14 Best Micro-Cap Cryptocurrency to Invest in 2024

Looking to invest in the best micro-cap cryptocurrencies for upside potential? In this guide, we discuss quality micro-cap coins that could generate huge returns in the long run. Read on to discover the next 100x crypto gem.

- First truly multi-chain Doge token, promising interoperability across major blockchains

- Easy to buy and claim $DOGEVERSE tokens during presale phase

- Could be the next Doge-inspired coin to explode ahead of Doge Day

- ETH

- usdt

- Infinitely upgradeable AI meme coin, with modular technological capabilities.

- Huge staking rewards available everyday during presale.

- Presale price rises every two days - buy now to benefit from best price before listing.

- ETH

- usdt

- Send SOL and wait for airdrop - the new way of doing presales

- Over $10M raised, launches April 29

- No hard cap total - first come first served

- Solana

- First of its kind daily rewards based on the performance of Mega Dice Casino

- $DICE holders can enjoy 25% rev-share through the Mega Dice Referral Program

- $2,250,000+ USD airdrop for casino players

- Solana

- ETH

- bnb

- Learn-to-Earn platform that rewards users for learning about crypto

- Stake $99BTC tokens in secure smart contract to earn passive rewards

- Get the edge in fast-moving markets with expert crypto trading signals

- ETH

- usdt

- Bank Card

- +1 more

- Innovatives VR & AR Gaming Project

- Aiming to Raise $15M Across 12 Rounds

- Token Holders Get Lifetime Access to VR Content

- ETH

- usdt

- Bank Card

- Trending meme coin with P2E utility & staking rewards

- Price up 10x in past month, rumors of Binance listing

- 12k+ holders and growing

- Bank Card

- usdt

- ETH

- Buy and hold $SMOG to generate and earn airdrop points

- 35% of supply reserved for future airdrop rewards

- Viral potential after pumping over 1000%

- usdt

- Solana

- Native BSC token

- Audited by Coinsult

- Long-term rewards for holders

- bnb

- usdt

- Bank Card

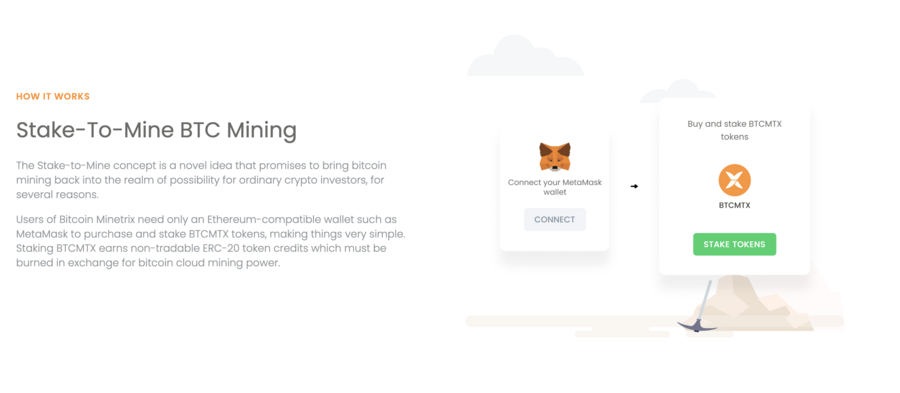

- Innovative stake-to-mine project for easy BTC mining

- Presale has raised over $6.5m so far

- Over 90% staking APY during presale

- ETH

- bnb

- usdt

- +1 more

- Access to huge fee revenue through staking

- 50% of 10bn token supply available at presale stage

- 85% of fees go back to the community

- usdt

- bnb

- ETH

- New meme coin offering an immersive experience via high-stakes battles

- Participants can buy and stake $SHIBASHOOT tokens for rewards in excess of 25,000% p/a

- Token holders can cast votes on key project decisions and try their luck in the 'Lucky Lasso Lotteries'

- ETH

- usdt

- bnb

- First crypto-based lending platform, allowing loans up to 75% of the total Memereum assets.

- Comprehensive insurance coverage for digital coins and precious metals, including gold and silver.

- High-value holders get state-of-the-art NFTs, valued over $1,500 in the open market.

- bnb

- usdt

- ETH

- Innovative AI crypto casino offering staking, airdrops and custom games

- $HPLT presale has raised over $400k so far with +60M bets placed by +150k users

- Offers daily staking rewards, hype NFTs and is fully audited by Certik

- bnb

- ETH

- usdt

The Best Micro-Cap Cryptocurrencies to Invest in

Here’s a list of the best micro-cap cryptocurrencies for 2024:

- Dogeverse — Multichain altcoin pioneering cross-chain utility and staking rewards

- Slothana — Solana-based altcoin offering high staking rewards and rapid transactions

- 99Bitcoins — Revolutionary Learn-to-Earn Micro-Cap Crypto

- 5th Scape — New crypto project combining AR, VR, and blockchain technologies

- Sponge V2 — Popular meme coin upgraded to a V2 with a new play-to-earn gaming ecosystem

- Bitcoin Minetrix — Revolutionary crypto decentralizing cloud mining

- Tamadoge — Earn TAMA tokens in the metaverse by minting an NFT pet

- SushiSwap — Decentralized exchange with borrowing and lending

- Gala — Blockchain guild hosting play-to-earn games

- inSure DeFi — Web3 insurance for crypto portfolio scams

- Ribbon Finance — Yields generated through automated derivative strategies

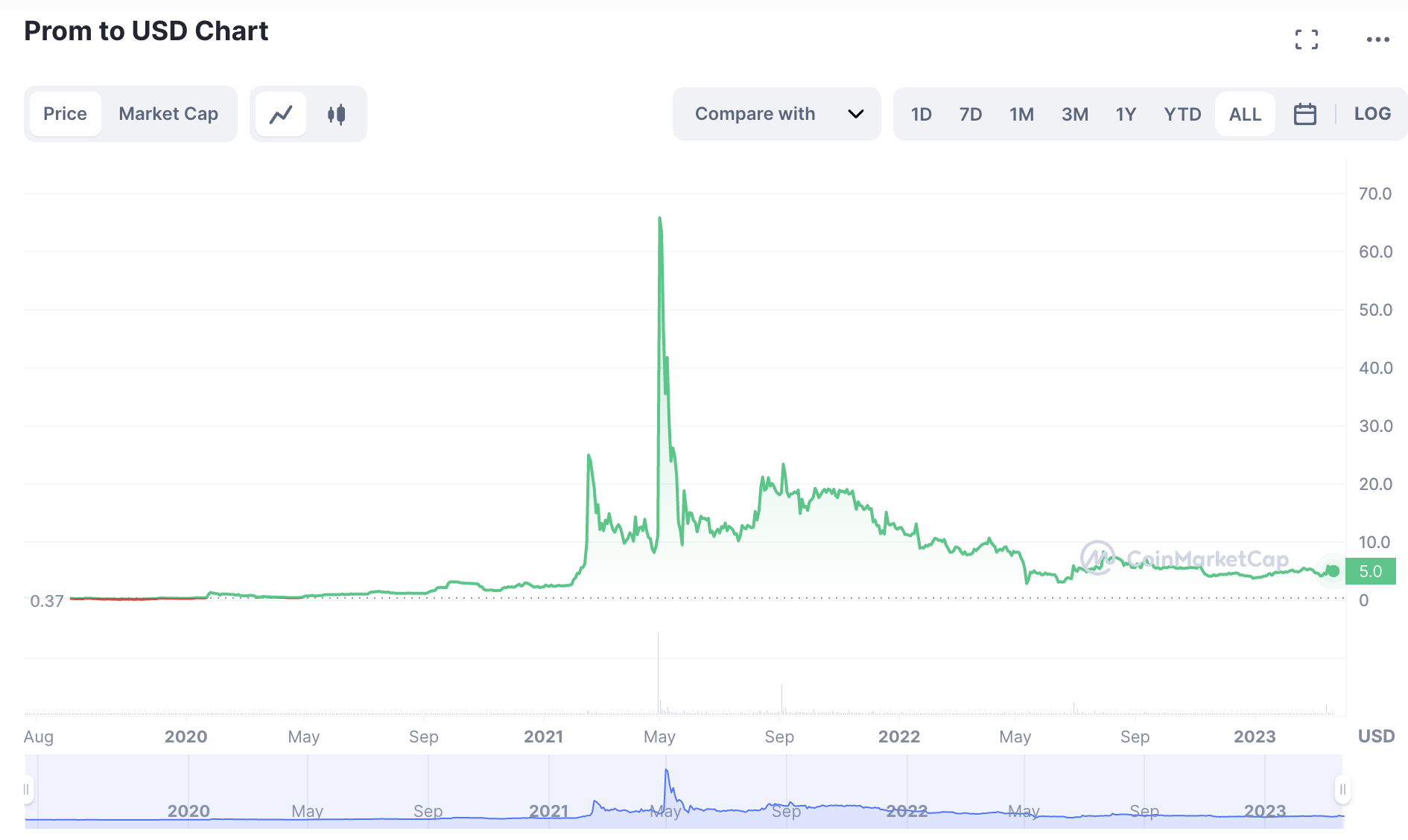

- Prom — NFT marketplace for in-game assets

- Band Protocol — Cross-chain data oracles for smart contracts

- JUST — DeFi tools for the TRON network

A Closer Look at the Top Micro Market Cap Crypto Coins

When selecting the best micro-cap crypto to buy, investors need to look at factors other than just the market capitalization. This includes the use case of the crypto token, what market it operates in, and the upside potential of the project.

Below, we analyze the best micro-cap cryptocurrencies to invest in today.

1. Dogeverse — Overall Best Micro-Cap Crypto to Buy on Presale

is the best micro-cap crypto to invest in during its presale phase due to its innovation and potential for growth. Dogeverse stands out with a unique blend of meme culture, community support, utility, and a clear roadmap.

The presale’s rapid pace, raising $1 million in two days, indicates strong investor confidence and interest.

Central to Dogeverse’s innovation is its multichain capability, operational on Ethereum, BNB Smart Chain, and Polygon, with plans to extend to Solana, Base, and Avalanche. This differentiates Dogeverse from typical meme coins while making it accessible to a broader investor base.

The project’s roadmap outlines security through contract audits, a phased presale, robust community engagement, and a clear path towards both decentralized and centralized exchange listings.

The total supply of 200 billion $DOGEVERSE tokens will be strategically allocated for staking, liquidity, marketing, and ecosystem development. Dogeverse also promises low transaction fees and state-of-the-art bridging technology.

Offering a rare combination of innovative features, a strategic growth roadmap, and a commitment to community and ecosystem development, Dogeverse stands out as the best micro-cap cryptocurrency to buy in 2024.

| Presale Started | April 2024 |

| Purchase Methods | ETH, USDT, and card |

| Chain | Multichain |

| Min Investment | None |

| Max Investment | None |

2. Slothana — Solana-Based Altcoin Offering High Staking Rewards and Rapid Transactions

is a promising micro-cap crypto. This coin is captivating investors with its explosive launch and unique appeal. Inspired by the concept of an “office sloth” transitioning to crypto trading, Slothana resonates with a vast audience, evident in its presale success.

With a straightforward presale mechanism, investors simply send Solana (SOL) to a designated address, receiving $SLOTH tokens via airdrop. This innovation has contributed to its rapid $1 million fundraising within two days.

Key factors driving Slothana’s price potential include strong community support, evident in its swift fundraising; upcoming exchange listings, enhancing accessibility and demand; and integration into Solana’s efficient ecosystem, promising increased visibility and utility.

Currently priced at $0.018 (1 SOL = 10,000 $SLOTH), Slothana presents an early investment opportunity, especially as the meme token market and broader crypto recovery suggest potential price appreciation upon exchange listings.

| Presale Started | March 2024 |

| Purchase Methods | SOL |

| Chain | Solana |

| Min Investment | None |

| Max Investment | None |

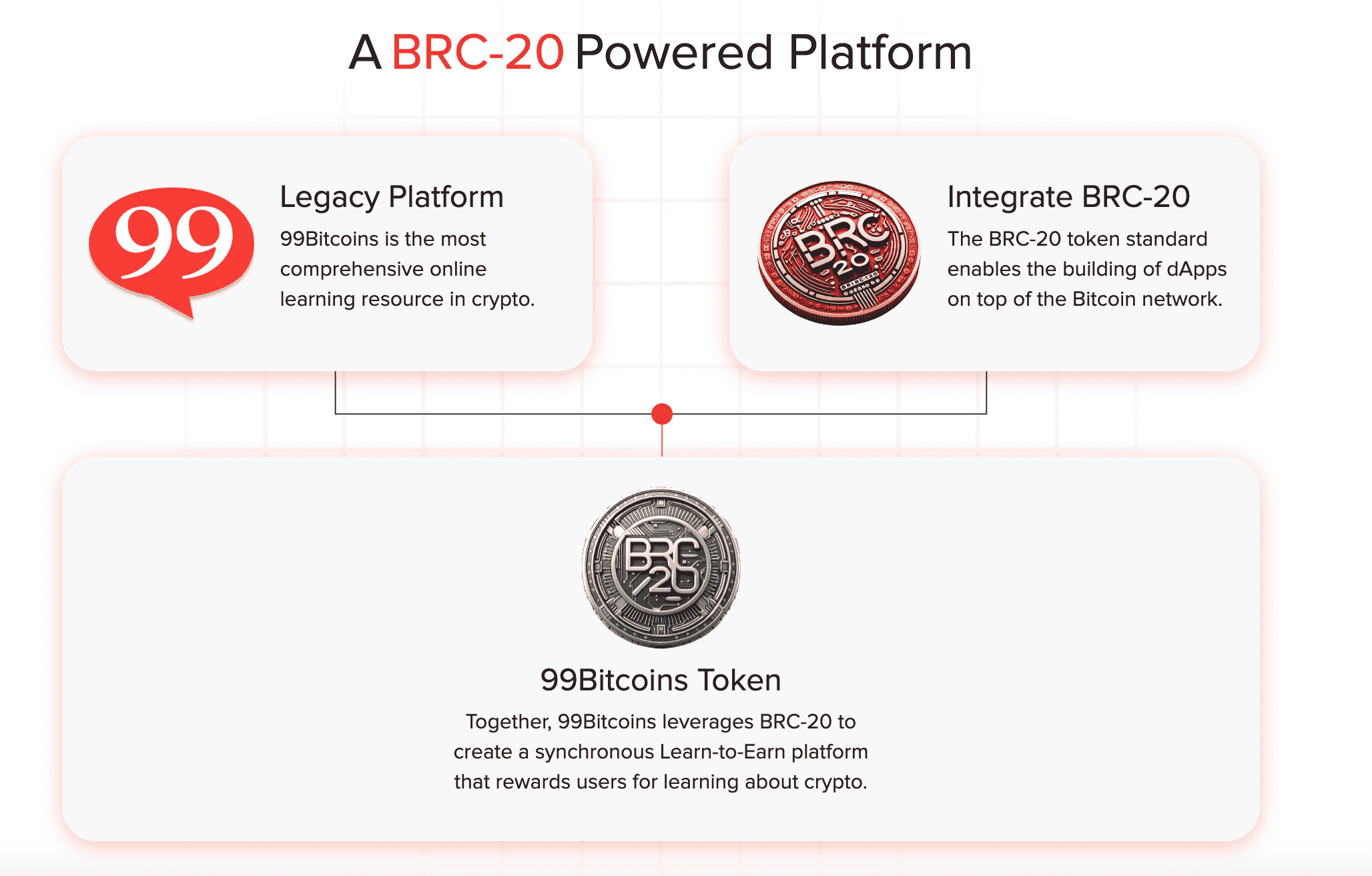

3. 99Bitcoins — Revolutionary Learn-to-Earn Micro-Cap Crypto

99Bitcoins is a revolution in crypto education. Launched in 2010, this platform has become a behemoth in the crypto learning arena, amassing over 700,000 YouTube subscribers and 2 million course registrants. Their latest venture? The launch of the $99BTC token.

99Bitcoins stands out due to its robust community and innovative learn-to-earn model. Users gain $99BTC tokens through active platform engagement, with rewards redeemable for exclusive content and partner discounts. This model incentivizes learning and fosters a supportive community ecosystem.

$99BTC runs on Ethereum, with plans to transition to the BRC-20 standard. This move is groundbreaking, enabling DeFi on the Bitcoin blockchain and positioning $99BTC at the forefront of this technological leap.

In a generous nod to its community, 99Bitcoins will airdrop $99,999 in $99BTC tokens to 99 early backers, rewarding those who contribute to this learn-to-earn project. With Bitcoin’s price surging and the novel BRC-20 standard in play, $99BTC is poised for significant growth.

| Presale Started | April 2024 |

| Purchase Methods | ETH, USDT, and card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

4. 5th Scape — New Crypto Project Combining VR and Blockchain Technologies

5th Scape is a pioneering project at the intersection of virtual reality (VR) and cryptocurrency. Launched with a mission to integrate these two technologies, 5th Scape offers a VR ecosystem complete with games and equipment, all powered by its utility token, $5SCAPE.

$5SCAPE is the backbone of the 5th Scape ecosystem, facilitating transactions for games, subscriptions, and exclusive in-game items. Holders are rewarded with various benefits, including discounts, free basic access to games, and early access to new VR content.

Currently at the presale stage, $5SCAPE’s roadmap outlines ambitious plans for VR development and community expansion. With a gradual increase in presale token price, investors have the opportunity to capitalize on unrealized gains before the token’s anticipated launch on decentralized exchanges at $0.01.

Currently at a presale price of $0.00285 per token, the value of $5SCAPE will be influenced by several factors, including market movements, developments in the VR sector, regulatory landscapes, and exchange listings.

With planned releases of VR games and trailers, alongside the broader VR market’s expected growth, $5SCAPE is a micro-cap crypto with promising potential for 2024 and beyond.

| Presale Started | February 2024 |

| Purchase Methods | ETH, USDT, MATIC, BNB, and card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

5. Sponge V2 — Popular Meme Coin Upgraded to a V2 with a New Play-to-Earn Gaming Ecosystem

Sponge soared into the scene in 2023, instantly becoming one of the top meme coins of the year. Now, the popular cryptocurrency is revamping itself by offering additional use cases.

Sponge V2 is the upgraded version of Sponge. Using the stake-to-bridge mechanism, Sponge will connect V1 token holders with the new V2 token. Existing V1 token holders can stake their tokens on the newly launched V2 smart contract. You will receive an equal amount of V2 tokens, once your V1 tokens are locked-in. Furthermore, the V2 smart contract will offer annual yields for the next four years.

Sponge will also launch a new play-to-earn racer game, where players compete to climb up an online leaderboard. The top performers will be rewarded with $SPONGE tokens. From a total supply of 150 billion, over 51% of the tokens will be offered through staking and P2E gaming rewards.

At the time of writing, investors can generate 166% staking APY on the V2 contract. So far, over $20 million worth of $SPONGE has been staked. $SPONGEV2 currently costs $0.001879 per token. Read the Sponge V2 whitepaper and join the Telegram channel for more information.

| Presale Started | December 2023 |

| Purchase Methods | ETH, USDT, MATIC |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

6. Bitcoin Minetrix — Revolutionary Crypto Decentralizing Cloud Mining

At the top of our list for the best micro cap cryptocurrency is Bitcoin Minetrix ($BTCMTX). This revolutionary cryptocurrency leverages blockchain technology to decentralize the cloud mining space.

Cloud mining is a process where individuals can rent mining power from centralized businesses. However, this space is plagued with fraudulent activities and scams. To solve this problem, Bitcoin Minetrix is tokenizing cloud mining. $BTCMTX, the native token, can be staked on the Ethereum-based smart contract.

As your tokens are staked, you can start generating tokenized cloud mining credits. These credits can be burned to acquire rented mining times, to earn a portion of Bitcoin mining revenues. Furthermore, staking $BTCMTX leads to APYs (Annual Percentage Yields) as high as 73%. From a total supply of 4 billion – 70% has been allocated to the ongoing presale. This micro-cap crypto has raised more than $9 million since the presale launched a few months ago.

At press time, $BTCMTX is priced at $0.013 on presale. The price will increase to $0.0148 by the final presale round. For more information on this cryptocurrency, go through the Bitcoin Minetrix whitepaper and join the Telegram channel.

| Presale Started | 26 Sept 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

7. Tamadoge — Earn TAMA Tokens in the Metaverse by Minting an NFT Pet

(TAMA) is also one of the best micro-cap cryptos to buy today. This project has a broad ecosystem that covers a wide range of web3 products. But at its core, Tamadoge is a play-to-earn game that requires players to mint a virtual pet NFT. Tamadoge pets are randomly generated from Ethereum smart contracts. As such, each pet is unique and has its own traits.

Players can then train their pets to improve their strengths. Moreover, players can feed their Tamadoge pets and even enter battles with other users. There will be a leaderboard that rewards successful players with TAMA tokens. Tamadoge is also building a metaverse. Called the ‘Tamaverse’, this will offer play-to-earn games in an immersive environment.

The Tamadoge whitepaper also states that augmented reality will be incorporated into its NFT games. Tamadoge completed its presale in late 2022 and is now listed on many exchanges, including OKX, Gate.io, and Uniswap. Tamadoge has a market capitalization of just $12 million. As such, this is one of the best micro-cap tokens for long-term upside.

8. SushiSwap — Decentralized Exchange With Borrowing and Lending

SushiSwap (SUSHI) is one of the best micro-cap cryptos for investing in decentralized finance. Its proprietary exchange supports a range of services. This includes token swaps generated by an automated market maker (AMM) protocol. In simple terms, this allows a trader to buy a cryptocurrency without a seller.

This is because the AMM uses liquidity pools. Investors can provide liquidity to a pool to earn interest. SushiSwap offers attractive APYs and investors can withdraw their tokens at any time. SushiSwap also supports decentralized loans. SushiSwap has its own native token, SUSHI. Previously trading with a market cap of nearly $3 billion, SUSHI is now worth just $300 million.

9. Gala – Blockchain Guild Hosting Play-to-Earn Games

While play-to-earn gaming projects generally create their own titles, Gala (GALA) does things differently. Put simply, Gala operates a gaming guild on top of the Ethereum blockchain. It enables developers to create and run their games on Gala, all of which offer play-to-earn rewards. Moreover, rewards are paid in the project’s native token, GALA.

Across 28 games, Gala has distributed more than $2.2 billion worth of rewards. All Gala games also come with in-game ownership, backed by an Ethereum NFT. Gala has also entered the world of decentralized music and film. This allows artists to sell their creations and dictate their own terms. GALA is currently trading with a market cap of just $290 million.

10. inSure DeFi – Web3 Insurance for Crypto Wallet Scams

Launched in 2020, inSure DeFi (SURE) is looking to bridge the gap between insurance and crypto investments. In a nutshell, the project insures crypto wallets against the threat of a scam. For example, if the crypto wallet is hacked and the tokens are stolen, the user can make a claim. In terms of the specifics, users will first need to buy SURE tokens.

This is the utility token backing the project and the insurance kicks in seven days after making the purchase. Moreover, the SURE tokens need to be stored in a private wallet and not an exchange. After investigating and approving the claim, inSure DeFi will cover the loss, payable in SURE tokens. As of writing, inSure DeFi has a market capitalization of just $115 million.

11. Ribbon Finance – Yields Generated Through Automated Derivative Strategies

Ribbon Finance (RBN) is also one of the best micro-cap cryptocurrencies to consider today. It has built an innovative system that generates yields from crypto derivatives, such as options and futures. Some of its core strategies include covered calls, put-selling, and principal protections. Yields depend on the strategy and the token being traded.

For example, covered calls on Ethereum are currently yielding an APY of 70%. From the perspective of investors, the process is passive. Investors simply need to choose their preferred strategy and deposit some crypto. Ribbon Finance has some serious backers, including Coinbase Ventures and Paradigm. Its native token RBN has a market cap of just $125 million.

12. Prom – NFT Marketplace for In-Game Assets

While many blockchain games enable users to earn and buy in-game items, not all projects have an in-built marketplace. Prom (PROM) has solved this issue by creating a decentralized marketplace that allows users to sell their gaming NFTs. 27 games are supported with more being added in the coming months.

This includes MetaSoccer, Elips Battle, Cryptoblades, and Tiny World. Users can set their own price when listing an in-game NFT and multiple digital currencies are supported. Moreover, Prom also enables users to rent NFTs, allowing the owner to earn passive income. Its utility token PROM, has a market capitalization of just over $91 million.

13. Band Protocol – Cross-Chain Data Oracles for Smart Contract

Another project that caught our eye when searching for the best micro-cap cryptocurrencies is Band Protocol (BAND). Launched in 2019, Band Protocol specializes in data oracles for smart contracts. This means that it provides real-world data to the blockchain. Not only that, but Band Protocol has cross-chain functionality.

This means that it can provide real-world data to multiple network standards without requiring a third party. While its protocol receives an average of 33,000 requests per day, it is able to facilitate data blocks in just six seconds. According to CoinMarketCap, Band Protocol had a market cap of just $50 million at the start of 2023. It has since increased to $200 million.

14. JUST – DeFi Tools for the TRON Network

Although TRON has one of the most efficient blockchains for speed, fees, and scalability, it lacks a comprehensive range of DeFi tools. That was until JUST (JST) entered the market with its decentralized suite of lending and earning services. The platform specializes in TRC-20 tokens and popular liquidity pools cover TRX, BTT, USDT, and TUSD.

JST is the project’s native governance token, enabling holders to cast votes on how JUST is run. Users can also mine JST for additional rewards. When JUST was launched in 2020, it was trading at just $0.0084. As of writing, JUST is worth $0.026 per token – representing growth of 200%. This translates into a market capitalization of $228 million.

What Is Micro-Cap Crypto?

Micro-cap cryptocurrencies refer to projects with a small market capitalization. This is often a valuation of under $300 million, similar to micro-cap stocks. While micro-cap cryptocurrencies can be ultra-volatile, they also offer an attractive upside.

This is because micro-cap cryptocurrencies have the potential to generate sizable gains. After all, it doesn’t take as much buying pressure to quickly increase the value of a micro-cap cryptocurrency. This is because there is less liquidity and depth in the market.

For example, if an investor buys $100,000 worth of a cryptocurrency with a market cap of just $5 million, this could increase the price by double-digit percentages. This isn’t the case with multi-billion dollar projects like Bitcoin. In fact, a $100,000 buy order would barely move the market at all.

How to Find Micro Market Cap Cryptocurrencies?

Read on to discover what methods seasoned investors use when researching the best micro-cap cryptocurrencies.

Use CoinMarketCap to Source Micro-Caps

CoinMarketCap is a great starting point when searching for the best micro-cap cryptos. By default, the data aggregator website lists cryptocurrencies in descending order by market capitalization.

This means that investors simply need to get down to $300 million and this will display thousands of micro-cap coins.

Investors can then research their chosen projects by reading the whitepaper, assessing the token’s use cases, and more.

Invest in Presales for the Best Entry Price

The vast majority of crypto presales will offer access to a newly launched micro-cap token. This is because presales are fundraising campaigns that help fund a new project.

The project will sell its native token at a huge discount to early investors. After the presale sells out, the token is then listed on an exchange.

Not only do presales allow micro-cap investors to secure an attractive entry price, but there is often an immediate upside on offer.

Look for Concepts That Could Become Global

Another strategy to consider when searching for the best micro-cap tokens is to focus on innovative concepts.

Think along the lines of investing in social media in the early 2000s or EVs in the 2010s. In doing so, investors can gain exposure to new markets before they have had the chance to blossom.

Are Micro-Cap Crypto Gems a Good Investment?

Whether or not micro-cap cryptocurrencies are worth buying will depend on the goals and risk tolerance of the investor.

Here’s what to consider before proceeding:

Consider the Enhanced Risk

All cryptocurrencies are considered risky investment products. However, those with a micro-cap valuation come with an even greater level of risk.

After all, if a whale sells a huge chunk of tokens via a single trade, this could wipe a sizable amount of value from the project.

Moreover, many micro-cap cryptocurrencies are backed by up-and-coming projects. Many of which never meet the expectations of their investors.

Long-Term Upside Can be Huge

While riskier than large-cap projects, micro-cap cryptocurrencies invariably offer a much higher upside. This is especially the case in the long run, as newly launched projects have time to grow organically.

Moreover, many micro-cap projects are at the start of their development phase. This means that it can take several years for the concept to reach the masses. But nonetheless, the upside potential of a token with a micro-cap valuation can be significant.

For instance, when Shiba Inu was launched in mid-2020, it was worth just a few million dollars. In just over a year, Shiba Inu went on to reach a market cap of over $40 billion. This translates into gains of over 10,000x.

Micro-Caps Are Ideal for Small Investments

Those on a budget are constantly on the lookout for the best micro-cap cryptocurrencies. The reason for this is that even with a small investment, if a micro-cap ‘moons’ the returns can be sizable.

- For example, when BNB launched in 2017, it had a market capitalization of just over $10 million.

- Today, BNB is worth over $50 billion.

- This amounts to growth of over 500,000%.

- Therefore, investing just $100 in BNB in 2017 would now be worth $500,000.

Conclusion: What Is the Best Micro-Cap Cryptocurrency to Invest In?

Finding the next 100x gem is often a case of focusing on quality micro-cap cryptocurrencies. This is because micro-caps have considerable room for growth, especially if they are behind innovative concepts.

The top micro cap crypto on our list is Dogeverse ($DOGEVERSE). With a successful presale and plans to expand across various blockchain ecosystems, Dogeverse presents an enticing opportunity for investors seeking high-growth potential.

FAQs

What is a micro-cap crypto?

Micro-cap cryptocurrencies have a market capitalization of under $300 million. In a similar way to micro-cap stocks, this market is attractive to investors that seek huge returns. This is why the Dogeverse’s presale is proving so popular.

What are the best micro-cap cryptos to buy?

Overall, Dogeverse is the best micro-cap crypto to buy due to its rapid presale success, multichain compatibility, and potential for high growth in the altcoin market.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman