Best Crypto to Buy Now in January 2026 – Top Crypto to Invest In

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. However, this potential compensation never influences our analysis, opinions, or reviews. Our editorial content is created independently of our marketing partnerships, and our ratings are based solely on our established evaluation criteria. Read More

Some of the best crypto to buy now are the well-established Bitcoin and Ethereum, while higher-risk options include Solana and BNB. For investors seeking exposure to utility or AI, Bittensor and Hyperliquid stand out, as they tie blockchain to real-world use and high-volume trading.

These cryptocurrencies are top options for investing based on historical performance, long-term growth, utility, and other factors. They fall into three primary categories: high-risk, low-risk, and utility and AI, which reflect the state of the market today.

Let’s dive in for a deeper analysis of each coin our methodology has identified as a good potential option for your portfolio, bearing in mind sector trends that could also determine a good crypto to buy right now.

- In This Article

-

- 1. Solana (SOL) — High-Speed, Low-Fee Blockchain for Scalable DeFi and dApps

- 2. BNB Coin (BNB) — Exchange Utility Token Powering Trading Fees and Perks

- 3. Cardano (ADA) — Research-Driven Blockchain Focusing on Security, Scalability, and Sustainability

- 4. Dogecoin (DOGE) — Meme-Based Cryptocurrency Used for Tipping and Online Payments

-

- 1. Define Your Goals

- 2. Understand the Project's Use Case

- 3. Analyze Project Fundamentals: Review the Whitepaper and Roadmap

- 4. Look Into Liquidity, Market Capitalization, and Trading Volume

- 5. Consider Tokenomics

- 6. Scrutinize the Team and Backers

- 7. Analyze Community Size and Strength

- 8. Study the Price History and Track Record

- In This Article

- Show Full Guide

-

- 1. Solana (SOL) — High-Speed, Low-Fee Blockchain for Scalable DeFi and dApps

- 2. BNB Coin (BNB) — Exchange Utility Token Powering Trading Fees and Perks

- 3. Cardano (ADA) — Research-Driven Blockchain Focusing on Security, Scalability, and Sustainability

- 4. Dogecoin (DOGE) — Meme-Based Cryptocurrency Used for Tipping and Online Payments

-

- 1. Define Your Goals

- 2. Understand the Project's Use Case

- 3. Analyze Project Fundamentals: Review the Whitepaper and Roadmap

- 4. Look Into Liquidity, Market Capitalization, and Trading Volume

- 5. Consider Tokenomics

- 6. Scrutinize the Team and Backers

- 7. Analyze Community Size and Strength

- 8. Study the Price History and Track Record

Key Takeaways: Best Crypto to Buy Now

- The best cryptos to buy right now include lower-risk, higher-risk, utility, and AI cryptocurrencies.

- These projects include Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Solana (SOL), and BNB Coin (BNB).

- Some of the reasons why investors are buying crypto right now include institutional momentum, favorable policies, and improvements in technology.

- Investing in cryptocurrency can be risky, and you should evaluate a project before investing.

- To mitigate some risks from investing, consult a professional, diversify, DYOR, and never invest more than you can afford to lose.

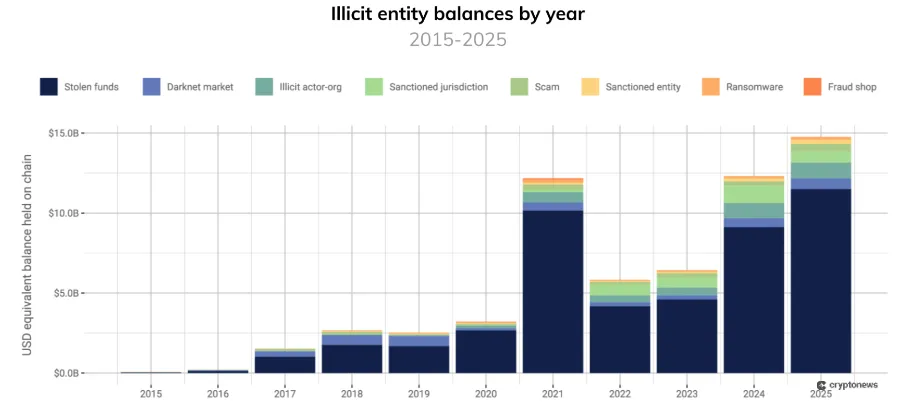

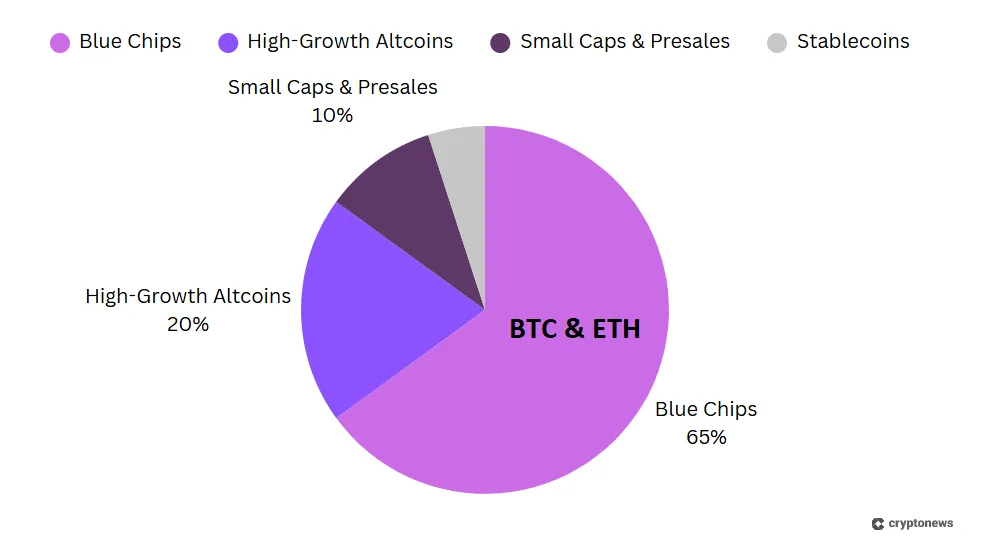

Don’t get me wrong — this doesn’t mean blue-chips aren’t prone to wild fluctuations. However, their large market capitalizations are like the keels of a vessel, maintaining balance with their massive weight. The best long-term crypto assets represent large markets with millions of users and high trading volumes. Bitcoin, Ethereum, and XRP are established ecosystems with entire markets built around them. They are suitable for conservative investors still open to crypto exposure. However, one of their main drawbacks is that they can’t offer the upside potential of early-stage projects. We selected these three lower-risk crypto assets based on factors like market capitalization, trading volume, active user base, and ecosystem size. Let’s look closer at these top options. Key Information: Bitcoin With more than half of the whole crypto market’s value and growing interest from Bitcoin ETFs, Bitcoin is still leading the pack. It’s easy to buy and sell, keeps getting small upgrades, and many investors treat it like a long-term reserve asset. Key Information: Ethereum For these reasons, Ethereum really stands out. It’s not just well-known – it underpins many major crypto projects, from faster Layer 2 networks to popular token types like ERC-20 and ERC-721, making it the base many developers rely on to build new financial tools. Key Information: XRP What sets XRP apart from most other cryptocurrencies is its real-world adoption and regulatory clarity. It powers RippleNet’s payment infrastructure and may soon benefit from spot ETF approvals. This makes it a stable, utility-centric option. These altcoins have more upside potential than blue chips, often showing larger percentage moves. But as you know, the catch is that volatile assets are unpredictable and can swing against you at any moment. To eliminate extreme risks, such as sudden collapses or rug pulls, we handpicked the best short-term crypto assets among the countless options. Unlike blue chips, these more volatile cryptocurrencies are suitable for day trading. Our list of scalable altcoins may be the ideal starting point for anyone asking which crypto to buy today for the short term. It includes Solana, BNB, Cardano, and Dogecoin, offering a mix of large Web3 ecosystems and community-backed meme coin exposure. We paid attention to their market cap, ecosystem activity, relevant partnerships, and social media traction. Below are the top choices. Key Information: Solana Solana is a good alternative in case you are interested in venturing into DeFi. It supports large DEXs, lending apps, and yield products, which have the advantage of its rapid transaction times, minimal charges, and an increasing number of builders and users. Key Information: BNB Moreover, BNB holders can stake their tokens or participate in Binance savings products and generate yield. As time goes by, BNB is seeing increased acceptance by merchants and payment platforms, which in turn expands its real-world utility beyond the Binance ecosystem. Key Information: Cardano is a leading blockchain platform that uses proof-of-stake consensus, called Ouroboros, to support smart contracts and dApps. Its main goal is security, as it focuses on providing a highly secure and scalable infrastructure while emphasizing academic research and peer-reviewed development. Cardano’s ecosystem continues to grow with ongoing updates to smart contract capabilities and partnerships in different sectors, including DeFi and NFTs. Moreover, Cardano is considered one of the top L1 blockchains positioned for growth, with analysts expecting ADA, Cardano’s native coin, to reach between $0.39 and $0.39 in 2026. Key Information: Dogecoin Low fees and fast transactions make it ideal for tipping and micro-payments. As adoption grows and community support stays strong, DOGE is well-positioned for continued momentum through 2026, especially as more payment platforms and retailers begin to accept it as a real currency. Some of the best utility tokens include HYPE and HBAR, which power a trading hub and a dApp ecosystem, respectively. A special category to explore is Layer 2 solutions built around Ethereum, which have become indispensable for their scaling potential. Elsewhere, top AI crypto coins like TAO have also been among trending coins since the AI craze began. Growth-oriented investors may look to these and other utility tokens for day trading and short-term gains. We selected a few coins that dominate their niches, have gained traction, represent mature markets, and remain well-positioned for future growth. Check them out below. Key Information: Bittensor When buying Bittensor, it rewards contributors with the native token TAO, encouraging them to become a collaborative intelligence economy. Moreover, Bittensor’s core architecture combines subnets, a blockchain layer, and an API that, mixed together, offer a wide range of AI services and applications. Key Information: Hyperliquid The HYPE token drives the ecosystem, providing the right to govern, a portion of the trading fees, and a deflationary strategy that burns a quarter of the supply each year. Furthermore, its actual use, quickness, and income render it one of the greatest cryptos to purchase at present. Key Information: Hedera With its innovative structure, Hedera is tackling problems others haven’t solved, like fair transaction ordering and sustainable scalability. Its tech is already being used in CBDCs, supply chains, and AI data validation. Crypto remains high risk, but lower prices, ongoing innovation, and institutional interest explain why some investors are choosing to buy the dip in January 2026. Investing in the best to buy right now makes sense if you look at the options in totality. As stated previously, the crypto market is currently marked by fear with brief intermittent rallies. According to our research, high-risk (e.g., Solana and BNB) and low-risk cryptocurrencies (e.g., Bitcoin and Ethereum) diversify a portfolio enough for upside exposure and downside protection. Meanwhile, utility and AI cryptocurrencies capture value from actual services. These projects generate revenue streams, which give them stability. This gives them the properties of both high-risk and low-risk cryptocurrencies: upside potential and downside protection through real demand for tokens that capture the value generated from said demand. Cryptocurrencies have become a diverse market, so it’s important to start by defining your specific goals. Do you seek long-term, steady growth, or are you ready to actively trade for short-term gains? Blue-chip coins may be better suited for long-term growth, while scalable altcoins can offer quicker returns, although they carry higher risk. Once you select a cryptocurrency that fits your goals, you should check its use case and see what specific problems it solves. The investment philosophy of the legendary Warren Buffett, “Never invest in a business you cannot understand,” applies to cryptocurrencies as well, maybe even more so. Some crypto coins may power one-stop, industry-agnostic chains, while others focus on specific sectors. Always check whether the use case is still relevant and offers long-term value. For example, metaverse projects are currently in standby mode, while AI and payment coins are thriving. Most crypto assets have a whitepaper outlining their mission and key concepts. Ideally, this comes with a well-designed webpage and a clear roadmap. Take your time to read these. Sometimes, whitepapers introduce revolutionary innovations. Think about zkSNARKs, decentralized AI networks, oracles, or restaking. If you catch these trends early, you could get in before most investors even notice. Market capitalization, trading volume, and liquidity are also key metrics of a crypto asset, which are important factors. High market capitalization is an indication that the investors have confidence in a certain undertaking. High volume of trade and growth in its market size indicate that the project is being captured very fast. Typically, the coins with large capitalization can be assumed to be more responsible, whereas small-cap and early-stage projects have low liquidity and considerable volatility. Tokenomics refers to the economic principles defining aspects like a token’s total supply, pace of token unlocks (vesting schedule), distribution model, allocation, deflationary mechanisms, and other financial dynamics. You should look for healthy tokenomics models that prioritize organic growth and community building rather than benefiting the team and private investors in a disproportionate way. Speaking of the team, you should do a background check and analyze the history of team members. Have they held key executive roles at reputable companies in the past? Many blockchain developers and managers come from established fintechs or other well-known entities. For example, the team behind Facebook’s abandoned Libra project split into two main groups and went on to build Aptos and Sui, two Layer 1 chains that have experienced rapid growth. When it comes to meme coins and small-cap crypto projects, anonymous teams have become the norm. Still, there are specialized security firms that can audit team profiles without revealing their identity. You’d be interested in crypto coins backed by large and engaged communities. This is a strong indicator of a project’s strength and momentum, especially in the case of meme coins. In fact, for them, community engagement can be the primary driving force. Check the cryptocurrency’s social media presence, including activity on X, Telegram, Discord, or Reddit. Projects with passionate and loyal communities can be more resilient during market downturns. If you want to invest in established crypto projects (a.k.a. dino coins), look at their past price charts and how they handled tough periods, such as the 2022–2023 crypto winter. Newer projects may not have much history, but you can still study how their sector performed or compare them with coins that have similar token structures. Take the dot-com bubble in the 2000s, for example. While many low-quality online projects failed, it didn’t mean the internet itself had no value. Similarly, as the crypto market matures, here are the main risks you should know about. Crypto assets are notorious for their volatility. This is a significant risk even for blue-chip coins. Still, Bitcoin and Ethereum are creating the trends rather than following them. Therefore, they’re more stable and resilient. Small-cap coins show much higher volatility and carry significant risk for traders using leverage. One of the big problems of crypto is that its regulatory environment is very fragmented and inconsistent across jurisdictions. For example, in China, the world’s second most populous country, crypto is completely banned, while in the European Union, it has a dedicated and relatively friendly regulatory framework. In the US, still the biggest crypto market by volume and usage, the rulebook is patchy and varies across regulators and states. Things are slowly getting clearer, though, with FIT21 passing the House in 2024 and the GENIUS Act now outlining how stablecoins and watchdog roles should be handled. You will often hear that blockchain offers unmatched security. While this is true for Bitcoin and perhaps a few other established Layer 1 chains, the broader Web3 ecosystem built around these chains is plagued by security risks, such as vulnerable smart contracts and coding flaws. In late 2025, two major incidents reflect the security weakness in decentralized finance (DeFi). Balancer Protocol lost over $116 million in a cross-chain exploit targeting its V2 pools, marking one of the largest crypto security breaches this year. A few hours later, Stream Finance discovered that an external fund manager had lost $93 million of its fund assets, causing its stablecoin Stream USD (xUSD) to lose its peg and crash. To reduce the risk of similar events, it’s safer to use crypto projects that have been audited by well-known security firms such as Certik or Halborn. Due to the lack of crypto literacy, criminals and hackers are taking advantage of the situation and carrying out social engineering activities and using hacking attacks targeting both centralized and decentralized systems. Chainalysis noted in October 2025 that illicit organizations had close to 15 billion dollars worth of funds, and stolen funds constituted the biggest portion. It is a new record peak, in part, explained by an increase in the price of crypto assets in 2025. Rug pulls, Ponzi schemes, pig butchering, and other social engineering devices are all scams that are constantly being developed by criminals, and with AI getting more popular, diversity increases. While analyzing key metrics, you should know that data can be distorted due to market manipulation, as many small projects use bots to inflate market cap and volume figures to create the false impression of success. This is a serious problem in crypto, affecting DeFi, NFTs, and the broader Web3 sector. For example, CryptoSlam found that 42.52% of NFT trading on Ethereum links to wash trading, a manipulative practice where the same group buys and sells NFTs to inflate volume data. Before investing in any crypto project, take the time to research it thoroughly. Check out our guide on evaluating a cryptocurrency, and review each aspect, from the whitepaper and team to tokenomics and community engagement. Don’t just rely on social media hype or your friend’s advice. One of the best ways to mitigate risk is to diversify your crypto exposure by allocating across different cryptocurrency types, including blue-chip and small-cap coins. If you have capital but aren’t sure how to get started in crypto or what the legal and tax implications might be, it’s wise to consult with a financial advisor or crypto-savvy professional. Again, don’t believe anyone promoting themselves as a crypto expert — look for a reputable individual or firm that can guide you. It may sound like a cliché, but never invest more than you can afford to lose. Crypto markets are highly speculative, and you should never sell your car or house, or dip into your savings, chasing the “next big thing.” We reviewed the coin’s price action over the past week and up to 12 months, examining both short-term fluctuations and longer-term trends. We also considered its overall market value to understand its position and weight in the wider crypto market. We looked at how cryptocurrency is used in real life, paying attention to any features or applications that make it stand out. We also reviewed the technology behind it and recent updates that strengthen its practical use. To analyze the adoption by the community, we have examined the relevance and liveliness of the project on X, Reddit, Telegram, and other forums. We also examined the practical applications, both among merchants and applications themselves, as well as by regular people, since broader usage tends to be more indicative of a healthier ecosystem. We researched the development team’s track record and reputation; while we don’t dismiss newcomers, past experience and successful projects help build credibility. We also checked how open the team is with updates, progress reports, and challenges, because the more the community knows, the more confident people feel about buying and holding the coin. We evaluated the security design of the blockchain, including its consensus mechanism and resistance to common attack vectors. On top of that, we reviewed any past security incidents or bugs and assessed how quickly and effectively the team responded and fixed them. We checked whether the cryptocurrency operates in line with relevant regulations in its main regions, since compliance is key for long-term survival and institutional interest. We reviewed the project’s roadmap to see if it sets out clear, realistic updates and milestones that can guide future growth. These scores together gave us a full view of each cryptocurrency’s strengths and potential, allowing us to assign a rating to every coin recommended on this page. To determine if a crypto is worth buying, you need a data-driven approach, analyzing its key metrics, long-term potential, real-world utility, tokenomics, regulatory compliance, and unique selling point. However, even when arguments are backed by fundamentals, choosing the “best” cryptocurrencies ultimately depends on your financial goals and risk tolerance. Aggressive growth-oriented investors will likely be interested in tokens with strong upside potential, while conservative investors may stick with blue chips. Match your goals and your risk appetite to the right asset, and never invest more than you can afford to lose.

Top Crypto Tokens to Buy in 2026: Quick Comparison

Asset

Risk Level

Time Horizon

Primary Use

Bitcoin (BTC)

Lower

Long-term

Store of value

Ethereum (ETH)

Lower

Long-term

Smart contracts & DeFi

XRP (XRP)

Lower

Long-term

Cross-border payments

Solana (SOL)

Higher

Short/Long

High-speed dApps & DeFi

BNB (BNB)

Higher

Short/Long

Exchange & ecosystem utility

Cardano (ADA)

Higher

Long-term

Proof-of-stake smart contracts

Dogecoin (DOGE)

Higher

Short-term

Meme liquidity & payments

Bittensor (TAO)

Higher

Long-term

Decentralized AI network

Hyperliquid (HYPE)

Higher

Short-term

On-chain derivatives trading

Hedera (HBAR)

Medium

Long-term

Enterprise dApps & tokenization

Best Cryptos to Buy with Lower Risk for Long-Term Investment

With millions of digital assets across hundreds of chains, many investors wonder which crypto to buy today for the long term. The answer comes down to stability, which is why blue-chip cryptos should be first in line. They can help investors navigate the extreme volatility typical of this emerging industry.1. Bitcoin (BTC) — Original Digital Currency and Leading Store-of-Value Crypto

BTC +0.42% is the oldest and most widely adopted cryptocurrency. It has a flawless 15-year track record, a market cap of $1.79T, and is recognized as legal tender in countries like El Salvador. It has officially been classified as a commodity by both the SEC and CFTC. Overall, its decentralized proof-of-work network is unmatched in security and scale.

2. Ethereum (ETH) — Smart Contract Powerhouse for DeFi, dApps, and Web3

ETH +0.83% is the backbone of Web3, powering most decentralized apps, NFTs, and DeFi protocols. Its Pectra upgrade has enhanced scalability and performance, reinforcing its position as the most widely used blockchain globally.

3. XRP (XRP) — Fast, Low-Cost Settlement Token for Global Payments

XRP +2.14% is a digital asset built for fast, low-cost, cross-border payments. Transactions settle in seconds for less than a penny, making it ideal for banks, remittance providers, and payment networks moving money globally.

Top Cryptos to Buy with Higher Risk for Short-Term Investment

Growth-oriented investors leaning toward more risk would be more tolerant of volatility. In fact, short-term gains derive from price fluctuations, so it makes sense to explore the most volatile crypto assets.1. Solana (SOL) — High-Speed, Low-Fee Blockchain for Scalable DeFi and dApps

SOL +1.61% is a very fast blockchain, handling around 960 transactions per second as of November 18, 2025, with almost no fees, even when many people use it at once. Its built-in time-stamping system helps it stay quick and smooth, making it a favorite for DeFi apps, NFTs, and busy trading platforms.

2. BNB Coin (BNB) — Exchange Utility Token Powering Trading Fees and Perks

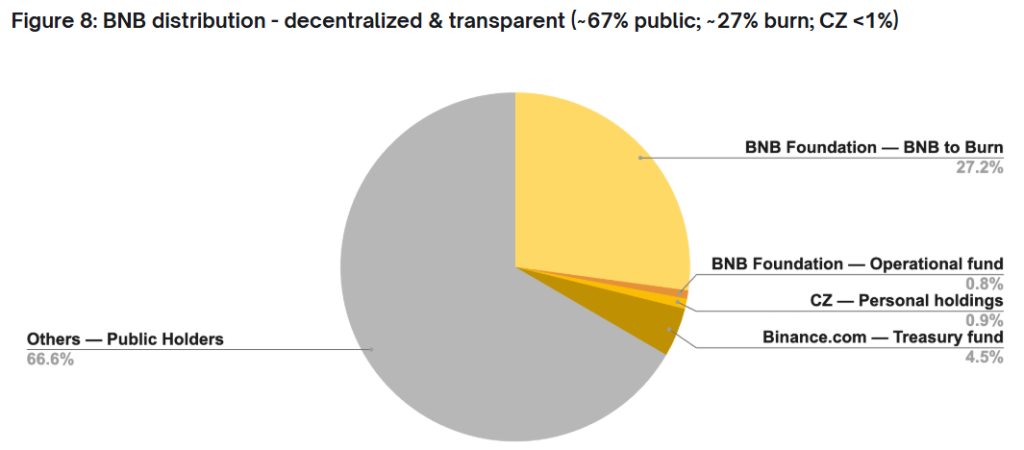

BNB +1.69% is widely viewed as a good buy thanks to its utility, broader applications, and being the native token of the BNB ecosystem. It makes paying trading fees on Binance much cheaper, as the platform usually offers discounts of around 25%, increasing profit for frequent traders. It also gives holders access to exclusive token sales and new project launches on Binance Launchpad.

3. Cardano (ADA) — Research-Driven Blockchain Focusing on Security, Scalability, and Sustainability

4. Dogecoin (DOGE) — Meme-Based Cryptocurrency Used for Tipping and Online Payments

DOGE +0.96% is a solid option for high-volume traders thanks to its deep liquidity on major exchanges and steady daily turnover. It runs on a Scrypt-based Proof of Work system, keeping the network decentralized and still mineable with widely available hardware.

Best Crypto Projects for Specialized Investors — Utility and AI Tokens

While large smart contract networks like Ethereum, Solana, and BNB Chain cover many use cases, some investors prefer clearer themes. Utility and AI tokens stand out because they focus on specific services, link directly to real-world demand, and can show more obvious growth paths.1. Bittensor (TAO) – Decentralized AI Network Rewarding Open Machine Learning Contributions

TAO +2.65% is a decentralized blockchain protocol tailored for machine learning (ML) and artificial intelligence (AI). It offers an open marketplace where developers and users can share, train, and even exchange AI models without requiring permissions.

TAO +2.65% is a decentralized blockchain protocol tailored for machine learning (ML) and artificial intelligence (AI). It offers an open marketplace where developers and users can share, train, and even exchange AI models without requiring permissions.

2. Hyperliquid (HYPE) — High-Performance Trading Chain for Derivatives and On-Chain Order Books

HYPE +4.00% is redefining crypto trading with ultra-fast, on-chain perpetual futures that rival centralized exchanges. Built on a custom Layer 1, it offers sub-second settlement while maintaining full transparency and self-custody — an ideal blend for serious traders.

3. Hedera (HBAR) – Enterprise-Focused Network Using Hashgraph for Fast, Cheap Transactions

HBAR 0.02% is powered by Hashgraph, not traditional blockchain, enabling thousands of fast, secure transactions per second with sub-cent fees. Its enterprise-grade tech is built for real-world use, attracting major partners like Google, IBM, and Dell for applications in tokenization and micropayments.

HBAR 0.02% is powered by Hashgraph, not traditional blockchain, enabling thousands of fast, secure transactions per second with sub-cent fees. Its enterprise-grade tech is built for real-world use, attracting major partners like Google, IBM, and Dell for applications in tokenization and micropayments.Why Are Investors Buying Crypto Right Now?

Buying crypto right now can still make sense if you believe in its long-term future and accept short-term swings. After a sharp drop that pushed Bitcoin below $85,000 and then back near $93,000, many long-term holders see this “Extreme Fear” phase as a chance to accumulate.

Why Buy the Best Crypto to Buy Now?

How to Evaluate a Cryptocurrency Before Investing

In bull cycles, a crypto market can uphold numerous assets, yet they are not the ones that are resilient in the long term. It is advisable to perform a careful assessment of the cryptocurrencies before committing financial resources to them that extends beyond their price. These are some of the main factors to be considered.1. Define Your Goals

2. Understand the Project’s Use Case

3. Analyze Project Fundamentals: Review the Whitepaper and Roadmap

4. Look Into Liquidity, Market Capitalization, and Trading Volume

5. Consider Tokenomics

6. Scrutinize the Team and Backers

7. Analyze Community Size and Strength

8. Study the Price History and Track Record

What Are the Risks of Investing in Cryptocurrency?

Cryptocurrencies represent a new asset class that is still finding its place alongside traditional markets. In the meantime, they carry a significantly higher risk, which is to be expected of emerging trends.📈 High Volatility

🧑⚖️ Lack of Regulation

🔒 Security Risks

🧑💻 Scams and Hacks

🌎 Market Manipulation

Risk Management Tips for Investing in Crypto Projects

Many investors find the crypto space appealing for its high-growth opportunities, but the risks are also high. Here are a few basic principles and steps to protect your capital.🔍Do Your Own Research

📚 Diversify Your Cryptocurrency Portfolio

🧑💼 Consult With a Professional

💸 Invest Only What You Can Afford to Lose

Methodology: How We Rated the Best Cryptos to Buy

To curate this list of the best cryptos to buy, our crypto analysts collectively dedicated over 300 hours to research. They evaluated factors like historical performance, long-term potential for growth, current price, utility, and security. Here’s how we researched and weighted each criterion. For more information, please read our full research methodology.Market Performance (25%)

Utility and Use Cases (20%)

Community and Adoption (15%)

Development Team (15%)

Security (15%)

Regulatory Compliance (5%)

Roadmap and Future Plans (5%)

Conclusion: Our Take on the Best Crypto to Buy Right Now

The best cryptos to buy right now include XRP, Bitcoin, Solana, and Ethereum. XRP stands out in terms of real-world adoption, while Bitcoin remains the most reliable long-term store of value.Frequently Asked Questions (FAQs)

Which crypto has the most potential in 2026?

Is Bitcoin and crypto the same?

What are the most popular cryptocurrencies?

What has been the most active cryptocurrency in 2026?

What is the best crypto to invest in with $1,000 right now?

What are the best niche cryptocurrencies?

References

About Cryptonews

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.