Massive Short Interest Pushes Funding Rate of Tron’s TRX to Negative 500% Annually

The price to short the Tron blockchain’s native token TRX reached as high as 500% annually on crypto exchange Binance today, as traders rush to place bets that the token will fall further.

News of the sharp spike in the so-called funding rate for the TRX perpetual futures contract on Binance was shared by Tron founder Justin Sun himself on Twitter on Monday. The outspoken crypto entrepreneur, who left Tron to work as a diplomat for Grenada, said that he doesn’t think this level of short interest can last for even 24 hours.

“Short squeeze is coming,” Sun added.

Funding rate of shorting #TRX on @binance is negative 500% APR. @trondaoreserve will deploy 2 billion USD to fight them. I don't think they can last for even 24 hours. Short squeeze is coming. pic.twitter.com/VRExM6UK70

— H.E. Justin Sun 孙宇晨 (@justinsuntron) June 13, 2022

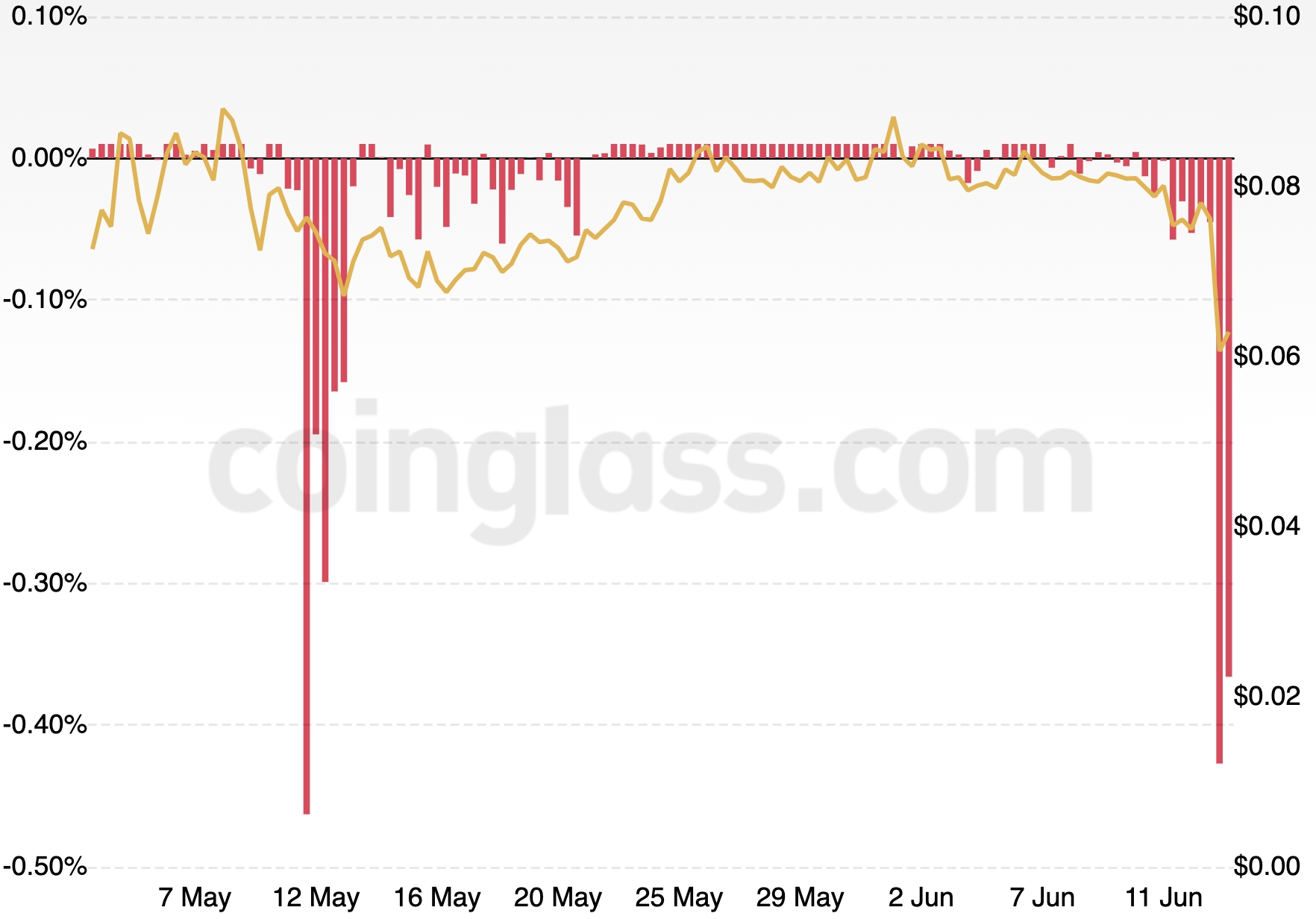

At the time of writing (11:30 UTC), the funding rate had fallen somewhat, with Binance now charging 0.4272% per 8-hour period to those traders who are short TRX perpetual contracts, per data from CoinGlass.

On an annualized basis, the rate adds up to 468%.

TRX funding rate (red) and price (orange) on Binance:

The massive shorting interest comes as TRX as of Monday at 11:30 UTC had already fallen by 17% for the past 24 hours and 23% for the past 7 days, trading at a price of USD 0.0628.

TRX price on Binance:

Shortly after, Sun took to Twitter again to share that the TRON DAO Reserve has deposited USDC 100m on the crypto exchange Binance to purchase TRX.

Doing our part. https://t.co/ykZj4R3pVE

— H.E. Justin Sun 孙宇晨 (@justinsuntron) June 13, 2022

Meanwhile, it also appears that the peg of USDD, the new stablecoin recently unveiled by Sun, has come under some pressure.

As of 11:30 UTC, USDD traded at USD 0.992, after having touched a low of USD 0.984 earlier in the day, per CoinGecko data.

“700 million USDC has been injected into TRON DAO Reserve for USDD peg,” Sun wrote, adding “Well done!”

700 million USDC has been injected into @trondaoreserve for #USDD peg. Well done! https://t.co/r11PnBte4g

— H.E. Justin Sun 孙宇晨 (@justinsuntron) June 13, 2022

Tron and the TRX token have come into renewed focus after Sun revealed plans for USDD, an algorithmic stablecoin with similarities to the now-failed terraUSD (UST). The stablecoin was promoted as “the most decentralized stablecoin in human history,” and was said to offer holders annual returns of 30% for staking it, higher than the 20% that was famously offered for UST.

Following the collapse of UST, however, Sun has attempted to distance his own project from Terra’s stablecoin. Among other things, he said that USDD will always have a backing of at least 130%, made up of various cryptoassets and other stablecoins.

____

Learn more:

– Justin Sun’s Tron Reveals More Details of USDD Backing in a Move to Distance It from UST

– USDD vs UST: Is Justin Sun’s New Stablecoin Just a Clone of UST?

– Top 4 Play-to-Earn Games on Tron

– Justin Sun Spoke of ‘Cooperation with Russia’ After Donating Funds to Ukraine

– TRX Drops as Justin Sun Leaves Tron to Become His Excellency Ambassador

– His Excellency Ambassador Justin Sun Is Going to Space in 2022