Why Is Crypto Down Today?

As of this writing, crypto prices are up slightly. However, given recent gains, that could change quickly. Later today, the question could instead be, “Why is crypto down today?” or “Why did crypto crash today?” It’s a whipsaw world we trade in, and crypto markets trade up or down for a number of reasons.

Just this week, crypto markets have seen euphoria, profit-taking, and even some liquidations of short positions. In this article, we explore the reasons for a Bitcoin drop or crypto crash. Curious to know why the cryptocurrency market is down today or wondering why did Bitcoin crash? Let’s find out.

Why Did the Cryptocurrency Market Crash Today?

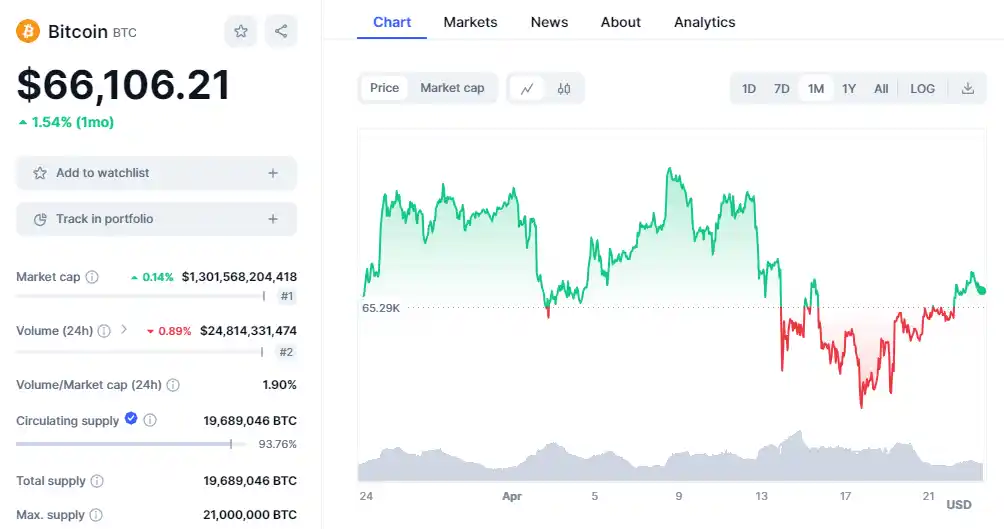

The most recent crypto crash, which started on April 13, was significant, with major cryptocurrencies like Bitcoin and Ethereum recording substantial losses. This decline is largely attributed to escalating geopolitical tensions, which have sparked investor panic and led to widespread sell-offs.

Despite the historical pre-halving surges that typically boost market sentiment, the Bitcoin halving has coincided with this unrest, exacerbating market volatility. As investors flee, traders are capitalizing on the turmoil, although this activity doesn’t necessarily reflect a change to a bullish market outlook.

Increased transaction fees related to the new protocol launch on the Bitcoin network have also contributed to the downturn. The Runes protocol, introduced around the time of Bitcoin’s halving, allows users to mint digital tokens directly on Bitcoin’s blockchain.

This new feature sparked intense competition among users to register unique asset names first, causing them to pay higher transaction fees to prioritize their transactions. This demand surge led to a significant increase in Bitcoin network fees.

Additionally, the first conviction in a crypto market manipulation case has likely shaken investor confidence, introducing fears about potential legal repercussions for other projects and individuals within the space.

This uncertainty can lead to reduced investment and increased sell-offs as market participants reassess the risks associated with crypto investments.

Still, the market has rallied slightly post halving, with Bitcoin and Ethereum registering 5.58% and 3.6% gains, respectively, over the last seven days.

Why Is Bitcoin Down Today?

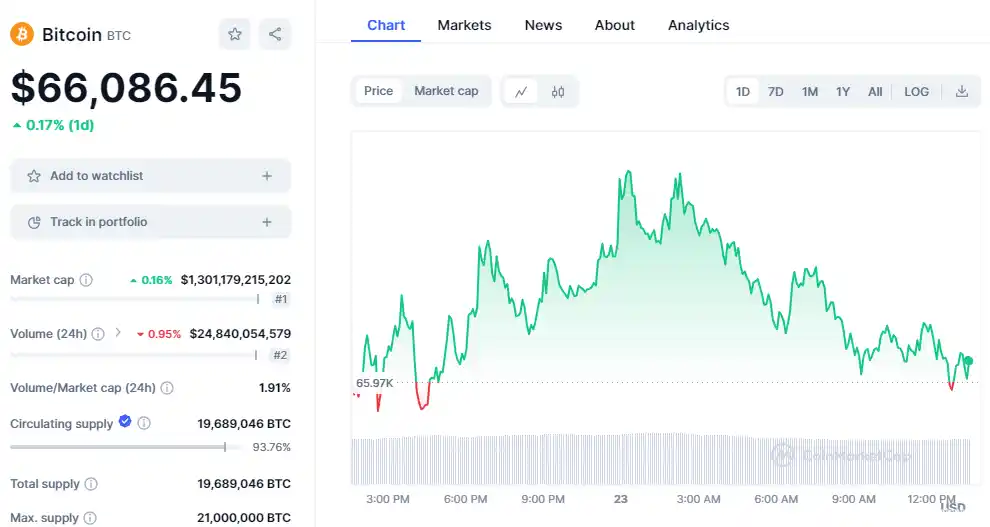

Following the Bitcoin crash that started on April 13 and ended on April 22, the token’s price has resumed an upward trajectory. Bitcoin is up today due to a modest increase in the overall cryptocurrency market cap, which rose by 1.06%.

This positive shift in market cap has positively influenced Bitcoin along with other top cryptocurrencies like Solana, XRP, Cardano, TRON, and NEAR Protocol, each showing gains of up to 2%.

But will it last? According to Vikram Subburaj, CEO of Giottus Crypto Platform, Bitcoin is showing early signs of a potential extended rally, with favorable RSI (66) and stochastic (100) levels suggesting a possible rise towards $70,000 in the coming week.

Similarly, Rajagopal Menon, Vice President at WazirX, observed that the overall market sentiment is optimistic, with buyers currently predominating over sellers.

Sathvik Vishwanath, Co-Founder & CEO of Unocoin, noted that Bitcoin’s recent price of $66,270 and a breakthrough past $64,853 indicate upward momentum. According to him, Bitcoin’s resistance levels are at $66,910, $69,232, and $71,425, with support levels at $63,045, $61,387, and $59,686.

Vishwanath highlighted that technical indicators, including the RSI and a 50-day EMA at $64,788, reinforce market optimism and suggest strong buying potential above $64,850, but also warn of a possible sell-off below this threshold.

What Forces Influence Crypto Prices?

Crypto markets can move on a dime, switching from uptrends to sudden drops without warning. Part of the challenge lies in market size. The industry’s relative youth and smaller market capitalization make it more volatile.

For context, the entire crypto market is worth the same as Apple alone, both having a total market cap of $2.56 trillion. As the market evolves, several factors can influence prices going forward.

Supply and Demand

Like all markets, crypto prices answer to supply and demand. If supply outpaces demand, prices fall. When demand exceeds supply, prices rise as buyers compete for purchases.

Market-leading cryptocurrencies, Bitcoin and Ethereum, both benefit from limited supplies. Bitcoin is programmatically limited to 21 million bitcoins.

Ethereum’s supply, while not hard coded, employs a burning mechanism that reduces supply while the consensus protocol mints new ETH. The result has proven to be slightly deflationary.

If long-term demand remains high for these two coins, prices should increase.

Fundamentals

Crypto fundamentals often use different measures compared to stocks. Cryptocurrency investors consider several metrics, including:

- Adoption rates: BTC and ETH are now household names. Both blockchain networks see wide usage across the globe, adding to the “network effect” that makes these assets valuable. Changes in usage and adoption rates can affect prices.

- Transaction volume: Transaction volume plays a vital role in coin and token prices. In addition, total value locked (TVL), a measurement of activity on smart-contract blockchains, becomes an important fundamental measurement that can impact prices.

- Revenue: Mining or staking revenue reflects the health of the network by ensuring decentralized participation in consensus when revenues are strong. In proof-of-stake networks, investors can share in these yields.

- Yields: Beyond proof-of-stake yields, certain crypto tokens act as a ‘key’ to earn yields on decentralized protocols.

- Network security and technology: Bitcoin derives its value from its scarcity, decentralization, and the network’s security. The technology behind a given cryptocurrency leads investors to either embrace or eschew the protocol, ultimately reflecting in the price.

Macro Influences

External factors like interest rates or inflation can affect crypto prices. Bitcoin’s price, in particular, responded to changes in both, because many investors see BTC as a hedge against inflation.

Sentiment

Like other trading markets, the crypto market goes through bull and bear cycles. When market sentiment is bearish, prices can trade sideways or down before reaching a turning point.

Technicals

Chart technicals often play a large role in trading, now magnified by automated trading. Traders worldwide make trading decisions based on technical indicators, which, in a relatively small market, can create a self-fulfilling prophecy.

Is Cryptocurrency Safe to Invest In?

Investing in cryptocurrency comes risks. However, key crypto assets, such as BTC and ETH, have far outperformed traditional investments in the past decade. To reduce risk in crypto investments, consider making crypto a limited part of a larger investment portfolio.

To reduce volatility, use dollar-cost averaging (DCA) to purchase a fixed dollar amount at fixed intervals. This strategy buys more of the asset when prices swoon and smaller amounts when prices spike, often reducing average costs in the long run.

Conclusion: Why Is Crypto Down Today?

Today, the cryptocurrency market is seeing an upward movement due to a slight increase in the overall market cap. Bitcoin, alongside other major cryptocurrencies like Solana and Ethereum, is experiencing gains, driven by optimistic market sentiment and favorable technical indicators suggesting potential for continued growth.

When you’re ready to invest, consider using a beginner-friendly platform like eToro. Every account gets a $100,000 “demo account,” allowing you to practice trading against real-time market conditions. eToro also offers copy trading, which lets you follow the moves of successful traders on the platform. Best of all, trading fees are straightforward, using a flat 1% commission on crypto spot trades.

FAQs

What caused Bitcoin to drop today?

Bitcoin’s recent drop is largely attributed to escalating geopolitical tensions and investor panic, leading to widespread sell-offs. Additionally, increased transaction fees from the new Runes protocol and the first conviction in a crypto market manipulation case have also contributed.

Why is the crypto market down today?

The crypto market isn’t down today; instead, it has shown modest gains. This positive shift is driven by a slight increase in the overall cryptocurrency market cap, leading to an upward movement in major cryptocurrencies like Bitcoin and Ethereum.

References

- CryptoNews: Is Bitcoin Halving 2024 a Game-Changer for Investors? Find Out What Experts Predict

- CoinDesk: Bitcoin Miners Reap Windfall as ‘Runes’ Debut Sends Transaction Fees to Record Highs

- CryptoNews: Mango Markets Hacker Found Guilty, Faces 20 Years in Prison

- The Economic Times: Bitcoin rises above $66.6k; Dogecoin, Toncoin decline up to 8%

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell