Poloniex

Self-proclaimed “legendary crypto assets exchange,” Poloniex is not as popular as it just to be anymore, but it still offers quality service when it comes to trading bitcoin and altcoins. It offers the lowest fees in the industry and only asks only for your email during registration as identity verification is 100% optional. However, it lags behind other exchanges in terms of customer service and has experienced a security breach back in 2014. After changing owners 2019, the exchange has relocated to Seychelles and adopted a more open, loosely regulated approach, which allows it to offer a wider array of services, support more cryptocurrencies, and gradually get back towards being an important part of cryptoverse’s infrastructure.

Poloniex Review: Key Features

Poloniex is a centralized cryptocurrency exchange for both experienced and amateur cryptocurrency traders. It offers a range of crypto markets, advanced trade types, as well as margin trading and crypto lending, which makes it a convenient place for traders from all walks of life.

Poloniex exchange homepage. Source: Poloniex.com

General info

| Web address: | Link |

| Main location: | Seychelles |

| Daily volume: | 1866.7 BTC |

| Mobile app available: | Yes |

| Is decentralized: | No |

| Parent Company: | Polo Digital Assets Ltd. | ||

| Transfer types: | Credit Card, Debit Card, Crypto Transfer, | ||

| Supported fiat: | - | ||

| Supported pairs: | 94 | ||

| Has token: | -| Fees: | Low(Compare rates) | |

Founded: January 2014

Web address: poloniex.com

Support contact: https://support.poloniex.com/hc/en-us

Parent Company: Polo Digital Assets, Ltd.

Company location: F20, 1st Floor, Eden Plaza

Eden Island, Republic of Seychelles

Pros & Cons

- Very low fees Wide range of supported cryptocurrencies Margin trading support Margin lending support Only email is required to trade

- No fiat currencies Customer support can be slow Has been hacked in the past Unregulated exchange

Screenshots

The key features of the exchange include:

- Trade 60+ cryptocurrencies, including bitcoin (BTC), ethereum (ETH), litecoin (LTC), ripple (XRP),tron (TRX), eos (EOS), monero (XMR), and many more.

- Low fees. Poloniex has the lowest trading fees amongst popular altcoin exchanges.

- Margin trading. Aside from spot trading, you can also conduct low fee margin trades with up to 2.5x leverage.

- Poloniex margin lending. You can earn passive income by lending your crypto assets with interest.

- Poloni DEX and IEO launchpad. Invest in the hottest new crypto projects, and make use of Poloniex’s decentralized counterpart Poloni DEX.

- Sign up and trade within minutes. Poloniex does not force you to pass KYC (know your customer) checks, so you can sign up with your email and start trading immediately. If you don’t have any cryptocurrency yet, you can buy some with fiat using its Simplex integration, though this operation will require you to verify your identity.

In 2021, Poloniex does not support fiat trades and deposits, and its customer support efforts are still minute. However, after it’s relocation toSeychelles, the crypto exchange underwent a series of changes and is one of the best altcoin exchanges today in terms of the platform’s usability, fees, and performance.

Source: Poloniex.com

In this Poloniex review, we’ll look into the exchange’s current situation, trading fees, services, ease of use, and accessibility.

Poloniex History and Background

Launched in Delaware, USA, Poloniex began in January 2014. Its founder is Tristan D’Agosta, who has a background in music and previously established the Polonius Sheet Music company in 2010.

Right after the launch, Poloniex suffered a high-profile hack in March 2014 when it lost about 12% of its BTC, which was worth approximately USD 50,000 at the time. Nevertheless, the exchange’s management responded to the hack openly and by offering full reimbursements for the stolen 97 bitcoins out of D’Agosta’s company profits.

After a shaky start, Poloniex had to temporarily increase its fees and made the headlines again in 2016 as the first exchange to list Ethereum (ETH) cryptocurrency. After that, the exchange’s trading volume began to increase, and it became one of the more popular exchanges in terms of liquidity.

Source: Poloniex.com

In early 2018 Poloniex was acquired by payments company Circle, which reportedly aimed to transform it into America’s first fully regulated crypto exchange. The company paid USD 400,000 for the acquisition.

In order to become regulatory compliant, the exchange delisted almost 50% of its crypto assets that are at risk of being classified as securities and implemented strict KYC (know your customer) checks.

Another customer pain-point was Poloniex’s customer support, which was as dull as ditchwater and had over140,000 outstanding customer support tickets. It’s been reported that some customers have been waiting for several months before they heard back from the exchange. Such poor customer service had led to a loss of thousands of Poloniex users.

2019 was another big year of changes for Poloniex exchange. Early in the year, the exchange faced challenges posed by the uncertainty in the U.S. cryptocurrency regulatory environment. As a result, it continued reducing the list of available coins for the U.S. crypto investors. In the summer, Circle-owned exchange bumped into another hurdle due to the cryptocurrency CLAM crash as many investors experienced unexpected losses.

In November 2019, Circle spun out Poloniex into a separate entity, Polo Digital Assets, Ltd., backed by an unnamed group of Asian investors, which includes TRON’s CEO Justin Sun. The newly formed company was registered in Seychelles – a remote island in the Pacific known for crypto favorable regulations. It is also a home for other unregulated cryptocurrency exchanges like BitMEX, Prime XBT, and reportedly even Binance. Commenting on this move, Circle said that it faced “challenges as a US company growing a competitive international exchange.”

Under new leadership, the Poloniex crypto exchange took another direction and dropped forced AML/KYC checks, so from now on, it is possible to trade on Poloniex without verification again. Besides, the platform added new features revoked trading access for the United States customers, meaning that it completely abandoned the idea to become a fully regulated exchange.

Source: Poloniex.com

In December 2019, Justin Sun led exchange made it to the spotlight once again. This time, it attracted controversial sentiment due to the delisting of DigiByte (DGB), a somewhat popular altcoin, after Justin Sun and DigiByte’s founder Jared Tate got into a skirmish on Twitter.

In 2021, Poloniex remains a popular digital currency exchange with some of the lowest trading and withdrawal fees on the market. In February, the exchange experienced some issues with its order book and had to delete 12 minutes of trading history due to a bug. In April, the exchange revamped its interface across its website and mobile apps and promised more significant improvements later in the year.

Poloniex supported countries

Currently, Poloniex is a global exchange with only a few geographic restrictions. The access to the Poloniex platform is prohibited for the residents and citizens of the following countries:

- Cuba

- Iran

- North Korea

- Sudan

- Syria

- The United States

Users from other countries can access and trade on Poloniex without restrictions.

To access the platform, you only need to provide your email, since identity verification is optional.

Poloniex verification. Source: Poloniex.com

Poloniex verification tiers

Poloniex cryptocurrency exchange offers two account verification levels: Level 1 and Level 2.

- Level 1: You obtain level one verification by default once you sign up on Poloniex. It allows for unlimited spot trading, deposits, impose an up to USD 20,000 daily withdrawal limit, and all other Poloniex services. You won’t be able to access Poloniex margin trading and IEO LaunchBase though and may experience issues with account recovery.

- Level 2: Access all Poloniex features, including up to USD 750,000 per day.

For level 1 verification, you only need to register on the exchange using a valid email address.For level 2, you will need to submit the following information and documents:

- Your residential address

- Your phone number

- Your date of birth

- Your ID, driver’s license, or identity card

- Proof of address

Here is a quick video on how to start trading on the Poloniex exchange using a tier 1 Poloniex account.

In addition to Level 1 and Level 2 accounts, large-volume traders, professionals, and institutions can apply for opening Poloniex Plus Silver, Gold, or Market Maker accounts.

Poloniex Plus services come with numerous benefits, including lower trading fees, premium features, account managers, whitelisting priority, increased withdrawal limits, and much more.

Differences between Poloniex Plus Silver and Gold accounts. Source: Poloniex.com

You can learn more about Poloniex Plus programs on the Poloniex support page or by contacting the exchange directly.

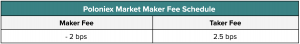

Speaking of Poloniex Market Maker Program, it was made to incentivize top liquidity providers to join the exchange. It offers them a rebate of 0.02% per executed maker order.

Poloniex Market Maker Fee Schedule. Source: Poloniex.com

To be eligible for the Poloniex Market Maker program, you must have a 30-day trading volume of a minimum of USD 10,000,000 and have at least 12 trading pair points per month.

Source: Poloniex.com

Each market maker’s performance is evaluated on a monthly basis. Learn more about how it all works here.

Poloniex Fees

When it comes to trading, Poloniex fees are amongst the lowest in the industry. Poloniex charges its users for placing spot and margin trades, as well as cryptocurrency withdrawals.

The Poloniex trading fee schedule is rather straightforward. The fee you pay per trade depends on whether you’re on the taker or maker side of the deal, as well as your 30-day trading volume. VIP customers that fall into Poloniex Plus Silver, Gold, or market maker tiers pay 0% for maker trades and less than 0.04% for executed taker orders.

| Maker Fee | Taker Fee | 30-day Trade Volume |

|---|---|---|

| 0.090% | 0.090% | Less than USD 50,000 |

| 0.075% | 0.075% | USD 50,000 – 1,000,000 |

| 0.040% | 0.070% | USD 1,000,000 – 10,000,000 |

| 0.020% | 0.065% | USD 10,000,000 – 50,000,000 |

| 0.000% | 0.060% | More than USD 50,000,000 |

| 0.000% | 0.040% | Poloniex Plus Silver |

| 0.000% | 0.030% | Poloniex Plus Gold |

| -0.020% | 0.025% | Poloniex Market Maker |

For the sake of comparison, Kraken offers a maker fee of 0.16% and 0.26% taker fee for low volume retail traders, while the most popular altcoin exchange Binance offers a0.1% base rate per trade for every low volume investor. Other popular altcoin exchanges, such as Coinbase Pro, Bitfinex, or Bittrex also charge much more per trade when comparing the most basic account tiers.

| Exchange | Maker fee | Taker fee | Visit Exchange |

|---|---|---|---|

| Poloniex | 0.09% | 0.09% | Visit |

| HitBTC (unverified) | 0.1% | 0.2% | Visit |

| HitBTC (verified) | 0.07% | 0.07% | Visit |

| Binance | 0.1% | 0.1% | Visit |

| KuCoin | 0.1% | 0.1% | Visit |

| Bitfinex | 0.1% | 0.2% | Visit |

| Kraken | 0.16% | 0.26% | Visit |

| Gate.io | 0.2% | 0.2% | Visit |

| Bithoven | 0.2% | 0.2% | Visit |

| Bittrex | 0.2% | 0.2% | Visit |

| Coinbase Pro | 0.5% | 0.5% | Visit |

Poloniex’s trading fees are higher than HitBTC’s, which charges as little as 0.07%. However, that rate applies to verified customers only, while unverified accounts pay a 0.1% maker fee and 0.2% taker fee for every trade executed on HitBTC exchange.

As such, Poloniex is the least costly option out there for users who seek to preserve their privacy.

The same fee schedule applies for Poloniex margin trading, as you will pay 0.09% per every executed margin trade (plus margin funding fees for traders who open leveraged positions).

Here’s how Poloniex ranks amongst other margin trading exchanges.

| Exchange | Leverage | Cryptocurrencies | Fees | Link |

|---|---|---|---|---|

| Poloniex | 2.5x | 22 | 0.09% | Trade Now |

| Prime XBT | 100x | 5 | 0.05% | Trade Now |

| BitMEX | 100x | 8 | 0.075% – 0.25% | Trade Now |

| Binance | 3x | 17 | 0.2% | Trade Now |

| Bithoven | 20x | 13 | 0.2% | Trade Now |

| Kraken | 5x | 8 | 0.01 – 0.02% ++ | Trade Now |

| Gate.io | 10x | 43 | 0.075% | Trade Now |

| Bitfinex | 3.3x | 25 | 0.1% – 0.2% | Trade Now |

As for deposits and withdrawals, Poloniex doesn’t charge anyone for depositing cryptocurrency. Even though no fiat currency can be deposited, withdrawn, or purchased on the platform, you can still use fiat-pegged stablecoins in your trades. Customers will be charged for withdrawals, although these are set by the network of each cryptocurrency being traded.

For example, bitcoin withdrawals cost 0.0005 BTC, making Poloniex among the very cheapest of exchanges for processing withdrawals.

Here is a small sample with some of Poloniex withdrawal fees for some of the top cryptocurrencies.

| Coin | Withdrawal Fee |

|---|---|

| Bitcoin (BTC) | 0.0005 BTC |

| Dogecoin (DOGE) | 20 DOGE |

| Ethereum (ETH) | 0.01 ETH |

| Dash (DASH) | 0.01 DASH |

| Litecoin (LTC) | 0.001 LTC |

| Tether (USDT) | 10 USDT (OMNI) / 1 USDT (ETH) / 0 USDT (TRX) |

| Monero (XMR) | 0.0001 XMR |

| Ripple (XRP) | 0.05 XRP |

| Tron (TRX) | 0.01 TRX |

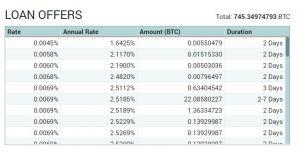

Last but not least, Poloniex has a margin lending and borrowing feature, which allows you to earn passive income from your crypto assets.

All margin borrowers pay interest to lenders based on the loaned amount. The lender typically specifies the interest rate; thus there are many different offers. As a lender, you will pay a 15% fee on earned interest paid by the borrower.

A small smaple Poloniex margin lending offers for BTC. Source: Poloniex.

In sum, Poloniex fees are very low, as it runs one of the least expensive crypto-to-crypto services in the industry.

Poloniex Security

Despite going through a high-profile hack early in its beginnings, Poloniex has recovered and today is considered to be a reliable exchange in terms of security.

After the hack, Poloniex CEO Tristan D’Agosta wrote:

“Since the hack, we implemented continual automatic auditing of the entire exchange, bolstered the security of all servers, and redesigned the way commands are processed so that an exploit like the one used in March is impossible.”

Even though the exchange lost 97 bitcoins, Poloniex had managed the situation relatively well. First, it reduced the balances of all exchange users by 12.3% to compensate users who lost their funds. Then, the exchange’s leadership compensated all users who had their balance deducted, thus demonstrating the commitment and conscience of its business.

Source: Poloniex.com

Poloniex had no notable security breaches ever since. Currently, the exchange is said to deploy the following security measures:

- Protection against DoS attacks.

- Cryptographic signatures-based DNS cache protection.

- Strong security against web attacks like robot infiltration.

- Most of the Poloniex user funds are stored in cold wallets.

- Role accounts to protect users private information

- Registry lock to prevent unauthorized changes to the website.

- Two-factor authentication.

- Session log history.

- Email confirmations and IP lockouts.

As per CryptoCompare Exchange Benchmark Q4 2019, Poloniex gets a grade B and ranks 17th amongst all 159 rated exchanges. The rating indicates that Poloniex’s security is average – the exchange scores 9.5 out of a maximum of 20 points.

On the other hand, Poloniex is an unregulated exchange. It operates outside of the traditional financial system, and that’s why it’s a crypto-to-crypto exchange only. As such, there are no guarantees if things go south, though Poloniex founders have proven to behave ethically in the past.

Another element of Poloniex security is that it respects your privacy. Since you do not need to pass KYC/AML checks before starting to trade, it has no user data to sell, which is good news for individuals who value their data and privacy.

Overall, it can be said that Poloniex takes its security seriously. It is not recommended to leave your funds on the exchange long-term, but it is unlikely to get hacked again at the moment you deposit your funds.

Poloniex Usability

Exchange usability is something that Poloniex does well. The range of screens, windows, and boxes it offers may confuse a more inexperienced trader at first. In contrast, an experienced trader may enjoy a great deal of flexibility and power in how they go about their crypto trading, be it spot, margin trades, lending, or participating in crypto project crowdfunding.

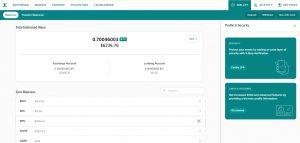

Poloniex exchange view. Source: Poloniex.com

In my view, Poloniex is one of the easiest exchanges for trading. After signing up with your email, you can deposit cryptocurrencies via the “Wallet” section, where you can manage all of your funds.

Poloniex \”Wallets\” section. Source: Poloniex.com

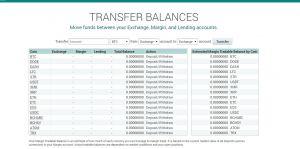

Using the “Transfer Balances” section, you can easily fund your exchange or lending accounts with a few simple clicks.

Transfer balances section. Source: Poloniex.com

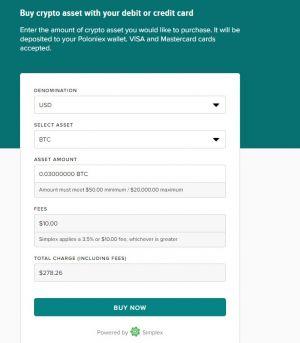

For those who don’t have any cryptocurrency, Poloniex offers an alternative – you can buy crypto directly with your credit or debit card using its Simplex integration – it will cost you either USD 10 dollars or 3.5% off a total transaction amount.

How to buy bitcoin using Poloniex exchange. Source: Poloniex.com

Poloniex crypto exchange has a slick design and a simple user interface. Though it may not be the simplest option for a complete beginner, it should not be an issue if you’re a quick learner – every window is laid out clearly and sits in the right place.

First and foremost, you will notice Poloniex’s chart for the specific order book. It is powered by TradingView, so you can customize it with your preferred indicators and other analysis tools.

Poloniex exchange view. Source: Poloniex.com

On the right side of the screen, you will see the “Markets” dashboard, where you can select cryptocurrency pair that interest you. At the moment, you can sort them by TRX, BTC, USD (stablecoins), and ETH pairs.

Below, you will find the “Notices” box, which informs you about the latest developments concerning Poloniex exchange, as well as your account.

Poloniex order books. Source: Poloniex.com

Next, you’ll see three orders placing windows for buying, placing stop-limit orders, and selling. Besides, you can observe buy and sell order books, market depth chart, your open orders, and trading history. If you enjoy the company, you can also check out Poloniex’s Trollbox, where you can chat with fellow traders.

Poloniex margin trading, available for verifying users only. Source: Poloniex.com

The margin trading dashboard looks precisely like the spot trading window. The only difference is the “Margin Account” summary table on the right side of the screen, and your open positions summary below it.

Poloniex margin lending. Source: Poloniex.com

When it comes to the margin lending section, you will find a clear and straightforward interface, too. Currently, Poloniex supports the lending of 16 crypto assets, but more are likely to be supported in the future. Here, you can find the latest markets and loan offers. Alternatively, you can create an offer with your preferred interest rate and conditions, too.

Performing any of these operations is easy, requiring only that the user transfer cryptocurrency from their exchange accounts to either their margin or lending accounts. This is also helped by the clear layout of Poloniex’s screens and pages, which have an uncluttered, white-background design.

Similarly, completion of trades and withdrawals is fairly quick, with the exchange stating that withdrawals will take no more than 24 hours at the very latest. That said, some customers have complained that, during peak trading periods, they can wait a while for a response from customer support.

Poloniex Mobile App

Poloniex mobile app.

Even though you can navigate the Poloniex website on your mobile phone browser, you can also use one of the Poloniex apps for either Android or iOS devices.

The apps are convenient for trading on the go, but they do not include all features available on the website just yet. You won’t have access to margin trading, the ability to buy crypto with a bank card or make use of margin lending or the Poloniex IEO platform.

Nevertheless, it’s still a good option for spot trading, managing accounts, creating alerts, and managing your crypto finance whenever you’re away from your computer.

Poloniex LaunchBase

Poloniex LaunchBase. Source: Poloniex.com

Initial exchange offering (IEO) enthusiasts can also make use of Poloniex LaunchBase, which debuted in May 2020.

Here, you can find some of the latest IEO projects entering the cryptoverse and invest in them from the early stage. Mind that you have to be a verified customer in order to participate in Poloniex’s IEOs.

Poloni DEX Decentralized Exchange

Poloni DEX exchange. Source: Poloniex.org

Poloni DEX is a decentralized version of Poloniex exchange. Although it is a different exchange than Poloniex, the two exchanges are working closely together since the acquisition and relocation of the company to Seychelles.

Poloni DEX was previously called “TRXMarket” and is a TRON-based exchange. The biggest plus is that it does not charge any trading fees (0% per trade), smooth design, and seamless user experience.

However, like most decentralized exchanges at this stage, it does lack liquidity, especially compared with its parent exchange, which makes it more difficult to execute trades on the exchange.

Poloniex Customer Support

Poloniex customer support is sort of a mixed bag, as many users have complained about how slow it is to respond. Regardless, it is reachable via the following channels:

- Support ticket system via the help center

- Extensive FAQ knowledge base

- Trollbox

- Twitter and other social media channels.

Poloniex does not offer phone support and is said to reply within several days. The fastest way to get support is by asking the moderators in the trollbox directly.

Poloniex Deposit and Withdrawal Methods

Poloniex allows trades only in cryptocurrency so customers have to make crypto deposits and withdrawals. Fortunately, this is simple enough: the Deposit & Withdrawals page gives customers a wallet address for each cryptocurrency they wish to deposit, and it allows them to enter their own external crypto wallet address for any currency they want to withdraw.

Poloniex does not support fiat deposits, but you can buy bitcoin and other cryptocurrencies using your credit or debit card via the exchange’s integration with the crypto payments processor Simplex.

With Simplex, you can purchase between USD 50 – 20,000 per day and up to USD 50,000 per month. The payment processing fees include either USD 10 fee or 3.5% off the total transaction amount (whichever is higher).

Buy bitcoin via Poloniex using its Simplex integration. Source: Poloniex.com

Poloniex deposits and withdrawals are processed quickly and without long delays. Poloniex does charge a withdrawal fee per every cryptocurrency, which varies per digital currency.

Poloniex Review: Conclusion

Poloniex exchange platform had turbulent several years, but it seems that now the exchange is ready to stabilize and win back its user base. The trading platform offers some of the lowest cryptocurrency trading fees on the market, margin trading, margin borrowing, has its decentralized exchange, and the IEO launchpad. Even though its customer service is not the best, it allows you to trade without forced KYC measures, which is a rare positive element in today’s crypto industry.

Poloniex remains unregulated, though, so be wary and don’t leave significant amounts of crypto assets on the exchange for prolonged periods. Due to its clear interface, the exchange is an excellent starting point for beginners, as well as more experienced traders. It takes just a couple of minutes to sign up and start trading, so use it to your advantage.