8 Best DCA Crypto Bots for 2024

As cryptocurrencies become more popular more people are looking to get in on the action and to start building a holding of crypto assets. One stress-free and hassle-free way that many are choosing to do this is by using a dollar-cost-averaging (DCA) crypto bot.

Here we’re going to look at the best DCA crypto bots and what they’ve got to offer. We’ll also be diving into what the DCA trading strategy is, how it works, and going through the pros and cons and give you a quick step-by-step guide for setting one up.

The Best DCA Crypto Bots Ranked

Below we’ve listed the best DCA crypto bots, complete with a short description of what each of them offers users.

- Dash 2 Trade: Cutting-edge analytics platform offering the best DCA bots and simplifying trading with automated strategies.

- Learn2Trade: Signals for both crypto and forex markets, offering a proprietary algorithm and trading bot for cryptocurrency markets.

- Crypto.com: A free and simple-to-use DCA crypto trading bot from one of the world’s top crypto exchanges, adjustable in the Crypto.com mobile app.

- Tradesanta: Crypto bot provider offering a wide range of highly customizable trading bot for cryptocurrency traders and investors.

- WunderTrading: Crypto trading bots for traders of all levels, from a reputable provider with highly-customizable DCA bots.

- 3Commas: A highly rated (by 1,500 Trustpilot users) bot provider, offering users a range of crypto trading bots for all market conditions.

- ByBit: An exchange offering customizable DCA bots and a unique portfolio DCA bot that can handle up to 5 coins simultaneously.

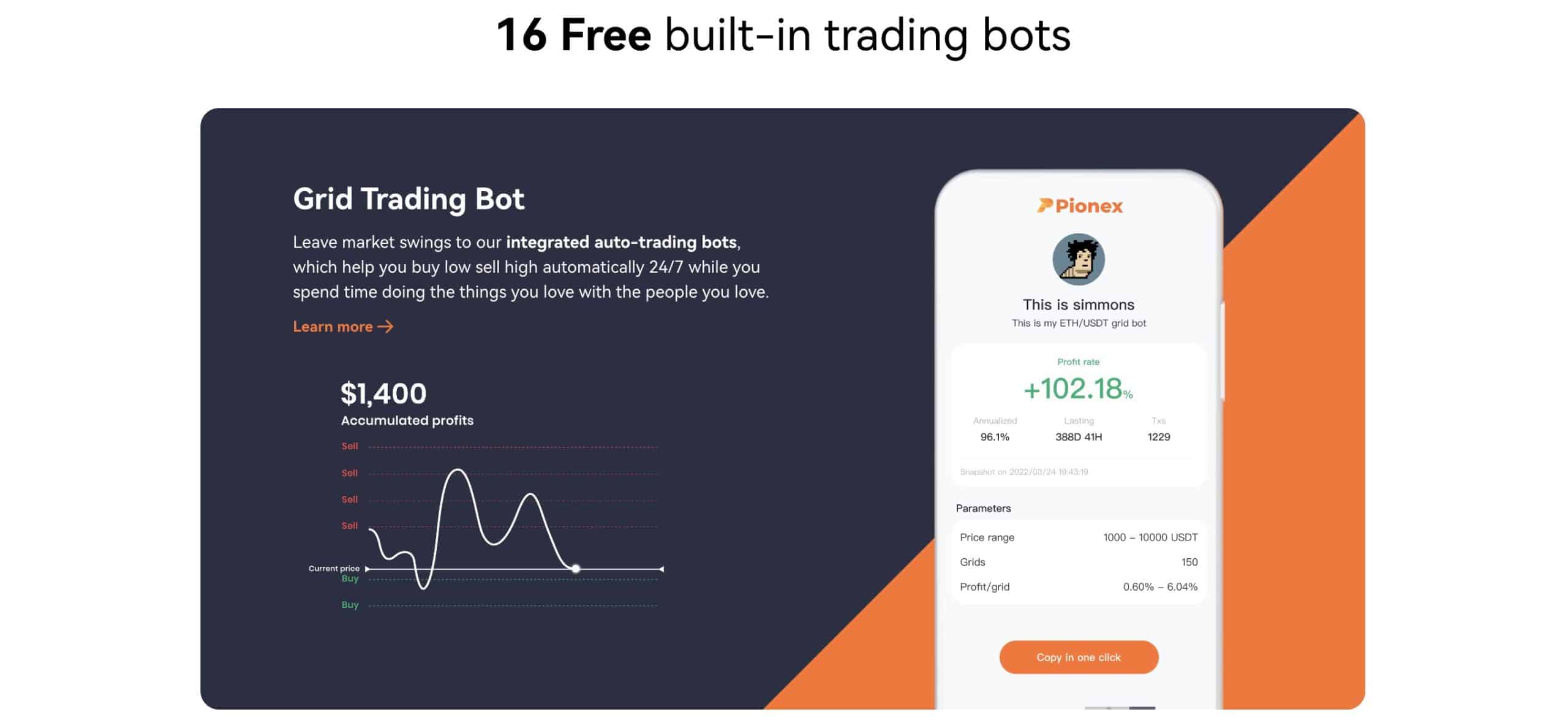

- Pionex: A centralized exchange with a focus on supplying trading bots for users of all levels, and one of the only providers of futures bots.

The Top DCA Crypto Bots Reviewed

Here we dive into each of the best DCA crypto bots listed above and look at what they offer to users.

1. Dash 2 trade – Overall Best DCA Crypto Bot in 2024

Dash 2 Trade currently offers the best DCA crypto bots in the market. It is a cutting-edge crypto analytics platform for today’s modern traders built by experienced traders and quants. The platform supports algorithmic trading with DCA and grid bots and plans to release more unique bot types.

These bots simplify the trading process, allowing users to automate their strategies and focus on other aspects of their trading. With more than 10,000 possible trading strategies, Dash 2 Trade backtesting allows users to test and run various strategies and indicators, helping them identify the most effective trading approaches.

Dash 2 Trade offers analytics for more than 400 coin pairs, providing traders with various options to hunt for profitable trades. It offers five guides describing important principles and the effective use of indicators to help you avoid the most common trading pitfalls and improve your trading skills.

The platform’s app is continually evolving and has plans in the pipeline for new features such as ‘CopyBots’ and a ‘Strategy Builder’ for Auto-Trader, which will launch in the first quarter of 2024. It aims to build a strong trading community by encouraging social trading through trading competitions and signal sharing.

Pros

- Versatile backtester for over 10,000 strategies.

- Automated trading with DCA and Grid bots.

- Access to unique indicators and market events.

- D2T token offers dashboard access and benefits.

Cons

- Integration with some exchanges is still underway.

- Some features are yet to launch.

2. Learn2Trade – Popular DCA Crypto Bot With A High Success Rate

The Learn2Trade platform is our next pick for the best DCA crypto bot, and interested users can receive periodic insights into the trades offered by the Learn2Trade proprietary algorithm bot for the cryptocurrency and forex markets through their free signals Telegram groups.

These free channels for each market allow users to periodically receive free trading signals from the Learn2Trade Proprietary algorithm. Users can use these free signals to assess the capabilities of the Learn2Trade bot and, if they like what they see, they can sign up to one of various monthly plans to access the bot, which provides subscribers with up to 70 trades per month.

The algorithm will trade the crypto markets 24/7 for investors, automatically opening and closing positions for them, operating with a purported 79% success rate. This bot can be set up in just 10 minutes and traders can choose to trade the crypto or forex markets.

Pros

- Free channels allow you to preview before you buy

- Up to 70 trades per month

- Bot places trades, along with take profit and stop loss limits

- Just 10 minute set up time

- VIP Telegram group for bot users

Cons

- Made for trading rather than accumulating funds

3. Crypto.com – Best DCA Crypto Bot Offering Set-And-Forget DCA Strategy

The Crypto.com DCA crypto trading bot is free to use for users of the Crypto.com exchange. It comes with two modes, Auto and Advanced. The Auto mode offers a set-and-forget DCA strategy where users select which asset they want to buy, how much, how often, and for how long they want the bot to repeat these purchases. They can also choose which cryptocurrency they want to use to make these purchases.

The advanced version of the bot offers more flexibility, including the option to set market or limit orders, the maximum number of orders the bot can have open at any time, and users even have the ability to set sell orders.

One of the biggest advantages of the Crypto.com bot is that is available to users through the Crypto.com mobile app, for iOS and Android, allowing them to make changes on the fly. However, it is only available for the Crypto.com platform and cannot be used on other exchanges.

Pros

- Simple and easy to use

- Highly trustworthy, built by one of the top crypto exchanges

- Offers flexibility for which currency to buy your asset with

- Can be set up on mobile

- Has an advanced version for greater fine tuning

- Users can set an end date for their DCA buys

Cons

- Is only available on the Crypto.com exchange

- Is limited to just creating buy and sell orders

- Has a 1.6 star rating on Trustpilot

4. Tradesanta – Offering Multiple Bots and Excellent Customer Service

The Tradesanta platform offers a wide range of bots for traders of all different skill levels, risk levels, and on many different exchanges—and their offering include a DCA bot for crypto trading.

Through a free trading terminal users can connect to and manage multiple trading portfolios across many of the top crypto exchanges. They can even take their DCA crypto trading bot mobile in the Tradesanta mobile app.

The Tradesanta platform also offers a host of other features for traders using their terminal, and this includes integrating trading signals into their trading bot, from a variety of well-known indicators, along with a copy trading feature that allows traders to copy the strategy of experienced traders.

Alongside existing DCA and other crypto trading bots, the Tradesanta platform also offers Bot Templates to users, which allow them to create their own customized crypto trading bot from scratch.

Pros

- A 4.2 rating on Trustpilot from existing customers

- Proprietary terminal for all your trading needs

- Aggregate portfolios from multiple exchanges

- Multiple different bots to choose from

- Copy trading feature

- Mobile app for monitoring trades on the go

Cons

- Might be a bit complex for new traders

- Too many options may deter some customers

5. WunderTrading- Fully Automated and Highly Customizable DCA Crypto Bots

offers beginner users a simple DCA crypto bot alongside highly customizable DCA bots that can be programmed with multiple signals and trading strategies to suit the needs of even the most advanced trader.

The WunderTrading terminal can be connected to over a dozen of the top exchanges, simultaneously, to allow users to trade and automate a distributed crypto portfolio from a central point. Even once set in motion, the parameters of each bot can be tweaked, allowing experienced users to fine tune their trading parameters.

The quality of services provided by WunderTrading has also earned them a 4.1-star rating from their customer on TrustPilot, and a Copy Trading feature allows users to mimic the activity of both human traders and trading bots that use the platform.

If all that wasn’t enough the WunderTrading platform offers a lifetime free plan for users, and a 7 day free trial for their PRO plan.

Pros

- Connect to over a dozen top exchanges

- Trade on multiple exchanges simultaneously

- Lifetime free plan available alongside paid plan

- 4.1 star user rating on TrustPilot

- Customizable bots programable with multiple signals

- Simple DCA bot available for users to start with

Cons

- Can be expensive compared to on-exchange platforms

- Too many options can be overwhelming for beginners

6. 3Commas – High Reputable Platform Offering Trading Bots for All Market Conditions

Alongside a reputable and easy-to-program DCA crypto trading bot, 3Commas also offers users numerous other bot options for their crypto trading needs—servicing beginner, intermediate, and advanced traders.

The 3Commas trading platform can be integrated with 16 of the biggest exchanges (the most of any third party bot provider on this list) and allows you to manage all your exchange accounts in one place.

With a 4.0 TrustPilot rating, from over 1,500 reviews, 3Commas provides an excellent customer experience and offers a free trial to all new customers.

Alongside all this, the bots offered by 3Commas are neatly categorized into 3 broad, categories: bear markets, bull markets, and sideways markets; which are then broken down further to cater to the trader’s particular needs.

Finally, new or inexperienced users can also access preset bots created by more experienced users on the platform and simply just put them to work for them.

Pros

- Highly rated by existing users

- Integrated with 16 of the biggest exchanges (the most on this list)

- Bots are categorized by market type

- Users can access successful bots created by other users

- Services all levels of trader

- Mobile app for managing positions on the go

Cons

- Some users have complained about the newer version of the app

- Customer support has also been mentioned among customer pain points

7. ByBit – Top Crypto Exchange with Built-in DCA Crypto Bot

The ByBit exchange offers its users free access to its DCA bot, with no additional or hidden fees. This bot is, purportedly, exceptionally easy to set up and once a trader gains more experience they can add and change bot parameters to meet their evolving trading needs.

Users of ByBit can run up to 50 bots simultaneously across numerous different pairs, or the same pairs, allowing for a diverse array of trading strategies to be run simultaneously. On the ByBit exchange users can also create a DCA bot with a portfolio of up to 5 coins, increasing the flexibility, and utility of this strategy.

Finally, ByBit is also available as a mobile app, allowing users of the exchange to manage their bots and trades from their smartphones. It also offers users access to over 1,000 cryptocurrencies—meaning that the opportunities available for users with this DCA bot are huge.

Pros

- No need to give account access to a third party

- Can create a DCA bot that trades a portfolio of up to 5 assets

- Over 1,000 cryptos available through the platform

- Bot parameters are adjustable

- Easy to set up bots

Cons

- Only offer DCA bots

- Only available on ByBit exchange

8. Pionex – Popular DCA Crypto Bots Featuring Integrated Auto-Trading Robots

The Pionex exchange is most well known for its Grid Trading bots, however, it also offers many other types of crypto trading bots—including DCA bots. The Pionex DCA bots can also be set to trade numerous currencies at once, allowing users to diversify their portfolio simply by using a bot.

More advanced users can adjust and customize their DCA bot to tailor it to their own trading strategy, incorporating numerous different settings and indicators. With over 400 supported cryptocurrencies, Pionex offers users ample opportunities for trading with their bots, and, because the bots are provided by the exchange themselves, there is no need to connect a third-party platform to your account.

With over 16 free bots on offer, users can select from multiple strategies when choosing what and how they want to trade—advanced users are also able to access multiple futures trading bots. Finally, Pionex has users in over 100 countries and regions around the world and has regularly seen a monthly trading volume in excess of $50 billion, meaning there should be no shortage of liquidity for traders.

Pros

- No need to give account access to a third party

- DCA bots can be set to trade numerous currencies at once

- Futures trading bots available

- 16 free bots available to all exchange users

- Professional trader platform

- Over 400 supported cryptocurrencies

Cons

- Not one of the major crypto exchanges

- Restricted trading for customers in the US and some other countries

What is a DCA Trading Bot?

A DCA trading bot is a bot that uses the dollar-cost-averaging strategy when making trades.

Dollar-cost-averaging is a popular trading strategy for traders looking to make a long-term investment. In the DCA strategy, a trader buys a set dollar value of an asset at regular intervals, regardless of the price of that asset and the number of assets they’re receiving for their capital. A DCA trading bot does this automatically for you.

For example, you might want to accumulate Bitcoin at a rate of $100 per week. So you would set your DCA trading bot to buy $100 of Bitcoin at a preset time every week. Your bot would then execute your purchases for you automatically—regardless of the price of Bitcoin or what is happening in the markets or news.

This allows a trader to accumulate an asset without having to watch the market and decide when they want to make their move. Ultimately, this can reduce the impact of volatility on the purchase of assets and allows the trader to get an average price for typically volatile assets, like cryptocurrencies.

DCA Trading Strategy Explained

The above method of purchasing an asset at set intervals regardless of price changes or changes in the markets is the most basic of DCA trading strategies. However traders can often fine tune their crypto DCA bot to different dollar-cost-averaging strategies depending on their overall goal.

Here we’re first going to look at the effects of the DCA strategy vs investing all your funds at once, and then cover a few different DCA trading strategies that many of the best DCA crypto bots can be programmed with.

How Dollar Cost Averaging Works

Let’s say two investors, A and B, want to invest $1,000 in a token today, and the market price is $52. Investor A spends their $1,000 immediately, getting 19.23 tokens in return. Investor B, however, decides to use the DCA strategy to spread their $1,000 investment out over 5 weeks. In the table below are the buys of Investor B.

| Investment | Asset Price | Quantity Bought | |

| Week 1 | $200 | $52 | 3.85 |

| Week 2 | $200 | $48 | 4.17 |

| Week 3 | $200 | $42 | 4.76 |

| Week 4 | $200 | $46 | 4.35 |

| Week 5 | $200 | $55 | 3.64 |

Over the course of 5 weeks, buying $200 of the asset per week, Investor B has accumulated a total of 20.77 tokens, paying an average of $48.15 for each token, and ending up with 1.54 tokens more than Investor A—an overall gain of 8% on the size of their holdings.

By steadily accumulating assets over an extended period, Investor B was able to make market volatility work in their favor and deliver them a greater return than Investor A’s lump-sum investment.

DCA Trading Strategies

The above DCA bot strategy, called Fixed Interval DCA, is excellent for investors looking to accumulate assets. However, a DCA bot for crypto can be programmed for more than simply accumulating a set amount of an asset at a set time, giving investors a variety of options. Primarily, the best DCA crypto bots might be programmed by the following DCA strategies:

- Price-Based DCA: Here the user sets their bot to only buy when the price of a token drops below a certain level. For example, you could tell your bot to buy $100 of a particular token every time its price drops below $50.

- Hybrid DCA: Bots can be programmed with more than 1 trigger, allowing an investor to have their bot buy $200 of a token every Wednesday at 12 pm and every time that token’s price drops below $50.

In addition to the above DCA strategies, some of the best DCA crypto bots can be programmed to put in and execute take profit levels for investors, so that they don’t miss the chance to profit should the token they’re investing in climb aboard a rocket to the moon.

Is DCA a Reserved or Risky Trading Strategy?

Dollar-cost-averaging is a reserved trading strategy for those looking to accumulate assets for long-term investment. It avoids the risks of buying at or close to the top and helps investors to take emotion out of their trades by automating the buying process.

Pros & Cons of DCA Crypto Trading

Every trading strategy has its pros and cons, even the most reserved, long-term trading strategies, and DCA crypto trading is no different. Some of these pros and cons come from the strategy itself, others are considered pros and cons as this strategy is most commonly compared to lump-sum investing.

Pros of DCA Crypto Trading

- Removes Emotion: Following the DCA crypto trading strategy stops the investor from seeking out market highs and trying to time the market.

- Potential Lower Average Price: Building up a position incrementally over time can result in a lower average price for the asset if the price drops or fluctuates to the downside.

- Can Increase Profits: If following the DCA strategy results in a lower average price for an asset then this can result in increased profits when the assets are finally sold.

- Instills Trading Discipline: Dollar-cost-averaging is an excellent strategy for new and long term investors, and it helps to teach discipline when it comes to keeping emotion out of trading and preventing impulsive decisions.

Cons of DAC Crypto Trading

- Hold Cash for Longer: Those who use the DCA strategy might end up sitting on their cash for longer, which doesn’t have the potential for producing returns, as cash that is invested in an asset does.

- Can Reduce Profits: If the market makes a big upswing as an investor implements their DCA strategy, then they could make a smaller profit compared to someone who invested a lump sum at the same time.

- Takes More Time and Energy: Investors are accumulating assets steadily, meaning that it takes them longer to build up a position. If they’re not using a bot this also means that they need to put the time and energy into making their trades.

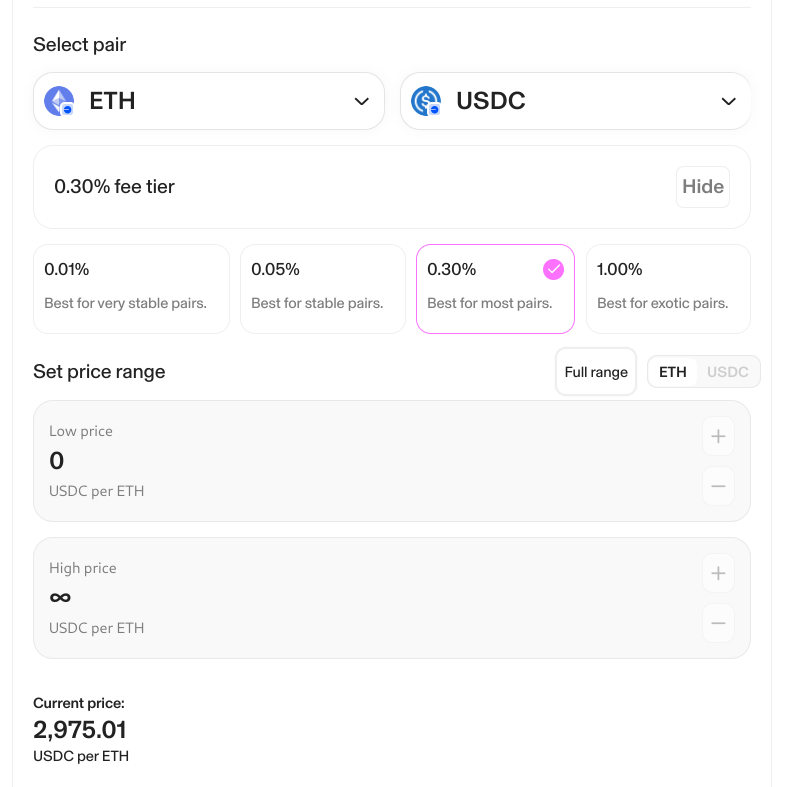

- Increase Fees: A lump-sum investment is one transaction with one fee. DCA investors must pay a transaction fee with each of their transactions. This can vary depending on which broker or centralized exchange an investor uses, or which blockchain they’re trading on if you’re using a decentralized exchange.

Do DCA Crypto Bots Really Work?

In short, yes, they do work. DCA crypto bots are relatively simple crypto trading bots and periodically execute trades for you without monitoring market conditions or reacting to anything except your initial orders and a clock.

That being said, if by asking this question you’re wondering whether DAC crypto bots can make you money then you need to look at a lot more than just the bot and the DCA investing strategy. This means taking into account the market climate at the time the strategy is implemented, the asset chosen, and your overall investment goals.

DCA crypto bots are an excellent way to build a long-term position by automating the process so the trader doesn’t bring emotion into their trade. However, it is worth noting that a Vanguard study from 2012 found that, historically, a lump-sum investment would’ve been more profitable than using a DCA strategy on 2 out of every 3 occasions.

Are DCA Crypto Bots Safe & Legal to Use?

Yes DCA crypto bots are legal, and exchanges will typically encourage their use by providing users with the API keys needed to connect their bot to the exchange’s interface and user’s account. However, it is worth noting that not all exchanges permit the use of bots, and not all bots are compatible with all exchanges.

How to Use a DCA Crypto Bot

How to set up or use a DCA crypto bot will vary by which bot provider you choose to use, along with how complex you want the strategy it follows to be. Here we’re going to run through the process of setting up a DCA crypto bot for a simple accumulation strategy, or a fixed-interval DCA:

- Step 1: Sign up to your preferred bot provider

- Step 2: If this is not your crypto exchange then you need to connect the bot to your exchange account, typically by giving it your API keys (instructions will exist on the exchange for this)

- Step 3: Select the cryptocurrency you want to accumulate

- Step 4: Set the amount (in your local currency or USD) of cryptocurrency you want the bot to automatically purchase

- Step 5: Set how often you want it to make this purchase and, if available, how long a period you want to do this for

- Step 6: Double-check all your parameters (and make sure there’s crypto in your account to make the purchases)

- Step 7: Confirm your bot configurations

Now you can sit back and relax, knowing that you’ll be steadily accumulating your chosen asset without having to worry about timing the market, or even making numerous transactions yourself.

Conclusion

Now you know all about DCA trading and the best DCA crypto bots you can go ahead and set one up to start helping you accumulate your chosen crypto asset in a stress-free and hassle-free way. Our recommended bot comes from Dash 2 Trade, who operate the crypto markets and has been highly rated by their customers. Users can automate their trading with DCA and grid bots, with more unique bot types coming soon.

References

- Trustpilot: Tradesanta on Trustpilot

- Trustpilot: WunderTrading on Trustpilot

- Trustpilot: 3Commas on Trustpilot

- Schwab: What is Dollar-Cost-Averaging

- Vanguard: Dollar-Cost-Averaging Study

FAQs

What are DCA Crypto Bots?

One of the simplest and most popular bots, dollar-cost-averaging (DCA) bots are used to make automated buy or sell trades on cryptocurrencies at regular intervals over a user-defined timeframe. They help an investor to gradually accumulate an asset while avoiding volatility.

Are DCA Bots Profitable?

DCA bots can be highly profitable for traders, as they stop them from making impulsive trades, and can help traders to accumulate unrealized gains over time. They are also great for accumulating assets and building a long-term position in the market.

Is DCA a Good Crypto Strategy?

For those who are long-term bullish on cryptocurrencies, using a DCA strategy can be an excellent way to average out costs in the highly volatile crypto market. It can also help to take the stress and emotion out of trading.

Does Binance have a DCA Bot?

Binance does offer a spot trading DCA bot, and this can be accessed through the trading bot menu on the Binance website. There are also numerous 3rd party bot providers offering bots that you can connect to your Binance account.

Which is the Best DCA Crypto Bot?

The best DCA bot is subjective, however, from our research, we’ve found that the Dash 2 Trade platform offers a standout bot service that users can use across multiple exchanges.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eric Huffman

Eric Huffman

Alan Draper

Alan Draper

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi