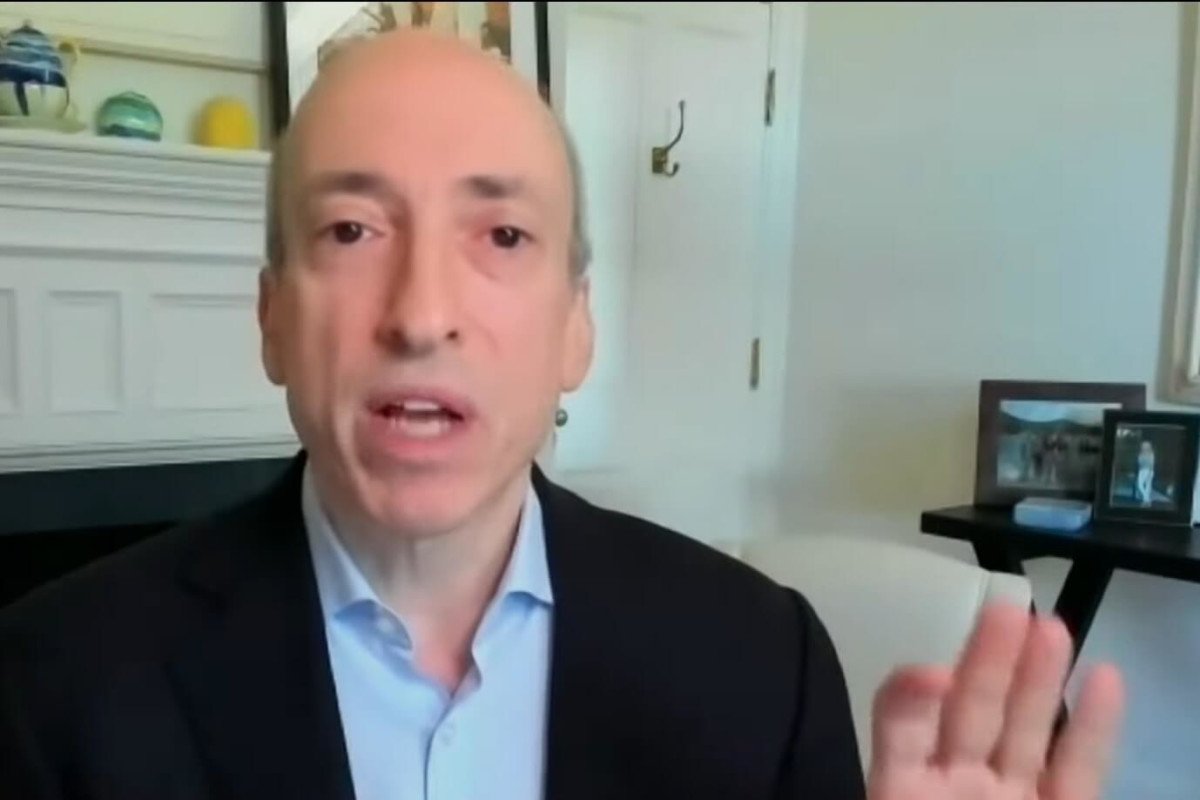

US SEC Chief Gensler Says Crypto Sector Rife with ‘Non-compliance’

The head of the US Securities and Exchange Commission (SEC), Gary Gensler, has said that his agency will “do what we can” to ensure crypto operators fall into line, but opined that many are refusing to abide by the rules governing securities.

Speaking during an interview with Bloomberg TV, Gensler stated that many operators’ business activities fell under “classic parts of the securities laws,” but that these companies were not toeing the line.

He said:

“Without prejudging any one platform or any one token, there’s a lot of non-compliance. Meaning that if you raise money from the public, and that public is anticipating, based on your efforts, some profit – that comes into the securities laws.”

He took aim in particular at crypto lending platforms, which have had a torrid past few months, explaining that “lending platforms are managing the money managing the crypto” – and that “those are the classic parts of the securities laws.”

Gensler emphasized that “far too many” crypto lending platforms “haven’t come in to basically comply with the law and register” with the SEC.

And he conceded that the SEC also needed to step up its own game if it wanted to “protect the public,” adding:

“I think that there is a need at the [SEC] to […] work through some of these things with these trading and lending and brokerage platforms.”

Gensler also opined that without “basic protections,” the crypto industry would struggle to survive in the long term, explaining: “If the crypto sector is going to persist, it’s only with trust. Otherwise, a lot of people will get hurt.”

He repeated allegations that the “vast majority” of tokens on the market “have the attributes of a bunch of promoters and sponsors raising money from the public and the public then needing certain protections.”

And, pushed on the question of whether the SEC would follow up with a fresh round of regulatory guidelines for the sector, Gensler refused to commit, instead stating that the agency would “continue to work” with players in the sector and would “continue to bring robust enforcement actions as well.”

____

Learn more:

– Pressure on SEC Chair Rises as Even WSJ Accuses Gensler of ‘Holding Investors Hostage’ with Bitcoin ETF Stance

– This Is Low Long Grayscale vs. SEC Battle Over Bitcoin ETF Might Last

– Regulatory Fog Remains as SEC Chief Doesn’t Mention Ethereum as a Commodity, Does Not Say Bitcoin is the Only One Either

– US SEC Talks Exemptions

– US SEC Launches Probe into Insider Trading Safeguards of Crypto Exchanges – Report

– SEC’s Peirce Says Crypto’s Lack of ‘Bailout Mechanism’ Is a Strength; FTX CEO as a ‘White Knight’