Bitcoin, Ether ‘Recovered Most of Their Losses’ after March Crash – Report

The world’s two most popular cryptocurrencies have recovered well following flash crashes in March – and the number of small-scale crypto owners appears to be on the rise, per a new report.

These were the findings of the latest CoinMetrics State of the Network report, published today.

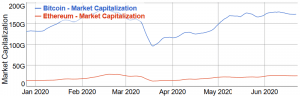

The report’s authors presented data that showed that both bitcoin (BTC) and ethereum (ETH) have recouped most of their losses after the sudden crash of March 12, when BTC briefly dipped below the USD 4,000 mark. Most altcoins were also hit with staggering falls.

However, BTC, ETH and many others have experienced slow and steady growth – or stability – in the following months.

The authors wrote,

“BTC’s market cap recovered to USD 187.58 bn by June 1, just shy of its February high. Similarly, ETH’s market cap reached USD 27.69 bn on June 1.”

Bitcoin and Ethereum market capitalization, 7-day moving average:

And per the authors, recent weeks have also been good to tokens such as cardano (ADA), and omiseGO (OMG), although bitcoin cash (BCH) and litecoin (LTC) “have lagged behind.”

Post-March 12, there has also been a rise in the number of addresses “holding relatively small amounts of crypto,” particular in BTC and ETH wallets, as well as Ripple’s XRP and tezos (XTZ).

The report made note of the fact that there were “noticeable increases” in the number of addresses holding at least 1 billionth of the total supply (0.000000001%) of the aforementioned tokens.

The authors said this was evidence, perhaps that the “amount of individuals holding these assets is growing, and that the amount of retail investors (i.e. non-institutional) may be increasing.”

However, they added a caveat, stating,

“It’s important to note that a single entity can own many addresses at once, so an increase in addresses does not necessarily mean an increase in usage. Alternatively, the rise could be caused by a small number of entities spreading their coins across many addresses.”

The report’s authors also claimed data showed that stablecoin trading, particularly in the BTC-tether (USDT) pairing had “exploded” of late, peaking just after the March 12 crash, but remaining high “ever since.”

At pixel time (12:10 UTC), Bitcoin is trading at USD 9,644. having appreciated 1.76% in a day and 1.36% in a week. Meanwhile, Ethereum is changing hands at USD 243. It went up 2.82% in a day and 3.76% in a week.