Polkadot (DOT) Price Prediction 2024, 2025, 2030

Polkadot (DOT) was created by one of the Ethereum cofounders and brought the concept of blockchain modularity into the mainstream long before it gained traction last year. With exciting upgrades planned for this year, many are wondering: what will happen to the price of DOT in 2024?

Coin Name Polkadot Polkadot Symbol DOT Polkadot Price $6.84 Polkadot Price Change 24h ▼ -0.05% Polkadot Price Change 7d ▼ -2.40% Polkadot Market Cap $6,756,721,378 Circulating Supply 987,579,314 DOT

In this Polkadot price prediction, we look at the Polkadot protocol, how it operates, and how it plans to evolve to stay relevant in the near and distant future. We’ll also provide a DOT price prediction for every year between now and 2030 as well as every decade between now and 2050. At the time of this writing (April 27, 2024), Polkadot price has increased in the past 24 hours and is now trading at $6.84, which is a -0.05% change from yesterday.

Polkadot Price Prediction Overview

In the table below, we’ve detailed our DOT price prediction for each of the next seven years between 2024 and 2034. In the sections following, we go into greater depth on our Polkadot coin price prediction for the most anticipated of these years.

Year Potential Low (ROI) Average Price (ROI) Potential High (ROI) 2025 $15.36 (124.44%) $15.58 (127.75%) $15.80 (130.96%) 2026 $14.83 (116.69%) $15.29 (123.50%) $15.73 (129.91%) 2027 $14.32 (109.24%) $15.00 (119.25%) $15.61 (128.21%) 2028 $13.81 (101.91%) $14.71 (114.99%) $15.53 (126.95%) 2029 $13.30 (94.38%) $14.42 (110.74%) $15.48 (126.31%) 2030 $12.81 (87.25%) $14.13 (106.49%) $15.47 (126.12%) 2031 $12.35 (80.47%) $13.84 (102.24%) $15.28 (123.38%) 2032 $11.74 (71.55%) $13.55 (97.99%) $15.32 (123.91%) 2033 $11.16 (63.12%) $13.25 (93.74%) $15.21 (122.33%) 2034 $10.75 (57.09%) $12.96 (89.48%) $15.22 (122.52%)

Polkadot Price Prediction 2024

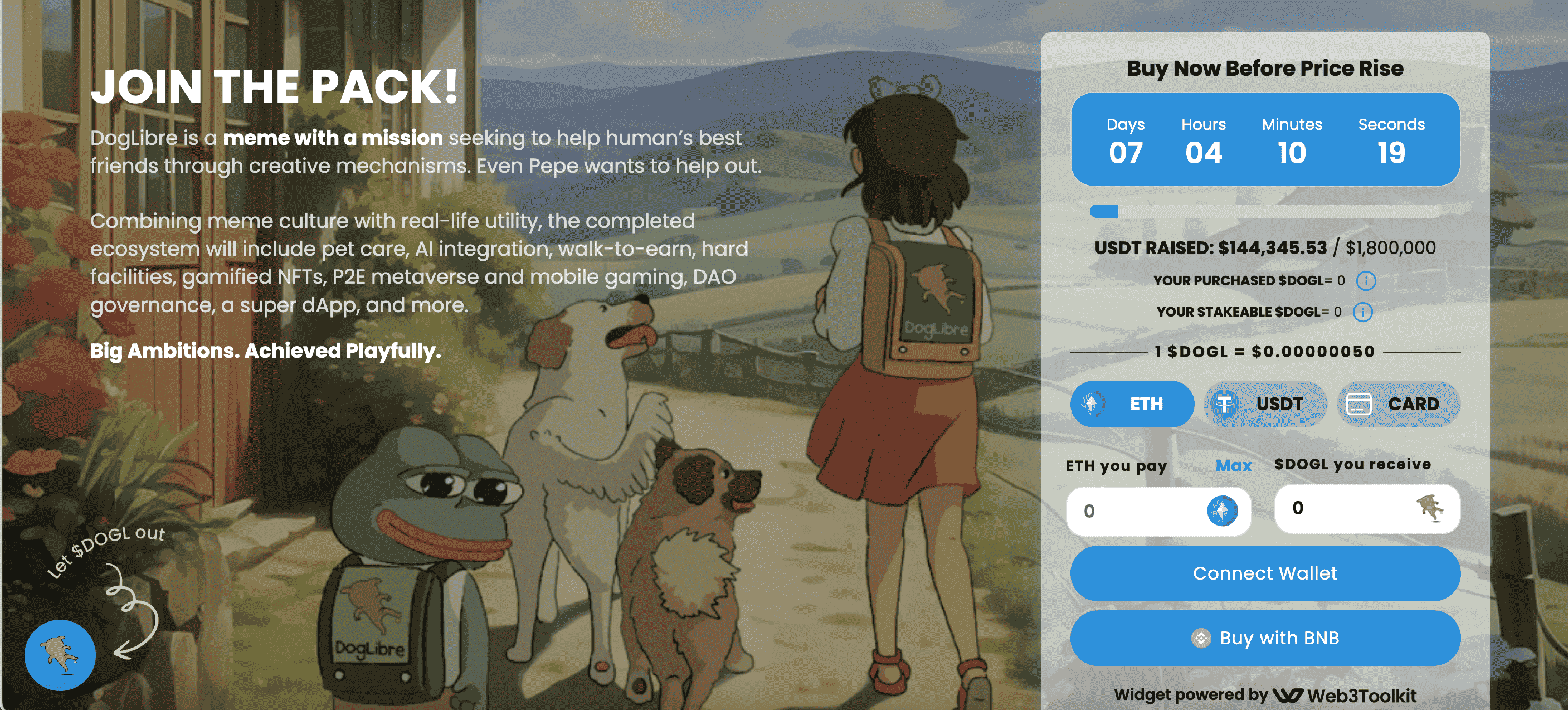

The beginning of 2024 has been positive for Polkadot and the rest of the cryptocurrency market. Looking forward, a Bitcoin Halving is due in April, and while the price impact of these events is typically felt 12–18 months after the fact, this one might be different, with all the current activity in the markets and the gain in the Bitcoin price.

In the world of Polkadot, on-demand parachains, previously called parathreads, and a move to a core-time marketplace instead of a slot marketplace are both updates that are expected to be released this year. This will also increase the number of applications that can use the chain, potentially increasing the demand for DOT.

Perhaps most exciting is the expected launch of Snowbridge, which links Polkadot to Ethereum via a trustless, decentralized bridge. This is expected to launch in the first half of the year and could bring significant upside to the token.

If Polkadot can continue building on the success of 2023 and all the factors affecting the crypto markets also stay positive, then 2024 is going to be a bright year for DOT. As a result, our Polkadot price prediction for 2024 contains a high of $22.50, an average price of $11, and a low of $5.50.

Polkadot Price Prediction 2025

2025 is when many analysts are expecting the next bull run to commence—if we’re not already in it. Not only is 2025 when the impact of 2024’s Bitcoin Halving is expected to be felt, but we can also expect an improvement in the macroeconomic climate and the implementation of regulations that are positive for the adoption of cryptocurrencies

As a result, 2025 will be when we’re completing a full Polkadot price prediction for the next bull run.

While the Polkadot roadmap does not stretch out this far, Polkadot’s already impressive transaction throughput and low fees for dApps sets DOT in good stead for when adoption begins. Speculators could start looking closely at these aspects of blockchains in 2025.

From this, our Polkadot price prediction for 2025 contains a high of $40, a low of $20, and an average price of $32.

Polkadot Price Prediction 2030

For an industry that evolves as quickly as the crypto industry, 2030 is far in the future. However, there are a few details that we can use to help inform a Polkadot crypto price prediction for 2030.

The first is that cryptocurrencies and blockchain technology are going to be operating within a regulatory framework and that the adoption and use of decentralized public ledgers are likely to be a mainstream practice.

In terms of Polkadot, we expect Polkadot to have endured and achieved a high level of adoption, thanks to its modular parachain building tools, and its agility as a network due to its compartmental qualities. We also expect it to continue evolving to suit the ever-changing needs of its users.

From this, we draw a positive conclusion for our Polkadot price prediction for 2030. However, with continued token inflation, growth in token price will not have been astronomical. Our 2030 DOT price prediction contains a high of $75, a low of $55, and an average price of $68.

Bonus: Extended Long-Term Outlook for the DOT Price Prediction

The above covers the remainder of this decade, but here we’ll quickly look at 2040 and 2050—which, unfortunately, don’t contain a Polkadot price prediction of $1,000.

Polkadot Price Prediction 2040

As the world continues to evolve it needs adaptable decentralized solutions more than ever. Polkadot continues to adapt to these needs and provide solutions required by society. Our 2040 DOT price prediction expects that DOT will maintain a price above $100 for the whole year, with a potential high of $132.

Polkadot Price Prediction 2050

In 2050, the global community will be reliant on blockchain technology to help secure everything from personal identity to election processes, and the continued evolution of Polkadot and its interconnected nature have helped it to maintain its position as one of the top blockchains. Inflation has prevented the token value from increasing too much, and we expect the DOT price and demand to have stabilized, with a high of $148 and an average price of $140.

Historical Performance of Polkadot

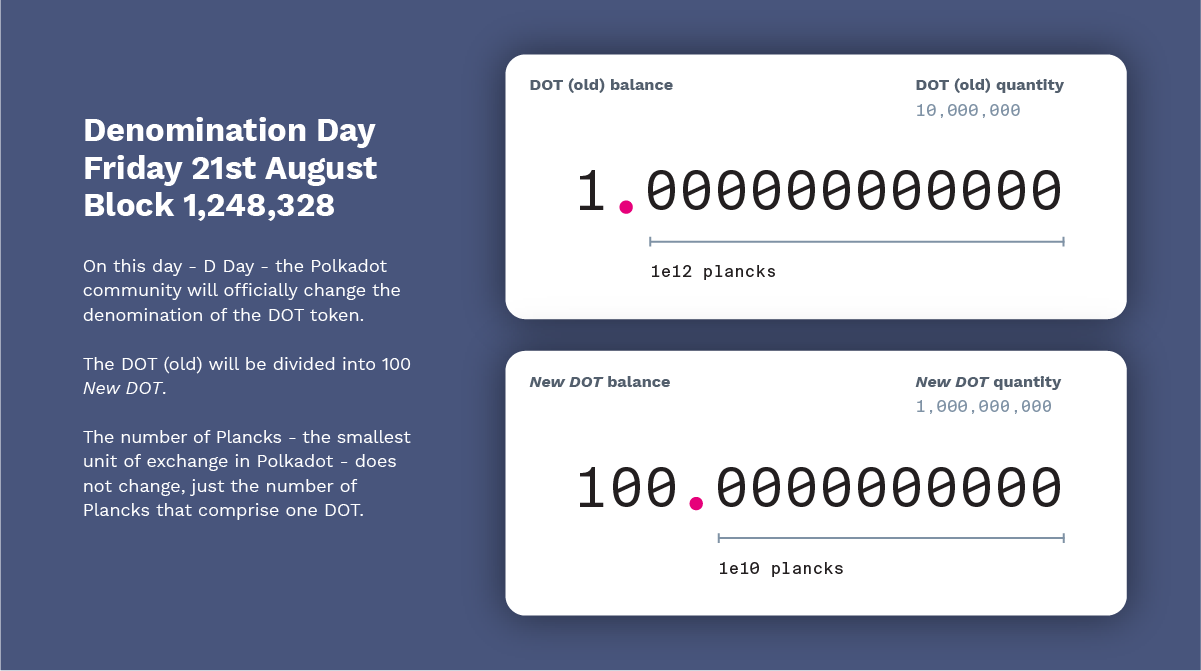

The Polkadot blockchain was officially launched in May 2020. However, it wasn’t until August 18th that tokens were unlocked and transferable. 3 days later the DOT token underwent a redenomination event—reducing the number of decimal places after the token and effectively increasing the supply 100-fold.

The first recorded price for DOT was $2.08 on August 18th, 2020. DOT enjoyed a positive start to life, and more than tripled in value by the end of August, finishing the month at $6.28. The price of DOT corrected and found support at the $4 level for the rest of 2020. At the end of the year, DOT joined the wider market bull run and started 2021 at $8.30, before rallying up to within touching distance of $50 on May 15th, a 23x fold increase on its initial price.

Despite announcing parachain implementation 2 days later, the token value declined rapidly, following price action in the rest of the market. DOT temporary support at $20, from late May to mid-June, before declining again. $15 acted as support in late June and early July before the token bottomed out at $10.38 on July 20th, a 79% decrease from its all-time high (ATH) of $49.83 two months ago.

From here, following the rest of the market again, the DOT token price rallied, hitting its current ATH of $55.08 on November 4th, 2021.

From here the token price rapidly declined, losing over 50% of its value in 6 weeks. Just after December 18th, when the Polkadot launch was deemed complete, DOT found support at $24, with a temporary bounce taking it briefly back above $32 before the end of the year.

Polkadot then continued its decline in early 2022. It found tentative support at $16 in February and twice found resistance at the $22.40 level in Q1. DOT, however, continued to decline for the rest of 2022 and bottomed out at $4.23 on December 30th, a 92% drop from its all-time high.

Polkadot rallied into 2023 with the rest of the crypto market and found resistance at $7 in the first half of the year as it hit a high of $7.89 in February. From these highs, it declined, finding support at $4.50 in mid-June. The price of DOT climbed to resistance at $5.50, and then subsequently declined to bottom out at $3.58 in mid-October.

After the Coin Telegraph shared a false report of Spot Bitcoin ETF approval on October 16th the market started its current rally. Polkadot climbed above $9 before the year finished and ended 2023 at $8.20, almost double (90%+) its price at the start of the year.

In 2024, DOT’s price momentum has been largely positive. It found support at $6.35 in late January and then surged upward, climbing above $10 at the beginning of March for the first time since June 2022 and touching $11. At the time of writing, DOT was priced at $10.10, with a market cap of $13 billion.

What is Polkadot and What is it Used For?

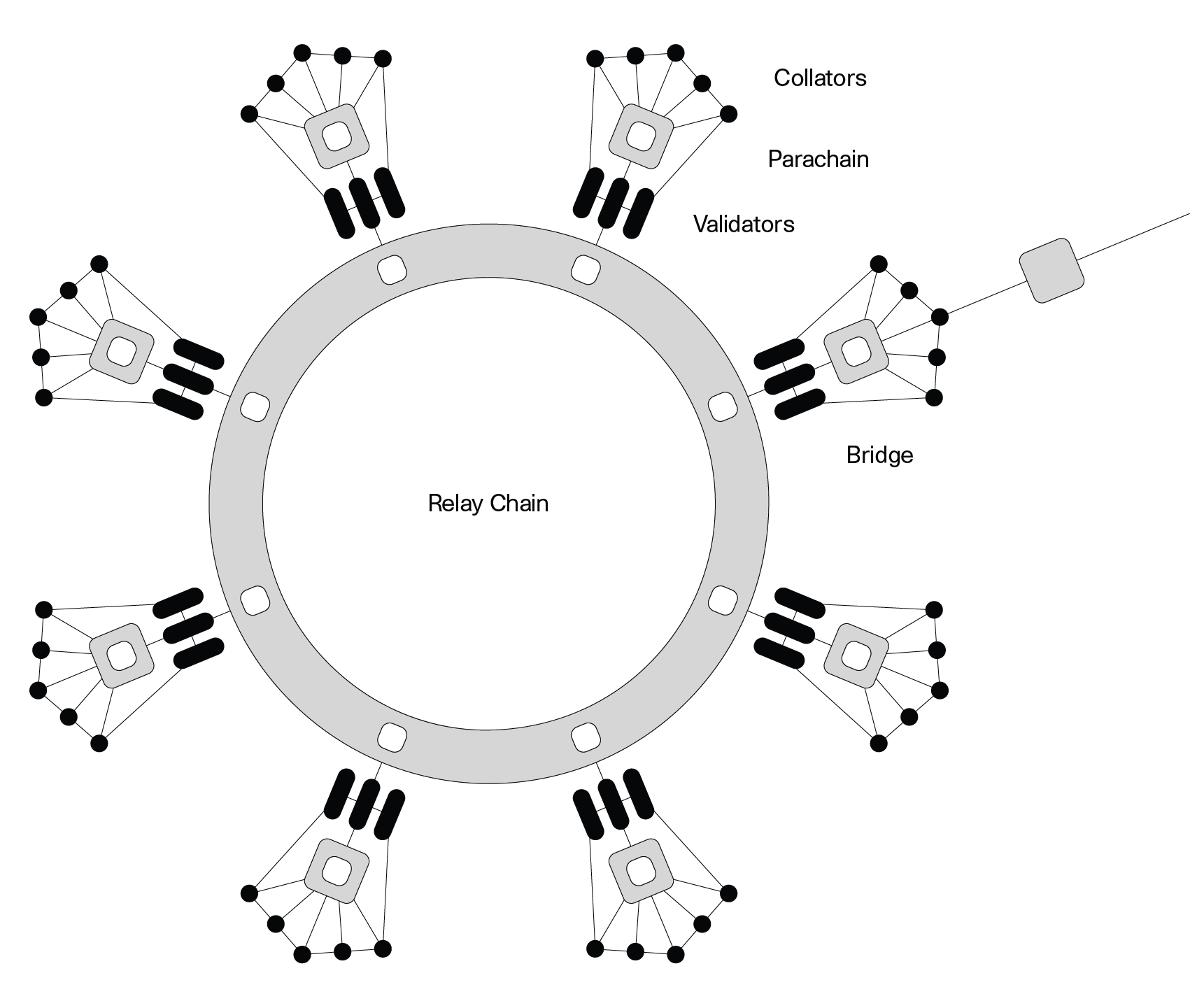

Polkadot is a sharded network of specialized blockchains that can process transactions in parallel—greatly increasing the network transaction throughput. It consists of the Polkadot Relay Chain, deemed to be the Layer 0, and the many application-specific blockchains, called parachains, that are built on top of it.

Polkadot was created on the premise that we will live in a multi-blockchain future and is designed for building applications as parachains, with each one optimized to suit a particular function rather than building generic multipurpose blockchains.

The Polkadot protocol is overseen by the Web3 Foundation and built by Parity Technologies, which was founded by Ethereum cofounder Dr. Gavin Wood and the former head of security for the Ethereum Foundation, Dr. Jutta Steiner.

It aims to be the foundation of an interconnected blockchain world and offers numerous unique features, including the cross-chain transfer of all types of data and assets, not just tokens, a unique proof-of-stake consensus mechanism, and forkless upgrades for parachains.

The Polkadot Protocol Architecture

The Polkadot Relay Chain acts as the main chain, layer 0, of the system and offers reduced functionality compared to other blockchains. It is not focused on hosting dApp and is instead only concerned with network governance and security.

The Relay Chain acts as the data availability layer for the parachains and validates the block data it stores for them. To do this, the Relay Chain sells block space, in the form of slots, to the parachains. Parachain bid for these by locking DOT token.

The network’s validators, which secure the Relay Chain, validate the transaction data from the parachains before it is committed to the Relay Chain.

This data is first collected by the parachain’s full nodes, known as collators, who maintain their specific shard (parachain) by collecting transactions and producing proof for validators to add their blocks to the network.

Users can use decentralized access points, in the form of light, web-browser-based clients, that automatically verify the information received from a parachain’s full nodes by comparing it to an available Merkle root of the latest chain state.

Polkadots Parachains

Parachains are where users interact with dApps on the Polkadot network. Parachains inherit the security of the main chain and each is its own networks, typically designed to fulfill a specific function. Parachains don’t even have to be blockchains, can have their own economies with their own native tokens, and are not required to hold or use the DOT token. Polkadot currently hosts over 300 dApps, all built on parachains.

Parachains can be custom-built using the Substrate plug-and-play, modular blockchain-building framework. This modular design allows for forkless upgrades, as developers can easily add on new features.

Special bridge parachains can be built to allow Polkadot and its network of parachains to connect to external networks—such as the soon to launch Snowbridge connecting the network to Ethereum.

The XCM Messaging Standard

Even though all the parachains in the Polkadot network can differ greatly from each other in design and function, they can still communicate with each other and external blockchain. This can, for example, allow a user on one parachain to use a smart contract on another.

Any chain connected to Polkadot can communicate with and exchange information with any other chains in the network.

The XCM standard allows this by simply defining how the messages should look and act, not what they should contain—this means that they can be used for the transfer of both data and value. Messages that fit this standard are then sent through the Relay Chain and delivered to the recipient chain.

While the relay chain is currently the path for XCM messages, a cross-chain messaging protocol (XCMP) is under development to allow parachains to communicate with each other directly. This will be done through dedicated communication channels, and setting up one of these channels will require locking up DOT.

The Relay Chain: Consensus and Security

The Relay Chain is focused on securing the parachains, their data, and the whole Polkadot network. As such, it doesn’t offer things like tokens and smart contracts. The currency of the Relay Chain is DOT, which is mainly used for staking and governance votes. Tasks managed by the relay chain can be delegated to system parachains.

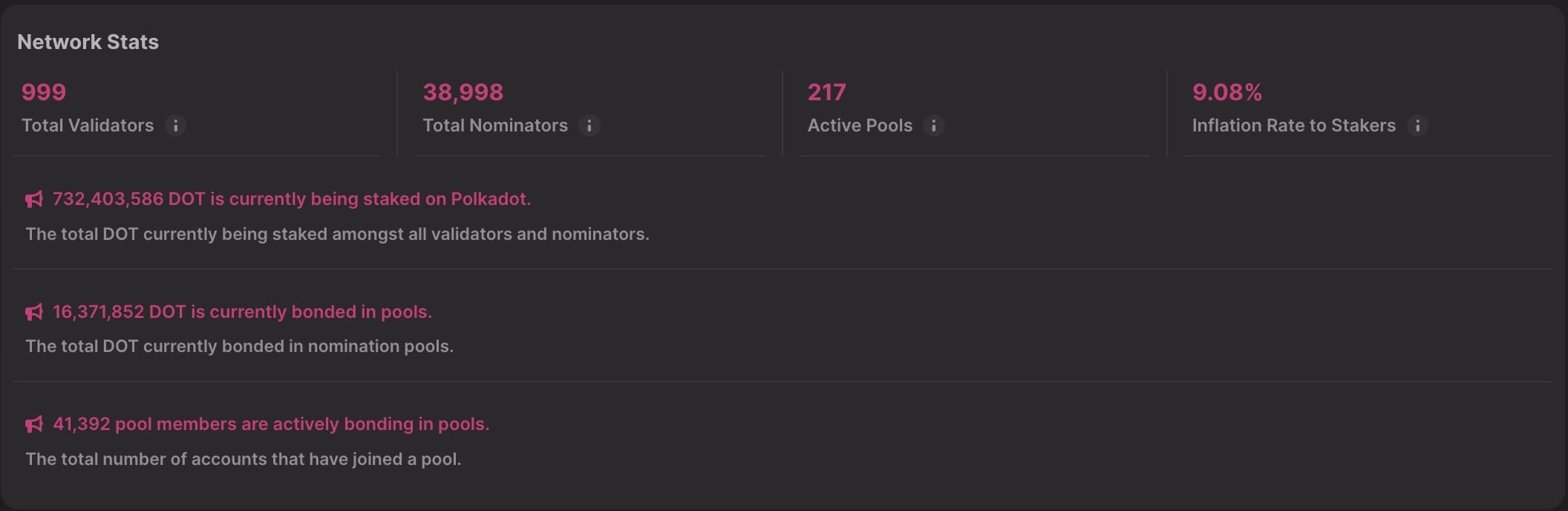

The Relay Chain is secured by a nominated proof-of-stake (NPoS) consensus model and is secured by the network validators who validate the blocks of parachains and add them to the network. Holders of DOT can lock up their tokens and nominate up to 16 validators to secure the network. Earning DOT rewards for doing so.

Block space is the commodity of the Relay Chain and this is auctioned as 6-month slots, for a maximum of two years at a time, to parachains—who purchase this to store their data, paying for it in DOT.

DAO Governance and A Treasury

The Relay Chain and, ultimately, the Polkadot protocol are governed by a DAO. Here, DOT holders can propose and vote on changes to the protocol, and every decision goes through a public vote.

A Council, elected by DOT holders, also exists, alongside a Technical Committee that is made up of the teams building Polkadot. Council members propose elements for DOT holders to vote on but also have the power to veto dangerous or malicious votes. The Technical Committee can propose and fast track, with Council approval, emergency votes for implementation on time-sensitive tasks.

An on-chain treasury, funded by new DOT emissions, is controlled by the voters of the Polkadot DAO.

DOT Token Features and Utility

While parachains can have their own tokens, the DOT token is an integral part of the Polkadot ecosystem. Use cases of the DOT tokens are as follows:

- Paying for slots for block data storage on the Relay Chain

- Paying transaction fees on the Relay Chain

- Voting on governance proposals

- Voting to elect council members

- Rewarding validators and delegators (called nominators)

- Staking to run a validator node and earn rewards

- Locking to nominate validators, help secure network, and earn rewards

- Locking to connect parachains to the network

- Locking to open up communication channels between chains

The DOT is an inflationary token, and the inflation rate is set to 10% annually, although this can be adjusted through on-chain governance. Newly issued DOT is used to pay validators and nominators as a reward for securing the network.

A staking rate is used to determine the rate of token emissions, with the goal of maintaining an Ideal Staking Rate, currently set at 60%. This is to ensure a balance between maximum possible security and token liquidity. When the staking rate deviates from this 60%, in either direction, a proportion of staking fees are directed to the treasury, thereby incentivizing validators and stakers to help maintain the ideal staking rate.

Factors Influencing Polkadot’s Price

As with even the best altcoins, Polkadot’s DOT token will, for the foreseeable future, move in tandem with the rest of the crypto market as it is affected by factors such as movements in the Bitcoin price movements, regulatory change, and global adoption.

However, the Polkadot ecosystem has its own unique factors that will affect the price of the DOT token.

Major Polkadot Governance Decisions

Anyone who holds DOT can create a governance proposal, and all DOT holders can vote on that proposal. As the network expands and evolves there are likely to be some big governance decisions that the community will vote on. This includes changing the Staking Rate, the DOT inflation rate, and what is funded by the Polkadot Treasury.

Here, it is also worth considering the veto power held by the council. If this is used controversially to veto a successful vote on a major governance decision then this could have a huge effect on the token price.

Parachain Auctions

Polkadot currently only supports a limited number of parachains, 100, and the Relay Chain block space needed by these parachains is auctioned every 12 days. To win one of these actions the parachains must win a candle auction, where the last bid placed at the time the auction finishes wins the slot.

Bidders must lock up their bid of DOT tokens until the auction is over, and this means that the supply of DOT is reduced, reducing the availability of DOT.

The winner of each auction must also lock their tokens up for 96 weeks, the length of their rented time slot. As the popularity of the Polkadot network grows we can expect these auctions to be more and more competitive and greater amounts of DOT to be locked up during the auction and by the eventual winner.

Staking Rates and Validator Performance

Native staking is supported on Polkadot, and those participating in staking receive a portion of the newly emitted DOT tokens as a reward.

The amount of new DOT issued to stakers depends on the difference between the current percentage of DOT staked and the optimal Staking Rate, currently 60%. Any deviation from this means more funds are directed to the treasury and less likely to hit the markets in the near future, reducing sell pressure on DOT.

A staking participant’s individual rewards are based on the performance of the validator they choose and, as such, will also be impactful on how quickly tokens are moved to market.

Polkadot Ecosystem Development

As the Polkadot ecosystem grows and as the protocol continues to move forward, interest in the protocol is likely to grow. This growth will increase demand for Polkadot’s DOT token, and positive ecosystem developments that increase the profile, utility, or other aspects of the network are likely to have the same impact.

Polkadot Price Predictions by Other Experts

Our price prediction for DOT is not the only one out there. So, to supplement our offerings, we’ve combed the internet to find other experts who are bold enough to make a Polkadot price prediction.

Egon Polkadot Prediction

On the website and YouTube channel AllInCrypto, writer Egon predicts that Polkadot can hit highs of $26 in 2024.

Rahul Unnithan Polkadot Prediction

Writing for the Crypto Bulls Club, Rahul Unnithan predicts Polkadot will trade in a range between $8.422 and $61.632 in 2025. He also predicts highs of $298.18 in 2030.

Praveen Jadhav Polkadot Prediction

The writer and analyst Praveen Jadhav, writing for the OvenAdd platform, predicts that DOT will not break its all-time high until 2030‚ with an expected maximum price of $56.44.

Cianna Joy Polkadot Prediction

On TheNewsCrypto website, writer Cianna Joy forecasts that the DOT token will hit a high of $15 in 2024 and trade between $8.20 and $30 in 2030.

Prasanna Peshkar Polkadot Prediction

Writing for the CryptoTicker website, Prasanna Peshkar predicts that the price of DOT could hit $50 by the end of 2024.

Is Polkadot a Good Investment?

Created by one of Ethereum’s cofounders and built to allow for application-specific blockchains that can be easily constructed in a modular fashion, Polkadot seems quite future-proof. Its community governance, upcoming bridge to the Ethereum network, and soon-to-be-reworked auction process all also help to point toward a bright future for Polkadot.

However, a crowded blockchain world, a reliance on users continually competing to obtain block space, and a relatively high inflation rate could see Polkadot and its native DOT token fall out of favor with users and speculators in the future.

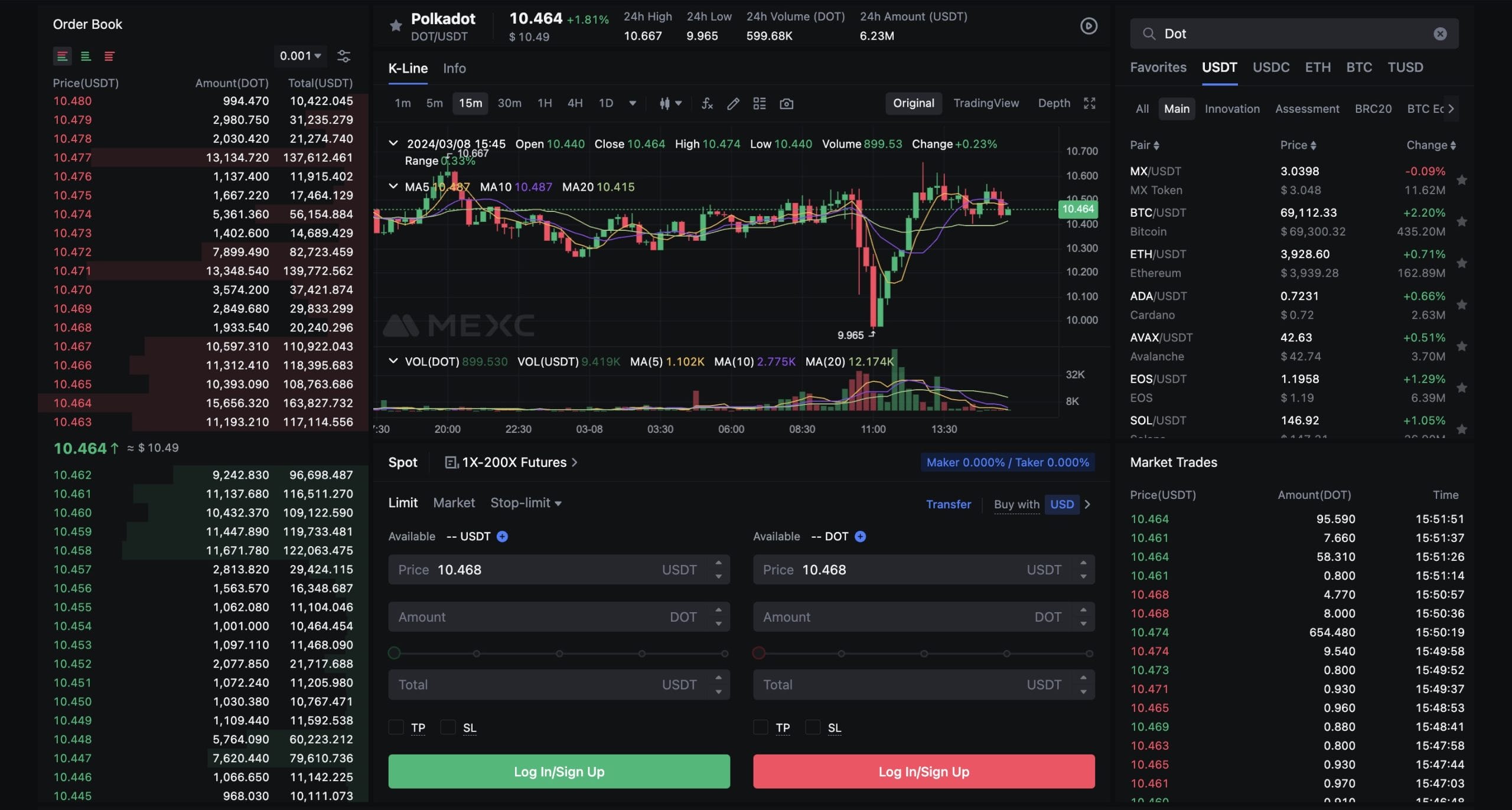

Best Place to Buy Polkadot

With many crypto exchanges out there, it can be hard to choose which one best suits your needs. However, out of all of the exchanges that offer DOT, our top pick is MEXC.

The MEXC exchange was founded in 2018 by experts from the banking industry and has been developed as a high-speed exchange that can process over 1.4 million transactions per second. MEXC is available in over 170 countries.

MEXC offers users 0% fees on their Spot market for all assets, not just DOT. It also offers users margin and futures trading, including Polkadot perpetual futures, with up to 20x leverage.

With support for over 1,000 coins, a 1:1 proof of reserve for top assets, and 10 million customers around the world, MEXC is our top pick for where to buy DOT to add to your portfolio.

Bottom Line for Polkadot

As a modular blockchain system with some exciting upgrades planned for 2024, many DOT holders are excited about the prospects of their bags. Zooming out to look at the wider crypto market, you see many analysts agreeing with them that this is going to be a good year for DOT and crypto as a whole.

With a former Ethereum cofounder at the helm and modularity already built into its design, Polkadot looks like it is here to stay long-term as the blockchain world evolves to address its scalability issues.

FAQs

Will the Polkadot Price Recover?

Our Polkadot price prediction expects the Polkadot price to recover through 2024 and 2025, with highs of $22.50 and $40 in each year, respectively. Longterm we expect Polkadot to reach new ATHs in 2029.

Can Polkadot Reach $100?

Yes, the price of Polkadot’s DOT can reach $100, and we expect it to do so in the 2030s, with 2040 being the first time it spends a whole year above $100.

Does Polkadot Have a Future?

According to our Polkadot price prediction and analysis, Polkadot has a very bright future, both technologically and in terms of price. For the latter, we predict that DOT will trade between $5.50 and $22.50 for 2024.

How High Can Polkadot Go?

From our Polkadot price analysis, DOT will trade for an average price of $11 in 2024 and hit a high of $22.50. Our Polkadot price prediction also forecasts a high of $88 by the end of the decade.

What Price Will Polkadot Reach in the Next Bull Run?

Our Polkadot price prediction expects DOT to hit a high of $40 in the next bull run, which will run from 2024 into 2025.

References

- Polkadot 2023 Roundup (Medium)

- The Launch of Parachains (Medium)

- Parachains are Live! Polkadot Launch is Now Complete (Medium)

- Clarification on Sharing False Spot Bitcoin ETF News (CoinTelegraph)

- Candle Auction (Oxford Reference)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Viraj Randev

Viraj Randev