8 Best Crypto Copy Trading Platforms in April 2024

Crypto copy trading is a great way to invest without actively researching the market. All you need to do is choose a seasoned trader to copy and decide how much money to invest. Thereon, you’ll automatically replicate the trader’s buy and sell orders.

This guide explores the best crypto trading platforms for copy trading in 2024. Read on to get started with a copy trading account in under five minutes.

List of The Top Crypto Copy Trading Platforms

Consider one of the platforms below when copy trading crypto in 2024:

- eToro – Overall Best Crypto Copy Trading Platform in 2024

- Kraken – Unbroken Security Record Since Launch

- OKX – Great Option to Copy Trade Crypto Futures

- Bybit – Leading Derivatives Platform With High Leverage Limits

- PrimeXBT – Build a Diversified Copy Trading Portfolio

- MEXC – Follow Traders Who Buy and Sell New Crypto Assets

- Binance – Largest Copy Trading Platform for Daily Volume and Liquidity

- Gate.io – Copy Automated Bot Strategies for 24/7 Crypto Exposure

Crypto Copy Trading Platforms Reviewed – Detailed Analysis

We’ll now explain how each copy trading platform works. We cover various important metrics including fees, supported markets, key features, security, reputation, and more.

1. eToro – Overall Best Crypto Copy Trading Platform in 2024

eToro is the best option when copy trading crypto. Unlike most platforms in this space, eToro is a heavily regulated brokerage. It holds multiple tier-one licenses, including regulation from FINRA (US), FCA (UK), and ASIC (Australia). Put otherwise, your capital is safe when using eToro. What’s more, there are thousands of copy traders to choose from.

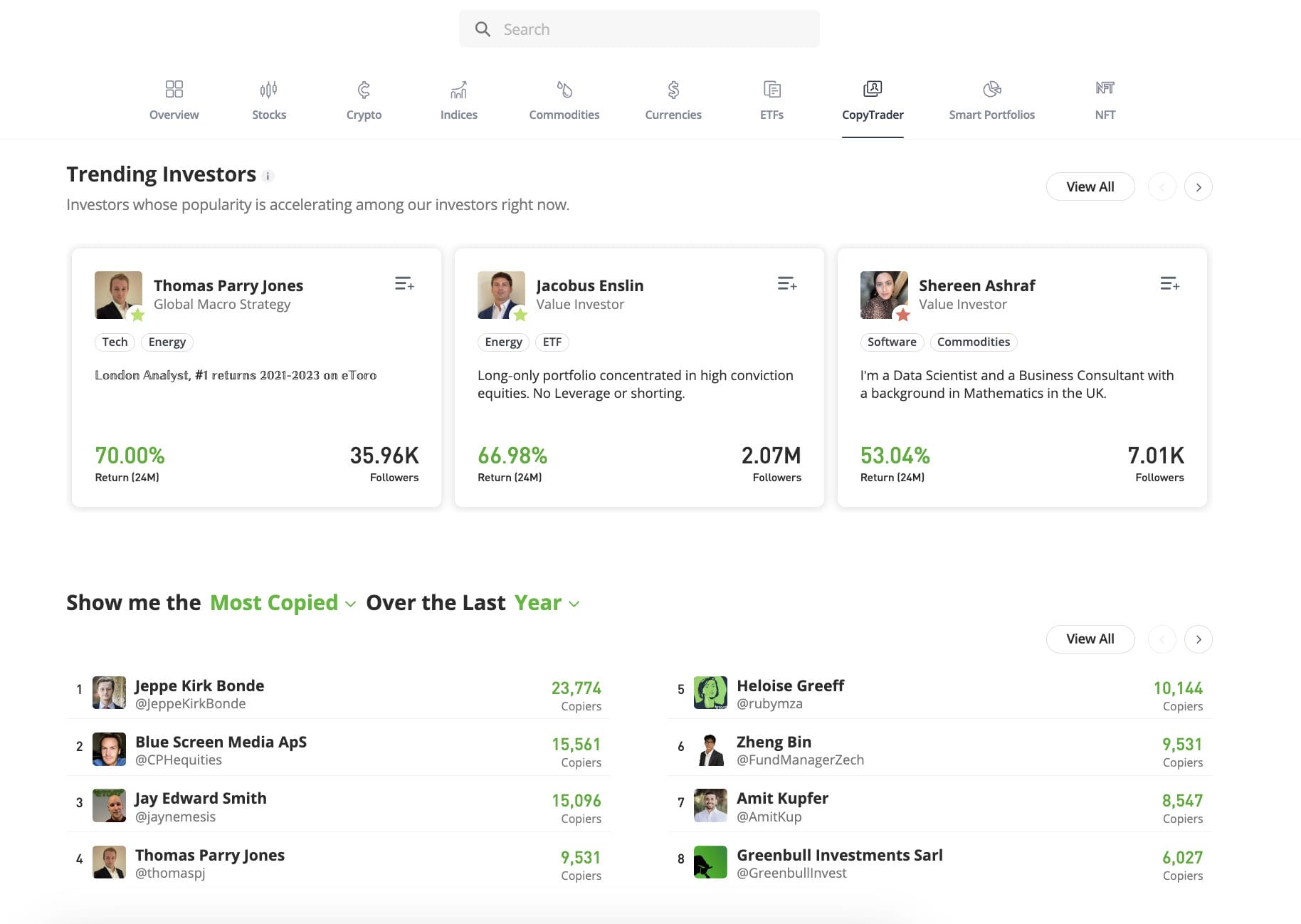

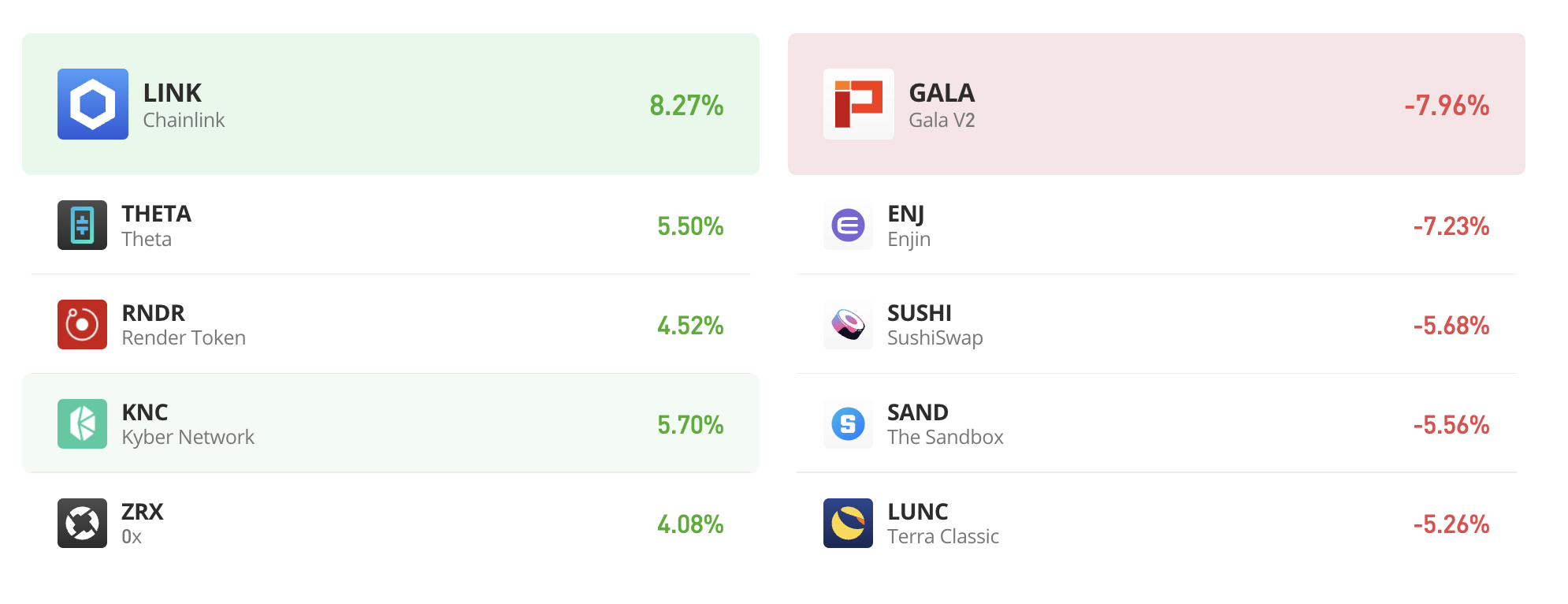

You can narrow down your search by using eToro’s filters. These include the return on investment, monthly gains/losses, average holding time, risk rating, maximum drawdown, and preferred markets. eToro supports some of the best cryptocurrencies to trade, including Bitcoin, XRP, Litecoin, Bitcoin Cash, Uniswap, Shiba Inu, Dogecoin, and Ethereum.

Some eToro traders like to invest in other markets too. eToro supports stocks, ETFs, forex, commodities, and indices. No additional fees are charged when copy trading. However, you’ll need to cover standard commissions. eToro charges 1% per slide on crypto trades, which is higher than other platforms. The minimum copy trading investment is $200.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| eToro | 2007 | No additional fees to copy trade. Investors must cover trading commissions. Crypto buy and sell orders cost 1%. | No | $200 |

Pros

- Backed by a heavily regulated brokerage

- Supports some of the best altcoins

- Thousands of copy traders to choose from

- No additional fees to copy trade

- Also supports other assets – including stocks and forex

- Rated as ‘Excellent’ on Trustpilot

- eToro has partnered with Twitter to make copy trading more accessible

Cons

- 1% commission on crypto trading orders

- Minimum copy trading investment of $200

2. Kraken – Stellar Reputation for Security Providing Access to a Wide Range of Features

Although the Kraken exchange doesn’t feature an in-built copy trading facility, the platform does support the connection of third party trading bots which can allow you to mirror the actions of successful traders. For more information, be sure to read our article on crypto trading bots.

Established in 2011, Kraken is the 6th largest crypto exchange by 24 hour volume. With an unbroken track record of zero security instances in its long history, Kraken is a tried and tested platform which is trusted by millions of investors worldwide.

Kraken currently provide trading for 246 different cryptocurrencies. Users can also access staking facilities, margin trading and NFT markets making the platform a popular choice for those looking for a variety of features alongside a trusted reputation for safety and security.

Kraken supports a range of ways to purchase cryptocurrency from debit and credit cards, bank transfers, third party providers such as Apple Pay and of course crypto deposits. Card purchases incur a fee of 3.75% while bank transfers cost just 1.5%. Kraken relies on the maker-taker structure for trading fees with lower fees for those trading higher volumes.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| Kraken | 2011 | Make-taker structure. Starting from 0.25% dependent on 30 day trading volume. | N/A | None |

Pros

- Trusted reputation with impeccable security record

- Wide range of different cryptocurrencies

- Margin trading, staking and NFT marketplace available

- Allows the connection of third party trading bots

Cons

- Some features unavailable in certain US states

3. OKX – Great Option to Copy Trade Leveraged Crypto Futures

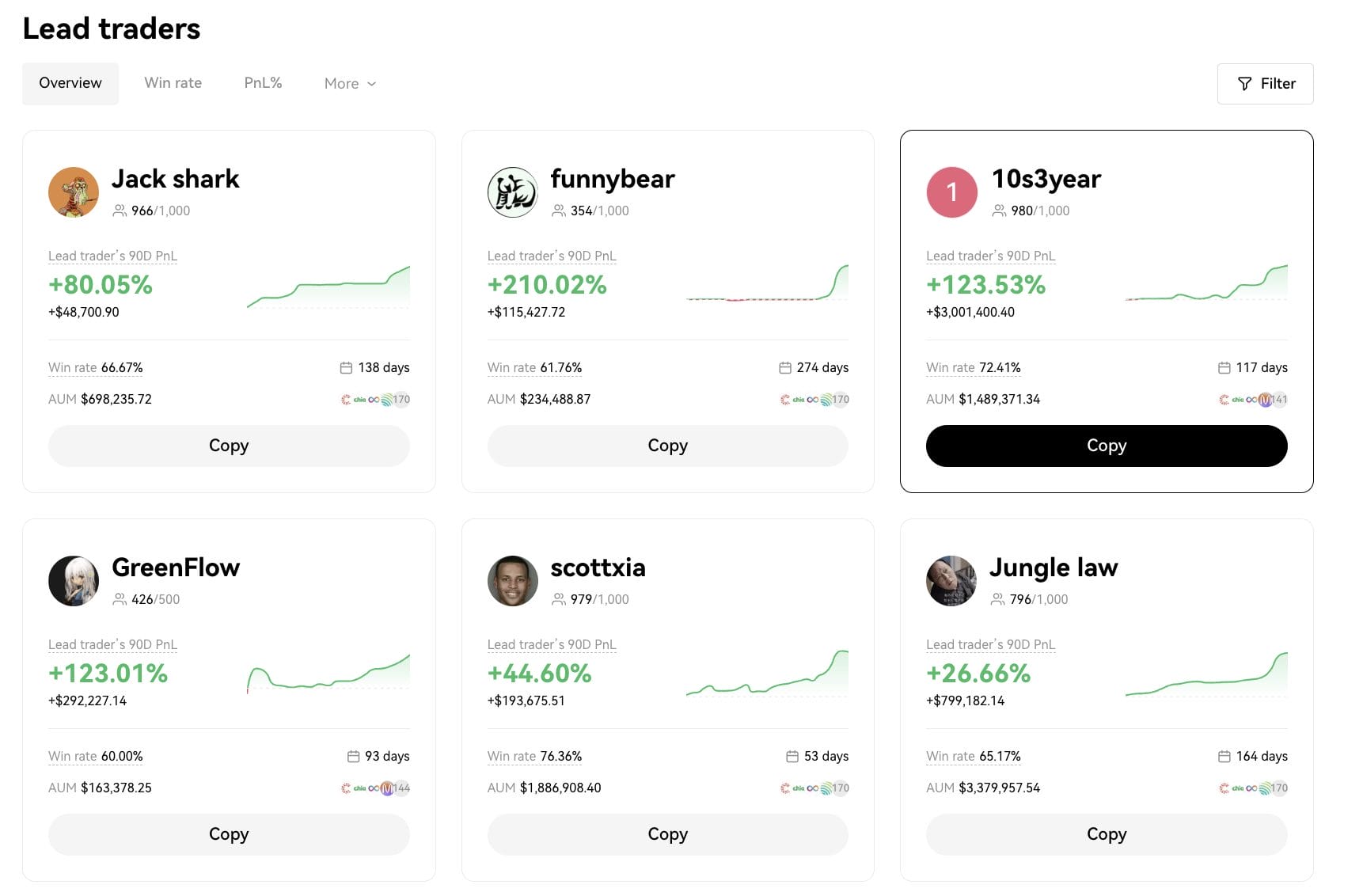

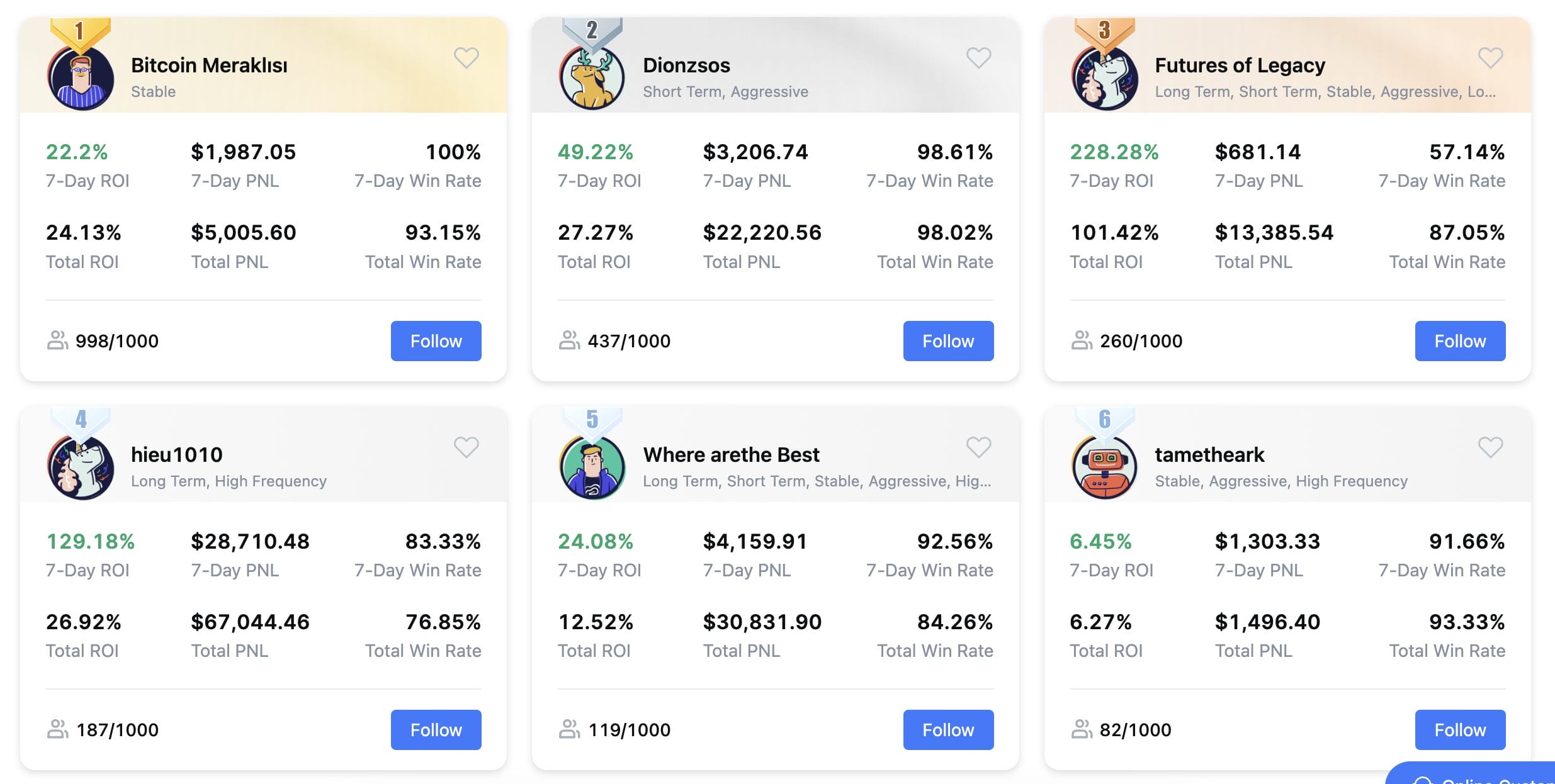

OKX is one of the best crypto copy trading platforms for leveraged futures. There are many top-rated traders to choose from. You can sort traders by their historical win rate or profit/loss percentages. Other search filters include assets under management and the total number of followers.

Clicking on a trader will display additional data points, such as their preferred crypto markets and ongoing orders. OKX supports a huge range of perpetual futures markets. The most popular include Bitcoin, Ethereum, Polygon, XRP, Solana, Dogecoin, and Pepe. Leverage of up to 100x is available on some markets. This makes OKX one of the best crypto leverage trading platforms.

In addition, OKX also supports the spot trading markets. This is a lower-risk way to copy trade crypto. OKX doesn’t charge copy trading fees. However, you’ll need to cover standard trading commissions. Futures and spot trading commissions start from 0.05% and 0.1%, respectively. No minimum investment requirement is stated, which is a solid benefit for those on a budget.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| OKX | 2017 | No additional fees to copy trade. Investors must cover trading commissions. Futures and spot trading commissions start from 0.05% and 0.1%, respectively | No | None |

Pros

- The best option for copy trading the futures markets

- Get leverage of up to 100x

- Supports hundreds of trading pairs

- Futures commissions start from 0.05%

- No copy trading minimums

Cons

- Futures copy trading is high-risk

- Not available in all countries, such as the UK and the US

4. Bybit – Leading Derivatives Platform With High Leverage Limits

Bybit is also worth considering if you’re looking to copy trade with high leverage limits. It offers leverage of up to 125x on major cryptocurrency markets like Bitcoin and Ethereum. You can also get high leverage on some of the best meme coins, such as Pepe, Shiba Inu, and Dogecoin. Bybit’s copy trading dashboard supports plenty of crypto instruments.

This includes derivatives like delivery and perpetual futures, not to mention USDC-backed options. You can also copy trade the spot markets, with Bybit supporting hundreds of pairs. Traders are initially sorted by their key features, such as the return on investment, the highest profit margins, and the lowest drawdown.

Clicking on a trader shows a huge amount of data points, including the historical win rate, maximum drawdown, average profit/loss, the Sharpe ratio, and the average holding time. There is no minimum copy trading amount required. That said, traders charge a profit-sharing percentage, averaging 10-20%. You’ll also need to cover trading commissions.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| Bybit | 2018 | Futures and spot trading commissions start from 0.02% and 0.1%, respectively | Yes – set by traders | None |

Pros

- High-volume derivatives exchange supporting futures and options

- Also offers a spot trading platform with hundreds of pairs

- Major cryptocurrencies come with leverage of 125x

- Trading fees for market takers start at 0.02% per slide

- No minimum investment requirements

Cons

- Profit-sharing fees average 10-20%

- Using too much leverage can result in substantial losses

5. PrimeXBT – Build a Diversified Copy Trading Portfolio

PrimeXBT is one of the best crypto copy trading platforms for building a diversified portfolio. Not only does it offer a huge range of traders to choose from but also a wide selection of markets. For instance, PrimeXBT supports everything from XRP, Polkadot, and BNB to Litecoin, Avalanche, and EOS.

It also supports commodities like gold and silver, not to mention indices and forex. One of the most popular copy traders on PrimeXBT is ‘Bossman’. This is a scalping trader that specializes in crypto and forex. Over the prior 60 days, this copy trader is up over 4,600%. That said, we found that PrimeXBT fees can be costly.

For example, the Bossman strategy costs 20% in platform fees and 20% in trader commissions. This means you’ll keep just 60% of any profits generated. Lower fees are available when you increase your tier. Nonetheless, we like that investors can get started with any amount. As such, all budgets can diversify across multiple traders and markets.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| PrimeXBT | 2018 | Platform fees range from 5% to 20% of generated profits, depending on the account tier | Yes – 20% | None |

Pros

- A great option to copy trade multiple asset classes

- Supports crypto, indices, commodities, and forex

- Used by over 1 million traders

- Available online and as an iOS/Android app

- Robust security – including cold storage of client-owned assets

Cons

- Platform fees of up to 20%

- Profit-sharing fees of 20%

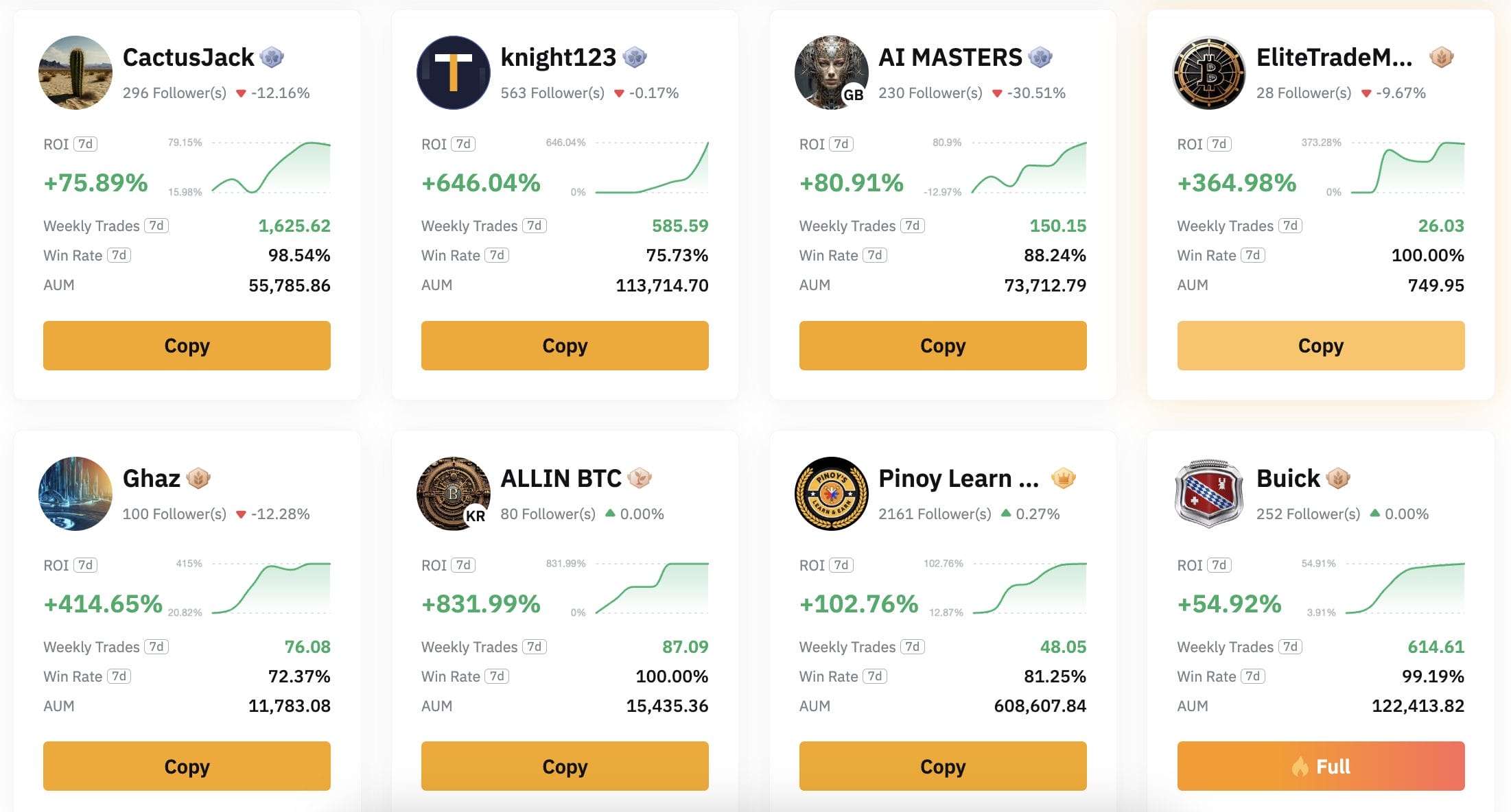

6. MEXC – Follow Traders Who Buy and Sell New Crypto Assets

MEXC, considered one of the best crypto exchanges, is also a great option for copy trading. It boasts huge trading volumes and millions of daily active traders. What’s more, MEXC doesn’t charge spot trading commissions. And, if you’re copying a futures trader, commissions amount to just 0.01% per slide.

We like that MEXC offers lots of filters when searching for a trader to copy. You can initially rank traders based on their historical win rate, total profit/loss, total return on investment, and the number of followers. Traders set their own profit-sharing commissions on MEXC. We found that the top traders charge 15%.

In terms of crypto markets, MEXC supports some of the best micro-cap cryptocurrencies. This is because it’s often one of the first crypto exchanges to list newly launched coins. As such, MEXC is a great option if you’re targeting a high-risk, high-return strategy. MEXC also offers leveraged markets. Bitcoin, for example, can be traded with leverage of up to 200x.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| MEXC | 2018 | No commissions on spot trading markets. Futures commissions start from 0.01% per slide. | Yes – averages 10-15% | None |

Pros

- Popular tier-one exchange with huge trading volumes

- No trading commissions in the spot markets

- A great option for trading micro-cap coins

- More than 5,000 copy traders to choose from

- Accounts take seconds to open

Cons

- The top traders charge profit-sharing fees of 15%

- Doesn’t accept US clients

7. Binance – Largest Copy Trading Platform for Daily Volume and Liquidity

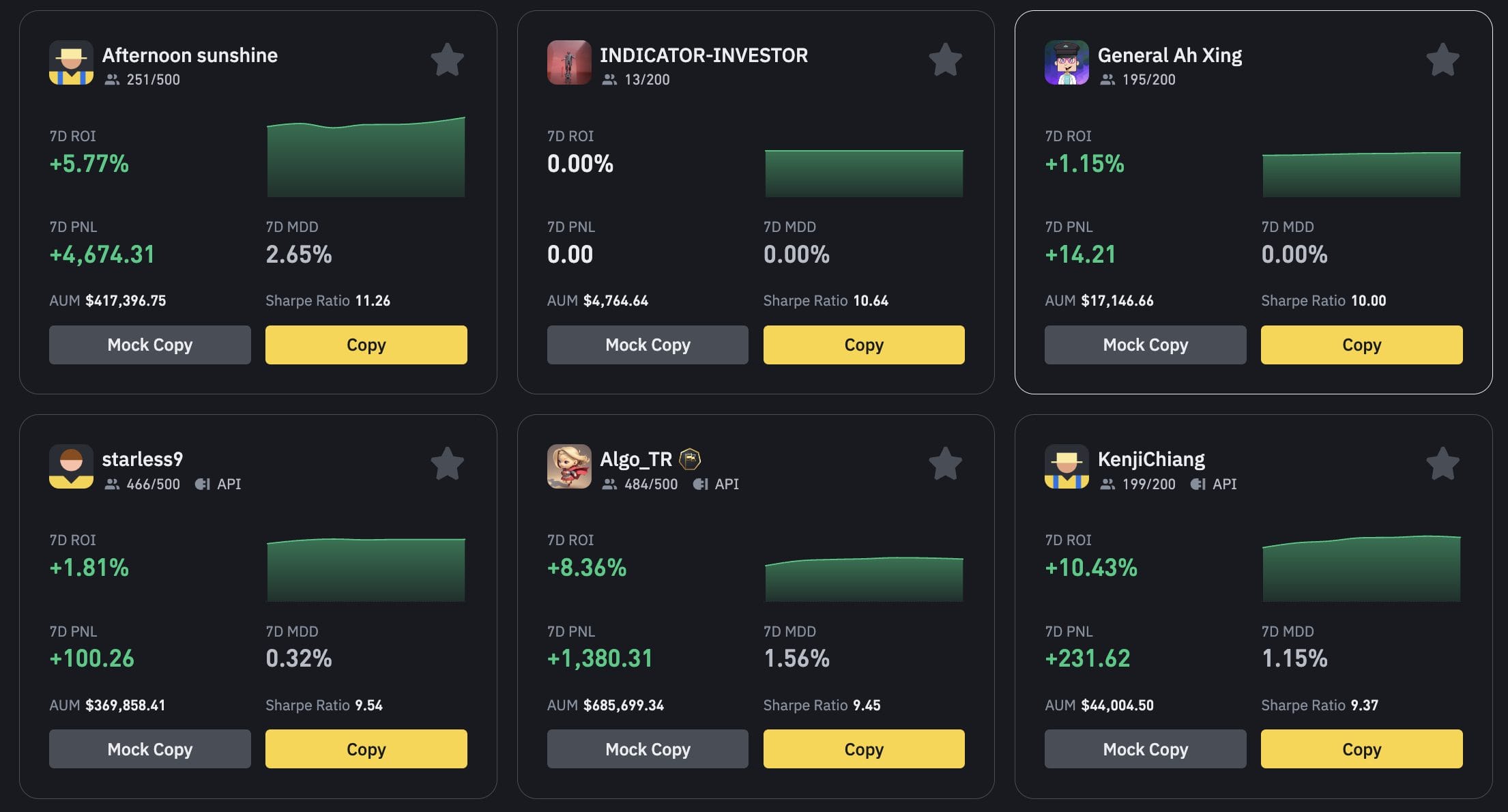

Binance is the largest copy trading crypto platform for daily volume and liquidity. It handles billions of dollars worth of trades every day and serves more than 180 million users globally. There are thousands of verified traders signed up for Binance’s copy trading tool. You can easily find a suitable trader based on key data points.

This includes the profit/loss, return on investment, and assets under management. Results can be sorted across multiple periods, ranging from seven days to three months. ‘Afternoon Sunshine’ is one of the most popular Binance traders to copy right now. This treader has made over 4,600% in the prior seven days.

Each copy trader chooses their profit-sharing commission. We found this averages 10%. There will also be a minimum investment requirement. This varies depending on the trader. For instance, Afternoon Sunshine requires at least 1,000 USDT. Other traders require just a few dollars. You’ll also need to cover trading commissions, although this starts from just 0.1% in the spot markets.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| Binance | 2017 | Futures and spot trading commissions start from 0.02% and 0.1%, respectively | Yes – averages 10% | Varies depending on the copy trading |

Pros

- Attracts the most crypto trading volume and liquidity

- Supports hundreds of crypto pairs

- Profit-sharing commissions average just 10%

- Copy trade the spot and futures markets

- Lots of filters to find suitable traders to copy

Cons

- Some traders set high minimum investment requirements

- Copy trading isn’t available on the Binance.us website

8. Gate.io – Copy Automated Bot Strategies for 24/7 Crypto Exposure

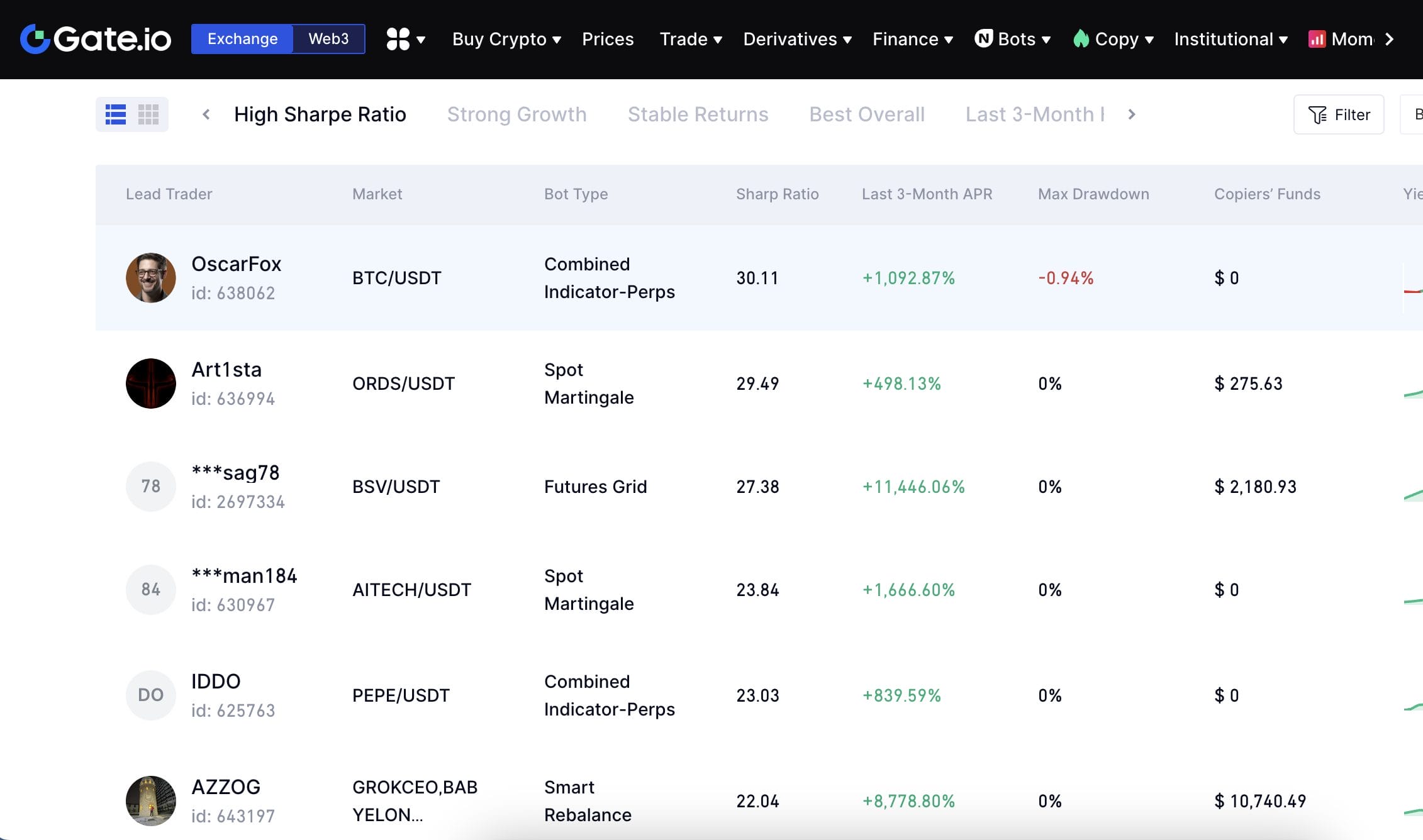

Gate.io is a popular crypto exchange that also offers copy trading tools. Although Gate.io enables users to copy human traders, it also supports automated bots. These are pre-programmed bots that buy and sell crypto 24 hours per day, seven days per week. There are many bot strategies to choose from. First, you’ll need to select from spot trading or the futures markets.

Next, you can view the top bots for return on investment, stable growth, and the Sharpe ratio. Alternatively, you can view bots based on their core technical indicator. Options include the MACD, Bollinger Bands, and the Percentage Channel. We also like that Gate.io offers hundreds of trading markets. This includes popular coins like Bitcoin, Ethereum, Pepe, and Solana.

It also supports up-and-coming projects like Jupiter and Bonk. Gate.io also attracts huge trading volumes, ensuring that your copy bot has access to premium liquidity. Gate.io doesn’t charge fees to copy an active bot. You’ll simply need to cover standard trading commissions. These start from 0.05% and 0.1% on futures and spot trading, respectively.

| Copy Trading Platform | Established | Trading Fees | Profit Share? |

Minimum Investment

|

| Gate.io | 2013 | Futures and spot trading commissions start from 0.05% and 0.1%, respectively | No | None |

Pros

- Deploy a crypto copy trading bot 24/7

- Over 3,000 bot strategies to choose from

- Trade with or without leverage

- Find bots based on their specialist technical indicator

- Only pay standard trading commissions

Cons

- Some bots have a short trading history

- Not as user-friendly as other platforms

What is Copy Trading in Crypto?

Crypto copy trading enables you to ‘copy’ another investor like-for-like. This means you can trade crypto without needing to actively watch over the markets. No fundamental research or technical analysis is needed either. Instead, you’ll be trading crypto passively. Anything your chosen trader buys or sells will be replicated in your own account.

Some copy traders have an exceptional track record. Copying a seasoned trader means you can replicate their success. For instance, if the trader makes a return on investment (ROI) of 15%, so will you. Your profits will be proportionate to your investment amount. So, if you invested $2,000 into a trader that made 15%, you’d make $300.

However, as explained by the Financial Times, copy trading can also result in substantial losses. Put otherwise, if your chosen trader makes a loss, so will you. Therefore, it’s important to research copy traders extensively before proceeding. Metrics to focus on include historical win rates, profit/loss percentages, ROIs, average trade duration, and the trading strategy.

An Example of Copy Trading:

Here’s an example of how copy trading works:

- You’ve invested $500 into a crypto trader

- The trader has a $10,000 bankroll. They invest $1,000 into Litecoin. That’s 10% of their overall capital

- You automatically buy Litecoin. You also invest 10%, so that’s $50 (10% of your $500 investment)

- The trader sells their Litecoin position several weeks later – making a 60% gain

- Your $50 position is automatically sold, also at a 60% gain. This means you made $30 passively.

Just remember that copy trading crypto platforms charge fees. Not only trading fees but profit-sharing commissions. These fees will eat into your potential gains.

How We Selected The Best Crypto Social Trading Platforms

We searched high and low for the best crypto copy trading platforms. Some of the factors we focused on include the number of active users, fees, account minimums, supported markets, and user-friendliness.

We’ll now take a closer look at these research methods, allowing you to choose the best platform for your needs.

Highest Active Users

We first explored the number of active users across each copy trading platform. This is an important indicator, as it highlights how reputable and popular the platform is. For example, eToro and OKX have over 30 million and 50 million clients, respectively. They also boast significant trading volumes, so there are always sufficient liquidity levels.

The large number of active users is also important to attract the best copy traders. After all, traders usually make money via a profit-sharing agreement. For instance, they might retain 10% of any profits generated from each follower. This means talented crypto traders will choose a platform with the most traffic.

Most Cryptocurrencies Available to Trade

We also prioritized crypto copy trading platforms supporting the widest range of markets. For a start, we ensured that large-cap coins like Bitcoin, Ethereum, XRP, BNB, and Solana were available. We then delved into small and medium-cap coins. This enables users to target higher-growth markets.

We also assessed what financial instruments each platform offers. For example, eToro provides access to the spot markets, with dozens of cryptocurrencies paired with the US dollar. It also supports crypto crosses like ETH/EOS, BCH/LTC, and BTC/XLM.

Traders with a higher appetite for risk might consider OKX and Bybit. These platforms allow you to copy crypto futures traders. This invites leverage and short-selling, which aren’t available when spot trading. Ultimately, you’ll need to assess supported markets when choosing the best social trading platform for crypto.

Lowest Fees

Fees will always need to be paid when copy trading. We found that in all cases, you’ll need to cover standard trading commissions.

- For example, OKX spot trading fees start from just 0.1%.

- Suppose your chosen trader buys $1,000 worth of XRP on your behalf.

- This means you’ll indirectly pay a trading commission of $1.

Most platforms also charge a profit-sharing commission. This goes straight to the trader and it’s only based on net gains. For instance, suppose you make a $500 profit from one copy trade. The trader charges a profit-sharing commission of 20%. As such, the trader makes $100 and you’re left with $400 gains.

Traders can normally set their own profit-sharing commission. That said, some platforms directly pay their copy traders, meaning you aren’t required to hand anything over. eToro, for example, doesn’t charge any additional fees. You only need to cover its standard 1% commission, which is charged per slide.

Best Layout and Design

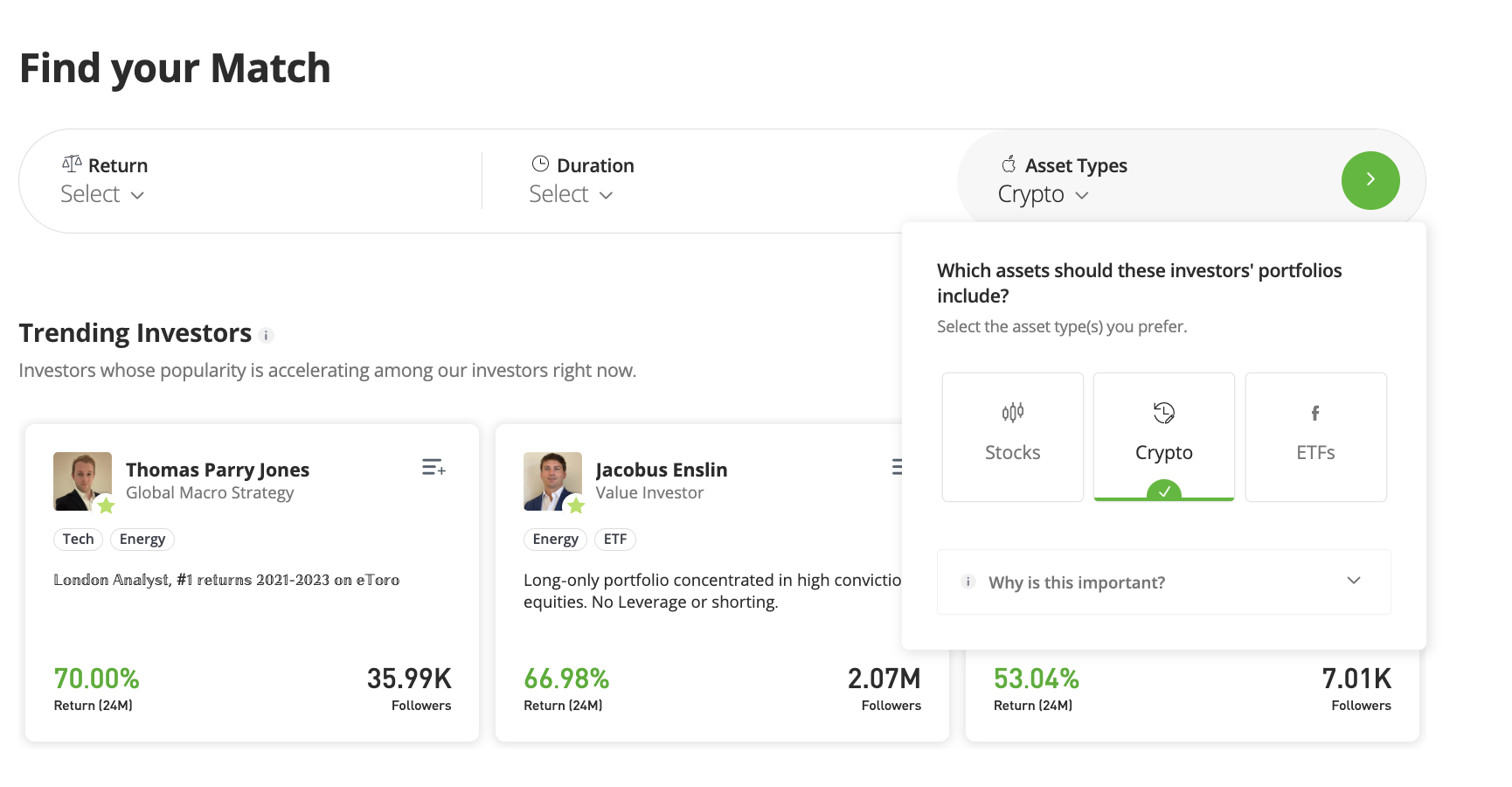

Not all copy trading platforms offer a user-friendly experience. Make sure you choose a platform that aligns with your trading experience. For example, eToro is the best option for beginners. It offers a simple layout, not to mention a seamless registration process.

eToro also makes it simple to find a suitable trader. It offers plenty of filters, including return on investment, timeframe, and maximum drawdown. More experienced investors might consider OKX. It offers advanced copy trading tools, such as high leverage, derivatives, and bespoke orders.

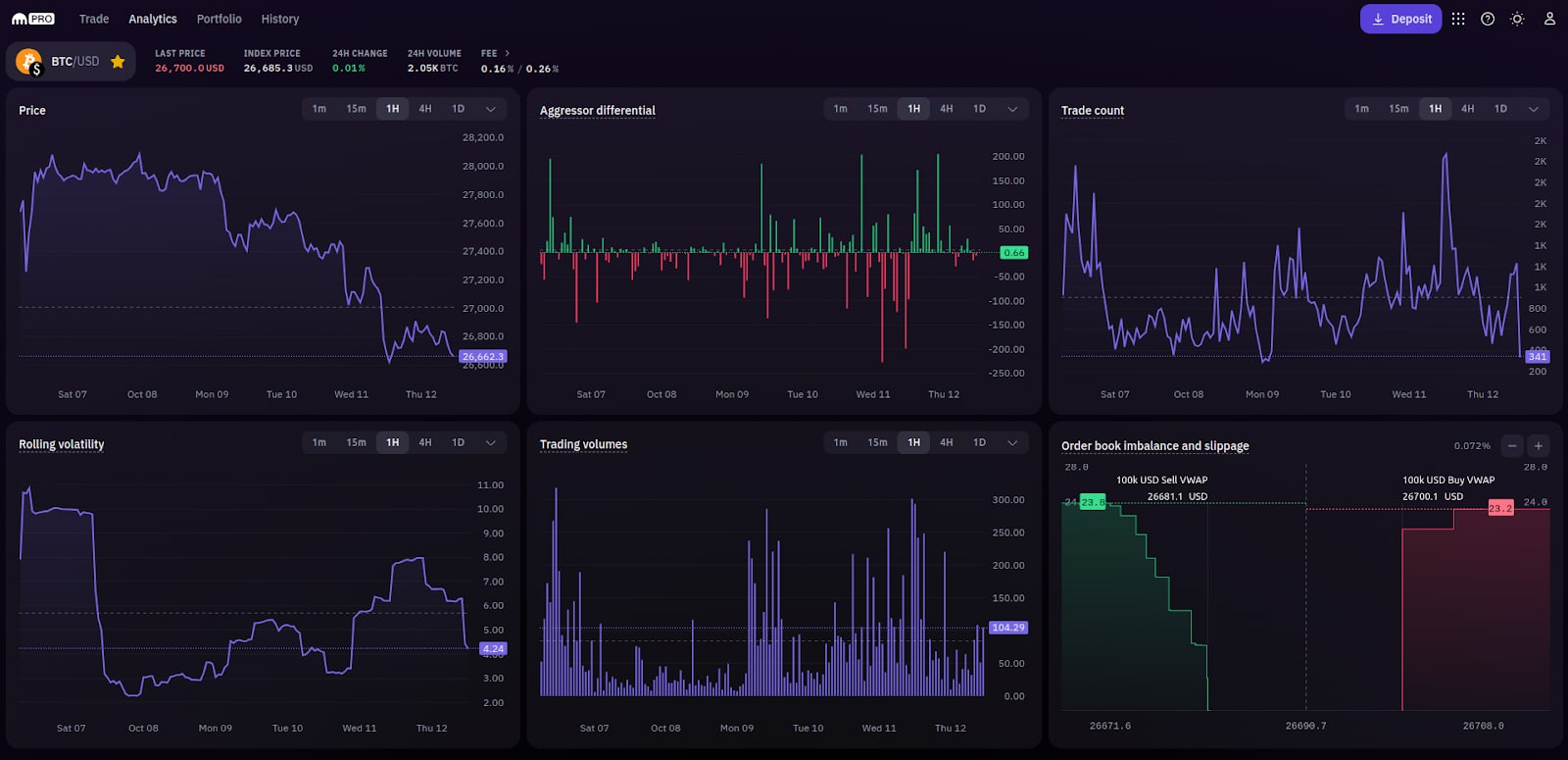

Trade Execution Speed

Execution speeds are also important when selecting a copy trading crypto site. In a nutshell, this is the time it takes for your order to be executed. This is based on when the copy trader placed the order.

The best platforms offer execution speeds in milliseconds. This means you won’t need to worry about slippage. However, we also found platforms that have slow execution times. This means you might get an unfavorable entry or exit price.

Top Crypto Copy Trading Features to Look For

Investors should look for certain features when choosing a copy trading site. This includes risk management tools, transparent performance metrics, and social integration.

We’ll now explore these popular features in more detail.

Risk Management Tools

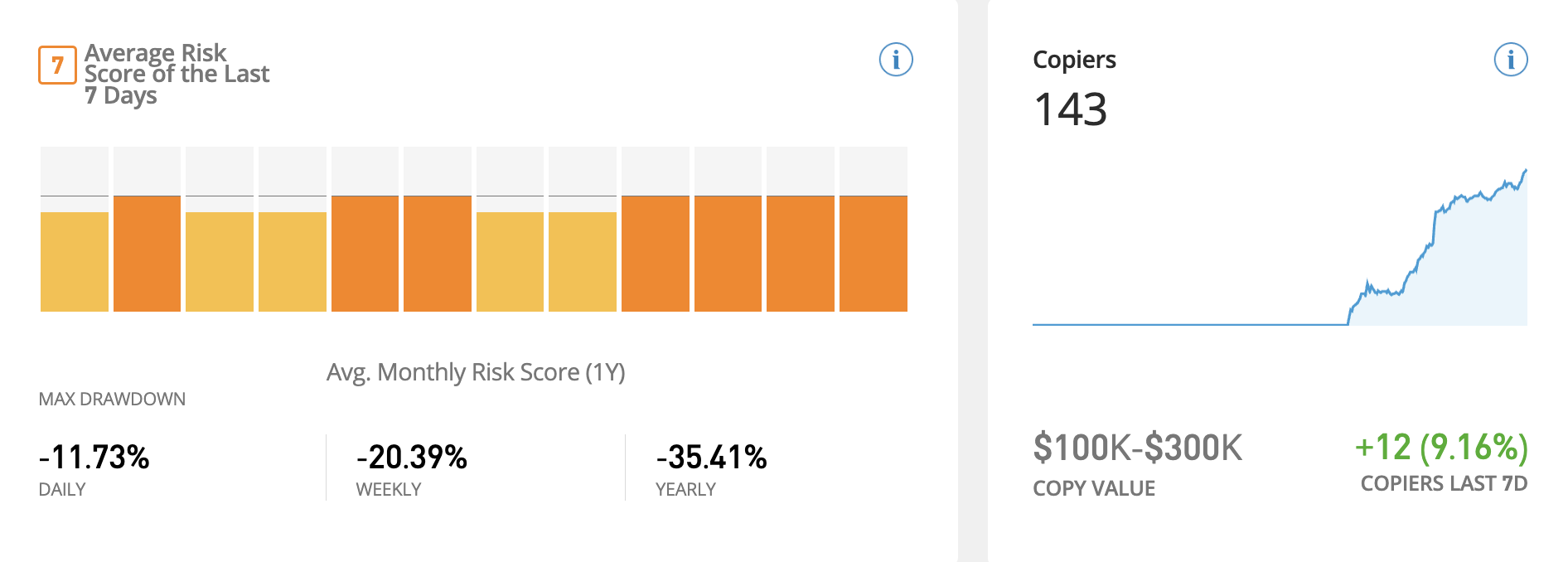

Risk management is imperative when copy trading crypto. Your chosen trader should already have a risk-mitigation strategy in place. You should understand this in full before risking any capital. However, you should also have your own risk management plan. This will ensure you avoid losing too much money.

At a minimum, your chosen copy trading platform should support stop-loss orders. These allow you to automatically close a trade if it declines by a certain amount.

- For example, suppose you’re copying a crypto trader that recently bought BNB

- Due to unexpected market conditions, BNB has declined by 30% in the prior 24 hours

- Fortunately, you have an automated stop-loss of 10%

- This means you stopped copying the BNB position once it declined by 10%

It’s sometimes possible to set stop-loss amounts on copy traders themselves. For example, you might want to stop copying a trader if they’ve lost more than 15% in a 30-day period.

Another risk management tool is being able to add and remove assets from a copy trading portfolio. This is a feature offered by eToro. For example, you might notice that your chosen trader has just bought Cardano. However, you don’t believe that Cardano represents a good investment. Therefore, you manually remove Cardano from the copy portfolio.

Transparent Performance Metrics

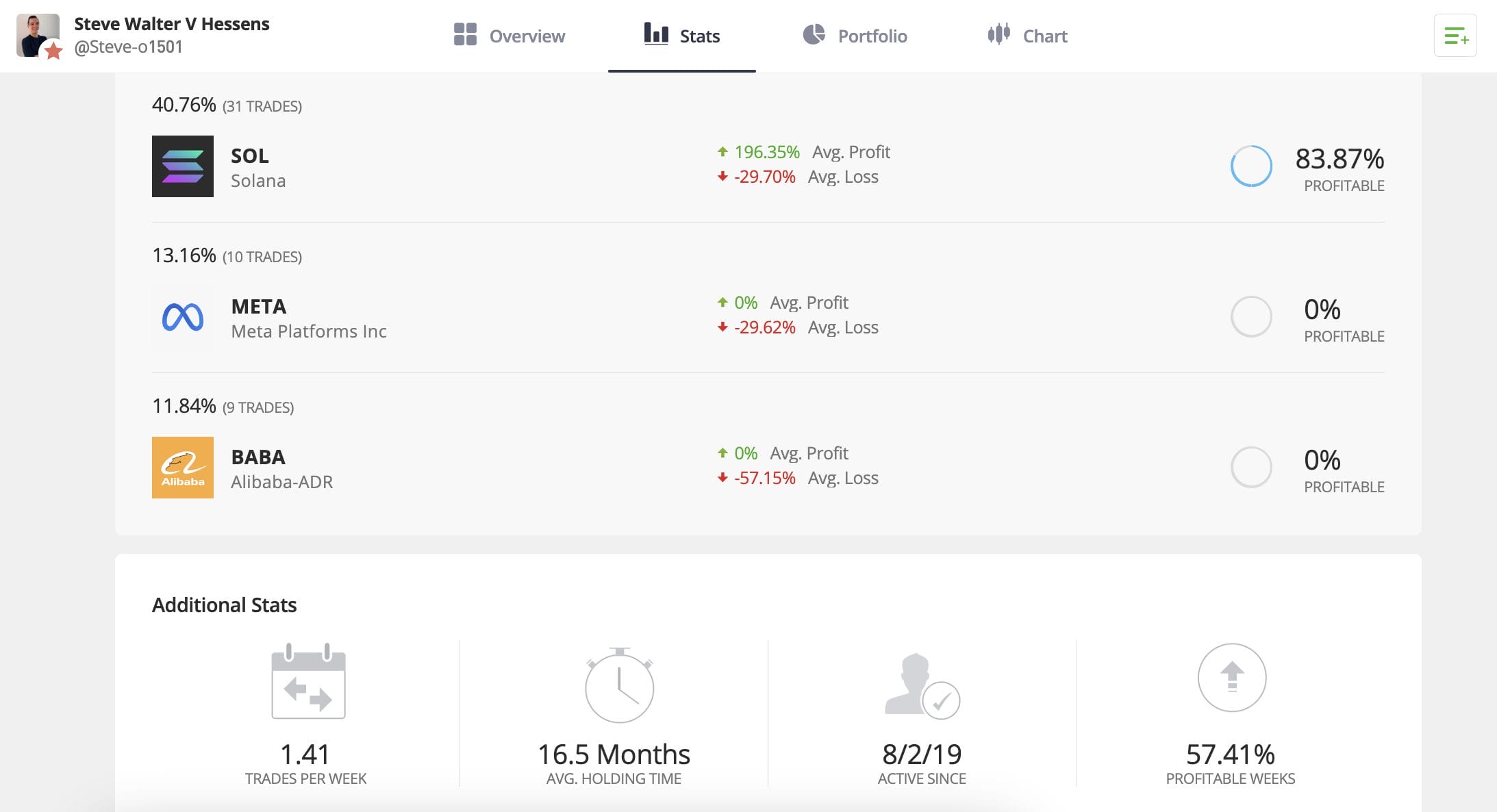

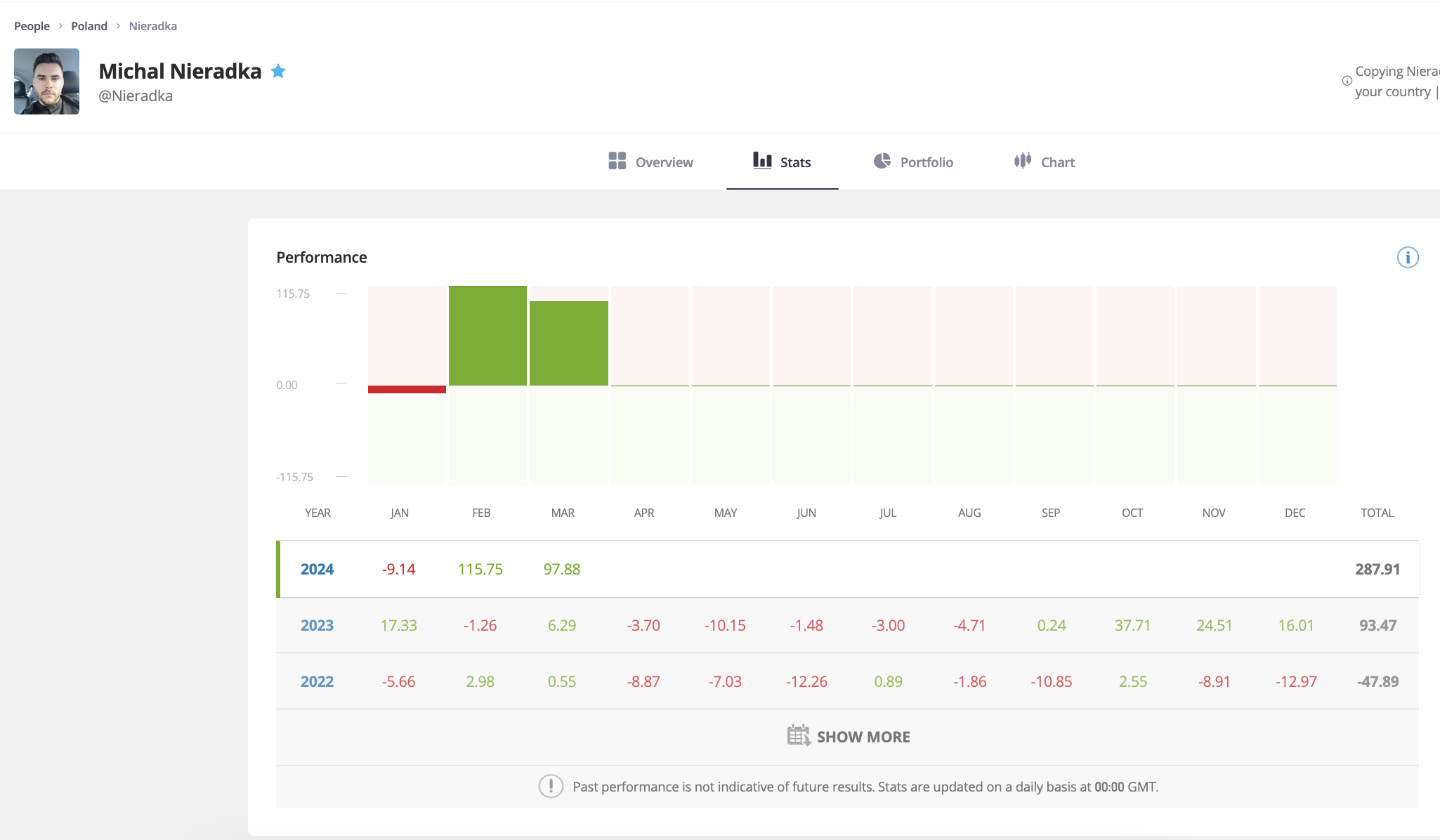

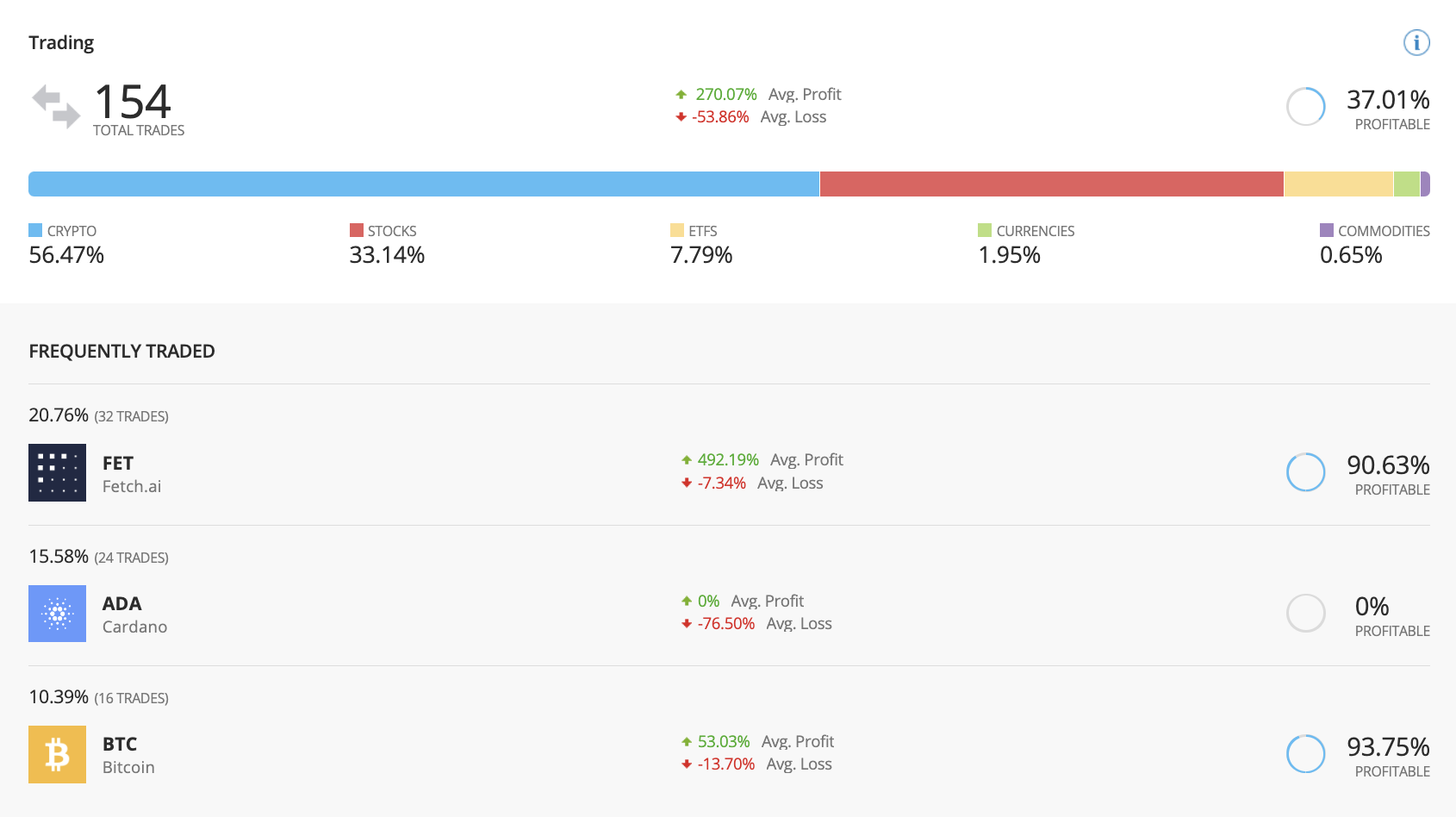

Performance metrics are also crucial when copy trading crypto. Without them, you wouldn’t be able to choose a suitable trader. Some of the most important performance metrics include:

- ROI: The ROI is the total return on investment over a certain period. For example, a trader might have made gains of 50% since joining a copy trading platform. So, if you invested in the trader from day one, you’d also have made 50%.

- Average Gains: It’s also wise to assess the average gains over an extended period. For example, their average monthly profit or loss in percentage terms. This ensures the trader has a consistent track record, rather than having had a lucky month.

- Average Trading Duration: This metric shows the average time the trader keeps a position open. For instance, an average duration of two hours means they’re likely a day trader. An average duration of several weeks or months means they’re a longer-term investor.

- Maximum Drawdown: The maximum drawdown percentage helps you understand how much risk the trader takes. It’s the maximum decline of a bankroll value from the previous peak. For example, if the trader goes from $10,000 to $6,000, that’s a drawdown of 40%.

- Preferred Pairs: We’d also suggest exploring the trader’s preferred crypto pairs. This will also help you understand their risk and reward mindset. For example, if they frequently trade Bitcoin and Ethereum, this could be considered a lower-risk approach. However, a trader who focuses on small-cap coins takes on a lot more risk.

These are just some of the performance metrics to look for. There are many others, such as the total number of followers and assets under management.

Nonetheless, just make sure the metrics are based over an extended period. For instance, you might find that a trader has an ROI of 400% since joining the platform. However, if they only joined 60 days ago, the ROI has little validity.

How Much Should I Invest in Crypto Copy Trading?

- No two investors are the same. You should assess your own investment budget and risk tolerance.

- In addition to diversification, consider dollar-cost averaging your copy trading portfolio.

- For example, you might passively invest just $50 per month, rather than injecting a lump sum.

- That said, you’ll need to ensure you meet the minimum investment requirements. This will vary depending on the copy trading provider.

Social Integration

Social integration, although not compulsory, is also worth exploring when choosing a copy trading platform. This is a tool available on leading platforms like eToro. Put simply, you’ll be able to communicate with other traders. It takes a similar approach to social media, such as being able to ‘Like’ comments and start new threads.

The benefit here is that you can discover insights from experienced investors. You can also ask questions about a specific investment to see what other traders think.

How to Start Crypto Copy Trading

We’ll now explain how to get started with a crypto copy trading account today. We’re using eToro for this walkthrough, but the steps are similar across most platforms.

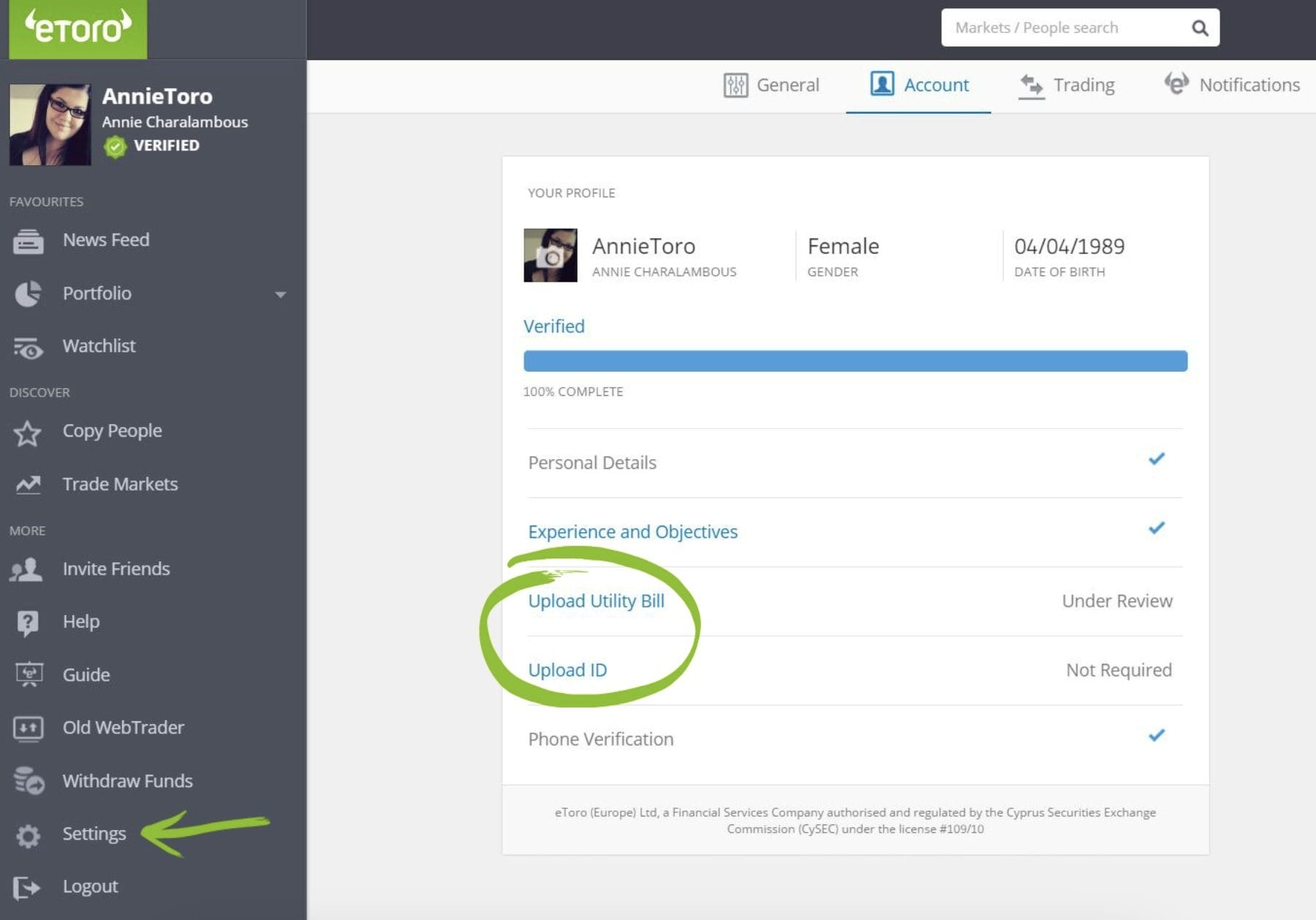

Step 1: Open an Account

Assuming you’ve chosen a suitable copy trading platform, visit the provider’s website and open an account. This shouldn’t take you more than a few minutes.

eToro is licensed by multiple tier-one regulators, so it’s legally required to collect personal information. It will also ask for KYC documents, such as a driver’s license or a passport.

Step 2: Browse Copy Traders

The next step is to research available copy traders. This is a time-consuming yet highly important process. After all, you’ll want to ensure you’re copying the best crypto traders on the platform.

Some of the questions to ask when researching traders include:

- How much profit has the trader made since joining the platform?

- What period is the ROI based on?

- What is the trader’s average holding time and preferred crypto markets?

- Does the trader frequently engage with their followers?

- What is the maximum drawdown percentage?

Ultimately, you’ll want an intimate understanding of a trader before you copy them.

Step 3: Choose Investment Amount and Deposit Funds

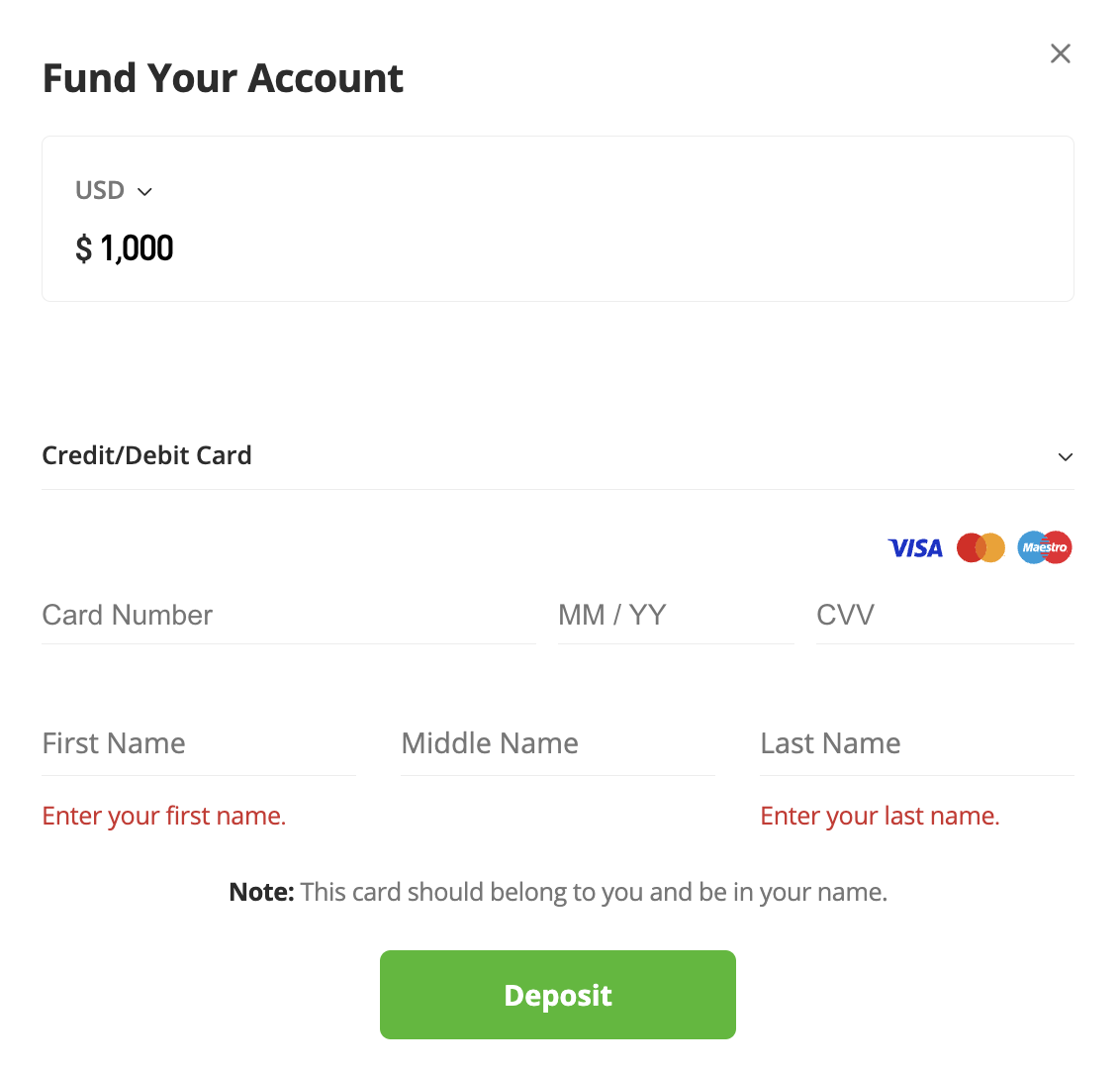

You’ve now decided which trader(s) to copy. Next, decide how much money you want to invest. eToro has a minimum investment of $200 per trader. Other platforms don’t have a minimum.

Just make sure you have a sensible investment budget. You should only invest disposal funds – meaning you’re not using money required for day-to-day expenses.

You’ll then need to make a deposit into your copy trading account. If you’ve already verified your identity on eToro you can deposit fiat money. Payment methods include e-wallets, debit/credit cards, and bank wires.

Step 4: Set Up Copy Trading Order

You can now use your account funds to invest in your chosen trader. After clicking the ‘Copy’ button, you’ll need to type in your investment size.

Make sure you think about the copy trading stop-loss percentage. This is set at 40% by default. In this instance, eToro will close all open positions if the copy portfolio declines by 40%. All future buy and sell orders will be copied once you confirm the investment.

Step 5: Monitor Copy Trading Investment

It’s important to monitor your copy trading investments. Try to avoid checking in too often – once a week is sufficient. If you’re copying a long-term investor then once a month is likely better.

You can amend your copy portfolio at any time. For example, eToro allows you to adjust the investment size. You can manually add or remove individual investments too. You can also stop copying a trader entirely.

Is Crypto Copy Trading Profitable?

Beginners will often ask the question; Is Bitcoin copy trading actually profitable? It can be, but it depends on the performance of the trader you’re copying. After all, copy trading tools enable you to replicate a trader’s return on investment. For example, if you’re copying a trader that makes a 40% ROI, you’ll also make 40%.

Sure, you might need to deduct profit-sharing fees from this figure. But you’ve made a profit nonetheless. However, now let’s suppose you copy a trader who enters a prolonged losing run. If they’re 30% down for the month, you’ll also be looking at a 30% loss.

With this in mind, it’s smart to copy multiple traders. This ensures you’re not over-exposed to one individual. Crucially, traders can’t make a profit every month indefinitely. At some stage, they’ll run into a downward trend. Having multiple traders in your portfolio can help you minimize these losses.

Conclusion

In summary, copy trading can help you become a more efficient crypto investor. You won’t need to waste time analyzing the markets, let alone placing orders. To get started with the leading crypto copy trading platform, consider joining eToro.

This regulated platform has thousands of seasoned traders signed up for its copy trading program. No additional fees apply when copying traders – simply cover the standard trading commission.

FAQs

Does crypto copy trading work?

Yes, copy trading does work – you’ll automatically copy the chosen trader like-for-like. However, just remember that profits and losses will be replicated, so ensure you consider the risks.

How do I start crypto copy trading?

Open an account with a regulated copy trading broker like eToro. Deposit some funds, research which crypto trader to copy, and confirm the investment. Thereon, buy and sell orders will be copied automatically.

Is crypto copy trading profitable?

Your profits will be determined by the trader you copy. While some traders are profitable, others lose money. Your return on investment will be mirrored.

What is the best crypto copy trading platform?

eToro is regarded as the best copy trading crypto platform. It has over 30 million users, thousands of verified traders to copy, and a regulated framework.

Is crypto social trading worth it?

Yes, crypto social trading can be worth it if you don’t have the time or experience to actively trade. It’s also ideal for discovering new trends and insights that might have otherwise been missed.

References

- Twitter partners with eToro to let users trade stocks, crypto as Musk pushes app into finance (CNBC)

- Copy trading: a road to riches or risk? (Financial Times)

- How to calculate ROI to justify a project (Harvard Business School)

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman