How to Build the Best Crypto Portfolio Allocation in 2024

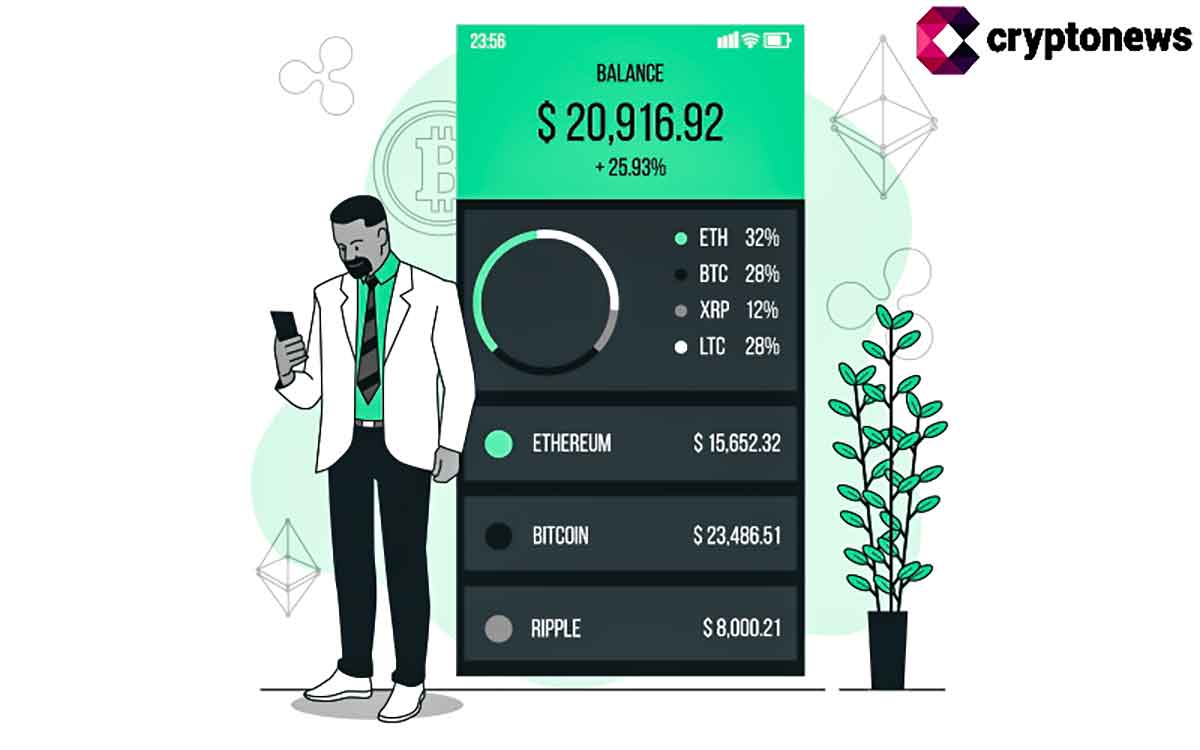

Creating a diversified crypto portfolio is crucial, considering how volatile and speculative this trading industry is.

In this regard, a well-diversified portfolio should contain a wide variety of crypto assets across many different niche markets. The purpose of this guide is to explore the best crypto portfolio allocation for risk-averse investors.

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode ahead of Doge Day

- ETH

- usdt

- Send SOL and wait for airdrop - the new way of doing presales

- Over $10M raised, launches April 29

- No hard cap total - first come first served

- Solana

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

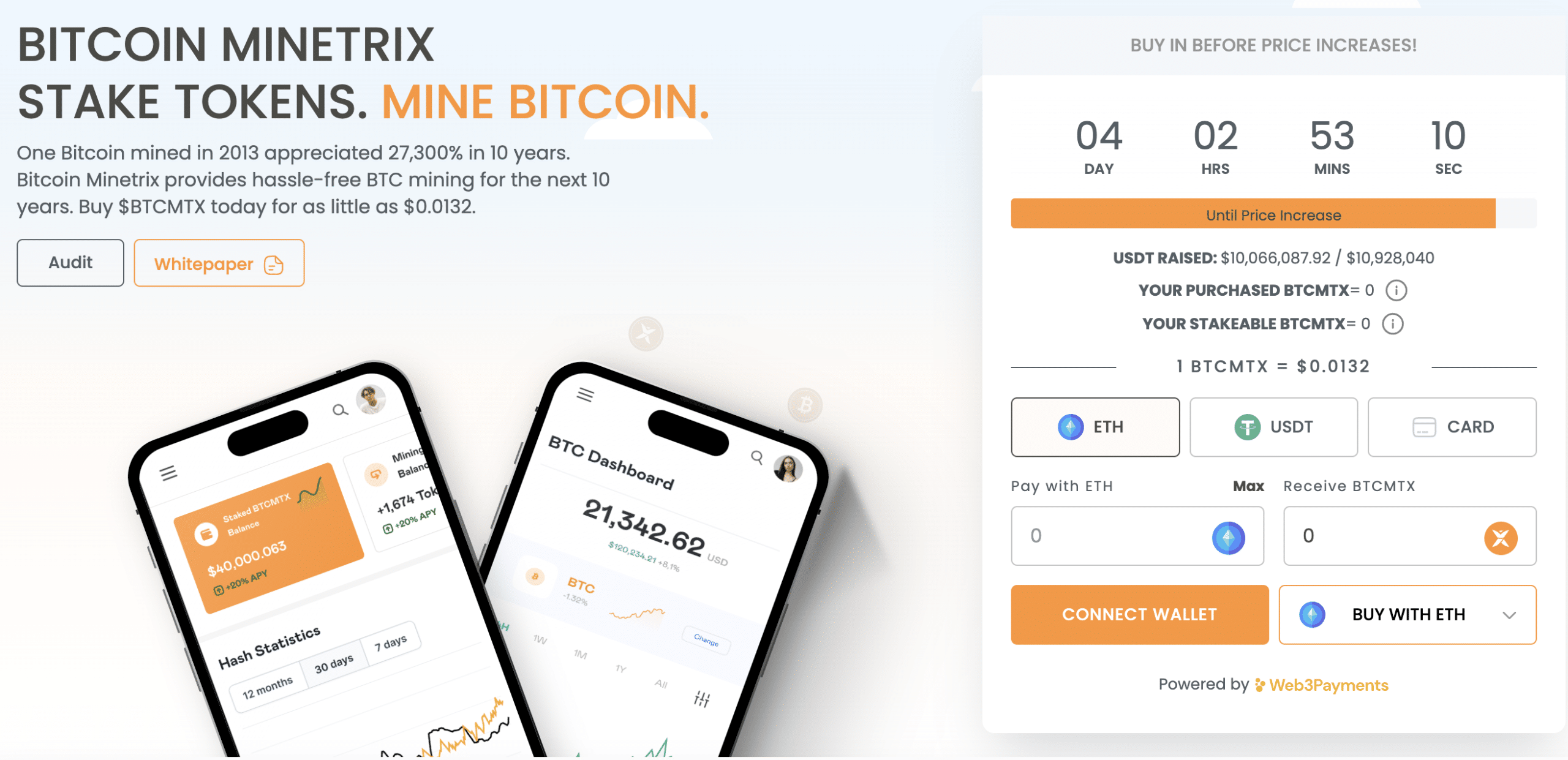

- Innovative stake-to-mine project for easy BTC mining

- Presale has raised over $6.5m so far

- Over 90% staking APY during presale

- ETH

- bnb

- usdt

- +1 more

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- Access to huge fee revenue through staking

- 50% of 10bn token supply available at presale stage

- 85% of fees go back to the community

- usdt

- bnb

- ETH

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- Innovative AI crypto casino offering staking, airdrops and custom games

- $HPLT presale has raised over $400k so far with +60M bets placed by +150k users

- Offers daily staking rewards, hype NFTs and is fully audited by Certik

- bnb

- ETH

- usdt

Best Crypto Portfolio Allocation Summary

Holding a diversified portfolio of cryptocurrencies will ensure that investors avoid becoming over-exposed to a small number of coins. This means that if one project doesn’t quite perform as well as expected, other coins within the diversified portfolio could help cover the losses.

Therefore, the overarching purpose of crypto portfolio allocation is to spread the risk across many different projects. First and foremost, investors should ensure that their portfolio allocates funds to established, large-cap cryptocurrencies.

Bitcoin and Ethereum represent good options here. At the other end of the scale, investors might also wish to allocate funds to newly launched projects with a smaller market capitalization. This offers investors the opportunity to target higher gains.

Another angle to take is to diversify into other crypto asset markets entirely, such as relevant stocks or even interest accounts.

Ultimately, the key takeaway is that the more high-quality assets there are in a portfolio, the more risk-averse it is in the long run. Just remember, even allocating a small amount of capital to higher-risk projects can work out favorable long-term, providing the portfolio is well-diversified.

Best Cryptocurrencies to Add to Your Portfolio

As noted above, the best crypto portfolio allocation strategies will ensure that a portfolio is diversified across many different types of digital assets.

In this section, we offer some insight into how a well-diversified portfolio might allocate its funds.

1. Dogecoin20 – Latest Meme Coin to Add to Your Portfolio With Over 200% Staking APY

Dogecoin20 is an exciting new meme coin presale that aims to repeat the success of similar meme coins like Dogecoin and Dogwifhat. To achieve that, Dogecoin20 offers a generous staking APY of over 200% during the early stages of the presale. This could be one of the reasons why investors have already dropped over $4.4 million within two weeks since the presale launched and added it to their portfolios.

To participate in the presale, you need an Ethereum wallet and some ETH and USDT. The token price during the early stages stands at $0.000203 but it will increase during the presale, giving early investors the lowest price before the token officially launches and lists on exchanges.

From the total token supply of 140 billion, 25% will be offered in the presale and 12.5% will be distributed to stakers within the first year, based on the Dogecoin20 whitepaper. Early investors who stake the token during this time will get to increase their bags without making additional purchases.

If you’re not interested in staking, buy DOGE20 tokens with BNB and wait for the presale to end to claim your tokens. This way you’ll save money on transaction fees and you can sell your tokens whenever you want.

To get the latest information about this exciting new meme coin, follow Dogecoin20 on X and join the Dogecoin20 Telegram channel.

| Presale Started | March 2024 |

| Purchase Methods | ETH, USDT, BNB and Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

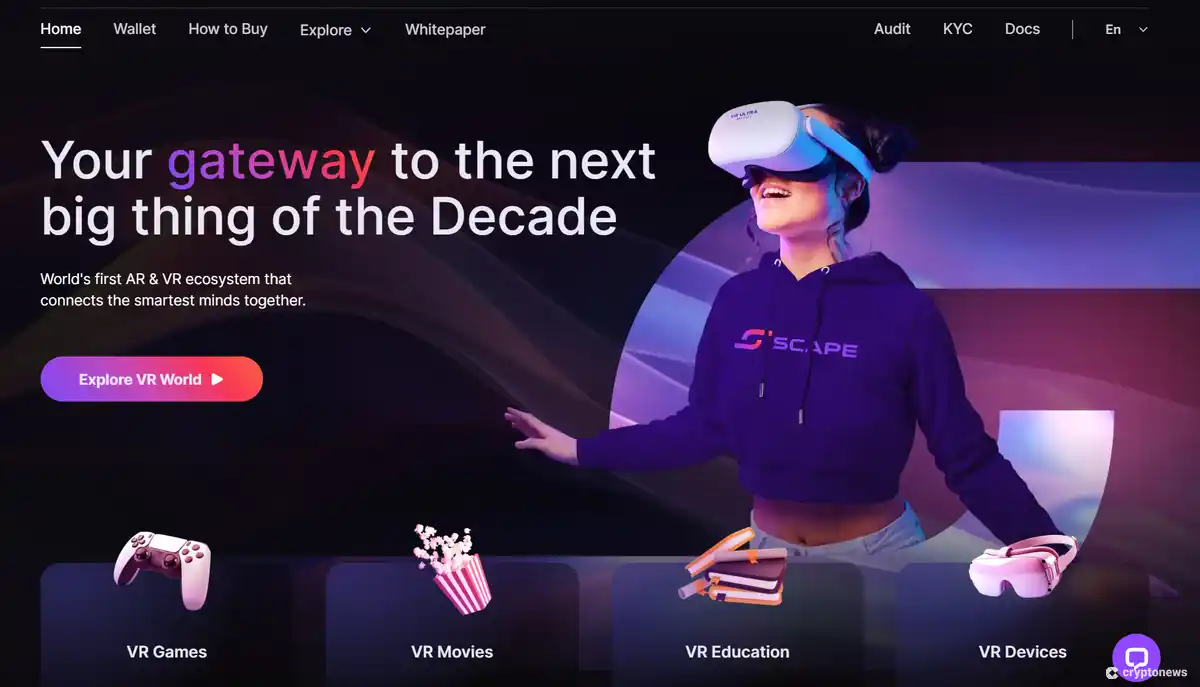

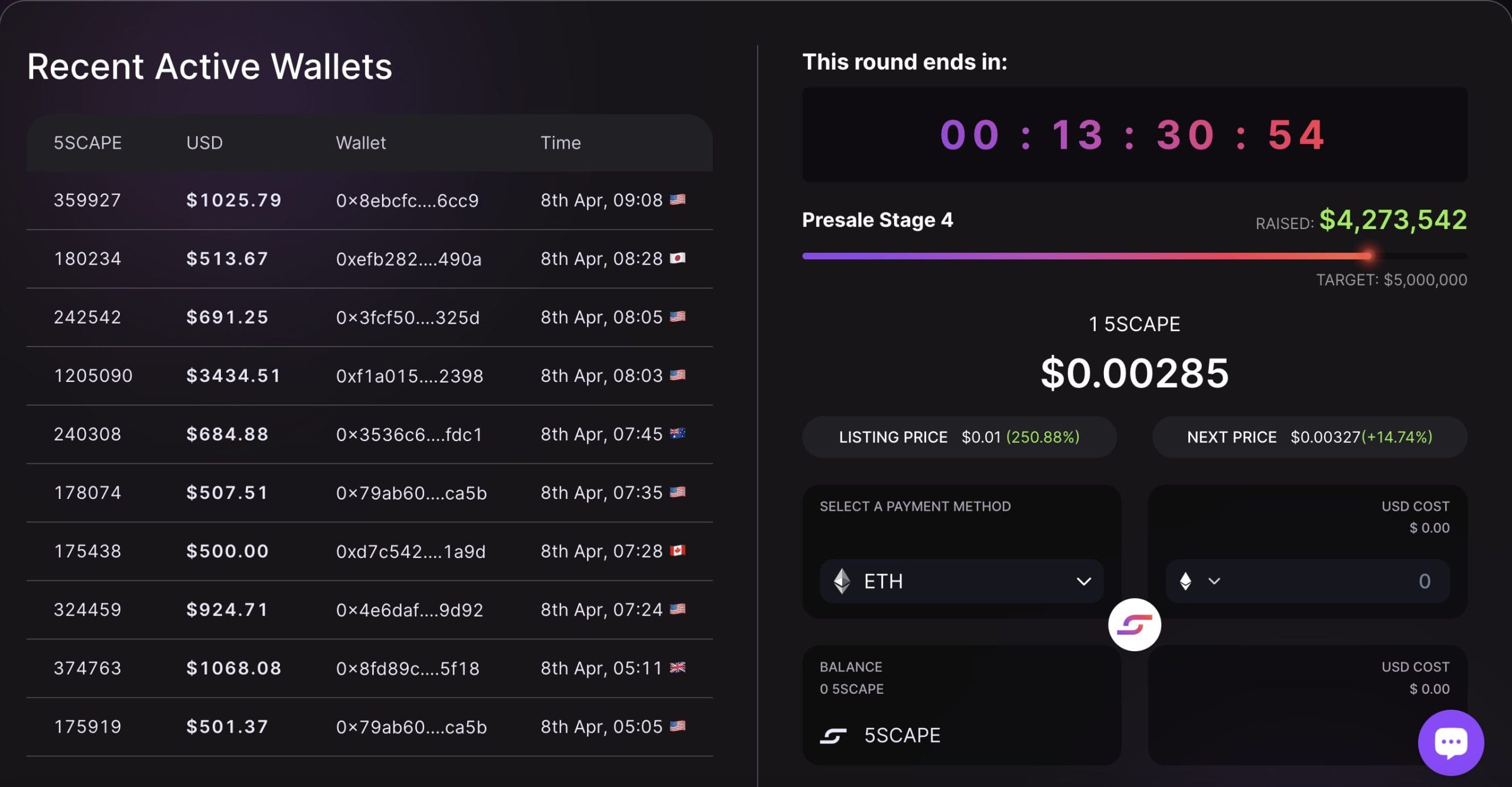

2. 5th Scape – New Crypto Gives Exclusive Access to Different VR Experiences

Investors could allocate their funds by investing a portion into $5SCAPE, the native token of 5th Scape. One of the emerging areas of the last few years has been virtual reality. 5th Scape takes it a step further by combining VR gaming experiences within the blockchain.

This utility token will be used to gain direct benefits and exposure within the VR gaming world. 5th Scape will create a number of VR-themed environments – ranging from gaming modes to educational seminars and access to blockbuster movies. $5SCAPE token holders get exclusive and lifetime access to a number of 5th Scape’s ecosystems.

For instance, you can take part in different MMA, Soccer, and Cricket-themed VR experiences. To heighten the gaming experience, players can purchase 5th Scape’s VR headsets and gaming chairs. These offer ergonomic support and use precise motion tracking. Token holders can purchase these products at discounted rates.

Interested investors can get in early by purchasing $5SCAPE through the ongoing presale round. You only need to pay $0.00285 per token, as per the ongoing round. The presale will feature 12 rounds, across which more than 4 billion tokens will be allocated. This comprises 80% of the total 5.21 billion token supply.

After the presale concludes, $5SCAPE will list at a price of $0.00285 per token. So far, the presale has raised over $4.2 million. The hard cap target is set at $15 million. Learn more about this cryptocurrency by going through the 5th Scape whitepaper and joining the Telegram channel.

| Presale Started | January 2024 |

| Purchase Methods | USDT, BNB |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

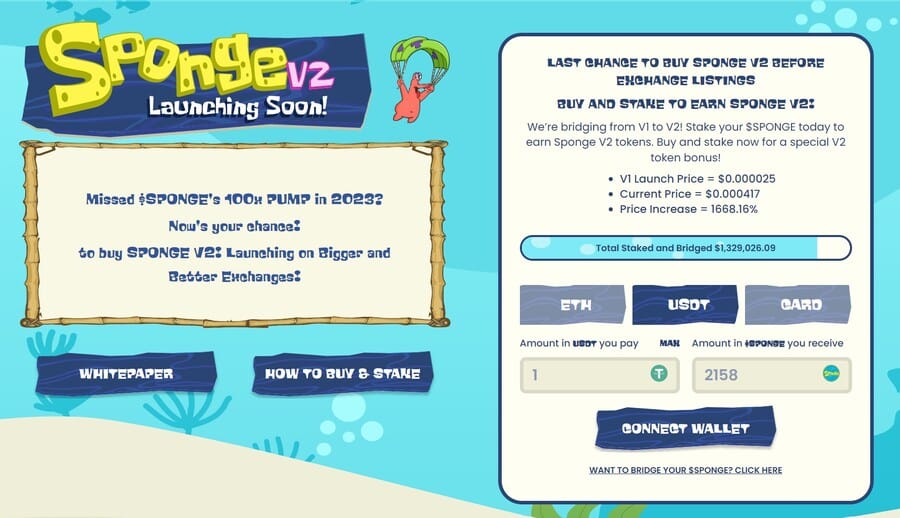

3. Sponge V2 – Popular Crypto That Follows the Success of Sponge V1, Which Surged 100x From Presale Prices

Sponge V2 is a popular crypto to add to your portfolio as it has a massive reward potential. Its previous version, the Sponge V1, had a market cap of $100 million at its peak in 2023. With a racing play-to-earn game in the pipeline and a strong community behind it, Sponge V2 has a potential to surpass its predecessor.

However, you can only get the Sponge V2 tokens by staking your V1 tokens. If you don’t have any, visit the Sponge V2 website, connect your MetaMask, or any other Ethereum wallet, and use ETH or USDT to make the purchase.

Stake your tokens to take advantage of the strong annual percentage yield that stands over 246% as of this writing. The APY will drop, which makes it prudent to stake as early as possible. But with over 43% of the total token supply dedicated to staking emissions, according to the Sponge V2 whitepaper, it’s likely that the strong APY will last longer compared to other tokens.

Once the bridge from Sponge V1 to Sponge V2 token process ends, the stage two begins. During this time you can claim your locked tokens, which you can keep staking, holding or you can sell them on major exchanges as the token will be listed by then. In stage three, the racing play-to-earn game is planned for release.

Follow Sponge V2 on X and join the Sponge V2 Telegram channel to get the latest information about the project. If you want to engage with the developers and the community, join the Sponge V2 Discord.

| Presale Started | Dec 2023 |

| Purchase Methods | ETH, USDT and Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

4. Smog – Best Crypto To Add To Your Portfolio That Offers A 42% Staking APY And High Airdrop Rewards

Many investors are turning to Smog ($SMOG) for the best crypto portfolio allocation. It is a hot new meme token on Solana that’s gaining massive investor popularity.

Since its launch on the Jupiter DEX in February 2024, Smog’s market cap has surged from $2 million to over $100 million in just over a week, showing its potential for massive growth. At press time, its market cap is currently around $60 million.

With a total supply of 1.4 billion tokens, Smog has reserved 490 million tokens for its “Greatest SOL Airdrop” campaign, which aims to promote community engagement through social media and various challenges. This campaign has seen over 7,000 participants in just a few days, showing high investor traction.

Additionally, Smog’s staking program offers a lucrative 42% APY. Around 10.5 million tokens have already been staked, showing high investor trust and confidence.

Also, there is anticipation surrounding Smog’s potential listings on more exchanges, which could increase its market exposure and liquidity. Such developments have positioned Smog as a top choice for investors in their crypto portfolio allocation.

Those who want to learn more about the platform and its ecosystem can read the Smog whitepaper. Interested buyers can also follow Smog on X (Twitter) and enter its Telegram channel for the latest updates.

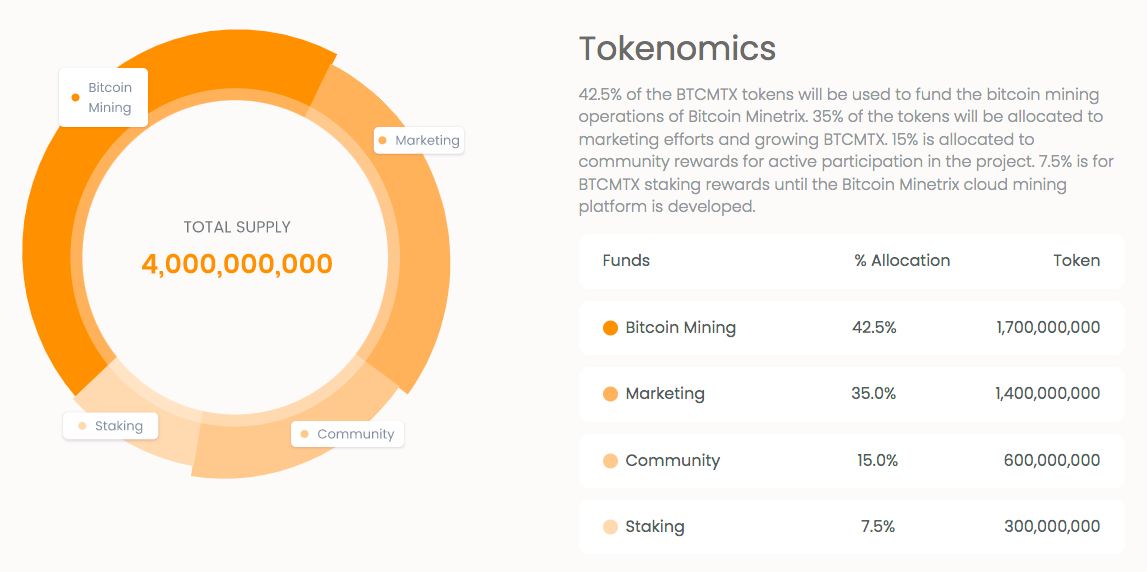

5. Bitcoin Minetrix – New Stake-to-Mine Crypto Tokenizing Cloud Mining Credits and Offering High Annual Yields

Investors can allocate their portfolio by purchasing crypto presales such as Bitcoin Minetrix (BTCMTX). While presales can be a high-risk investment, users can also enter the projects at a very early stage.

Bitcoin Minetrix is revolutionizing the cloud mining space by tokenizing cloud mining credits into ERC-20 tokens. Cloud mining is a process through which third parties rent out mining times to individuals. This reduces the cost of setting up mining rigs and buying expensive mining and hardware equipment.

However, the cloud mining space is uncertain due to the number of scams taking place. Therefore, Bitcoin Minetrix has decentralized the cloud mining process. By introducing $BTCMTX, the native token, Bitcoin Minetrix allows token holders to stake their holdings and earn tokenized cloud mining credits.

These credits are recorded on a digital ledger, and cannot be duplicated. To further entice the investor, Bitcoin Minetrix will also provide passive income on your staked tokens. At press time, Bitcoin Minetrix is offering staking APYs (Annual Percentage Yields) as high as 66% on the Ethereum-powered staking contract.

While the cloud mining credits one generates cannot be traded, they can be burned on the blockchain to acquire Bitcoin cloud mining power. The mining power is used to earn allocated mining times and generate a percentage of the Bitcoin mining fees.

Interested investors have the opportunity to buy $BTCMTX on round three of the presale, before the price surges. Currently, the token is priced at only $0.0132. However, $BTCMTX will be subject to price increases at each stage of the 39-stage presale.

The presale is allocating 2.8 billion tokens – equating to 70% of the total 4 billion token supply. Bitcoin Minetrix is also running a token minedrop – which will offer $30,000 worth of $BTCMTX tokens to ten lucky presale entrants.

So far, the presale has raised more than $10 million. Read the Bitcoin Minetrix whitepaper and join the Telegram channel to learn more about this cryptocurrency.

| Presale Started | 26 Sept 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

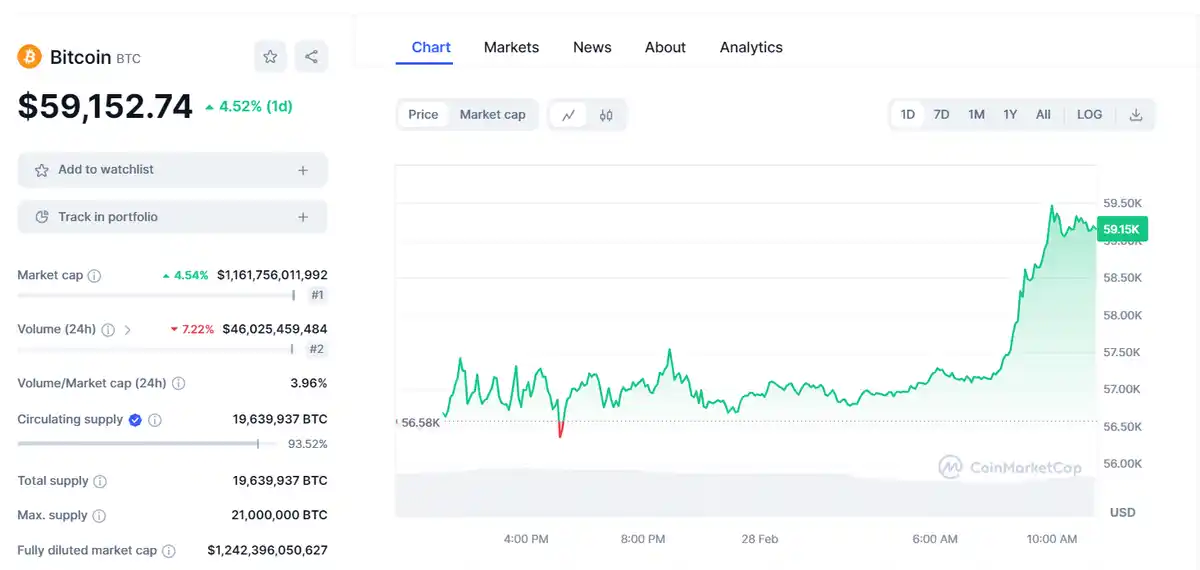

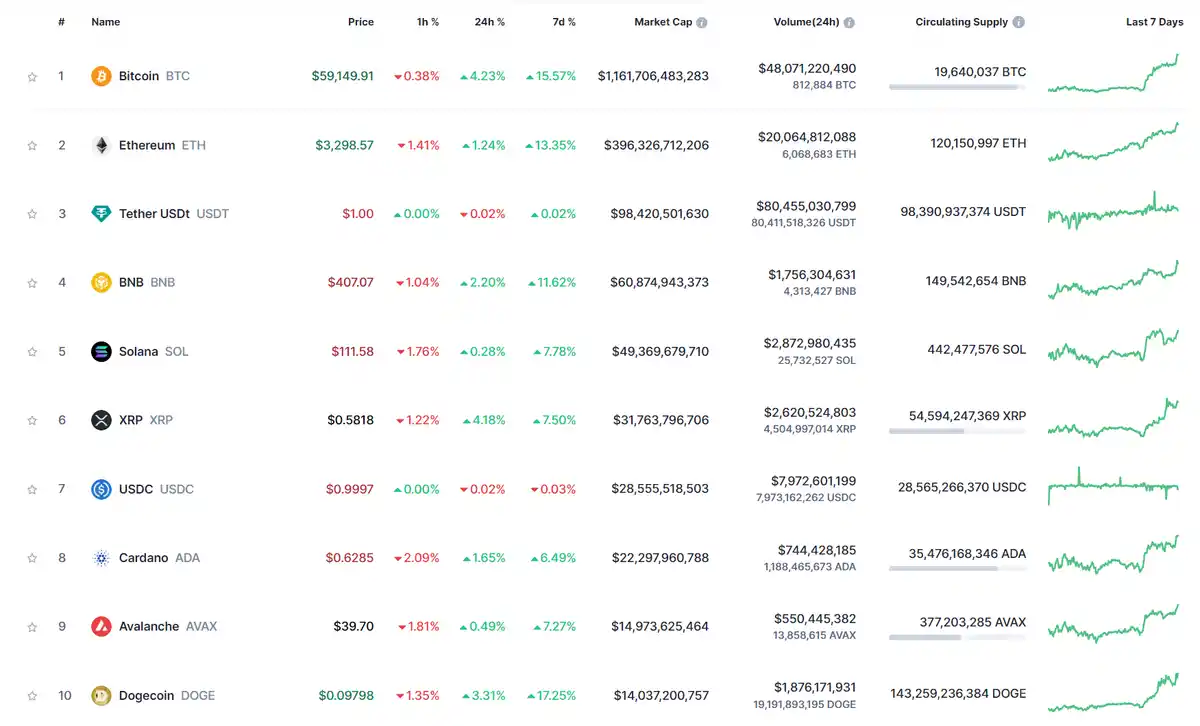

6. Bitcoin – Best Crypto Asset for Risk-Averse Portfolio Allocation

Bitcoin is the largest and most valuable crypto asset in this space. Crucially, although Bitcoin will arguably grow at a slower pace in comparison to the best altcoins in the market, the de-facto cryptocurrency offers some much-needed portfolio stability – at least in the long term.

At its peak, when Bitcoin hit an all-time high of over $68,000 in November 2021, this digital asset was worth more than $1 trillion. The valuation of Bitcoin declined by 70% from its prior peak, but is now climbing steadily up again as the Bitcoin halving event approaches. This offers a superb opportunity from a cryptocurrency asset allocation perspective, as Bitcoin can be purchased at a significant discount ahead of this major event.

Rather than allocating capital to Bitcoin in one lump sum, risk-averse investors might instead consider a dollar-cost averaging strategy. This means buying a small amount of Bitcoin each week or month at a fixed investment stake. In doing so, each purchase will attract a different cost price, which will be averaged out over time.

Another reason why investors might consider allocating a large weighting to Bitcoin is that the crypto asset is limited in supply. Just 21 million Bitcoin will ever exist, which makes the cryptocurrency a scarce asset. Moreover, the circulating supply of Bitcoin is fixed and predictable, with new coins being minted every 10 minutes.

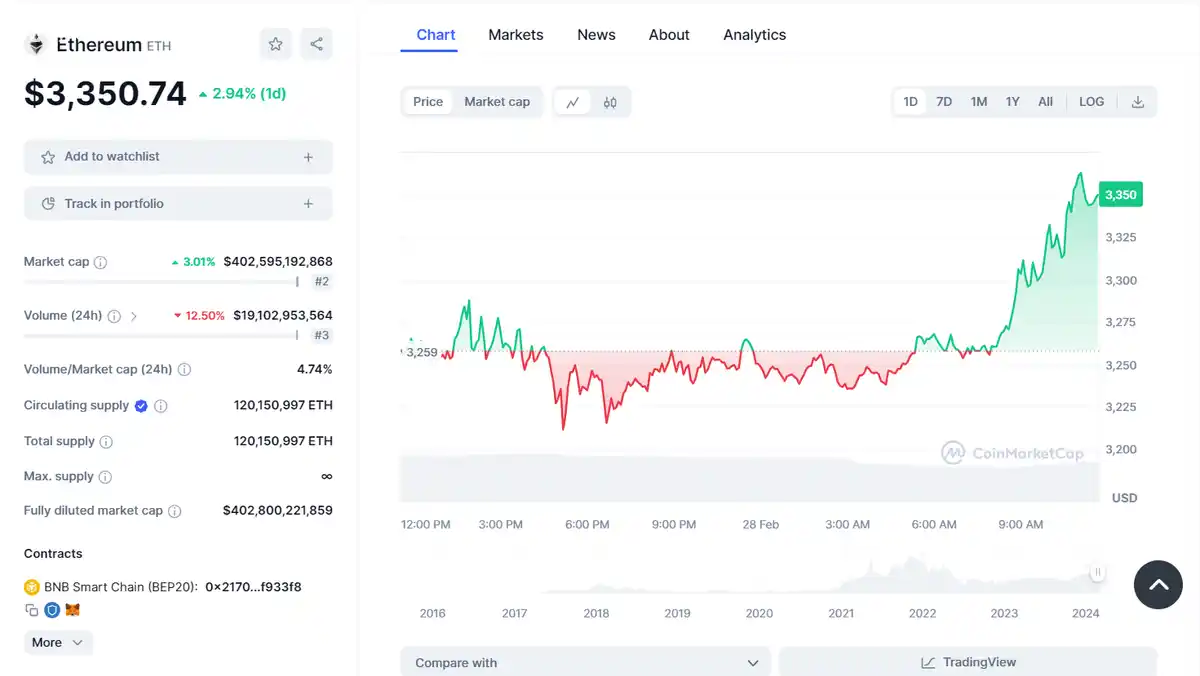

7. Ethereum – Largest Smart Contract Blockchain With Thousands of ERC-20 Tokens

Behind Bitcoin, Ethereum is the second-largest crypto asset in this space. This is another project to consider when evaluating the best crypto portfolio allocation strategy. As of writing, Ethereum carries a market capitalization of over $402 billion.

When compared to Ethereum’s all-time high of almost $5,000, the crypto asset is trading at a discount of 33%. While the value of Ethereum declined considerably since the bull market peaked in late 2021, it is on a path to recovery. This once again offers an attractive entry price when investing in Ethereum. In terms of longevity, although there are other competitors in the smart contract arena, Ethereum is the de-facto blockchain network in this regard.

To illustrate this point, there are many thousands of altcoins built on top of the Ethereum blockchain – otherwise known as ERC-20 tokens. This is because Ethereum is a trusted network that is renowned for its security and efficiency. This is especially the case now that Ethereum has completed its much-anticipated ‘merge’ to proof-of-stake.

This will benefit Ethereum and ERC-20 tokens greatly, as transaction fees are now lower and speeds are much faster. Moreover, Ethereum is now more scalable, which will potentially attract even more projects to its ERC-20 framework. Many of the best upcoming ICOs are Ethereum-based too, which offers even more demand for its decentralized smart contract services.

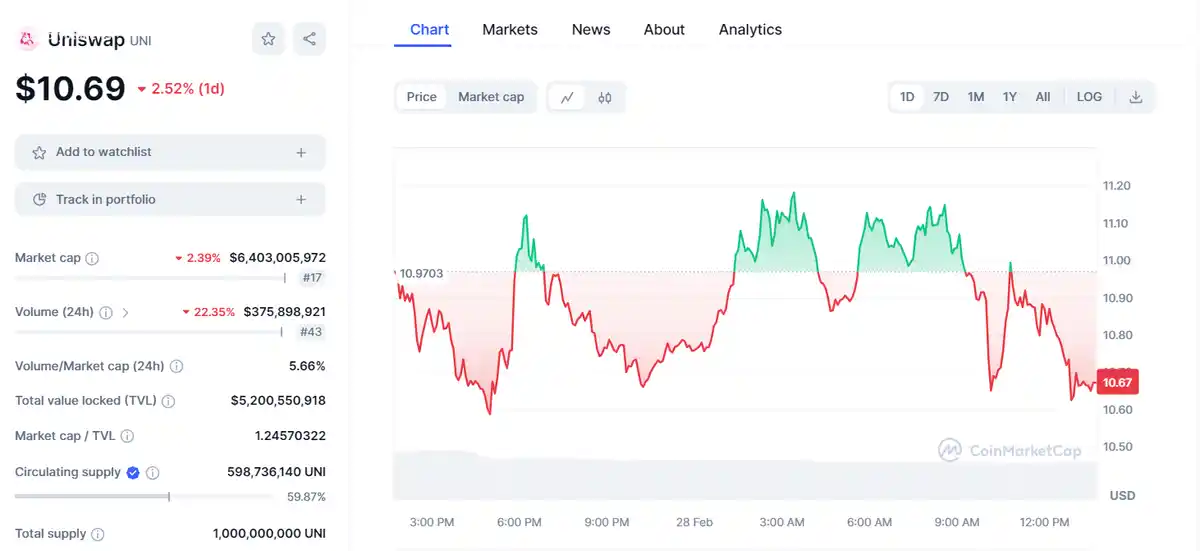

8. Uniswap – Invest in the Future of Decentralized Finance

The best crypto portfolio allocation strategies will also dedicate capital to growing trends and markets. At the forefront of this is decentralized finance, which offers traditional financial services to consumers without requiring investors to go through a third-party intermediary. Uniswap is a leader in this space, with the project focusing on Ethereum-based tokens.

On Uniswap, investors can swap one ERC-20 token for another without needing to create an account or provide any sensitive KYC documents. Instead, investors simply need to connect an Ethereum-compatible wallet to the Uniswap ecosystem and swap the two tokens in real time. Uniswap can facilitate this via an automated market marker (AMM) protocol.

In the most basic of terms, this removes the need for traditional order books. Instead of requiring a seller to be present in the transaction, the AMM system at Uniswap relies on liquidity pools. Each pair will have equal amounts of both tokens, which ensures that Uniswap can offer its trading services in a decentralized manner – 24/7.

Furthermore, liquidity pools can be funded by anyone, which enables investors to generate passive income on their idle tokens. Uniswap is therefore one of the best yield farming crypto platforms for passive investors. One of the easiest ways to add UNI tokens to a portfolio is to invest via the regulated and low-cost broker.

Building a Diversified Crypto Portfolio – Balancing Methods

There is no one-size-fits-all strategy that can be taken when evaluating the best crypto portfolio allocation. The reason for this is that each investor will have their own financial goals and risk appetite.

Nonetheless, there are a number of core strategies that can be undertaken when building a balanced crypto portfolio, which we discuss in more detail in the sections below.

Portfolio Weighting

A great starting point is to assess the weighting of the crypto portfolio. The ‘weighting’ simply refers to the percentage breakdown of each crypto investment type. A well-balanced portfolio should be heavily weighted to large-cap and established projects.

- While the specific weighting will ultimately be determined by the investor, risk-averse traders might consider allocating 70% of their crypto portfolio to Bitcoin and Ethereum.

- The argument here is that both projects have solidified their status in this space, and subsequently, represent two of the best long-term crypto assets.

- In this scenario, this would leave 30% of the portfolio on small and medium-cap projects.

Although riskier when compared to Bitcoin and Ethereum, smaller-cap projects that have recently entered the crypto space can provide above-average gains.

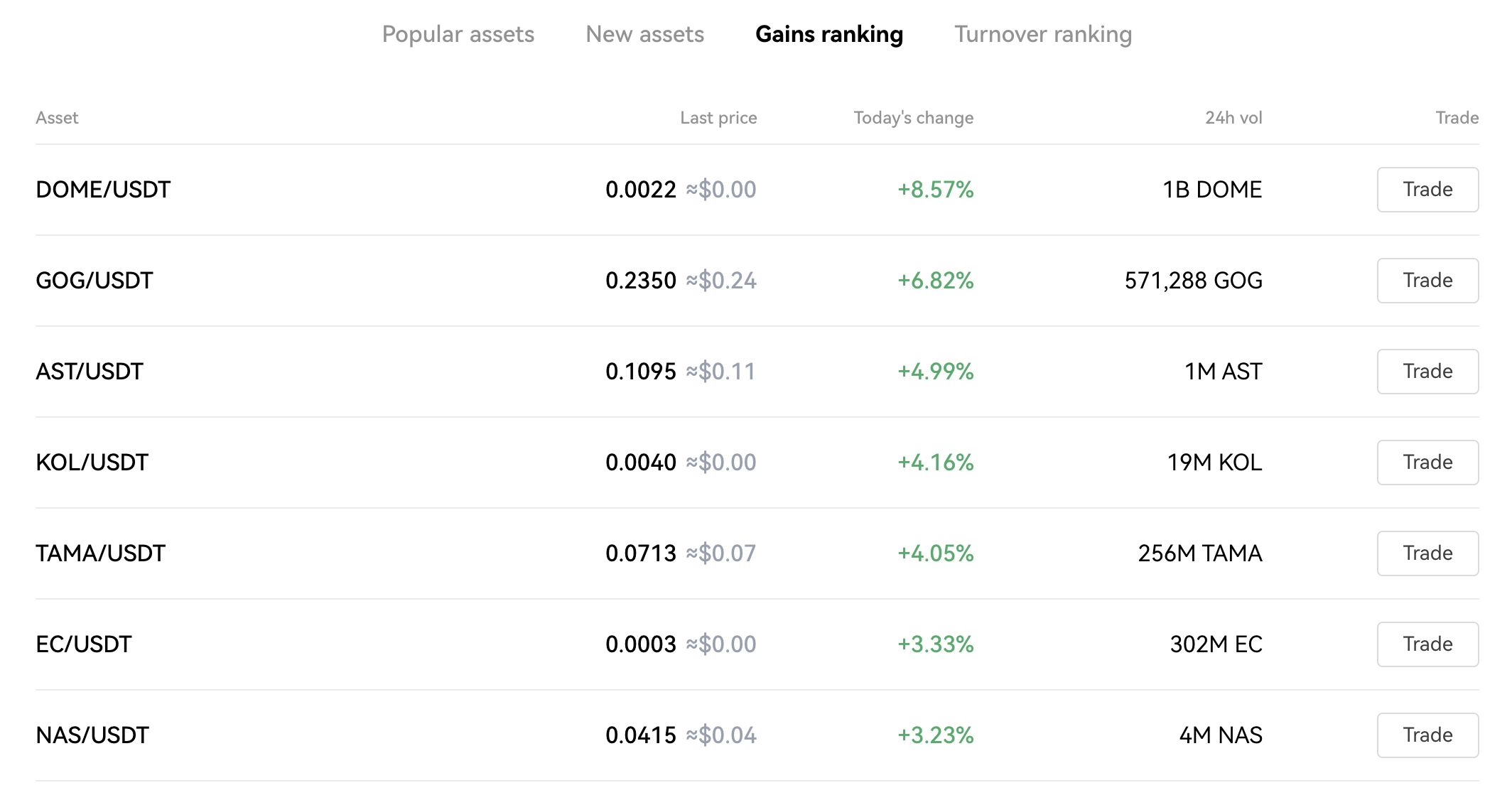

Diversification of Each Niche Market

Each crypto project in the market will look to target a specific niche – such as the metaverse, NFT gaming, smart contracts, or interbank payments.

The fact is, however, that within each niche, there are many crypto assets competing for their share of the respective market.

Let’s take smart contracts as a prime example:

- We mentioned earlier that Ethereum dominates this space considerably – with thousands of ERC-20 tokens built on its network.

- However, there are many other smart contract blockchains in the market – some of which offer faster, cheaper, and more scalable transactions.

- Therefore, one of the best crypto portfolio allocation strategies in this regard would be to diversify the investment funds across multiple smart contract projects.

- While Ethereum might be heavily weighted, the portfolio could also allocate capital to the likes of Solana, Cardano, and Neo.

This strategy can also be deployed when investing in higher-growth projects. For instance, in addition to Smog and SpongeV2, investors might allocate funds to a selection of other crypto presales.

Consider Other Asset Classes When Gaining Exposure to Crypto

There is often a misconception that the only way to gain exposure to cryptocurrencies is to buy individual coins. While this is often viewed as the most effective way of investing in crypto, other options exist. And crucially, this offers an additional way to create a well-balanced and diversified portfolio.

Let’s take Coinbase as a prime example. This large crypto exchange is a publicly traded stock on the NASDAQ. As Coinbase is a pure-play crypto stock, this means that its value is closely associated with the broader market. More importantly, from an investment perspective, Coinbase offers exposure to the wider industry without needing to pick and choose suitable crypto projects.

Avoid Being Overexposed to Crypto

Additionally, it is also important to remember that to truly become a risk-averse investor, portfolios should never be 100% exposed to crypto.

On the contrary, it is wise to consider investing in other asset classes entirely, such as stocks, ETFs, or precious metals.

In doing so, when the broader crypto market is bearish – like it is right now, other assets within the portfolio might counter these losses.

For example, oil stocks and index funds have generated phenomenal results in 2022 due to ever-rising energy prices.

Why it’s Important to Have a Well-Balanced Crypto Portfolio

It can be tempting to go ‘all-in’ on a crypto asset that offers an attractive upside potential. However, investors should remember that this marketplace is hugely speculative. Many, if not most, cryptocurrencies in this space do not offer any long-term utility.

Instead, investors will buy tokens simply with the view of making short-term gains. While this strategy can work for some investors, most will end up burning through their capital in the long run.

Investing in low-cap projects and crypto presales can still represent a viable investment strategy. However, investors should think carefully about how much of their portfolio to allocate to each project and exactly how much to invest in each crypto. Another factor to bear in mind is that there are now more than 21,000 cryptocurrencies listed on CoinMarketCap.

There is only so much liquidity to go around, meaning that not all projects will witness notable growth – if at all. But, by investing in a large number of projects with a sensible amount of capital, this offers the best crypto portfolio allocation strategy in the long run.

How to Diversify Your Cryptocurrency Portfolio

Creating a diversified and well-balanced cryptocurrency portfolio can be a daunting task for beginners.

In this section, we offer a step-by-step overview of how to proceed.

Step 1: Assess Investment Capital

The first step for investors to take is to evaluate how much capital they can allocate to their crypto portfolio.

This should be an amount that the investor is comfortable losing, owing to the speculative and volatile nature of crypto assets.

Step 2: Create DCA Strategy

Once the size of the investment capital has been assessed, the next step is to create a dollar-cost averaging (DCA) strategy. This means that instead of investing the entire capital in one lump sum, the investor will split each crypto asset purchase over an extended period of time.

- For example, let’s say that the investor has $5,000 that they wish to allocate to their portfolio

- An example of a sensible DCA strategy would be to split the $5,000 capital over 10 monthly investments of $500

This means that the investor will average out the cost price of each crypto asset that they buy.

Step 3: Determine Portfolio Weight

Before assessing the best crypto to buy, investors should first evaluate their portfolio weighting. This should be determined by the financial goals and risk appetite of the investor.

To offer some insight, investors might consider allocating 70% of the portfolio to large-cap cryptocurrencies. Large cap, or large capitalization, refers to the market capitalization of at least $10 billion.

The investor might then consider allocating 20% to medium-cap projects that have a valuation of between $2 billion and $10 billion. As of writing, there are approximately 80 projects that meet this criterion.

The final 10% of the portfolio could go to small-cap projects, which cover more than 99% of the 21,000+ tokens listed on CoinMarketCap. Within this segment of the portfolio, investors might consider adding dozens or even hundreds of small-cap tokens, for ultimate diversification.

Step 4: Begin Investing

Once the make-up of the portfolio has been identified, the investor can then begin allocating funds to each crypto asset. In this regard, it is important to choose an exchange that offers access to a large number of cryptocurrencies alongside competitive fees.

OKX is a great option, not least because the exchange offers more than 600+markets across large, medium, and small-cap cryptocurrencies. Just remember, that each purchase should be in line with the dollar-cost averaging strategy discussed in Step 2.

For example, if 10% of the portfolio was allocated to small-cap cryptocurrencies and the monthly DCA investment is $500, just $50 should go to projects within this category.

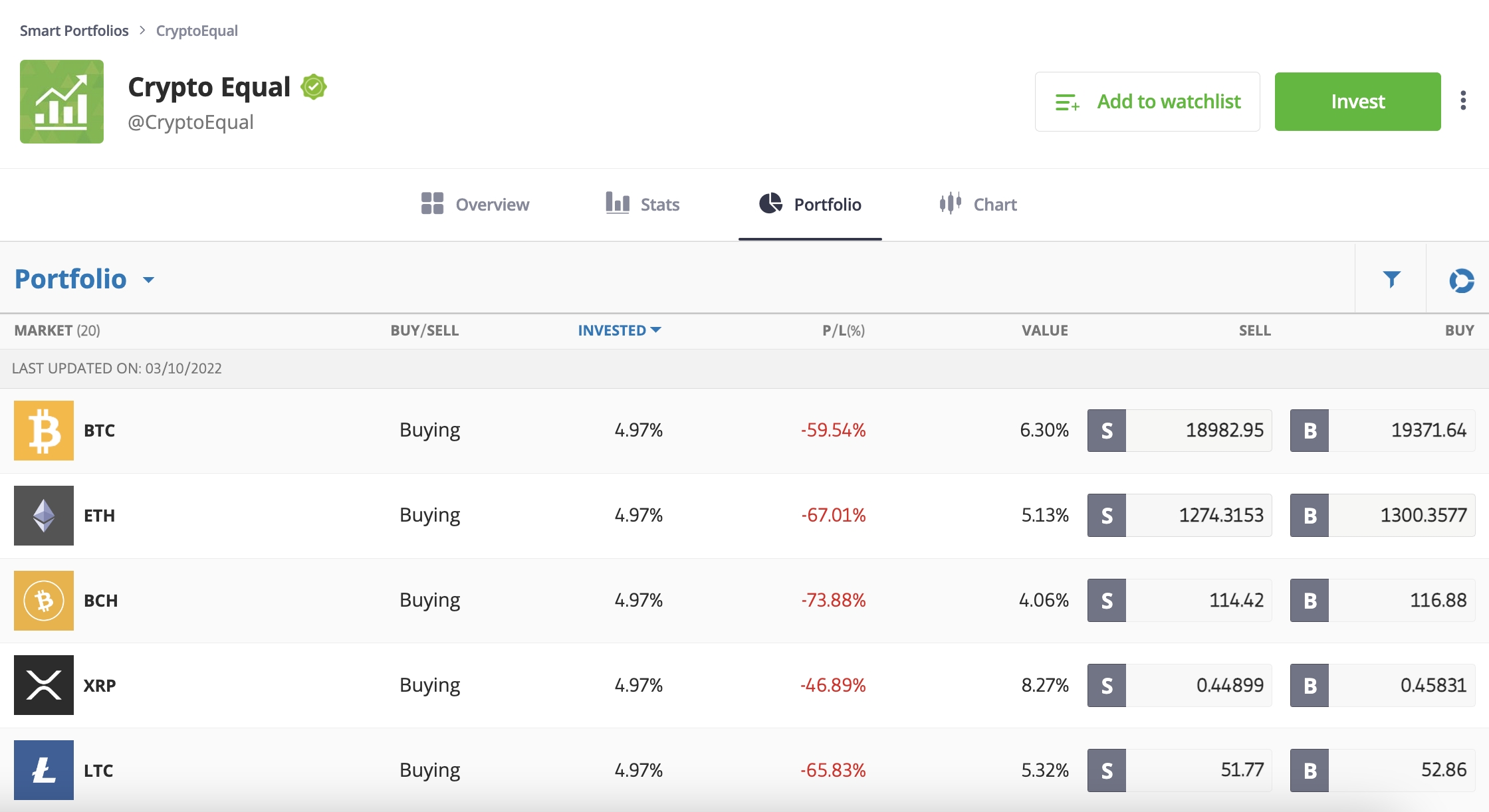

Examples of Well Balanced Crypto Portfolio Allocations

To reiterate, there is no one-size-fits-all strategy when creating a well-diversified and balanced crypto portfolio. On the contrary, the make-up of the portfolio will differ from one investor to the next, based on their risk profile and long-term goals.

Nonetheless, to offer some insight into what a medium-risk crypto portfolio might look like with an investment capital of $10,000, consider the following example:

50% – Large-Caps

A medium-risk crypto investor might elect to allocate just 50% of their portfolio to large-cap coins. As noted above, just six crypto assets carry a large market capitalization, excluding stablecoins.

The investor might elect to hold 50% of their large-cap crypto investments in Bitcoin, with the balance spread out across the remaining five tokens.

So, the total investment is $10,000 and 50% is allocated to large-cap projects – so this segment of the portfolio would look like the following:

- Bitcoin – $2,500

- Ethereum – $500

- BNB – $500

- Cardano – $500

- XRP – $500

- Solana – $500

30% – Medium-Caps

Of the $10,000 capital, the investor elects to allocate 30% to medium-cap projects – or $3,000.

The investor might elect to buy a wide range of crypto assets from various markets and niches. In this example, we’ll say the investor opts for five different mid-caps at $600 each.

- Uniswap – $600

- Polkadot – $600

- Polygon – $600

- TRON – $600

- Shiba Inu – $600

20% – Small-Caps

The remaining 20% – or $2,000 of the portfolio will be allocated to small-cap projects.

In this example, the investor opts for eight small-caps at $250 each.

An example of this might look like the following:

- Smog – $250

- SpongeV2 – $250

- DeFi Coin – $250

- Lucky Block – $250

- Compound – $250

- Waves – $250

- Nexo – $250

- The Graph – $250

Portfolio Recap

To recap, from a $10,000 capital investment, the portfolio has opted for six large-caps ($5,000), five medium-caps ($3,000), and eight small-caps ($2,000).

As a result, the portfolio owns 20 different crypto assets from a range of different markets. This is, however, just a simplified example of cryptocurrency portfolio allocation.

Investors should determine their own portfolio weighting and chosen projects, as per their own financial goals and risk profile.

Conclusion

To ensure that investors enter and remain in the cryptocurrency arena in a risk-averse manner, portfolio diversification should be considered. A well-balanced portfolio will contain a good blend of large-cap projects, inclusive of Bitcoin, Ethereum, and BNB.

Exposure to newly launched and small-cap projects might be considered too for maximum upside potential. Dogecoin20 is a good option here – as it offers high staking APYs of 200% during the early stages of the token presale.

FAQs

What is the best portfolio for crypto?

The best portfolios in the crypto space tend to be well-diversified. With more than 21,000 projects to choose from, diversification has never been more important. Consider allocating a large segment of the portfolio to established projects like Bitcoin and Ethereum, with the balance split out between up-and-coming tokens such as Dogecoin20.

How should I diversify my crypto portfolio?

The easiest and perhaps most effective way of diversifying a portfolio is to invest in dozens of different projects. Established tokens in the portfolio might include Bitcoin, Solana, BNB, and XRP. Investors should also consider allocating funds to smaller-cap cryptocurrencies that offer a more attractive upside. All in all, the portfolio should be balanced to mitigate the risk of being overexposed to a crypto project that fails.

How many coins should I have in my crypto portfolio?

There really is no limit to the number of coins that can be held in a well-balanced and diversified portfolio. In fact, it is often the case that the more different projects that an investor has exposure to – the better. Consider using an exchange like OKX for the diversification process, which offers more than 600 markets.

What percentage of a portfolio should be crypto?

This really depends on the risk appetite and individual profile of the investor. Risk-averse investors will typically limit their exposure to crypto – with just 5-10% of their portfolio allocated to the space. At the other end of the spectrum, some investors choose to be 100% in crypto. This is, however, a high-risk strategy, especially considering that the broader crypto market tends to move in tandem.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Nick Pappas

Nick Pappas

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman