12 Best Decentralized Exchanges (DEXs) in 2024

Decentralized exchanges offer cryptocurrency trading services without centralized order books. Swaps are facilitated by liquidity pools, meaning traders can buy or sell tokens without another market participant. Most decentralized exchanges support anonymous trading without a requirement to open an account.

Read on, we rank and review the 12 best decentralized exchanges for 2024. We compare exchanges by fees, supported coins, safety, liquidity levels, and available DeFi tools like lending and borrowing.

List of Top Decentralized Exchanges

Here’s a list of the best decentralized exchanges for 2024:

- OKX – Overall Best Decentralized Exchange for 2024

- PancakeSwap – Most Popular DEX for Trading BNB-Based Tokens

- dYdX – Trade Advanced Crypto Derivatives With High Leverage

- Uniswap – Market Leader for Trading ERC-20 Tokens

- Jupiter – Buy and Sell Solana-Based Tokens With Advanced Tools

- SushiSwap – User-Friendly DEX Built on the Ethereum Framework

- Raydium – Invest in Brand-New Solana Projects From the Ground up

- ApeSwap – Swap, Stake, and Lend Crypto in One Decentralized Hub

- Trader Joe XYZ – Top-Rated DEX for Trading Avalanche Tokens

- THORChain – Solid Option for Decentralized Savings Accounts

- QuickSwap – State-of-the-Art Charting Tools With Technical Indicators

- Helix – Deploy Automated Bots in Decentralized Trading Conditions

12 Best Decentralized Exchanges: Full Reviews

Looking for more information about the decentralized exchanges listed above? Read on, we’ll now review each platform in full.

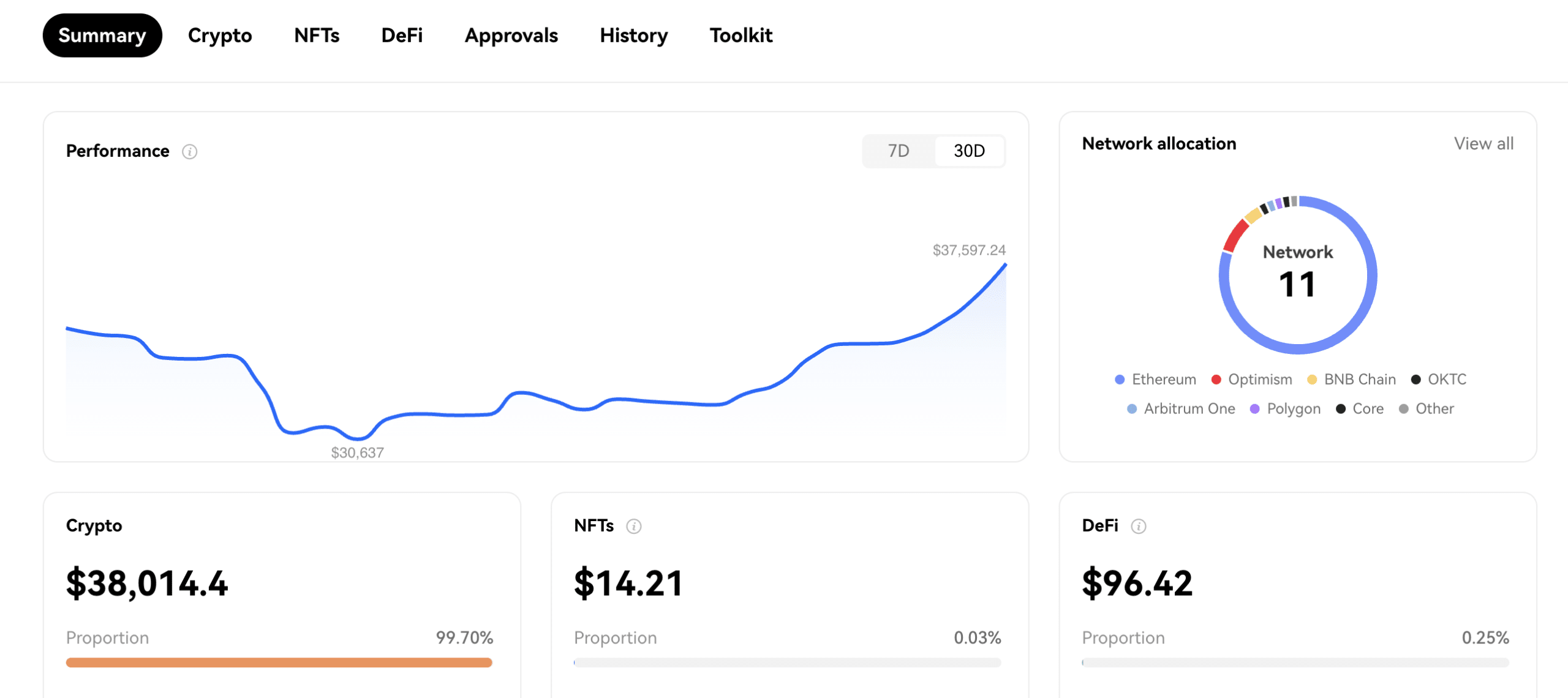

1. OKX – Overall Best Decentralized Exchange for 2024

We rate OKX as the overall best decentralized exchange. OKX supports more than 70 blockchain networks. This includes everything from Dogecoin, Litecoin, and Ethereum to Solana, Binance Smart Chain, and Polygon. OKX supports cross-chain functionality too. This means you can swap tokens from two different network standards.

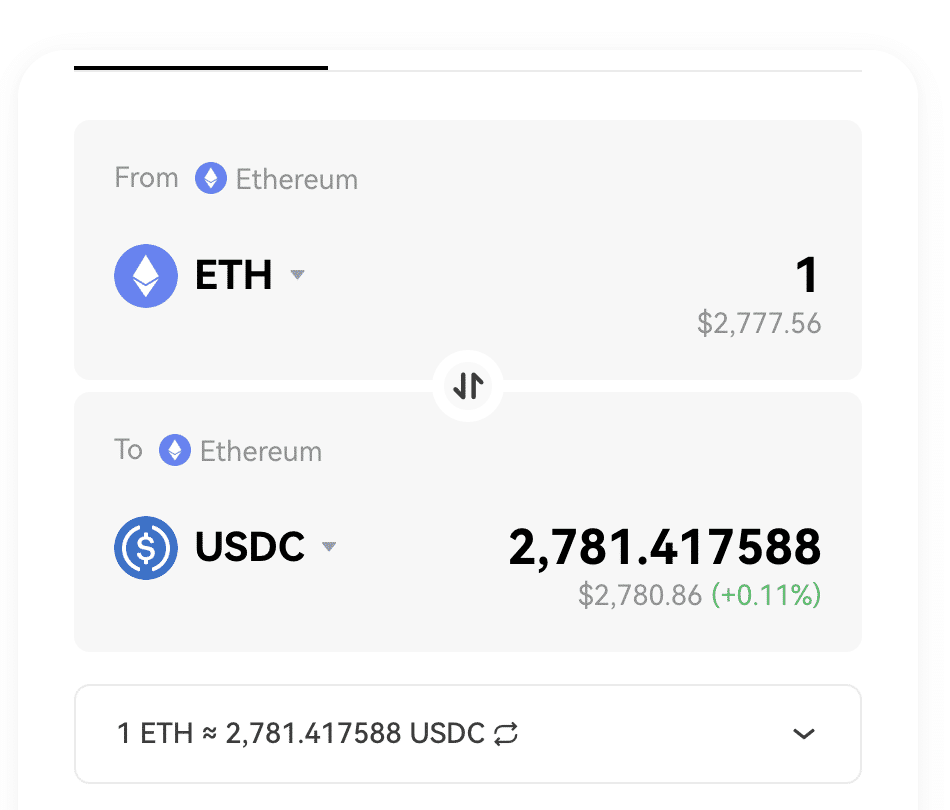

For instance, swapping MATIC for Litecoin or Tether for BNB. It takes seconds to get started with OKX. Connect a wallet, set up an order, and place the trade. The newly purchased tokens will then appear in your connected wallet. OKX is also one of the best options for earning DeFi yields.

This is because OKX uses a bridge aggregator, meaning it connects with liquidity pools from other exchanges. This ensures users get the highest yields possible without needing to leave the OKX platform. The main drawback of OKX is that fees are built into the exchange rate. This means you’ll need to calculate what you’re paying in real-time.

2. PancakeSwap – Most Popular DEX for Trading BNB-Based Tokens

PancakeSwap is the leading decentralized exchange for BNB-based tokens. It offers premium liquidity and ever-growing trading volumes. More than 17 million trades have been executed in the prior 30 days. PancakeSwap offers a user-friendly experience. After connecting a wallet simply choose which cryptocurrencies to swap.

PancakeSwap has also introduced cross-chain trading. This enables users to swap BNB tokens with other network standards, such as Ethereum, Arbitrum, Aptos, Polygon, and Base. In terms of fees, PancakeSwap charges a 0.07% commission on buy and sell orders. This is reduced to 0.02% when supplying PancakeSwap with liquidity.

In addition to token swaps, PancakeSwap offers many other features. This includes staking and yield farming, allowing users to earn passive income. However, yields aren’t as competitive as other decentralized exchanges. For example, PancakeSwap pays just 1.1% when staking Tether. PancakeSwap also offers a crypto lottery – the jackpot is currently over $38,000.

3. dYdX – Trade Advanced Cryptocurrency Derivatives With High Leverage

dYdX is a decentralized exchange that specializes in cryptocurrency derivatives. This enables you to trade cryptocurrencies without owning the underlying tokens. The benefit of trading derivatives is that you’ll have access to leverage. dYdX offers leverage of up to 20x on dozens of cryptocurrencies.

This includes Bitcoin, Dogecoin, Cardano, Ethereum, and Litecoin. dYdX comes packed with advanced trading tools. This includes real-time pricing charts, technical indicators, and multiple order types. This includes limits, stop-losses, and take-profits. dYdX can be accessed on multiple device types.

This includes web and mobile browsers, plus a native app. Trading fees start at 0.05% per slide for market takers. That’s just $0.50 for every $1,000 traded. dYdX offers lower fees on larger accounts. However, you’d need to trade more than $1 million every 30 days to reduce the fee to 0.04%.

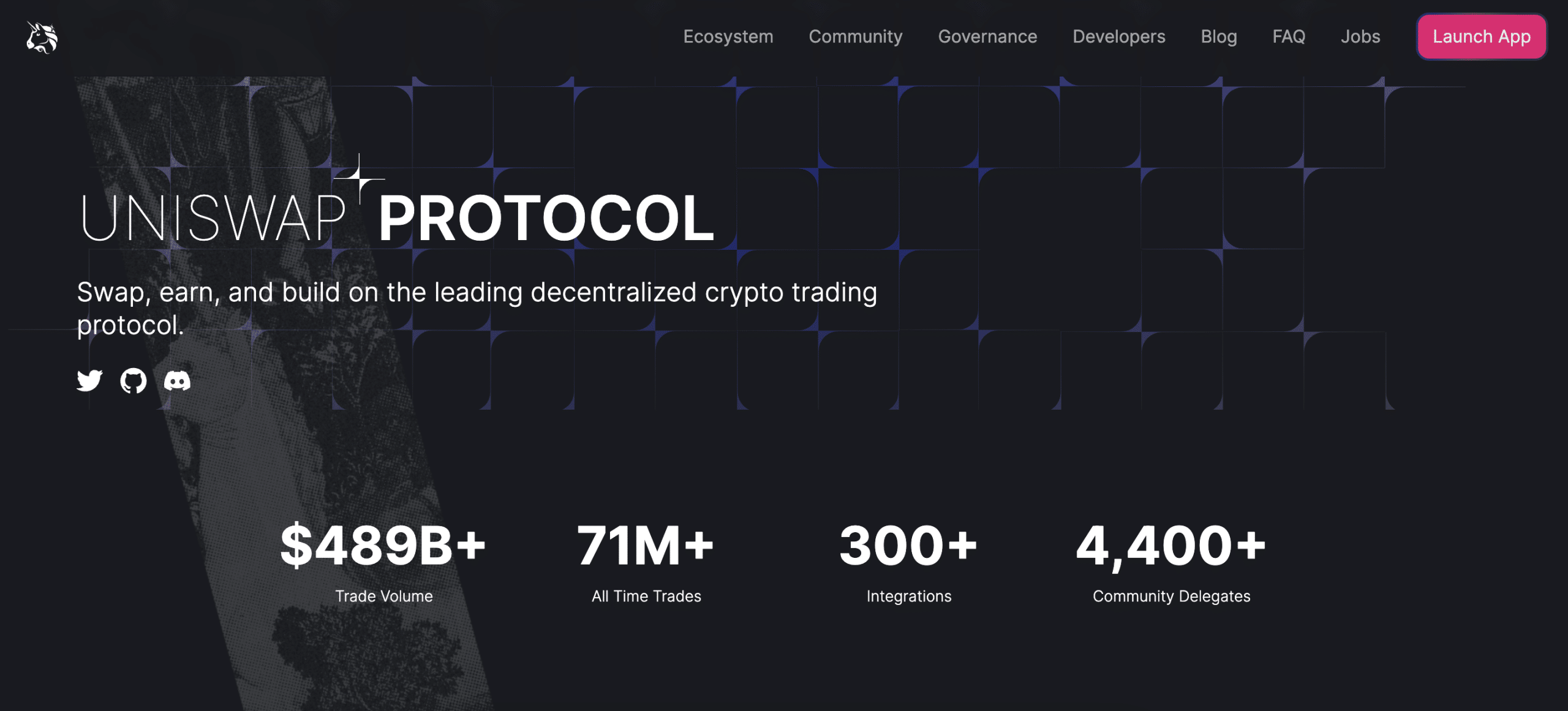

4. Uniswap – Market Leader for Trading ERC-20 Tokens

Uniswap is an established decentralized exchange that’s popular with Ethereum-based projects. It supports thousands of ERC-20 tokens, including Aave, DAI, USD Coin, Tether, and Wrapped Bitcoin. Uniswap is often the first exchange listing for ICO campaigns. This is because anyone can list on Uniswap; it’s just a case of adding liquidity.

In addition, Uniswap also supports cross-chain trading. Networks include Binance Smart Chain, Celo, Arbitrum, and Base. Tokens on any of these networks can be swapped anonymously. We also found that Uniswap offers a great user experience. Finding tokens and setting up orders is a breeze.

Uniswap is also popular for earning DeFi yields. Staking, for example, offers competitive APYs on many cryptocurrencies. Another feature is Uniswap’s governance model. Those holding UNI tokens can vote on key proposals. This ensures a fair and inclusive ecosystem for all. Uniswap charges trading commissions of 0.03% per slide.

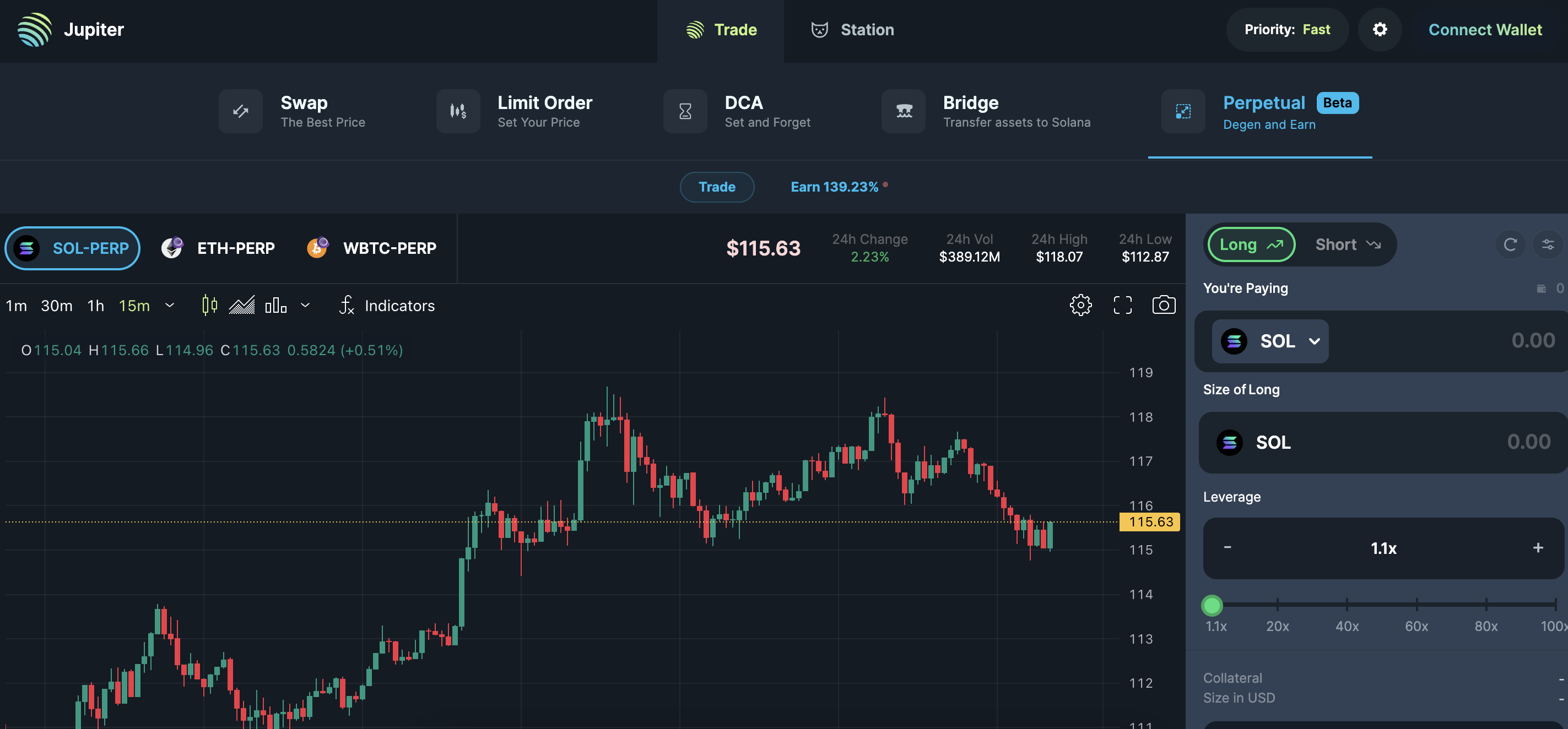

5. Jupiter – Buy and Sell Solana-Based Tokens With Advanced Tools

Jupiter is a decentralized exchange operating on the Solana network. It benefits from lightning-fast transactions, low fees, and the ability to scale. Jupiter supports most SOL-based tokens. Just connect a wallet and choose which cryptocurrencies you want to trade.

We also like that Jupiter offers dollar-cost averaging tools. This allows you to invest fixed amounts into a cryptocurrency. For instance, you might want to buy $100 worth of SOL every week. Jupiter also supports limit orders. This means you can enter a new trading position at your preferred price.

Jupiter also supports advanced trading tools. It comes with real-time charting and full customization. Not to mention perpetual swaps contracts. Jupiter also has a native cryptocurrency, JUP. Although JUP has secured many tier-one exchange listings, it’s down 67% since launching in January 2024.

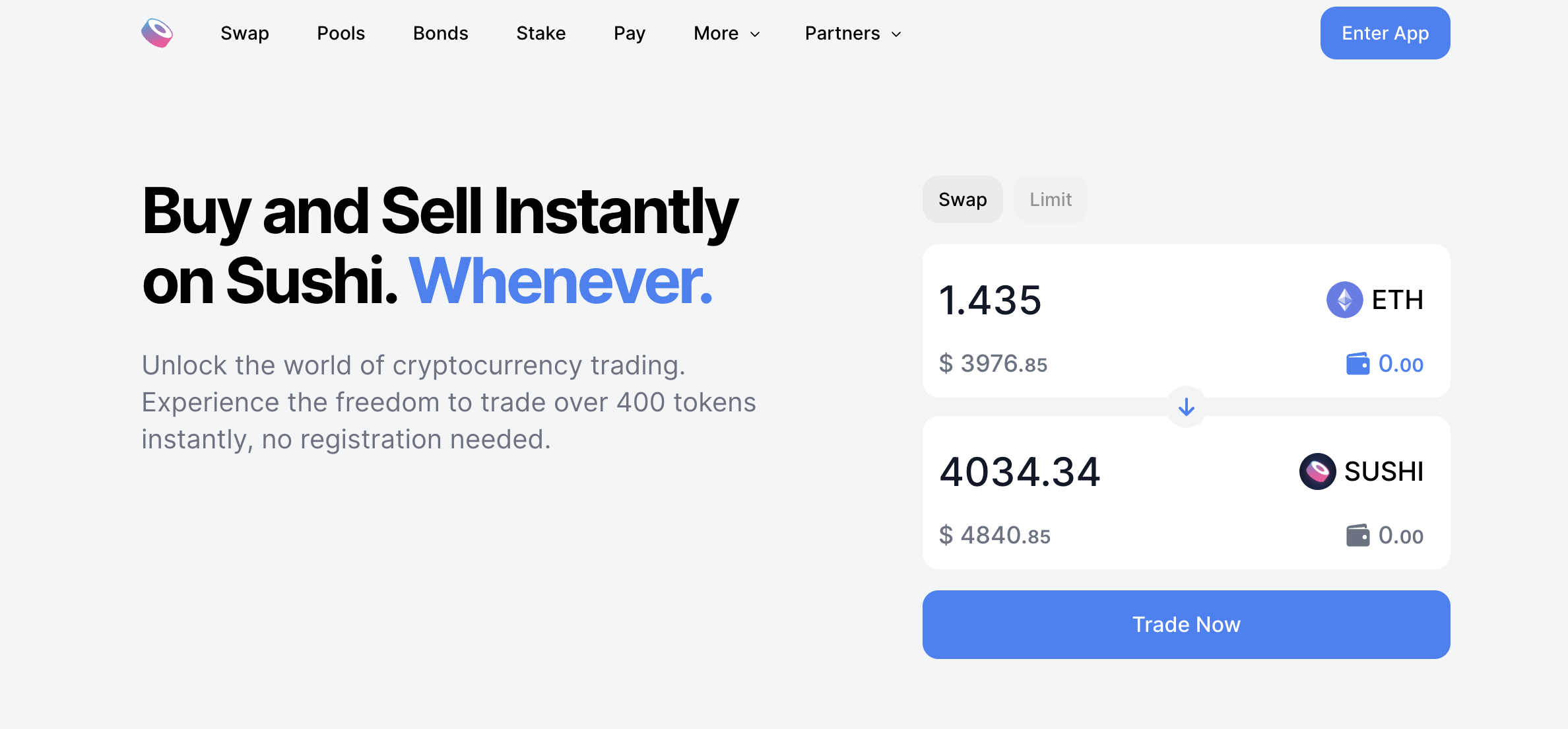

6. SushiSwap – User-Friendly DEX Built on the Ethereum Framework

SushiSwap is a user-friendly decentralized exchange, making it a great option for first-timers. No account is needed – just connect a wallet. SushiSwap was built on the Ethereum framework, so it supports thousands of ERC-20 tokens. This includes everything from Wrapped Bitcoin and USD Coin to Yearn.finance and Chainlink.

Like many decentralized exchanges, SushiSwap also offers cross-chain functionality. It supports popular networks like Arbitrum, Polygon, Binance Smart Chain, and Optimism. This is in addition to ThunderCore, Base, Gnosis, and Fantom. Standard trading fees at SushiSwap are just 0.3% per slide.

However, swapping tokens from different blockchain standards will result in additional fees. This is determined by the liquidity provider. SushiSwap is also one of the best yield farming crypto platforms. It offers very competitive rates, especially on pairs with lower liquidity levels. SushiSwap also supports staking.

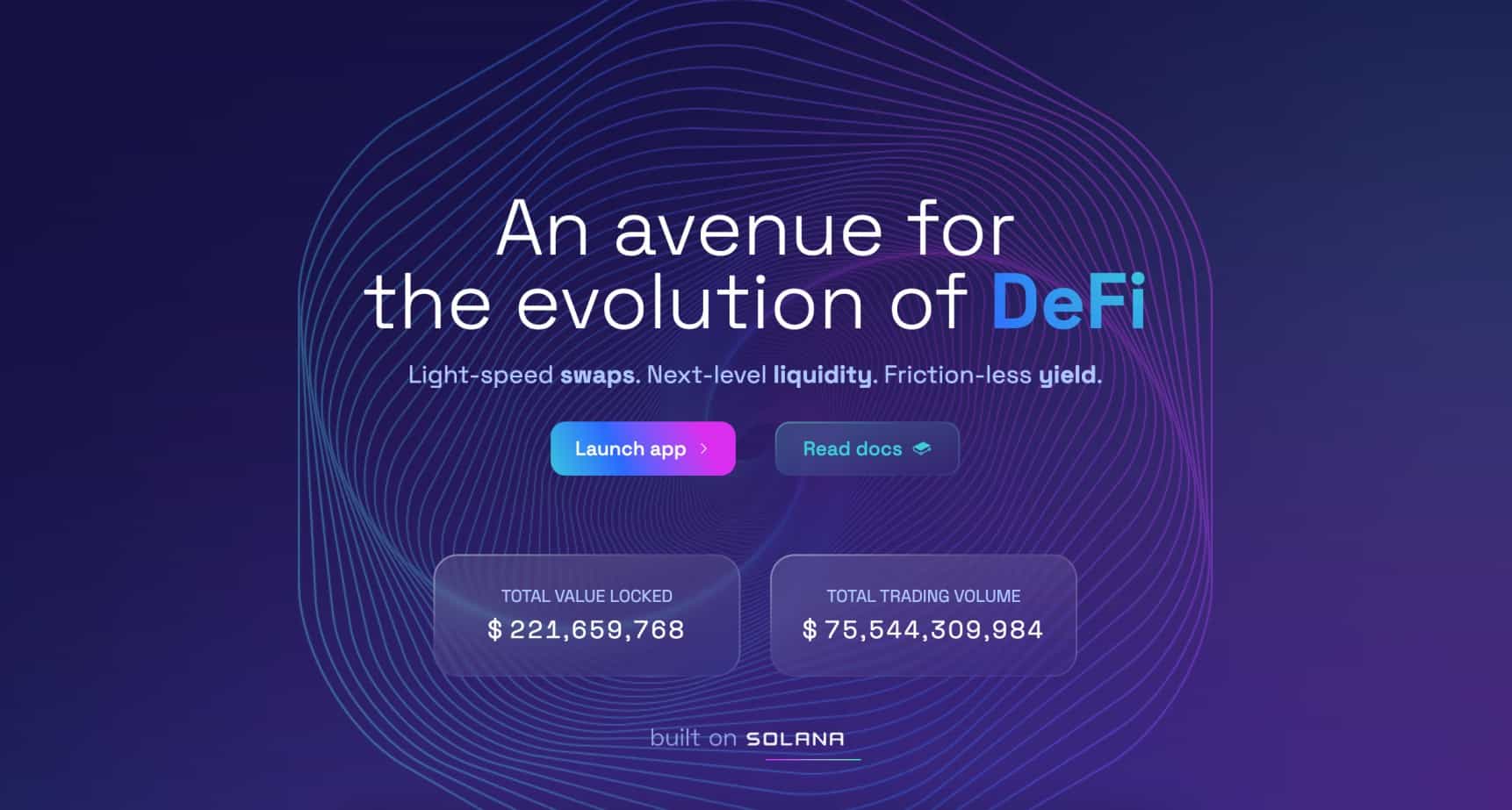

7. Raydium – Invest in Brand-New Solana Projects From the Ground up

Raydium is another top-rated decentralized exchange built on the Solana network. It’s one of the largest for SOL-based trading volume; Raydium executed more than $131 million worth of trades in the prior 24 hours. The Raydium platform is very simple to use. Like many decentralized exchanges, it’s just a case of connecting a wallet.

Raydium is also a great option for investing in brand-new Solana projects from the ground up. This is because Raydium offers a launchpad to crypto startups. Raydium not only helps with the fundraising process but also with listings.

Raydium is also a good option for earning yields on SOL-based tokens. For example, you’ll get APYs of 9.52% on RAY/SOL liquidity pools. Raydium is also competitively priced. Market takers pay just 0.25% per slide. Those holding Raydium’s native token, RAY, get a share of trading commissions.

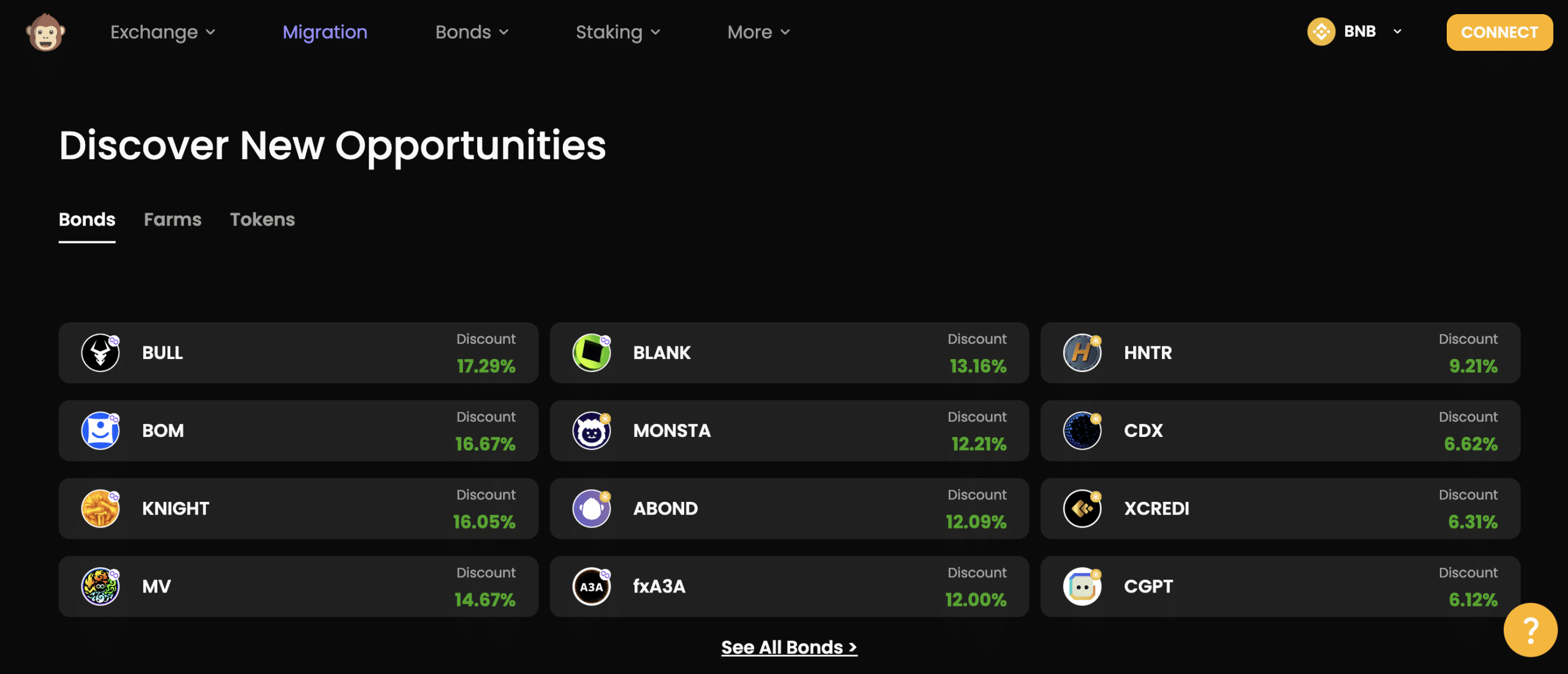

8. ApeSwap – Swap, Stake, and Lend Crypto in One Decentralized Hub

Next up is ApeSwap, an up-and-coming decentralized exchange with many features. It supports thousands of cryptocurrencies across nine network standards. This includes Binance Smart Chain, Polygon, Optimism, Ethereum, Arbitrum, Gnosis, zkEVM, Fantom, and Avalanche.

ApeSwap is competitively priced, you’ll pay just 0.2% on buy and sell orders. ApeSwap also supports plenty of yield farming pools. This covers cross-chain pools like IOTA/BNB, ADA/ETH, and BTC/BNB. ApeSwap is also a great option for borrowing cryptocurrencies.

After putting up collateral, you can choose from a range of loan currencies. This includes Ethereum, Tether, USD Coin, and BNB. ApeSwap also has a native ecosystem token, ABOND. It has a market capitalization of just $3.7 million, making it one of the best micro-cap cryptocurrencies to buy.

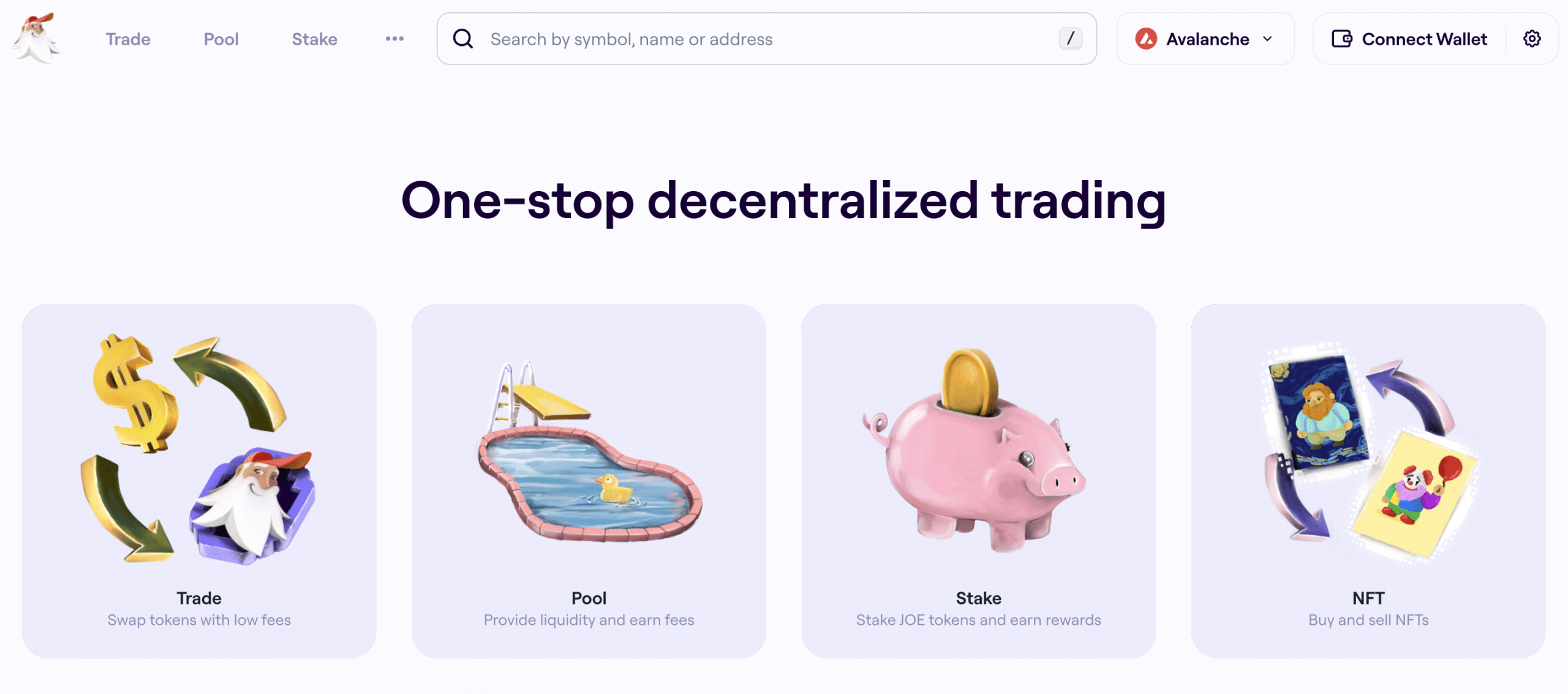

9. Trader Joe XYZ – Top-Rated DEX for Trading Avalanche Tokens

Trader Joe XYZ is the best decentralized exchange for trading AVAX-based tokens. Built on the Avalanche network, the exchange offers efficient trading conditions. Traders pay commissions of 0.3% per slide, which aligns with the industry average. While Trader Joe XYZ is ideal for trading AVAX tokens, it also supports three other networks.

This includes Binance Smart Chain, Ethereum, and Arbitrum. Cross-chain swaps are supported, so you can trade cryptocurrencies across multiple networks.

Trader Joe XYZ is also a good option for earning yields. For instance, those staking the exchange’s native token, sJOE, will earn an APY of 5.56%. That said, Trader Joe XYZ is lacking when it comes to high-level analysis tools. What’s more, there are limited pricing charts and only basic order types are supported.

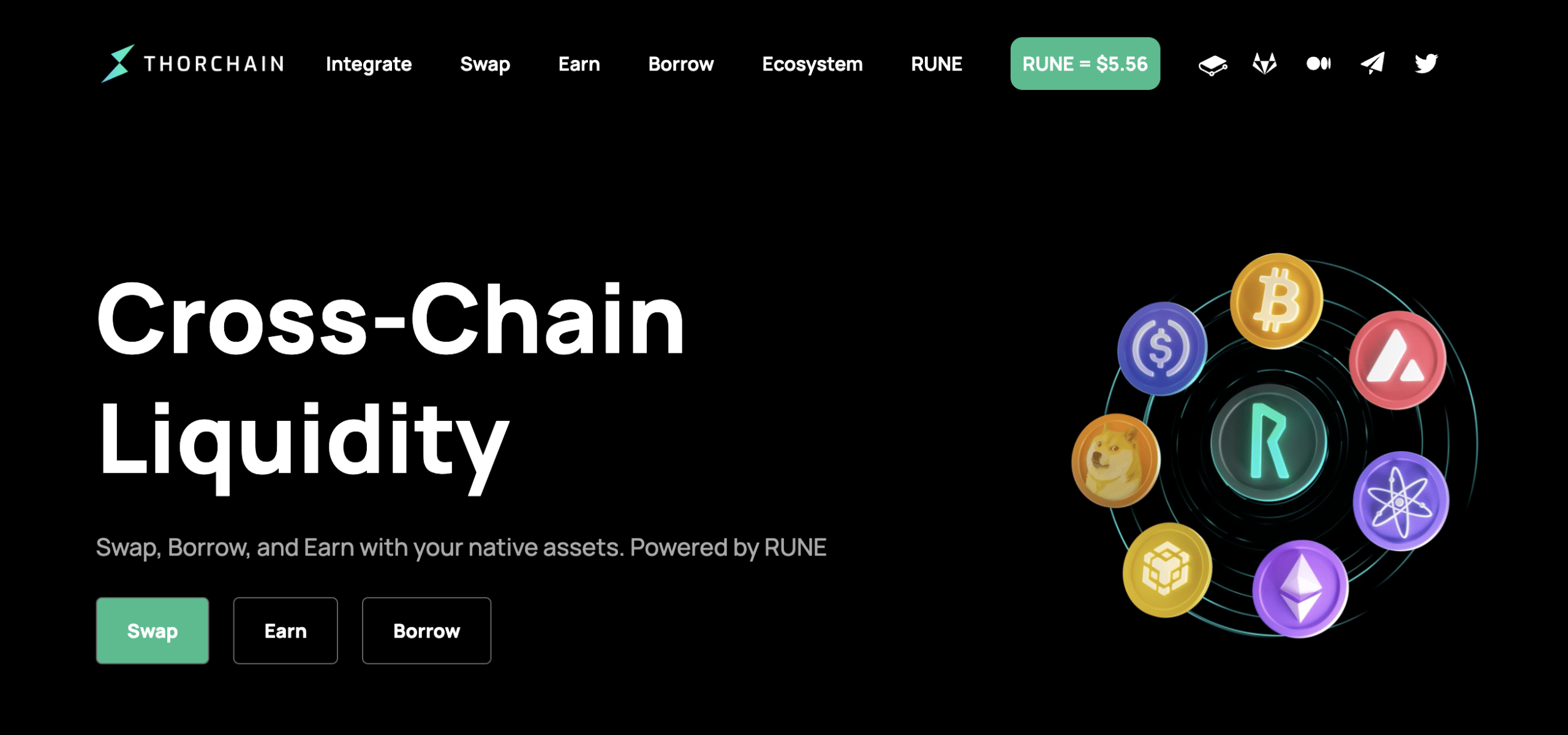

10. THORChain – Solid Option for Decentralized Savings Accounts

THORChain is a popular decentralized exchange that supports some of the best cryptocurrencies to buy. This includes Ethereum, Cosmos, Bitcoin Cash, Litecoin, Dogecoin, and BNB. You can easily swap your preferred tokens without creating an account. This includes cross-chain swaps.

In terms of trading fees, THORChain charges 0.3% per slide. This is the case with cross-chain orders too, which offers great value. Moreover, you can reduce your trading fees by holding vTHOR tokens.

The more vTHOR tokens you hold, the bigger the reduction. THORChain is a great option for depositing idle tokens into decentralized savings accounts. You’ll get APYs of 16.05% and 21.30% on BNB and Cosmos, respectively. You can also get 5.12% on Dogecoin deposits.

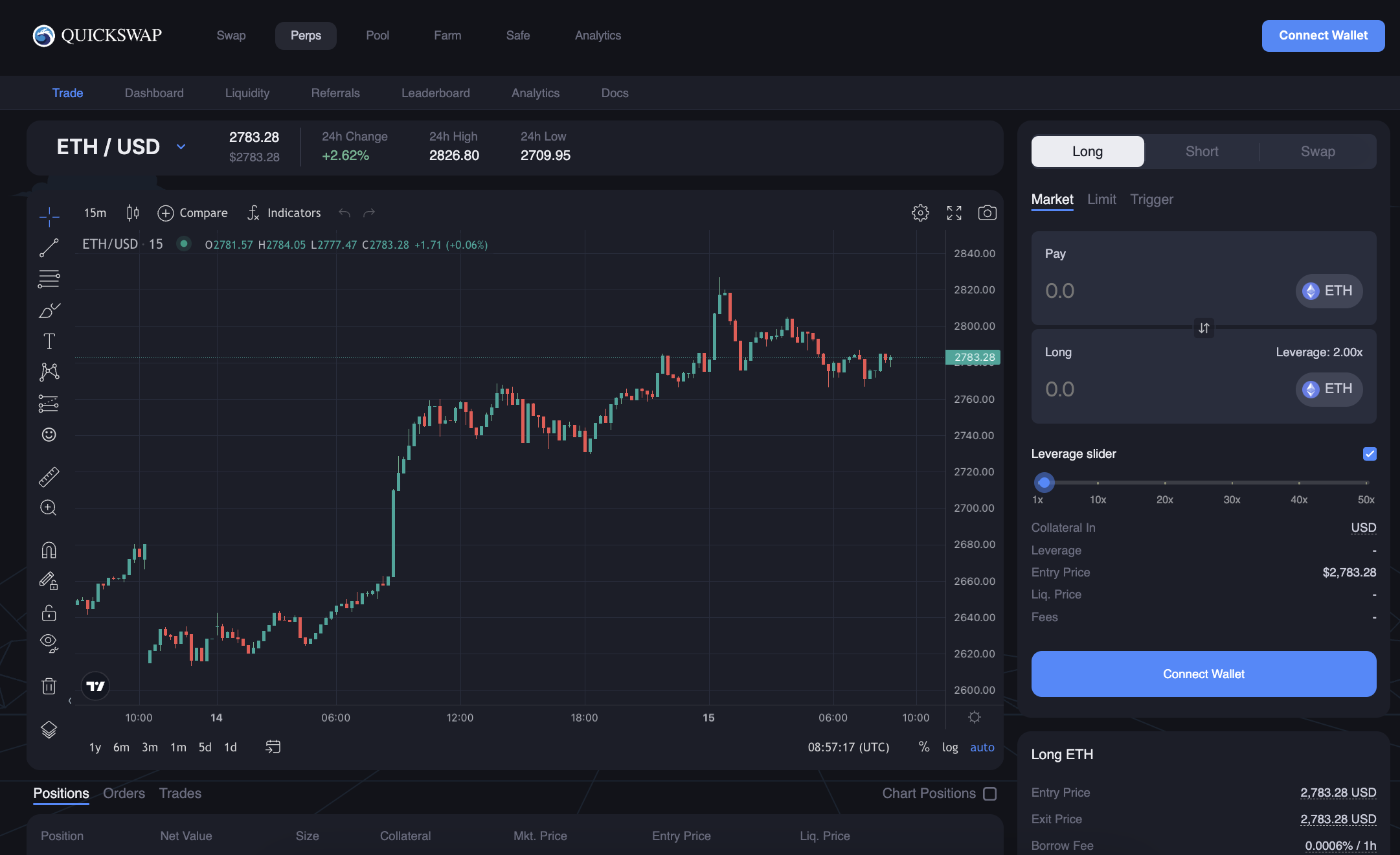

11. QuickSwap – State-of-the-Art Charting Tools With Technical Indicators

QuickSwap is a great option for seasoned traders who want advanced charting tools. It offers fully-fledged pricing charts with real-time quotes, not to mention a full suite of technical indicators. This includes the MACD, MA Cross, Chop Zone, Parabolic SAR, and Trend Strength Index.

Another plus point is that QuickSwap was built on the Polygon network. This means transactions are processed quickly and cost-effectively.

That said, QuickSwap also supports other network standards. This includes Ethereum, DogeChain, Kava, and zKatana. QuickSwap is also popular for its perpetual swaps. Markets include Bitcoin, Ethereum, and Polygon; each paired with the US dollar. While QuickSwap has a fiat gateway facility, this will trigger KYC requirements.

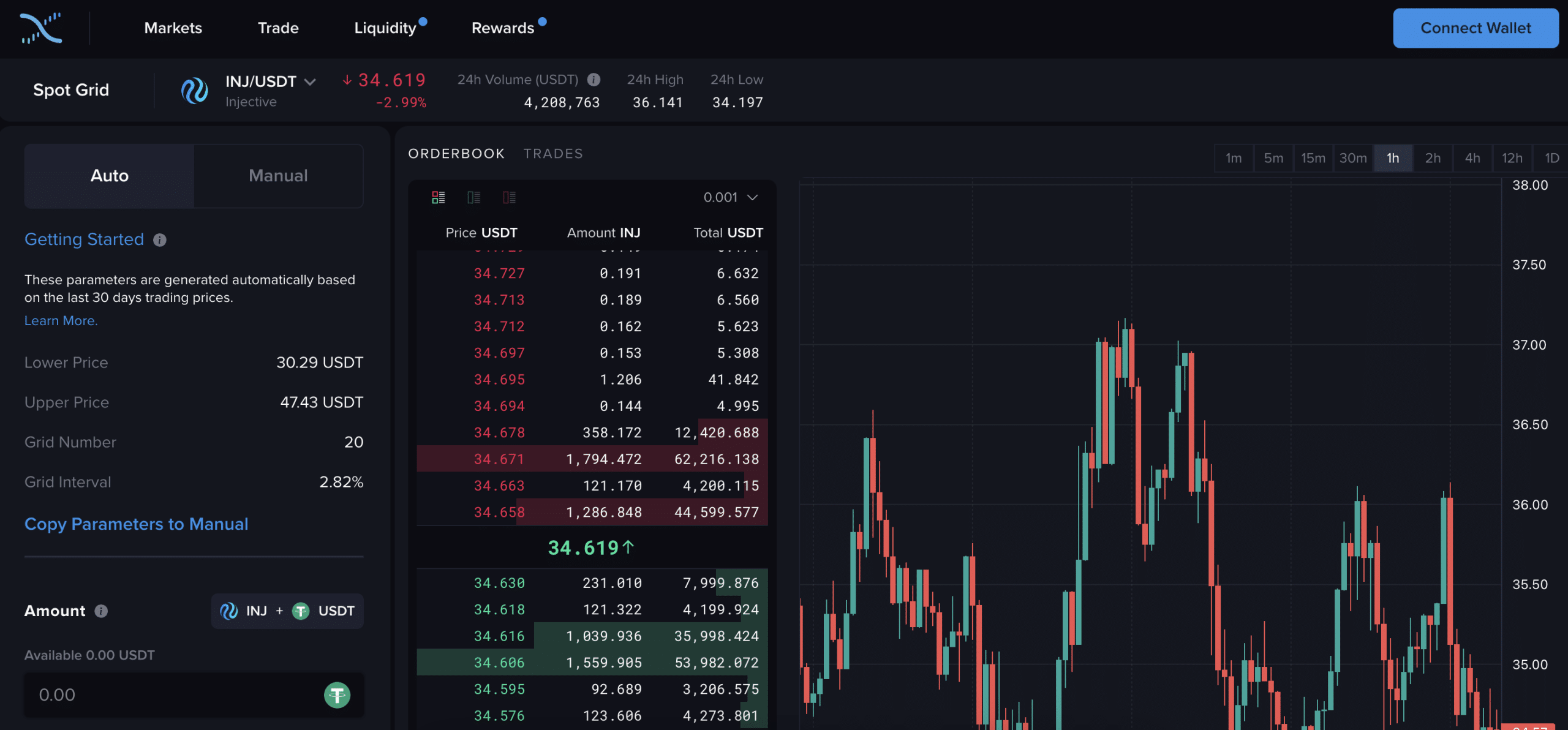

12. Helix – Deploy Automated Bots in Decentralized Trading Conditions

Last on this list of decentralized exchanges is Helix. We found that Helix enables users to create and deploy automated bots. This means you can trade the decentralized markets without lifting a finger. Simply set your bot parameters and allow it to trade on your behalf.

Helix bots can trade more than a dozen cryptocurrencies. This includes Cosmos, Solana, Tether, and Injective. Helix also offers charting tools with multiple time frames, not to mention decentralized order books.

However, technical indicators and drawing tools aren’t currently supported. Although Helix is best suited for seasoned crypto traders, it also offers a simple swapping feature. Choose which cryptocurrencies to exchange, connect a wallet, and confirm the order.

What is a Decentralized Exchange? (DEX)

Decentralized exchanges are similar to traditional cryptocurrency exchanges, as they enable buyers and sellers to trade cryptocurrencies. However, there are some clear differences. For a start, decentralized exchanges operate without a centralized order book. This means traders can buy or sell cryptocurrencies without needing another market participant.

- In simple terms, decentralized exchanges use ‘liquidity pools’ to facilitate trades.

- For instance, suppose you’re currently holding Uniswap (UNI) tokens, but you want to exchange them for Tether (USDT).

- On a decentralized exchange, you’d use the UNI/USDT liquidity pool to complete the trade.

- Put otherwise, UNI tokens go in, and USDT comes out.

Decentralized crypto exchanges use an automated market maker (AMM) model to determine pricing. AMM is an advanced algorithm based on liquidity, trading volume, market capitalization, and other metrics. Unlike centralized exchanges – such as Binance and Coinbase, decentralized exchanges support anonymous trading.

There is no requirement to open an account. Traders can connect their private wallets to the exchange and choose which tokens to swap. The swapped tokens will be deposited into the connected wallet within seconds. Anonymity is supported because decentralized exchanges do not directly handle traders, let alone fiat money purchases.

Instead, all buy and sell orders are executed by smart contracts, which connect to liquidity pools. Another feature of decentralized exchanges is that they support decentralized finance (DeFi) tools. For example, anyone can add cryptocurrencies to a liquidity pool and earn a share of trading fees. Staking and lending are also available at decentralized exchanges.

How We Selected the Best Decentralized Exchanges

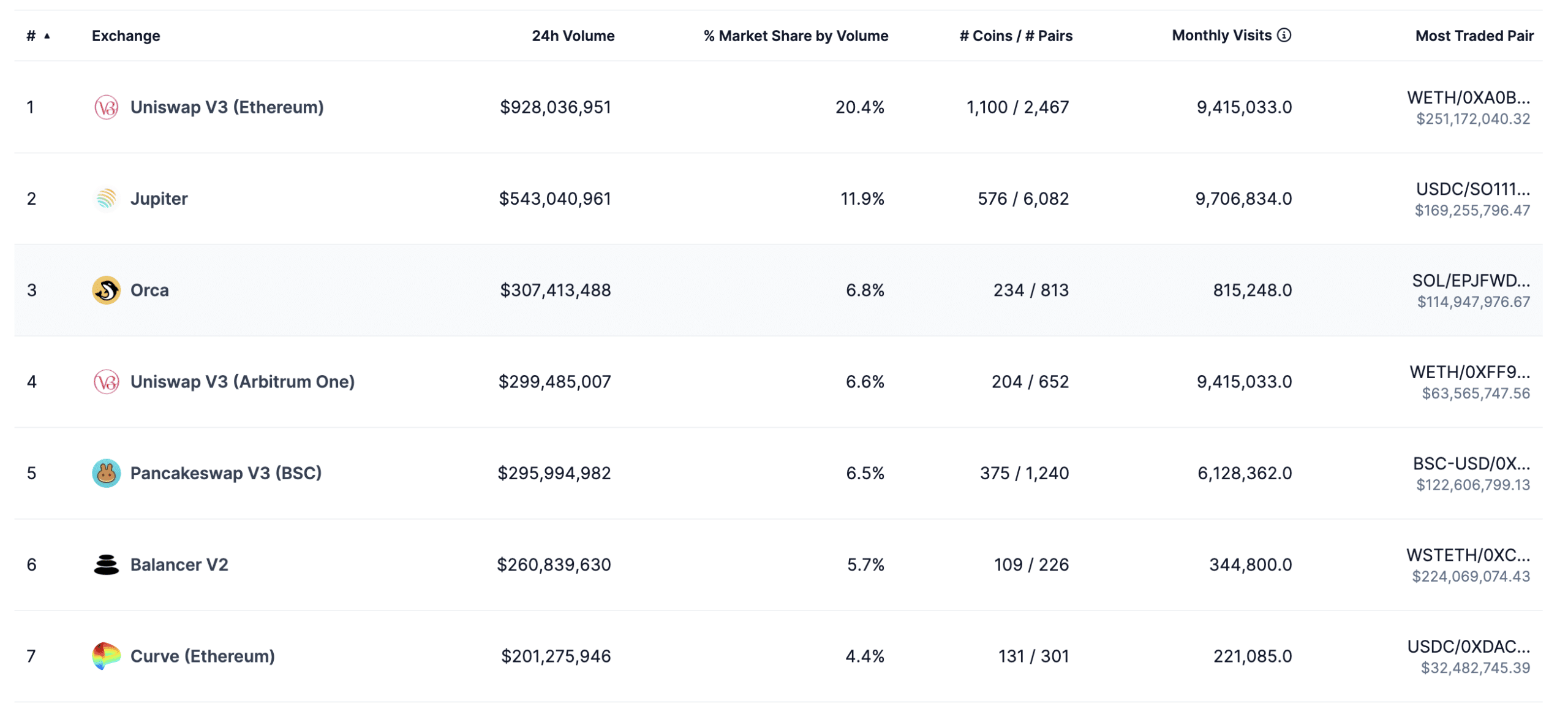

According to CoinMarketCap, there are hundreds of decentralized exchanges in the market. Daily trading volumes range from a few dollars to over $1 billion. This means you’ve got plenty of options when selecting an exchange.

In this section, we reveal our methodology when ranking the best decentralized exchangers for this comparison page.

Supported Networks

First, we assessed what blockchain networks each decentralized exchange supports. For instance, if it supports the Ethereum network, the exchange will likely list thousands of ERC-20 tokens. Similarly, you’ll find thousands of BEP-20 tokens if the exchange supports the Binance Smart Chain.

The reason is that anyone can add a cryptocurrency token to a decentralized exchange. As long as there’s a liquidity pool, buyers and sellers can trade. In addition, the best decentralized crypto exchanges support cross-chain trading. For instance, you might be able to trade Ethereum for BNB, even though they operate on independent networks.

Can I Trade Bitcoin on a Decentralized Exchange?

- Unlike Ethereum, Binance Smart Chain, and Solana – the Bitcoin network doesn’t support smart contracts. This means trading Bitcoin on a decentralized exchange is challenging.

- The most common workaround is to trade Wrapped Bitcoin (WBTC); an ERC-20 token that’s pegged to Bitcoin’s value.

- However, this can be a risky move, as you won’t directly own the real Bitcoin.

Liquidity

Liquidity is very important when researching decentralized exchanges. As we’ve established, liquidity pools are used instead of centralized order books. So, if there aren’t enough tokens in a liquidity pool, traders won’t be able to complete their swap.

- For example, consider the ETH/USDT liquidity pool.

- Let’s say it contains 2 ETH and 5,500 USDT.

- However, you want to swap 3 ETH for USDT.

- In this instance, there isn’t enough liquidity.

While this is rarely an issue when trading large-cap cryptocurrencies like Ethereum, Tether, USD Coin, BNB, or Solana – it can be problematic when investing in micro-cap tokens.

Fees

Decentralized exchanges make money by charging trading fees. This is often a very small commission, averaging 0.1% – 0.3% of the trade amount.

You should also check the average spreads on your preferred pairs. If there’s too much of a distance between buy and sell prices, you might not be getting a good deal.

Slippage is another indirect fee to factor in when choosing a decentralized exchange. This is when you place a trade but it’s executed at a less favorable price. For instance, you might buy Solana at $117, but see that you actually paid $118.

Security

Decentralized exchanges are considered a lot more secure than traditional cryptocurrency exchanges. This is because your cryptocurrency tokens are never held by the platform. Instead, everything is executed by smart contracts and liquidity pools.

All that said, it’s crucial to check that the decentralized exchange has been audited. This ensures its underlying smart contract is safe, secure, and free of vulnerabilities.

We also prefer decentralized exchanges that have a bounty program. This rewards developers when they find bugs and vulnerabilities that hackers could exploit.

DeFi Products and Yields

We prioritized decentralized exchanges that offer DeFi products with competitive yields. This should include yield farming, which enables users to deposit idle cryptocurrencies into liquidity pools. They’ll then earn a share of any trading fees generated.

Staking is also popular on decentralized exchanges. Explore factors like supported staking coins, average yields, and minimum lock-up terms.

Some decentralized exchanges also offer borrowing services. This means you can borrow cryptocurrencies from another user, without needing to go through a third party. You’d need to deposit collateral to get the loan and pay the funds back with interest.

How to Trade Cryptocurrency Using a DEX: 3 Steps

Trading on a decentralized exchange for the first time can be intimidating. Read on, we explain how to place a decentralized cryptocurrency trade in three simple steps.

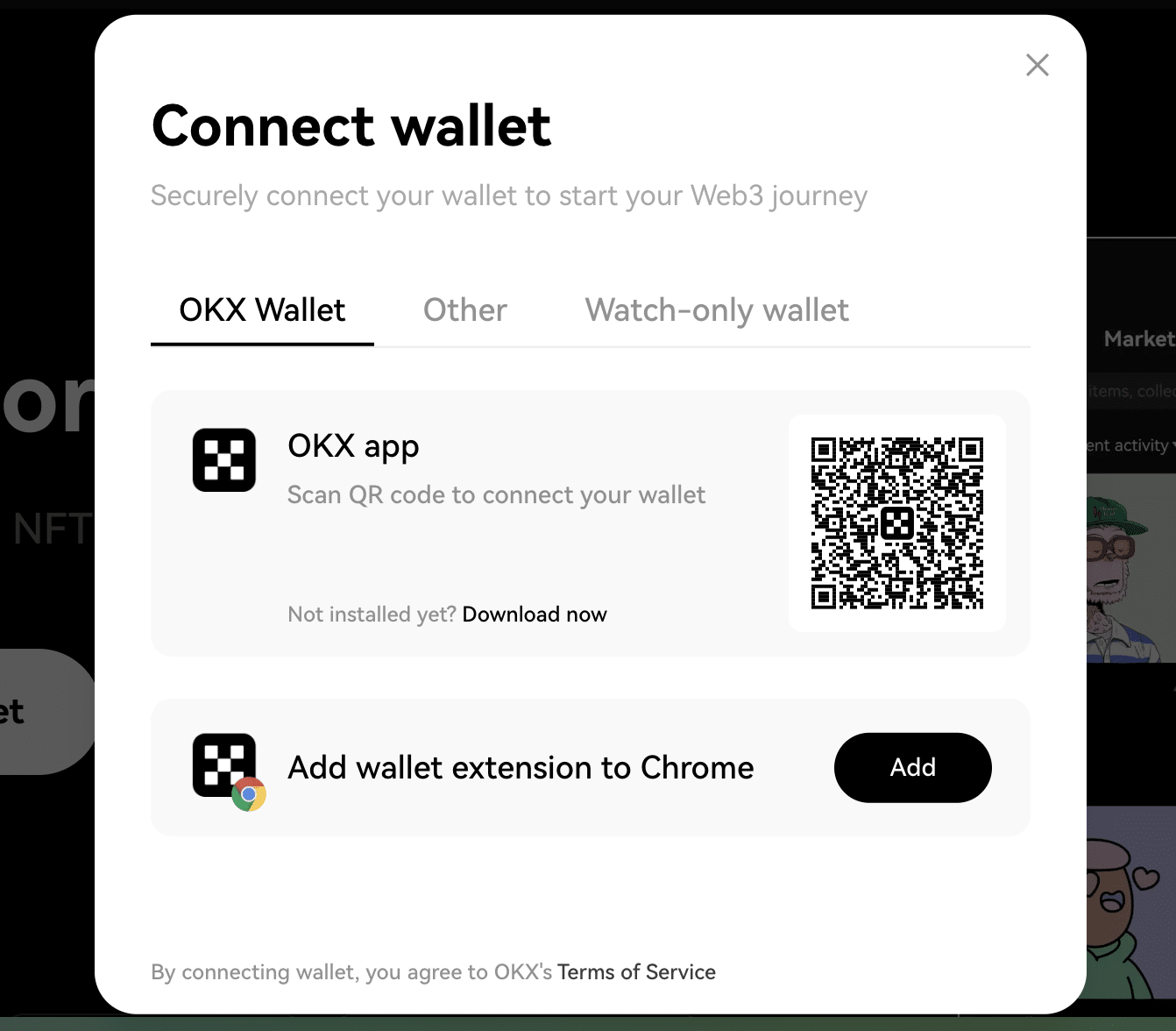

Step 1: Connect Your Wallet

One of the best things about decentralized exchanges is you don’t need to open an account. Nor do you need to supply personal information, contact details, or ID verification documents. Instead, visit your preferred exchange and connect a wallet.

The best crypto wallets for decentralized trading are Trust Wallet and MetaMask. That said, many other options exist. You’ll likely need to confirm the connection request from within your wallet. This ensures it’s really you making the request.

Step 2: Select a Trading Pair and Amount

Now that your wallet is connected, you can choose which cryptocurrencies to trade. First, you’ll need to select the cryptocurrency that you want to swap. This should be a cryptocurrency that’s currently in your wallet. Second, choose the cryptocurrency that you want to receive. You’ll also need to type in the trade amount.

This should be stated in the number of tokens. The equivalent number of tokens will then be displayed in real-time. Importantly, you might need to increase the slippage percentage. This is the maximum disparity between the current and execution prices of the cryptocurrencies you want to trade.

For example, suppose you set the slippage to 3%. This means the exchange will only execute the trade if the price doesn’t deviate by more than 3%.

Step 3: Place Your Trade

You can now place your trade. The token swap should go through within seconds. Behind the scenes, a smart contract will deduct tokens from your wallet and deposit them into the liquidity pool.

The smart contact will then deposit the new cryptocurrency tokens into your wallet. If you’ve finished trading, disconnect your wallet from the decentralized exchange.

If the swap fails, this is often because of slippage, which we discussed above.

What Are The Advantages of Using a DEX?

This section covers some of the key advantages of decentralized exchanges. This includes having full control of your cryptocurrencies, increased security, global accessibility, and the ability to trade anonymously.

Full User Control and Security

Decentralized exchanges ensure you always keep full control of your cryptocurrencies. This is because you won’t be required to make a deposit, let alone keep your cryptocurrencies on an exchange. Instead, you’ll be buying and selling cryptocurrencies via smart contracts.

All you need to do is connect a wallet and choose which cryptocurrencies to trade. The smart contract will then complete the exchange without ever touching your funds.

Now compare this to a traditional cryptocurrency exchange. You’d need to deposit funds into the exchange’s wallet, which you don’t have the private keys for. This means you need to trust that your cryptocurrencies are safe. Just remember, many cryptocurrency exchanges have been hacked, resulting in billions of dollars in stolen funds.

Global Accessibility

Decentralized exchanges are accessible globally. This means that, unlike centralized exchanges, there are no country-specific restrictions. Anyone can log onto a decentralized exchange, connect a wallet, and swap tokens.

No KYC Requirements

Most tier-one cryptocurrency exchanges have implemented KYC processes. This means you’d need to provide personal information and contact details when registering. KYC also involves unloading ID verification documents, such as a passport or driver’s license. This ensures that centralized exchanges comply with global money laundering laws.

In contrast, decentralized exchanges do not implement KYC checks. Users aren’t required to open an account or provide any personal data. The decentralized trading process is completely anonymous.

However, there is one exception to this rule. Some decentralized exchanges have partnered with ‘fiat gateways’. This enables their customers to buy cryptocurrencies with a debit/credit card. The fiat gateway will be required to KYC the buyer. Therefore, those wanting to trade anonymously should avoid fiat payments.

What Are The Risks of Using a DEX?

We also identified some risks when researching decentralized exchanges. This includes a more complicated trading process, transaction delays, limited liquidity, and smart contract risks.

Complexity and Transaction Delays

Decentralized exchanges can be a lot more complex to use when compared to traditional cryptocurrency exchanges. You’ll need to have at least a basic understanding of some key cryptocurrency principles.

- For example, you’ll need to have a suitable wallet with some cryptocurrency tokens inside.

- You’d then need to connect the wallet to the exchange.

- After that, you’d need to assess liquidity levels, trading volumes, market prices, and potential slippage risks.

- Any mistakes can result in a hugely unfavorable price.

In contrast, the best cryptocurrency exchanges offer a smooth and hassle-free investment process. It’s normally just a case of choosing which cryptocurrency to buy and entering your debit/credit card details.

Additionally, we found that transactions are often delayed when using a decentralized exchange. This is because platforms rely on smart contracts and the blockchain network. If the network is in high demand, delays can occur. Centralized exchanges execute trades internally via order books. This means transaction speeds are almost instant.

Limited Liquidity and Trading Volume

Decentralized exchanges have a small fraction of liquidity when compared to traditional exchanges. For example, according to CoinGecko, $4.3 billion was trading on all decentralized exchanges in the prior 24 hours. Over the same period, nearly $19 billion was traded on Binance alone.

When you also factor in Coinbase, Bybit, OKX, KuCoin, Kraken, Gate.io, and other leading platforms, you’ll see that decentralized trading volumes are a drop in the ocean. This results in weakened liquidity levels, meaning inefficient trading conditions. This is because traders might need to settle for an unfavorable price to buy or sell.

Smart Contract Risks

In general, decentralized exchanges are considered safer than centralized platforms. However, you also need to consider smart contract risks. After all, smart contracts are never 100% secure. Should a hacker find a vulnerability, this could result in a loss of funds.

For example, KyberSwap – a decentralized exchange, was hacked for $50 million last year. This is why you should only use a decentralized exchange if its smart contract has been audited. This should be a thorough and transparent audit from a reputable third party.

Conclusion: What is the Best DEX?

Decentralized exchanges offer many benefits, including anonymity, cross-chain token swaps, and the ability to trade without centralized order books. Overall, OKX is the best option.

OKX supports thousands of cryptocurrencies across 70+ blockchain standards. It also offers a bridge aggregator, meaning you’ll get the best DeFi yields in the market.

FAQs

What is the best decentralized exchange?

OKX is the best decentralized exchange. It supports 70+ network standards, is compatible with multiple device types, and offers some of the best DeFi yields in the space.

Should you trade cryptocurrency on DEXs?

Crypto DEXs are ideal if you want to trade cryptocurrencies anonymously, meaning no reliance on centralized third parties. There’s no requirement to open an account either – simply connect a wallet and begin trading.

What is the cheapest decentralized exchange?

Nomiswap is considered the cheapest decentralized exchange, as it offers 0% commissions on token swaps. However, Nomiswap struggles to attract sufficient liquidity,

Are decentralized exchanges safe?

In general, decentralized exchanges are safe, as trades are executed by smart contracts. This means that decentralized exchanges never touch client funds. However, if the exchange’s smart contract is hacked, this could lead to a loss of funds.

References

- Crypto exchanges keep getting hacked, and there’s little anyone can do (NBC News)

- Opinion: Why crypto businesses need anti-money laundering regulations (World Economic Forum)

- KyberSwap offers 10% bounty to attacker who made off with $50M (Business Insider)

- Top cryptocurrency decentralized exchanges (CoinMarketCap)

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman