10 Best Crypto Exchanges for Day Trading in 2024

Selecting the best crypto exchange for day trading is crucial. You’ll need a trusted exchange with low commissions, tight spreads, and plenty of liquidity. Not to mention a wide range of markets and analysis tools.

Read on as we rank and review the 10 leading platforms for crypto day trading in 2024.

List of The Best Crypto Exchanges for Day Trading

Listed below are the 10 best crypto exchanges for day trading:

- Binance – Overall Best Crypto Exchange for Day Trading

- Coinbase Advanced – Trusted Crypto Exchange With Tier-One Security

- OKX – Day Trade Over 500 Crypto Pairs at 0.1% Commission

- MEXC – Great Day Trading Platform for High Leverage

- eToro – Overall Best Place to Day Trade Crypto in 2024

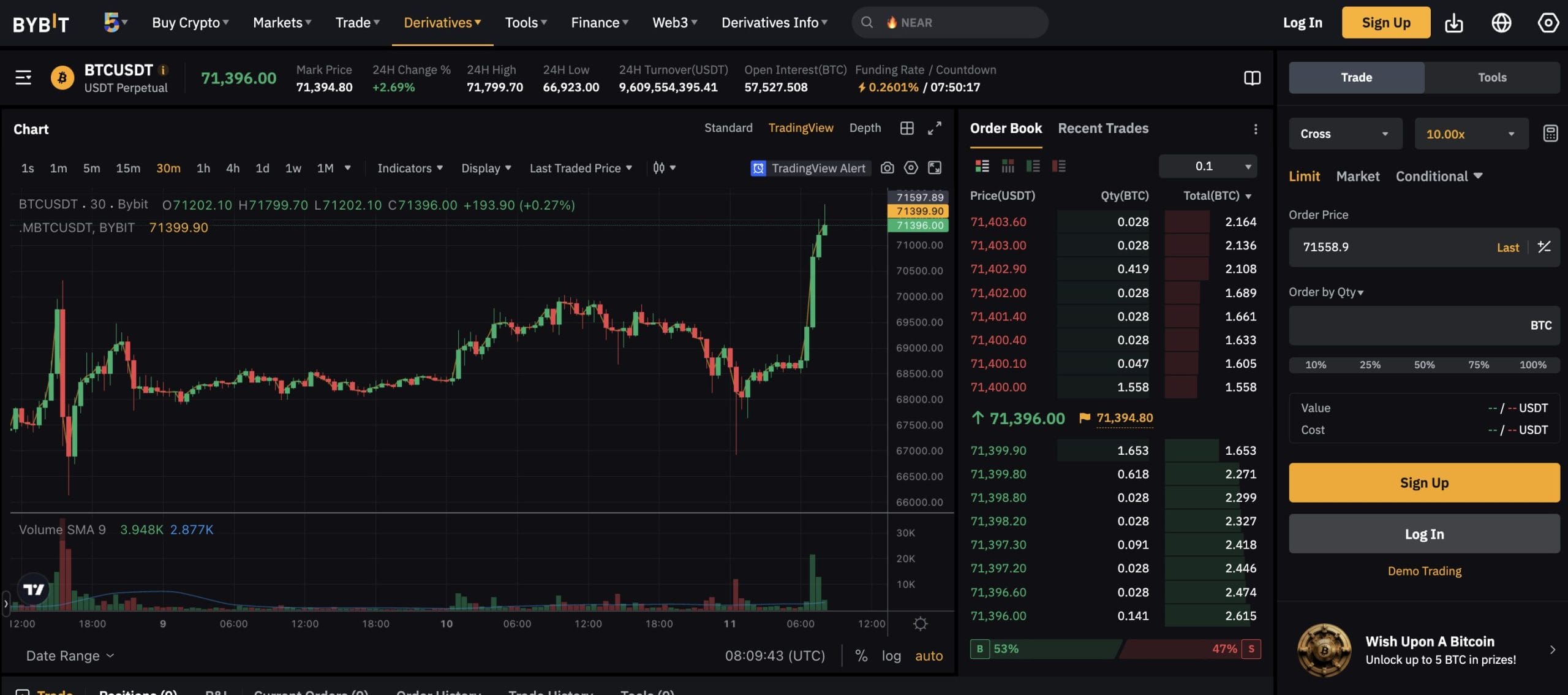

- Bybit – Popular Exchange for Day Trading Futures and Options

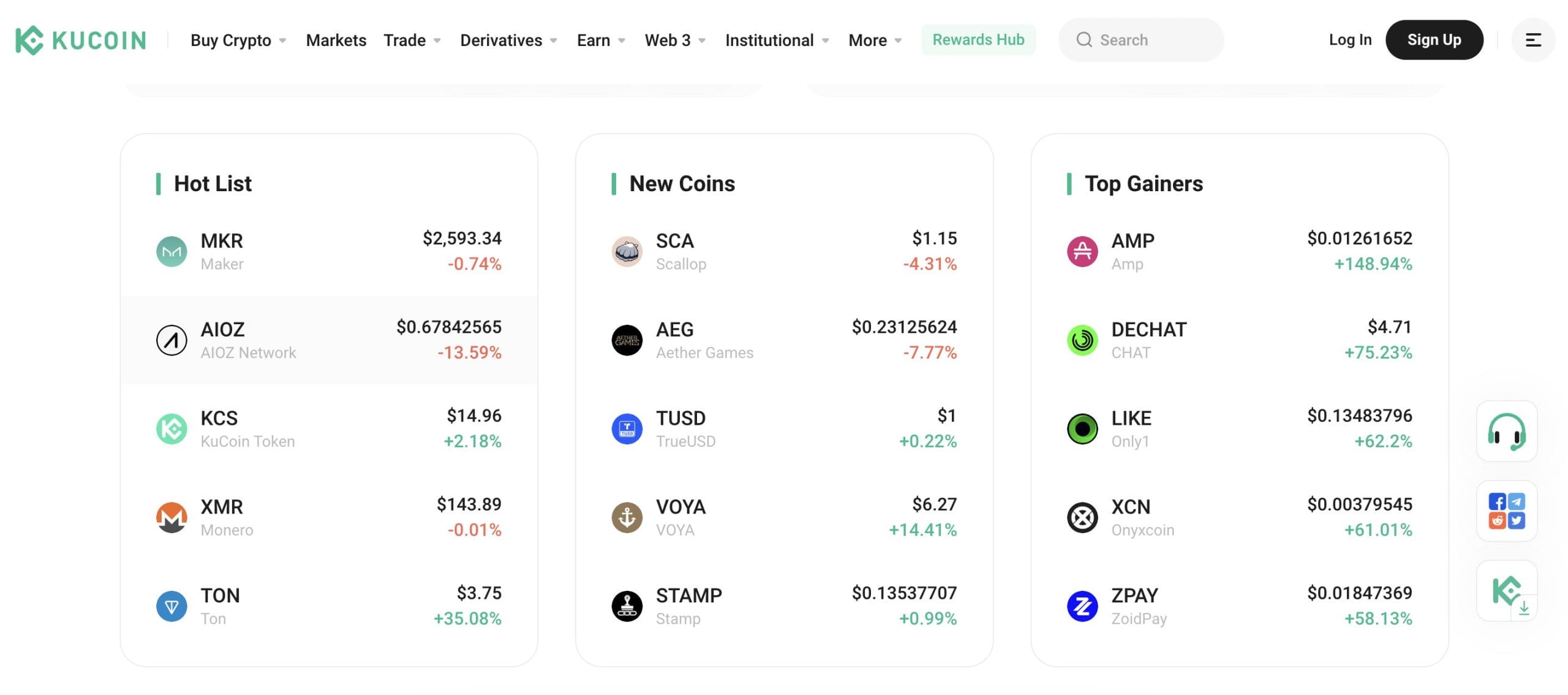

- KuCoin – Top-Rated Platform for New Cryptocurrency Listings

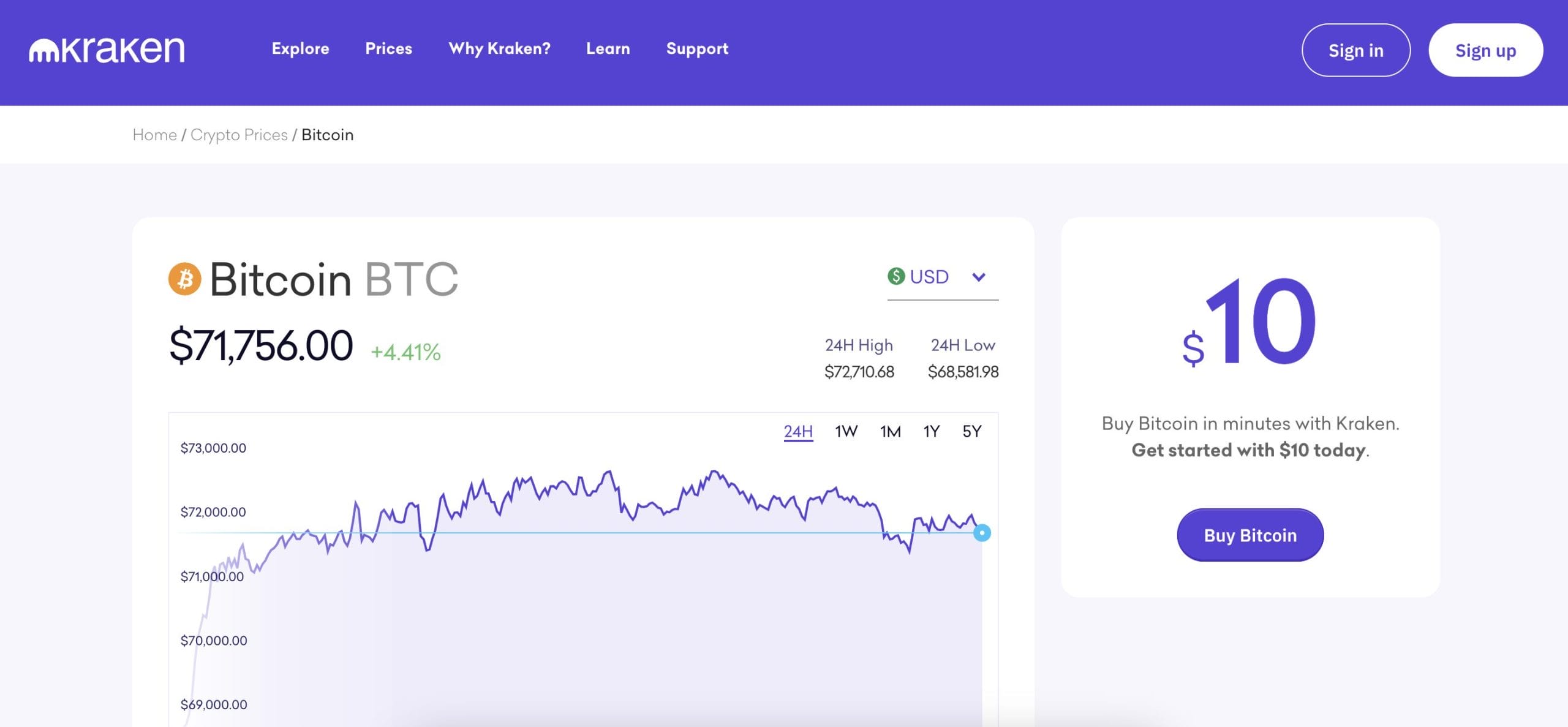

- Kraken – User-Friendly Exchange With a $10 Minimum Deposit

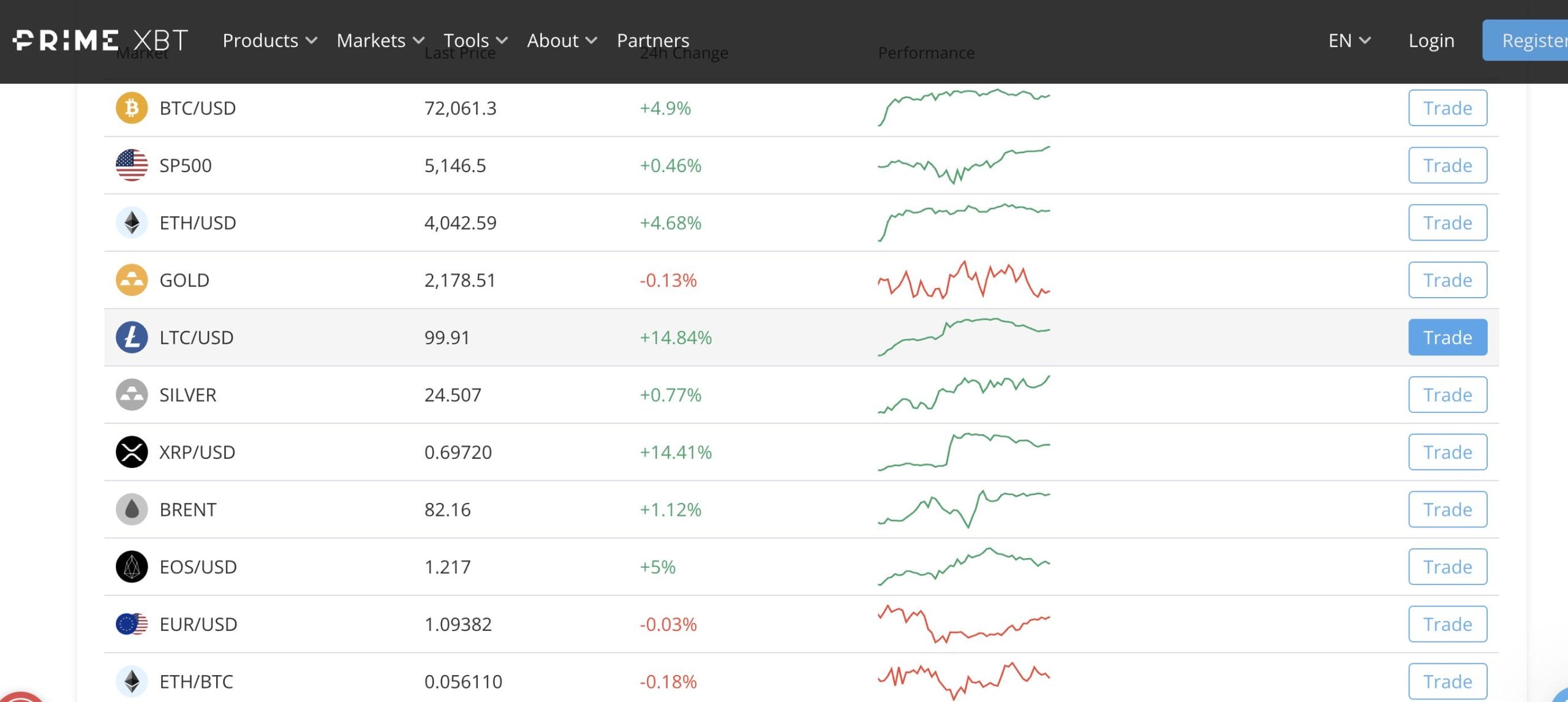

- PrimeXBT – Best Option for Day Trading Multiple Financial Markets

- Margex – Privacy-Focused Platform With 100x Leverage

Top Day Trading Crypto Exchanges Compared

Below, is a table comparing the spot trading fee, number of tradable coins, trading volume rank, and leverage of the best day trading crypto exchanges in April 2024. We also included whether US clients are accepted.

Company

Spot Trading Fee

Tradable Coins

Trading Volume Rank

Leverage Available

US Clients

Binance

0% to 0.6%

350+

#1

Yes, up to 100x leverage via perpetual futures

Yes

Coinbase

0% to 0.6%

200+

#2

Yes, up to 10x leverage via perpetual futures

Yes

OKX

0.08% to 0.1%

320+

#4

Yes, up to 100x leverage via perpetual futures

No

MEXC

0%

1,700+

#11

Yes, up to 200x leverage via perpetual futures

No

eToro

1% + spread

80

N/A

Yes, up to 2x leverage via CFDs

Yes

Bybit

0.1%

1,120+

#3

Yes, up to 125x leverage via perpetual futures

No

KuCoin

0.1%

700+

#7

Yes, up to 100x leverage via perpetual futures

No

Kraken

0% to 0.4%

200+

#6

Yes, up to 50x leverage via perpetual futures

Yes

PrimeXBT

0.05%

30+

N/A

Yes, up to 200x leverage via perpetual futures

No

MargeX

0.019% to 0.2%

35+

N/A

Yes, up to 100x leverage via perpetual futures

No

The Best Crypto Exchanges for Day Trading Reviewed

We’ll now discuss the best crypto exchanges for day trading in detail. Read on to choose the most appropriate trading platform for you.

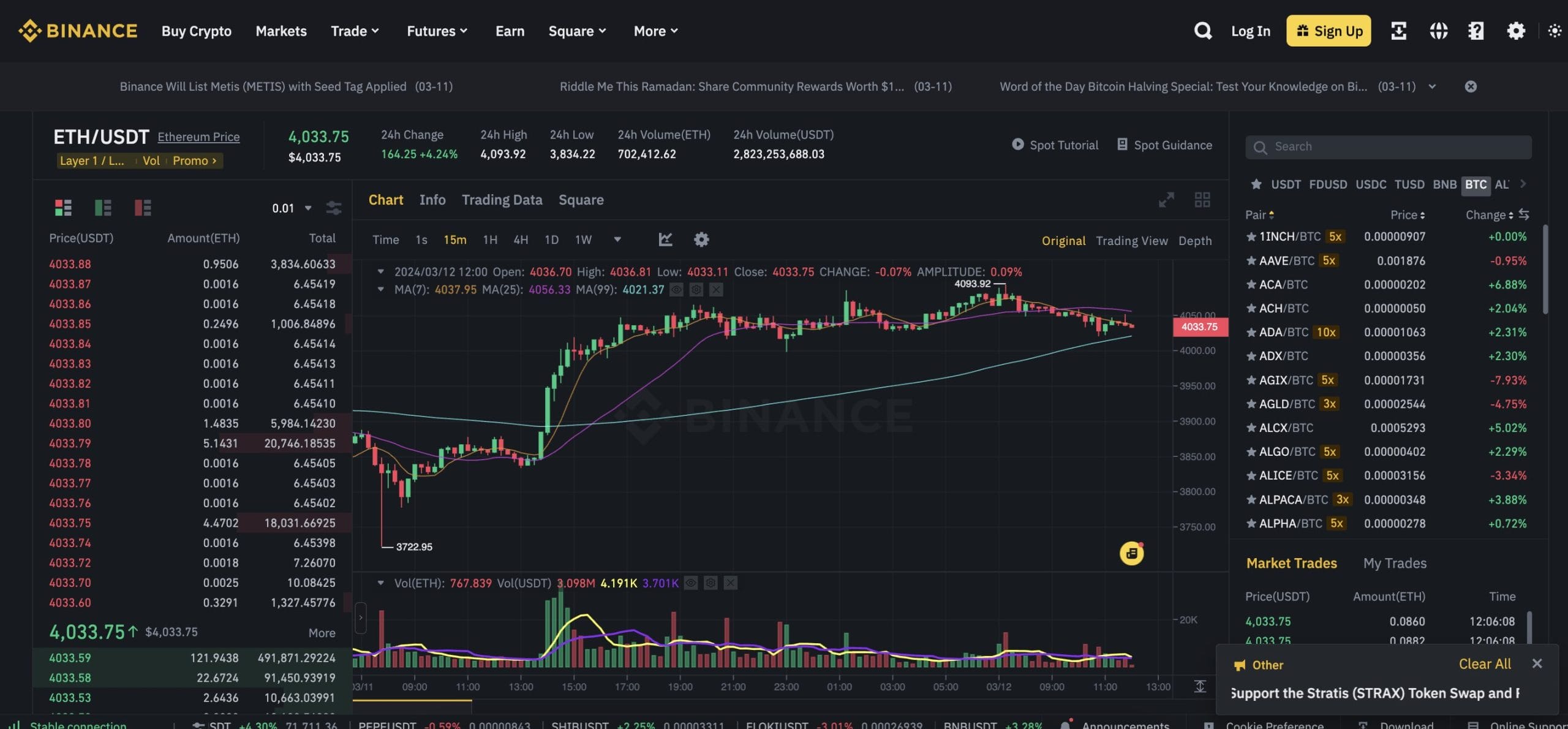

1. Binance — Overall Best Crypto Exchange for Day Trading

The best crypto exchange for day trading is Binance. Almost $50 billion worth of spot trades have gone through Binance in the last 24 hours. This is in addition to over $110 billion in derivative volume. What’s more, Binance claims more than 181 million users, and offers everything a day trader needs to make consistent gains.

For a start, day traders pay just 0.1% per slide when trading the spot markets. This is reduced when holding BNB or meeting 30-day trading milestones. Hundreds of cryptocurrencies are listed on Binance, so you’ll never be short of trading opportunities. You can also trade leveraged futures and options. The maximum leverage limit is 100x.

Binance is also a great choice for technical traders. Its charting screens are integrated with TradingView. This means day traders can access over 100 indicators and drawing tools. Binance welcomes traders from most countries, including the US. Americans need to use the Binance.us website, which comes with reduced functionality.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| Binance | 350+ | 0% to 0.6% | Yes, up to 100x leverage via perpetual futures | Yes, US clients must use the Binance.us website |

Pros

- Best exchange for day trading crypto with high liquidity

- Buy and sell crypto with low spot trading fees

- Charting screens integrate with TradingView

- Offers 100x leverage on perpetual futures

Cons

- US clients have access to fewer markets and products

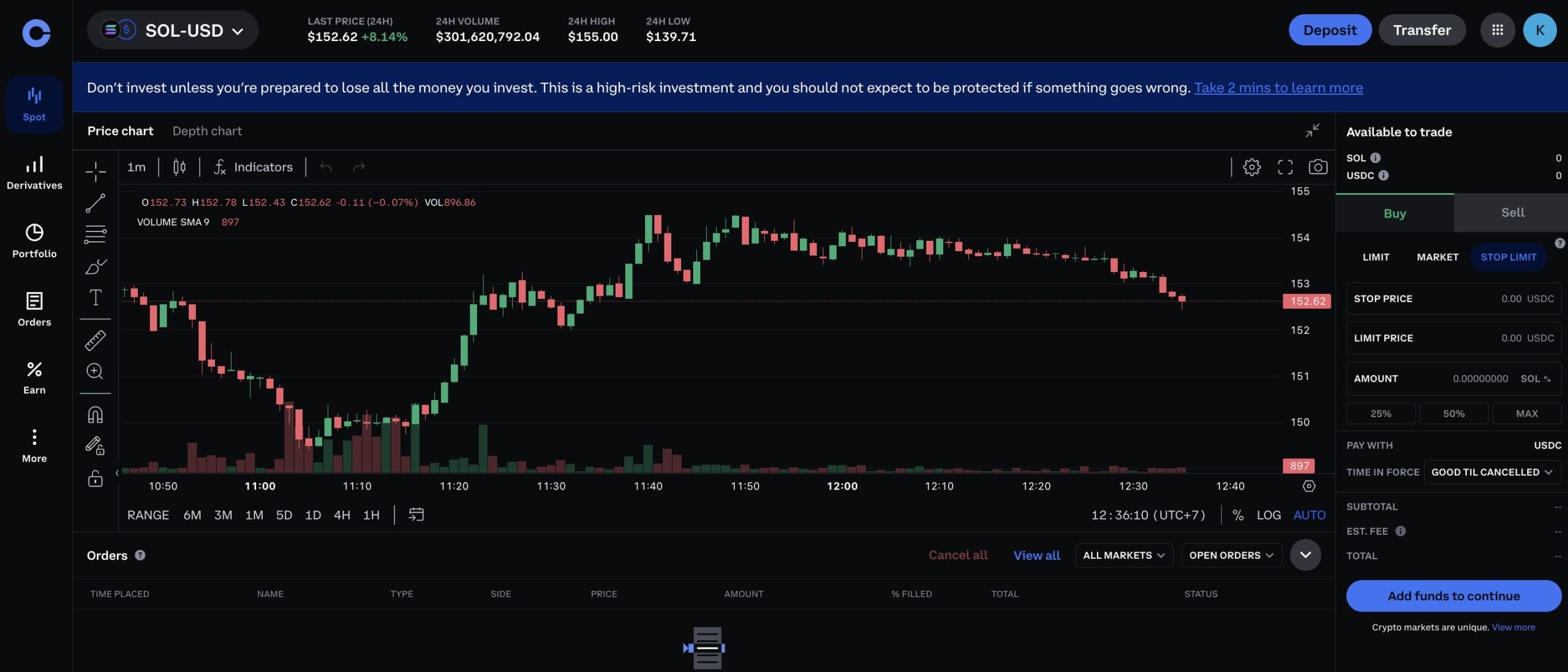

2. Coinbase Advanced — Trusted Crypto Exchange With Tier-One Security

Next is Coinbase Advanced (formally Coinbase Pro). This is Coinbase’s sister platform, accessible through the same account. Coinbase Advanced comes with considerably more features than its primary exchange. This includes advanced charting screens with TradingView integration. Charts can be customized too.

You’ll also find in-depth order books and several order types to choose from, including stop-losses and take-profits. Coinbase Advanced is also more cost-effective than Coinbase. Trading commissions start from 0.6% per slide. Hitting 30-day trading minimums will reduce the commission.

We also like that Coinbase Advanced supports spot trading and derivative markets. The latter includes perpetual futures with 10x leverage. As a US-based exchange with a NASDAQ listing, Coinbase Advanced is a great option for Americans. It’s also a solid option for safety. Coinbase deploys institutional-grade security tools, including 2FA, device whitelisting, and cold storage.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| Coinbase Advanced | 200+ | 0% to 0.6% | Yes, up to 10x leverage via perpetual futures | Yes |

Pros

- One of the safest crypto day trading platforms

- US clients can trade crypto with margin

- More than 300 spot and derivative markets to trade

- Regulated and listed on the NASDAQ exchange

- ACH deposits are fee-free

Cons

- Trading commissions are higher than most other exchanges

- Debit/credit card payments cost 3.99%

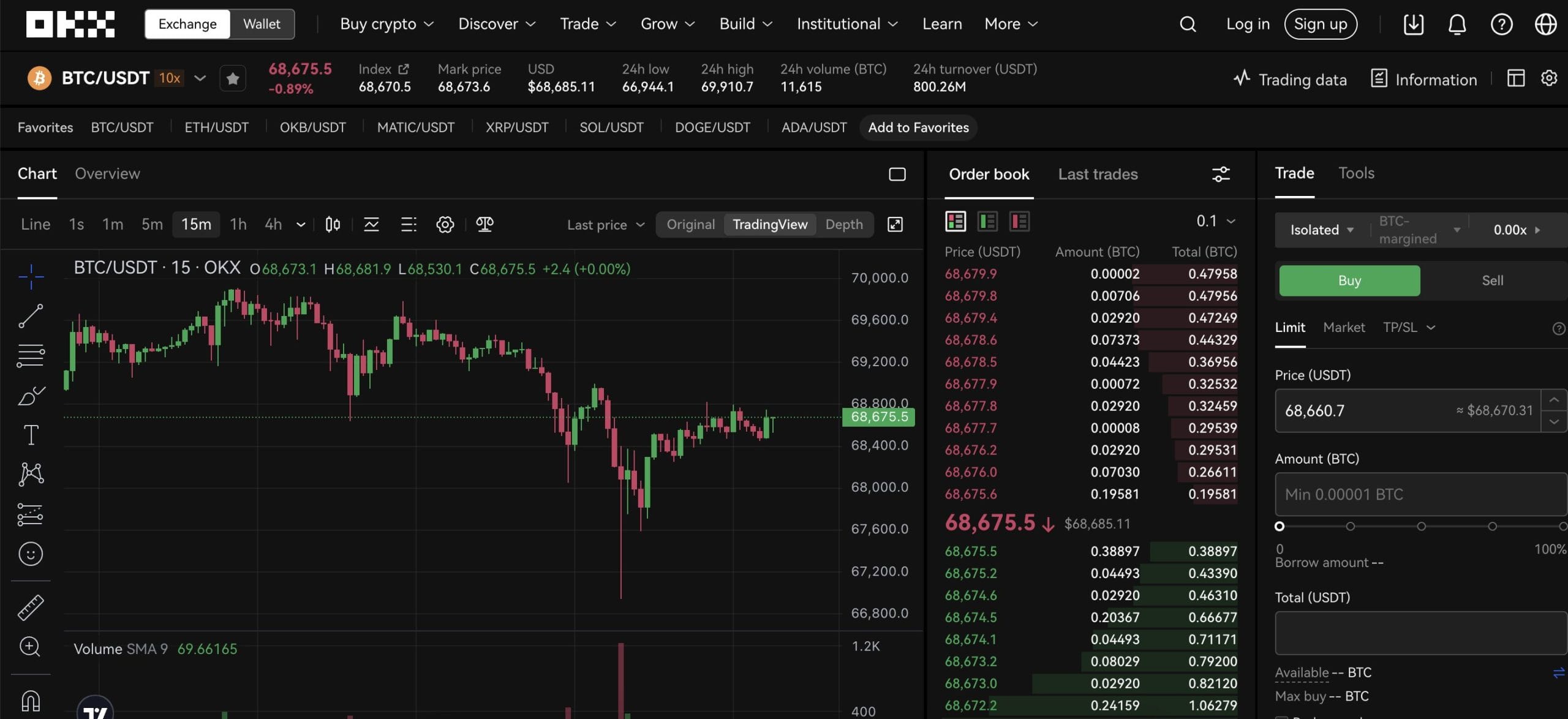

3. OKX — Day Trade Over 500 Crypto Pairs at 0.1% Commission

We found that OKX is one of the best crypto exchanges for day trading with low fees. It offers a maker-taker structure, and fees are lowered when trading volumes increase. In simple terms, beginners pay 0.1% per slide, or $1 for every $1,000 traded. The lowest commission available is 0.015% per slide. Commissions can also be reduced when holding OKB tokens.

OKB is OKX’s native cryptocurrency. It takes seconds to join OKX. Deposits can be made with Visa, MasterCard, and local banking methods. OKX also supports peer-to-peer payments. Day traders have many options when speculating on crypto. OKX supports spot trading markets, not to mention perpetual and delivery futures.

Margin accounts and options are also available. OKX also supports copy trading and automated bots. Almost $7 billion was traded on OKX in the past 24 hours, ensuring that day traders have access to premium liquidity levels. We also like that OKX offers one of the best crypto wallets. This is a decentralized wallet available on desktops, mobiles, and browsers.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| OKX | 320+ | 0.08% to 0.1% | Yes, up to 100x leverage via perpetual futures | No |

Pros

- Trade over 500 crypto markets at 0.1% commission

- Supports spot trading, futures, options, and margin accounts

- Offers copy trading tools and automated bots

- Premium liquidity levels are available 24/7

- Easily deposit funds with fiat money

Cons

- Beginners might find the trading platform intimidating

- Debit/credit card fees are built into the exchange rate

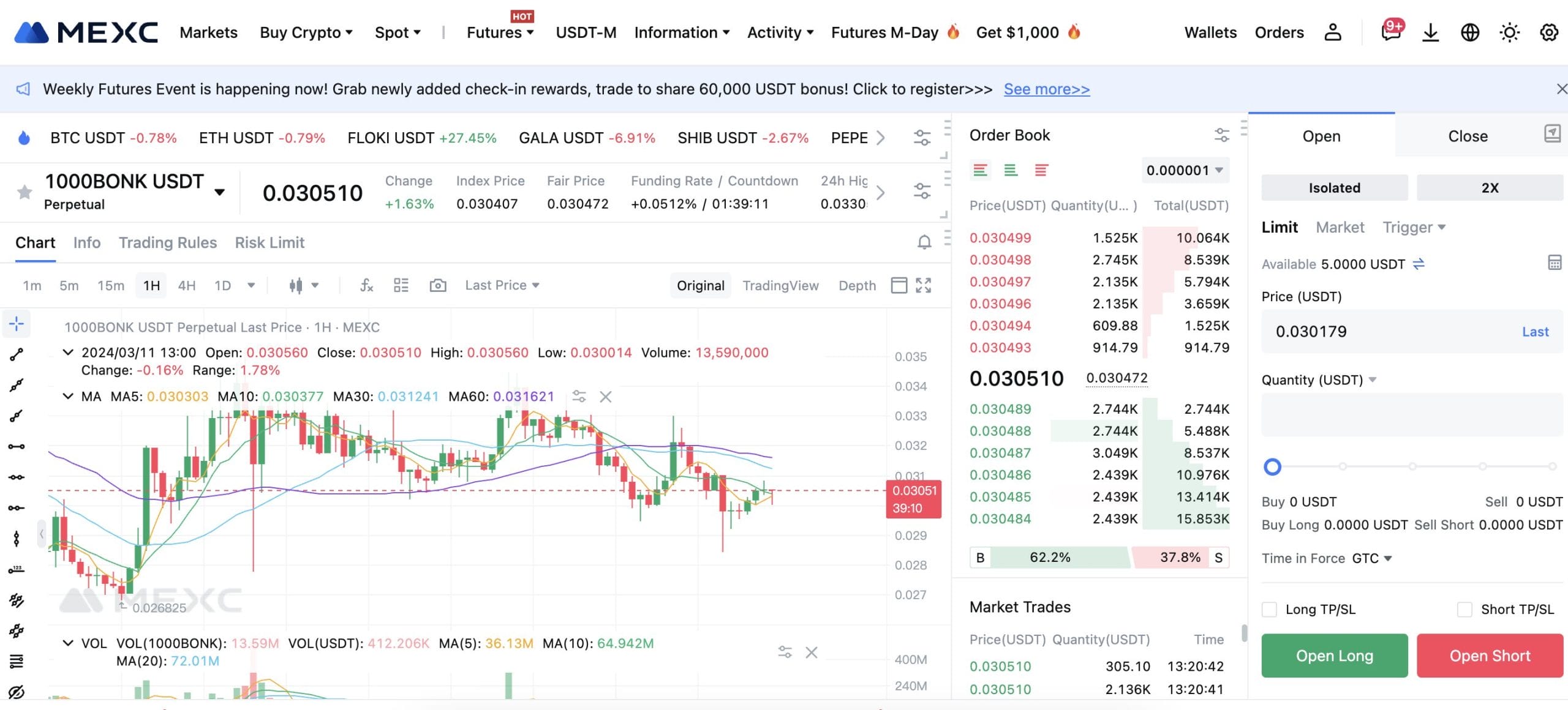

4. MEXC — Great Day Trading Platform for High Leverage

As one of the best crypto trading leverage platforms, day traders will also like MEXC. This tier-one exchange offers leverage of up to 200x. This means a $1,000 account balance offers $200,000 in trading capital. MEXC offers leverage via perpetual futures. This means you can go long or short on your chosen markets.

More than 1,700 coins are listed on MEXC, ranging from Bitcoin, Bonk, Shiba Inu, and Uniswap to Ethereum, Cardano, Solana, and Arbitrum. Trading perpetual futures will cost you just 0.01% per slide. MEXC removes the commission completely when trading the spot markets. This makes MEXC a great option for scalpers, as market spreads are also competitive.

MEXC is considered a safe day trading platform. It offers two-factor authentication (2FA), cold storage, whitelisting, withdrawal blocks, and SMS verification. MEXC also has verified proof of reserves and high liquidity.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| MEXC | 1,700+ | 0% | Yes, up to 200x leverage via perpetual futures | No |

Pros

- Best crypto day trading platform for high-leverage

- Ge up to 200x leverage when trading perpetual futures

- No trading commissions when spot trading

- More than 1,700 coins are supported

- Robust security controls and verified proof of reserves

Cons

- Does not allow US clients

- Some listed coins appear to be dead projects

5. eToro — Best for Day Trading Beginners

eToro is the best crypto exchange for day trading beginners. It’s an established broker that was launched in 2007. It has approval from multiple regulatory bodies in the US, Europe, Australia, and more. Safety is assured with eToro keeping client funds in segregated accounts. eToro offers a wide range of crypto day trading markets.

More than 80 coins can be traded against USD, including Bitcoin, Uniswap, Decentraland, BNB, XRP, Cardano, and Solana. Some coins can be traded against other currencies, including EUR and JPY. You can also trade crypto-cross pairs like ETH/BTC. The minimum trade size is just $10. Eligible clients can also trade crypto via contracts-for-differences (CFDs).

Not only do eToro CFDs allow 2x leverage, but also short-selling tools. eToro offers plenty of analysis features, including market news, sentiment bars, real-time pricing, technical indicators, and drawing tools. eToro also supports crypto copy trading, so you can mimic the positions of an experienced day trader. eToro charges a 1% trading commission on crypto, which is expensive.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| eToro | 80+ | 1%+spread | Yes, up to 2x leverage via CFDs | Yes |

Pros

- Best crypto exchange for day trading beginners

- Trade over 80 crypto markets from just $10

- User-friendly dashboard is ideal for newcomers

- Regulated by multiple tier-one bodies

- Accepts e-wallets, debit/credit cards, and banking methods

Cons

- Non-USD deposits are charged 1.5%

- Crypto trading commission is 1%

6. Bybit — Popular Exchange for Day Trading Futures and Options

The best crypto exchange for day trading derivatives is Bybit. This platform offers a huge selection of leveraged markets, including perpetual and delivery futures. These come with maximum leverage limits of 125x. As such, you can amplify a $100 account balance to $12,500. Bybit also supports leveraged options with competitive strike prices and premiums.

Bybit is also suitable for trading spot markets. All trading products come with advanced charts and analysis tools. Not to mention in-depth order books. We also like that Bybit supports hundreds of cryptocurrencies. These range from micro-cap crypto to large-caps and everything in between. While Bybit is ideal for depositing crypto, it also accepts fiat money.

First-time traders can instantly buy cryptocurrencies with a debit/credit card. More than 65 fiat currencies are accepted. Deposits can also be made on a peer-to-peer basis. Bybit is also renowned for offering great customer support. Live chat is available 24/7 and waiting times are usually swift.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| Bybit | 1,100+ | 0.1% | Yes, up to 125x leverage via perpetual futures | No |

Pros

- Best crypto day trading platform for derivatives

- More than 1,100 cryptocurrencies are supported

- Get 125x leverage on BTC/USDT perpetual

- Never pay more than 0.1% per slide to spot trade

- Top-rated customer support team

Cons

- Sign-up bonuses come with unfavorable terms

- US clients are prohibited from joining

7. KuCoin — Top-Rated Platform for New Cryptocurrency Listings

We found that KuCoin is one of the best options for day trading new cryptocurrencies. The KuCoin Spotlight is a launchpad for innovative projects. After raising funds, these cryptocurrencies trade on the main KuCoin exchange. What’s more, KuCoin frequently lists new cryptocurrencies from other launchpads.

It also runs day trading competitions on newly listed coins. This increases exposure for new projects and helps KuCoin increase trading volumes. KuCoin is also a great option for trading established cryptocurrencies like Bitcoin and Ethereum. More than $2.5 billion in trading volume was recorded in the past 24 hours.

When it comes to day trading fees, KuCoin has a standard commission of 0.1% per slide. This can be reduced when paying fees in KCS, KuCoin’s native token. Hitting 30-day trading milestones also reduces the commission rate. KuCoin also offers perpetual and inverse futures with leverage of up to 100x. These can be traded from 0.06% per slide.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| KuCoin | 700+ | 0.1% | Yes, up to 100x leverage via perpetual futures | No |

Pros

- Great option for day trading up-and-coming coins

- KuCoin Spotlight gives you access to new projects

- Maximum spot trading commission of 0.1%

- Supports over 700 cryptocurrencies

- Get leverage of up to 100x on perpetual futures

Cons

- Not suitable for novice traders

- KYC is now mandatory for all users

8. Kraken — User-Friendly Exchange With a $10 Minimum Deposit

A great option for beginners is Kraken. It offers a safe and user-friendly trading dashboard that supports over 200 cryptocurrencies. This includes some of the best altcoins, such as Kava, Algorand, Polkadot, Solana, and TRON. The minimum first-time deposit on Kraken is $10. Accepted payment types include ACH, SEPA, and debit/credit cards.

While Kraken is ideal for novice day traders, it’s also suitable for professionals. Kraken Pro is an advanced charting dashboard that comes packed with features. This includes indicators like MACD and Moving Averages. Kraken Pro also supports crypto futures with 50x leverage. Alternatively, you can also open a margin account with 5x leverage.

Kraken charges 0% to 0.4% per slide when spot trading cryptocurrencies. This is reduced incrementally as you meet monthly trading milestones. Futures trading fees are even more competitive; you’ll never pay more than 0.02% per slide. Kraken is regulated in multiple markets and offers robust security tools. It was founded in 2011, making it one of the oldest exchanges.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| Kraken | 200+ | 0% to 0.4% | Yes, up to 50x leverage via perpetual futures | Yes, but some states are prohibited |

Pros

- Buy and sell more than 200 cryptocurrencies

- User-friendly investment dashboard

- Offers a professional platform for seasoned day traders

- Access leverage via margin accounts and futures

- One of the oldest crypto exchanges in the industry

Cons

- Some US states are banned

9. PrimeXBT — Best Option for Day Trading Multiple Financial Markets

Next is PrimeXBT, which is one of the best options for diversification. In the digital asset space, it lists some of the best cryptocurrencies to trade. This includes Bitcoin, Litecoin, BNB, Stellar, Dogecoin, Chainlink, and Solana.

Cryptocurrencies can be traded via perpetual futures. This means traders can go long or short. Moreover, PrimeXBT offers leverage of up to 200x. In addition to cryptocurrencies, PrimeXBT also supports major and minor forex pairs.

Other markets include commodities and indices. We also like that PrimeXBT offers competitive trading fees. Crypto trading commissions are 0.05% (spot) and 0.02% (futures) per slide. Forex, commodities, and indices can be traded on a spread-only basis. Do note that due to licensing restrictions, PrimeXBT isn’t available in the US.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| PrimeXBT | 30+ | 0.05% | Yes, up to 200x leverage via perpetual futures | No |

Pros

- Supports crypto, forex, indices, and commodities

- Offers crypto leverage of up to 200x

- Crypto spot trading commissions of just 0.05%

- More than 170,000 trades are placed daily

Cons

- Not available to clients in the US

- Doesn’t offer crypto options

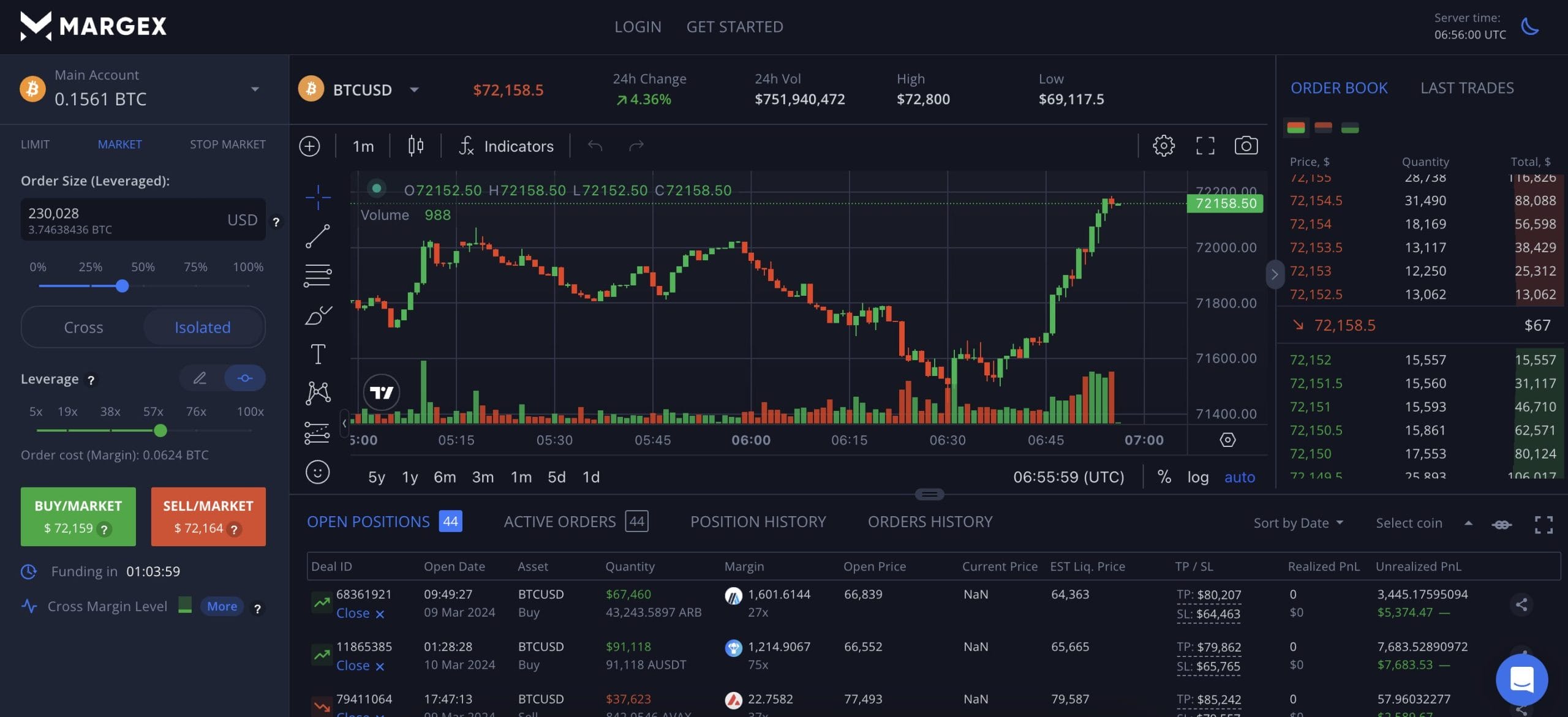

10. Margex — Privacy-Focused Platform With 100x Leverage

Crypto day traders who want to avoid the KYC process might consider Margex. This privacy-focused trading platform doesn’t collect personal information. This means you can day trade the crypto markets anonymously. Opening an account simply requires an email address and a password.

First-time clients receive a bonus of up to $100, which can be used against trading commissions. Fees are competitive at Margex, with trades costing 0.019% to 0.2%. Do note that Margex doesn’t offer spot trading markets right now. Instead, it specializes in perpetual futures, standing out among no-KYC crypto exchanges.

Leverage of up to 100x is available, and both long and short orders are supported. Some of the futures markets available on Margex include Bitcoin, Dogecoin, Arbitrum, SushiSwap, Shiba Inu, Ethereum, and XRP. Margex offers a day trading app for iOS and Android. Alternatively, you can trade on a desktop device via the Margex website.

| Day Trading Platform | Crypto Markets | Spot Trading Commission | Margin Facilities? | US Clients? |

| Margex | 35+ | 0.019% to 0.2% | Yes, up to 100x leverage via perpetual futures | No |

Pros

- Offers anonymous day trading accounts

- Get started with an email address and password only

- Trade 35+ crypto markets with high leverage limits

- Go long or short on all supported pairs

- Great trading app for iOS and Android

Cons

- Unregulated status

What Is Crypto Day Trading?

Crypto day trading is a short-term investment strategy. Similar to other day trading markets, you’ll be buying and selling crypto assets throughout the day. This means that trading positions only remain open for several hours. In some cases, minutes. With this in mind, crypto day traders make much smaller profit margins than long-term investors.

That said, multiple positions are often placed each day. Although day trading can be profitable, you’ll need to have a grasp of technical analysis. This means analyzing charts, historical trends, real-time prices, volume, volatility, and technical indicators to find the best crypto to day trade. Without these tools, you won’t be able to predict the crypto markets in the short term.

There are several crypto day trading startegies to follow in 2024. For example, some traders will buy a new coin, hope that it increases, and then sell it a few hours later. Others will short-sell a coin if they believe the markets are about to decline. It’s also possible to day trade crypto with futures, options, and other derivative products.

How We Ranked The Best Crypto Exchanges for Day Trading

To rate the best crypto exchanges for day trading, we assessed eight key factors, scoring them on a scale of 1-10. We then weighed the categories to calculate an overall score for each crypto day trading exchange. Finally, we tallied the final scores to rank them.

Lowest Trading Fees (25%)

While low fees are important for all investment strategies, they’re imperative when day trading crypto. After all, day traders target much smaller margins, especially when positions remain open for several minutes. This means that unfavorable fees can make day trading unviable.

On average, we found that exchanges charge 0.1% per slide. MEXC takes things to the next level, as spot trading commissions have been removed. In addition, we explored the average market spread for each exchange. This is the difference between the buy and sell price. Tight spreads are crucial to keep overall trading fees to a minimum.

What’s the Spread in Crypto Day Trading?

The ‘spread’ is found in all trading markets, from crypto and stocks to indices and forex. It’s the difference between the buy and sell prices in a specific market.

- For example, let’s say that the ‘true’ market price of XRP is $0.60.

- On your chosen exchange, the ‘buy’ price of XRP is $0.61

- The ‘sell’ price is $0.59

- So, regardless of whether you go long or short, you’re paying the exchange a spread of $0.01 for every 1 XRP traded

Fastest Order Execution (25%)

Another important metric for day traders is fast execution times. This is especially the case in the crypto trading space, where prices are extremely volatile. If execution speeds are slow, slippage can occur. Slippage is when traders get a different price to what they expected when placing an order.

- For example, suppose you’re day trading Ethereum.

- You place a buy order when Ethereum is priced at $4,000.

- However, your order is executed at $4,100.

- This means you’ve suffered slippage of 2.5%.

Most crypto day trading sites display their average order execution speed; this should be in the milliseconds. However, what exchanges publish isn’t always the reality. Therefore, we tested average speeds ourselves.

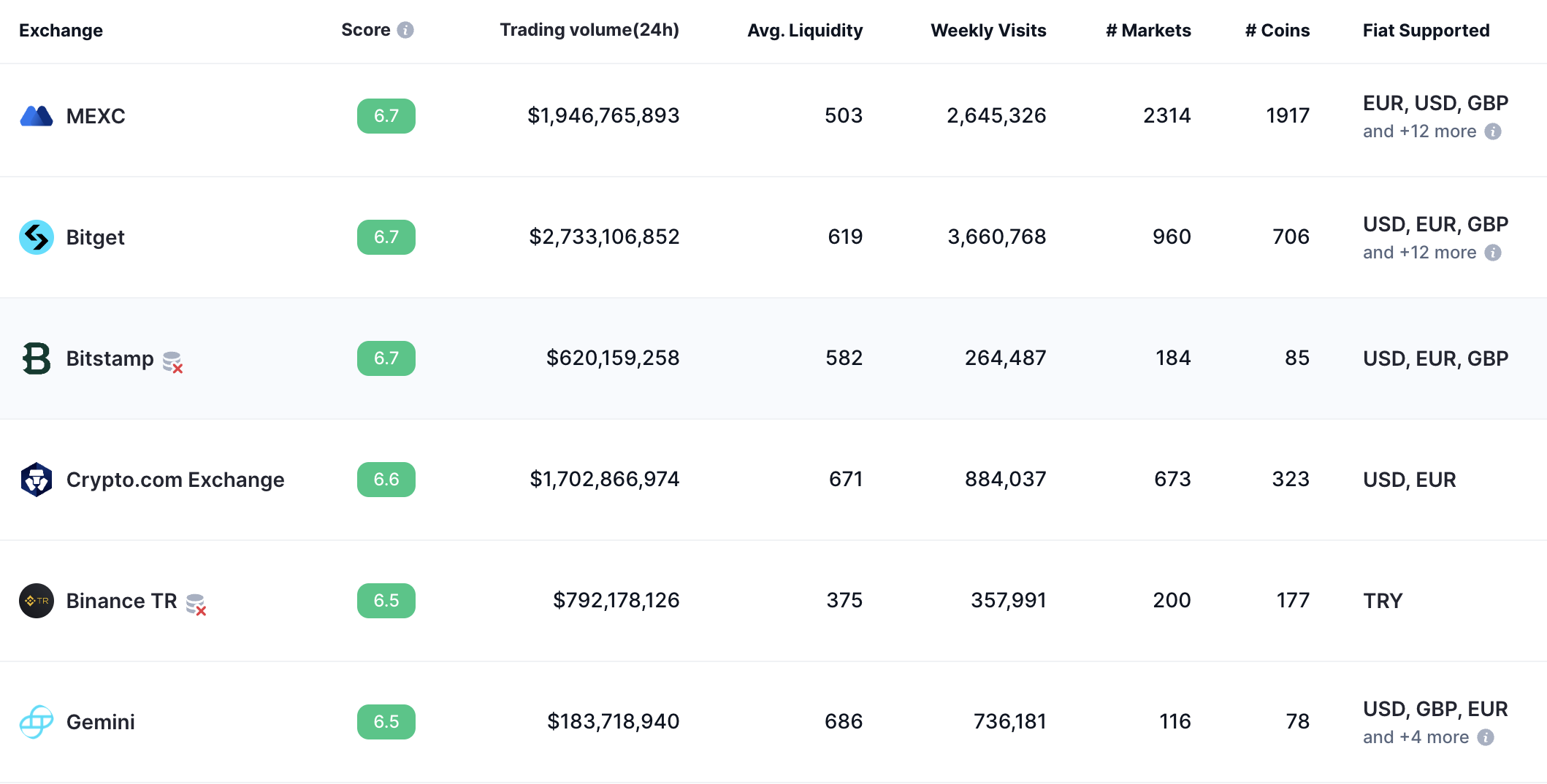

Highest Trading Volume and Liquidity (25%)

High trading volumes are another non-negotiable metric when day trading crypto. Insufficient trading volume results in low liquidity levels.

In turn, this means unfavorable market conditions and difficulty in buying ir selling a crypto pair at a suitable price. Low liquidity also means an inadequate order book. This can result in significant slippage.

Fortunately, all of the platforms listed on this page offer huge trading volumes. For example, MEXC processed almost $2 billion worth of orders in the prior day. This includes more than $570 million in BTC/USDT positions.

Most Trading Pairs (15%)

Seasoned day traders like to have access to a wide range of markets. This ensures that there are sufficient trading opportunities throughout the day. Therefore, we prioritized platforms that support many crypto pairs.

At a minimum, this should include large caps like Bitcoin, Ethereum, and XRP. We also like to see up-and-coming cryptocurrencies that are new to the market. These offer day traders higher profit potential.

Widest Global Availability (10%)

We also prioritized crypto day trading platforms that operate globally. This ensures traders from most countries have access to a platform.

For example, many crypto platforms do not allow US traders. This includes MEXC, OKX, PrimeXBT, and Bybit. US traders are welcomed by eToro, Coinbase, and Kraken.

How Is Crypto Day Trading Taxed?

In most countries, any profits you make from crypto day trading will be subject to capital gains. For example:

- You buy Bitcoin at $30,000

- You sell Bitcoin at $30,500 a few hours later, resulting in a 1.66% gain

- You risked $1,000 on this trade

- Your capital gains are $16.66

Due to the sheer number of positions entered by day traders, it’s important to keep adequate records. Everything will need to be tallied up at the end of the year. This will determine whether or not any capital gains tax is due.

Moreover, some countries have different tax rates depending on how long the crypto position was held. For instance, investments held for under 12 months in the US are subject to short-term capital gains. All day trading positions will fit within this category.

Conclusion

Crypto day trading can be lucrative, but make sure you’re well-versed in risk management and technical analysis. If you’re a complete beginner, consider getting started with eToro.

Used by over 30 million traders, eToro supports more than 100 crypto trading markets. eToro also allows you to ‘copy’ seasoned day traders, meaning you won’t need any prior experience.

FAQs

What crypto platform is best for day trading?

The best crypto day trading exchange is Binance. With low fees, high liquidity, extensive cryptocurrency listings, leveraged trading, integrated charting tools, and broad accessibility, it caters to all trader needs.

Can you day trade on Coinbase?

Yes, day trading is possible on Coinbase through its trading platform Coinbase Advanced, offering features like spot trading, limit orders, and market orders.

What is the best crypto exchange for day trading in the US?

Binance.US is the best crypto exchange for day trading in the US. It offers a wide range of cryptocurrencies, low fees, and advanced trading features like leveraged trading and integrated charting tools, catering to active traders’ needs.

What is the best app to day trade crypto?

Binance is the best app to day trade crypto due to its extensive range of trading pairs, low fees, high liquidity, and advanced trading features like margin trading and futures contracts, providing traders with ample opportunities and tools for successful day trading.

Is crypto day trading profitable?

Only a small percentage of crypto day traders make money. To give yourself the best chance possible, learn technical analysis, risk management, and best practices for volatile markets.

Does Binance offer crypto day trading software?

Yes, Binance offers desktop software for Windows, Mac, and Linux, providing traders with a seamless user experience when day trading crypto.

References

- CASS 7.13 Segregation of client money (FCA)

- New Binance chief refuses to disclose global headquarters’ location (Financial Times)

- Cryptocurrency futures and options (CME Group)

- Corporate – Income determination (PwC)

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman