Top 6 Crypto Growth Drivers By Binance’s VIP Clients

Change in global and local regulations was again chosen as the largest driver for the cryptoasset industry, a survey by Binance Research showed.

The research arm of the major crypto exchange Binance conducted their second survey, distributed to their large institutional and VIP clients. The survey included 76 participants, English and Mandarin speakers, most of which are firms, funds, and institutions with allocations to cryptoassets ranging from USD 100,000 to more than USD 25 million, while 54% of respondents keep their cryptoasset investment/trading portfolio between 1 and 10 coins.

Out of that sampling of client respondents, 60 have each selected three from the list of twenty growth drivers, after which the researchers finalized the list of six growth drivers for the future of the cryptocurrency and digital asset industry:

- change in global and local regulations (44.3%)

- traditional brokerages offering crypto services, such as E-Trade or Fidelity Digital Assets (34.4%)

- development of options contracts and other derivatives (27.9%)

- Bitcoin exchange-traded funds (ETFs) (27.9%)

- Facebook’s Libra (19.7%)

- Central Bank Digital Currencies (CBDC) (19.7%).

The report states that, in both surveys (in June and October) the respondents ranked regulations as the top potential growth driver, as well as the most considerable risk driver.

However, among the features that the respondents didn’t find particularly relevant as growth drivers, receiving fewest votes, the report lists privacy features, staking solutions, private blockchains, security tokens and decentralized exchanges, respectively.

On the other hand, when it comes to the largest risks, 48.3% of the 60 respondents have chosen platform-specific failure, such as hacks, followed by Tether’s legal issues (43.3%). Libra and CBDC found themselves on the list of the lowest risks, contrary to what one might deduce given the ongoing regulatory scrutiny and debates.

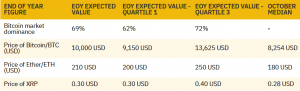

The report also made a few forward-looking comments. The price predictions by the respondents for the three largest coins by market capitalization (given in October, for the period until December 31) were bullish, says the report, but adds that “these predictions remained quite conservative in their magnitude for an industry as volatile as the digital asset one.”

On the other hand, Bitcoin market dominance median prediction was some 69% (compared with 65.5% today), which means that they had higher expectation for it by the end of the year in October than in June. “This echoes the fourth largest risk to clients, who quoted the lack of retail interest in the altcoin market as one of the critical risks for the development of the cryptoasset industry,” Binance Research concludes.

Other findings in the report include:

- Tether (USDT) remains the go-to stablecoin, with 40.25% out of 69 respondents choosing it;

- USD Coin (USDC) is in the second place with 19% of votes;

- the share of respondents who have used decentralized exchanges (DEXs) has declined since June from 55% to 42.6%;

- 75% of respondents do not use crypto lending and borrowing services, while most of the remaining 25% use both custodial and non-custodial services;

- staking is more popular than lending, with 56% of the respondents staking some of their cryptoassets;

- 29.4% of the respondents stake by themselves and 22% rely on third-party services (mostly exchanges).