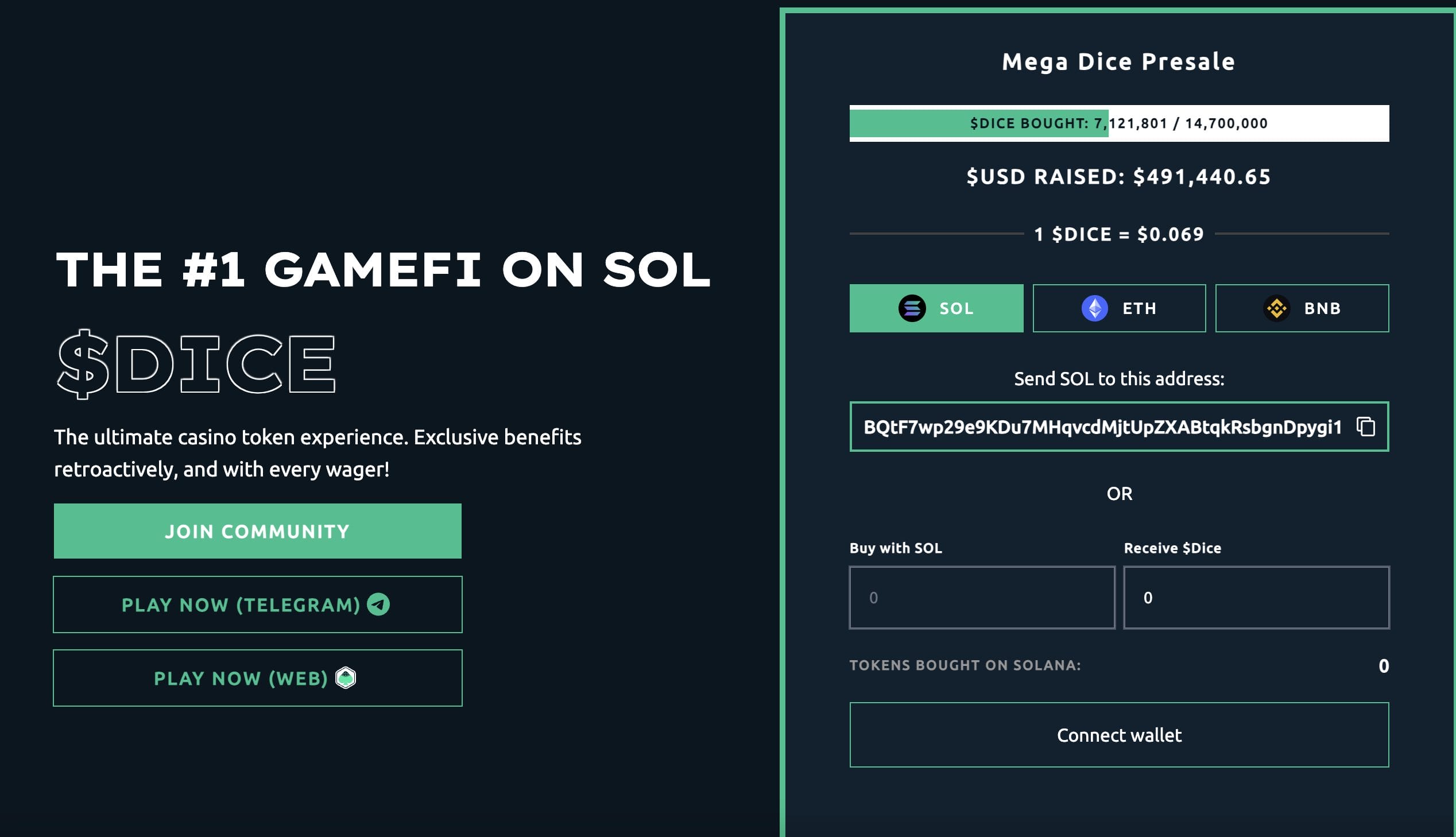

3. Mega Dice Token – CasinoFi Crypto Token Offers In-Game Benefits and Tradable NFTs

Mega Dice Token ($DICE) powers Mega Dice’s Casino and sports betting platform. The newly launched token will offer in-game benefits, passive income, and early bird bonuses to presale investors.

This utility token can be staked on Mega Dice Token’s smart contract to earn a high APY. Notably, staked token holders are eligible to earn daily rewards across the 4,500 casino games and 50+ sports betting markets on Mega Dice Casino. The ongoing $DICE presale is allocating 35% of the total 420 million token supply.

A handful of early presale investors will earn free $DICE tokens as part of an early bird bonus. Token holders can also win from an airdrop prize pool worth $2.25 million. Mega Dice Token will also reward a certain number of token holders with limited-edition NFTs – which can be held to gather exclusive rewards in the gaming ecosystem. The NFTs can also be traded on the platform.

$DICE holders also get to take part in Mega Dice Token’s affiliate program, which offers 25% of the affiliate’s revenue back to token holders. Currently, $DICE is priced at $0.069 on presale, which has raised more than $490K. Stay tuned for more updates by going through the Mega Dice Token whitepaper and joining the Telegram channel.

| Presale Started | April 2024 |

| Purchase Methods | SOL, ETH, BNB |

| Chain | Solana |

| Min Investment | None |

| Max Investment | None |

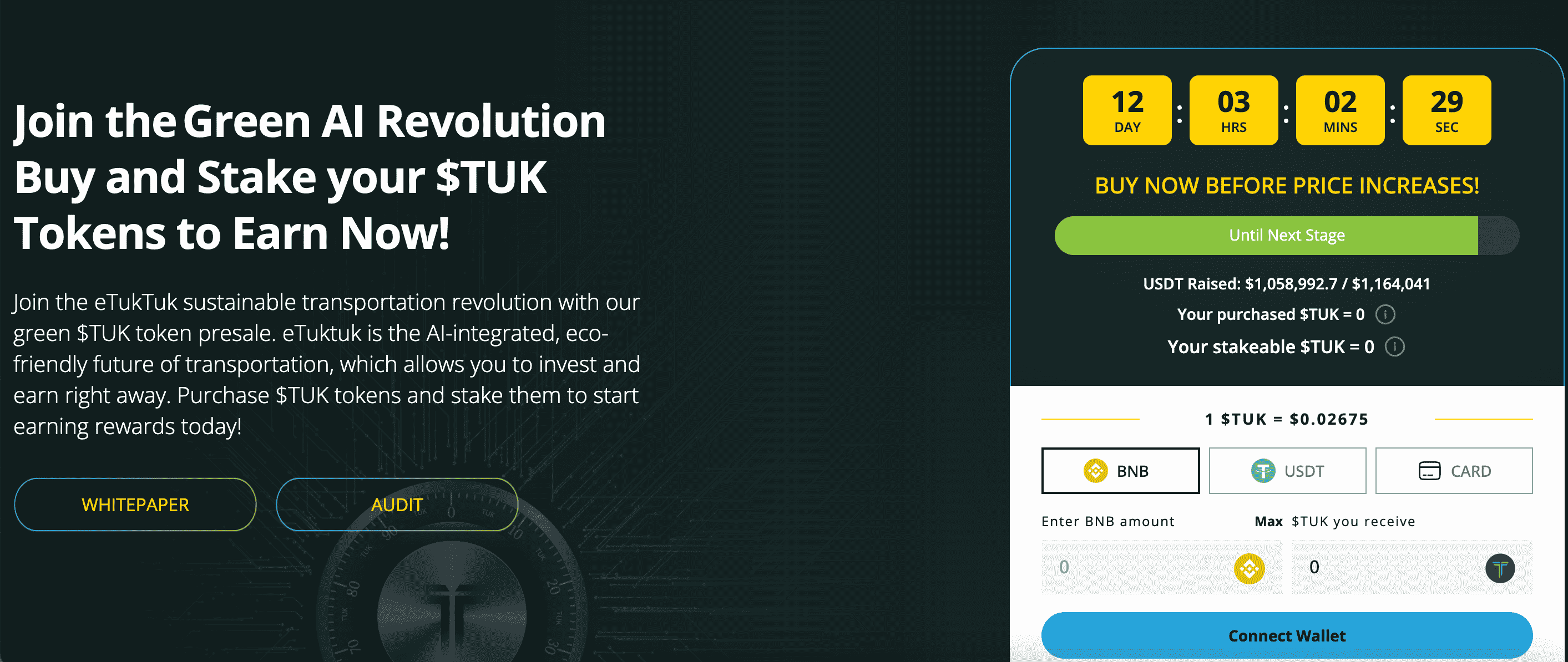

4. eTukTuk – Driving the Change with $TUK Token and Fueling the Future of Electric Mobility

eTukTuk aims to revolutionise the Tuk Tuk economy by harnessing the power of electric vehicles for cleaner air and a better profit model. Through a popular ongoing presale, eTukTuk has raised over $1 million so far. $TUK token is currently available at $0.00002009.

eTukTuk is a real-world use case for blockchain technology, demonstrating the scope of collective community power. Alongside real-world change, eTukTuk is helping token holders earn rewards while eliminating financial divides. With eTukTuk, the team aims to act as a blueprint across developing countries to make the switch to electric vehicles.

The project is working towards mitigating the harmful effect of 270 million internal combustion engine (ICE) TukTuks and other two and three wheeler vehicles. For this, eTukTuk has developed a revolutionary ecosystem that aims to reduce air pollution, CO2-related health conditions, and financial exclusion.

For crypto enthusiasts, the project has the $TUK utility token powering its ecosystem that provides rewards to long-term network participants. As the number of stations installed by eTukTuk grows, with increased network usage, stakers will earn a greater yield. Moreover, drivers pay a fee for using their vehicles, thereby generating revenue for the network.

For more information about the project, check out eTukTuk’s Telegram, Twitter, YouTube, and Discord. You can also also read its whitepaper.

| Presale Started | Ongoing |

| Purchase Methods | ETH, BNB, USDT, and Card |

| Chain | BNB Chain |

| Min Investment | None |

| Max Investment | None |

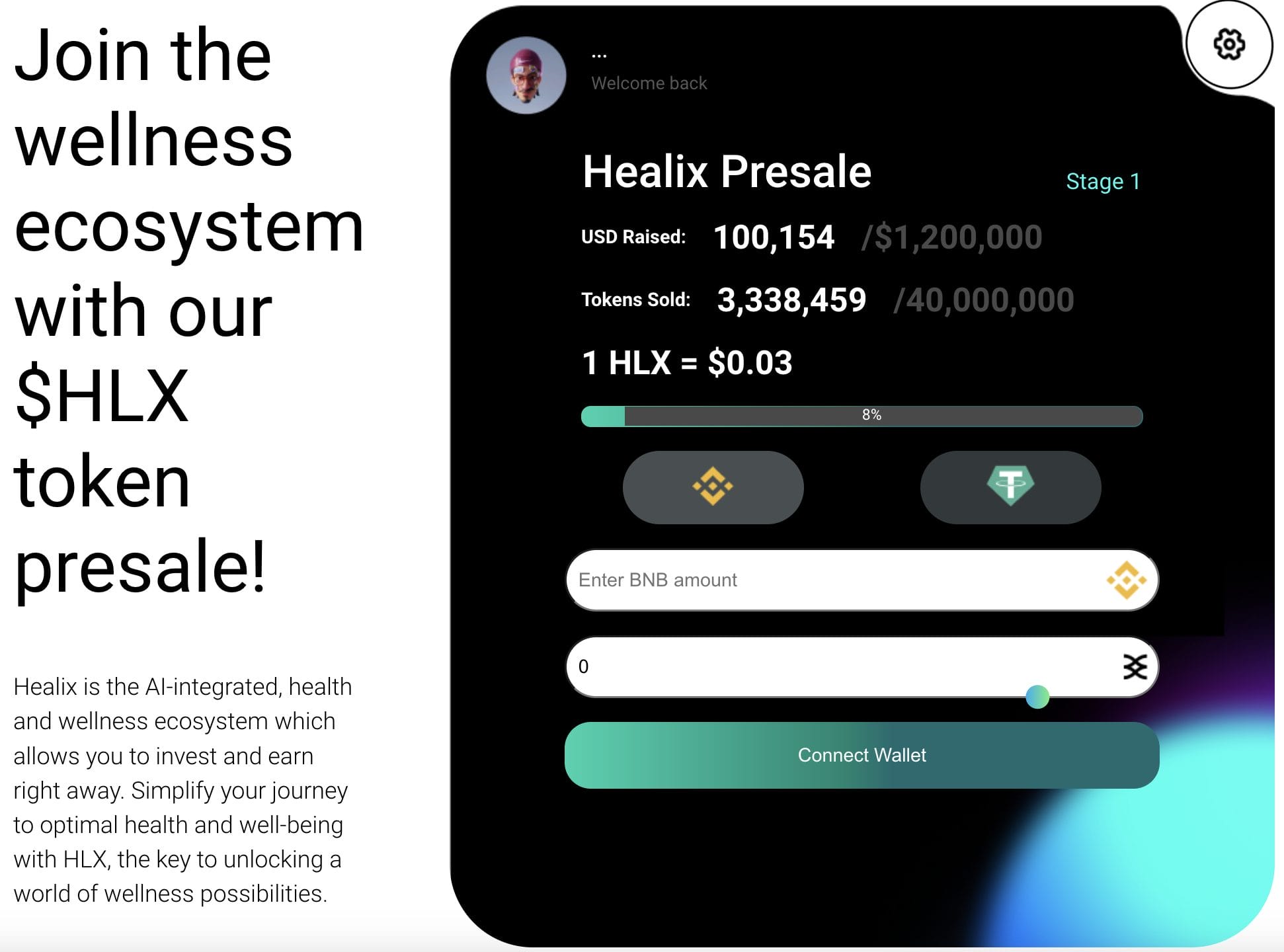

5. Healix – Decentralized Healthcare Token Offers Premium Benefits Using AI Technologies

Healix ($HLX) is one of the most innovative crypto projects in 2024. It decentralizes the healthcare space by leveraging blockchain and AI tools. $HLX, the native token, will allow you to access premium healthcare benefits, appointments, and other medical information.

Through the Healix app, token holders can access their blood levels by a simple face scan. The project uses AI generative models to allow users to access a trustworthy chatbot, which answers all medical-related questions. $HLX tokens can be staked on the smart contract, where you are rewarded with multiple benefits depending on the number of tokens staked.

The benefits include annualized token bonuses, discounts on Healix’s partner programs and services, and premium access to Healix’s app features. Cashback up to 10% is also provided on HLX payments through this staking tier. Healix introduces the Health Quotient (HQ) – a novel feature offering real-time insights into your overall health. Users access personalized health recommendations and can constantly track their progress.

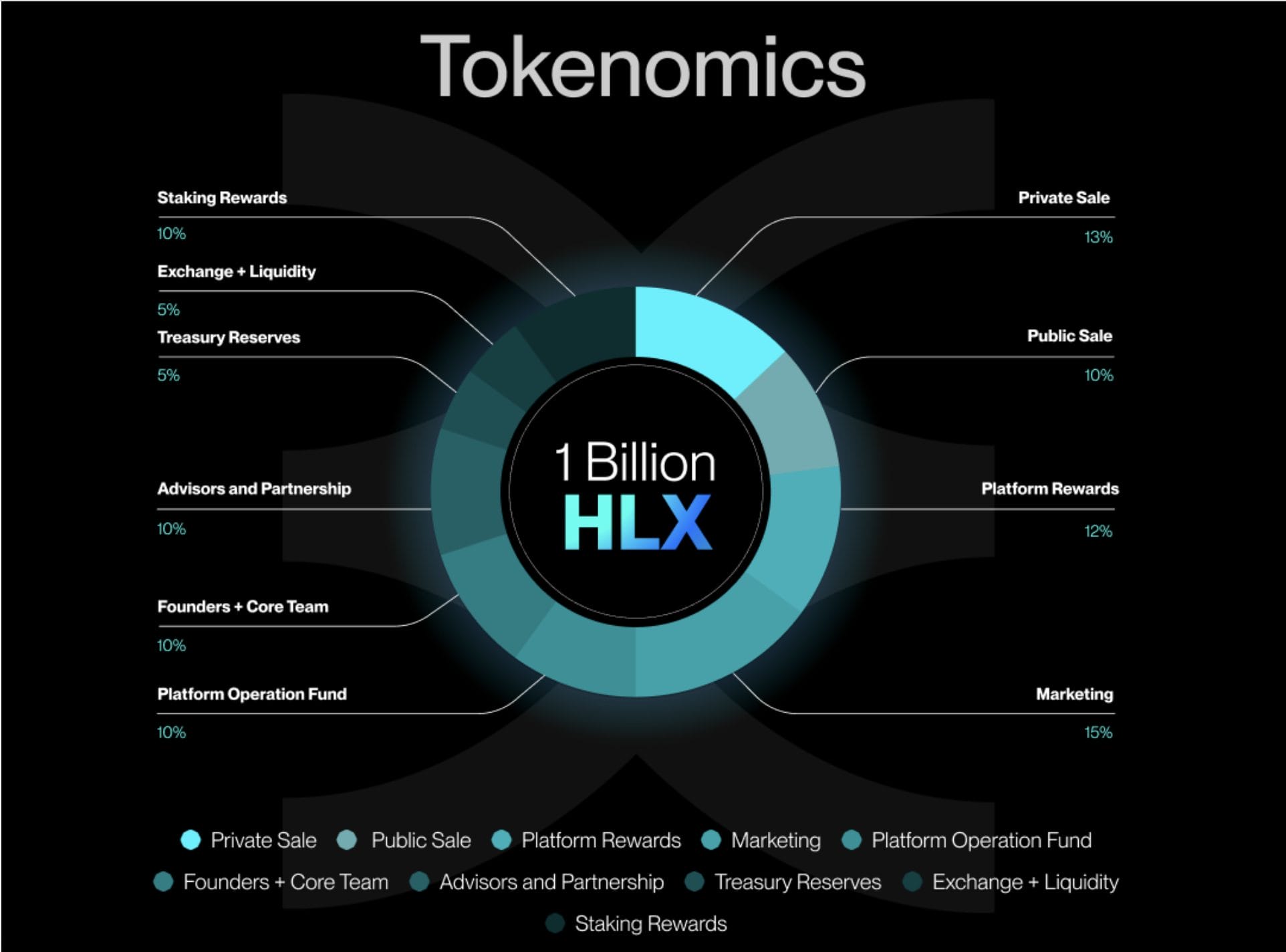

Notably, Healix offers $HLX tokens as rewards as you progress toward your overall health goals. From a 1 billion token supply, 220 million tokens will be distributed as staking and platform rewards. 100 million tokens are being offered through the ongoing presale. At press time, $HLX is priced at $0.03 per token. Read the Healix whitepaper and join the Telegram channel for more information.

| Token Symbol | HLX |

| Presale Supply | 100 Million |

| Token Type | BEP-20 |

| Payment Method | BNB, Tether |

| Listing Price | N/A |

6. Decentraland – Metaverse Project with Huge Institutional Backing

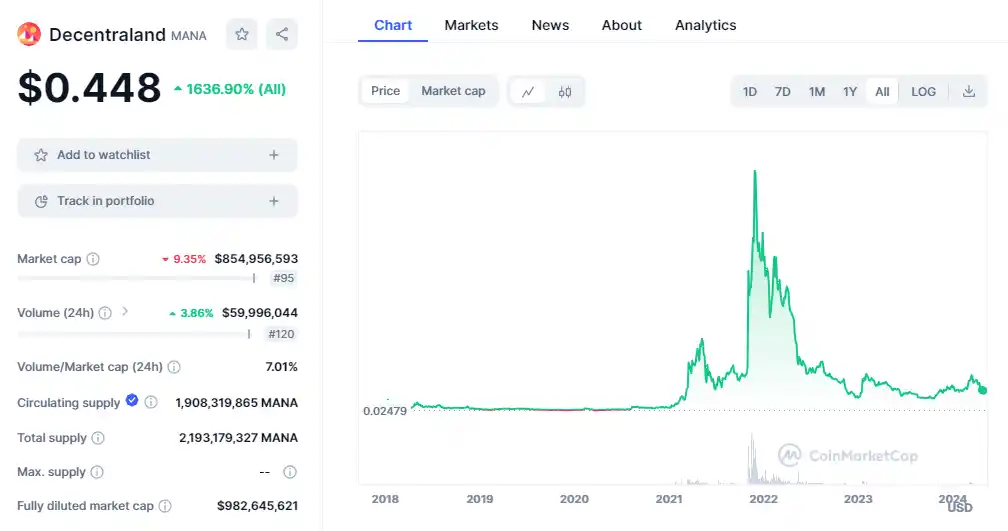

Another area with a strong utility focus is the metaverse. One of the best metaverse coins in this regard is MANA, which underpins the Decentraland ecosystem. As we briefly noted earlier, MANA is the native token of the Decentraland metaverse and can be used to purchase land and pay for in-world goods and services.

The price of each virtual plot will vary depending on market conditions and the location within the metaverse. For instance, buying land close to Snoop Dogg or Paris Hilton will come at a huge premium. MANA can also be used to access play-to-earn games within Decentraland, as well as the trading of NFTs. More utility is expected as the metaverse concept becomes more mainstream. In the meantime, MANA can be purchased at a huge discount when compared to its former peak price.

Despite surging by 80% in the last 4 months, MANA is down by 45% in the previous year (at time of press) making the coin an attractive buy right now. With all-time highs of close to $5 it has a lot of room for upside potential.

7. Ethereum – Utility Token That Backs Thousands of ERC-20 Standard Projects

It could be argued that Ethereum is one of the best utility tokens in the market. Put simply, thousands of projects are built on top of the Ethereum blockchain via the ERC-20 standard. This means that in order to send and receive funds, each respective project will be required to pay transaction fees in ETH, commonly referred to as GAS.

Furthermore, ETH is required when deploying Smart Contracts – whether initiated by Ethereum itself or by one of the many thousands of ERC-20 tokens. The previously discussed MANA, for example, is built on top of Ethereum, as are many other leading metaverse projects – such as Sandbox, Enjin, ApeCoin, and Axie Infinity.

Over the course of time, this will ensure that Ethereum remains relevant as an in-demand utility token. Ethereum is also attractive right now considering that due to its Proof of Stake architecture the protocol is virtually carbon neutral. As the development of the blockchain industry evolves, eco-friendly networks will become more and more popular.

As the chart above shows, Ethereum is showing strong signs of life and looks on course to beat its previous all-time high, set in November 2021, again. With significant software upgrades around the corner accompanied by rumors of a proposed Ethereum ETF circulating, 2024 could be a great year for Ethereum.

8. XRP – Provides Utility for the Ripple Interbank Payments Network

Although the US Securities and Exchange Commission disagreed, we believe that XRP is one of the best utility tokens to explore. After all, XRP sits at the heart of the Ripple interbank payments network, which enables financial institutions to transact across borders in a low-cost and fast way.

In the Ripple use case, when cross-currency transactions are required, XRP forms a bridge of liquidity. This ensures transactions do not need to use correspondent banks which are both slow and expensive. Through XRP, Ripple are targeting banks and financial institutions, as opposed to offering any utility for consumers.

Nonetheless, XRP is a large-cap utility token that can be purchased from dozens of leading exchanges. Given Ripple’s victory over the SEC, resulting clarification and the state of the world economy, many experts believe XRP could pose an attractive option for institutional investors looking to make the most of the next crypto bull run. With current prices some 600% off its previous all-time high, its easy to see why.

9. BNB – Proprietary Token of the Binance Smart Chain Ecosystem

Binary Finance or Binance for short, aim to revolutionize traditional finance through the application of decentralized technologies. BNB is the utility token at the heart of the Binance eco-system which includes the world’s largest crypto exchange by volume, Binance.

More importantly, BNB is the native digital currency of the Binance Smart Chain, which hosts thousands of NFTs, protocols and tokens. In a nature similar nature to Ethereum and ETH, all Binance Smart Chain transactions must be paid in BNB.

Moreover, the vast bulk of tokens that are listed on the Binance Smart Chain are paired with BNB. This means that in order to buy the token, investors must first obtain BNB before completing the swap. BNB also enables traders on Binance to access a reduction in fees and commissions.

As you can see from the chart above, BNB has shown strong resilience through an otherwise brutal bear market. At current prices, it is less than 90% from its previous all-time high. With Binance under new ownership since November 2023, BNB coin is in good hands and looks set to continue its exponential growth into the rest of the decade.

10. ADA – Native Coin of the Cardano Ecosystem

Conceived, designed and written by one of the core founders of Ethereum, Charles Hoskinson, Cardano is a Proof of Stake blockchain that seeks to create a society that is more secure, transparent and fair. At the heart of the Cardano network is the ADA token which allows holders to vote in the development of the software, underlining the project’s commitment to democratic ideals.

In competition with other Layer 1 protocols such as Ethereum, Solana and Ripple, blockchain developers are able to create a variety of decentralized applications (dApps) and Smart Contracts with Cardano. With working use cases already in agriculture, education and retail, the future for ADA and Cardano continues to look bright.

As with most of the crypto market, ADA fell from its all-time high in late 2021. However, regardless of price, the project continued to develop and launch new products and, to date, Cardano remains the 8th largest cryptocurrency by market cap. As their charismatic leader Charles Hoskinson remains at the helm, this popular crypto project has every chance of retaining, if not exceeding, its previous high of $3.00.

11. Chainlink – Decentralised data oracle for real-world integration

Designed as a bridge between blockchains and off-chain environments, Chainlink was founded in 2017 by Sergey Nazarov and Steve Ellis. Built on Ethereum, Chainlink was created to facilitate the transfer of ‘tamper proof data’ from the real world into Smart Contracts.

If we are to enter a digital age then it is imperative that, as a society, we dont exist in a series of walled gardens. By linking the real and the digital worlds, Chainlink fixes this.

With Chainlink being something of an originator in the oracle space, the project has benefitted significantly from first mover advantage. That said, as you can see from the chart above, native token LINK lost a lot of value in the bear market of 2022-23. That being said, the token has shown the strength to grow over 100% in less than 6 months and to this day remains one of the most sought after cryptos in the market.

12. Polygon – Ethereum Layer 2 scaling solution designed for interoperability

Formerly known as MATIC, Polygon is an easy-to-use platform that has been designed to help Ethereum scale thereby aiding infrastructure development and real-world use. Without protocols like Polygon, Ethereum is slow and expensive. At its core, Polygon is a flexible and modular framework that enables the construction of a wide variety of applications.

With a nod to its past roots, MATIC is the name of the Polygon native token and is used to not only pay transaction fees but to also secure and govern the network. Widely available across many cryptocurrency exchanges, MATIC remains one of the most popular cryptocurrencies in 2024.

As we can see from the above chart, MATIC is a volatile crypto with a series of aggressive highs and lows. That being said, the token has shown considerable resilience throughout the previous bear market remaining a firm favourite with investors. With many expecting a return to all-time highs in 2024, investing in MATIC now might prove to be a wise decision.

What Are Utility Tokens?

Utility tokens are digital assets designed for specific uses within a blockchain ecosystem. Unlike cryptocurrencies like Bitcoin, which are primarily used as digital money, utility tokens provide holders with access to services or benefits. For example, a token might allow users to vote on decisions within a platform, pay for services, or execute smart contracts.

A well-known utility token is Ether, used to pay for transactions and services on the Ethereum network. Unlike meme coins, such as dogwifhat, which often gain popularity and value based on social media trends and community support rather than functional use, utility tokens have practical applications that support their value. They are integral to the operation of their respective platforms.

5 Examples of Crypto Utility

To help you understand what utility tokens are and what they’re used for, here are five examples of crypto utility and how users benefit from it.

1. Play-to-Earn Rewards

Tokens providing play-to-earn gaming rewards are used in blockchain games, where players create or earn digital assets through gameplay. Benefits include generating income while playing and gaining real-world value from virtual achievements.

Utility

- Buying in-game items

- Trading for other cryptocurrencies

- Selling for real money

Examples

- Sponge V2 (SPONGEV2): Earned by playing its racer game; can be staked for rewards.

- Mega Dice Token (DICE): Offers in-game benefits; can be staked for rewards in casino games and sports betting.

- Axie Infinity (AXS): Earned by battling and breeding digital creatures; can be staked for governance rights and rewards.

2. Investing in the Metaverse

Utility tokens allowing users to invest in the metaverse enable ownership or investment in virtual properties and assets. These tokens facilitate purchasing, trading, and developing digital real estate and other virtual goods.

Utility

- Buying digital land

- Trading virtual assets

- Developing virtual spaces

Examples

- Decentraland (MANA): Used for transactions in virtual real estate.

- Enjin Coin (ENJ): Used to create and manage virtual goods and assets.

- The Sandbox (SAND): Enables users to build and trade in a virtual world.

3. NFT Rewards and Trading

Utility tokens that facilitate NFT rewards and trading allow users to buy, sell, or earn NFTs related to various NFT projects. These tokens enhance user engagement and provide financial incentives through unique digital collectibles.

Utility

- Purchasing NFTs

- Earning through NFT rewards

- Trading on NFT marketplaces

Examples

- Mega Dice Token (DICE): Provides tradable limited-edition NFTs as rewards.

- Rarible (RARI): Allows users to mint and trade NFTs on its platform.

- Chiliz (CHZ): Enables sports fans to trade sports-related NFTs.

4. Transactional Currency

Transactional currency tokens are used to pay for network fees, facilitating blockchain operations. These tokens enable seamless transactions and ensure network security by incentivizing validators.

Utility

- Paying transaction fees

- Ensuring network security

Examples

- Ethereum (ETH): Required for gas fees on Ethereum transactions.

- Binance Coin (BNB): Used for transaction fees on Binance Smart Chain.

- Cardano (ADA): Pays for operations on the Cardano network.

5. Passive Income

These tokens enable holders to earn passive crypto income, typically through staking, where tokens are locked in a smart contract to support network operations, in return for rewards.

Utility

- Staking for network support and rewards

Examples

- eTukTuk ($TUK): Provides staking rewards as network usage increases.

- Healix ($HLX): Staking offers health-related benefits and token bonuses.

Are Utility Tokens a Good Investment?

Utility tokens can be a good investment due to their practical applications within blockchain projects. These tokens offer access to specific functionalities such as:

- Playing games (e.g., Mega Dice Token)

- Using software (e.g., Ethereum for smart contracts)

- Participating in the metaverse (e.g., Decentraland)

Their value is often driven by the demand for the services they enable, which can grow as the platform expands and attracts more users. However, while utility tokens offer unique opportunities for gains, especially in growing blockchain ecosystems, they also carry high risks related to market, technological, and regulatory changes. Investors should perform thorough research and consider their risk tolerance before investing.

Conclusion

This market insight has explored the best utility coins to consider buying today. While crypto assets in general are high-risk financial instruments, there are still a number of attractive entry points for both new and experienced investors. Most of the largest and most successful cryptocurrencies have tokens that are integral to the operation of the network.

Understanding how utility coins bring value to the parent blockchain will help you make better investment decisions. One of the best utility tokens right now is Dogeverse ($DOGEVERSE). This is a multi-chain meme cryptocurrency, compatible with six blockchains. Furthermore, $DOGEVERSE can be staked to generate high annual percentage yield.

FAQs

What are some examples of utility tokens?

Utility tokens offer holders a real-world use case. A prime example of this is BNB, which fuels the Binance Smart Chain and offers discounts to traders on the Binance exchange.

What is a utility token in crypto?

In its most basic form, utility tokens are cryptocurrencies that represent real-world value, because they provide holders with a use case. This is in stark contrast to a meme coin like Dogecoin, which is typically purchased for speculative reasons only.

Which coins have the most utility?

Many would argue that ETH has the most utility, considering that it is the required transactional currency for thousands of ERC-20 projects built on the Ethereum network. Moreover, ETH is used to power Smart Contract agreements.

Is Shiba Inu a utility token?

Shiba Inu (SHIB) was originally created in 2020 as a direct competitor to Dogecoin’s status as the de-facto meme coin. However, considering that Shiba Inu has since created a metaverse ecosystem of its own, SHIB is now arguably a utility token. The reason for this is that when buying virtual plots of land within the Shiba Inu metaverse, SHIB is the primary currency of choice.

References

- Fortune: Someone just paid $450,000 to be Snoop Dogg’s neighbor in the metaverse. Here’s how you can live by a celebrity too

- Yahoo Finance: Grayscale: Ethereum’s Rally Mainly Due to Dencun Upgrade, Not Spot ETFs

- Reuters: Ripple Labs notches landmark win in SEC case over XRP cryptocurrency

- Bloomberg Law: The Dual Nature of “Utility” Tokens and Dual Token Structures

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Sergio Zammit

Sergio Zammit

Eric Huffman

Eric Huffman