12 Best Low Market Cap Crypto Coins to Buy in 2024

Many investors look to low market cap crypto projects for their growth potential in the market. While there are many low cap projects out there, it’s important to select those that are legitimate. This guide will rank the best low cap crypto projects of 2024. We also explain how investors can find their own low cap hidden gems and why they can be attractive additions to any crypto portfolio.

Best Low Market Cap Crypto Coins

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode ahead of Doge Day

- ETH

- usdt

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

- Access to huge fee revenue through staking

- 50% of 10bn token supply available at presale stage

- 85% of fees go back to the community

- usdt

- bnb

- ETH

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- ETH

- Innovative AI crypto casino offering staking, airdrops and custom games

- $HPLT presale has raised over $400k so far with +60M bets placed by +150k users

- Offers daily staking rewards, hype NFTs and is fully audited by Certik

- bnb

- ETH

- usdt

List of the Best Small Market Cap Crypto

We have vetted each of the following low cap cryptocurrencies to ensure they are genuine projects with high potential for growth.

- Dogeverse (DOGEVERSE) — Overall best low market cap crypto coin, offers multi-chain compatibility.

- WienerAI (WAI) – Exciting new AI dog-themed meme token offering huge passive staking rewards.

- Mega Dice Token (DICE) – CasinoFi crypto token offers staking rewards and tradable NFTs.

- 99Bitcoins – Learn-to-earn crypto offers huge staking APYs. Over $893K raised in presale.

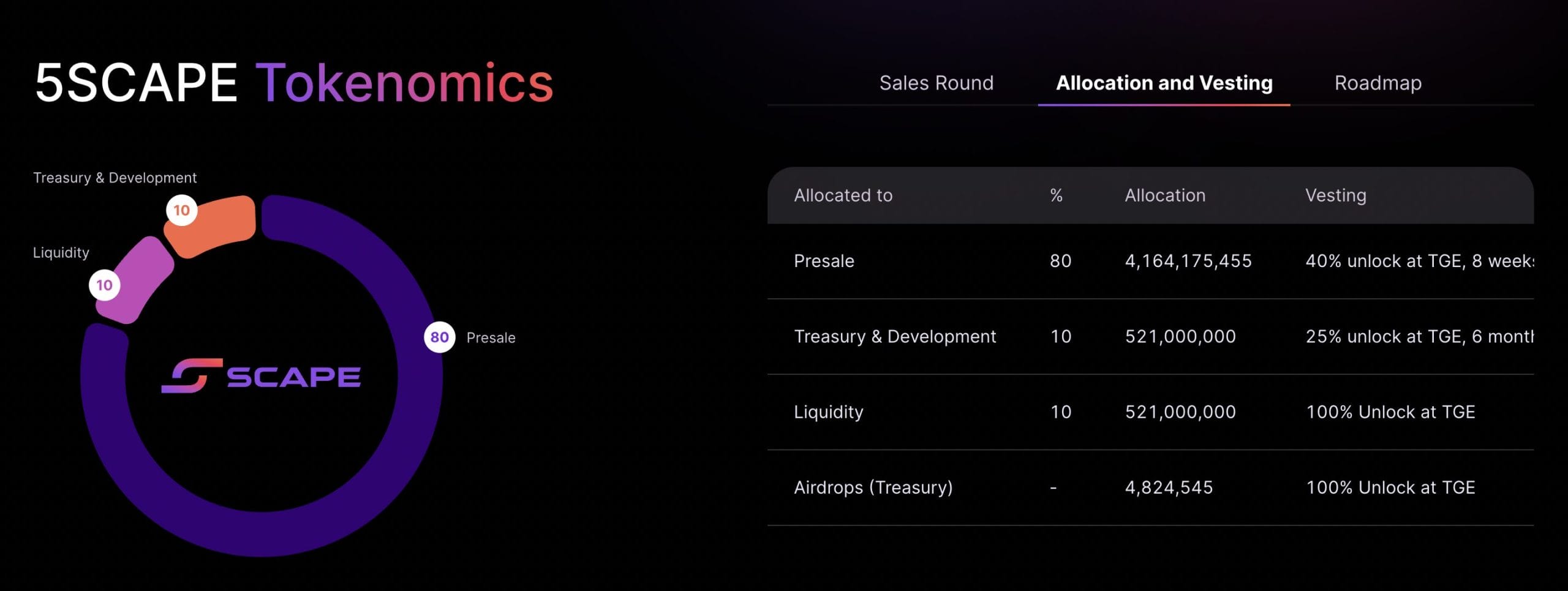

- 5th Scape (5SCAPE) — Virtual and augmented reality gaming cryptocurrency. Get high staking APYs.

- Sponge V2 (SPONGEV2) — New token version of a popular meme coin, soared by 100x in 2023.

- Smog (SMOG) — Top meme coin offers high staking yields and airdrop rewards.

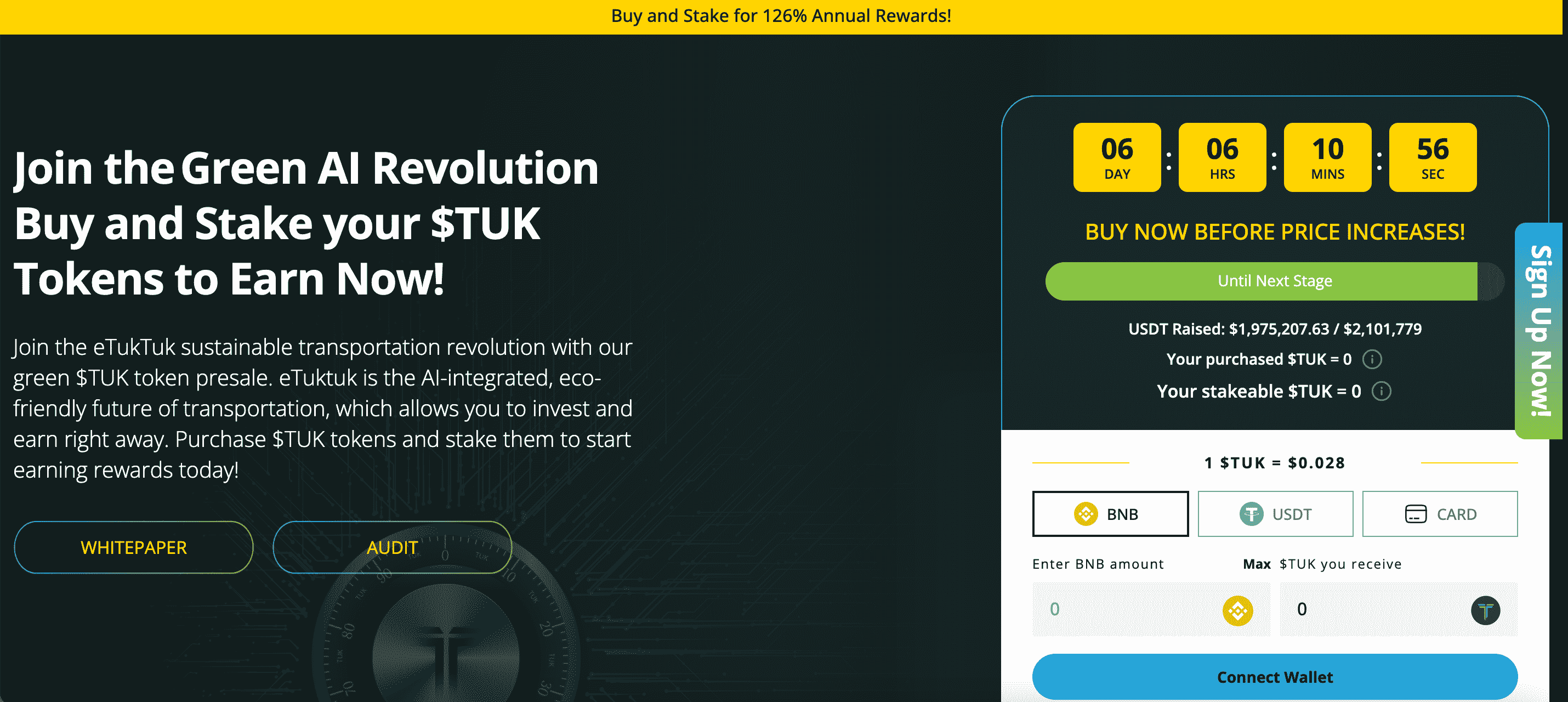

- eTukTuk (TUK) — Eco-friendly cryptocurrency promotes EV adoption among TukTuk drivers.

- Slothana (SLOTH) — Top Solana-based meme cryptocurrency, based on an office sloth.

- HypeLoot — Top cryptocurrency platform for profit sharing.

- Blockbets – Massive utility and profit sharing for this GambleFi token.

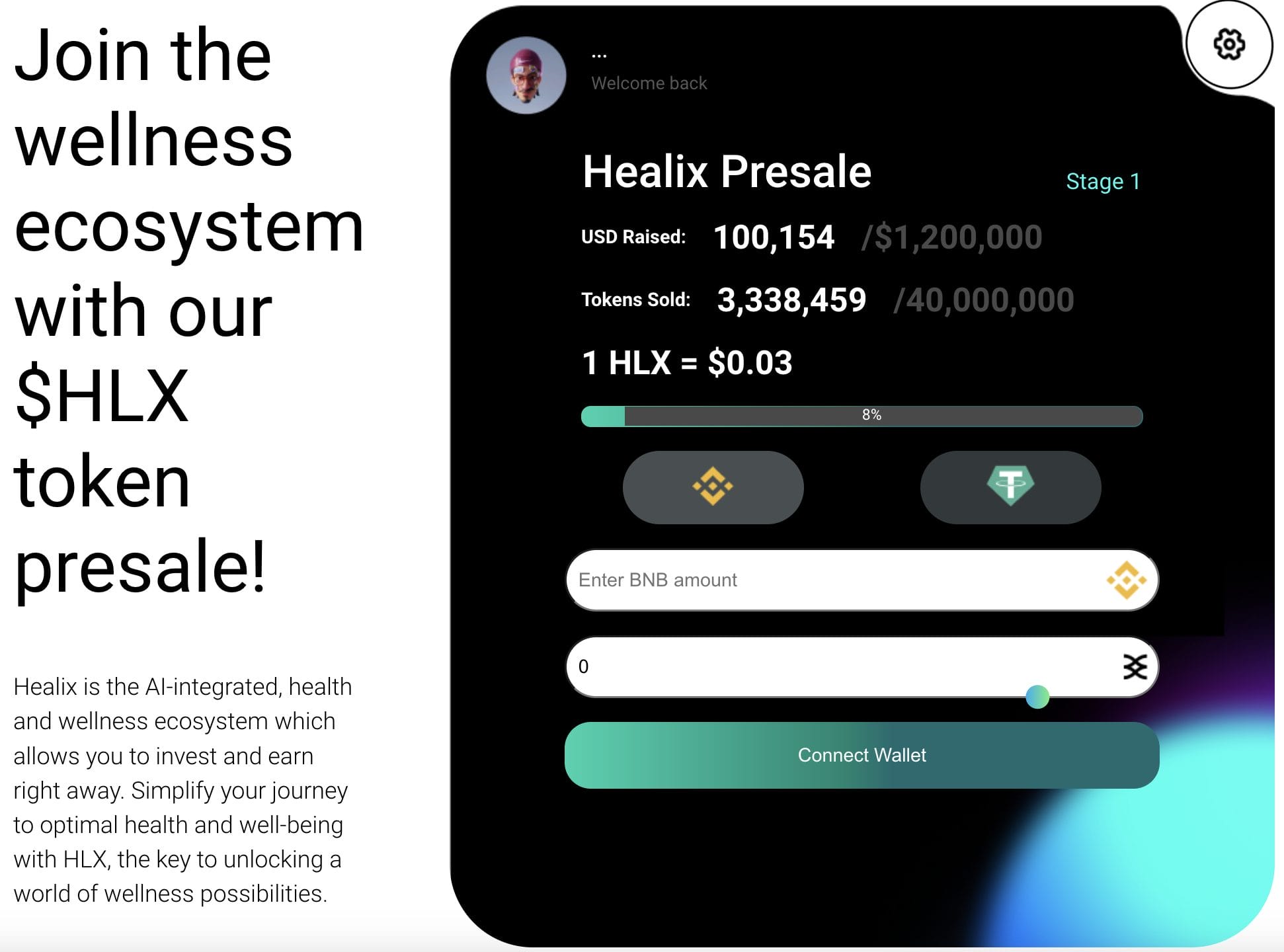

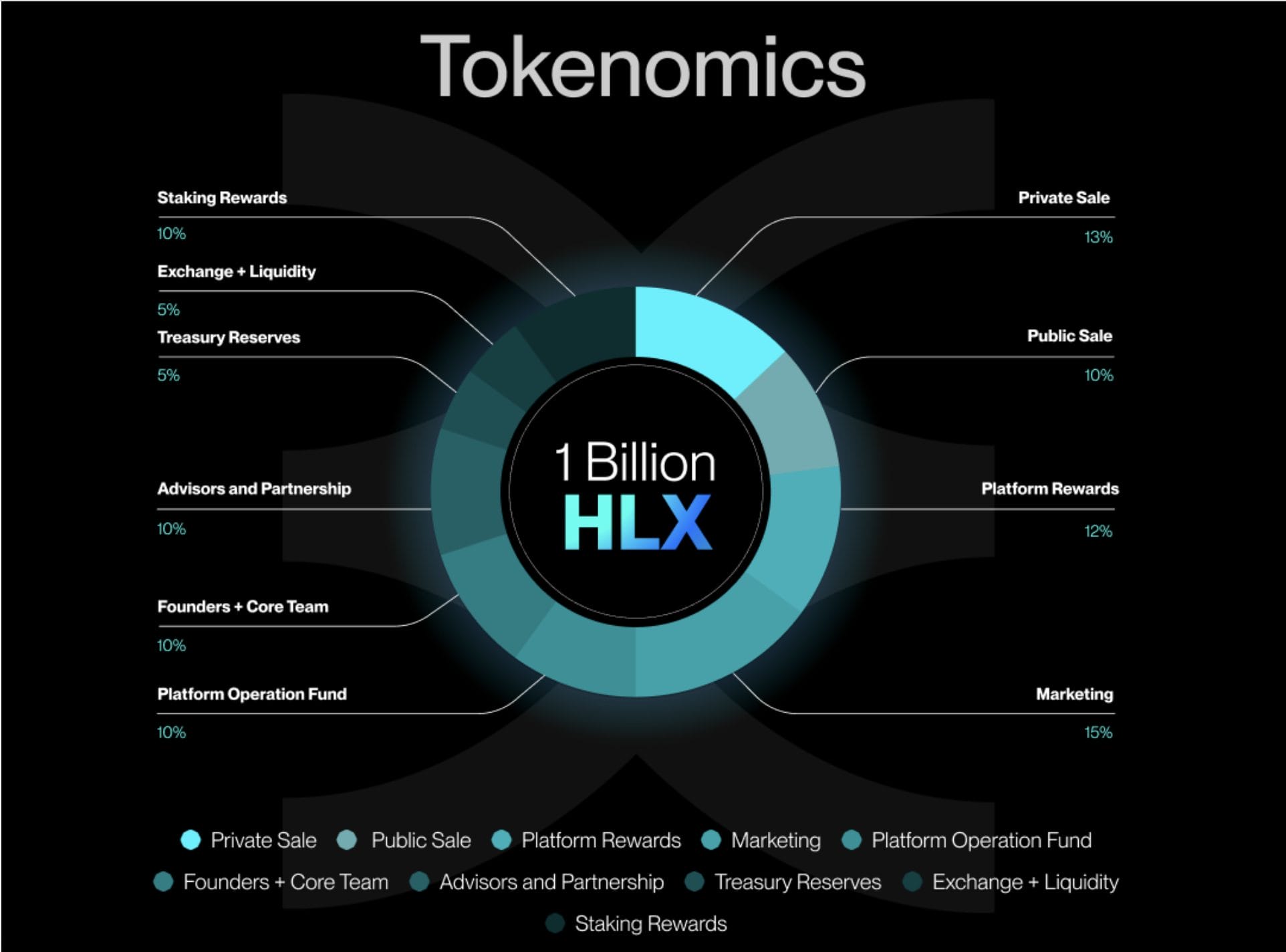

- Healix – New crypto decentralizes the healthcare space. Get premium access to healthcare products.

Best Low Cap Crypto Gems: A Closer Look

To narrow down our list to the 11 best low market cap crypto coins to buy in 2024, we started by analyzing 120+ small cap tokens based on four criteria: their development team, technology and innovation, market potential, and community.

Each criterion weighed 25% of the final coin rating. After rating all tokens, we ranked them based on their final scores. Let’s take a closer look at the best low market cap crypto projects that made it into our top 9 list.

1. Dogeverse — Overall Best Low Market Cap Crypto Coin to Buy in 2024

The latest dog-themed meme coin set to explode is Dogeverse. This multi chain meme coin has been released to coincide with ‘Doge Day’ on April 20th. In less than 24 hours the token presale raised more than $300,000 leaving early investors with high hopes on making a considerable return on their investment.

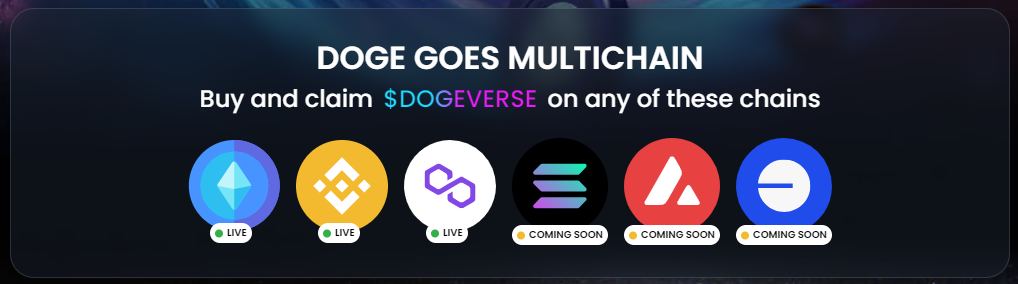

Dogeverse has been built on the Ethereum blockchain and has been designed for multi chain use. This means that Dogeverse is the first dod-themed multi chain meme coin which allows holders to buy and claim the token through a variety of channels. With support for Binance and Polygon already live, plans are also in place to access the token through Avalanche, Base and Solana in the coming weeks. As the first multi chain meme coin to target 6 chains at once, Dogeverse has the potential to go viral and follow in the footsteps of other popular BASE and SOL meme tokens.

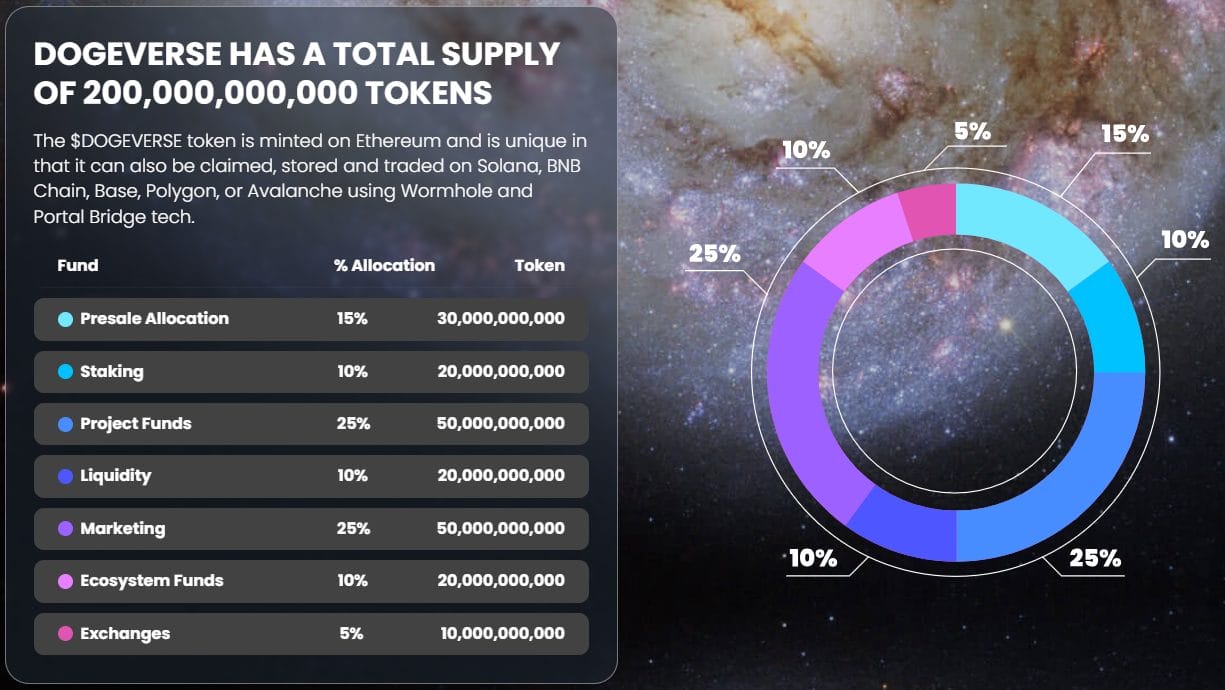

The project also allows holders to earn passive rewards through the in-built staking mechanism. Staking rewards are to be distributed over two years and provide returns of 600,000%. The total supply of Dogeverse is 200 billion with 15% of the total allocated to the presale. For more information on the project be sure to head over to the official website. To keep up to date on all the latest news and updates, you can follow the project on X and join the exclusive Telegram channel.

| Presale Started | 8th April 2024 |

| Purchase Methods | ETH, MATIC, USDT, BNB |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

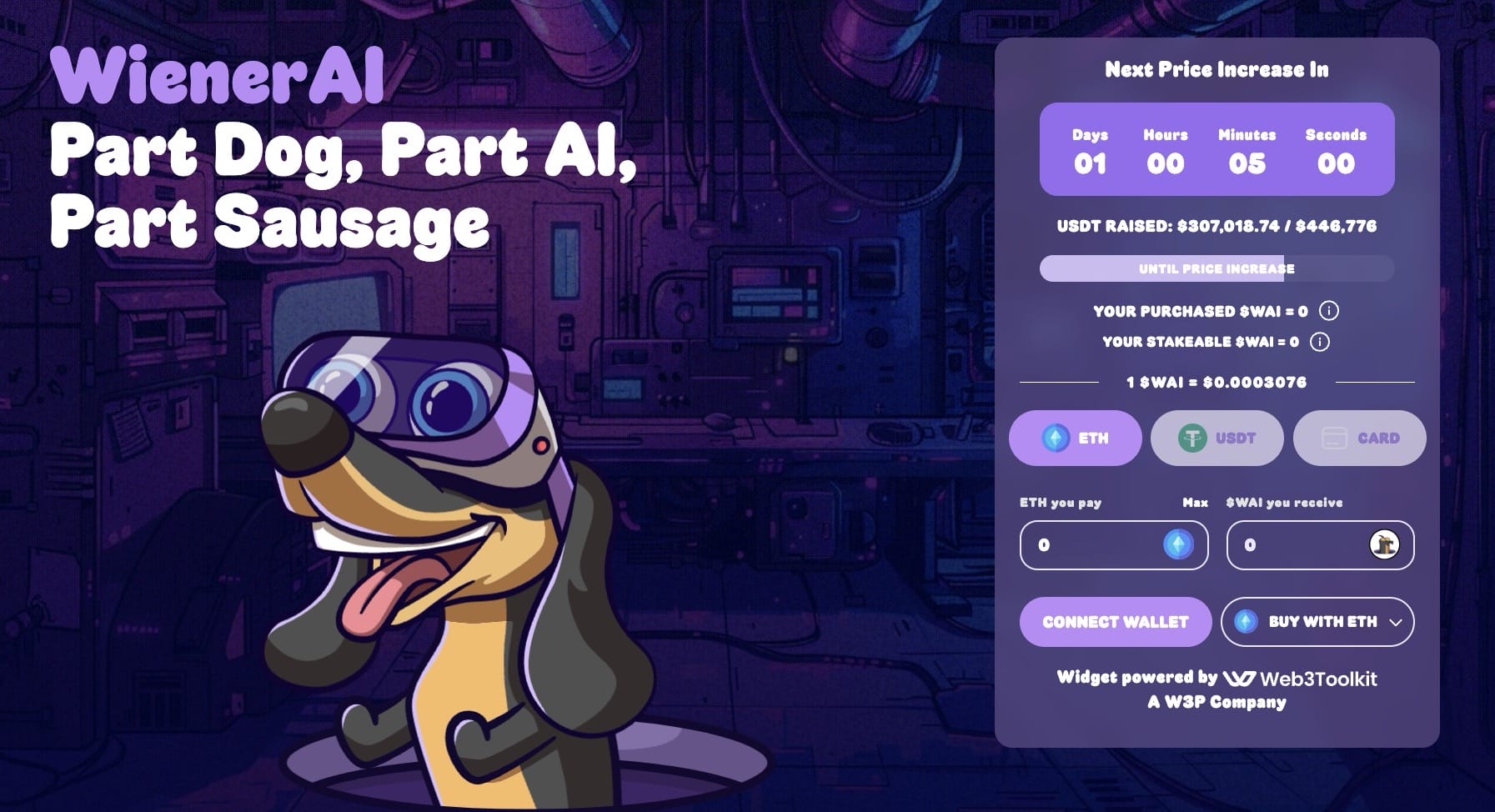

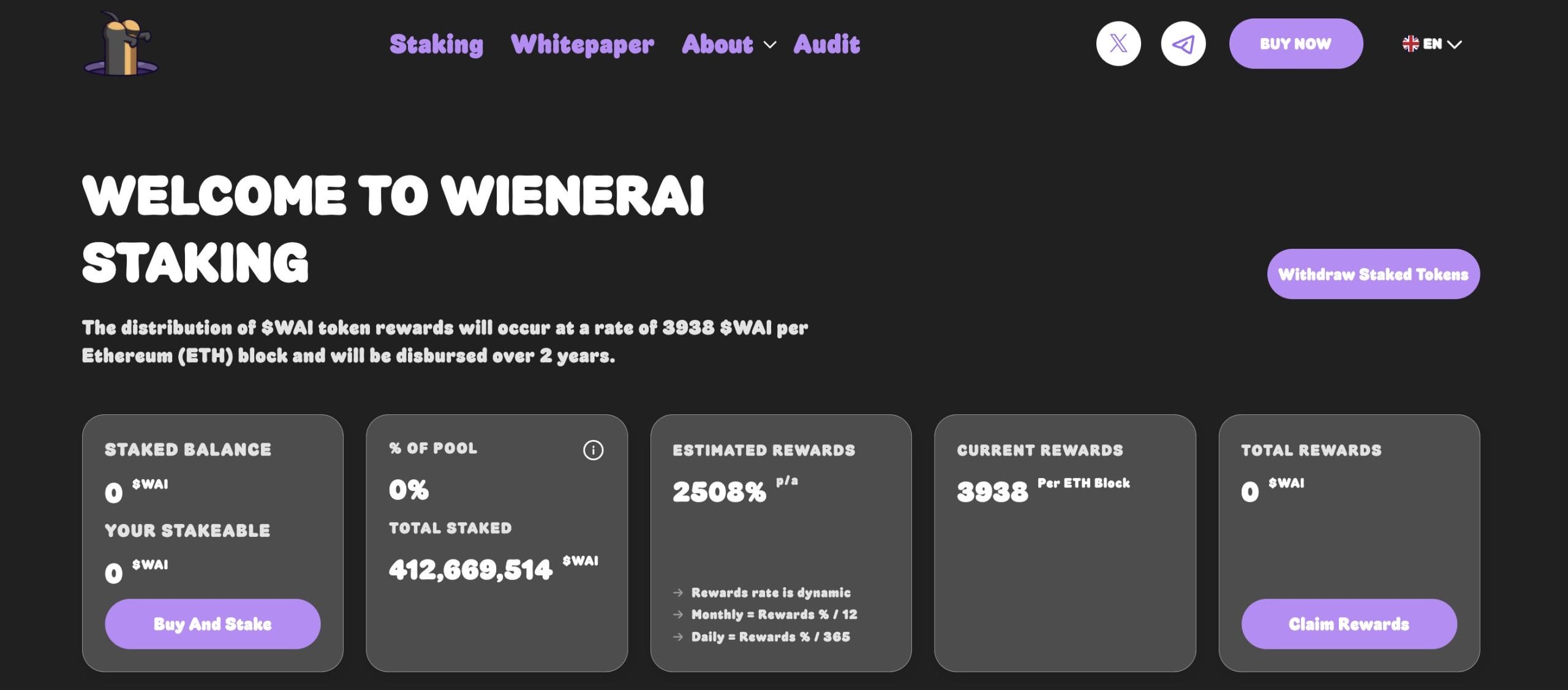

2. WienerAI (WAI) – New AI Meme Token Offering Massive Staking Rewards

WienerAI ($WAI) is an amazing new meme token that offers impressive staking rewards for anyone who buys it at the early presale stage. Gunning for the ‘top dog’ position among the rest of the market, WienerAI looks set to become a hit in 2024.

The creators of Wiener AI are looking to create a massive internet frenzy for the native token $WAI, similar to what we have seen with other dog-inspired tokens such as $Doge, $Dogwifhat and $Bonk. What’s more, $WAI token holders can put their investment to work and immediately begin staking $WAI for passive rewards.

All you have to do to buy the token is head to the official presale website and connect your favourite wallet. You can buy $WAI using BNB, ETH, MATIC or USDT.

With the current trend for dog-inspired meme coins rages on, buying WienerAI might prove especially lucrative for the earliest buyers. The total token supply is 69 billion of which 40% (27.6 billion) have been reserved for the presale.

For more information check out the official WienerAi website. For all the latest news on the project, follow WienerAI on X and join the exclusive Telegram group.

| Presale Started | April 2024 |

| Purchase Methods | USDT, ETH, BNB, MATIC, and card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

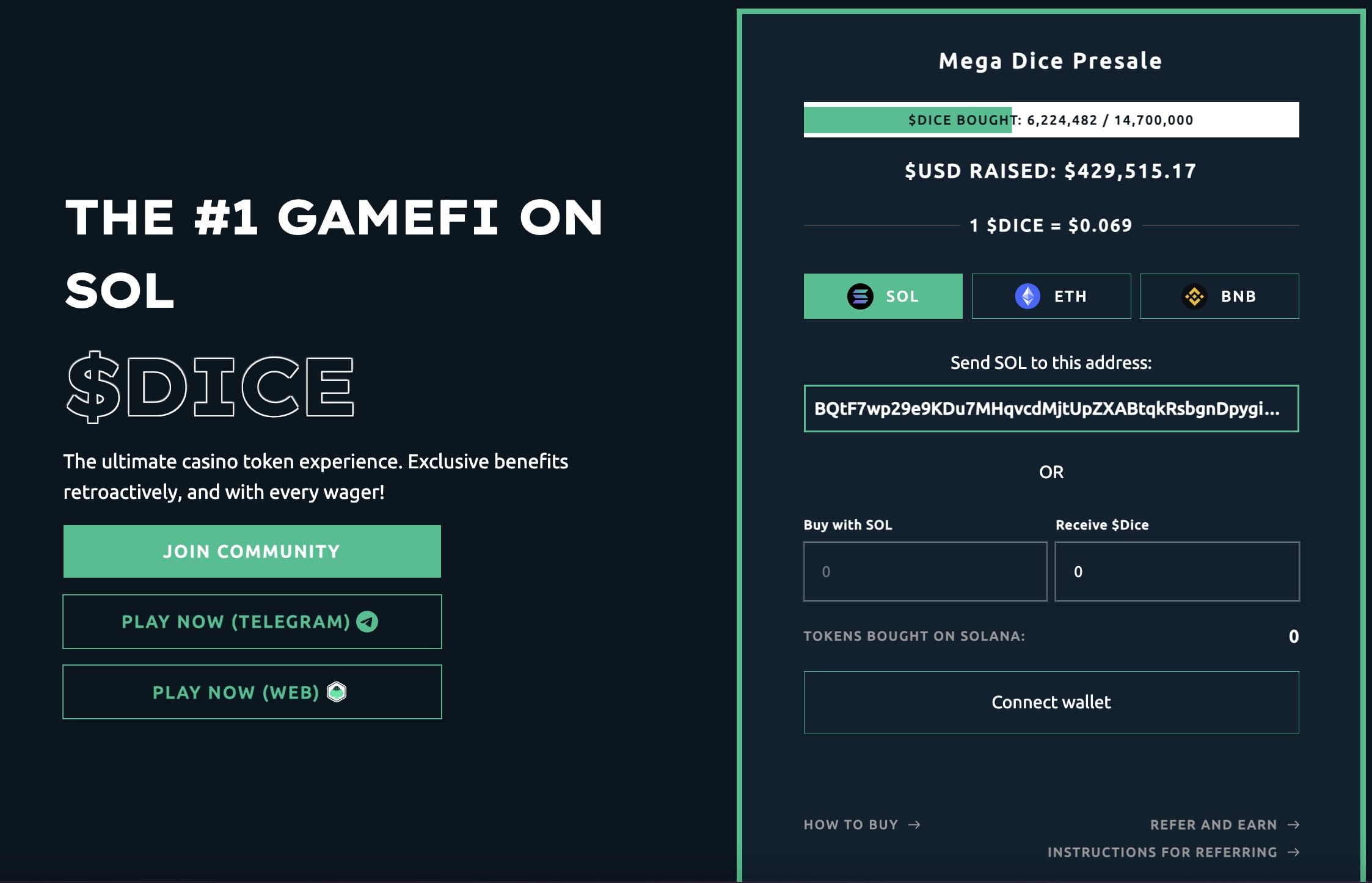

3. Mega Dice Token – CasinoFi Crypto Offering In-Game Bonuses

Mega Dice Token ($DICE) is the native token of the Mega Dice Casino and sports betting platform. This cryptocurrency can be used to access high staking yields, in-game bonuses, and tradable NFTs.

From a total supply of 420 million, 35% of the $DICE supply is being distributed through the presale. This low cap crypto has raised over $420K in only a few days since the presale launched. The token can be staked across three staking pools to generate high annual yields.

Staked token holders can also get daily bonuses on over 4,500 casino games and 50+ sports betting markets. Token holders can purchase limited-edition NFTs, which give you special privileges and rewards on the ecosystem.

By joining the $DICE presale at an early stage, you can also receive additional tokens as part of an early bird incentive. 15% of the token supply will also be allocated through token airdrops. At the time of writing, $DICE is priced at just $0.069 per token.

Learn more about this cryptocurrency by going through the Mega Dice Token whitepaper and joining the Telegram channel.

| Presale Started | April 2024 |

| Purchase Methods | SOL, ETH, BNB |

| Chain | Solana |

| Min Investment | None |

| Max Investment | None |

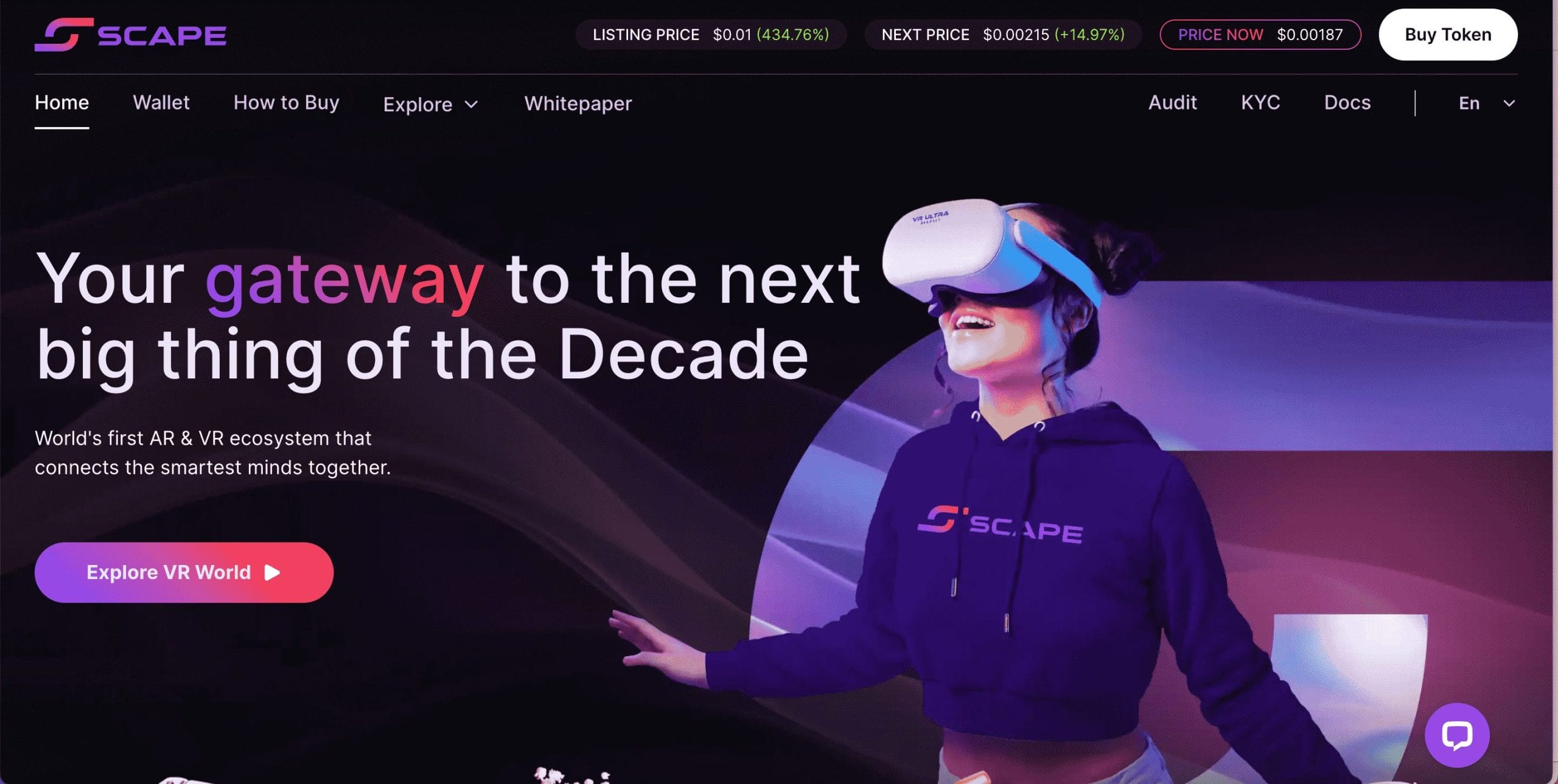

4. 5th Scape — Best VR Gaming Low Market Cap Crypto Coin

5th Scape ($5SCAPE) is the world’s first augmented and virtual reality crypto gaming ecosystem. $5SCAPE, the native token, can be used to access all premium content and get discounts on products.

5th Scape aims to offer hyper-realistic gaming opportunities – providing gaming content, educational resources, and blockbuster movies. $5SCAPE token holders can access a special collection of VR experiences. For instance, the VR games include MMA fighting modes and simulations of Cricket and Soccer tournaments. Token holders can also access free educational content through modules and seminars. To heighten the VR experience, 5th Scape offers VR headsets and gaming chairs. These offer ergonomic designs and use precise motion tracking to depict real-world movements. This low-cap cryptocurrency has a total supply of 5.21 billion.

So far, 80% of the supply is available to buy through the presale. The presale will consist of 12 rounds, at the end of which 5th Scape hopes to raise $15 million. The listing price is set at $0.01 per token, a 434% increase from the current price of $0.00187 per token. Keep yourselves updated with this crypto by going through the 5th Scape whitepaper and joining the Telegram channel.

| Presale Started | January 2024 |

| Purchase Methods | USDT, BNB |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

5. Sponge V2 — Best Play-to-Earn Low Market Cap Coin

Sponge V2Sponge V2 is an evolution of the original $SPONGE meme crypto, which saw a 100x value increase in 2023. This new version aims to build on its predecessor’s success by adding new features and improving user engagement. A key addition in Sponge V2 is a Play-to-Earn (P2E) game, allowing users to use their V2 tokens in an interactive game. This addition can potentially increase the token’s utility.

The project also introduces a Stake-to-Bridge system for a smooth transition from Sponge V1 to V2. Staking V1 tokens permanently locks them, and users receive V2 tokens in return. This approach promotes long-term investment in the Sponge ecosystem. Sponge V2 also targets listings on major Tier-1 exchanges like Binance and OKX, aiming to replicate the success of other top meme coins and increase market visibility and trading volume.

The community backing of Sponge V2 includes over 30,000 users, with 11,500+ token holders. The token supply has a cap of 150 billion, with a significant portion set aside for staking and play-to-earn rewards. This distribution strategy is designed to promote active participation and improve token utility.

Importantly, Sponge V2 offers a minimum 40% Annual Percentage Yield (APY) over four years. Initial investors in Sponge V1 for staking will receive equivalent V2 tokens.

Users can join the SpongeV2 Telegram channel and follow it on X (Twitter) to get the latest P2E game launch and exchange listing information.

| Presale Started | Dec 2023 |

| Purchase Methods | ETH, USDT, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

6. Smog — Best Small Market Cap Token for Airdrop Rewards

Smog ($SMOG) is currently at the top of our list of the best low cap cryptos. It is a trending new meme coin on the Solana blockchain that has quickly gained investor attention after its launch on Jupiter DEX. Starting with a market cap of $2 million, Smog’s value rose by over 3000%, reaching nearly $65 million.

The platform has gained much traction due to its “The Greatest SOL Airdrop” campaign, which plans to distribute 490 million of its 1.4 billion tokens to its growing community this year. This move aims to boost community engagement. It also plans to reward investors with a 42% APY for staking, with a 90-day lock-in period to encourage long-term holding.

Unique in its approach, Smog avoided a presale and opted for a fair launch, ensuring equal opportunities for all investors. It also plans to allocate a large portion of its supply for marketing, with ambitions to become a leading SOL meme coin. The platform is now eyeing listings on centralized and decentralized exchanges to increase its adoption and maintain interest.

Smog is worth considering for investors looking for promising low-cap cryptos with attractive staking rewards. Those interested in the project’s progress can read the whitepaper, join its Telegram channel and follow it on X (Twitter) for more details.

7. eTukTuk — Best Eco-Friendly Low Market Cap Crypto Project

eTukTuk is an upcoming green low-cap crypto project gearing up for its debut in Sri Lanka, aiming to tackle two challenges: environmental impact and economic inequality. It proposes a shift for TukTuks, from reliance on fossil fuels to electric power.

This transformation offers two-fold benefits: promoting sustainability and cost-effectiveness. eTukTuk aims to make electric vehicles and charging stations affordable and accessible, reducing carbon emissions for environmental well-being.

Moreover, it offers competitive running costs, potentially increasing driver earnings by a remarkable 400%. As a result, the presale of the $TUK token is gaining significant interest. At the time of writing, $TUK is priced at $0.0295 per token – and has raised over $2.9 million since the start of the presale.

With its extensive TukTuk network, Sri Lanka could be an ideal springboard for the launch of this platform. The project, which is built on the Binance Smart Chain, is backed by The Capital Maharaja Group, a prominent Sri Lankan business house holding a 20% stake. This tie-up enhances the project’s reach and credibility.

Additionally, eTukTuk leverages blockchain for digital identity assignment, advocating for widespread financial inclusion. It functions as a tool aiming to close the economic gap. As per the eTukTuk whitepaper, $TUK token holders can stake their tokens, support charging station operations, and earn annual returns.

eTukTuk represents a vision of blending transport reform and economic growth without compromising environmental health. Stay updated on recent updates by following the eTukTuk Telegram channel.

| Presale Started | June 2023 |

| Purchase Methods | USDT, BNB |

| Chain | Cardano |

| Min Investment | $10 |

| Max Investment | None |

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.