Crypto Market Sentiment Improves Further, XRP Leads

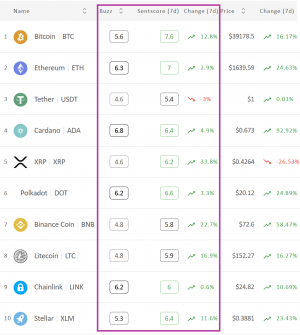

The beginning of February brought some much-anticipated optimism in terms of crypto market sentiment, as nearly all major coins have improved their moving 7-day average sentiment score (sentscore). In turn, the combined moving 7-day average sentscore for 10 major coins, increased from 5.8 last week to 6.33 today, according to Omenics, a crypto market sentiment analysis service.

Nine out of ten top coins ended the week positively, as only Tether’s (USDT) sentscore declined approximately 3%. Bitcoin (BTC) climbed up back to very positive zone (7.6), while Ethereum (ETH), Cardano (ADA), XRP, Polkadot (DOT), Chainlink (LINK), and Stellar (XLM) established their positions into somewhat positive zone. Notably, XRP has improved the most sentiment-wise, climbing from 4.8 all the way up to 6.2 this week – an increase of 34%.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive zone.

Looking at the past 24 hours, most sentscores of the top 10 coins are slightly in the red zone. Still, bitcoin leads the way with a very positive 7.7, followed by ETH with 6.9. Cardano stands out with a sentiment decrease of -6.7%, which has pushed it out back into the neutral zone with a sentscore of 5.9. Out of all top 10 coins, none of them are in the negative in the past 24 hours.

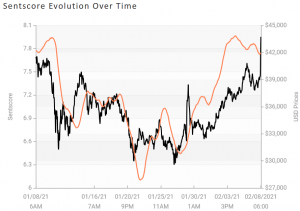

Daily Bitcoin sentscore change in the past month:

Looking outside of the top 10 coins list, amongst other 26 cryptoassets measured by Omenics, the largest 7-day move was made by EOS, which climbed into a somewhat positive zone, scoring 6.1 – a 24.4% weekly growth in market sentiment. The lowest sentscores amongst outsiders are held by Crypto.com (CRO) and USD Coin (USDC), which are 4.8 and 4.9, respectively. The former declined -7.4% last week, while the latter dropped by -9.6%.

___

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 36 cryptocurrencies.