How to Use a Bitcoin ATM in 2024: Step-by-Step Guide

A Bitcoin ATM is a machine that allows you to buy or sell Bitcoin using cash or a card without needing a traditional bank account. These ATMs simplify the process of trading Bitcoin and are growing in popularity.

In this guide, you’ll learn how to use Bitcoin ATMs and their pros and cons. We’ll also cover how to follow best practices when using these machines.

What is a Bitcoin ATM?

A Bitcoin ATM— or BTM — is a convenient machine that allows you to buy or sell Bitcoin using cash or a debit card. These ATMs make buying or selling Bitcoin easy without needing a regular bank account or an online crypto exchange. Bitcoin ATMs are becoming quite popular, especially with the increase in the number of people using cryptos.

A Brief History of Bitcoin ATMs

The first Bitcoin ATM was installed in October 2013 by a company called Robocoin in a Waves Coffee shop in Vancouver, Canada. Although it stopped operating there in 2015 due to operational problems, the number of Bitcoin ATMs has grown significantly since then.

Over time, more companies started making Bitcoin ATMs, which began popping up in different countries worldwide. At the time of writing, there are nearly 37,199 Bitcoin ATMs worldwide. Most of these ATMs are located in the United States.

While these machines definitely offer convenience, they often have high transaction fees. This could be one of the reasons why we still haven’t seen widespread adoption of these machines.

Bitcoin ATMs have also faced several legal issues. The operators of these ATMs are legally bound by anti-money laundering (AML) and know-your-customer (KYC) regulations in crypto, which means that they must verify the user’s identity. This can be a downside for users who prefer to keep their information private.

Some countries have very strict regulations surrounding Bitcoin, and this can extend to Bitcoin ATMs. For example, the FCA in the UK has carried out raids on locations suspected of hosting unregistered Bitcoin ATMs.

Today, Bitcoin ATMs are making Bitcoin more accessible to regular users, but their long-term adoption and feasibility are yet to be proven.

How to Use a Bitcoin ATM: Step-by-Step Buying Guide

Have you ever wondered how does a Bitcoin ATM work? It’s quite similar to traditional ATMs, which are user-friendly and offer a quick way to transact (with a few specific nuances). Here are some simple yet detailed steps that show you how to use a Bitcoin ATM machine:

1). Prepare Your Wallet

Before using a Bitcoin ATM, you need a crypto wallet compatible with Bitcoin to store your BTC. There are many types of crypto wallets you can opt for that are available as an app or a separate physical device.

Choose a wallet that works best for you and keeps your crypto safe. Make sure to have your wallet’s QR code or public Bitcoin address ready, as you’ll need it to receive the Bitcoin you buy.

2). Locate a Nearby Bitcoin ATM

Use websites like CoinATMRadar or bitcoin.com’s ATM map to find a Bitcoin ATM nearby. These websites tell you where the ATMs are when they’re open and what cryptos they support.

When choosing an ATM, it is very important to check for Bitcoin transaction fees, limits, and the machine’s location. Try to use a machine in a well-lit, safe place, especially if you plan to buy a lot of Bitcoin.

3). Complete Identity Verification (If Required)

As discussed before, most Bitcoin ATMs now ask for some kind of identification because of KYC and AML rules. This usually means giving your phone number to get a code via text message. Enter the code into the machine to confirm your identity.

Do Bitcoin ATMs require an ID?

Depending on the amount of Bitcoin you’re buying and local rules, some crypto ATMs may also ask you to scan an ID card.

4). Initiate the Transaction and Enter the Amount

Once you’ve verified your identity, you can choose your transaction type, i.e., buy or sell Bitcoin. Here, just select the Buy Bitcoin option on the ATM screen and enter the amount of cash you want to exchange for the BTC. The machine will show you how much Bitcoin you’ll get based on the current exchange rate minus any fees.

5). Enter Your Wallet Address or Scan the QR Code

To ensure the Bitcoin you bought is sent to the right place, you need to give the ATM your Bitcoin public address. The easiest way to do this is by scanning your wallet’s QR code using the ATM’s scanner.

You can also type in your wallet’s address using the on-screen keyboard. Please double-check the address to avoid sending your BTC to the wrong address, as it will be irreversible.

Note: If you have a wallet on an exchange, you can also use the Bitcoin public address of this wallet to receive your BTC.

6). Insert Cash

Once you’ve rechecked your wallet address or scanned the QR code, you can just simply insert your fiat currency into the machine. The machine will then show you how much BTC your fiat currency is worth on the screen. Please review the transaction details before moving on (including the exchange rate and any fees).

7). Complete Transaction

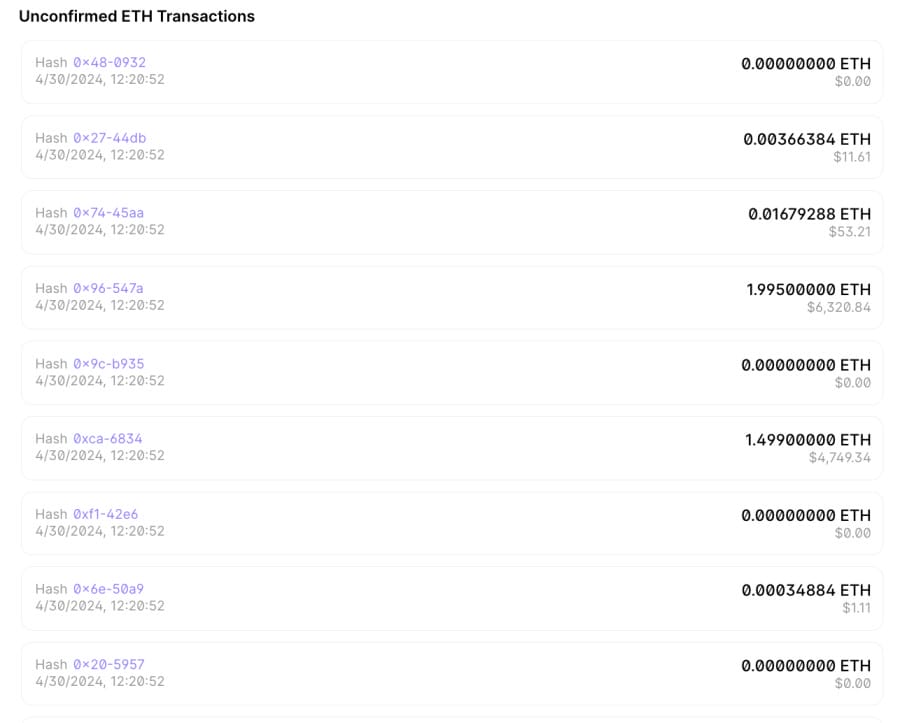

If you’re satisfied with the transaction details, you can confirm it by pressing the ‘Buy’ or ‘Confirm’ button on the machine. The ATM will then process the transaction, which may take a few minutes to an hour (depending on network confirmations). Once the transaction is complete, the ATM will give you a receipt with the details.

8). Confirm You Have Received Crypto

Check your wallet to make sure you received the BTC after confirming the transaction. Remember that the coins may take some time to appear in your wallet (as the blockchain’s network will confirm the transaction). It is also very important to store your cryptocurrency safely once you’ve received it.

Note: you should contact the ATM operator or your wallet provider for help if you have any problems with the transaction.

How to Sell Bitcoin for Cash Using an ATM

Keep in mind that some Bitcoin ATM machines may only support buying or selling. Once you’ve found a machine that supports selling, the process is relatively simple.

As we saw in the previous section, the initial steps for selling Bitcoin are the same as buying it. You’ll need a compatible wallet that holds the Bitcoin that you want to send. Then, you just need to click the ‘sell’ button instead of buy. Then, follow these steps:

1). Enter Amount to Sell

Start by choosing the “Sell Bitcoin” or “Cash Out” option on the ATM screen. Enter how much Bitcoin you want to sell or how much cash you want to get. The machine will then show you the current exchange rate and any fees. Read this information carefully before moving on.

2). Generate Receive Address

The Bitcoin ATM will then provide a unique Bitcoin address to which you can send your BTC. This address will usually be shown as a QR code on the screen. Use your smartphone to scan the QR code or write the address carefully.

3). Send Bitcoin

Use your Bitcoin wallet to send the amount of BTC you want to sell to the address the Bitcoin ATM gave you. Double-check the address to make sure it’s right. Once you’ve sent the Bitcoin, notify the BTM by choosing the correct option on the screen, like “Sent” or “Done.”

4). Confirm the Transaction

The Bitcoin ATM will wait for the Bitcoin network to confirm your transaction. This usually takes a few minutes. Some machines might ask for more than one confirmation before giving you the cash, while others may give you the money right away. Look at the screen for updates on the transaction and follow any other instructions if needed.

5). Collect Cash

Once the transaction is confirmed, the Bitcoin ATM will give you the cash minus any fees. Take the money from the machine and make sure you get the right amount. Don’t forget to take your receipt, which has important information about the transaction, like the Bitcoin address, the amount you sold, and any fees.

Note: Bitcoin ATM fees for selling Bitcoin can be higher than other ways of selling, so think about this when deciding to use a Bitcoin ATM. Also, be aware of your country’s tax rules for crypto transactions for reporting any gains or losses.

One-Way vs Two-Way Bitcoin ATMs

It is with noting that not all Bitcoin machines work the same way. There are two main types of BTMs: one-way and two-way machines. Knowing the difference between these two types is important to understand how to use a Bitcoin ATM.

Pro Tip: Fees and transaction limits may also vary depending on the type of BTM. it’s always a good idea to compare different BTMs in your area to find the most affordable and convenient one.

One-Way Bitcoin ATMs

If you’re wondering how to use Bitcoin ATM with cash, one-way Bitcoin ATMs (unidirectional BTMs) let you buy Bitcoin using cash. These machines are the most common type of BTM and are made for people who want to buy crypto quickly.

To use a one-way BTM, you simply put cash into the machine, give your Bitcoin wallet address (usually by scanning a QR code), and the machine sends the amount of Bitcoin you bought (minus any fees) to your wallet. One-way BTMs are perfect for beginners who want to invest in Bitcoin without needing to sell their crypto as well.

Two-Way Bitcoin ATMs

Two-way Bitcoin ATMs (bidirectional BTMs) let you both buy and sell Bitcoin. To sell Bitcoin using a two-way BTM, you usually need to send your Bitcoin to the machine’s wallet address. Once the blockchain confirms the transaction, the machine gives you the cash minus any fees. Two-way BTMs give users more flexibility in managing their crypto, and they can cash out when needed.

Bitcoin ATM Payment Methods

To know how to use a Bitcoin machine, it is also important to know what types of payment methods it accepts. The specific options can differ depending on the machine and who runs it, but most BTMs offer different payment methods to make it as easy as possible for people to use them.

Pro tip: Fees may differ depending on the payment method you choose, so it’s always a good idea to compare the costs of each option to find the one that saves you the most money.

Some of the most common Bitcoin ATM Payment Methods are:

- Cash: Most Bitcoin ATMs accept cash payments, making it the most popular way to buy Bitcoin. You just put cash into the machine, and the amount of Bitcoin you bought (minus any fees) will be sent to your wallet address. Cash payment is quick and doesn’t require any extra setup.

- Debit/Credit Cards: Some Bitcoin ATMs let you buy crypto using your debit or credit card. This payment method is convenient for people who don’t want to carry cash or who want to use their card’s rewards program. However, not all BTMs take card payments, and those that do might charge higher fees than cash transactions.

- Mobile Wallets: Some Bitcoin ATMs let you buy or sell Bitcoin using mobile wallet apps, like Google Pay or Apple Pay. You usually need to scan a QR code shown on the BTM screen with your mobile wallet app to use this method.

- Prepaid Cards: Only a few Bitcoin ATMs accept prepaid cards for payment. You can buy these cards and load them with a specific amount. To use a prepaid card at a BTM, you just insert the card into the machine and follow the instructions on the screen to finish the transaction.

- Online Bank Transfers: Sometimes, crypto ATMs may even support online bank transfers for payments. This lets you buy Bitcoin directly from your bank account without needing cash or cards. However, this option isn’t that common and may require you to take some extra steps to verify your identity.

Bitcoin ATM Fees and Spending Limits

It is worth noting that BTM fees are usually higher than the fees charged by online crypto exchanges. They can range from 7% to 25%, with an average of 10% to 15%.

How much does a Bitcoin ATM charge for $1000?

For example, if you’re buying $1000 worth of Bitcoin and the fee is 10%, you’ll get $920 worth of Bitcoin and pay an $80 fee. Similarly, if you’re selling $1,000 worth of Bitcoin and the fee is 7%, you’ll get $930 in cash and pay a $70 fee.

Also, remember that BTMs have spending limits that can differ depending on the machine and who runs it. These limits ensure the machines follow AML rules set by the Bank Secrecy Act (BSA) in the United States. In most cases, spending limits are between $1,000 and $10,000 per transaction, which means BTMs won’t be able to cater to very big transactions.

Also, some BTMs may ask you to give a phone number for text verification or scan a government-issued ID (like a driver’s license) to complete a transaction as a part of its KYC process.

The Pros and Cons of Bitcoin ATMs

Knowing the pros and cons of Bitcoin ATMs can help you decide if they are right for you. For instance, a BTM may be a good choice if you prefer quick payments in cash. But, if you’re looking for low transaction fees or want to make huge transactions, you may be better off using a crypto exchange.

Advantages of Bitcoin ATMs

Here are some of the advantages of using a Bitcoin ATM:

- Accessibility: Bitcoin ATMs provide a simple and user-friendly way to buy or sell Bitcoin. This makes them accessible to people who may not be familiar with online exchanges or are not comfortable using complex trading platforms.

- Instant Transactions: BTMs allow you to buy or sell Bitcoin instantly (usually in just a few minutes). This is especially useful if you need to make an urgent transaction or don’t want to wait for a long verification process

- Cash Transactions: Most Bitcoin ATMs accept cash payments. This is convenient for people who prefer to use physical money or don’t have a traditional bank account.

- Anonymity: While some BTMs require identity verification for larger transactions, many machines offer more anonymity than online exchanges (which often ask for more personal information and documents).

Drawbacks of Bitcoin ATMs

Bitcoin ATMs have some drawbacks, including:

- Higher Fees: One of the main disadvantages of Bitcoin ATMs is the high transaction fees. BTM fees can range from 7% to 25%, which is much higher than the fees charged by most online crypto exchanges.

- Limited Availability: Although the number of Bitcoin ATMs is growing, they are still not as common as traditional ATMs. This can make it hard for some users to find a convenient location to buy or sell Bitcoin.

- Transaction Limits: Most Bitcoin ATMs have transaction limits due to AML regulations (usually between $1,000 and $10,000). These limits can be a downside for users who want to make big transactions.

- Security Risks: While Bitcoin ATMs themselves are generally secure, users should be careful when using machines in unfamiliar or poorly lit areas. It’s also important to check the machine hasn’t been tampered with and protect your wallet information during transactions.

Best Practices for Using a Bitcoin ATM

Just taking a few precautions can help protect your money and have a safer experience. Here are some key things to keep in mind:

- Research The BTM Operator: Research the company running the Bitcoin ATM to check if it is reliable and follows local rules. Look for reviews from other users and check the operator’s website to confirm that it is registered with the appropriate authorities.

- Check The Exchange Rate: It is crucial to check the exchange rate the BTM offers along with the transaction fees. Compare the machine’s rate to the current market rate to ensure you get a fair deal. Some machines may advertise low fees, but their exchange rates might not be as good.

- Protect Your Privacy: While many Bitcoin ATMs offer some anonymity, protecting your personal information is still important. Don’t share your wallet details or private keys with anyone, and be careful when entering sensitive information into the machine.

- Secure Your Wallet: Please make sure you have a secure Bitcoin wallet to store the crypto you buy. Think about using a hardware wallet for extra security, and always keep your wallet’s private keys or recovery phrases in a safe place.

- Double-check Transaction Details: Carefully review all the details before finalizing a transaction (including the amount, fees, and recipient address). Make sure you’ve entered the correct information and that you’re sending money to the right wallet.

Alternatives to Using a Bitcoin ATM

Here are some popular alternatives to using a Bitcoin ATM:

- Centralized Exchanges: These are online platforms like Coinbase, Binance, and Kraken, where you can trade Bitcoin and buy new cryptos. These exchanges usually have lower fees than BTMs. However, they typically require users to sign up and verify their identity.

- Decentralized Exchanges: Some of the best decentralized exchanges (like Uniswap and PancakeSwap) let you trade cryptos directly from your wallet without a central authority. DEXs often give you more privacy and security than CEXs because you fully control your money. However, DEXs may be complex for beginners and have fewer payment options.

- Peer-To-Peer (P2P) Platforms: These are marketplaces (like Paxful) where you can buy or sell Bitcoin directly with other people. These platforms offer many different ways to pay, including cash, bank transfers, and online payment services. P2P transactions can give you more privacy and flexibility, but you must be careful when dealing with people you don’t know or trust.

- Over-The-Counter (OTC) Trading: This involves buying or selling large amounts of Bitcoin directly between parties without going through a public exchange. OTC desks are usually for wealthy individuals and institutional investors who need more liquidity and privacy.

Conclusion

Bitcoin has been on a consistent uptrend since 2013. Its community has continued to grow over the years, and the number of Bitcoin ATMs has also increased.

Looking ahead, the demand for Bitcoin ATMs could continue to grow. However, buyers need to understand the full picture and the associated pros and cons of using these machines.

Bitcoin ATMs provide a quick way to trade Bitcoin, especially for those new to cryptos or without access to traditional banking services. While they offer quick transactions, users should also weigh the high transaction costs and the exchange rate differences before transacting.

FAQs

How do I use a Bitcoin ATM for the first time?

Ensure you have a Bitcoin wallet, then find the nearest machine using a site like CoinATMRadar to use a Bitcoin ATM. Verify your identity at the ATM if required and scan your wallet’s QR code to complete the transaction.

How do I send money using a Bitcoin ATM?

At a Bitcoin ATM, select the option to send money and enter the amount you wish to transact. Scan your wallet’s QR code for the address where you want to send the Bitcoin. Insert cash, confirm the details, and complete the transaction.

Is a Bitcoin ATM easy to use?

Yes, Bitcoin ATMs are designed for easy use. Like regular ATMs, they give simple instructions on the screen for buying or selling Bitcoin, which makes them quite accessible for beginners.

Is it worth using a Bitcoin ATM?

Using a Bitcoin ATM can be worthwhile due to the convenience of quick transactions without needing a bank account. However, you must also consider the typically higher transaction fees than crypto exchanges.

Do Bitcoin ATMs require ID verification?

Yes, most Bitcoin ATMs require some form of ID verification as part of anti-money laundering (AML) and know-your-customer (KYC) regulations, especially for transactions over certain amounts.

How long do Bitcoin ATM transactions take?

Bitcoin ATM transactions usually complete within a few minutes, but the time may vary based on network traffic and the number of confirmations the ATM requires for the transaction.

References

- Total number of Bitcoin ATMs in operation (Coin ATM Radar)

- Bitcoin ATMs’ country-wide location (Statista)

- The Financial Conduct Authority continues crackdown on unregistered crypto ATMs in the UK (FCA)

- Bitcoin.com’s ATM map (Bitcoin.com)

Kane Pepi

Kane Pepi

Michael Graw

Michael Graw