Crypto Market Sentiment Sinks into Neutral Zone; EOS Rules the Week

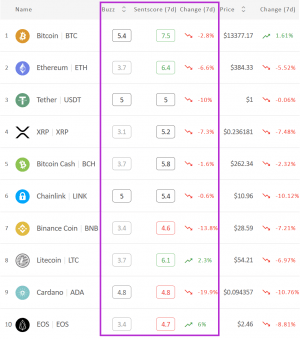

The combined moving 7-day average crypto market sentiment score (sentscore) for the top 10 coins by market capitalization dropped out of the positive zone last week, and though it had stood very near the border at the time, it sunk deeper into the neutral zone since, according to the crypto market sentiment analysis service Omenics. Compared to the score of 5.92 a week ago, the sentscore for the past seven days is now 5.55/10.

Despite bitcoin (BTC) making a significant break last week, nearing the USD 14,000 level, the top 10 coins didn’t see the best of weeks sentscore-wise. All but two of the coins’ scores fell. These two are the winners of the week, the first of which is EOS, having risen 6% to the score of 4.7. And this comes after the coin stood as the second-largest loser of the last week, behind tether (USDT).

The other green coin is litecoin (LTC), which experienced a 21% rise in its price in October, and now its sentscore also went up 2.3% – though that wasn’t enough to lift it from last week’s score of 6.1. Nonetheless, it’s still one of only three coins in the positive zone.

Speaking of which, despite their respective falls, bitcoin and ethereum (ETH) still remain in the positive zone, though significantly further from the nearly-reached next levels: score of 8 for the former and 7 for the latter.

The drops have been quite large this time around, resulting in more coins falling below the grade of 5. At the top here is cardano (ADA), whose score decreased nearly 20%. And it’s not the only coin with a double-digit drop. Binance coin (BNB)‘s and tether’s scores dropped 14% and 10%, respectively. Chainlink (LINK) had the smallest drop of less than 1%.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive

The situation for these coins within the last 24 hours alone is not any better. Though the combined moving average sentscore for the top 10 coins managed to just barely break back into the positive zone last Monday, compared to that, it now dropped to 5.47/10. Still, all but one coin are green today. The week’s winner is the day’s loser. EOS is not only the single red coin today, but its drop also pushed it into the negative zone (3.9), making it the only coin there. The three coins in the positive zone this week, are there this day as well. BNB and ADA are still below the grade of 5, with the former standing relatively near the negative zone (4.1).

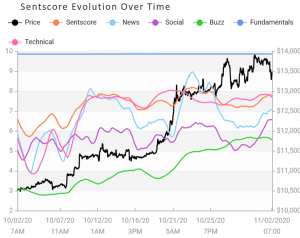

Daily Bitcoin sentscore change in the past month:

Focusing now on the weekly performance of the 29 coins outside the top 10 list which are also tracked by Omenics, we find that only 6 coins had a rise in their scores. Of these, trueUSD (TUSD) took the lead with a 9% rise. Among the red coins, tezos (XTZ) dropped the most (16.5%) and into the negative zone with a score of 3.7. Monero (XMR) was in the positive zone for a while, but thanks to its 9% drop, it fell to 5.3/10, with no coins taking its spot. And while the number of coins in the positive zone fell to zero, that in the negative zone climbed to three. Besides tezos, ontology (ONT) also joined komodo (KMD) which has been residing in this zone for several weeks now.

___

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 39 cryptocurrencies.