Litecoin Price Prediction 2024, 2025, 2026 – 2034

As an early fork of Bitcoin, undertaken by a highly respectable software engineer, Litecoin (LTC) was, for a long time, one of the top altcoins and considered “the silver to Bitcoin’s gold”. It has since fallen out of favor with investors, who now prefer tokens with more utility and personality.

However, Litecoin’s cheap and fast payment utility still stands strong, and, in this Litecoin price prediction, we’re going to look at what affects the Litecoin price in the years to come. While also looking at what the Litecoin network offers users, now and in the future.

Litecoin Price Prediction Overview

- Litecoin was launched in 2011 and has long been seen as the silver to Bitcoin’s gold.

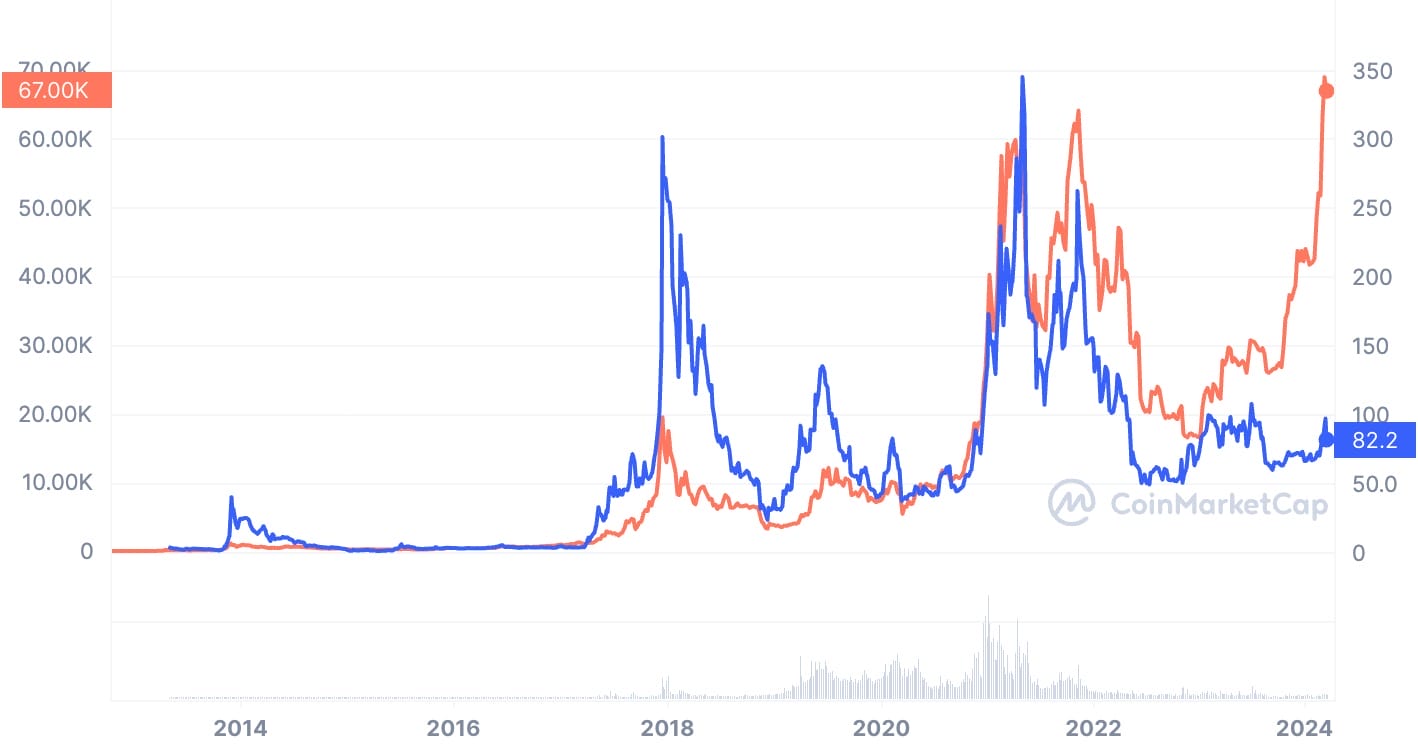

- Historically, Litecoin has rallied before each of its own Halving events, and followed the Bitcoin price closely in its post-halving rallies.

- Litecoin spent most of its former years below $6, before rallying to a high of $373.66 in December of 2017.

- In the crypto market rally of 2021Litecoin hit its ATH of $412.96 on May 9th, 2021.

- It has since underperformed and steadily dropped down the charts as investors have chosen meme coins, layer 2 tokens, and protocol utility and governance tokens over mono-utility layer 1 coins.

- Despite this narrative persisting in the crypto world, the Litecoin Foundation touts Litecoin as a form of fast and cheap payment.

- Our outlook for LTC is a positive one, should crypto regulations fall in its favor.

Litecoin Price Predictions 2024-2034

The table below offers a summary of Litecoin price predictions for each year of the next decade. In the sections beneath this table, we have covered what might impact the Litecoin price in each of these years.

| Year | Potential Low (ROI) | Average Price (ROI) | Potential High (ROI) |

|---|---|---|---|

| 2025 | $101.39 (24.74%) | $101.74 (25.16%) | $102.04 (25.53%) |

| 2026 | $100.05 (23.08%) | $100.73 (23.92%) | $101.32 (24.65%) |

| 2027 | $98.69 (21.41%) | $99.72 (22.68%) | $100.63 (23.80%) |

| 2028 | $97.25 (19.64%) | $98.72 (21.44%) | $99.91 (22.91%) |

| 2029 | $95.93 (18.02%) | $97.71 (20.21%) | $99.32 (22.18%) |

| 2030 | $94.48 (16.24%) | $96.70 (18.97%) | $98.62 (21.32%) |

| 2031 | $93.21 (14.66%) | $95.70 (17.73%) | $97.84 (20.37%) |

| 2032 | $91.87 (13.02%) | $94.69 (16.49%) | $97.19 (19.56%) |

| 2033 | $90.38 (11.19%) | $93.68 (15.25%) | $96.55 (18.78%) |

| 2034 | $89.12 (9.63%) | $92.68 (14.01%) | $95.83 (17.89%) |

Litecoin Price Prediction For 2024

Litecoin started 2024 well and has followed a Bitcoin and wider crypto market rally that ensued as a result of Bitcoin ETF approval in January. It also followed a wider market correction, losing ~20% of its value in mid-March as Bitcoin and the market dipped.

Looking further out into 2024 there is little to get excited about in the Litecoin world as there is no roadmap to outline a future for the cryptocurrency. The Litecoin Summit 2024 is happening in Nashville, USA, in July and such an event will produce announcements and positive news that might boost the Litecoin price.

Overall, our Litecoin Price Prediction for 2024 is positive but subdued, and mainly reliant on the positive momentum expected for Bitcoin and the wider cryptocurrency market.

Litecoin Price Prediction For 2025

With a seemingly pivotal presidential election happening in the USA in 2024, it is likely that the duty of regulating cryptocurrencies in the world’s largest economy will be pushed back into 2025. With one of the two candidates calling Bitcoin an ‘additional form of currency’, and the huge uptake of Bitcoin ETFs in 2024, there is a prospect that these regulations could be positive for cryptocurrency adoption and use.

With Litecoin touted as a cryptocurrency for instant payments, and familiar to many due to its longevity in the markets, regulations that provide a framework for merchants to accept cryptocurrencies as payment are likely to favorably impact Litecoin—which is already accepted by over 2,500 stores and merchants. This is true in the USA and any other countries around the world that implement positive regulations for cryptocurrency payments.

Finally, 2025 is when many expect the impact of the 2024 Bitcoin Halving to be felt—an impact that typically pushes the world’s number 1 cryptocurrency to new ATHs, and drags the rest of the market up with it. This will likely have a positive effect on the price of Litecoin which tracks Bitcoin’s price movements closely during these events.

All-in-all, 2025 is set to be a hugely positive year for Litecoin and the cryptocurrency market, and our Litecoin price prediction for 2025 is equally as positive.

Litecoin Price Prediction For 2026

If 2025 is when the markets rise as a result of the 2024 Bitcoin Halving, then 2026 is when those price are expected to come back down to earth—with cryptocurrencies typically losing 75% of their value in the fallout.

However, with cryptocurrency regulations being put in place around the world—as a result of their increased popularity over the last Halving cycle—along with increased institutional and public adoption of these assets, then this drop is predicted to be substantially less than before.

This means that, while Litecoin is forecast to lose value over the course of 2026, it will not do so at the same rate as before.

Litecoin Price Prediction For 2027

2027 is the year of the next Litecoin Halving, when block rewards will be reduced from 6.25 LTC to 3.125 LTC. As with previous Litecoin Halvings, and in opposition to what happens with Bitcoin Halvings, the price of tokens is expected to rise before the event, before dramatically falling afterward.

However, with crypto payment regulations firmly in place by 2027, and many thousands of merchants around the globe accepting Litecoin for payment, we expect less sell pressure than in previous Litecoin Halving events and for the token to sustain something closer to its higher valuation. Consequentially, our 2027 Litecoin price prediction offers muted price growth but still price growth nonetheless.

Litecoin Price Prediction For 2028

Cryptocurrencies should be well on their way to widespread adoption by 2028, as the public’s demand for such is met by regulation that favors their use and acceptance as payment in countries around the world.

Litecoin, with a Foundation made up of experienced industry experts helping to direct its course, is likely to have stayed out in front when it comes to being used as a means of payment.

2028 is also the year of the fifth Bitcoin Halving event. With adoption of cryptocurrencies, both by individuals and institutions, now global, prices are expected to rise in early 2028 in anticipation of this event, and then expected to drop afterwards in a “buy the rumor sell the news” style.

Litecoin will follow this, as despite its adoption as a convenient method of payment, many still see it as the silver to Bitcoin’s gold—a narrative that it has struggled to break away from.

Litecoin Price Prediction For 2029

If there is a fallout from the fifth Bitcoin Halving then this will be felt in 2029. However, the Litecoin Foundation may have helped to increase the utility of Litecoin so much by this point that it has partially decoupled from the Bitcoin price, and is less impacted by drops in the Bitcoin price than before.

As a result, while Bitcoin price predictions might have Bitcoin dropping in price in 2029, Litecoin is expected to remain relatively stable as a result of its utility.

Litecoin Price Prediction For 2030

Cryptocurrencies are an evolving industry based on the novel and fast-evolving technology of blockchains. As a result it can be difficult to forecast their prices far into the distant future.

However, 2030 looks to be the year that cryptocurrencies stabilize as a part of society, and people and nations around the world are transacting more and more on the blockchain than ever.

Numerous improvements to the Litecoin protocol by this point are likely to keep it out in front as one of the more favorable decentralized cryptocurrencies amongst the public. As a result, our Litecoin price prediction for 2030, is resoundingly positive.

Litecoin Price Prediction For 2031

This is the year of the fifth Litecoin Halving, with mining rewards being reduced from 3.125 LTC to 1.5625 LTC per block. Many users will buy into the history of these events, turning them into a self-fulfilling prophecy and, again, this Litecoin Halving will be a “buy the rumor sell the news” event.

So—for those wondering “will Litecoin go up?” this time around—Litecoin is expected to rise in the first half of 2031, and fall in the second half, after the Halving.

Litecoin Price Prediction For 2032

Another Bitcoin Halving and another chance for Litecoin to prove its resilience and how much it has separated from the Bitcoin price. As it has now grown immensely in popularity, and is being used daily around the globe, the Litecoin Halving, not the Bitcoin Halving, is what actually puts pressure on the Litecoin price in 2032 as renewed scarcity drives prices upwards.

Litecoin Price Prediction For 2033

The Bitcoin Halving fallout will have little impact on the Litecoin price, which, like all good means of exchange, has now begun to stabilize in price, with a steady level of inflation dictated by increased demand and decreasing supply.

Litecoin Price Prediction For 2034

Stable price growth has dominated the Litecoin narrative until now, and our Litecoin price prediction finds that the Litecoin Foundation has guided the Litecoin protocol to an excellent position in 2034.

Here it is one of the preeminent, decentralized methods of exchange, accepted by merchants around the world and used for all sorts of transactions. Token prices are stable but increase at a steady pace, in line with the increase in demand for Litecoin itself.

Historical Performance of Litecoin

Litecoin was launched in October 2011, but the earliest price data we have comes from April 28th, 2013, where one token was priced at $4.3668. In November 2013 the crypto market rallied hard, an event attributed to the 2012 Bitcoin Halving. In this rally, Litecoin hit a high of $40.57.

From this high Litecoin declined, and continued to do so throughout 2014, bottoming out with its all-time low of $1.11 in January 2015. LTC stayed under $6 for most of 2015, 2016, and Q1 of 2017.

A bull run ensued at the beginning of Q2 2017, and Litecoin gained an incredible 85x to hit an ATH of $373.66 in December of 2017. During this time Litecoin also added the SegWit upgrade to the network, and moved toward adding support for the Lightening Network by the end of the year.

The Litecoin price declined precipitously throughout 2018, bottoming out at $22.21 in December almost exactly a year after hitting its ATH, a loss of 94%.

While the whole crypto market dropped in this time, with Bitcoin losing 83% of its value, some still hold Litecoin’s creator, Charlie Lee, responsible for Litecoin’s decline as Lee announced that he had sold all of his Litecoin holdings on December 20th, 2017.

The Litecoin price rallied in the first half of 2019—hitting highs above $140—in anticipation of the Litecoin Halving expected in August, before dropping into the Halving event and continuing to decline afterwards. That December it bottomed out at support around $40.

An early 2020 rally to $80 was quickly topped out by the emerging Coronavirus pandemic, and LTC declined to hit a low around $25 before climbing above $40 and using that price as support for the middle of 2020.

In late October 2020, along with the rest of the crypto markets, Litecoin rallied, eventually hitting its current ATH of $412.96 on May 9th, 2021. It quickly declined, finding support at the $120 level, before rallying back to find resistance at $280 in November.

From here Litecoin declined as the crypto markets entered the long Crypto Winter of 2022. In May 2022 Litecoin upgraded to integrate the optional privacy solution Mimblewimble, an upgrade that saw a 19% drop in LTC price.

On June 8th, as a result of this upgrade conflicting with South Korea’s stringent AML regulations, the South Korean-based exchanges Bithumb and Upbeat announced they were withdrawing support for Litecoin. This led to a 34.78% loss in value over a week which caused Litecoin to hit a bottom of $41.60.

From here Litecoin increased, finding support at $50 for the rest of 2022, before rallying into 2023. With the upcoming Litecoin Halving in August, the price rose struggled against resistance at $100 in the first half of the year, before spiking 20% in a single day on June 30th. The LTC price then declined sharply into the Litecoin Halving event, finding support of $63, $65, and then $60 in the aftermath.

From here, Litecoin rallied with the rest of the crypto markets into 2024, hitting highs near $80. After losing 10% of its price on the 3rd day of 2024, finding support at $65, Litecoin traded sideways. At the end of February the Litecoin price rallied, briefly breaking $105 on March 11th, before dropping down to find support above $80.

Current State of Litecoin

| Coin Name | Litecoin |

| Litecoin Symbol | LTC |

| Litecoin Price | $81.29 |

| Litecoin Price Change 24h | ▼ -0.59% |

| Litecoin Price Change 7d | ▼ -4.05% |

| Litecoin Market Cap | $6,055,420,212 |

| Circulating Supply | 74,495,150 LTC |

On the charts, Litecoin is currently performing exceptionally well, and has followed Bitcoin and the rest of the crypto market up the charts since February, but has seen a sharp, 20% correction since climbing above $100 for the first time in almost 8 months.

Since the beginning of 2024 the Hashrate of Litecoin miners, along with the difficulty to mine blocks, has increased dramatically, hitting its highest level ever.

This means that more miners are using more resources to try mine Litecoins, greatly increasing the security of the chain for users. After a huge spike in transaction count at the end of 2023, the Litecoin transaction count has decreased by 80% to rest around 200,000 per day, almost double what it was before the increase at the end of 2023.

Market Position and Performance

Litecoin currently sits 20th when coins are ranked by market cap, just behind Uniswap, with a market cap of $7 billion. While it has followed general crypto market movements into 2024, Litecoin has not enjoyed its own pump.

This is most likely down to the fact that nothing has emerged from its ecosystem to excite investors, and that investors have been focusing on meme coins, AI coins, and Ethereum layer 2 tokens, as this is where the hype has been so far in 2024.

What is Litecoin and What is it Used For?

Launched in October 2011, Litecoin was initially designed to complement the Bitcoin network, an “lite version of Bitcoin” that would act as the silver to Bitcoin’s gold. It was specifically designed to address Bitcoin’s shortcomings, high transaction fees (for the time) and slow transaction confirmation times, and to combat the use of ASIC mining rigs that have since come to dominate Bitcoin mining.

Litecoin’s creator is Charlie Lee, a MIT graduate and former Google software engineer who went on to be Engineering Director of Coinbase and is now the Director of the Litecoin Foundation. Lee announced Litecoin on the popular Bitcointalk forum and open sourced the Litecoin code on October 7th 2011.

This allowed others to review the code and run it on a testnet to ensure it was all working smoothly. This was all part of Lee’s attempt to make the launch of Litecoin as fair as possible. The time of mainnet launch was then established via a poll on the Bitcointalk form and the network went live on October 12th 2011.

Fun Fact – The Litecoin genesis block contains the NY Times headline from October 5th, 2021: Steve Jobs, Apple’s Visionary, Dies at 56; to prove it was created after this date.

There was no premining for Litecoin and all the LTC coins in circulation have be emitted through the mining process.

Litecoin Compared to Bitcoin

While Litecoin is seen to have become a competitor to Bitcoin, it was meant to supplement it by being faster, cheaper, and, therefore, more suited for day-to-day transactions. To create Litecoin Charlie Lee forked the Bitcoin protocol but made numerous changes:

- Litecoin’s token hard cap is 84 million, 4x that of Bitcoin’s 21 million

- Litecoin’s block time is 1/4 that of Bitcoin’s, 2.5 minutes vs 10 minutes

- Litecoin uses Scrypt for its hashing function in its mining algorithm and Bitcoin uses SHA-256

- Litecoin kept the 4 year halving schedule intact, increasing the number of blocks between Halvings by a multiple of 4, from 210,000 to 840,000

What’s in a Hashing Function?

Hash functions are used to ensure the integrity of data, e.g. the word Cryptonews or a whole book, and create a unique 64 character output, e.g. 783a355dec6f7549accf8eb752dae0390af125f68c0bed1eeeb0a3e8acdc7faf, to represent it. Any change in the input will create a very different output.

When mining crypto, miners need to recreate a target hash for each block to earn that block’s reward, and a block’s hash is immutably stored in its header to allow users to verify that the data in the block has not been tampered with.

Different hash functions require different computing resources, the Bitcoin mining focuses on GPUs and could initially be done on a computer, however specialized mining machines, called ASIC miners, were developed to refine the process, making it hugely impractical to use a desktop computer to mine Bitcoin.

Litecoin’s creator chose a hashing function that focused on using higher memory, instead of GPU, to combat the rise of ASIC mining. However, ASIC miners were also created for the Litecoin mining algorithm, making this innovation in Litecoin obsolete.

The resulting network was indeed an improvement on the initial Bitcoin protocol in terms of measurable metrics. The table below compares the important throughput metrics of the Bitcoin and Litecoin blockchains, two of the best proof-of-work coins:

| Bitcoin | Litecoin | |

| Transaction Cost | $7.258 | $0.01 |

| Transaction Confirmation Time | 10 minutes | 2.5 minutes |

| Maximum Transaction Per Second | 7 TPS | 56 TPS |

Fun Fact – Dogecoin is a fork of Luckycoin, which was a fork of Litecoin, and these two protocols share the same mining algorithm.

Litecoin Network Upgrades and Confidential Transactions

The Litecoin network has undergone many of the same upgrades and improvements as Bitcoin, typically implementing them earlier than Bitcoin—leading many Bitcoin maximalists to jest that Litecoin is Bitcoin’s testnet.

Litecoin has received all the major upgrades that have been implemented on the Bitcoin mainnet, including SegWit and Taproot, along with the Lightening Network and a few of its own. The most notable of these is the privacy and scalability upgrade, Mimblewimble, implemented in May 2022.

Mimblewimble, named after the tongue-tying spell from Harry Potter, is a block extension protocol that operates within a space in the Litecoin block and gives the network’s users the option of confidential transactions. When using Mimblewimble, a transaction’s value and the addresses used in it are concealed from everyone except the participants.

Using the Mimblewimble functionality of the Litecoin network is similar to using the Lightening Network. A user first sends their coins to a Mimblewimble address, and can then transact privately using the Mimblewimble protocol. When they want to retrieve their tokens they simply send their tokens out of the Mimblewimble protocol.

Litecoin Foundation

The Litecoin Foundation is a nonprofit based in Singapore and was created to promote the adoption, education, and development of the Litecoin protocol. Since its inception, the Litecoin Foundation has spearheaded and funded numerous projects to enhance the user experience and utility of the Litecoin blockchain. These include the Litecoin Core protocol and the following projects:

- Litewallet: The official Litecoin wallet of the Litecoin Foundation that works like many mobile wallets and allows users to buy, send, and receive Litecoins.

- Mimblewimble: The previously discussed privacy extension to the Litecoin protocol.

- Lightening Network: A layer 2 solution that added low-cost, scalable microtransaction capabilities to the network.

- OmniLite: A layered protocol that allows for the creation of tokens, smart contracts, and NFTs on top of the Litecoin network.

What Can Litecoin Be Used For?

Litecoin’s main use is as a means of payment and settlement between individuals and merchants. It is, purportedly accepted at over 2,500 stores and merchants around the world, over 100 businesses accept Litecoin through BitPay, where it is the top payment currency. Merchants can choose to accept it through the Shopify and WooCommerce e-commerce platforms.

With the release of ordinals and the launch of OmniLite on top of the Litecoin network the use cases for Litecoin are increasing. These protocols now mean that users can buy and sell NFTs and tokens with Litecoin, and interact with protocols and dApps managed by smart contracts that are connected to the network.

Factors Influencing Litecoin’s Price

The price of Litecoin is affected by many factors. Here we’ve listed the preeminent factors affecting Litecoin and its price:

- Wider Crypto Market: (a.k.a. The Price of Bitcoin) This is the preeminent factor affecting the valuation of all altcoins until we see crypto regulations put in place which allow for these coins and tokens to be used as a medium of exchange and accepted by merchants around the globe.

- Adoption for Payment: Litecoin is touted as a fast, cheap form of payment. As it lacks many other straightforward use cases, the adoption of Litecoin as a form of payment will increase its utility and demand for the token.

- Network Utility: While payments may be Litecoin’s main focus there are layer 2s and other forms of utility being added to the network. If these become more widely used then demand for Litecoin is going to increase.

- Global Crypto Regulations: Litecoin aims to be a coin for payments. Before this can happen en masse the right regulations need to be in place to make people feel comfortable using it. If enacted regulations try to protect existing methods of payment then the Litecoin price and utility may struggle in the future.

- Privacy Coin Woes: Litecoin has already been delisted by South Korean exchanges because of its optional privacy element. As governments around the globe seem to be particularly wary of privacy-focused coins this might impact whether or not it is favored or not favored—or even permitted—as a means of exchange.

- Protocol Improvements: While it is touted as a cheap and easy means of payment, there are many other altcoins out there now that can exchange value faster and at a lower cost to the user. Improvements to the Litecoin protocol to keep up with competitors are likely to boost its price.

Litecoin Price Predictions by Other Experts and Analysts

As one of the most popular altcoins, there are no shortage of Litecoin price predictions out there to read through. Here we’ve summarized some top Litecoin price predictions from around the web to give a good overview of what is expected for the Litecoin price.

Charlie Lee Litecoin Prediction

Charlie Lee, the founder of Litecoin, stated in early 2023 that Litecoin could be valued as high as 10% of the Bitcoin price, also expecting it to trade at 0.025 LTC/BTC, during the next bull market.

As we expect that to be this year, and for Bitcoin to hit a maximum of $90,000, that prices Litecoin at a healthy $2,250 in the next bull market.

Master Litecoin Prediction

Writing on X in February, the popular @MASTERBTCLTC account predicts a $5,000 Litecoin price by June of 2024.

SimpleSwap Litecoin Prediction

In a video on YouTube, the SimpleSwap exchange predicts that Litecoin’s price will range between $151 and $200 in 2025 and between $270 and $300 in 2030.

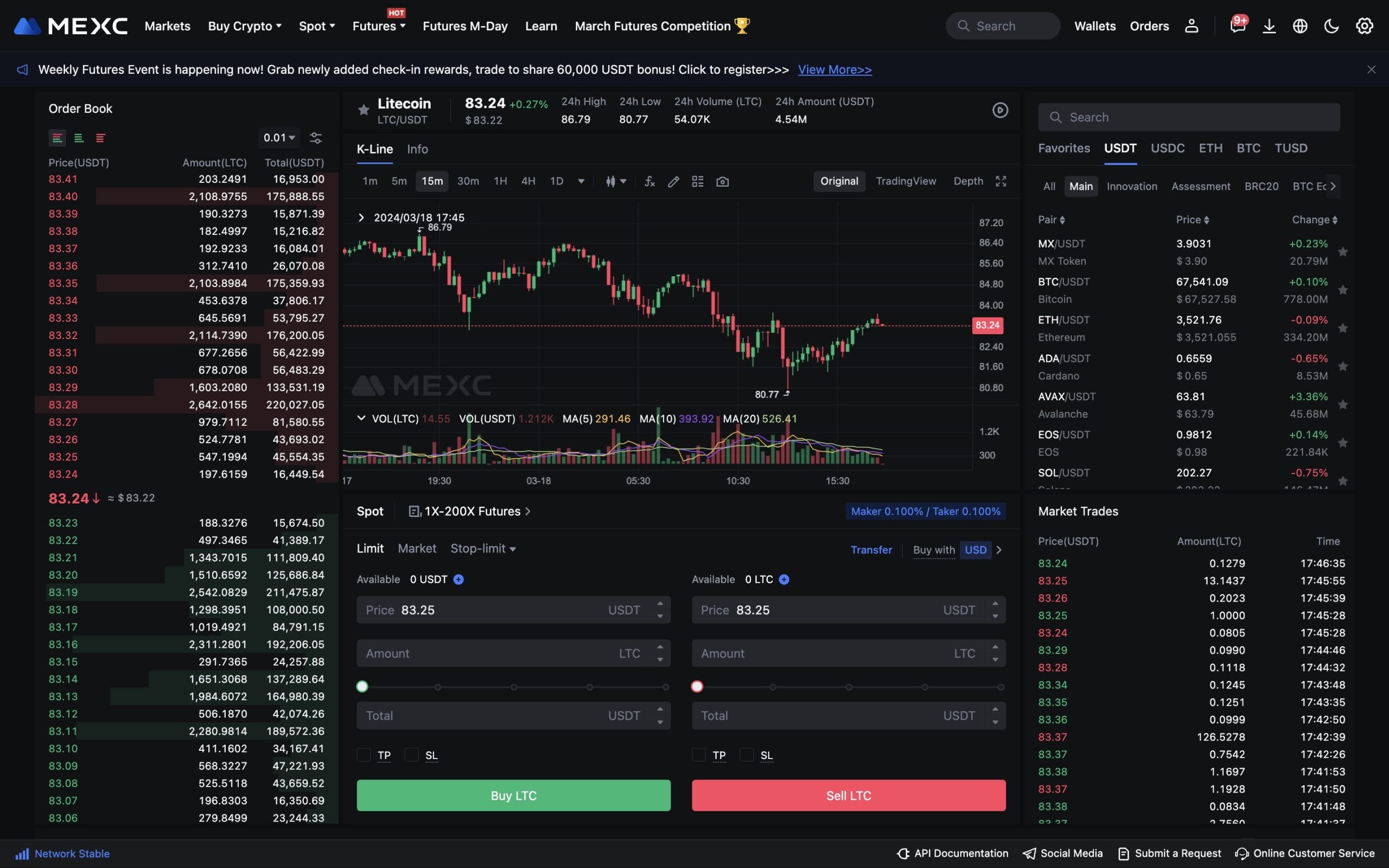

How to Buy Litecoin?

As one of the most popular and long-term altcoins, Litecoin is available on almost all of the top crypto exchanges. However, the exchange that we most recommend for buying and trading Litecoin is MEXC.

With over 10 million customers worldwide, 0% spot market trading fees, a mobile app, and professional charting tools, MEXC is perfect for traders of all levels. On MEXC users can trade LTC on 4 different markets, including a Perpetual Futures market.

How to Buy Litecoin (LTC) on MEXC

- Open your free MEXC account

- Fund your account through one of the available payment methods: debit/credit card, bank transfer, P2P purchases, or a third-party vendor.

- Head to the Spot Market page on MEXC

- In the top right-hand corner is a search bar where you can search for “LTC” and choose your preferred trading pair

- In the Buy section the module at the bottom of the page you can enter your Litecoin order and hit “Buy LTC”

Bottom Line for Litecoin Price Prediction

Long touted as the silver to Bitcoin’s gold, Litecoin has slipped down the chart with the emergence and popularity of stablecoins, meme coins, and protocol governance and utility tokens. However, it still sticks to its original vision and purpose and will keep focusing its development and energy in that direction.

As cryptocurrency regulations emerge, and utility starts to take precedence over speculation, Litecoin could yet again see a return to the top ten and fulfill its purpose as a fast and cheap payment solution. However, an in-built, but optional, transaction privacy function could mean that it is not favored by crypto regulators and therefore falls out of favor with the general public.

FAQs

Will Litecoin Recover?

As a crypto bull market gets underway in 2024 our authoritative price prediction predicts that Litecoin will go from strength to strength in a crypto-centric future.

Is Litecoin a Good Long-Term Investment?

Long considered the silver to Bitcoin’s gold, many would say that Litecoin makes an excellent long-term investment—especially with a limited supply of 84 million tokens. But, the Litecoin Foundation is focused on making it a means of payment, which dampens the “silver to Bitcoin’s gold” narrative.

Risks and Considerations in Litecoin Investment

Like all cryptocurrencies Litecoin is a volatile assets, and its success largely hinges on the adoption of the coin as a method of payment. However, there is a finite number of Litecoin (84 million) that will ever exist, so if demand increases so will the price.

Will Litecoin Be the Next Bitcoin?

With Litecoin having 4x as many tokens as Bitcoin it only needs to reach 1/4 of the valuation to be priced the same. However, with its long-term position set in the market, and it being seen as the silver to Bitcoin’s gold, it is highly unlikely to be summiting the charts anytime soon.

References

- Litecoin Foundation proudly presents Litecoin Summit 2024 in Nashville, Tennessee – Litecoin.com

- Donald Trump says he has ‘fun’ with crypto, bitcoin is an ‘additional form of currency’ – TheBlock.co

- Litecoin Successfully Activates SegWit – CoinDesk.com

- Litecoin Creator Sells Stake Citing ‘Conflict of Interest’ – CoinDesk.com

- Crypto Exchanges Delist Litecoin Over Privacy Feature Concerns – DeCrypt.co

- Litecoin blasts past $100 amid surging hash rate, upcoming ‘halving’ – TheBlock.co

- THE FUTURE OF MONEY. – Litecoin.com

- Litecoin Project – GitHub.com

- Lightning Network – Lightening.Network

- Who Accepts Litecoin? A Complete Guide on How to Spend Litecoin. – Bitpay.com

- Blockchain is revolutionizing how the world pays, learn the stats behind the shift. – Bitpay.com

- @SatoshiLite Tweet – Twitter.com

- @MASTERBTCLTC Tweet – Twitter.com

- Litecoin LTC Price Predictions 2025, 2030, and 2035 – YouTube.com

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eliman Dambell

Eliman Dambell

Michael Graw

Michael Graw