Young Investors Drive Increased Aussie Bitcoin & Crypto Investments

Younger Australian investors are driving the country’s increasing crypto ownership, accompanied by rising investments by high-end crypto holders, a recent survey showed.

18.4% of respondents said they own some form of cryptoasset, up from 16.8% in 2019, Independent Reserve (IR), an Australia and New Zealand-focused crypto exchange with around 150,000 customers, said in its Independent Reserve Cryptocurrency Index 2020 report. The survey of 1,100 “everyday Australians” was carried out by consumer research firm PureProfile.

According to IR, most of the ownership growth was driven by the 25-44-year-old respondents.

“We need to find new ways to bring people into the industry, remembering that inclusion was one of the original principles of Bitcoin,” Adrian Przelozny, CEO of IR, was quoted as saying in the report.

And it looks like the coronavirus pandemic was among the obstacles this year to get more crypto users on board.

While some other reports indicated that the pandemic has had more of an effect on the American bitcoin (BTC)-buying community than first thought, the Australian survey showed that 34% of those respondents who intended to purchase crypto in 2020 didn’t proceed with the purchase because they were either directly impacted by the economy or because of the uncertainty caused by it.

Also, it looks like the recent crackdown on XRP-affiliated Ripple in the US hit many Australians also as XRP is the number two coin among the respondents.

And here are some other findings in the report:

- BTC dominates Australian cryptoasset holdings – 74% of the respondents said they own BTC, followed by XRP (28%), ethereum (ETH) (27%), bitcoin cash (BCH) (17%), litecoin (LTC) (15%), chainlink (LINK) (5.2%), while 8.5% of the respondents own other tokens too.

- Monthly investments in crypto stayed mostly stagnant between 2019 and 2020, but the number of high end AUD 1,000+ (USD 760) per month respondents almost doubled from 1.3% in 2019 to 2.3% this year. The number of people under 45 who invest more than AUD 10,000 in crypto every month has tripled.

- Younger Australians are more likely to believe that crypto will be widely accepted in the future. At the same time, 25-34-year-olds are three times more likely to worry about the effects of quantitative easing, or intensified money printing by the Reserve Bank of Australia on their financial future than 55-64 year olds.

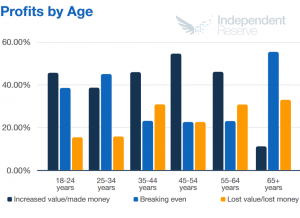

- Among the respondents, current crypto ownership is 10.3% for women versus 26.8% for men, but women are twice as likely to break even in crypto investments than men, with 52.5% versus 28.9%.

___

Learn more:

Australian Firm to Accept Tether in Sydney Stock Exchange IPO Bid

Crypto Adoption in 2021: Bitcoin Rules, Ethereum Grows & Faces Rivals

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

18% of Asked Americans Bought Crypto, Most Know Only Bitcoin – Survey

People Tell Cryptoverse to Fix These Things to Reach Bitcoin Mass Adoption