List of the Top Crypto Leverage Trading Platforms

Listed below are our picks for the 10 best crypto leverage trading platforms.

- eToro – Trade top crypto assets with up to 30x leverage

- MEXC – Up to 200x trades with 100+ leveraged pairs

- OKX – Trade spot margin, futures, or perpetual futures with low fees

- Kucoin – Up to 125x leverage trading with spot, futures, and trading bots

- Binance – Deep liquidity for futures, margin spot, and perpetual futures markets

- Kraken – Margin trading for US and worldwide markets

- Coinbase – US margin trading for expiry futures and worldwide perpetual futures

- PrimeXBT – Newbie-friendly futures and crypto CFD trading

- Bybit – Powerful trading platform with 125x trades and 200+ pairs

- Margex – Customer-first platform with 100x trades and 36 trading pairs

Crypto Leverage Trading Platforms Reviewed

Below, we review the top platforms for crypto trading with leverage. Please note that availability varies by region. For example, only two, Coinbase and Kraken, explicitly support leverage trading for US traders. Leverage trades and derivatives can create regulatory concerns for trading platforms in specific jurisdictions.

1. eToro – Top-Rated Platform With Crypto, Stocks, and Commodities

Although eToro isn’t the cheapest place to trade with leverage, the well-known social trading platform offers a newbie-friendly onboarding process and several tools to help new traders learn the ropes.

eToro Copy trading lets you follow the moves of successful traders on the platform, and eToro does not charge a subscription fee for copy trading. Another popular feature is eToro’s demo account. All account types get a generous $100,000 demo account to practice trading without risking real capital. Test your trading strategies before investing real money.

eToro uses Contracts for Difference (CFDs) to leverage crypto trading, with leverage of up to 30x available in most supported markets. CFDs are derivatives that compare the difference between the market price and the contract price to calculate potential profits or losses. Note that CFDs are not available through eToro in the UK or US.

The platform also offers stocks, ETFs, spot crypto trading, commodities, and currency trading, making it a popular way to diversify and gain exposure to multiple markets.

| Types of Crypto Leverage Trading |

Contracts for Difference |

| Maximum Leverage |

30x |

| Fees |

1% on crypto trades, plus spread |

| Number of Trading Pairs |

Varies by market, up 80 |

Pros

- Copy trading to follow other traders’ moves

- $100,000 demo account

- Expansive offering of asset types

Cons

- Higher fees than other platforms

- Low leverage limits

Visit eToro

2. MEXC – Non-KYC Leverage Trading With up to 200x

MEXC is quickly becoming a favorite amongst traders who want advanced trading features and a wide selection of cryptocurrencies. The platform offers more than 2,000 crypto assets for spot trades. Low trading fees help round out the value proposition, but MEXC also offers leverage crypto trading on 100+ assets, including BTC, ETH, and a wide range of altcoins.

MEXC uses perpetual futures (perps) to provide crypto market trading with 5x to 200x leverage. You’ll find plenty of action on popular pairs like BTC/USDT, but the platform also supports leveraged trades for hot meme coins like PEPE, WIF, BONK, and FLOKI. Trade the market long or short and settle the trade in USDT or the underlying crypto.

BTC and ETH both support leverage trades of up to 200x, along with several other crypto assets like PEPE, SOL, and HBAR. Many assets may be limited to 125x.

| Types of Crypto Leverage Trading |

Perpetual futures |

| Maximum Leverage |

200x |

| Fees |

Futures: 0% maker, 0.02% taker |

| Number of Trading Pairs |

100+ leveraged pairs |

Pros

- Withdraw up to 10 BTC per 24 hours without KYC

- Massive selection of cryptocurrencies

- Copy trading and demo trading

Cons

- More complex trading interface

- Third-party account funding

- No support for fiat withdrawals

Visit MEXC

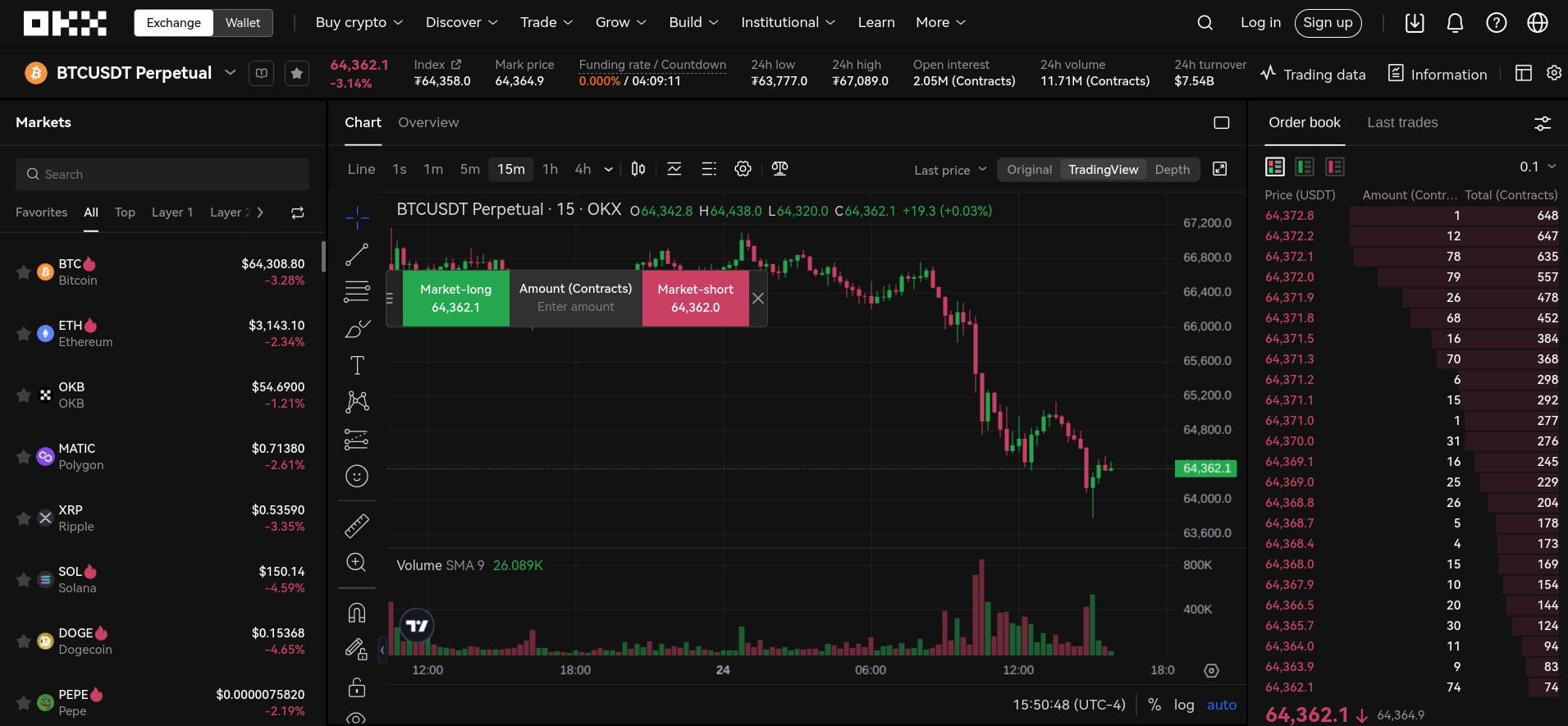

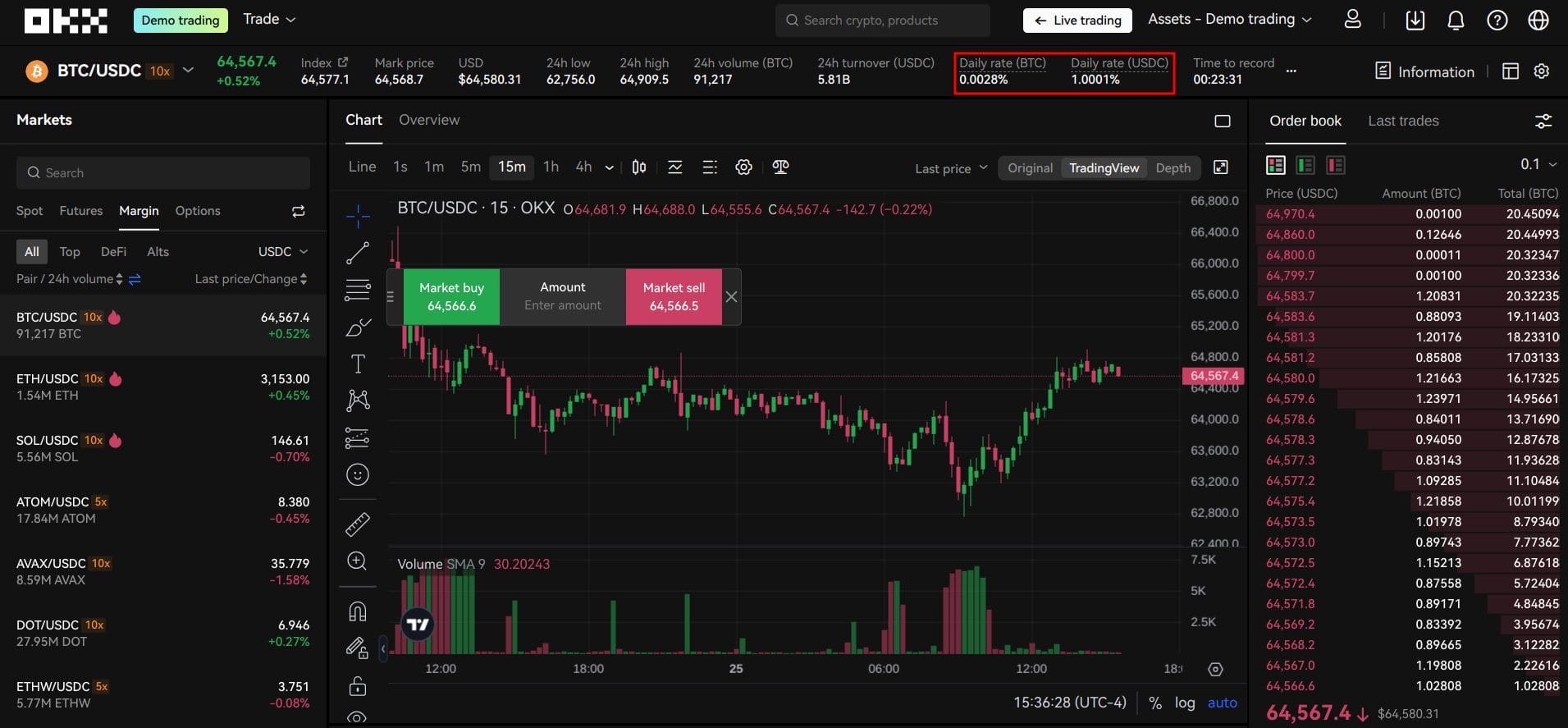

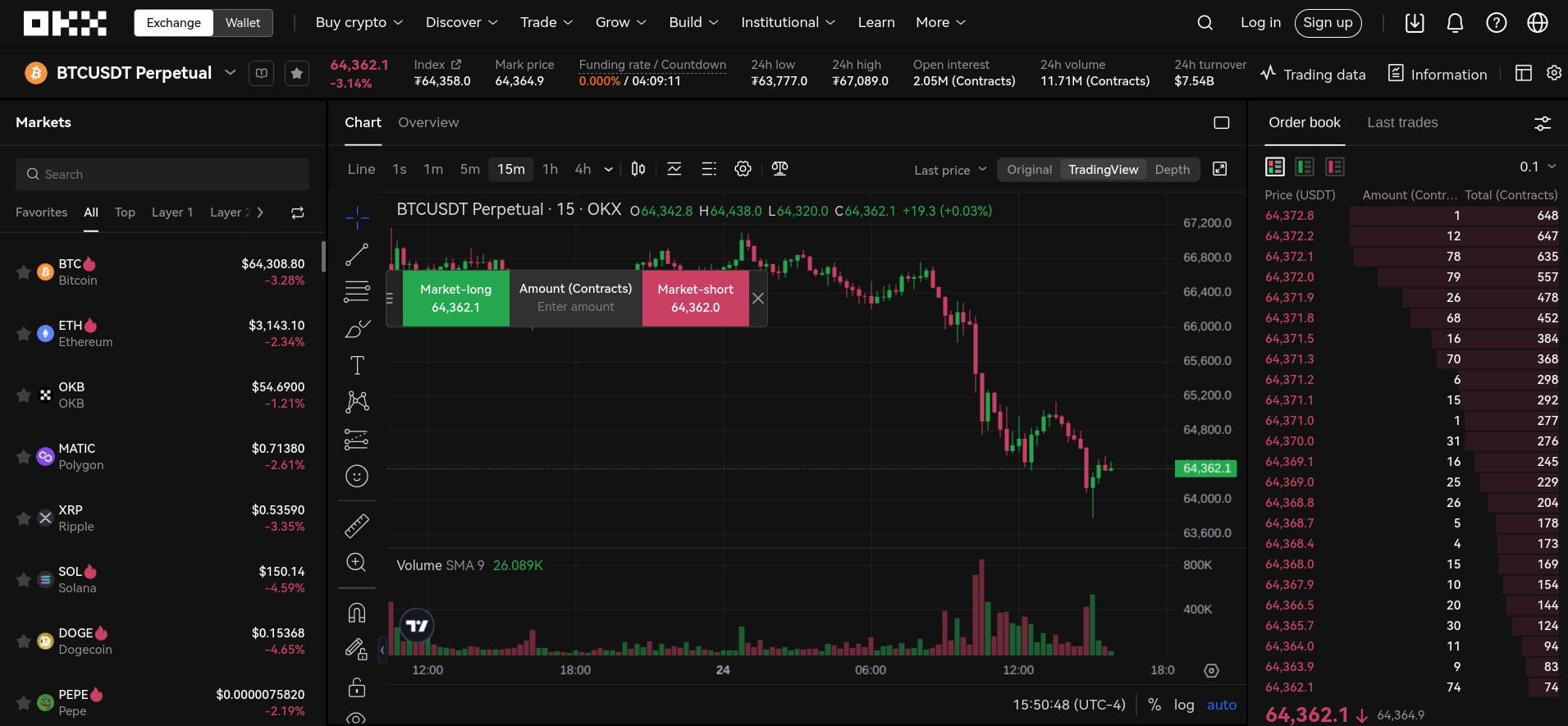

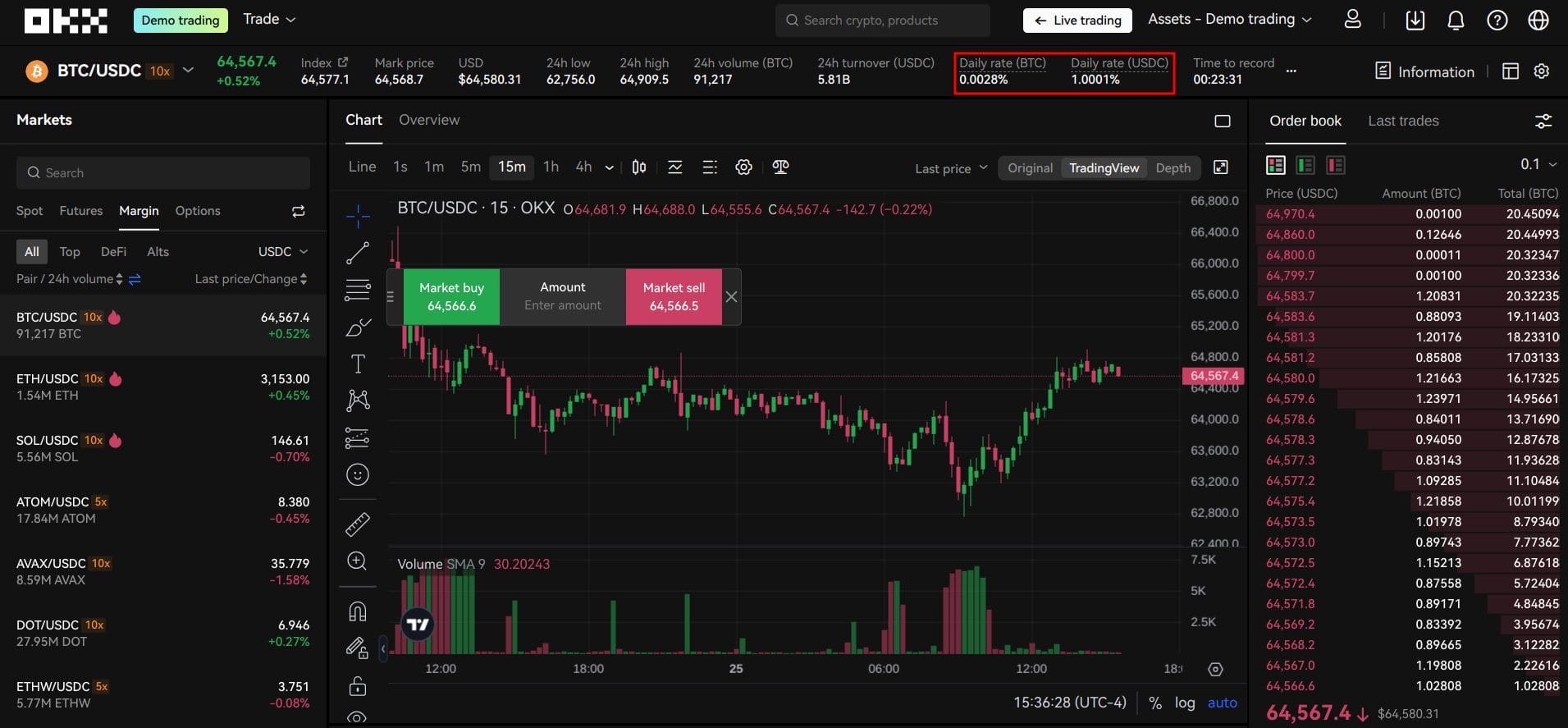

3. OKX – Powerful Leverage Crypto Trading Platform With Demo Account

OKX has become one of the top crypto exchanges by trading volume largely due to its advanced features and a wide selection of leveraged crypto trading options. The platform offers more than 350 cryptocurrencies for spot trades and over 100+ trading pairs for futures trading with leverage. OKX also provides leveraged spot trades for 10 pairs with 10x leverage available. Futures trades offer up to 125x leverage, with the highest levels available for crypto-margined trades.

Additional features include traditional futures trading, options trading, and automated trading bots, providing even more ways to leverage trade crypto. While the platform’s many features can make it more challenging for new traders, OKX provides a well-funded demo account that lets you learn the platform at your own pace without risking real money. OKX also offers copy trading, another popular way to learn crypto trading by following the moves of successful traders on the platform.

| Types of Crypto Leverage Trading |

Spot margin, futures, perpetual futures, trading bots |

| Maximum Leverage |

125x crypto-margined futures |

| Fees |

0.02% maker, 0.05% taker |

| Number of Trading Pairs |

9 crypto margin pairs, 100+ futures pairs |

Pros

- Available in more than 160 countries

- Multiple ways to use leverage

- Demo account for practice trading

Cons

- Challenging funding in some regions

- Complicated interface

Visit OKX

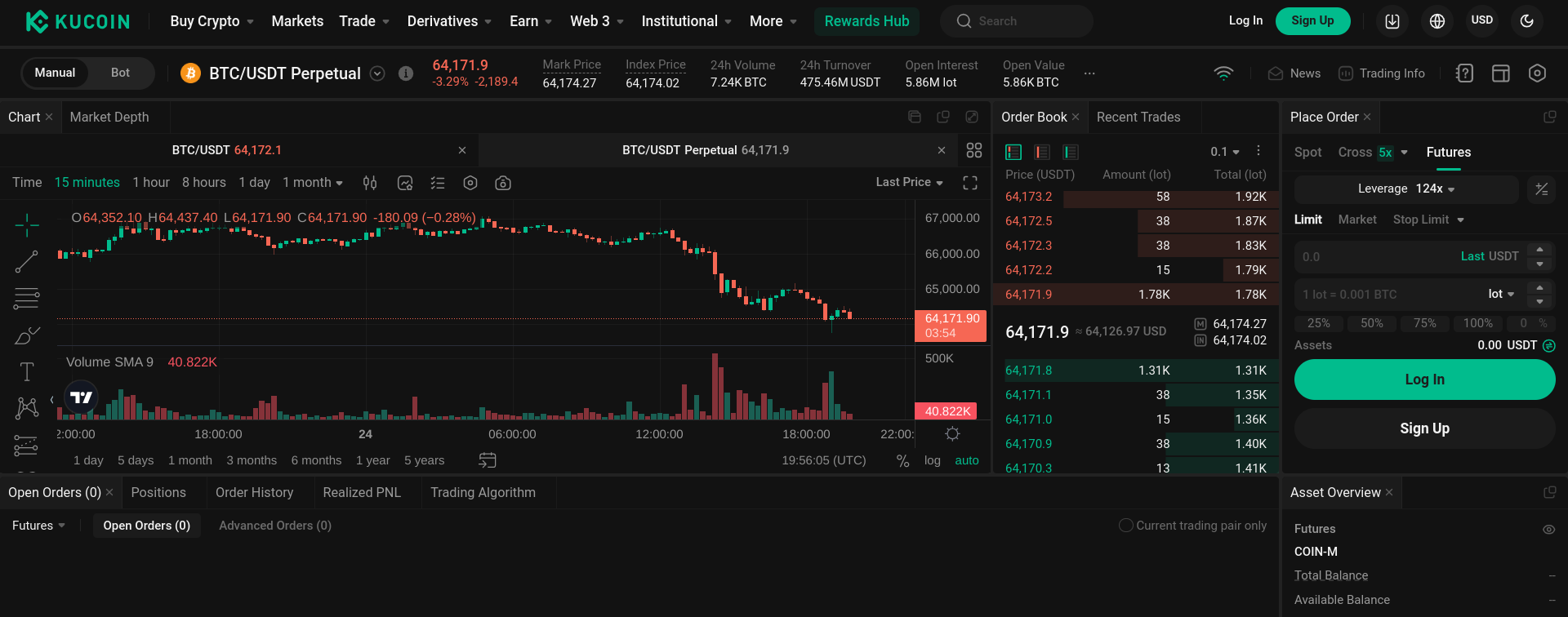

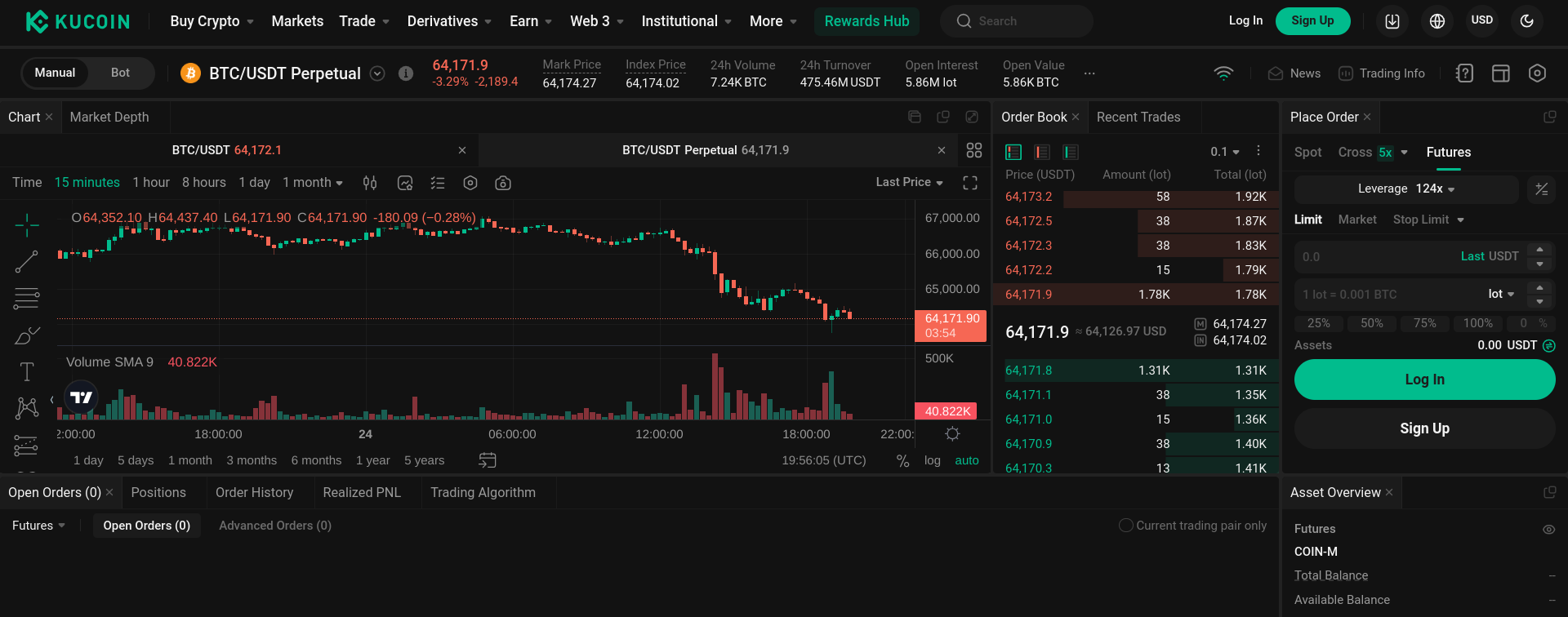

4. Kucoin – Up to 125 on 100+ Trading Pairs and 3x Leveraged Tokens

Kucoin offers more than 800 cryptocurrencies and often has new cryptos before other platforms. This broad selection carries over to Kucoin’s 50+ pairs for margin spot trades, more than found on many other platforms. In addition, Kucoin offers nearly 100 futures pairs with up to 125x leverage for BTC and up to 50x leverage for smaller but popular altcoins like BONK.

The platform also offers leveraged tokens (long and short), an alternative to margin trading that doesn’t risk liquidation. However, the token value can go to zero for losing trades, and the leverage ratio is fixed at 3x. Periodic token rebalancing can also lead to out-of-sync values.

Trading bots add another way to trade with leverage, putting your trades on autopilot according to predefined trading rules.

| Types of Crypto Leverage Trading |

Spot, futures, leveraged tokens, trading bots |

| Maximum Leverage |

125x |

| Fees |

0.020% maker, 0.060% taker (futures) |

| Number of Trading Pairs |

100+ futures contracts |

Pros

- Easy-to-use leveraged tokens

- 50+ spot margin pairs

- 50x leverage for top meme coins and altcoins

Cons

- Complex interface

- No demo account

Visit Kucoin

5. Binance – Deep Liquidity for Margin Spot, Futures, and Perpetual Futures up to 125x

Binance’s position as the largest crypto exchange by trading volume translates to outstanding liquidity in spot trades as well as robust leverage markets. The platform offers 5x margin trading on 100+ USDT trading pairs and 10x leverage on several BTC-based trading pairs. Derivatives include quarterly and perpetual contracts that provide up to 50x leverage, as well as options trading. BTC futures allow up to 125x leverage, although max leverage varies by margin type, cross or isolated.

Binance caps the funding rate at 2%, a helpful feature to prevent runaway costs if markets flip. You’ll also find a wide range of advanced trading tools and bots that can use leverage to collect profits on autopilot 24/7.

Spot and margin fees come in at 0.1% for both limit and market orders, with additional discounts on margin trading services and fees available for higher trading volume or when paying fees with BNB. The latter allows traders to reduce trading fees by 25%.

| Types of Crypto Leverage Trading |

Futures, margin spot, perpetual futures |

| Maximum Leverage |

125x |

| Fees |

0.1% maker, 0.1% taker |

| Number of Trading Pairs |

100+ |

Pros

- Industry-leading liquidity

- Low trading fees

- Capped funding rates

Cons

- Challenging for new traders

- No demo account

Visit Binance

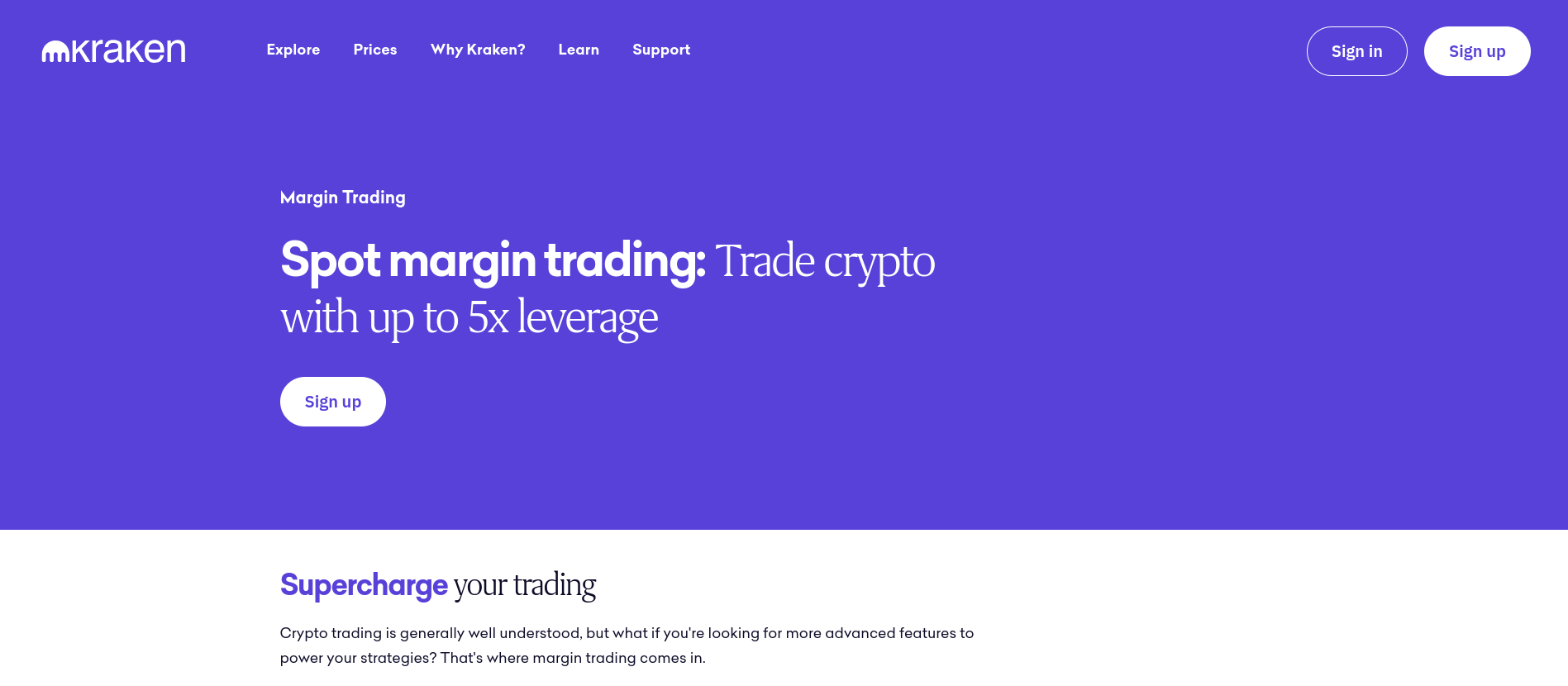

6. Kraken – Transparent Exchange with Margin Trading for US Traders

Kraken offers both futures trading and perpetual futures, although availability varies by market. The platform offers a wide range of dated futures, including monthly, quarterly, and semi-annual. Additionally, Kraken makes perpetual contracts available in non-US markets. However, spot margin trades are available to qualified US traders.

Known for its transparency, Kraken provides a no-surprise fee structure, including detailed disclosure of margin fees (0.02% opening fee for most assets) and competitive fees for both spot and futures trades.

Spot and margin trades pay 0.25% maker and 0.40% taker fees. Futures trading fees, at 0.02% limit fees and 0.05% market order fees, compare well with competitors. Discounts are available for higher monthly trading volumes and easy to reach with higher leverage.

In keeping with its reputation for transparency, Kraken offers proof of reserves, a third-party audited way of proving the exchange has the crypto showing on your account dashboard.

| Types of Crypto Leverage Trading |

Margin spot, futures, perpetual futures |

| Maximum Leverage |

Up to 50x |

| Fees |

0.25% maker, 0.40% taker |

| Number of Trading Pairs |

100 |

Pros

- Proof of reserves

- Margin available to qualified US traders

- 50x futures leverage

Cons

- Higher trading fees for spot trades

- Limited fiat currencies supported

Visit Kraken

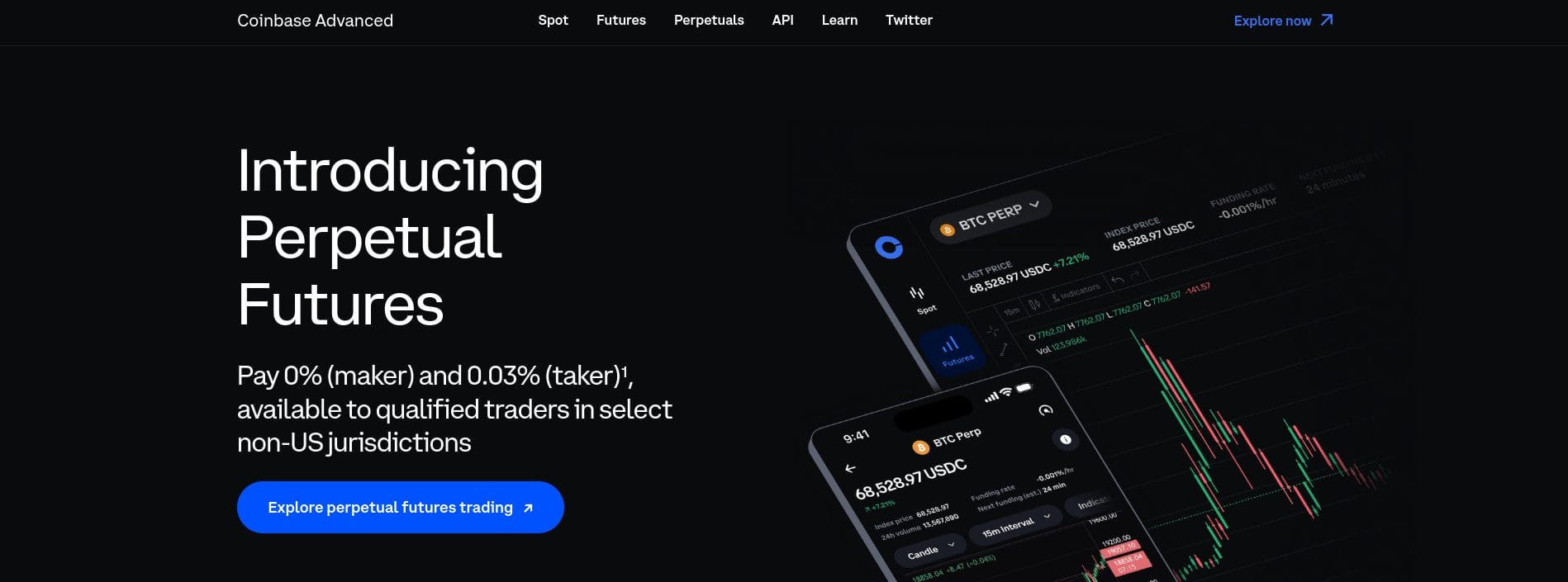

7. Coinbase Safety-Minded US Futures Trading and Worldwide Perpetual Futures

Coinbase, one of the most trusted crypto trading platforms, recently began offering perpetual futures trading with leverage. As with most other crypto leverage-trading platforms, US traders are excluded. However, in other markets, the new offering takes a more conservative approach to crypto leverage trading.

Leverage is capped at 10x, and positions are capped at $90,000. Separate quantity caps apply to perpetual contracts as well. Qualified US traders can access leveraged futures markets and expiry futures contracts for BTC, ETH, LTC, and BCH. Coinbase International offers leveraged trading for 33 assets, including BTC and ETH, as well as other popular assets like SOL, LINK, and XRP. The platform also offers hot meme coins like PEPE and WIF.

Coinbase isn’t known as a low-cost leader, but this new offering bucks the trend. Perpetual futures trading launched with 0% maker fees and 0.03% taker fees.

| Types of Crypto Leverage Trading |

| Expiry futures, perpetual futures |

|

| Maximum Leverage |

10x |

| Fees |

0% maker, 0.03% taker |

| Number of Trading Pairs |

33 |

Pros

- Free limit orders

- Popular altcoins and meme coins

- Safety-conscious leverage limits

Cons

- Limited selection

- Only available to qualified traders

- Separate ID verification

Visit Coinbase

8. PrimeXBT – Up to 200x Leverage on Top Crypto Assets

Contract for Difference (CFD) platforms are becoming more popular and offer a convenient way to trade crypto prices without all the storage considerations that come with trading futures or real crypto assets. PrimeXBT makes CFDs available for more than 40 crypto assets and allows up to 200x leverage for crypto futures markets.

Fees for futures trades are among the lowest we’ve seen in our roundup of the best crypto leverage trading platforms, with 0.01% limit orders and 0.02% market orders. Funding rates are also low, with 0.0001 funding rates per 8-hour interval.

Like eToro, OKX, and a handful of other platforms, PrimeXBT offers copy trading, which lets you follow other trades on the platform — trade for trade. A funded demo account is also available, but users are required to join a contest.

PrimeXBT offers one of the cleanest trading interfaces you’ll find anywhere, allowing you to focus on trades without pop-ups or clutter.

| Types of Crypto Leverage Trading |

CFDs, futures |

| Maximum Leverage |

200x |

| Fees |

0.01% maker, 0.02% taker |

| Number of Trading Pairs |

40+ |

Pros

- Copy trading

- Newbie-friendly platform

- 24.7 customer service

Cons

- No demo account

- CFD crypto only

- Limited futures pairs

Visit PrimeXBT

9. Bybit – 200+ Leverage Trading Pairs, With Spot Margin and 125x Futures

Bybit built its name on leverage trades and crypto options trading and remains one of the best places to trade Bitcoin with leverage as well as 70+ spot margin assets. The platform also offers perpetual futures trading for more than 200 USDT pairs and additional options for USDC pairs, as well as expiry futures for both USDC pairs and inverse (coin collateral) contracts.

While well-designed, the trading app focuses on advanced traders, making it better suited to those with experience in leverage trading. Top features include copy trading and a demo account, the latter of which can help newer traders learn the platform. Bybit also offers trading bots and AI-guided trades.

Max leverage for Bybit is 125x, and the platform’s low fees help boost trading profits. Futures trades costs 0.02% for limit orders and 0.055% for market orders.

| Types of Crypto Leverage Trading |

Futures, perpetual futures, spot margin |

| Maximum Leverage |

125x |

| Fees |

0.02% maker, 0.055% taker (futures) |

| Number of Trading Pairs |

200+ |

Pros

- Copy trading & demo account

- AI trading and bots

- 70+ spot margin pairs

Cons

- Geared toward advanced traders

Visit Bybit

10. Margex – 100x Leverage Trading for Mobile and Desktop Traders

Margex combines a clean user interface with up to 100x leverage on 36 crypto assets. The platform serves more than 150 countries worldwide and offers 24/7 support. Similar to other platforms like eToro, Margex also offers copy trading, letting traders copy the trades of profitable traders on the platform in one click.

Leverage trades center on perpetual futures, with a minimum leverage of 5x and a maximum of 20x to 100x, depending on the traded asset. BTC and ETH both support 100x positions.

Low trading fees round out a well-designed offering that focuses on doing fewer things than other platforms but doing them well. Limit orders for futures are 0.019%, while market orders cost 0.06%. Margex also provides an expansive help center that makes finding information about the platform and trading rules a breeze compared to other platforms.

| Types of Crypto Leverage Trading |

Futures |

| Maximum Leverage |

100x |

| Fees |

0.019% maker, 0.060% taker |

| Number of Trading Pairs |

36 |

Pros

- Choose your settlement collateral

- Well-supported iOS & Android app

- Copy trading

Cons

- Limited cryptocurrency selection

- No spot margin trades

Visit Margex

What is Crypto Leverage Trading?

Crypto leverage trading refers to borrowing against your trading assets to create larger trading positions. A leverage trade lets you control a larger amount of assets with a smaller initial investment amount.

For example, if you have $1,000 in BTC on the platform, the maximum size of your trade without leverage is $1,000. However, when crypto trading with leverage, you can trade larger amounts than you have in your trading account. Alternatively, you can simply use a portion of your trading assets to make leveraged trades, preserving the balance for future trades. You might make a leveraged trade with just $1,000 out of a $50,000 trading balance.

A 2x leverage trade lets you create a $2,000 trade using $1,000 in trading assets. Similarly, 10x leverage lets you make a $10,000 trade using $1,000 of trading assets. Some Bitcoin leverage trading platforms let you trade with much higher leverage of up to 100x or even 200x.

How Does Crypto Leverage Trading Work?

Leverage trading uses your crypto assets as collateral. When you enter a leveraged trade, you choose which assets you’ll use as collateral as well as the amount.

However, the process typically works in reverse, meaning you choose which assets to use and then choose a leverage amount, i.e., 2x, 5x, or another leverage amount. The platform then computes the amount you need in collateral automatically. This collateral used in the trade is called the margin for the trade.

Leverage trading often lets you make trades in either direction, long or short. If your trade goes well and you make a profit, your profit is multiplied by the leverage amount. In a 5x trade, you would make five times the profit compared to a non-leverage trade — if the trade is profitable.

Not all trades make a profit, though, and the margin shrinks as a trade loses money, possibly causing you to lose your margin altogether. Leverage amplifies both gains and losses.

Choosing Leverage Level (2x to 100x+)

Let’s examine some examples of leverage in action and compare them to a non-leveraged trade. We’ll use BTC as an example because it’s well-supported by crypto-leverage trading platforms.

First, we can examine profitable trades using a $1,000 investment. In this example, we’re betting on an increase in the price of BTC to $65,000 based on an entry price of $63,500.

| Leverage |

BTC Entry Price |

BTC Exit |

Profit |

| 1x (no leverage) |

63500 |

65000 |

23.62 USD / 2.36% |

| 2x |

63500 |

65000 |

47.24 USD / 4.72% |

| 5x |

63500 |

65000 |

118.11 USD / 11.81% |

| 10x |

63500 |

65000 |

236.22 USD / 23.62% |

| 50x |

63500 |

65000 |

1181.10 USD / 118.11% |

| 100x |

63500 |

65000 |

2362.20 USD / 236.22% |

With the highest leverage (100x), a $1,000 trade generates a gross profit of $2,362.20. Leverage is a powerful trading tool — if the market favors your trade.

Now, let’s look at potential losses. Remember, leverage also amplifies losses. Let’s say the trade isn’t going your way, and you close it or use a stop-loss order. It’s best to preserve trading capital so the stop-loss is set at just $500 below the entry price.

| Leverage |

BTC Entry Price |

BTC Exit |

(Loss) |

| 1x (no leverage) |

63500 |

63000 |

(7.87 USD / 0.79%) |

| 2x |

63500 |

63000 |

(15.75 USD / 1.57%) |

| 5x |

63500 |

63000 |

(39.37 USD / 3.94%) |

| 10x |

63500 |

63000 |

(78.74 USD / 7.87%) |

| 50x |

63500 |

63000 |

(393.70 USD / 39.37%) |

| 100x |

63500 |

63000 |

(787.40 USD / 78.74%) |

At the highest leverage, the trade loses $787.40 with a $500 dip in the price of BTC. Leaving the trade open and incurring more losses could wipe out the entire $1,000 leveraged long position.

At 100x, a 1% move down in price wipes out your margin $1,000 margin. However, the platform will likely liquidate the position before that. We’ll cover liquidations in just a bit. By contrast, a 5x leverage position requires a 20% loss to lose the position’s margin.

The maximum leverage levels available vary by platform and by trade type. The assets you use as collateral can also play a role in how much leverage you can use. BTC trades often offer the highest maximum leverage limit, with lower leverage levels available for many altcoins.

MEXC offers 200x leverage on BTC, whereas Bybit supports 100:1 leverage for BTC trades. In both cases, these are considered high-risk trades because a sudden market move can trigger a loss. However, you have the option to use any leverage amount up to the maximum.

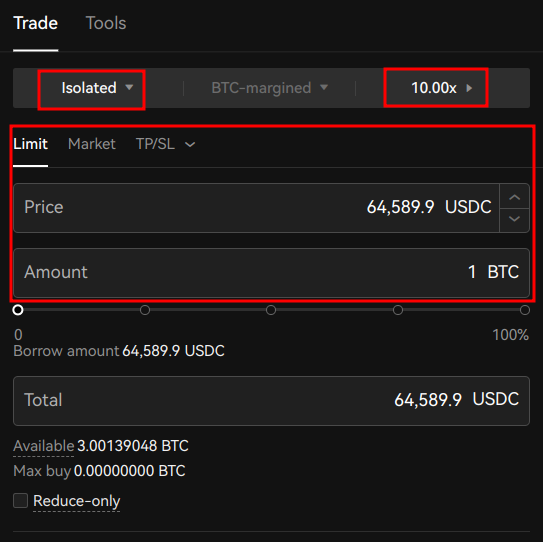

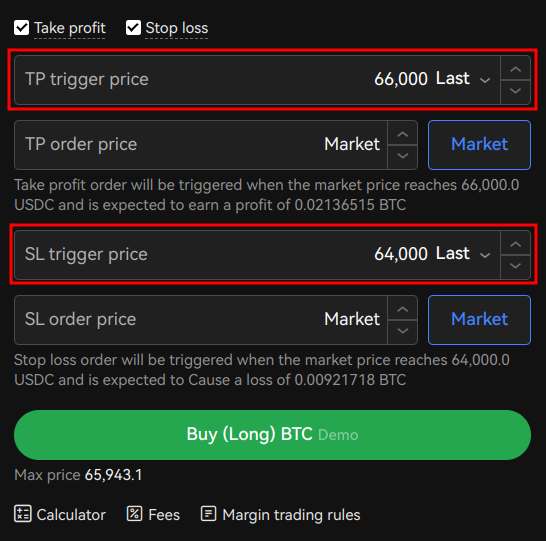

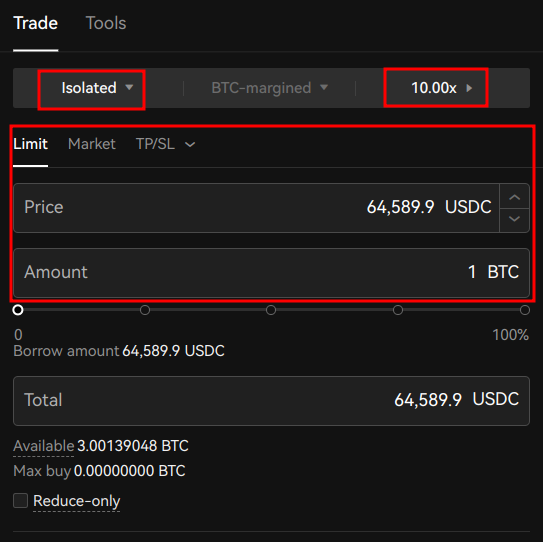

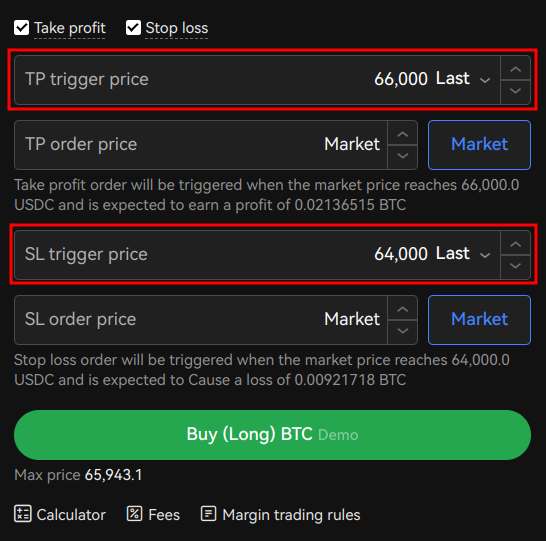

Placing Your Order

Most crypto leverage trading platforms use a similar trading screen for advanced trades. Choose whether to use isolated margin or cross margin. Then, choose your leverage amount and the amount of the trade. You can also choose between fixed-price limit orders or market orders. Limit orders usually have lower fees but may not execute right away (or at all).

You can also set your stop-loss and take-profit triggers at this step on many platforms.

Interest and Fees

Depending on the type of leverage order you use, you’ll pay one of two types of fees in addition to trading fees. If your position is liquidated, you’ll also pay a liquidation fee in many cases.

- Spot market margin trades charge a daily interest rate on the borrowed funds.

- Perpetual futures contracts use a funding rate to help keep the contract price close to the spot market price. When the funding rate is positive, longs pay this funding rate to short sellers. When the funding rate is negative, short sellers pay the funding fee to longs.

- Trading fees vary based on the type of trade. Perpetual futures contracts, for example, typically have extremely low trading fees. However, the fee is charged based on the size of the position, which can add up quickly with high leverage.

- Liquidation fees are also common, and the amount can be difficult to pin down until you’ve been liquidated and do the math. Bybit, for example, charges a 2% liquidation fee on spot margin orders liquidated by the platform. OKX doesn’t specify the amount but uses the liquidation fee to strengthen its insurance fund.

Liquidation

When leverage trading crypto, liquidation is the largest risk. If your trade value falls below a certain threshold, the platform can sell your position to cover the loss. We discuss this in more detail in a later section on risks.

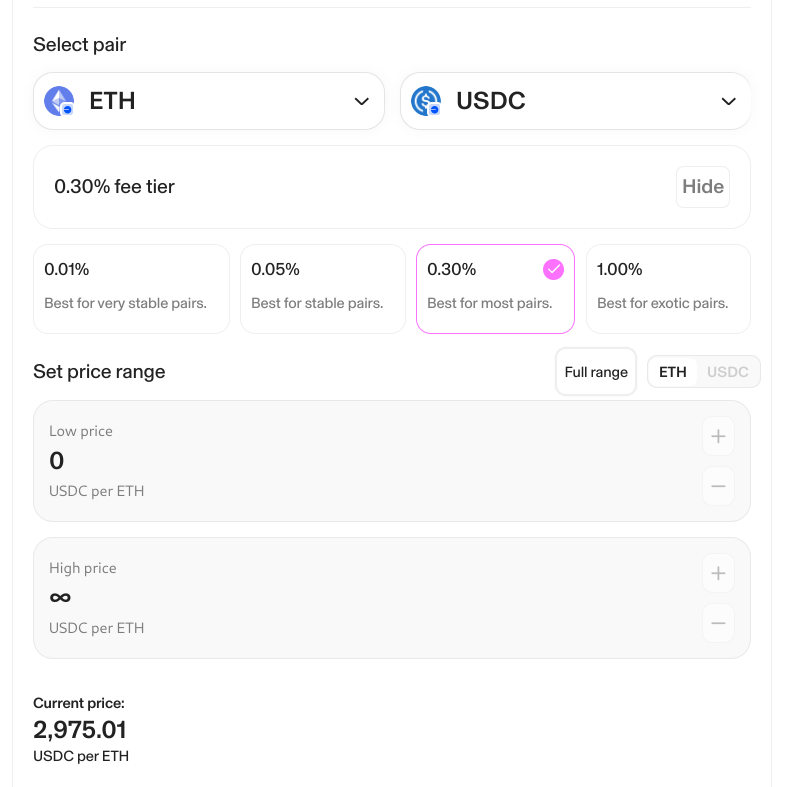

Leverage vs Margin Trading: What’s the Difference?

Margin is used to create leverage. The terms margin trading and leverage are often used interchangeably. However, there is a nuanced difference. The term margin trading is most often used with spot markets, whereas leverage trading often refers to derivatives trading, such as perpetual futures. Leverage trading can also include other types of products, such as leveraged tokens that don’t require collateral.

- Spot trades are trades based on the current price “on the spot,” with immediate delivery of the traded assets when the trade completes.

- Derivatives trades derive their value from a base asset, such as BTC. However, the trade may be settled in another asset. For example, a BTC perpetual futures contract might settle in USDT.

If you’ve ever used a cheater bar to remove a stubborn lug nut, then you understand leverage. It’s a force multiplier, and the further away you are from the fulcrum (1x leverage), the more leverage you have. You can also think of the phrase “margin of error” to understand how margin works in leveraged trades. Basically, the margin in the trade is room for error. That’s how much you can afford to lose in a leveraged trade before the margin collateral you offer is gone.

In reality, you’ll likely be liquidated before the trade uses all your margin. Exchanges and trading platforms set liquidation levels above a certain threshold to avoid uncollectable debts from leverage trades that went south.

Is Crypto Leverage Trading Safe? The Risks

Leverage trading can create massive gains with a relatively small investment. However, leverage works both ways and multiplies losses, making crypto leverage trading riskier than non-leveraged trades. Let’s look at how the risks can play out, as well as ways to mitigate them to protect your trading capital.

1) Magnified Losses

As we showed earlier, leverage multiplies losses as well as gains. In an earlier example, a non-leveraged $1,000 trade for BTC resulted in a $7.87 loss when BTC’s price fell $500 from $63,500. When using 100x leverage, the loss increased to $787. Small downward price moves can quickly create large losses.

2) Margin Call Risk

A leveraged trade begins with an initial margin requirement but also uses a maintenance margin requirement as a backstop. Maintenance margin is the amount of collateral required to keep the position from being liquidated.

A margin call is a request for additional margin to hold the position open. In stock trading, for example, a broker may request an additional deposit if a leveraged position is endangered due to low margin.

However, in many crypto trading situations, margin calls are either not used or can’t be effective due to the speed at which the market moves. In high-leverage positions, maintenance margin levels can be passed by quickly. Instead, it’s possible to see the position liquidated to prevent a loss for the broker or platform.

3) Liquidation Risk

Liquidation refers to when a trading platform sells the margin collateral used to create the leveraged trade. For example, if the leveraged trade used $1,000 of margin collateral and the trade loss nears 100% of that amount, the trading platform will likely liquidate the position to prevent a loss for itself.

Isolated margin limits the risk for a specific trade to a fixed amount rather than using all of your eligible funds on the platform as collateral. MEXC uses the following formula for liquidations in an isolated margin trade:

Position Margin + Unrealized P&L ≤ Maintenance Margin + Liquidation Fees

The formula states that the margin amount plus the position’s profit must be higher than the maintenance margin plus the liquidation fees. If the value falls below that value, the position is liquidated (sold at market value), and the trade is closed.

Well-placed stop-loss orders reduce the risk of liquidation and preserve capital for future trades. However, it’s possible that your stop-loss triggers and closes the position, followed by a change in price direction immediately afterward.

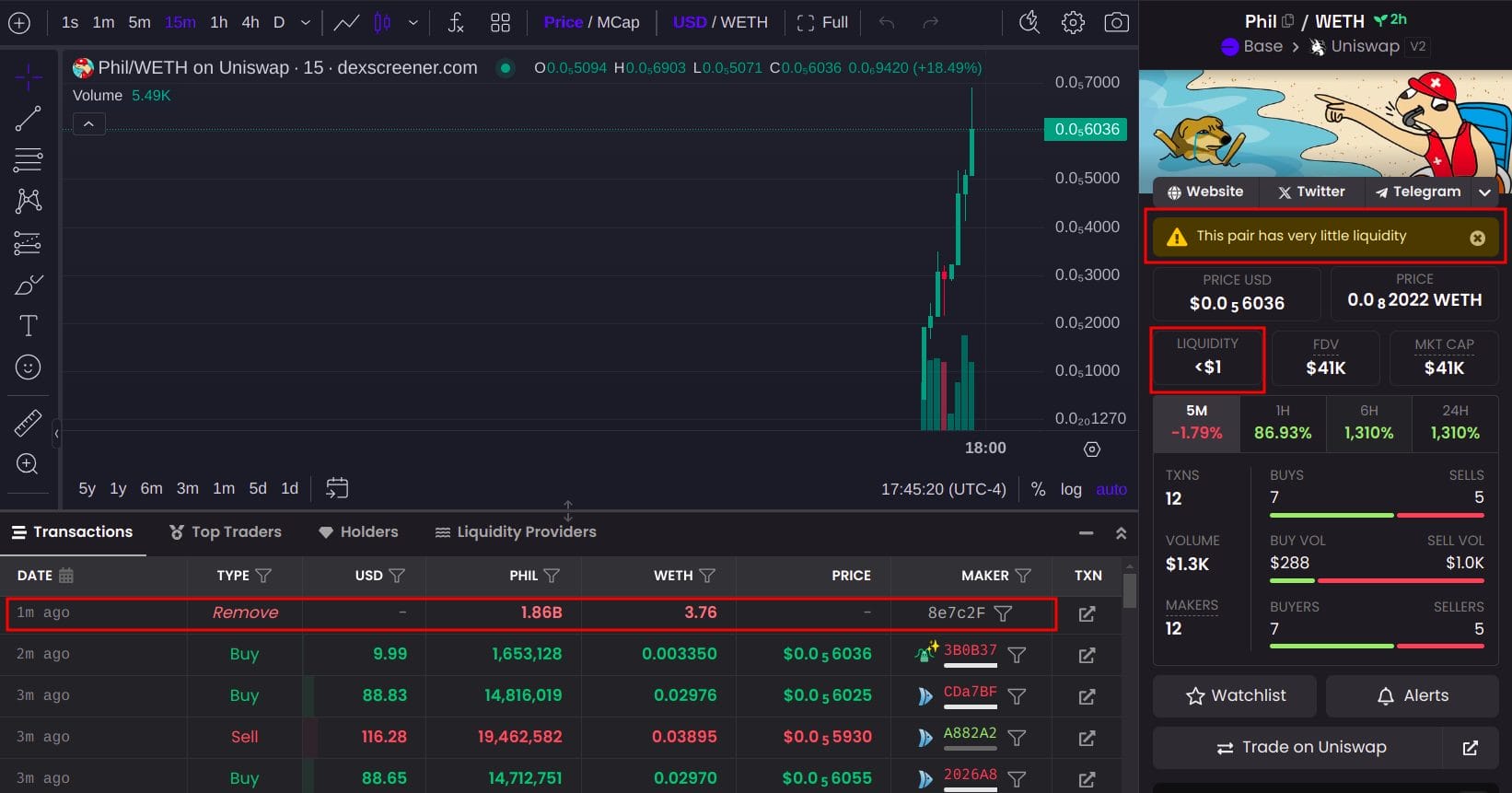

4) Counterparty Risk

Leverage trading platforms often don’t offer the same transparency that’s possible with spot trading platforms. Although both can be non-transparent, leverage platforms could bring a greater risk of insolvency, particularly during rapid market moves in either direction, which can cause losses for the exchange. 2022 brought the failure of several high-profile crypto trading platforms, including FTX, one of the largest exchanges in the world at the time.

In addition to market volatility, all crypto trading platforms bring some risk in the form of potential hacks or other types of failures.

5) Emotional Stress

Trading with leverage can also be more stressful compared to non-leveraged trades. For example, if you make a $1,000 spot trade to buy BTC, the price of BTC may go down. It may even go to zero one day, but you’ll have plenty of time to save some of your trading capital along the way if you need to sell. By contrast, with a leveraged trade, the $1,000 invested in the trade could be gone nearly instantly. For many traders, leverage trading is a much more stressful way to trade.

Most of the risks associated with leverage trading center on the amount of leverage used, with higher levels of leverage creating more risk — and likely more stress. To mitigate the risk of trading capital, consider trading with lower leverage ratios and choose when to use leverage carefully.

Conclusion – The Best Leverage Trading Platform for Crypto

With beginners in mind, as well as traders who want access to a broad range of asset types, eToro offers the best crypto leverage trading platform in the roundup. A conservative leverage limit of 20x on crypto CFDs promotes safer trading. eToro also led the field with social trading innovations like copy trading and also provides a well-funded demo account to help new traders get acquainted with trading before risking real money. Experienced traders will appreciate the ability to test strategies risk-free and the freedom to branch out to other asset classes if they see an opportunity.

Visit eToro

FAQs

What is 10x leverage in crypto?

10x leverage refers to borrowing against your assets on the trading platform to create a 10 times larger trading position. For example, you can use a crypto leverage trading platform to buy a $10,000 BTC position with $1,000 in margin collateral.

Where can I trade with 100x leverage crypto?

Several trading platforms support 100x crypto trades, including Margex, Bybit, PrimeXBT, Binance, Kucoin, OKX, and MEXC.

What is liquidation in leverage trading?

Liquidation refers to when a trading platform sells your margin to close your position. Liquidations occur when the maintenance margin for the trade is exceeded on trades that are losing money.

What is the best leverage for crypto?

Leverage limits are a matter of preference and are best determined by trading experience. However, in volatile markets like crypto, lower leverage is safer. Using lower leverage limits of 5x to 10x or lower provides a wider margin for error and allows for minor volatility while reducing the risk of liquidation.

How much can I lose with leverage trading?

You can lose all your margin trading with leverage. For example, if you use $1,000 of margin (collateral) to open a 100x long trade controlling $100,000 of BTC, a 1% drop in price (or less) would cause a liquidation and a 100% loss.

Where can I leverage trade crypto in the USA?

Both Kraken and Coinbase offer leveraged futures trades for qualified US traders.

References

Michael Graw

Michael Graw

Alan Draper

Alan Draper