8 Best Crypto Exchanges in Canada in 2024

Since the Canadian government has specific regulation surrounding cryptocurrencies, it’s important to find an exchange that is fully compliant with local laws. In this guide, we compare the best crypto exchanges in Canada in 2024 that are completely legal to use and offer a great trading experience.

Our research methodology considers a range of important metrics, such as fees, safety, payment methods, supported coins, user experience, and trading features. Read on to get started with a trusted Canadian crypto exchange today.

The Best Canadian Crypto Exchanges

When searching for cryptocurrency exchanges in Canada, you’ll find a mixture of well-known international exchanges, as well as platforms that only serve Canadians. Here is our top list of all the available providers:

- Kraken — Overall Best Canada Exchange in 2024

- Coinbase — Best for First-Time Crypto Investors

- Bitbuy — Domestic Exchange With 0% Interac e-Transfer Deposits

- Best Wallet — Decentralized Crypto Exchange With Complete Anonymity

- Coinmama — Instantly Buy Cryptocurrencies With a Debit/Credit Card

- CoinSmart — Trade Popular Crypto Assets at Just 0.2% per Slide

- Gemini — Safe Crypto Exchange Supporting 80+ Coins

- Crypto.com — Zero-Fee CAD Bank Transfers and 0.075% Commissions

The Best Canadian Cryptocurrency Exchanges Reviewed

There are numerous factors to consider when weighing up the which crypto exchange to use, especially when taking into consideration details that are unique to Canada, such as specific regulation and use of the Canadian dollar.

Our experts have reviewed the best Canadian crypto exchanges in full, highlighting the standout features for each platform. Read on to find the most suitable option for you.

1. Kraken — Overall Best Canada Crypto Exchange in 2024

In our view, Kraken is the best Canadian cryptocurrency exchange in the market. Founded in 2011, Kraken has been offering crypto trading services for more than 13 years.

It offers two ways to buy and sell crypto. First, the basic Kraken exchange is aimed at beginners. You simply need to choose which crypto you want to buy, type in the amount, and confirm the order.

Experienced investors might consider Kraken Pro. This is an advanced trading dashboard that comes packed with features. You’ll find real-time charts with technical indicators, drawing tools, custom order types, and in-depth order books.

After registering and uploading KYC documents, you can easily deposit Canadian dollars. Accepted payment methods include domestic wires, in-person bank deposits, and Interac e-Transfer. Debit and credit cards are also accepted.

Trading commissions on Kraken start at just 0.26%. Lower fees are available when trading larger amounts. The minimum deposit is just $10.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| Kraken | 200+ | 0% to 0.4% | Domestic wires, in-person bank deposits, Interac e-Transfer, debit/credit cards |

Pros

- Overall best crypto exchange in Canada

- Trade over 200 coins

- Low trading commissions

- Offers leveraged markets

Cons

- High trading volumes are needed to reduce fees

- Doesn’t offer a proprietary wallet

2. Coinbase — Best for First-Time Crypto Investors

First-time investors might consider Coinbase the best option. This user-friendly crypto exchange was founded in 2012. It boasts a regulated framework, robust security, and a public stock listing on the NASDAQ.

Coinbase Canada accounts take under 10 minutes to open – including the ID verification process. Canadians can then buy Bitcoin instantly with a debit/credit card.

You can also buy 200 other coins, including some of the best cryptocurrencies to buy, such as Ethereum, Uniswap, Chainlink, Dogecoin, Polygon, and Solana.

In terms of fees, using a debit/credit card to buy crypto will cost you 3.99% of the investment amount. The other option is to deposit funds via Interac e-Transfer — this is fee-free.

You can reduce trading commissions by using the advanced dashboard. This comes with charting tools and technical indicators, so might not appeal to newbies.

Coinbase is available on desktop and mobile browsers. It also offers a native mobile app for iOS and Android.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| Coinbase | 200+ | 0% to 0.6% | Interac e-Transfer, debit/credit cards |

Pros

- Established crypto exchange with robust security features

- Lists more than 200 crypto coins

- Interac e-Transfer deposits are fee-free

- Offers a native app for iOS and Android

- One of the best options for first-time investors

Cons

- 3.99% fee when using a debit/credit card

- Advanced dashboard needed to reduce commissions

3. Bitbuy — Crypto Exchange in Canada With 0% Interac e-Transfer Deposits

Next is Bitbuy, a Canadian cryptocurrency exchange that was founded in 2016. Headquartered in Toronto, Bitbuy is registered with FINTRAC and approved by the Ontario Securities Commission. It also has approval from the Canadian Securities Administrators, ensuring a safe trading experience.

Bitbuy is the best option for depositing funds with Interac e-Transfer. You won’t be charged any deposit fees. What’s more, the payment will be credited in under 30 minutes.

The minimum Interac e-Transfer deposit is just $50. Bank wires are also fee-free but the minimum increases to $10,000. Other options include debit/credit cards and Apple Pay. However, fees range from 1.95% to 2.95%.

Once you’ve made a deposit you’ll need to pay trading commissions. Beginners might consider the ‘Express Trade’ feature. Although this costs 2% of the purchase amount, it’s particularly useful for first-time investors. Experienced traders can use the ‘Pro’ tool, which reduces the commission to 0.10%. Bitbuy supports Bitcoin and 42 altcoins.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| Bitbuy | 43 | Up to 2% | Interac e-Transfer, bank wires, debit/credit cards, Apple Pay |

Pros

- Toronto-based crypto exchange founded in 2016

- Approved by the Ontario Securities Commission and Canadian Securities Administrators

- Native mobile app for iOS and Android

- Doubles up as one of the best crypto wallets

- Fee-free Interac e-Transfer deposits credited within 30 minutes

Cons

- 2.95% fee when using a credit card or Apple Pay

- Supports just 43 crypto coins

4. Best Wallet — Decentralized Crypto Exchange With Complete Anonymity

We found that Best Wallet is one of the best decentralized crypto exchanges for Canadians. As a decentralized exchange, or DEX, you won’t be required to open an account. There is no need to provide personal information, contact details, or ID verification documents.

Instead, Best Wallet enables you to trade in complete anonymity. All you need to do is connect a private wallet to Best Wallet and choose which crypto coins to trade.

Currently, Best Wallet supports all coins on the Ethereum, BNB Chain, and Polygon networks. Other networks will be added soon. Best Wallet uses external liquidity pools to facilitate trades. This means Canadians get the most competitive prices in the market.

Best Wallet is also a great option for storing crypto coins. It comes as a mobile app for iOS and Android. You can protect the wallet with two-factor authentication, a passcode, and biometrics. Best Wallet will soon be launching a native token, BEST. This is tipped to be one of the best future cryptocurrency projects.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| Best Wallet | All coins on the Ethereum, BNB Chain, and Polygon networks | Uses third-party liquidity pools for the best market prices (no markups) | Debit/credit card integration, but this will trigger KYC requirements |

Pros

- Best crypto app in Canada for decentralized trading

- Secures the best exchange rates in the market

- Download for free from Google Play or the App Store

- Supports all coins on the Ethereum, BNB Chain, and Polygon networks

- No account is required — trade crypto anonymously

Cons

- Doesn’t currently support Bitcoin

- Many core features are still being built

5. Coinmama — Instantly Buy Cryptocurrencies With a Debit/Credit Card

If you’re looking for the fastest way to buy crypto in Canada, Coinmama is a great option. Launched in 2013, Coinmama is a trusted crypto exchange with offices in Vancouver. Its parent company, Wellfield Technologies Inc., trades on the TSX Venture Exchange. As such, you should have no concerns about legitimacy.

Coinmama allows you to purchase crypto instantly with a debit/credit card. You’ll need to enter your unique wallet address when setting up the order. Once the debit/credit card payment is processed, the crypto will be transferred to your private wallet automatically. This removes the counterparty risks you’ll get with other Canadian crypto exchanges.

Now for the bad news: Coinmama is one of the most expensive crypto exchanges in Canada. For a start, debit/credit card purchases cost between 3.24% and 3.34%. You’ll also need to pay the Coinmama commission. This ranges from 0.9% to 3.9%, depending on your account tier. Coinmama supports more than 100 crypto coins.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| Coinmama | 100+ | 0.9 to 3.9% | Debit/credit cards, Skrill, Neteller |

Pros

- Established in 2013

- Lists more than 100 crypto coins

- Accepts debit/credit cards, Skrill, and Neteller

- Crypto coins are instantly transferred to your private wallet

- 24/7 customer support

Cons

- Trading commissions of up to 3.9%

- Debit/credit card fees of up to 3.34%

6. CoinSmart — Trade Popular Crypto Assets at Just 0.2% per Slide

Based in Toronto, CoinSmart is a popular crypto exchange that offers competitive trading fees. Canadians can buy and sell crypto assets for just 0.2% per slide. This amounts to just $2 for every $1,000 traded.

CoinSmart supports just 16 cryptocurrencies, but it covers the most popular, including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, EOS, and Stellar. You can also buy Dogecoin, Chainlink, Shiba Inu, Uniswap, and Solana.

Canadians have several options when funding their CoinSmart account. First, Interac e-Transfer comes with a $100 minimum, and the funds arrive on the same day. There are no fees on deposits over $2,000. Anything below $2,000 is charged 1.5%.

Bank wires are fee-free but come with a $10,000 minimum. Credit/debit cards, while processed instantly, cost at least 6.75%.

In addition, withdrawing Canadian dollars from CoinSmart costs 1% across all available methods. CoinSmart offers a simple investment platform that will appeal to beginners. Its app is free to download on iOS and Android devices.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| CoinSmart | 16 | 0.2% | Debit/credit cards, Interac e-Transfer, bank wire |

Pros

- Charges just 0.2% per slide in trading commissions

- A user-friendly platform with a native iOS/Android app

- Easily deposit and withdraw Canadian dollars

- Interac e-Transfer deposits over $2,000 are fee-free

- Headquartered in Toronto and registered with FINTRAC

Cons

- Debit/credit card fees start from 6.75%

- Just 16 cryptocurrencies are supported

7. Gemini — Safe Crypto Exchange Supporting 80+ Coins

Next is Gemini, an established crypto exchange offering Canadians a safe trading experience. This licensed exchange offers robust security features, including keeping the vast majority of client coins in cold storage. Two-factor authentication is also supported, ensuring your account is protected from unauthorized access.

Gemini supports more than 120 coins, making it a great option for diversification. This includes Bitcoin, Ethereum, Bitcoin Cash, Filecoin, and Dogecoin.

The Gemini trading dashboard is suitable for beginners and experienced investors alike. A notable feature is recurring buys. This enables you to dollar-cost average your crypto investments.

The main drawback of Gemini is its fee structure. Canadians pay 1.49% when buying and selling crypto. Orders below $200 are charged a flat fee, ranging from $1.49 to $4.99. This works at a higher rate than 1.49%. Canadians can deposit funds via wire transfer without paying any fees. PayPal deposits cost 2.50%.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| Gemini | 120+ | 0% to 0.4% | PayPal, bank wire |

Pros

- Deposit funds via bank wire without paying fees

- Supports over 120 coins

- Robust security features, including 2FA

- Suitable for newbies and experienced pros alike

- Also offers staking rewards

Cons

- PayPal deposits are charged 2.5%

- Doesn’t support Interac e-Transfer

8. Crypto.com — Zero-Fee CAD Bank Transfers and 0.075% Commissions

Last on this list of Canadian exchanges is Crypto.com. We found that this exchange offers some of the lowest fees in the market. For a start, trading commissions cost just 0.075% per slide.

This means you’ll pay just $0.75 for every $1,000 traded. Crypto.com offers reduced trading commissions when you hit volume milestones. You’ll also get lower fees when holding Crypto.com’s native coin, CRO.

Another benefit is that Crypto.com offers fee-free bank transfers for Canadians. The minimum deposit is just $20, which is ideal for first-time investors. Crypto.com also accepts debit/credit card payments. However, this will set you back 2.99%.

Crypto.com supports more than 250 cryptocurrencies, including Bitcoin, Ethereum, Solana, Polkadot, and Polygon.

It’s also one of the best places to earn crypto yields. For instance, you’ll get APYs of up to 5% when depositing Bitcoin. Rates depend on the lock-up term, which ranges from a flexible 1-month to 3-months.

| Crypto Exchange | Supported Coins | Trading Commission | Payment Types |

| Crypto.com | 250+ | From 0.075% | Debit/credit card, bank wire |

Pros

- Trade crypto from just 0.075% per slide

- Supports more than 250 coins

- CAD bank transfers are fee-free

- Minimum deposit of just $20

- Earn Bitcoin yields of up to 5%

Cons

- Debit/credit card payments cost 2.99%

- CAD deposits can only be made on the app

Methodology: How We Selected The Best Crypto Exchanges in Canada

Canadian crypto exchanges come in many shapes and sizes. We ranked the best providers based on a meticulous methodology. This explored key metrics such as security, licensing, supported coins, trading volumes, and commissions.

We’ll now break down our research method in a lot more detail. This will help you choose the best exchange for your requirements.

Lowest Trading Fees

Crypto exchanges charge trading fees, ensuring that they generate sufficient revenues. Most exchanges charge a variable fee that’s multiplied by your trading volume.

For example, Kraken Canada charges 0.26% per slide, meaning you pay a commission every time you buy or sell crypto. So, if you bought $1,000 worth of Ethereum on Kraken, your trading commission would amount to $2.60.

Like many exchanges, Kraken reduces the trading commission when you hit certain milestones. For instance, this reduces to 0.24% per slide when trading at least $50,000 in a 30-day period.

Crucially, you’ll want to pay the lowest trading fees possible. Otherwise, fees will eat away at your potential profits. The ‘spread’ should also be considered. This fee is rarely advertised by crypto exchanges. It’s simply the difference between the ‘buy’ and ‘sell’ prices. If the spread is too high, you could be overpaying to trade.

Wide Range of Payment Methods

You won’t be able to buy crypto in Canada without first making a deposit. This means using a traditional payment method to deposit Canadian dollars.

The fastest option is to use a debit/credit card. This is because your purchase will be credited instantly. However, this is also the most expensive option. For example, Coinbase and Coinmama charge debit/credit card fees of up to 3.99% and 3.9%, respectively. Bitbuy is slightly more competitive, charging 2.95%.

A more cost-effective option is to deposit funds via Interac e-Transfer. This payment method comes without deposit fees at Kraken, Coinbase, and Bitbuy.

Although it’s not instant, Interac e-Transfer deposits are usually credited within 30 minutes. You can then buy your chosen crypto assets with Canadian dollars.

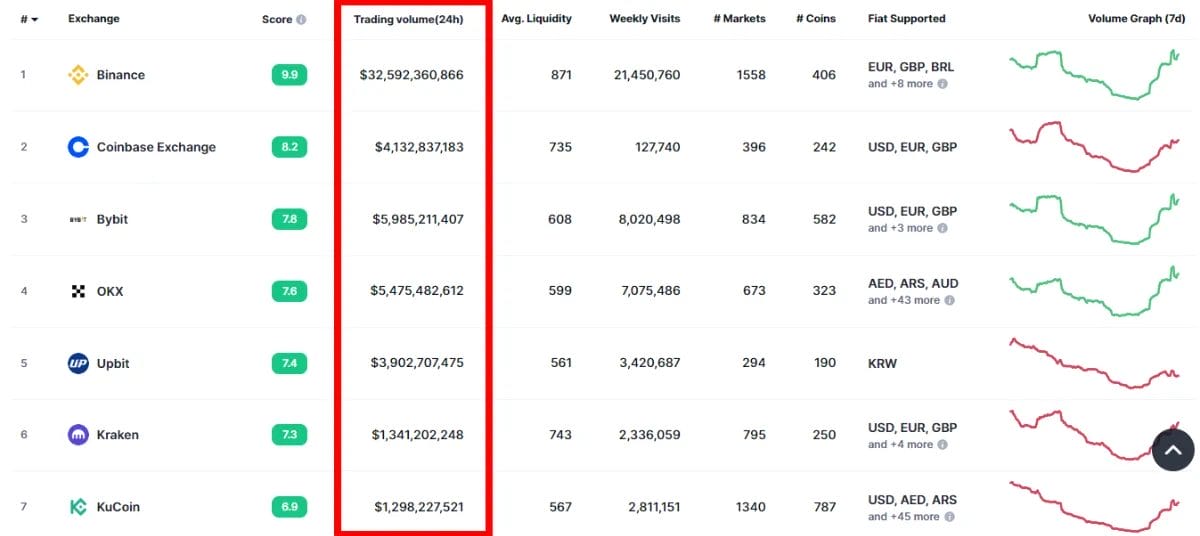

Highest Trading Volume

Often overlooked by beginners is average trading volumes. This is an important metric to consider when choosing a Canadian cryptocurrency exchange.

If trading volumes are too low, there might not be enough liquidity. This means wider market spreads and potential difficulties when cashing out.

For example, more than $1.3 billion worth of crypto was traded on Kraken in the past 24 hours. On Coinbase, this figure stood at over $4 billion. This means Canadian traders will face no liquidity issues when using these exchanges.

Most Cryptocurrencies Available

We also prioritized Canadian exchanges offering a wide selection of crypto assets. This ensures that investors can build a diversified portfolio without needing to use multiple exchanges.

Most exchanges support large-cap cryptocurrencies like Bitcoin, Ethereum, BNB, Solana, and Dogecoin. However, if you’re looking to invest in the best micro-cap cryptos, you might need to do some digging.

Don’t forget to check which trading pairs are available for your preferred crypto. Ideally, you’ll want the crypto to trade against the Canadian dollar. If not, you’ll need to factor in currency exchange fees.

Licensed to Operate

Not all crypto exchanges accept Canadian clients. This is due to licensing issues. For example, some of the best crypto exchanges, including MEXC, Binance, and KuCoin, prohibit accounts from Canada.

Therefore, we focused exclusively on exchanges that have the legal remit to operate domestically. We also prioritized exchanges that are registered with FINTRAC as a Money Service Business.

This ensures that exchanges comply with Canadian anti-money laundering regulations. Some exchanges take things to the next level by obtaining provincial approval. For example, Bitbuy is approved by the Ontario Securities Commission.

Best Security

Security is just as important as licensing. This ensures a safe trading experience. After all, many crypto exchanges have been hacked in recent years. Oftentimes, this results in a loss of client funds. With this in mind, Canadians should spend some time researching core security features.

For example, we expect crypto exchanges to offer two-factor authentication (2FA). This generates a unique code whenever you attempt to log in. The code is sent to your smartphone via an approved app, such as Google Authenticator. Put simply, without your smartphone, hackers won’t be able to bypass the 2FA safeguard.

Another important security feature is ‘whitelisting’. This prevents login attempts from unrecognized devices or IP addresses. Canadians should also evaluate the crypto exchange’s internal safeguards. For instance, we expect exchanges to keep the majority of client-owned coins in cold storage. This means your coins are never exposed to live servers.

What’s more, you’ll want to avoid becoming a victim of internal malpractice and fraud. Since the FTX bankruptcy, the best crypto exchanges in Canada have begun publishing ‘proof of reserves.’ This ensures exchanges have enough funds to cover client deposits.

What is Proof of Reserves?

- Proof of reserves is important when choosing a Canadian Bitcoin exchange.

- In simple terms, it shows how much capital the exchange has in relation to client deposits.

- The proof of reserves report should be compiled by a reputable auditor.

- It should detail the breakdown of reserves, including the crypto asset and the amount.

- The majority of reserves should be held in liquid crypto assets like Bitcoin, Tether, and Ethereum.

- This ensures the exchange has sufficient liquidity.

Which Crypto Exchanges Are Based in Canada? (FINTRAC-Registered)

Crypto exchanges that have a physical presence in Canada must be registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This is to prevent money laundering and terrorist financing.

FINTRAC registration carries many duties, such as adequate Know-Your-Custom (KYC) controls. This means collecting personal information and verification documents from all registered clients.

Some of the most popular Canadian crypto exchanges with FINTRAC registration include:

| Exchange | Location |

| Kraken | Halifax |

| Coinbase | Vancouver |

| Bitbuy | Toronto |

| CoinSmart | Toronto |

| Wealthsimple | Toronto |

| NDAX | Calgary |

| Newton | Toronto |

| VirgoCX | Toronto |

How to Buy Crypto in Canada Using Kraken

We’ve established that Kraken is the overall best cryptocurrency exchange for Canadian investors. This section explains how to buy crypto on Kraken for the first time.

Step 1: Open a Kraken Account

First, you’ll need to visit the Kraken website and click on the ‘Sign Up’ button. Proceed to fill out the registration form. This initially requires an email address, password, and your state/province of residence.

Kraken will then send an email confirmation containing a 6-digit password. Enter the password to complete the registration process.

Step 2: Get Verified

Kraken complies with all relevant laws surrounding anti-money laundering. Therefore, you need to complete the KYC verification process.

First, choose between Kraken and Kraken Pro. If you’re a beginner, we suggest Kraken. This is a user-friendly investment platform that’s aimed at novice traders.

Then, click the ‘Verify Identity’ button. You need to provide your first and last name, date of birth, residential address, and phone number. You also need to state your current occupation.

After that, you’ll be asked to upload two verification documents:

- Government-issued ID: A valid passport or driver’s license.

- Proof of address: Issued within the prior three months, showing your full name and residential address. Eligible documents include bank/credit card/insurance statements, utility bills, tax documents, payroll statements, and residence certificate.

Kraken is currently experiencing a large wave of new account sign-ups. This means it can take several days before your documents are verified. You won’t be able to make a deposit until the KYC checks are complete.

Step 3: Make a Deposit

Now, it’s time to deposit some funds into your verified Kraken account. Kraken accepts Canadian dollar payments, ensuring a fast and cost-effective deposit process.

- Some Canadians deposit funds via a domestic wire transfer. This is fee-free and requires a $100 minimum deposit.

- Another option is to deposit cash into a Canada Post location. This comes with a 0.25% + $1.25 fee, and the minimum is $20.

- You might also consider Interac e-Transfer. The minimum deposit is $5, and fees amount to just 0.5%. The funds should clear on a same-day basis.

Using a Debit/Credit Card at Kraken

- The fastest option is a debit/credit card purchase, which is processed instantly.

- This comes with a minimum purchase amount of just $12.50.

- However, debit/credit card fees are built into the exchange rate.

- This means you won’t know how much you’re paying until you set up an order.

Step 4: Search for Crypto

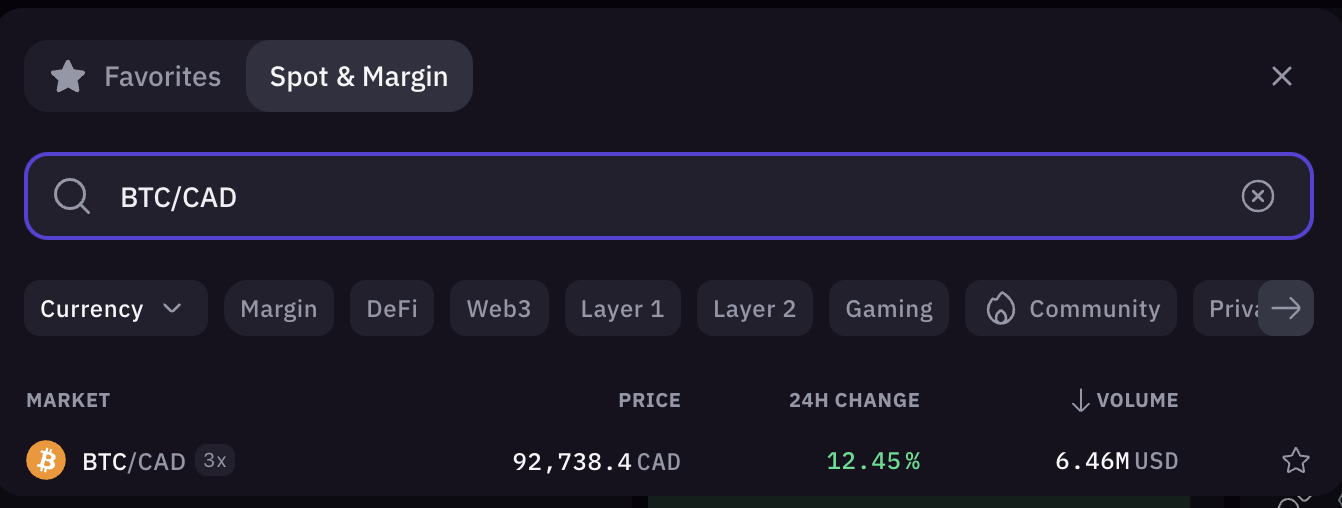

Now that your Kraken account is funded, you can search for the crypto you want to buy.

Head over to the spot trading exchange and type in the name of the crypto. In our example, we’re looking for Bitcoin. To ensure we’re trading Bitcoin against the Canadian dollar, we search for ‘BTC/CAD.’ Click the trading pair when it appears.

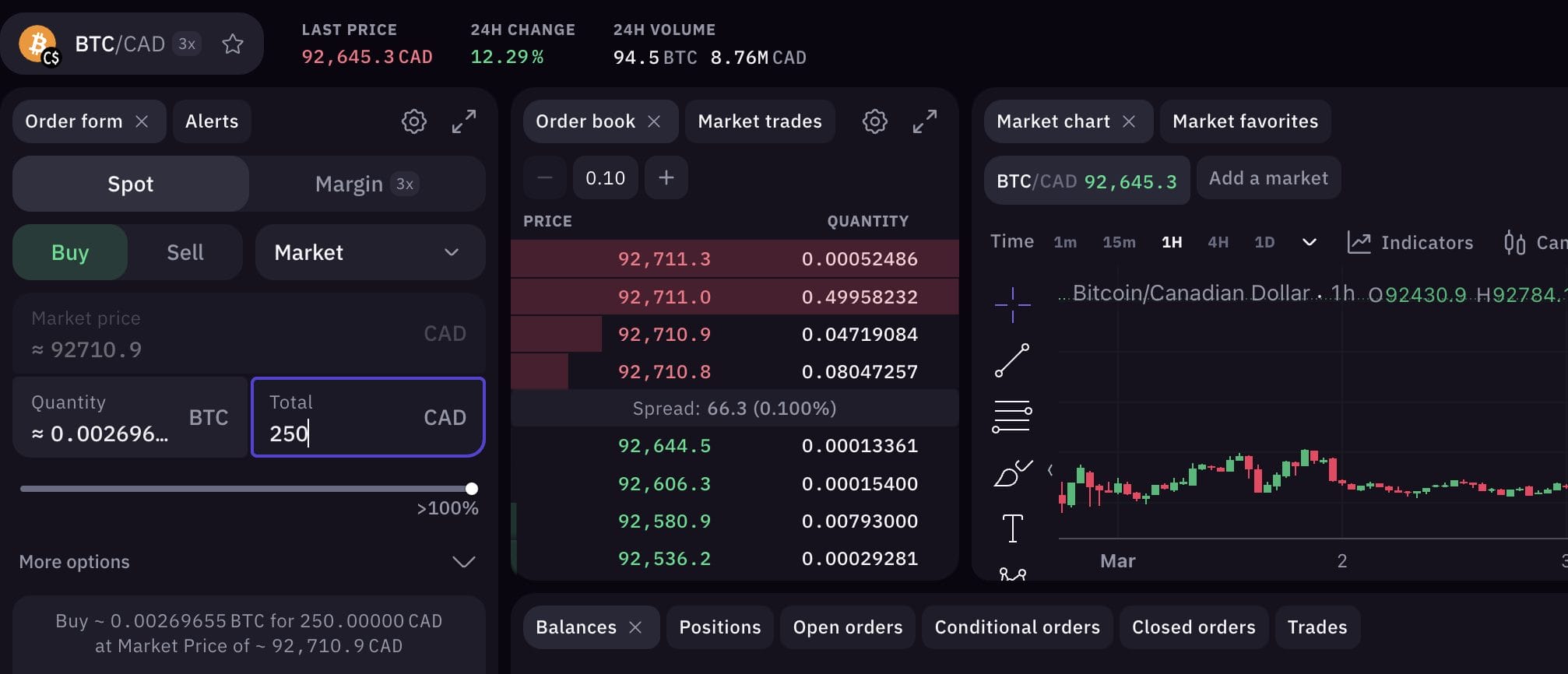

Step 5: Buy Crypto

The final step is to create a trading order. You’ll find this toward the left-hand side of the trading dashboard. First, click on the ‘Limit’ button. This will reveal a drop-down list of order types.

Select ‘Market’. This means your order will be processed instantly at the current market price. There’s plenty of liquidity on Kraken, so you don’t need to worry about slippage.

Next, in the ‘Total’ box type in the amount of dollars you want to invest. In our example, we’re buying $250 worth of Bitcoin. Finally, confirm the order. Kraken will then execute it in real time.

Alternative: Decentralized Exchanges

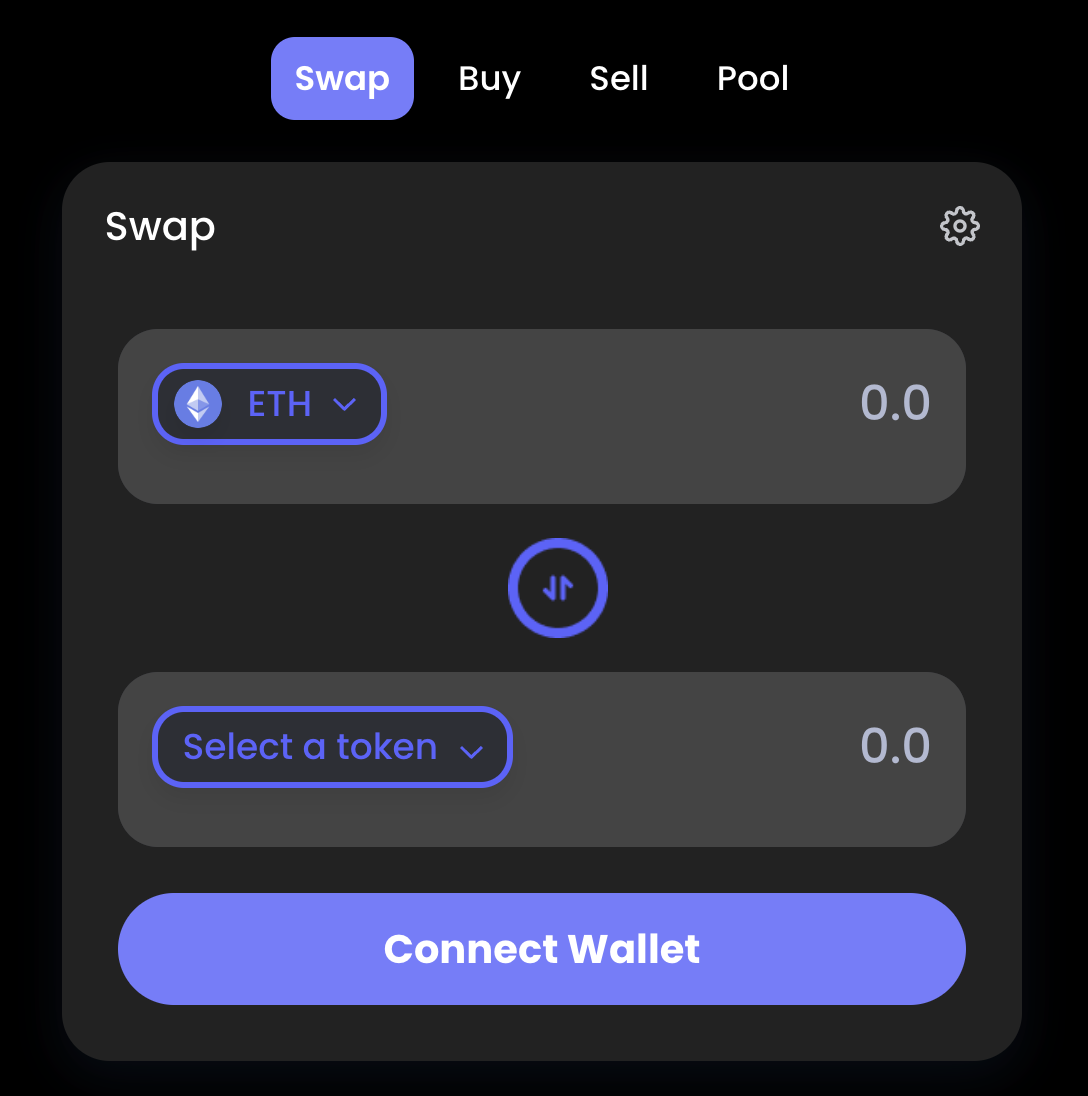

Unlike centralized exchanges, decentralized exchanges operate a borderless business model. This means that irrespective of where you’re from, anyone can trade crypto on a decentralized exchange — including Canadians.

This is because decentralized exchanges don’t have an account opening process. They don’t collect personal information or contact details like centralized exchanges. Nor are there any KYC verification processes.

To trade, Canadians simply need to connect a wallet to the decentralized exchange. They then need to choose which crypto assets to swap, for example, Ethereum (ETH) for Uniswap (UNI).

Decentralized exchanges never touch client-owned crypto. On the contrary, trades are executed by decentralized smart contracts. This ensures a safe and transparent trading experience.

However, decentralized exchanges can’t directly accept Canadian dollars. That said, some decentralized exchanges, including Best Wallet, have partnered with third-party gateways. This enables you to buy crypto with a debit/credit card. However, the fiat gateway will need to conduct KYC, meaning you won’t remain anonymous.

Which Canadian Crypto Exchange Went Bust?

One of the most high-profile crypto exchange collapses was QuadrigaCX; a Canadian platform that declared bankruptcy in 2019. According to CBC, more than $215 million worth of client-owned crypto ‘went missing.’ Its founder, Gerald Cotten, died a year before the bankruptcy.

Cotten was allegedly the only person to have access to QuadrigaCX’s wallets. As per an Ontario Securities Commission report, QuadrigaCX was nothing more than a classic Ponzi Scheme. Since the QuadrigaCX scandal, Canadian authorities have stepped up their efforts to protect retail clients.

This is why Canadians have access to a much smaller range of crypto exchanges when compared to other nations. Nonetheless, the QuadrigaCX case should highlight the importance of due diligence. Always research the credibility of an exchange before opening an account.

Consider its licensing status, whether it’s registered with FINTRAC, and if it’s approved by a regulatory body, such as the Ontario Securities Commission. You should also explore the exchange’s proof of reserves, ensuring they’ve been audited by a reputable third party. This ensures the exchange has enough capital to cover customer holdings.

Conclusion: What Is the Best Canadian Crypto Exchange?

Choosing the right Canadian cryptocurrency exchange is crucial. We’ve ranked the top providers and rated Kraken as the best option. Kraken Canada offers a safe trading experience, low commissions, and a simple way to invest.

It accepts CAD deposits via debit/credit cards, domestic wires, and Interac e-Transfer. What’s more, Kraken supports more than 200 crypto assets, making it a great choice for diversified portfolios.

FAQs

What is the best crypto app in Canada?

We rate Kraken as the best crypto app in Canada. The Kraken app supports more than 200 cryptocurrencies, and commission fees are low, ranging from 0 to 4%.

How do I buy crypto in Canada?

Choose a reputable crypto exchange, open an account, and deposit CAD with your preferred payment method. Search for the crypto you want to buy and confirm the order.

Which crypto exchanges are legal in Canada?

Popular crypto exchanges that legally operate in Canada include Kraken, Coinbase, and Bitbuy.

Is Coinbase good in Canada?

Yes, although Coinbase has high trading fees, it’s still a great option for Canadians. Coinbase offers a safe trading experience and lists over 200 popular coins.

Is Binance legal in Canada?

Binance Canada no longer operates. Binance pulled out of the Canadian market in 2023.

What is the safest Canadian crypto exchange?

Coinbase is one of the safest crypto exchanges in Canada. This regulated exchange offers 2FA and whitelisting security and keeps 98% of client-owned funds in cold storage.

References

- Money services businesses (FINTRAC)

- Canada’s anti-money laundering and anti-terrorist financing regime strategy 2023-2026 (Department of Finance Canada)

- Funds hacked in 2024 increased by 15.4% vs. the same period in 2023 (Cointelegraph)

- Funds Stolen from Crypto Platforms Fall More Than 50% in 2023, but Hacking Remains a Significant Threat as Number of Incidents Rises (Chainalysis)

- Crypto exchange Quadriga was a fraud and founder was running Ponzi scheme, OSC report finds (CBC)

- QuadrigaCX: A review by staff of the Ontario Securities Commission (Ontario Securities Commission)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman