DeFi Unlocked: How to Earn Crypto Investment Income on yearn.finance

As the decentralized finance (DeFi) landscape continues to grow, capital inflows are on the rise, suggesting that – despite some bubble attributes – DeFi might remain a part of the digital asset markets in the years to come.

In our DeFi Unlocked series, we explore the most popular decentralized finance protocols to highlight potential income-generating opportunities.

In this article, we will discuss yearn.finance (YFI), how it works, and how you can use it to earn crypto investment income.

Defining yearn.finance

Officially launched in July 2020, yearn finance has made quite an entrance into the DeFi landscape. Bolstered by an impressive rally, its token achieved an over 435% increase in market capitalization in only one month. Today, the YFI token, ranked 32nd by market capitalization, is trading at around USD 21,300, after it surpassed the value of bitcoin (BTC) (around USD 10,500 today) to become the most expensive digital asset. However, YFI crashed by 30% in the past month, while BTC is down 9%.

The project describes itself as a bundle of decentralized finance products aimed at building and supporting “a simple way to generate high risk-adjusted returns for depositors of various assets via best-in-class lending protocols, liquidity pools, and community-made yield farming strategies on Ethereum” (ETH). Yearn provides a gateway into the DeFi economy through its various products.

The platform currently has four major products, namely Vaults, Earn, Zap, and Cover. The platform was created by coder Andre Cronje, who is well regarded due to his numerous code reviews.

Vaults

Vaults are an innovative way to make funds, locked away in tokens, generate income. Cronje developed the protocol after he experienced annoying challenges when managing his friends’ stablecoins in the context of participating in the DeFi sector.

Vaults allow users to hold a token while simultaneously growing the value of their holdings. By depositing a token they are holding, say chainlink (LINK), into the vault, users can earn income because yearn.finance borrows stablecoins against their deposits. The liquidity providers receive a token, which represents their participation in the pool.

The protocol’s algorithm ensures that the stablecoins picked are those whose pools are generating the greatest yields. Any income generated above the stablecoin debt is immediately turned into the original token – in this case LINK – and stored in the vault, increasing the users holdings over time. This new LINK acts as the yield that the user generates.

Due to its similarity to robo-advisers in the traditional financial sector, Vaults seem to be popular with people in the DeFi sector. By leveraging Vaults, users can put their holdings to work and earn income that they are likely unable to generate when trading on their own. The product focuses on stablecoins, though it has opened access for tokens like ETH and might continue to do so in the future.

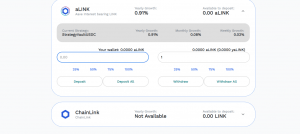

To redeem the yield, users have to redeem the token they received when they initially provided liquidity. For instance, if our user deposited LINK into the Aave pool, they received aLINK. This aLINK represents the liquidity they have deposited. Additionally, users can put the token which represents their liquidity, aLINK, on another protocol and earn yield from it. This composability is a key attractive feature for those looking to maximize their profits.

Yearn describes Vaults as community-developed yield farming robots because the participants in the pool play an essential role. The more the users, the better the earnings. Additionally, this pooling approach saves on transaction fees.

It is important to note that Vault is designed to rebalance itself and the ratios of the tokens held therein. Thus, after every interaction, such as withdrawals or deposits, the system rebalances to protect the holdings in the Vault. Moreover, Vault is monitored by the yliquidate system, which prompts the protocol to rebalance instead of liquidation.

Earn

Earn is the second product on the yearn.finance roster. Earn is a lending aggregator designed to find and leverage the highest yields for supported tokens at all times. Earn achieves this by consistently moving the tokens between a number of lending platforms on Ethereum, most notably Aave, dYdX, and Compound. The tokens supported by Earn include DAI, USDC, USDT, TUSD, sUSD, or wBTC.

For instance, a user may send DAI to the Earn yDAI pool. Directed by the underlying algorithm, the system automatically deposits the DAI into one of three lending protocols on the Ethereum blockchain. Yearn then withdraws and deposits in other lending protocols as the interest rate changes between them. In this way, the user gains the most optimal interest from the liquidity they provide in DAI.

Earn is also an important building block for yVaults as it is the protocol that influences how much yield can be generated. With every interaction users have with Earn, it rebalances to optimize the yield for the whole pool.

Zap

The third product, Zap, is described as a tool that enables users to switch between “various stablecoins and a basket of interest-bearing stablecoins (yTokens) or pools (yCRV)”.

Zap helps simplify taking complex positions while simultaneously providing users with a more enjoyable user experience as opposed to taking positions manually, which is both time consuming and costly. Via Zap, users can avoid fees on unnecessary transactions and move tokens directly into or out of Curve pools from the base assets.

Cover

Cover is the most recent product launched on yearn.finance. It is an interesting look into providing the platform’s users with some protection in case of any malicious activity or happenstance that would drain the pool. To mitigate risk, a user simply sends funds to the pool and will be eligible for a pay out.

The yInsure pooled insurance is underwritten by Nexus Mutual, a decentralized insurance alternative. Currently, users can only earn returns on USDC for insuring the yUSD contract but plans to expand the offerings are underway.

Governance and YFI

Yearn has an active governance forum. Due to its decentralized nature as well as the design specifications of Vaults, users are interested in participating in the governance process. Among the most important issues which users vote on are the strategies for different vaults. The strategy with the most votes is leveraged with the profits going to the users.

To vote, users must use YFI. YFI is the native asset of the yearn.finance ecosystem. To ensure fairness, proposals must meet quorum requirements before the voting can begin. After picking the proposal with majority support, the changes can only be implemented when six of the nine members in the muti-sig wallet sign it. The users who are multi-sig signers were voted in by the community.

There are only YFI 30,000 in existence now. All of it has already been distributed by frontman Cronje to people who were already participating as liquidity providers in certain pools. None of it was set aside for the developers. While Cronje claims that YFI should be earned and not used as a speculative investment tool, its price has seen massive upside gains over its lifetime. To acquire YFI now, you must purchase it.

Using yearn.finance

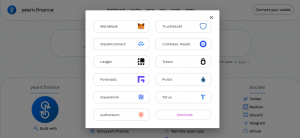

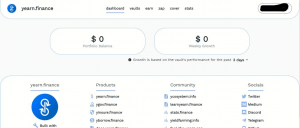

To begin using yearn.finance, navigate to its website. Then, click on “Dashboard,” where you will need to connect a wallet.

Once you connect the wallet of your choice, your dashboard will show your address and balance at the top right corner.

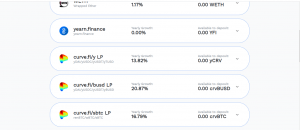

Navigate to Vaults where you will see a list of supported assets.

For consistency with our example we shall pick the aLink pool we referenced earlier.

- To deposit funds simply input an amount and click deposit. Once finished you will receive yLINK, which you can then use to redeem your yield.

What are the risks?

First, there is the risk of losing your funds if a Yearn pool is drained by a malicious party. Given the nascent nature of the DeFi space, this is a risk one must always consider.

Secondly, there have been concerns about how exactly Vaults work. There are fears that the code is not robust enough and has attack vectors. Another party, Jesse Walden, a crypto commentator, said: “If you look at how these vaults generate that yield, there’s very little information.”

Therefore, while yearn.finance might look like an easy-to-use DeFi platform that provides several decentralized financial solutions, with all new blockchain protocols, investors need to be cognizant of the risks and should be careful not to invest more than they can afford to lose.

___

Learn more:

How to Earn Crypto Investment Income on Compound

How to Earn Crypto Investment Income on Balancer

How to Earn Crypto Investment Income on Curve Finance

How to Earn Interest Lending Crypto using Aave

How to Earn Crypto Investment Income on Uniswap