Cardano Price Prediction 2024, 2025, 2026–2034

Despite its technological merits and sustained position as a high market cap project, many cryptocurrency investors know little about the Cardano blockchain and its token ADA. Currently as of April 27, 2024, Cardano (ADA) is trading at $0.468, which is a +0.39% change over the past 24 hours.

In this Cardano price prediction, we dive into what Cardano offers users and what the technological future looks like for this blockchain. But first, we provide a Cardano price prediction for each year between now and 2030 and discuss how we came to these conclusions.

Cardano Price Prediction Overview

| Coin Name | Cardano |

| Cardano Symbol | ADA |

| Cardano Price | $0.468 |

| Cardano Price Change 24h | ▲ 0.39% |

| Cardano Price Change 7d | ▼ -4.38% |

| Cardano Market Cap | $16,701,420,535 |

| Circulating Supply | 35,636,631,396 ADA |

- Cardano launched in 2017 and its first listed price was $.02461.

- However, Cardano didn’t gain smart contract capabilities until 2021, when it also hit its all-time high of $3.10 on September 2, in the middle of a market-wide bull run.

- The price of ADA steadily declined over the next few years, finding critical support at the $0.25 mark in Q3 of 2023.

- From here Cardano’s ADA joined a market-wide, Bitcoin ETF-fueled rally to enter 2024 priced above $0.60, a price it regained in later February after falling to $0.46.

- We expect Cardano to close in on highs of $5 in 2030, posting new all-time highs (ATHs) in the 2 years prior to that.

- Amongst other things. the price of ADA is affected by the SEC and crypto exchange lawsuits, network scaling solutions, and the effectiveness of soon-to-be-introduced community governance.

Cardano Price Predictions 2024-2034

Below we’ve discussed our Cardano price predictions for each year between now and 2030 in detail, covering the different aspects we expect to impact the Cardano price in each year.

Year Potential Low (ROI) Average Price (ROI) Potential High (ROI) 2025 $2.48 (429.10%) $2.90 (519.59%) $3.57 (662.54%) 2026 $2.60 (454.75%) $3.48 (643.18%) $4.77 (917.65%) 2027 $2.80 (498.11%) $4.06 (766.76%) $5.99 (1,178.48%) 2028 $2.91 (520.96%) $4.64 (890.35%) $7.19 (1,433.58%) 2029 $2.95 (528.87%) $5.22 (1,013.94%) $8.64 (1,743.01%) 2030 $3.31 (605.82%) $5.80 (1,137.52%) $9.62 (1,952.38%) 2031 $3.32 (608.14%) $6.38 (1,261.11%) $11.02 (2,251.80%) 2032 $3.64 (675.76%) $6.96 (1,384.70%) $12.37 (2,539.79%) 2033 $3.80 (710.73%) $7.54 (1,508.29%) $13.39 (2,756.30%) 2034 $3.70 (689.73%) $8.12 (1,631.87%) $14.82 (3,061.44%)

Cardano Price Prediction For 2024

2024 started well for the crypto markets with Bitcoin, on the back of ETF approval, dragging the whole market back above a $2 trillion market cap as it climbed above $57,000. The first half of 2024 looks to have more excitement in store, with the anticipated Bitcoin Halving set to happen in mid-April.

While, historically, the impact of these events has not been felt until 12–18 months after the fact, the amount of attention Bitcoin has received so far might mean this year will be different.

In the world of Cardano, an upgrade to the network’s smart contracting language, Plutus, was released in February, among other improvements, it allows users to port smart contracts from Ethereum to the network. There is also the Chang hard fork, scheduled for Q1 of 2024, that will initiate governance capabilities and start the charge to deliver minimum viable community governance to the network by the end of the year—a process that has been years in the making.

Despite all this, Cardano’s status as a security will be fought in court, as Coinbase, Binance, and Kraken all ask their judges, in their individual lawsuits, to dismiss the cases, accusing the SEC of overreaching. Until this is decided, however, investors will be wary of ADA and the 11 other tokens listed as securities by the SEC.

All that said, our Cardano price prediction for 2024 is a largely positive one, and we expect Cardano to hit highs of $1.03, lows of $0.40, and maintain an average price of $0.60.

Cardano Price Prediction For 2025

2025 is when many analysts expect the effects of the Bitcoin Halving to be felt, and are predicting new all-time highs for the world’s top cryptocurrency. If that happens then the rest of the crypto market is likely to follow it up the charts.

While the effects of the Bitcoin Halving dominate the price narrative, governments around the world will work in earnest to implement cryptocurrency regulations, and the scope of these will have a great impact on the price of cryptocurrencies.

If you want to learn more about the Bitcoin Halving and how it may affect the broader crypto market, head over to 99Bitcoins where you can earn $99BTC tokens by engaging with their trusted crypto educational content.

In Cardano, there is hope that the lawsuits between the SEC and exchanges will have concluded by this time, maybe even with the US Congress stepping in to stop the SEC in its overreach.

The Cardano roadmap will have also have reached its conclusion late last year or early this year. With the community now having a large input on the future direction of the chain, a new roadmap may be released, potentially prompting price action.

As a result, our Cardano price prediction for 2025 is a high of $2.42, a low of $0.80, and a median price of $1.20

Cardano Price Prediction For 2026

If 2025 is when the crypto markets receive a boost from the Bitcoin Halving event, then 2026 is when they fall back to earth. While they may not fall in the same spectacular fashion as before, as a result of the institutional flow of money and regulatory frameworks in place, prices are expected to drop considerably.

Institutional adoption of decentralized blockchain technology will continue to grow, and protocols like Cardano will keep growing to accommodate them. Specifically for Cardano, the Hydra head protocol, currently in version 0.15.0, will likely have reached a secure and stable 1.0 by 2026 or sooner, paving the way for Cardano to onboard hundreds of thousands of users. All helping to dampen the price impact of the fallout from the 2024 Halving event.

As a result, our Cardano price prediction hosts a high of $1.50, a low of $0.60, and an average price of $1.20.

Cardano Price Prediction For 2027

By 2027 increased regulation, along with a greater knowledge of cryptocurrencies and blockchain technology, is going to help onboard more and more companies to the space.

Cardano, with its state-channel scaling solutions preferred to the rollup–based layer 2 ecosystems built on Ethereum, and previously successful partnerships—including those from early in its lifetime like the Ethiopian Government, Georgian National Wine Agency, DISH, and Brazilian oil giant, Petrabus—putting it in good stead for adoption by other companies.

As a result, we expect Cardano to have one of its most positive years in 2027, resulting in highs of $2.80, lows of $1.20, and an average price of $1.80.

Cardano Price Prediction For 2028

The further we head into the future the thicker the clouds of uncertainty are. However, 2028 will be the year of the 5th Bitcoin Halving event, and while, as before, the price impact is not expected to hit until next year, there is likely to be a pre-Halving scramble for Bitcoin due to its popularity and upcoming increasing scarcity—helping to push the rest of the market up, as the pull of bitcoin remains unavoidable.

We can also expect many of the releases currently under development by IOG for Cardano to have been deployed to the network and available for public use. Alongside this, the community will have chosen new projects to help advance the chain, all of which are likely to have drawn interest from the companies now using the chain as Cardano takes on a true life of its own.

From this, our Cardano price prediction draws a new all-time of $3.30 for ADA, a low of $2.20, and an average price of $2.40.

Cardano Price Prediction For 2029

Despite each layer 1 blockchain having its own thriving ecosystem, they are still under the influence of Bitcoin. As such, they may catch a ride up the charts along with the world’s #1 cryptocurrency.

For Cardano, and our Cardano price prediction, this means a new ATH of $4.98, within touching distance of $5, a low of $3, and a median price of $3.80 throughout the year.

Cardano Price Prediction For 2030

If Bitcoin draws coin prices up in 2029 it’s likely to draw them down again in 2030. However, with large parts of the world now onboarded into blockchain technology, the fallout from the 5th Bitcoin Halving event is likely to be much smaller than before, and tokens are likely to begin consolidating their value.

This means that our Cardano price prediction for 2030 holds a high of $4.50, a low of $3.80, and an average price of $4.20.

Remember that considering percentual gains is also important when analyzing potential investment opportunities.

For example, while Cardano is predicted to grow from a maximum of $1.03 to $4.50 between 2024 and 2030, the 99Bitcoins Token is expected to rise from $0.004 to $0.045 in the same time frame. This represents a 336.89% appreciation for Cardano, but 1,025% for 99Bitcoins. Don’t overlook this factor when making investment decisions.

Historical Performance of Cardano

The Cardano network was first funded by an Initial Coin Offering (ICO) that sold ADA vouchers to verified participants in Asia. The majority of this initial distribution of ADA was sold in Japan, and Cardano still has a strong connection with the Japanese crypto scene.

A total of 25,927,070,538 ADA were sold during presale, representing 57.62% of its total supply. ADA’s ICO price was just $0.0024 per token; at the time of writing, each costs $0.47, representing a 19,483% increase in value.

Purchasing tokens in crypto presales comes with risks, but it also increases the likelihood of generating massive gains — early ADA investors are the living proof of that.

Cardano’s Nomenclature

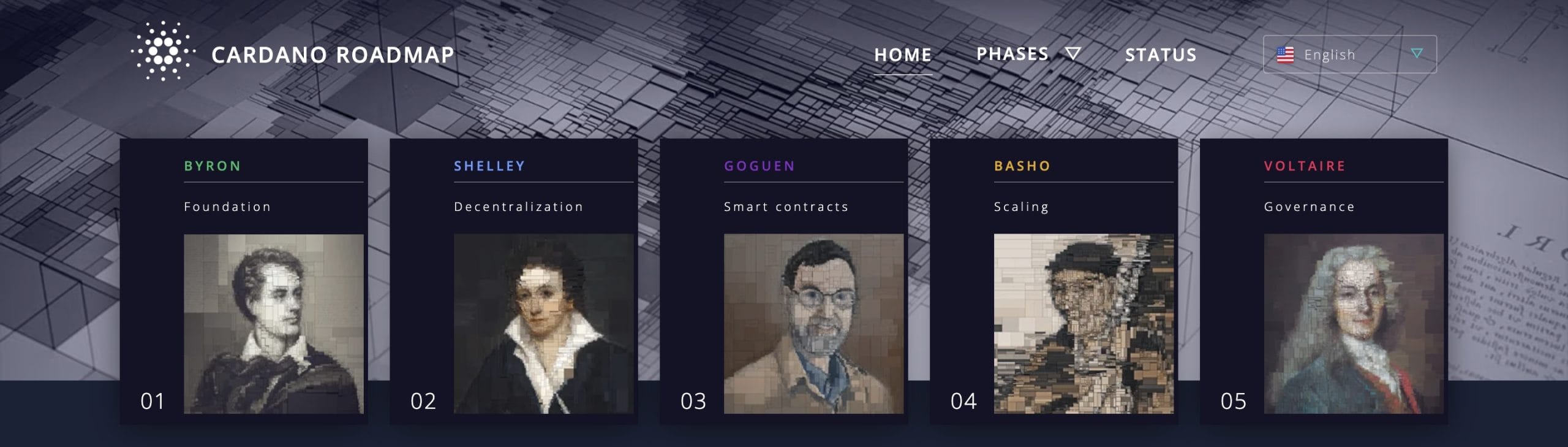

The names of the Cardano protocol, roadmap, and its hardforks are purposefully selected for their historical significance and symbolism.

As examples of this, the blockchain is named after Gerolamo Cardano, a prominent 16th-century mathematician. Its token, ADA, is named after Ada Lovelace, a 19th-century mathematician considered to be the first computer programmer—the divisible units of ADA are also called Lovelace.

2017–2019: Cardano’s Release and ADA’s Early Days

Cardano’s development started in 2015, however, the network’s mainnet was not released until September 29th, 2017, with the release of the Byron era. This primitive version of the network allowed users to buy and sell ADA and was aimed at bootstrapping the Cardano community.

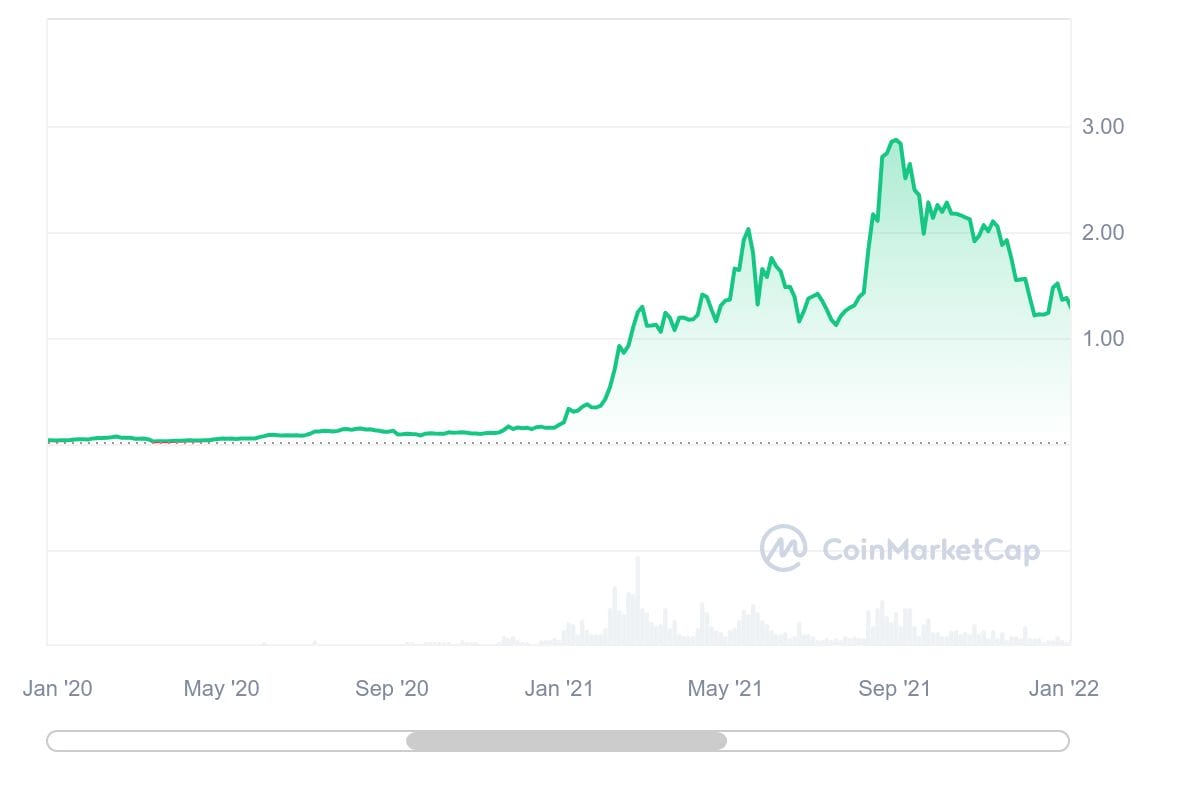

The first price for Cardano on CoinMarketCap is for October 1, 2017, and prices Cardano’s native ADA token at $0.02461. The price of ADA traded between $0.02 and $0.03 until the end of November—when it joined the wider market rally that saw Bitcoin hit the mainstream with a bang as it closed the year just under $20,000. In this rally, the ADA price gained 731% to top out just above $1 on January 3, 2018.

From there, it followed the wider market decline in 2018, steadily decreasing to find support at $0.03 in December 2018—97% down from its high just 12 months before. Despite this, Cardano entered the CoinMarketCap top 10 in 2018 and has held its position ever since.

2019 saw Cardano rise off its bottom of $0.03 at the end of December 2018, and meet resistance of $0.10 through June. From there it declined to find support at $0.033, finishing the year at $0.03347.

2020–2021: The Rise of Cardano and ADA

Cardano continued into 2020 as it had traveled through 2019, testing $0.10 again, before dipping below the $0.03 mark for two weeks in March. It then rallied in July, in anticipation of the Shelly hardfork on July 29, peaking at $0.1454, 11 days later on August 9—a 334% increase since the start of the year.

After this release, work started on the development of smart contracts for the platform, along with support for native tokens, fungible and non-fungible (NFTs).

On the back of this peak, ADA dipped in price, hitting $0.08 in September, before joining a wider market bull run into 2021. ADA’s climb was also fueled by the release of native tokens to the Cardano network, hitting $1.29 at the beginning of March. Then, after plateauing for seven weeks, it climbed above $2.02 in mid-May 2021.

Predictably, the price of ADA dipped after this, losing 44% of its value in 2 months, to $1.1228 in mid-July. However, in anticipation of the launch of smart contracts on the network in September, the price of ADA started to rise, hitting its all-time high of $3.1 on September 2—a 3,775% change since last September.

Despite Bitcoin rising above $68,000 in November 2021, ADA seemed to have run out of steam and declined, finishing the year at $1.31—a 57.54% decrease from its all-time high.

2022–Present Day: Price Declines But Increasing Activity

Into 2022, Cardano followed the decline of the rest of the crypto markets, finding support at $0.50 along the way before finishing the year just under $0.25, the beginning of the formation of support at this level, an 80% decrease in its price from the start of the year, and a 91.94% decrease from its all-time high in September 2021.

ADA started 2023 well, beginning by climbing the charts to find resistance at $0.4 in February, before declining to $0.3. ADA then peaked above $0.4 in April, meeting resistance at $0.45 and steadily declining through late April and May, as the bulls and bears tussled around the $0.4 mark.

However, things were thrown into disarray in early June, as the SEC sued Binance and Coinbase in quick succession, for the sale of unregistered securities. In both these lawsuits the SEC named Cardano’s ADA as an unregistered security, which then saw ADA lose 27.82% of its price in a week. Cardano’s developers, IOG, have provided a strong rebuttal to these claims.

ADA however, found support around the $0.25 mark and continued to trade hands around this price, besides a peak above $0.30 in mid-July, until October.

In mid-October 2023, a false report that the SEC had approved a Bitcoin ETF set Bitcoin surging above $30,000 and started the upward trajectory that saw the crypto markets continue climbing on the back of Bitcoin ETF speculation through to the approval of all 11 Bitcoin spot ETFs applications in January of 2024.

In this time, ADA climbed 152%, from $0.2469 on October 19 to $0.6231 in the last day of 2023. It then followed the moves of Bitcoin and the wider crypto market, initially dipping—to just under $0.50—after the approval of ETFs before climbing back above $0.60 at the end of February.

Current State of Cardano

Since the launch of native tokens and smart contracts in late 2021, Cardano has grown from having no projects or dApps to a flourishing ecosystem that is steadily overcoming its issues, with multiple vertical scaling solutions implemented in 2023, and emerging as a solid platform for conducting decentralized activity.

In its state of Cardano Q4 2023, Messari shares how the platform has matured throughout 2023. Here are some Cardano statistics, revealing its current state:

- #31 in DappRadars ranking of protocols by dApp count

- $403m in TVL, #14 when ranked by TVL, on DeFiLlama

- #20 in developer count, with almost 500 developers working in the ecosystem

- $638.4 million in NFT sales, #7 overall

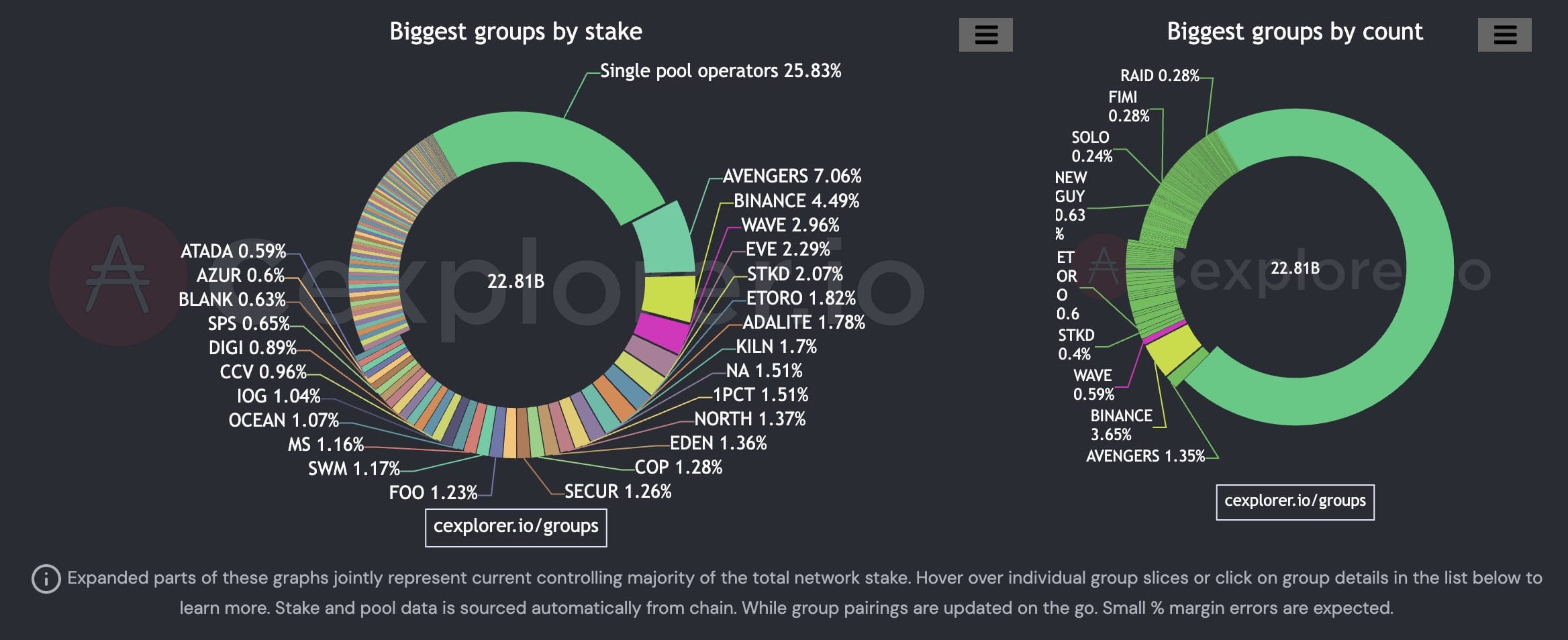

- 68% ($22.89 billion) of the circulating ADA supply is staked and securing the network

- Over 3,000 stake pools securing the network, 70% run by unique individuals

- A Nakamoto coefficient of 35, one of the highest in the top 20 blockchains

- Cardano has forged numerous partnerships, most notably with the Ethiopian Government, to register students’ records on-chain; and DISH, to record users’ loyalty rewards on-chain.

While Cardano might be nearing the end of its roadmap with the launch of minimum-viable decentralized governance targeted for this year, there are many protocols and solutions under development.

Examples include layer 2 scaling solutions, smart contracting language improvements, privacy centric sidechains, and the ability for other execution environments to use Cardano in a modular fashion as their settlement layer.

Market Position and Performance

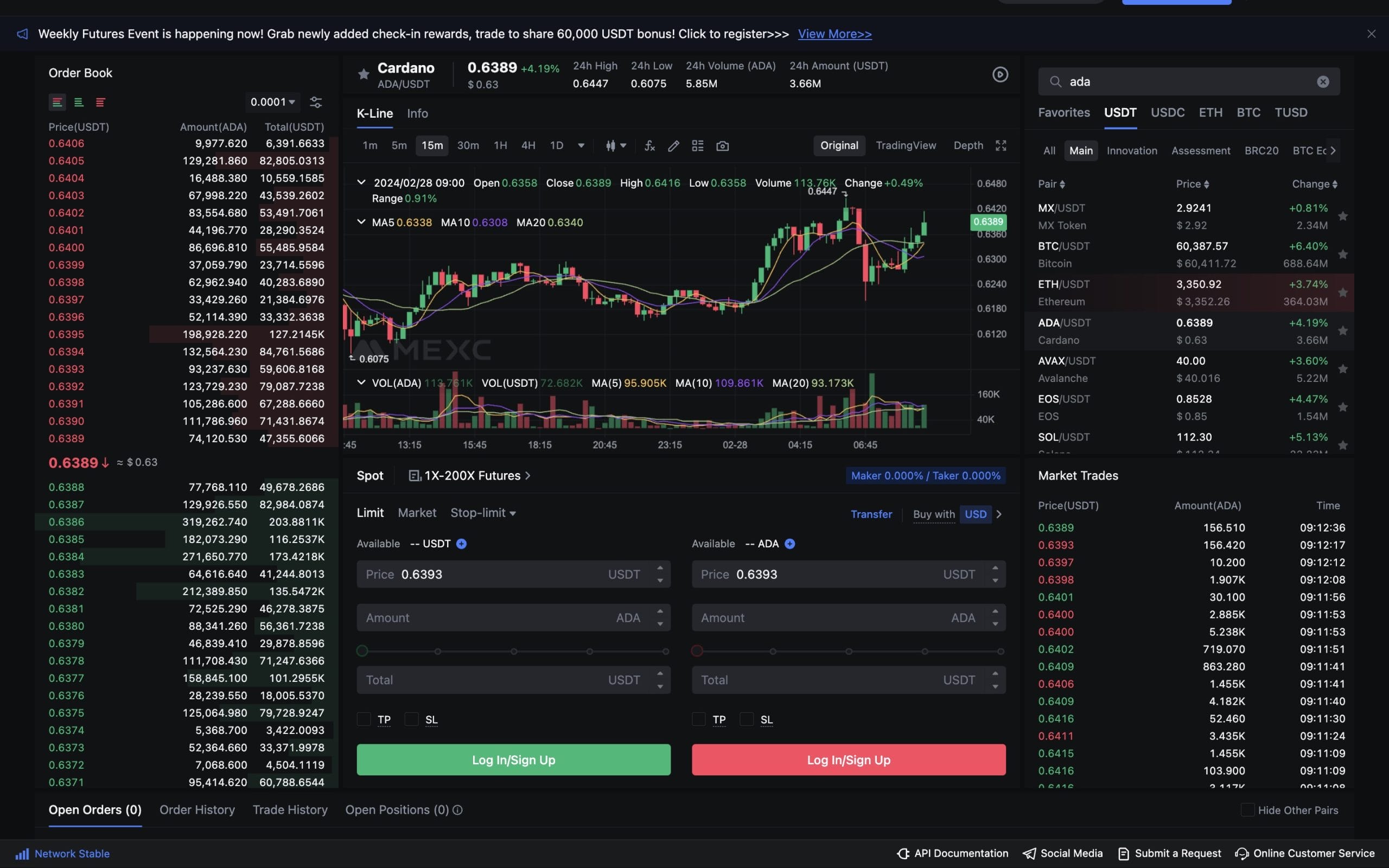

As mentioned, Cardano has been in CoinMarketCap’s top 10 since 2018. It currently sits in 8th position — 6th if you don’t count stablecoins. With a valuation of $0.6197 and a market cap of $21.8 billion, Cardano is almost 50% larger than Avalanche and 43% smaller than Ripple.

Below are two charts, the ADA vs BTC chart for the past year on the left and an ADA technical analysis on the chart on the right.

As we can see in the ADA vs BTC chart, the price of ADA has typically followed the movements of BTC over the last year—besides when impacted by specific news events, such as the SEC calling it a security in June.

In turn, it has also followed Bitcoin as it moved up the charts in late October 2023. The upward trend line this has created is set to converge with resistance that is building at the $0.64 price level in early April. ADA’s move above this resistance or break down through the trend line may be determined by whether Bitcoin can sustain its current rally.

What Is Cardano and What Is It Used For?

Cardano is an open source and decentralized blockchain network that runs using a proof-of-stake consensus model. It aims to solve the blockchain trilemma, is based on peer-reviewed research, and employs multiple novel concepts to try and bring a secure, decentralized, and scalable solution to the world.

Cardano, whose native token is ADA, was the brainchild of Charles Hoskinson, one of the cofounders of Ethereum. Cardano and Hoskinson took a lot of flack from the blockchain community during the protocol’s steady development, where the common insult was to call Cardano a “ghost chain” (i.e., a chain with nothing where nothing happens).

However, with a steadfast and growing community, as well as continued protocol updates, including the launch of smart contracts and native tokens in 2021, Cardano is growing to become a force to be reckoned with in the layer 1 blockchain space.

Despite all the criticism thrown its way, it has been a member of the CoinMarketCap top 10 list since 2018, and hosts a burgeoning DeFi space, NFTs, and native liquid staking.

Cardano has three founding entities:

- IOHK: Core developers of the Cardano protocol and spearheaded by Charles Hoskinson—now also known as IOG.

- Cardano Foundation: An independent non-profit that aims to advance Cardano and its “utility for financial and social systems”.

- EMURGO: The enterprise arm, aiming to develop commercial applications for Cardano.

Below we’ll delve into some of the main facets of the Cardano protocol and ecosystem.

Cardano Staking

Cardano’s proof-of-stake consensus protocol, called Ouroboros, is the first peer-reviewed proof-of-stake protocol and allows for native, liquid staking, where a user simply delegates their wallet to a stake pool, retaining full control of their funds along with their ability to spend those funds at will. Currently, 64% of the ADA in circulation is staked, and stakers are earning an average APY of 3.5%.

There are over 3,000 stake pools on Cardano, with unique stake pool operators, called Single Pool Operators, making up 70% of these.

Cardano’s Decentralization

A blockchain’s decentralization is measured by a number called a Nakamoto Coefficient, which is the number of individual parties who can conspire together to control the chain, also called a minimum attack vector. Cardano’s Nakamoto Coefficient is a healthy 35 (meaning that all of the top 35 stake pool operators must conspire to take control of the chain).

By comparison, the Nakamoto Coefficient of Ethereum is 2.

Cardano’s Next Steps in Decentralization

In addition to being secured by community-run stake pools, Cardano has its own decentralized funding mechanism for projects, called Project Catalyst. Here ADA holders vote on proposals asking for funds, distributed from a treasury of ADA. This program is constantly iterating and improving with each funding round it holds.

The final stage of the Cardano roadmap is focused on governance. Specifically, the Cardano community is currently focused on writing the Cardano Constitution, which will be implemented on-chain and represent minimum viable community governance for the blockchain—making it a truly decentralized chain. This will all be initiated by the Chang hardfork later this year.

A Secure Programming Language and The eUTxO Model

Smart contracts on Cardano came 8 years after Ethereum’s. This is partially due to its later start, but also due to the founder’s insistence on developing in the Haskell programming language.

Haskell is a purely functional programming language and a lot less popular than the languages used as a base for Solidity, the smart contracting language used for EVM-based smart contracts and the most popular smart contracting language by a long way.

However, as put by the Cardano Foundation: “[Haskell] is well-suited to write code that is robust and correct.” It can be combined with formal verification—the industry gold standard for audits and correctness—to produce high-assurance, robust code, which is potentially the reason why Cardano’s growing ecosystem is yet to see a smart contract hack.

Cardano also uses the UTxO model, just like Bitcoin, and unlike many other popular blockchains, like Ethereum and Solana, which use an account-based model. Cardano took Bitcoin’s UTxO model and extended it, eUTxO, to allow for extra functionality, like smart contracts, to be built on top of the ledger.

While this adds extra complexity and is why Cardano initially struggled to increase its transaction rate, it also gives the blockchain determinism.

Determinism means that a transaction’s validity can be known before submitting it to the chain and the transaction fee can also be determined before submitting it. This means that a user can know exactly how much a transaction will cost and whether it will be accepted by the chain before submitting it—this is in direct contrast to Ethereum as transactions on Ethereum can be rejected, with users also losing their gas fee in the process.

Cardano’s Set Transaction Fee

Cardano operates without a fee market, as Bitcoin and Ethereum do, so transaction fees are set and only change based on the complexity of the transaction. Currently, the minimum fee for a transaction is, and always has been, 0.17 ADA (about $0.11 at the time of writing).

Unlike on Bitcoin and Ethereum—as is visualized live on TxStreet.com—users cannot jump the queue by paying a higher gas fee on Cardano.

Scaling Cardano

Scaling is an element of the blockchain trilemma that the whole blockchain space is trying to address to help improve the user experience as it continues to onboard new users. Cardano’s scaling solution is called Hydra, after the multi-headed beast of Greek mythology.

Hydra is an isomorphic, multi-party, state-channel protocol. To break this down:

- Isomorphic: Hydra copies the on-chain execution environment, allowing for smart contracts that work on the Cardano mainnet to be executed in Hydra—also meaning that any disputes can be executed and settled on the main chain.

- Multi-Party: Multiple users can join a single instance of Hydra.

- State-channel: Hydra is an environment where these users can make as many fee-less transactions as they want between themselves. These transactions are not recorded and, therefore, they are private as only the members of the channel know what happened. Just like on the Bitcoin Lightening Network.

Hydra takes its name from the mythical beast because many instances of it can be deployed on the mainnet, each running their own functions and allowing the blockchain to scale in the most decentralized and efficient manner.

In addition to this, there’s also the idea that Cardano can be used in a modular way, paving the way for what IOHK are calling Partner Chains, that allow other computational environments, e.g., the EVM, to settle to the Cardano settlement layer—therefore utilizing Cardano security.

What Can Cardano’s Native ADA Be Used For?

So, while esoteric in the coding language that it uses, Cardano is built on a more robust base than many of the smart contracting platforms of today, offering a greater level of decentralization, native liquid staking, hosting a wild array of dApps and projects, being is explicitly intended for the good of the people, and has partnered with numerous companies and institutions around the globe. But what can you use Cardano’s ADA for?

- ADA can be delegated to a stake pool from a wallet to secure the network and earn rewards

- ADA is used to pay transaction fees on the network

- ADA is the main token pair in Cardano’s growing world of DeFi dApps

- ADA can be used to buy Cardano NFTs

- ADA can be used to vote on which projects should receive Funding in Project Catalyst

In addition to all this ADA will soon be able to be used to vote in governance proposals that concern the running of the Cardano network. They will also be able to be delegated to dReps, decentralized representatives who amass delegated voting power and use it to vote on governance proposals on behalf of their delegates.

Factors Influencing Cardano’s Price

Those asking, “will Cardano go up?”, as to take into account factors both inside and outside the Cardano ecosystem, like we did in our Cardano price prediction above. Below we’ve outlined major factors impacting the price of Cardano and shaping the future of the ADA chart.

Wider Crypto Markets

In particular, Bitcoin. As is with all other coins, ADA will follow the trajectory of Bitcoin up and down the charts until it has enough utility and enough demand to chart its own course through the charts.

SEC Lawsuits

With the SEC calling ADA a security in its lawsuits with Binance, Coinbase, and Kraken expect investors to be wary of it until its status is set in stone.

Crypto Regulations

These are where ADA status as not a security, or as a security, could be finalized. The standard and focus of crypto regulations introduced by different nation states around the world will greatly influence the price of cryptocurrencies up and down the charts.

Japan’s New Law

Approval of Japan’s proposed law for VC firms to be able to hold crypto may have a positive effect on the Cardano ecosystem and the price of ADA, as more than 94% of Cardano’s initial distribution went to individuals in Japan.

Ecosystem Growth

Cardano had a slow start, being one of the oldest layer 1 chains with the latest launch date for smart contracting capabilities. Another barrier to the growth of the ecosystem is the fact that the smart contracting language is based on Haskell, not a very common programming language. The thought is, however, that once corporations realize the security gains from using Haskell that the ecosystem will grow.

Upcoming Upgrades

Minimum viable community governance is set to launch in by the end of 2024, bringing the Cardano roadmap to an end. But development continues and the release of V1.0.0 of the Hydra scaling solution is definitely an event to look out for.

Popularity of Other Ecosystems

Simply because they’re more developer friendly other ecosystems might be favored over Cardano, therefore making it slowly fall out of favor with users.

Cardano Price Predictions by Other Experts and Analysts

We scoured the internet to bring you an array of Cardano price predictions from analysts and experts around the world.

Krisha (Mango Research) Cardano Prediction

Krisha, on the Mango Way YouTube channel, says that if Cardano breaks the $0.68 mark it has two target prices $1.16 and $2.15. However, there is no time frame given for these targets.

RippleCoinNews Cardano Prediction

In the CoinMarketCap community, the member RippleCoinNews has posted a price prediction for Cardano for the coming years, predicting a high of $1.08 in 2025 and a high of $7.31 in 2030, and even an average price of over $100 in 2050.

Alex Kind Cardano Prediction

In a post on LinkedIn the researcher Alex Kind predicted that ADA could hit a high of $1.35 in 2025, and go as high as $3.28 in 2030, climbing steadily year-on-year in between.

Coin Predictions Cardano Prediction

On their Medium blog, the Coin Predictions account aggregates predictions and finds that ADA will trade with an average price of $5-6 in 2024, with a minimum of $1.50 and a high of $12.

How to Buy Cardano?

Cardano is one of the top-ranked coins in the ecosystem, and this means that many exchanges offer it — even those that have been targeted by the SEC in the USA for doing so. But there’s one place we recommend above all if you’re looking to buy Cardano — the MEXC exchange.

Why Use MEXC to Buy Cardano?

Founded in 2018, the MEXC services over 10 million users in more than 170 countries. Developed by experts in the banking industry, MEXC supports 1,000+ coins through a high-speed trading platform, that can facilitate up to 1.4 million transactions per second.

MEXC offers an advanced trading platform that provides users with all the tools traders need to analyze the markets and execute their strategies. Those looking to spot trade benefit from 0% spot trading fees, and those looking to trade margins and futures markets can use leverage of up to 100x.

MEXC regularly posts daily trading volumes above $1 billion, and offers a public proof-of-reserves for some of the most popular assets traded on the platform; Bitcoin, Ethereum, USDT, and USDC.

Finally, for those who want to be able to access the markets on the go, MEXC offers an app for iOS and Android devices, meaning traders won’t have to miss the opportunity to make a trade because they’re away from their computers.

How to Buy Cardano ($ADA) on MEXC

Here’s a quick step-by-step guide on how to buy Cardano on MEXC:

- Create a free MEXC account.

- Add funds to your account using one of the available methods: debit/credit card, bank transfer, P2P purchases, or a third party vendor (e.g., Apple or Google Pay).

- Go to MEXC’s Spot Market page.

- Search for ADA in the search bar in the upper right corner and choose your trading pair.

- In the left-hand side of the module, at the bottom of the page, enter your order, and hit “Buy ADA.”

Conclusion: Cardano Price Prediction

While Cardano and its ecosystem have long been ostracized by many in the wider crypto world, its persistent presence in the CoinMarketCap top 10, evolving ecosystem, and technological success are signs that it is cementing its place as a powerful layer one blockchain that is steadily building toward success.

That said, however, finding developers willing to learn to code in its rather esoteric base language does present a barrier to entry that may hinder its progress, and its existing classification as a security in the USA may make some traders hesitant to invest.

But who knows where the road will turn next in the wild world of crypto.

FAQs

Will Cardano Recover?

We, along with many other experts, expect Cardano to recover in the future. Since its decline after the last bull market Cardano has improved the underlying blockchain, significantly increased the size of its ecosystem, and signed important partnerships with large companies. The future looks bright for Cardano.

Is Cardano a Good Long-Term Investment?

Cardano may be a good long-term investment. It’s predicted to rise by 336.89% by 2030 from its 2024 peak of $1.03. For risk-tolerant investors, presale coins like 99BTC offer higher potential long-term gains, with an expected increase of 1,025% by 2030.

Risks and Considerations in Cardano Investment

While it is a highly rated 3rd generation blockchain, Cardano investors do need to consider that it’s, currently, considered to be security by the SEC. They also need to understand that developers must know the Haskell programming language to build smart contracts for it—unlike many of the other top blockchains that use smart contracts written in Solidity, the world’s most popular smart contracting language.

Will Cardano be The Next Bitcoin?

While Cardano is built on the same UTxO model as Bitcoin, has a high level of decentralization, and it is mathematically possible for Cardano to gain value as Bitcoin did, it would require Cardano to emerge from the fringes and become a mainstream blockchain.

References

- Global Live Cryptocurrency Charts & Market Data – CoinMarketCap.com

- Unlocking More Opportunities With PlutusV3 – IOHK.io

- Kraken Joins Binance, Coinbase Seeking Dismissal of SEC’s Lawsuit – Bloomberg.com

- Cardano Foundation Partners with Georgian National Wine Agency – CardanoFoundation.org

- Cardano Foundation Partners With Brazil’s State-Owned Oil Company for Blockchain Education – Yahoo.com

- Genesis – Cardano.org

- Girolamo Cardano – St-Andrews.ac.uk

- Ada Lovelace – Britannica.com

- On the Origin of Cardano – Medium.com

- BYRON – Cardano.org

- Cardano – CoinMarketCap.com

- From $900 to $20,000: Bitcoin’s Historic 2017 Price Run Revisited – CoinDesk.com

- Evolution of Top-10 Coins in CoinMarketCap’s History (2013-2023) – CoinMarketCap.com

- Shelley is here: The Cardano Blockchain Undergoes a Historic Hard Fork – CardanoFoundation.org

- Cardano Alonzo Hard Fork: What You Need to Know – CoinDesk.com

- Bitcoin Hits New All-Time High Above $68,000 as Cryptocurrencies Extend Rally – CNBC.com

- US Tightens Crackdown on Crypto With Lawsuits Against Coinbase, Binance – Reuters.com

- Cardano Developer Rejects SEC Claim Its ADA Token Is a Security – CoinDesk.com

- Bitcoin Jumps to $30K, Then Dumps, as False Spot ETF Approval Report Circulates – CoinDesk.com

- US SEC Approves Bitcoin ETFs in Watershed for Crypto Market – Reuters.com

- State of Cardano Q4 2023 – Messari.io

- Top Blockchains – DappRadar.com

- Total Value Locked All Chains – DeFiLlama.com

- Explore Developer Data – DeveloperReport.com

- Top NFT Collectible Sales – CryptoSlam.io

- Cardano Explorer – Cexplorer.io

- Cardano Groups (Donuts) – Cexplorer.io

- Nakamoto Coefficient – Cexplorer.io

- Blockchain Finally Comes of Age With the World’s Biggest Blockchain Deployment – IOHK.io

- DISH Launches Decentralized Identification and Loyalty Coin System Built on Input Output Global (IOG) Technology – IOHK.io

- What is the Blockchain Trilemma? – TheBlock.co

- Library – IOHK.io

- IOHK | Cardano Whiteboard; Overview with Charles Hoskinson – YouTube.com

- Cardano ADA – Coinbase.com

- Nakamoto Coefficient — how decentralized is your blockchain – Medium.com

- Cardano Roadmap – Cardano.org

- Cardano’s Chang Hard Fork to Take Place in Early 2024 – Reddit.com

- Why Cardano Chose Haskell — and Why You Should Care – Medium.com

- Cardano’s Extended UTXO Accounting Model – Built to Support Multi-Assets and Smart Contracts – IOHK.io

- TRANSACTION FAILED – OUT OF GAS – Ledger.com

- MEXC Reserve Ratio – MEXC.com

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Viraj Randev

Viraj Randev