Kraken Crypto Exchange Review - Buy, Sell and Hold Crypto

Founded in 2011, US-based Kraken is the largest crypto exchange when it comes to trading bitcoin and altcoins in euros. It’s also one of the most secure exchanges out there, given its comprehensive range of safety measures, self-regulated approach, and security audits.

Another big plus is that its fees are among the lowest in the industry, with free deposits and very competitive withdrawals and trades. Besides, you can trade on the go using its web platform or one of its mobile apps.

Kraken Review

Kraken offers an exhaustive range of different trading options that range from placing the usual limit orders and stop-loss orders to a dark pool and margin trading. It enables trades not only between cryptocurrency pairs but also between fiat currencies (e.g., pounds, euros), so it’s an excellent fiat-to-crypto gateway.

During its year in the cryptoverse, it has made a name for the following key features:

Fiat-to-Crypto Onramp with High Liquidity

Kraken allows you to trade more than 200 cryptocurrencies in more than 190 markets with six fiat currencies: U.S. dollars (USD), euros (EUR), Canadian dollars (CAD), Japanese Yen (JPY), Great Britain Pounds (GBP), Australian dollars (AUD), and Swiss Francs (CHF).

Dark Pool

If you’re looking for an exchange with an invisible order book, look no further. In the dark pool, each trader only knows his orders and can trade anonymously without revealing their interest to other traders.

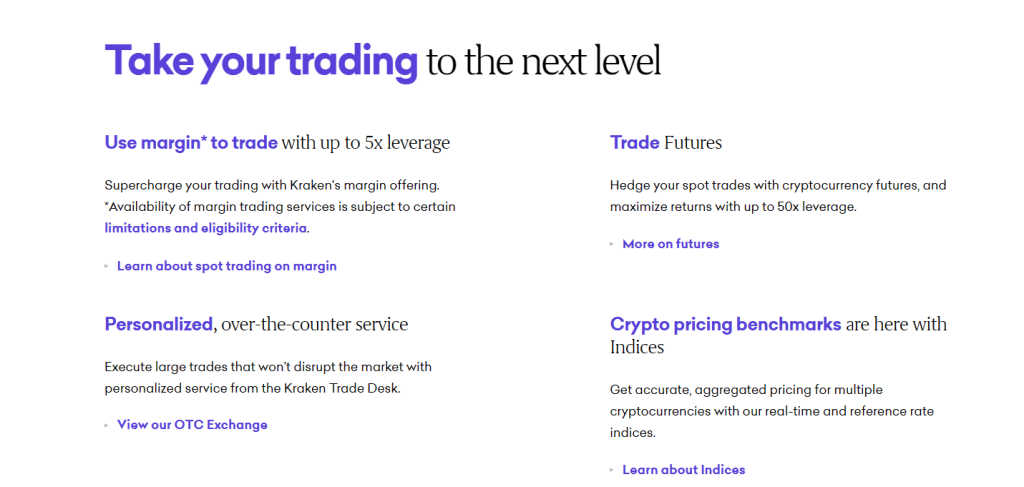

Kraken’s Over The Counter (OTC) Service

High volume traders can use Kraken’s OTC with a one-on-one service.

24/7 Customer Support Desk

Kraken offers around-the-clock global customer support chat in case you have questions or run into trouble using the exchange.

Margin and Futures Trading

The Kraken exchange offers cryptocurrency margin trading with up to 5x leverage.

Forex Trading

Aside from trading cryptocurrencies, you can also exchange your fiat currency into one of six other supported fiat currencies. Not every pair is supported, however.

Secure and Trustworthy Platform

Kraken is the industry leader in terms of crypto security. It has never been hacked before, so you can get a good night’s sleep even when your funds are left in the exchange’s custody.

All in all, Kraken is an old and reputable cryptocurrency exchange for traders looking for fiat on and off-ramp. It comes with a variety of features and advanced trading options for every seasoned trader, as well as simple trading options for novice crypto enthusiasts.

Kraken Exchange History and Background

Kraken was founded in 2011 by early crypto pioneer Jesse Powell and launched in 2013. Since then, it has become one of the most reputable exchanges in the industry.

Based in San Francisco, US, Kraken is a fully regulated exchange, meaning you must pass Know Your Customer (KYC) checks to trade. Besides, it has the distinction of being the exchange chosen by the Tokyo District Court to handle customer compensation claims related to the infamous collapse of Mt. Gox in 2014.

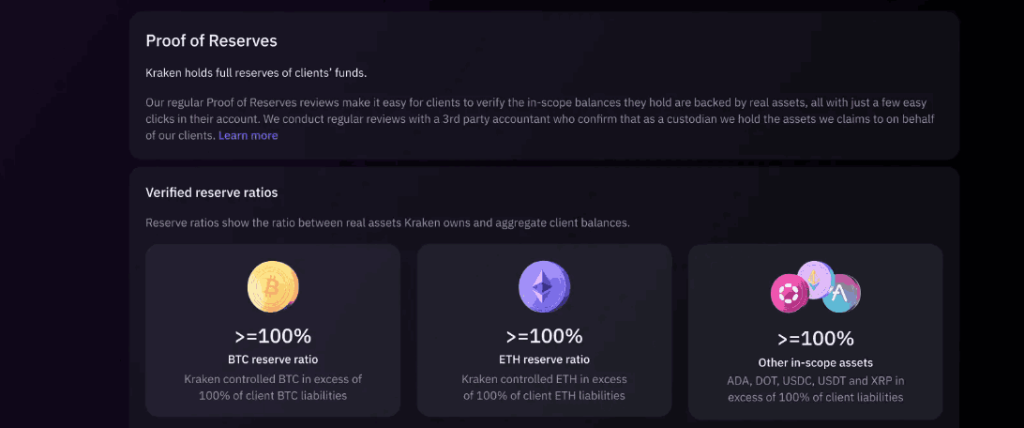

During its years of operations, Kraken has built a reputation as a secure destination and a popular choice among traders and institutional investors. It was the first crypto exchange to pass the Proof-of-Reserves cryptographic audit and it provides crypto market price information to Bloomberg Terminal.

Kraken is a self-regulated exchange and complies with rules and regulations in all supported jurisdictions. It is registered as a Money Services Business (MSB) with FinCEN in the United States (reg. no. 31000136371793) and FINTRAC in Canada (reg. no. M19343731). Kraken is regulated in the United Kingdom as a Registered Cryptoasset Firm by the Financial Conduct Authority (reg. no. 757895).

The exchange’s headquarters are in San Francisco, but it has offices in various cities all over the globe, including London in the UK, Tokyo in Japan, and Milan in Italy. According to Craft.co, Kraken has received more than USD 133 million in venture capital. As such, it has acquired a number of crypto-oriented startups like CryptoWatch, CleverCoin, Coinsetter, Cavirter, Bit Trade, Crypto Facilities, and InterChange.

The exchange serves more than 10 million customers in over 190 countries.

Supported Countries

Kraken is a worldwide exchange, though some of the exchange’s features may be limited to specific regions or jurisdictions. At the moment, Kraken does not serve the residents of:

- Afghanistan

- Cuba

- Iran

- Iraq

- Japan

- North Korea

- Tajikistan

Kraken is a fully regulated exchange and is accessible to the residents and citizens of the United States, except for residents living in the states of New York (NY) and Washington (WA). However, many features are not available to US residents, including staking and futures trading. You can check out the details country-by-country here.

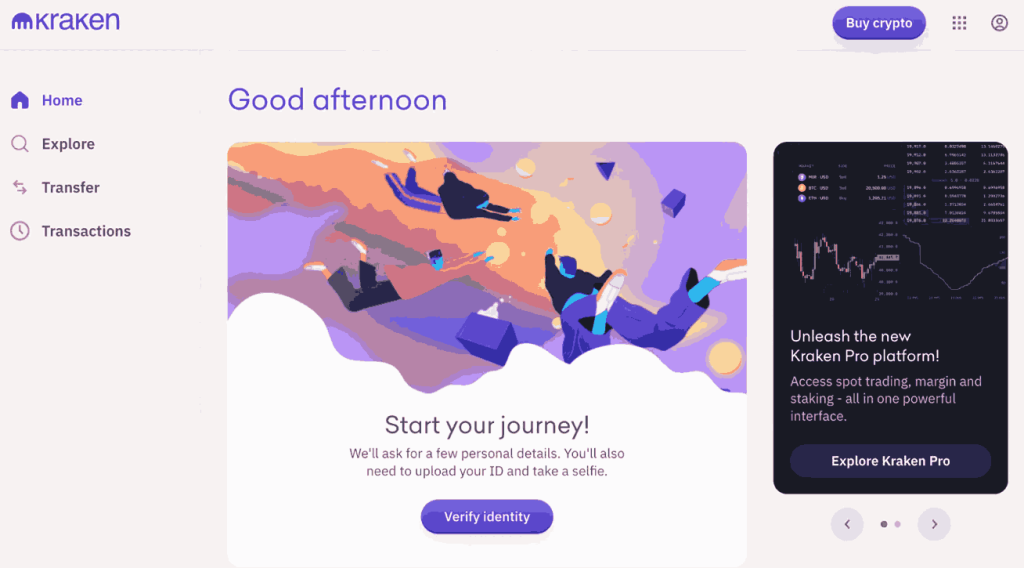

Registration Requirements

All users must verify their identity (KYC) before being eligible to trade on Kraken. There are three levels of account verification: Starter, Intermediate, and Pro.

| Features / Verification level | Starter | Intermediate | Pro |

|---|---|---|---|

| Verification time | 1 to 60 minutes | 1 to 5 days | 1 to 5 days |

| Security measures | Yes | Yes | Yes |

| Crypto deposits | Unlimited | Unlimited | Unlimited |

| Crypto withdrawals | Low limits | High limits | Highest limits |

| Fiat deposits | – | High limits | Highest limits |

| Fiat withdrawals | – | High limits | Highest limits |

| Exchange funds | Unlimited | Unlimited | Unlimited |

| Margin trading | Low limits | High limits | Highest limits |

| Dark pool trading | – | – | – |

| Kraken Futures | – | Yes | Yes |

| Corporate account | – | – | Yes |

| OTC desk | – | – | Yes |

| API keys | 16 | 16 | 25 |

| API call rate limits | Low | High | Highest |

In most locations, Kraken asks you to provide your full name, date of birth, address, and phone number. Besides, you have to be at least 18 years old and reside in a supported area.

Starter-level verification takes only up to an hour, while the corporate-level Pro verification process can take longer than five days.

Note that some features of Kraken may require a higher verification level compared with other supported countries and regions due to inconsistent crypto regulations worldwide.

Kraken Fees

Low fees are one of Kraken’s biggest attractions. All fees are charged on a per-trade basis, apart from the deposit and withdrawal fees. Kraken uses a typical maker-taker fee schedule based on the cryptocurrencies being traded and the volume a user has traded in the previous 30 days.

All trading fees fall into four categories: regular trading fees, stablecoin trading fees, dark pool trading fees, and margin trading fees.

Regular trading fees range from 0.25% for the makers and 0.4% for the takers, but they can be as low as 0.00% (maker) and 0.10% (taker) for users trading more than USD 10,000,000 per month. For instant Buy/Sell services, Kraken is less transparent and the website states that there will be a displayed fee plus a spread.

Different fees apply to trading pairs involving stablecoins. Here, you pay 0.20% or less (based on 30-day volume) per trade regardless of whether you are on the taker or maker side of the deal. Traders exchanging more than USD 1,000,000 a month in stablecoins do not pay any fees.

Compared with other exchanges, Kraken’s fees are cheaper than Bitstamp’s (0.5% per trade) but slightly more expensive than Coinbase Pro’s (0.15% makers and 0.25% takers). The exchange is also slightly more expensive than Bitfinex, which can boast of having the cheapest order execution fees amongst major fiat-to-crypto exchanges (0.10% makers, 0.20% takers).

Dark pool traders are charged the most – a 1% premium is added onto both taker and maker fees. If you trade more than USD 10,000,000 per month, the dark pool fees can be as low as 0.20% per trade.

Last but not least, different rates apply to Kraken’s margin trading. Bitcoin (BTC) and Tether (USDT) pairs have a 0.01% opening fee and a 0.01% rollover fee every 4 hours, while other cryptocurrencies cost 0.02% to open a trade and incur the same 0.02% fee every four hours.

Kraken charges less than all major margin trading exchanges, though these trades get more expensive the longer your position remains open. Margin allowance limits depend on your verification level. The maximum leverage available at Kraken is 5x.

Another category of Kraken fees is deposits and withdrawals. With deposits, these are free for the vast majority of cryptocurrencies. For some newer or less common currencies, such as Augur (REP), Gnosis (GNO), or Chainlink (LINK), there are deposit and wallet setup fees.

For instance, LINK has a 0.6 LINK address setup fee and 0.6 LINK deposit fee, while GNO is free to deposit but has a 0.07 GNO wallet fee. All withdrawals incur a fee with Kraken. As the sample table below illustrates, the withdrawal fees at Kraken aren’t the lowest compared with other exchanges, but they aren’t costly either. Also, the cost depends on the cryptocurrency being withdrawn.

| Currency | Kraken withdrawal | Coinbase Pro withdrawal | Bitstamp withdrawal | Bitfinex withdrawal |

|---|---|---|---|---|

| Bitcoin (BTC) | 0.0002 BTC | Free | 0.0005 BTC | 0.0004 BTC |

| Ethereum (ETH) | 0.003 ETH | Free | 0.006 ETH | 0.00378 ETH |

| Litecoin | 0.002 LTC | Free | 0.001 LTC | 0.001 LTC |

| Monero | 0.0001 XMR | Free | – | 0.0001 XMR |

| XRP | 0.2 XRP | Free | 0.02 XRP | 0.1 XRP |

The withdrawal fees and minimums for all cryptocurrencies on Kraken can be found here.

Kraken also charges fees for withdrawing fiat currencies. A standard USD wire would cost you 5 USD per transaction, while a global SWIFT USD transaction incurs a 35 USD fee. EUR withdrawal via SEPA would cost you 0.09 EUR, while worldwide SWIFT transfer via Etana Custody is priced at 35 EUR, too. CAD, GBP, CHF, and AUD withdrawals are possible, too, but the fees vary based on the transaction method.

A full overview of all Kraken’s withdrawal fees can be found here.

All in all, Kraken fees appear to be low, justified, and reasonable. As such, the exchange falls onto the less expensive end of regulated exchanges, even though some of its functions may have slightly cheaper alternatives elsewhere.

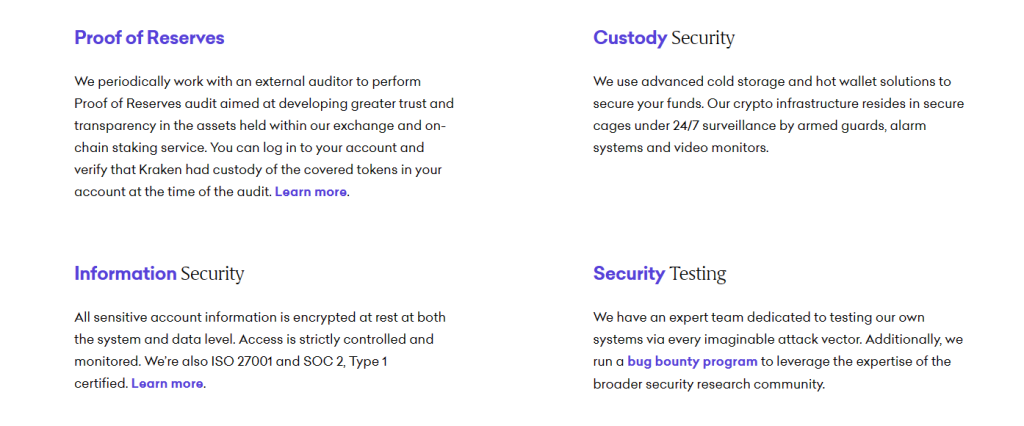

Kraken Security

Kraken takes security very seriously, and its wallets have never been hacked. Its platform has gone down only once – in January 2018 – since it launched in 2011, and even then this was to perform necessary system upgrades.

Aside from this upgrade, it takes a wide range of measures to lower the risks of coins being stolen through its system, including the following:

- Transferring new deposits directly to offline ‘cold’ wallets, which are physically isolated from any online system.

- Storing the vast bulk of coins in cold wallets, with only the coins required to maintain Kraken’s liquidity being kept in online ‘hot’ wallets.

- Storing a small number of coins in semi-cold wallets, which are kept on defended machines with locked drives.

- Encrypting all wallets and data in data centers.

- Bug bounty program to discover vulnerabilities.

These measures guard Kraken’s platform itself against being compromised by hackers, yet the exchange also has the following features in place to protect individual accounts:

- Universal 2nd Factor (U2F) authentication which is a secure way to protect your account using hardware authentication devices like YubiKey or its alternatives.

- Two-factor authentication, which can be used for logins, trades, funding, and for actions performed using Kraken’s

- Info-leakage protection: (opportunistic) login and password recovery attempts won’t reveal any account info or even the existence of an account.

- PGP/GPG encryption for emails. User verification documents are uploaded to an isolated, highly secure system. All sensitive user data is encrypted and can be decrypted only by accessing multiple security systems at once.

- Global settings lock can be activated to prevent changing of user account info (e.g., withdrawal address) by a third party who’s hacked into an account. It can be used to lock your account for a period of time – say if you are on vacation or plan on holding your assets long-term.

And if the above weren’t enough, Kraken also takes a number of measures to guarantee its legal compliance, system security, and financial security. These include the maintenance of full currency reserves with cryptographically verifiable proof-of-reserves audits and the daily backing up of data, all of which combine to significantly lower the risk of users losing money.

Apart from the security on the platform’s side of things, Kraken also conducts regular security audits when onboarding new cryptocurrencies and crypto security devices like hardware wallets.

Kraken’s security practices are widely recognized. The Centralized Exchange Benchmark by CryptoCompare, which weighs the security of the exchange, puts Kraken in 7th place amongst all exchanges with a superb A rating.

All in all, Kraken’s security is solid as a rock, as its practices are some of the best in the industry.

Exchange Usability

Kraken has a comprehensive variety of trading options. It lets you:

- Buy and sell bitcoin and altcoins using six fiat currencies (USD, EUR, GBP, JPY, CHF, CAD).

- Perform crypto-to-crypto trades.

- Perform Forex trades with supported fiat currencies.

- Place invisible orders in the dark pool.

- Margin trade with up to 5x leverage.

- Earn crypto using Kraken’s best-in-class staking service.

In addition to these services, high-volume Kraken traders (more than USD 100,000 per month) can use its OTC services and get a dedicated account manager for individual trading needs.

When it comes to an exchange’s usability, Kraken is best suited for advanced and professional traders. Even so, it has been working to improve its front end and help beginners buy and sell cryptocurrencies with ease, so now you can buy cryptocurrency directly via its overview dashboard by clicking the “New Order” tab.

Here, you can choose from three different order options: Simple, Intermediate, and Advanced. The Simple option is by far the simplest way to buy or sell your cryptocurrency holdings.

The Intermediate option allows you to input more advanced order features and variables that go according to your trading strategy.

The Advanced section includes everything you get with an Intermediate order plus the Conditional Close feature, which lets you set a condition on which the order will be executed. All in all, the platform’s interface is easy to use and navigate, as you can easily find whatever you’re looking for.

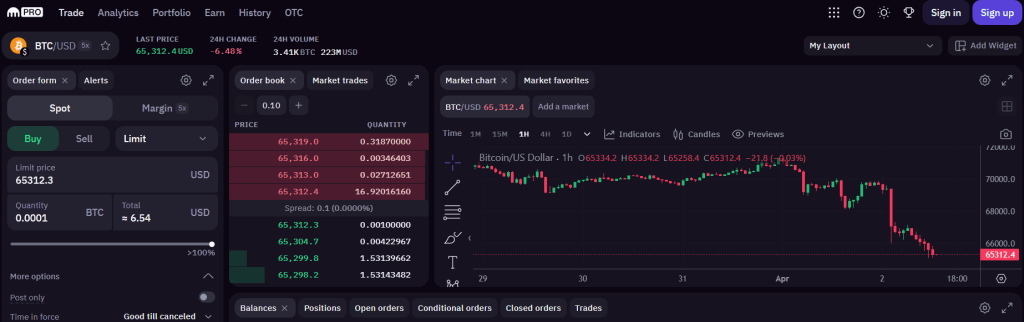

Aside from that, seasoned traders can go to Kraken Pro exchange for a more advanced trading view and features. Here, you can create a fully customizable panel based on your trading techniques, strategies, and technical analysis. It looks super cool, too, but it may be too confusing for beginners – it’s easier to use the “New Order” panel.

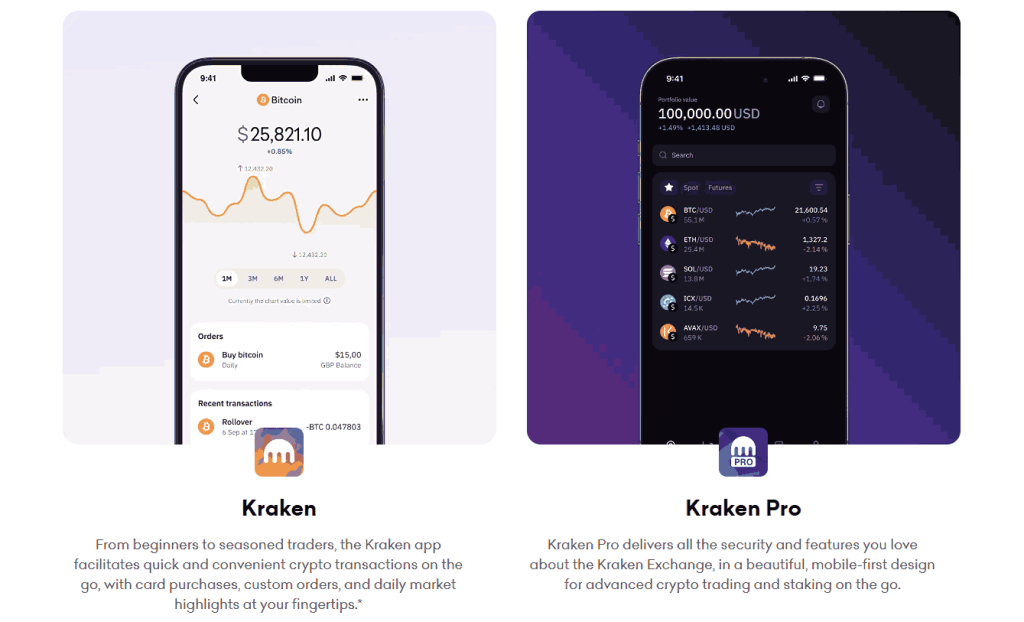

Kraken exchange is also accessible via a tablet or smartphone since its site is completely mobile-friendly. For the most optimal on-the-go trading experience, download and install either the Kraken or Kraken Pro mobile apps for both iOS and Android devices.

Regardless of your preferred interface, Kraken offers a wide range of trade types and even margin trading. This makes it a powerful resource for trading cryptocurrency and gaining the maximum possible value from funds.

Kraken’s customer support

Kraken has a comprehensive support center that provides answers to all your questions. If it doesn’t, you can reach out to its customer support team via a 24/7 chat on its website.

Supported Deposit and Withdrawal Methods

Kraken supports a variety of deposit and withdrawal methods. These include cryptocurrency deposits and fiat deposits via bank transfer. There are no credit or debit card deposit options for instant crypto purchases.

The supported fiat deposit and withdrawal bank transfer options include:

- FedWire / SWIFT / Etana Custody / Wire Transfer (1 – 5 business days)

- SEPA / SEPA (Etana Custody / Fidor / Bank Frick) (1 – 5 days)

- Canadian domestic wire transfer (1 – 3 days)

- In-person cash/debit via Canada post (30 – 60 minutes)

- InterFIn (0 – 10 min)

- FPS/BACS (Clear Junction) (0 – 3 days)

- CHAPS (Same day)

- SIC (near instant on working days during business hours)

The fees range from free to up to $35 USD or its equivalent based on the chosen method. Fiat deposits and withdrawals are not available for users at the Starter verification level. Many withdrawals also require you to withdraw a minimum amount which can be quite high.

Kraken review: Conclusion

Kraken is a trustworthy cryptocurrency exchange for both beginners and serious traders. Its vast selection of features, low fees, clear user interface, and liquidity are among its top attractions.

However, it’s not the best option if you’re looking for a place to buy cryptocurrencies quickly since it does not accept bank card deposits.

Aside from that, it is a top tier exchange with some of the best security practices in the industry, so if you don’t mind passing all the extensive KYC procedures, it’s a great exchange to have in your trading arsenal.